January 2025

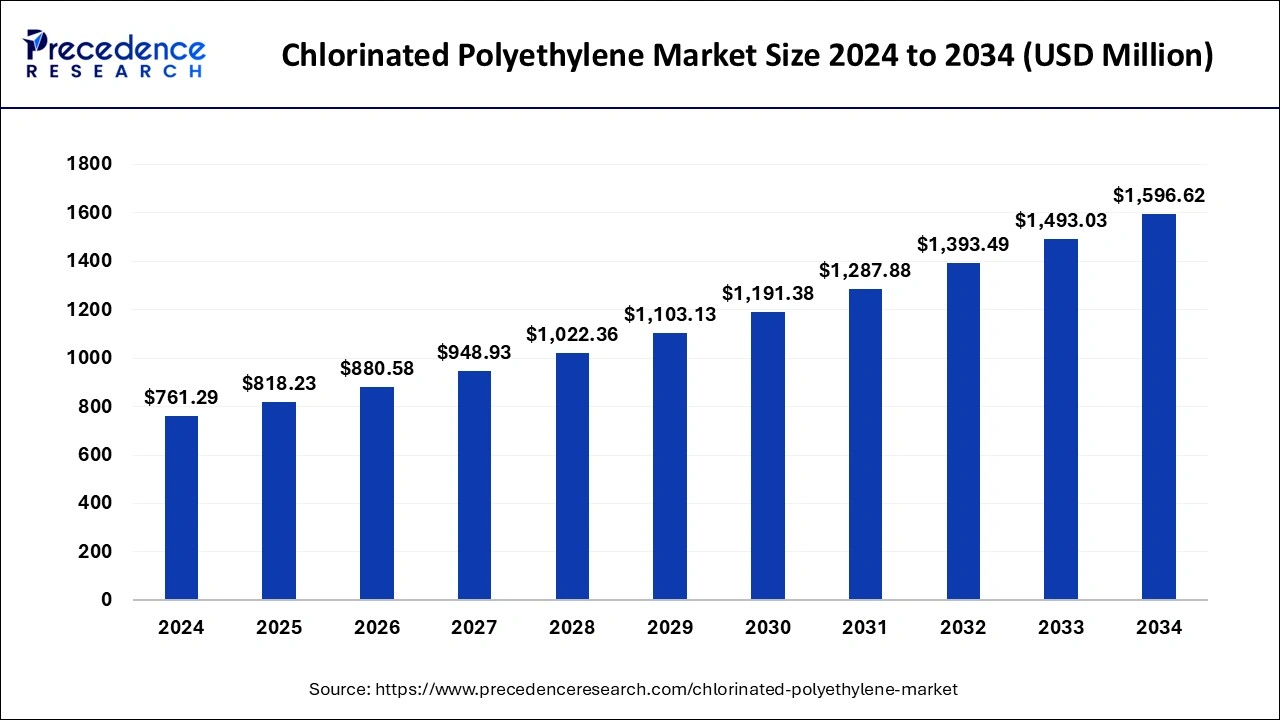

The global chlorinated polyethylene market size is accounted at USD 818.23 million in 2025 and is forecasted to hit around USD 1,596.62 million by 2034, representing a CAGR of 7.69% from 2025 to 2034. The North America market size was estimated at USD 319.74 million in 2024 and is expanding at a CAGR of 7.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chlorinated polyethylene market size was calculated at USD 761.29 million in 2024 and is predicted to increase from USD 818.23 million in 2025 to approximately USD 1,596.62 million by 2034, expanding at a CAGR of 7.69% from 2025 to 2034.

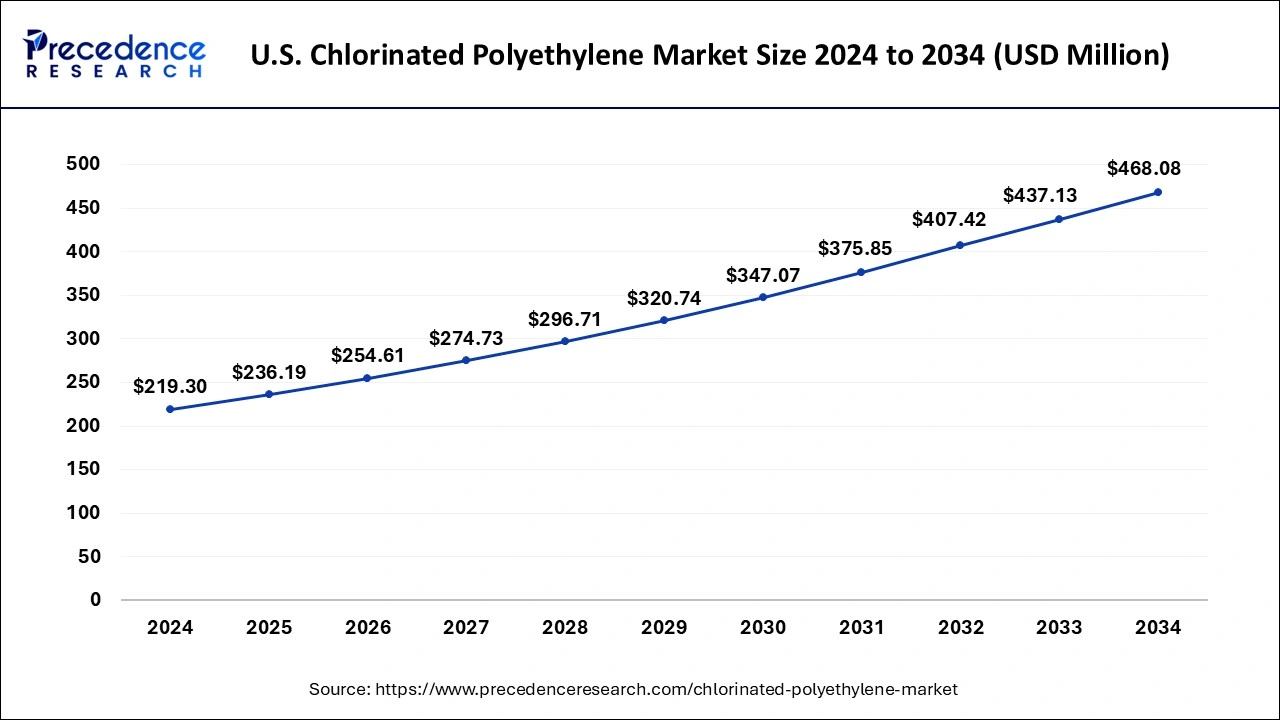

The U.S. chlorinated polyethylene market size was exhibited at USD 219.30 million in 2024 and is projected to be worth around USD 468.08 million by 2034, growing at a CAGR of 7.88% from 2025 to 2034.

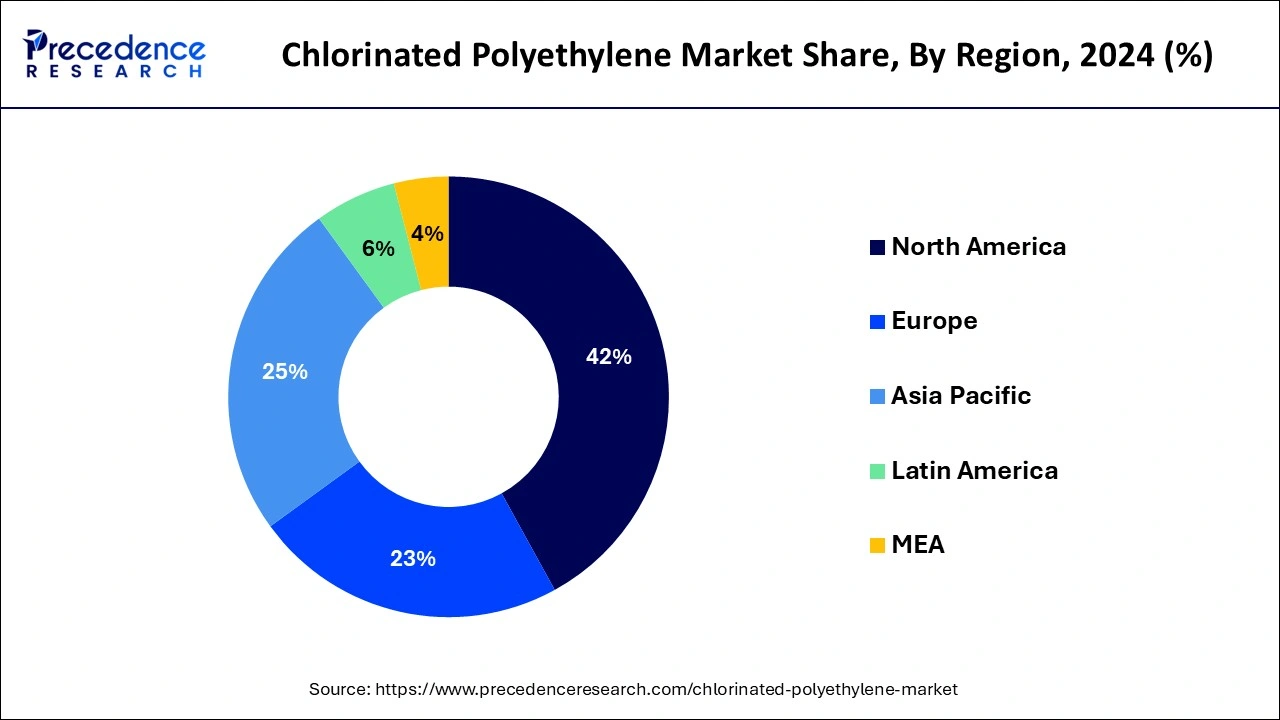

North America holds a share of 41% in the chlorinated polyethylene market due to robust demand across diverse industries. The region benefits from a well-established construction sector, where CPE is extensively used in applications like pipes and roofing materials. Additionally, the automotive industry's reliance on CPE for impact modification contributes to market dominance. Stricter environmental regulations also drive the adoption of CPE, which offers a balance between performance and sustainability. The mature industrial landscape, technological advancements, and a focus on high-quality materials further solidify North America's prominence in the CPE market.

On the other hand, Asia-Pacific is projected to witness rapid growth in the chlorinated polyethylene market due to escalating industrialization, infrastructure development, and increasing demand for PVC-based products. The region's robust manufacturing sector, particularly in China and India, drives the consumption of CPE in applications such as wires, cables, and construction materials. Additionally, rising automotive production and the expanding electronics industry contribute to the growing demand for CPE. Favorable economic conditions, coupled with the region's status as a key manufacturing hub, position Asia-Pacific as a significant player in the accelerating growth of the chlorinated polyethylene market.

Meanwhile, Europe's notable growth in the chlorinated polyethylene (CPE) market can be attributed to increasing demand across diverse industries, including construction, automotive, and consumer goods. The region's emphasis on sustainability and stringent quality standards drives the adoption of CPE for applications requiring durability and weather resistance. Moreover, ongoing research and development initiatives in European countries contribute to innovative CPE formulations, expanding its applications. The robust infrastructure projects and automotive manufacturing in Europe further fuel the demand for CPE, positioning the region as a significant contributor to the market's growth.

Chlorinated polyethylene (CPE) stands out as a specialized thermoplastic derived from polyethylene through a chlorination process, elevating its resistance to chemicals, weather elements, and flames. Frequently utilized as an impact modifier in PVC (polyvinyl chloride) manufacturing, CPE significantly enhances the toughness and flexibility of the final product. This transformation involves introducing chlorine atoms into the polyethylene polymer chain, resulting in a shift in material properties.

CPE offers exceptional durability against heat, chemicals, and UV radiation, making it a preferred choice for various applications like cable insulation, automotive parts, roofing materials, and industrial hoses. Its compatibility with different polymers, especially PVC, makes it a valuable additive across industries. Moreover, the degree of chlorination can be adjusted to achieve specific performance characteristics, providing flexibility for diverse applications. In essence, chlorinated polyethylene combines the inherent qualities of polyethylene with improved attributes, contributing to its widespread use in creating robust and weather-resistant materials.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.77% |

| Market Size in 2025 | USD 708.83 Million |

| Market Size by 2034 | USD 1,596.62 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

PVC modification demand

The surge in demand for chlorinated polyethylene (CPE) is intricately tied to the increasing need for PVC modification. PVC, a widely used thermoplastic, benefits significantly from CPE's role as an impact modifier. The incorporation of CPE enhances PVC's toughness, flexibility, and overall performance, making it an ideal choice for various applications. As the demand for modified PVC continues to rise, particularly in sectors such as construction, automotive, and consumer goods, the market for chlorinated polyethylene experiences a proportional upswing. CPE's ability to impart desirable properties to PVC, including improved weatherability and resistance to impact, positions it as a crucial component in the production of durable and versatile materials. The symbiotic relationship between CPE and PVC underscores the material's pivotal role in addressing the evolving needs of industries reliant on modified PVC, thus propelling the demand for chlorinated polyethylene in the broader market.

End-of-life disposal challenges

End-of-life disposal challenges pose a significant restraint on the market demand for chlorinated polyethylene (CPE). The chlorine content in CPE raises environmental concerns during disposal, as it can release harmful by-products. Proper disposal methods and recycling processes become imperative to mitigate environmental impact. The challenges associated with the end-of-life phase can affect consumer perception and industry acceptance, especially in regions with stringent environmental regulations and a growing emphasis on sustainable practices.

As environmental awareness increases, stakeholders in the CPE market need to proactively address these disposal challenges. Developing eco-friendly disposal methods and promoting recycling initiatives for CPE-containing products can not only mitigate environmental impact but also enhance the market's reputation. Failure to navigate these disposal challenges may lead to reduced demand for CPE as industries and consumers increasingly prioritize materials with more sustainable end-of-life solutions.

Renewable energy targets

Advancements in chlorinated polyethylene (CPE) formulations are creating significant opportunities within the market by expanding the material's applicability and performance characteristics. Ongoing research and development efforts focus on tailoring CPE properties to meet specific industry requirements, such as improved heat resistance, flexibility, and environmental sustainability. These innovations allow CPE to address diverse market needs, contributing to its versatility and competitiveness in various sectors. Innovative formulations enable CPE to meet evolving industry standards and regulations, positioning it as a preferred choice in applications ranging from construction and automotive to consumer goods. The ability to customize CPE properties not only broadens its scope but also enhances its compatibility with emerging technologies, ensuring a dynamic and responsive presence in the ever-evolving landscape of materials and polymer technologies.

In 2024, the CPE 135A segment had the highest market share of 45% on the basis of the product. CPE 135A is a specific grade within the chlorinated polyethylene (CPE) market. It represents a type of CPE characterized by a high chlorine content, typically around 35%, making it well-suited for applications requiring enhanced chemical resistance and impact strength.

In the market, the CPE 135A segment is witnessing a growing demand, particularly in PVC modification for products such as pipes, cables, and profiles. The trend is driven by its ability to impart excellent weatherability and toughness to PVC, aligning with the increasing requirements for durable and versatile materials in various industries.

The CPE 135B segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. CPE 135B is a specific grade within the chlorinated polyethylene (CPE) market, characterized by its high chlorine content, typically around 35%. This grade offers enhanced heat resistance, chemical stability, and impact strength, making it suitable for various applications. In recent trends, CPE 135B has seen increased demand in industries such as wire and cable insulation, automotive components, and industrial hoses due to its superior performance characteristics. The market is witnessing a shift towards CPE 135B as industries seek high-quality materials to meet stringent requirements in diverse applications.

According to the application, the wire and cable jacketing segment held a 27% market share in 2024. The wire and cable jacketing segment in the chlorinated polyethylene (CPE) market involves the use of CPE as a protective outer layer for wires and cables. This application benefits from CPE's excellent weather resistance, chemical stability, and flame-retardant properties, ensuring durability and safety in diverse environments. A notable trend in this segment is the increasing demand for CPE jacketing in response to growing infrastructure projects, particularly in telecommunications and power distribution, where reliable and robust wire and cable insulation is crucial for long-term performance.

The adhesives segment is anticipated to expand fastest over the projected period. In the chlorinated polyethylene (CPE) market, the adhesives segment refers to the utilization of CPE in adhesive formulations. CPE enhances adhesives by imparting improved flexibility, durability, and resistance to environmental factors. As a trend, the adhesives sector within the CPE market is witnessing increased demand due to the growing emphasis on high-performance adhesives in construction, automotive, and industrial applications. CPE's ability to enhance adhesive properties makes it a sought-after component, contributing to the expansion of the adhesives segment in the broader CPE market.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2025