January 2025

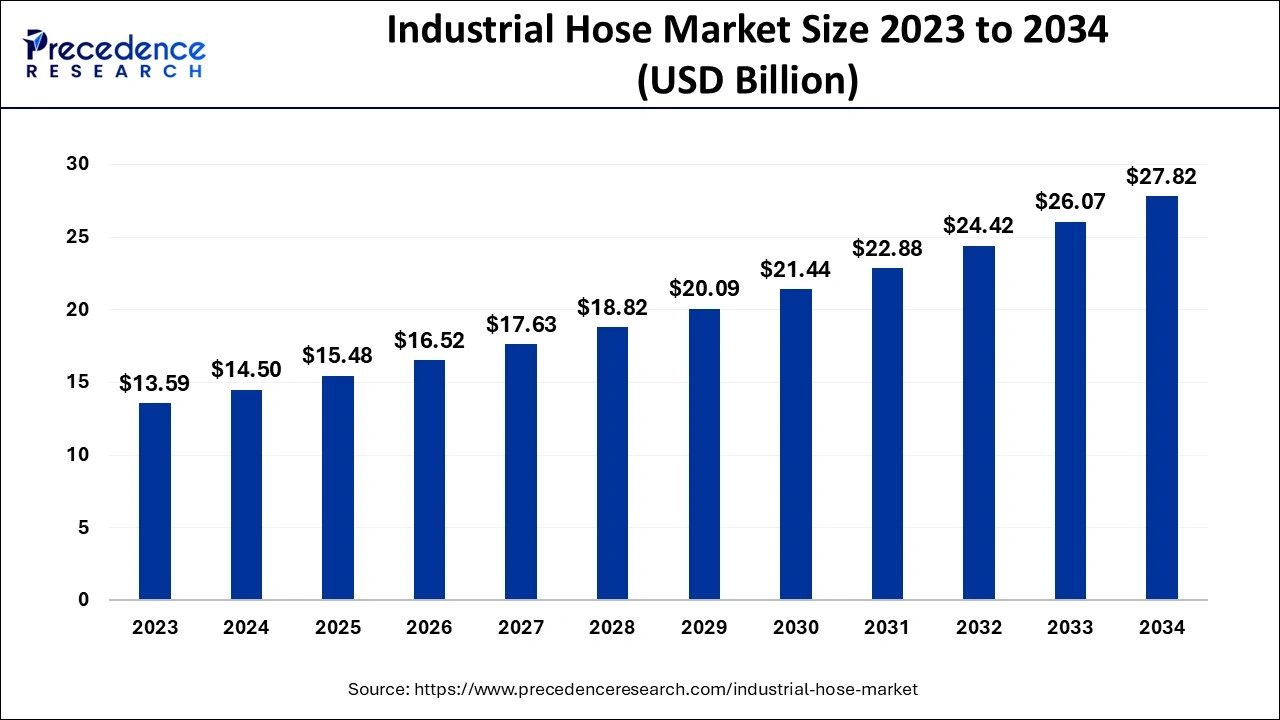

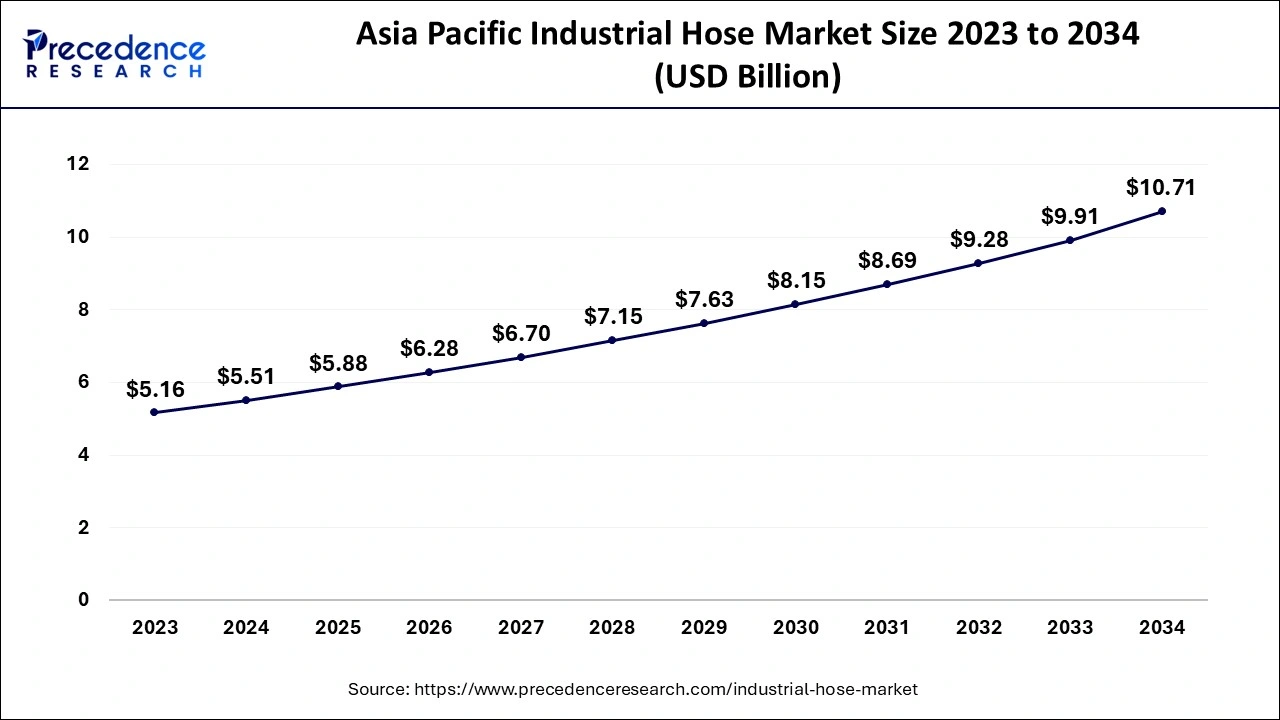

The global industrial hose market size is calculated at USD 14.50 billion in 2024, grew to USD 15.48 billion in 2025 and is predicted to hit around USD 27.82 billion by 2034, expanding at a CAGR of 6.73% between 2024 and 2034. The Asia Pacific industrial hose market size is calculated at USD 5.51 billion in 2024 and is expected to grow at a CAGR of 6.86% during the forecast year.

The global industrial hose market size accounted for USD 14.50 billion in 2024 and is expected to exceed around USD 27.82 billion by 2034, growing at a CAGR of 6.73% from 2024 to 2034. Increasing application of hose across diverse industries such as construction and chemicals is the key factor driving the growth of the industrial hose market. Also, the surge in oil and gas exploration supported by infrastructure development can fuel market growth further.

The Asia Pacific industrial hose market size is exhibited at USD 5.51 billion in 2024 and is projected to be worth around USD 10.71 billion by 2034, growing at a CAGR of 6.86% from 2024 to 2034.

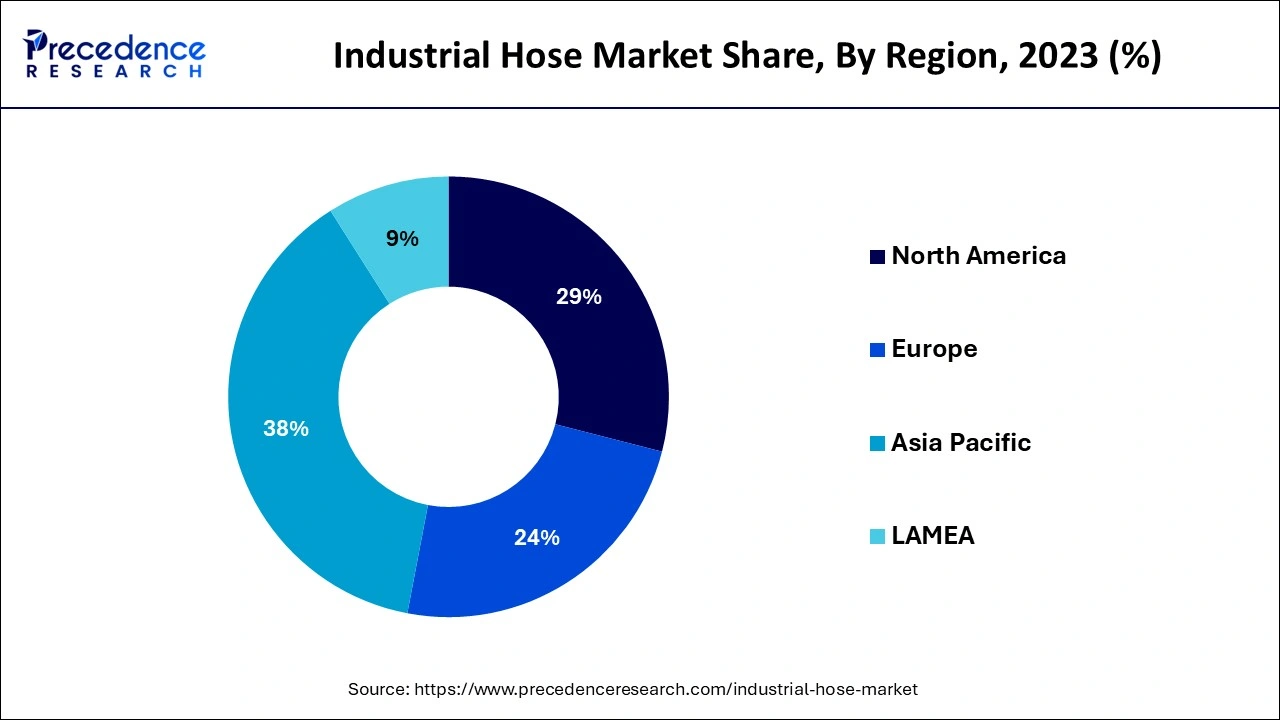

Asia Pacific dominated the global industrial hose industrial hose market in 2023. The dominance of the region can be attributed to the increasing construction projects in the region along with the increasing demand from the infrastructure sector in developing nations like India and Japan. Furthermore, rising urbanization and a surge of industries, including chemicals, automotive, and pharmaceuticals are observed in the region.

North America is anticipated to grow at the fastest rate in the industrial hose market over the studied period. The growth of the region can be linked to the growing demand for industrial hoses in non-residential construction projects like commercial buildings, colleges, and hospitals. Moreover, countries like the U.S. have strong economies due to their commercial real estate sectors.

A hose is a soft hollow tube designed to transport fluids from one place to another. Generally, the shape of this hose is cylindrical with a round cross-section. Common factors that must be considered while making a hose are weight, length, size, pressure rating, and chemical compatibility. The hose is mainly used in polyurethane, nylon, polyvinyl chloride, and polyethylene. Other hose materials are stainless steel and Teflon.

Production of Natural Rubber in India (2022)

| Type-wise Production of NR | March 2022 (tonnes) |

| Ribbed Smoked Sheet (RSS) | 24400 |

| Solid Block Rubber | 12750 |

| Latex Concentrates (Drc) | 10700 |

| Others | 1150 |

| Total | 49000 |

Impact of AI on the Industrial Hose Market

The integration of AI technologies is substantially changing the industrial hose market. Powerful predictive maintenance systems and analytics improve the shelf life and efficiency of hoses by predicting wear and tear before they occur. Furthermore, the use of AI in production processes ensures consistency and higher accuracy in hose manufacturing, decreasing defects and enhancing overall quality.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.82 Billion |

| Market Size in 2024 | USD 14.50 Billion |

| Market Size in 2025 | USD 15.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.73% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing use of hoses in the chemical industry

Hoses are used in the chemical industry for suction and discharge purposes because they are created for optimal functions. These hoses need high abrasion and chemical resistivity for the safe transfer of chemical substances. In addition, the industrial hose market products made of plastic materials like polyurethane have strong resistance to kerosene, oil, and gasoline. Which makes them suitable for industry use in chemicals, mining, oil and gas, and agriculture.

Low awareness among end users

Industrial hoses are utilized in several applications under critical conditions and should work properly to carry out the operation. The hoses are damaged because of leaks, bursts, abrasion tube swell, and coupling corrosion. Moreover, the global industrial hose market faces key obstacles to offering optimum quality and preventing manufacturing defects, and most end users are not aware of the concerns associated with hose failures.

New product launches

Providers in the industrial hose market are heavily investing in research and development to launch energy-sufficient and innovative industrial hoses. Major suppliers in the market are fuelling their spending on cutting-edge product launches to control their market position. Furthermore, the increasing demand for vehicles is significantly propelling the market expansion. Silicon, rubber, and PVC hoses are generally used in the manufacturing of hoses used in vehicles.

The rubber segment led the global industrial hose market in 2023. The dominance of the segment can be attributed to the various properties offered by rubber materials, such as durability, flexibility, and exceptional resistance to harsh conditions. Numerous kinds of rubber, like natural rubber and synthetic rubber (neoprene and EPDM), are chosen based on their special properties. In addition, this choice of rubber ensures that industrial hoses can manage the necessary temperatures, pressures, and chemical exposures, offering high performance across a number of applications.

The PVC (Polyvinyl Chloride) segment is anticipated to show the fastest growth in the industrial hose market over the forecast period. The growth of the segment is due to versatility, cost-effectiveness, and other functional characteristics offered by PVC materials products, which are much more flexible and lighter, which makes them easy to install and handle in a variety of applications. Additionally, they provide exceptional resistance to weathering, abrasion, and a wide range of chemicals.

The construction & infrastructure segment dominated the global industrial hose market. The dominance of the segment can be credited to the increasing demand for industrial hoses due to their properties, such as high strength and flexibility. In the construction industry, hoses are important for delivering grout and concrete efficiently, optimizing the swift flow of materials like fuel and water to construction sites. Hoses also play a key role in wastewater and stormwater management systems.

The pharmaceutical industry segment is estimated to grow at the fastest rate in the industrial hose market over the projected period. The growth of the segment can be driven by the rising need for hoses in the pharmaceutical industry as they ensure the efficient and safe transfer of products and other ingredients throughout the production process. These hoses are utilized for carrying liquids, bulk powders, etc between packaging lines and storage tanks. Their applications are in managing high-purity fluids, transferring (APIs), and handling sterile solutions under complete hygienic conditions.

By Material Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024