January 2025

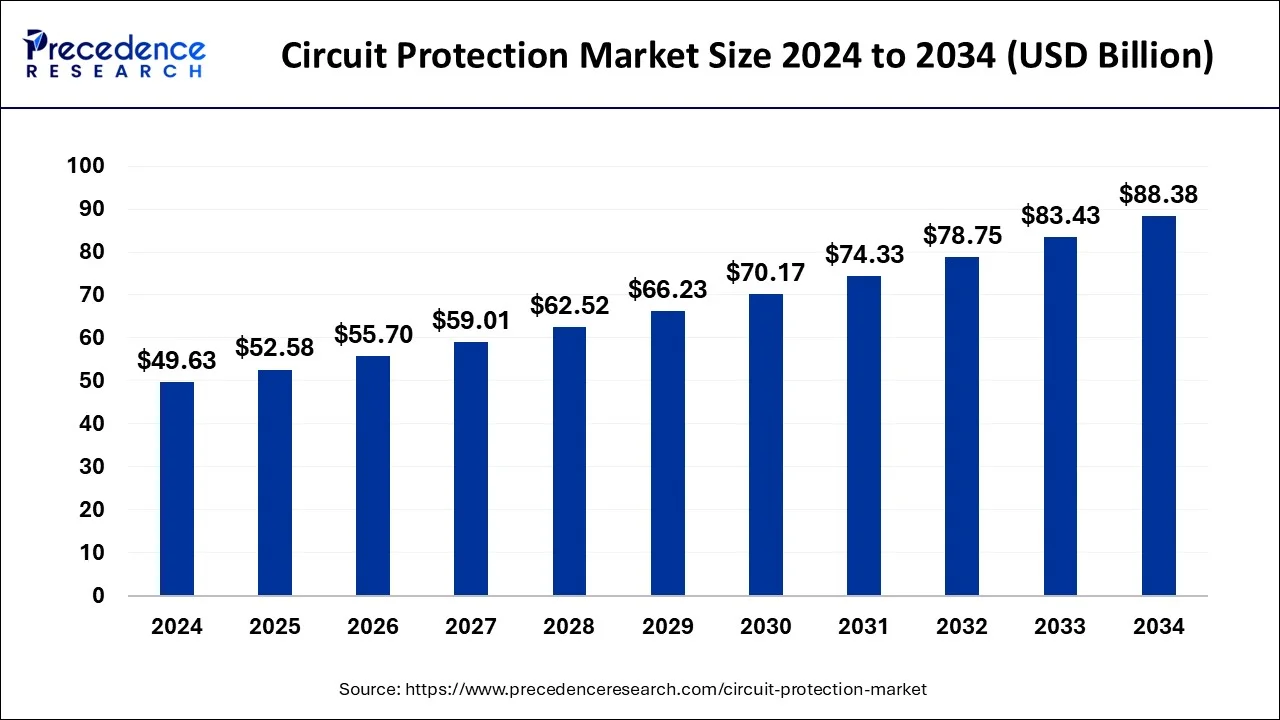

The global circuit protection market size was accounted for USD 49.63 billion in 2024, grew to USD 52.58 billion in 2025 and is predicted to surpass around USD 88.38 billion by 2034, representing a healthy CAGR of 5.94% between 2025 and 2034. The North America circuit protection market size was calculated at USD 17.87 billion in 2024 and is expected to grow at a fastest CAGR of 6.09% during the forecast year.

The global circuit protection market size was estimated at USD 49.63 billion in 2024 and is anticipated to reach around USD 88.38 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034.

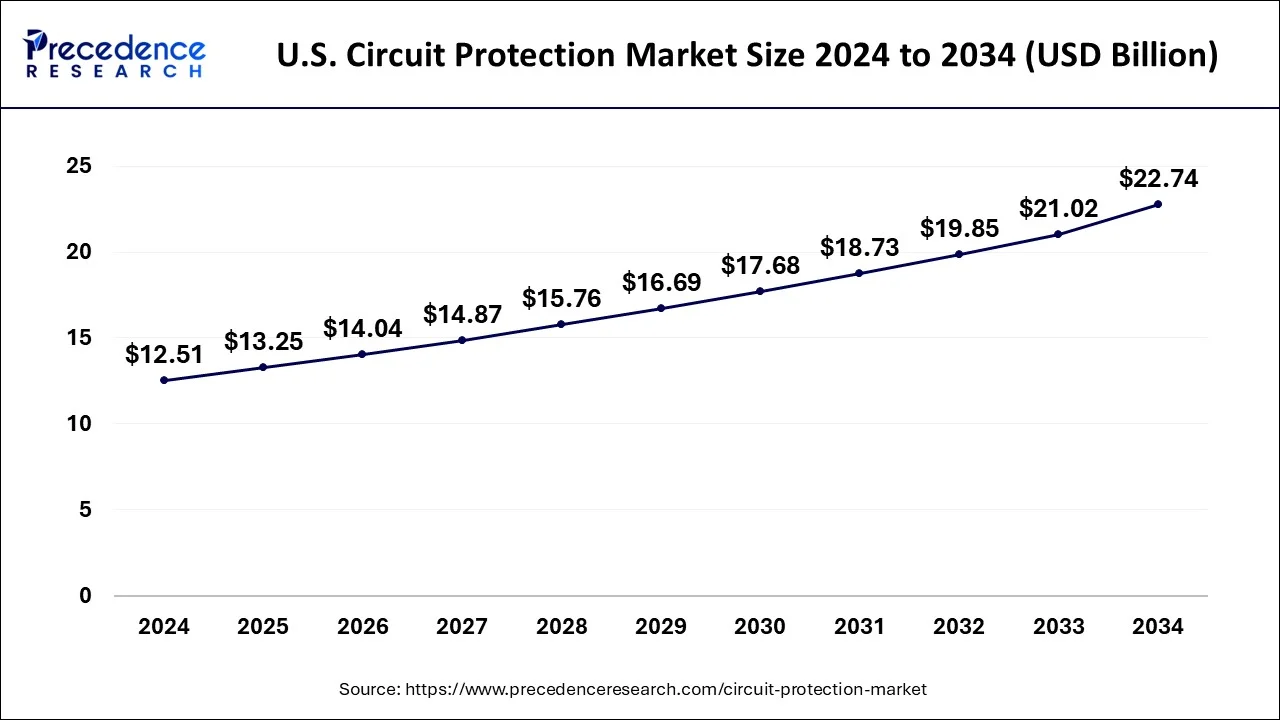

The U.S. circuit protection market size was evaluated at USD 12.51 billion in 2024 and is predicted to be worth around USD 22.74 billion by 2034, rising at a CAGR of 6.16% from 2025 to 2034.

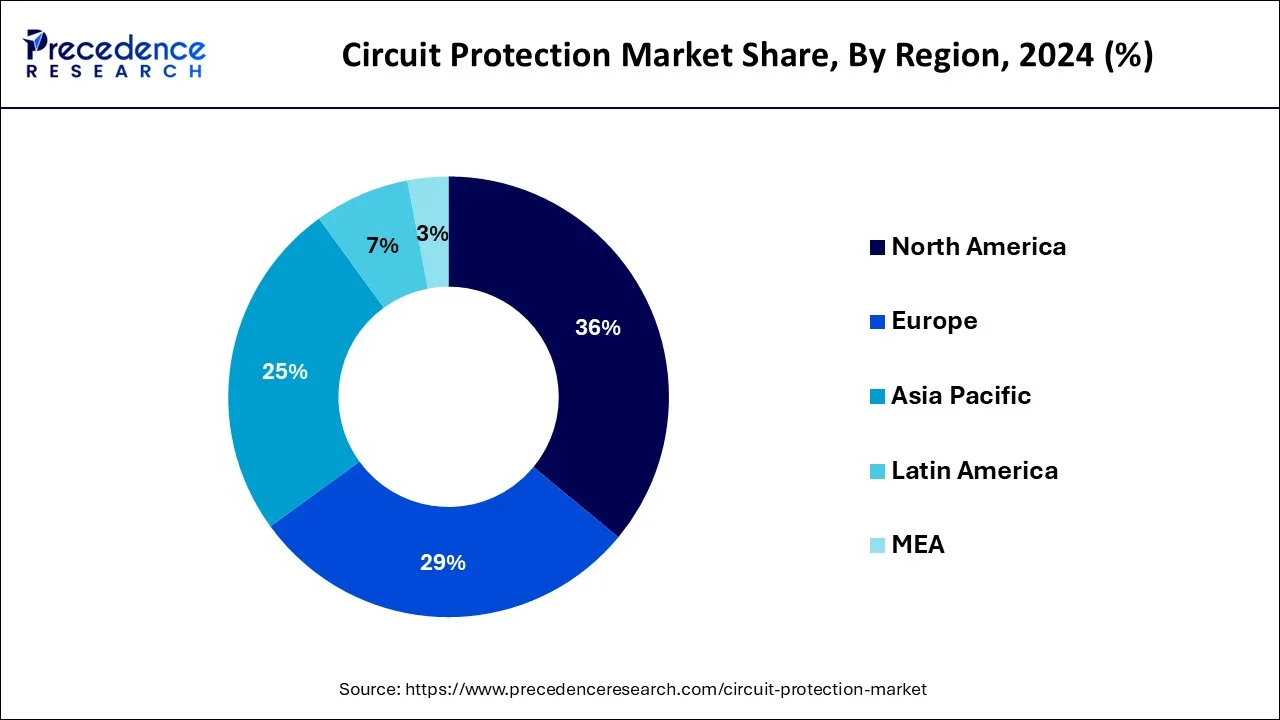

Based on region, North America accounted for around 36% of the market share in 2024. The increased awareness regarding the safety of personnels and electric devices has impeded the market growth in North America. Moreover, the increased industrialization and urbanization, development of strong IT infrastructure, and rising investments to enhance the telecommunication sector has significant contributions towards the growth of the market.

Asia Pacific is estimated to be the fastest-growing segment owing to the rapid industrialization and rapid urbanization in the region. Further, the rising government expenditure on the electrification of rural areas and the development of Smart Cities is anticipated to drive the market growth in the region.

The growth of the global circuit protection market is influenced by various factors such as increased adoption of electronic devices, rapid urbanization, and rising demand for the protection of appliances resulting from power failures. Moreover, the increasing demand for the circuit protection from the various end use applications such as commercial buildings, automotive, telecom, and agriculture is driving the global circuit protection market. The rapid industrialization and rapid urbanization is a major factor that is expected to fuel the demand for the circuit protection. According to the United Nations, Africa and Asia are the two major regions that are being urbanized at the fastest rate. Moreover, rising government expenditure on the electrification in the rural areas of the developing and underdeveloped nations is providing lucrative growth opportunities to the market players. Furthermore, the developments towards the development of smart cities in nations like India is expected to drive the demand.

The rising number of connected devices across the globe, rapid growth of the telecommunications sector, rising investments towards building a strong IT infrastructure, and growing number of residential and commercial buildings across the globe is significantly boosting the growth of the global circuit protection market. The increased adoption of the consumer electronic such as mobile phones, laptops, PCs, LED lights, air conditioners, fans, and washing machines has significant contributions towards the consumption of the circuit protection products. The circuit protection are very efficient at providing protection to the electronic devices from over temperature, overvoltage, and over current. The increased consumption of electricity in the industrial units has positively impacted the market demand in the past years and has exponential contributions in the development of the circuit protection market. Furthermore, the rising demand for the consumer electronics owing to the factors such as increasing disposable income, demand for home improvement, and rising standards of living is expected to drive the adoption of various electronics, which in turn is expected to augment the demand for the circuit protection products across the globe.

| Report Highlights | Details |

| Market Size in 2024 | USD 49.81 Billion |

| Market Size in 2025 | USD 49.81 Billion |

| Market Size by 2034 | USD 80.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.9% |

| Largest Market Size | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, Region |

The circuit breaker segment accounted largest market share in 2024. The increased demand for the smart grids, energy efficiency, and need to protect electrical circuit are the major drivers of this segment. Moreover the development of improved circuit breakers has offered enhanced protection to the electrical circuits. The increasing focus on the generation of huge amount of power including the renewable sources, rising urbanization, and demand for the uninterrupted power supply are the factors that are expected to fuel the segment growth in the upcoming years.

The GFCI segment is estimated to be the most opportunistic segment during the forecast period. The GFCIs protects the persons against the electric shocks. The increased government initiatives to adopt the GFCIs in the commercial and residential buildings is estimated to offer rapid growth of this segment. Moreover, rising safety awareness regarding the protection from electric shocks is anticipated to augment the demand during the forecast period.

The power generation segment led the market in 2024. The increasing demand for the power focusing on the adoption of Green Energy and technological advancements in the power generation sector has augmented the growth of this segment. Further, the rising demand for the efficient, uninterrupted, and flexible power is projected to contribute towards the market growth. Moreover, rapid electrification and urbanization is boosting the consumption of fuse, GFCIs, and other circuit protection products.

The HVAC segment is estimated to be the fastest-growing market during the forecast period. The HVAC stands for heating, ventilation, and air-conditioning. The rapidly growing commercial, industrial, and residential buildings all across the globe have significantly boosted the demand for the circuit protection products. Moreover, the rising urbanization in the underdeveloped markets is expected to drive the segment growth.

Based on distribution channel, the OEM segment dominated the market share in 2024 and is estimated to sustain its dominance during the forecast period. The rising demand for the safe and reliable products that meets the government standards regarding the circuit protection has boosted the growth of this segment.

The wholesale segment is expected to register the highest growth rate during the forecast period. Wholesalers forms a robust and prominent network of distributors. The wholesalers ensure the efficient and regular supply of the circuit protection products and helps to generate a regular revenue stream.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In February 2021 Littlefuse completed the acquisition of Hartland Controls, to strengthen its capabilities.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

By Product

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

August 2024

June 2024