May 2025

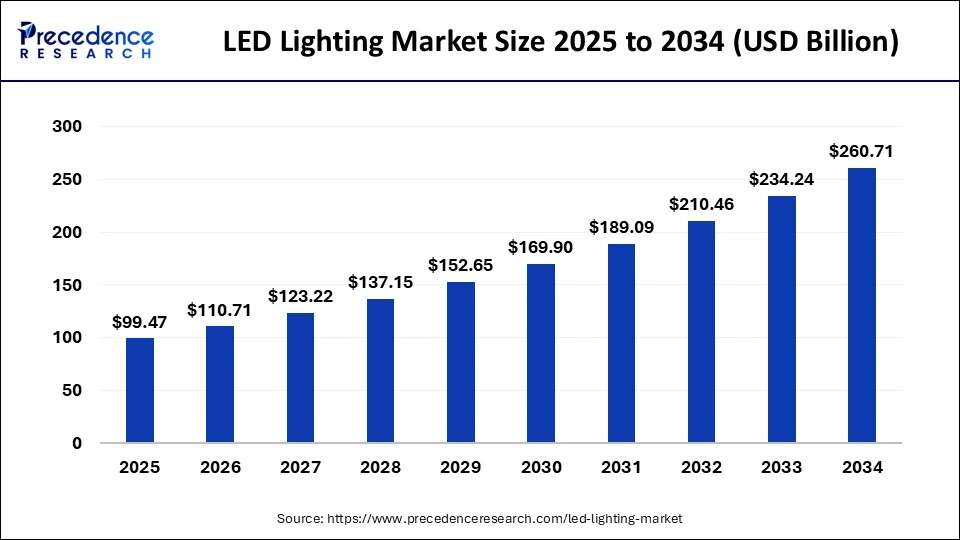

The global LED Lighting market size accounted for USD 99.47 billion in 2025 and is forecasted to hit around USD 260.71 billion by 2034, representing a CAGR of 11.30% from 2025 to 2034. The Asia Pacific market size was estimated at USD 39.32 billion in 2024 and is expanding at a CAGR of 10.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global LED lighting market size was calculated at USD 89.37 billion in 2024 and is predicted to increase from USD 99.47 billion in 2025 to approximately USD 260.71 billion by 2034, expanding at a CAGR of 11.30% from 2025 to 2034.

The Asia Pacific LED lighting market size was evaluated at USD 39.32 billion in 2024 and is predicted to be worth around USD 114.71 billion by 2034, at a CAGR of 10.30% from 2024 to 2034.

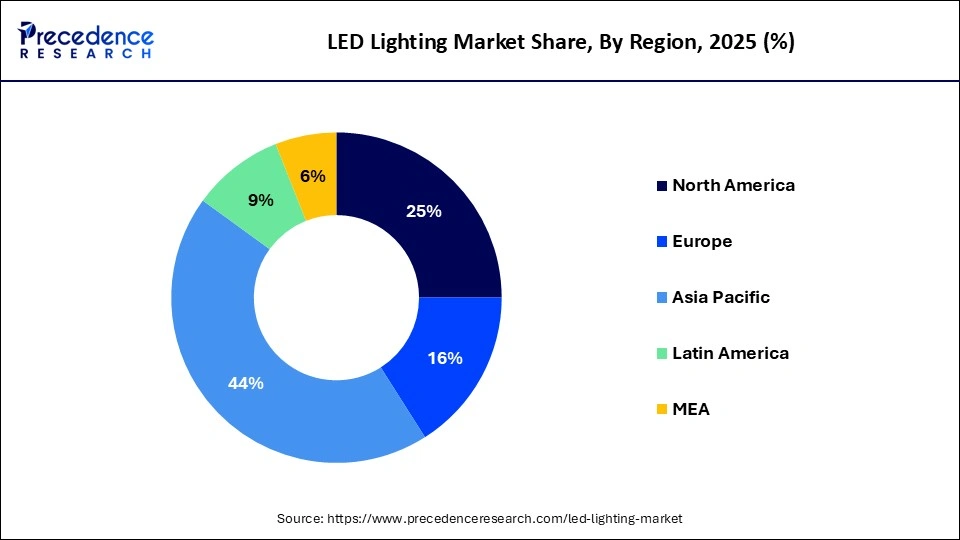

In 2024, the Asia Pacific captured a major market value share of more than 44% in the global LED lighting market and is projected to continue its dominance during the analysis period. This is mainly attributed to the large consumer base in the region. Most of the developing nations in the region have adopted stringent regulations and attractive offers for the public to escalate the adoption of LED lights in the region. LED lights are helpful in saving energy as they supply more watts per hour in less energy consumption. In addition, rise in the construction sector also positively influences the market growth. There are numerous developing countries present in the region that offer alluring opportunities for the development of medical, education, and infrastructure, thereby promoting the construction of hospitals, schools, buildings, and roads in the region.

Asia-Pacific

Lighting Up Progress with Policy (Top Countries in Asia-Pacific)

On the other hand, North America and Europe are the other prime contributors to the global LED lighting market growth. Technology advancement and significant initiatives taken by the governments of these regions for reducing energy consumption are some of the major factors responsible for the growth of the regions.

North America

Beams of Impact in the LED Landscape

Shedding Light on Innovation

| Report Scope | Details |

| Market Size in 2034 | USD 260.71 Billion |

| Market Size in 2025 | USD 99.47 Billion |

| Market Size by 2024 | USD 89.37 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.30% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Long Lifespan

LEDs use very little energy because they turn most of their energy into light instead of heat. When considering traditional lighting solutions, this efficiency translates into lower energy usage and longer lifespans. The adoption of LEDs is being encouraged by numerous governments across the globe through laws and policies that are designed to increase energy efficiency. The switch to LED lighting is being aided by programs that provide standards, rebates, and subsidies for energy-efficient lighting. The functionality of LEDs is being improved by their integration with smart technologies and the Internet of Things (IoT). Their popularity is growing in the home, commercial, and industrial sectors thanks to features including automation, motion detection, dimming, color changing, and remote control.

Aesthetic Preferences

LED lights are becoming more and more popular because they look good with contemporary, minimalist interior designs. This comprises subtle fixtures, neat lines, and thin profiles. Tunable white lighting is a feature of advanced LED goods that lets customers change the color temperature based on activities or the time of day. RGB LEDs are designed to satisfy customers who want programmable color options for mood lighting or special occasions. Smart LED lights that are programmable through voice assistants, apps, or home automation systems are in great demand. Functions such as scene-setting, scheduling, and dimming improve practicality and customization. Energy-star-certified products are recommended due to their demonstrated energy efficiency and compatibility with both practical and aesthetic standards.

Urbanization and Infrastructure Development

The development of infrastructure and urbanization are two important drivers propelling the market for LED lighting. The need for energy-efficient lighting options, such as LEDs, rises as cities grow and evolve. Residential illumination is becoming more and more necessary as more people migrate into cities. Because of their extended longevity and energy efficiency, LEDs are now the standard for both new and refurbished homes. The need for LED lighting is increased by the growth of commercial buildings, which include places of business, retail establishments, and lodging facilities. These industries place a high priority on energy efficiency in order to cut expenses. Sustainability is becoming more and more important to governments and municipalities. LEDs are essential for achieving energy-saving goals and lowering carbon emissions.

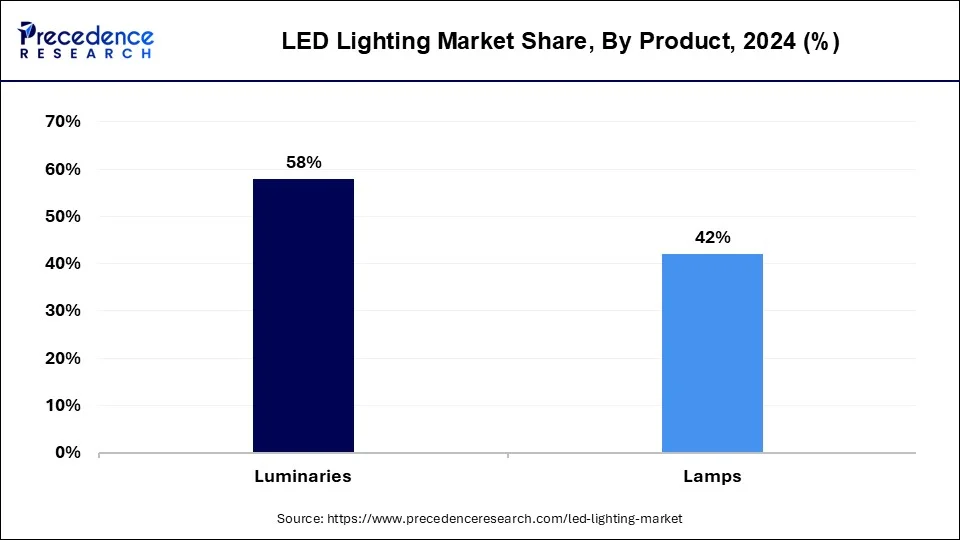

In 2024, LED luminaries occupied a major market value share of around 58% in the global LED lighting market and are expected to exhibit substantial growth over the forecast period. Luminaries are largely used in industrial and commercial applications. It includes lights used in high bays, streetlights, troffers, track lights, downlights, and suspended pendants for various applications. They are costlier than LED lamps and thus contribute a large amount of revenue to the global market. Further, the luminaries are easy to control and provide more light per output power. They also permit designers to use proficient designs that illuminate the same area using less light.

On the other hand, LED lamps exhibit the fastest growth of approximately 14% over the forecast period. LED lamps offer numerous benefits over incandescent lamps such as energy efficiency, robustness, and right temporal stability. In various countries, LED prices are expected to witness a steep decline in the near future, further boosting the demand for LED lamps.

By end-use, the commercial segment dominated the global LED lighting market and accounted for more than 52% of the market value share. Increasing demand for LED troffers and downlights significantly drives the growth of the segment. Commercial lighting mainly includes museums, galleries, and other exhibition lighting applications that predominantly use projectors, reflectors, and downlights. On the other side, residential segment is expected to witness the fastest growth during the forthcoming years. The growth of the segment is attributed to the rising adoption of LED A-type lamps due to their low price and various subsidy programs initiated by the agencies and governments of different regions. Price contributes as a decisive factor in driving the growth of the residential segment. Furthermore, consumer penetration towards smart home devices that also includes smart lighting accounted as the other prominent factor to propel the residential segment revenue over the predicted period.

By Product

By Application

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

August 2024

August 2024