September 2024

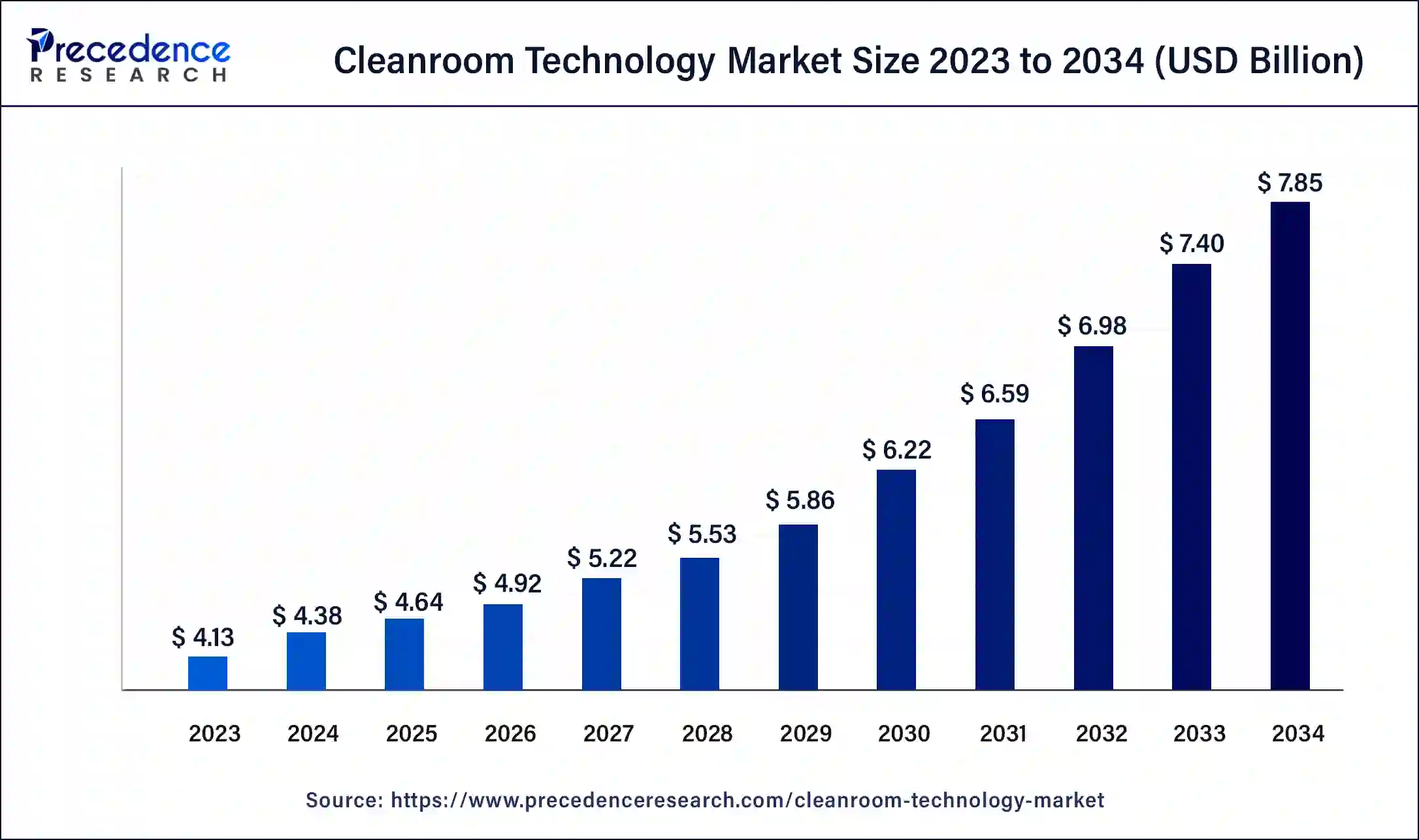

The global cleanroom technology market size was USD 4.13 billion in 2023, calculated at USD 4.38 billion in 2024 and is projected to surpass around USD 7.85 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034.

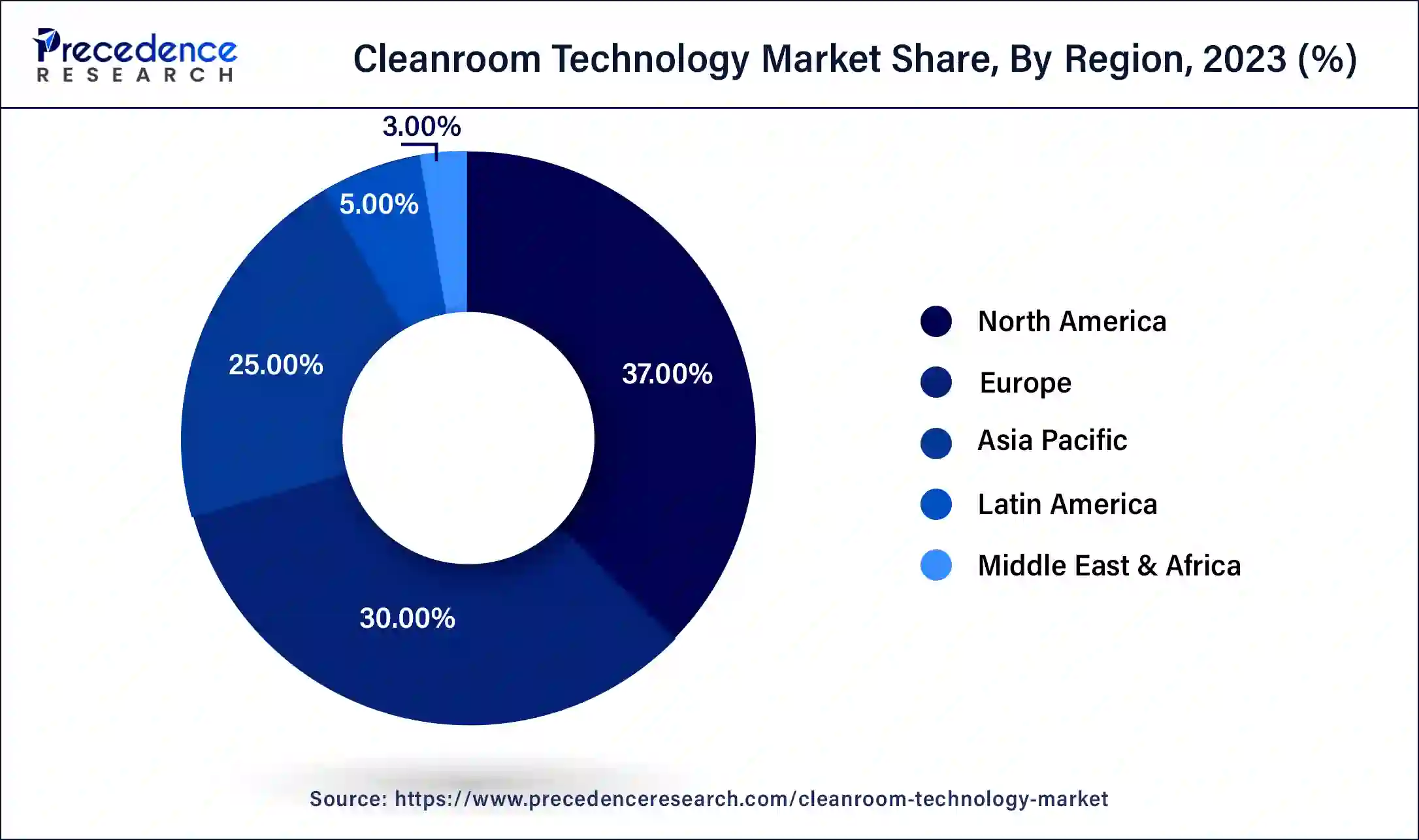

The global cleanroom technology market size accounted for USD 4.38 billion in 2024 and is expected to be worth around USD 7.85 billion by 2034, at a CAGR of 6% from 2024 to 2034. The North America cleanroom technology market size reached USD 1.53 billion in 2023.

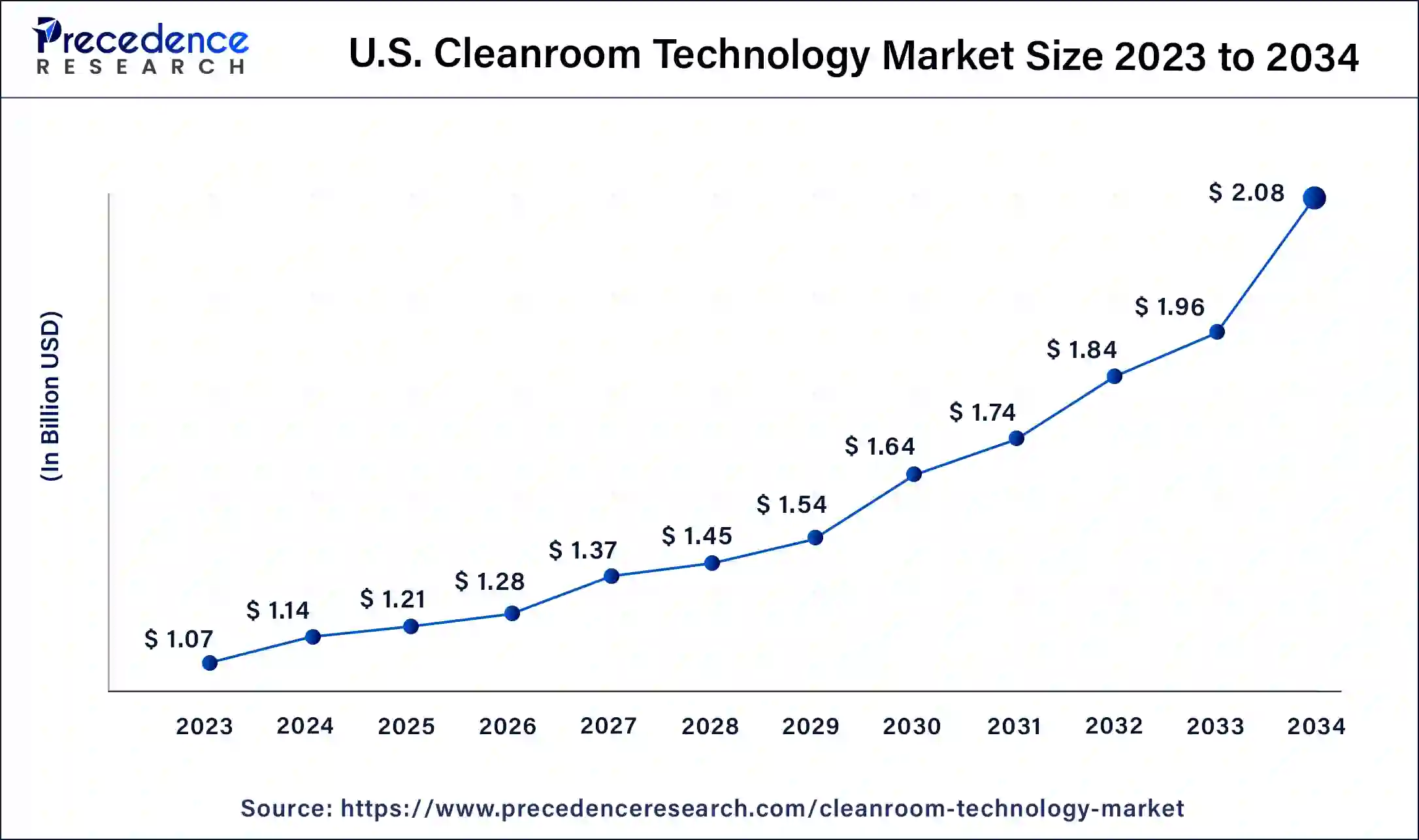

The U.S. cleanroom technology market size was estimated at USD 1.07 billion in 2023 and is predicted to be worth around USD 2.08 billion by 2034, at a CAGR of 6.2% from 2024 to 2034.

North America is the dominant region in the clean room technology market in 2023, driven by the presence of a well-established pharmaceutical and biotechnology industry, stringent regulatory requirements, high healthcare expenditure, and advanced technological capabilities. The pharmaceutical industry in North America is characterized by a high level of research and development activities, advanced manufacturing processes, and a strong emphasis on product quality and patient safety. This drives the demand for cleanroom technology to maintain controlled environments and prevent contamination during drug development and manufacturing processes.

Additionally, the stringent regulatory requirements set by FDA and other regulatory bodies in North America necessitate the use of cleanroom technology to comply with quality and safety standards. Moreover, the high healthcare expenditure in the region, along with the increasing focus on infection control in healthcare settings, further fuels the adoption of cleanroom technology, particularly in hospitals and diagnostics centers. The presence of advanced technological capabilities and a strong manufacturing base in North America also supports the dominant position of the region in the clean room technology market.

Cleanroom technology refers to a technological environment designed and constructed to minimize the presence of airborne particles, such as dust, bacteria, and other contaminants, to maintain a controlled level of cleanliness. Cleanrooms are commonly used in pharmaceuticals, biotechnology, electronics, aerospace, and healthcare industries, where maintaining a sterile or particle-free environment is crucial for product quality, safety, and regulatory compliance.

Cleanroom technology has gained significant traction recently due to increasing awareness about maintaining clean and controlled environments in various industries. The market for cleanroom technology has witnessed steady growth, driven by factors such as the growing demand for high-quality and contamination-free products, stringent regulatory requirements, and advancements in manufacturing processes and technologies.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.13 Billion |

| Market Size in 2024 | USD 4.38 Billion |

| Market Size by 2034 | USD 7.85 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Stringent regulatory standard

Cleanroom technology has stringent regulatory standards imposed by various industries. Industries such as pharmaceuticals, biotechnology, electronics, and healthcare are subject to strict regulations to ensure product quality, safety, and compliance with industry standards. Cleanrooms play a crucial role in meeting these regulatory requirements. For instance, in the pharmaceutical and biotechnology industry, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established guidelines such as Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) that mandate the use of cleanrooms for manufacturing, processing, and packaging of drugs and medical devices.

Failure to comply with these regulations can result in severe consequences, including product recalls, fines, and loss of reputation. Similarly, cleanrooms are essential in the electronics and semiconductor industry to prevent contamination during manufacturing processes, such as wafer fabrication, assembly, and testing, to ensure the production of high-quality and reliable electronic components. Cleanroom standards such as ISO 14644 and Federal Standard 209E set specific limits for airborne particle counts in cleanrooms, which are strictly regulated to meet industry requirements.

The need to comply with these stringent regulatory standards is a driving force for adopting cleanroom technology, as companies strive to meet the requirements and maintain compliance with industry regulations.

High initial investment

Cleanroom technology requires a significant upfront investment for the design, construction, and maintenance of cleanroom facilities. These facilities need to meet strict standards and regulations, including specialized HVAC systems, air filtration systems, and monitoring equipment, which are expensive to install and maintain. As a result, the high initial investment is a restraint for the growth of the cleanroom technology market, especially for small and medium-sized enterprises (SMEs) or startups with limited financial resources.

Stringent regulatory compliance

Cleanroom technology is subject to various regulatory standards and guidelines, such as ISO 14644, FDA guidelines, and EU GMP, which require strict compliance. Ensuring adherence to these regulations is complex and time-consuming, involving regular testing, monitoring, and documentation of various parameters, such as airborne particle counts, temperature, humidity, and pressure differentials. Non-compliance results in fines, product recalls, and damage to the reputation of the company. Meeting these stringent regulatory requirements is a restraint for some companies, particularly those with limited expertise or resources, to implement and maintain the necessary compliance measures, which impact their entry and growth in the cleanroom technology market.

Increasing demand for advanced manufacturing processes

The cleanroom technology market presents opportunities with the growing demand for advanced manufacturing processes in various industries such as pharmaceuticals, semiconductors, electronics, aerospace, and automotive, among others. Advanced manufacturing processes often require clean and controlled environments to ensure high-quality production, and cleanroom technology provides the necessary infrastructure to meet these requirements. As industries continue to advance and adopt new technologies, the demand for cleanroom technology is expected to increase, presenting opportunities for companies involved in the design, construction, and maintenance of cleanroom facilities.

Focus on energy efficiency and sustainability

As sustainability and environmental concerns become more prominent, there is a growing emphasis on developing cleanroom technologies that are energy-efficient and environmentally friendly. There is an opportunity for companies to invest in research and development to develop cleanroom solutions that minimize energy consumption, reduce waste, and incorporate renewable energy sources. Additionally, incorporating sustainable materials and construction practices in clean room facilities can also be an opportunity to attract environmentally conscious customers and meet green building certifications.

As the demand for eco-friendly cleanroom solutions increases, companies that prioritize energy efficiency and sustainability can gain a competitive edge and capitalize on the growing market for environmentally responsible technologies.

Based on product, cleanroom technology is segmented into equipment and consumables. In 2023, the equipment segment accounted for the major market share. Cleanroom equipment refers to the specialized machinery, tools, and systems used in the design, construction, operation, and maintenance of cleanroom facilities.

This includes HVAC (Heating, Ventilation, and Air Conditioning) systems, air filtration systems, laminar flow systems, cleanroom enclosures, air showers, and other specialized equipment that is essential for creating and maintaining a clean and controlled environment. Cleanroom equipment is critical for controlling airborne particles, temperature, humidity, and other parameters to meet the stringent requirements of cleanroom standards and regulations. Higher costs, longer lifespans, greater significance in compliance and functionality, customization, and technological advancements drive the growth of this segment. Clean room equipment requires substantial investment, has a longer lifespan, and is critical for compliance and performance of clean room facilities. Customization and innovation in clean room equipment also contribute to its dominance in the market.

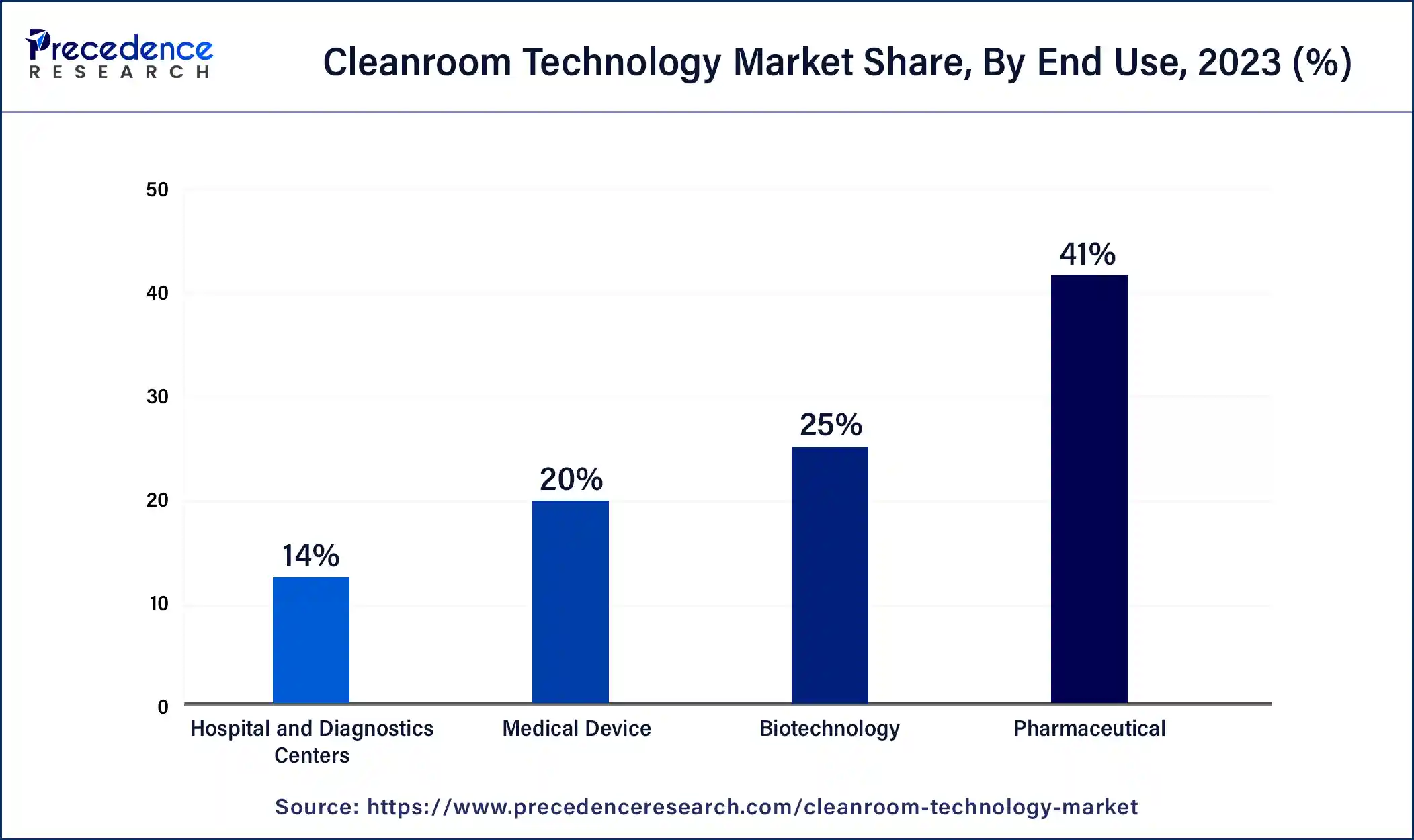

Based on end-use, the market is segmented into Pharmaceutical, Medical devices, Biotechnology, Hospital and diagnostics centers. In 2023, the pharmaceutical segment dominated the market and is expected to continue its dominance throughout the forecast period. The segment growth is driven primarily due to strict regulations and standards, the criticality of clean environments, increasing demand for pharmaceutical products, complex and diverse manufacturing processes, and a strong focus on patient safety and product quality.

The pharmaceutical industry is subject to stringent regulations and standards, such as good manufacturing practices (GMP) and FDA guidelines, to ensure the safety, efficacy, and quality of pharmaceutical products. Cleanroom technology is extensively used in various stages of pharmaceutical manufacturing, including drug development, production, packaging, and testing, to maintain sterile and controlled environments, prevent contamination, and comply with regulatory requirements.

In addition, the criticality of clean environments in the pharmaceutical industry cannot be overstated. To prevent cross-contamination, protect product integrity, and ensure patient safety, pharmaceutical manufacturing facilities require highly controlled and sterile environments. Cleanroom technology plays a vital role in maintaining the required air quality, temperature, humidity, and particulate levels, which are crucial for the production and storage of pharmaceuticals.

Segment Covered in the Report

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2023

February 2025

November 2024