March 2025

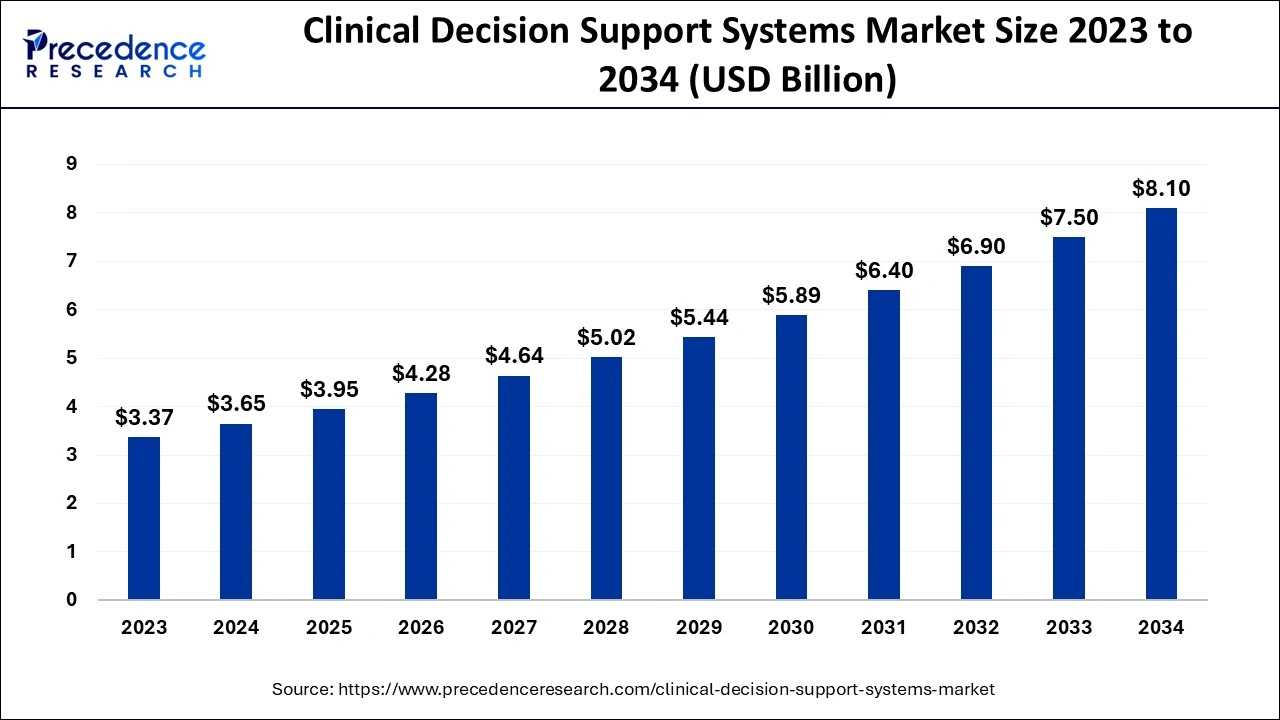

The global clinical decision support systems market size accounted for USD 3.65 billion in 2024, grew to USD 3.95 billion in 2025 and is predicted to surpass around USD 8.10 billion by 2034, representing a healthy CAGR of 8.30% between 2024 and 2034. The North America clinical decision support systems market size is calculated at USD 1.68 billion in 2024 and is expected to grow at a fastest CAGR of 8.42% during the forecast year.

The global clinical decision support systems market size is estimated at USD 3.65 billion in 2024 and is anticipated to reach around USD 8.10 billion by 2034, expanding at a CAGR of 8.30% from 2024 to 2034.

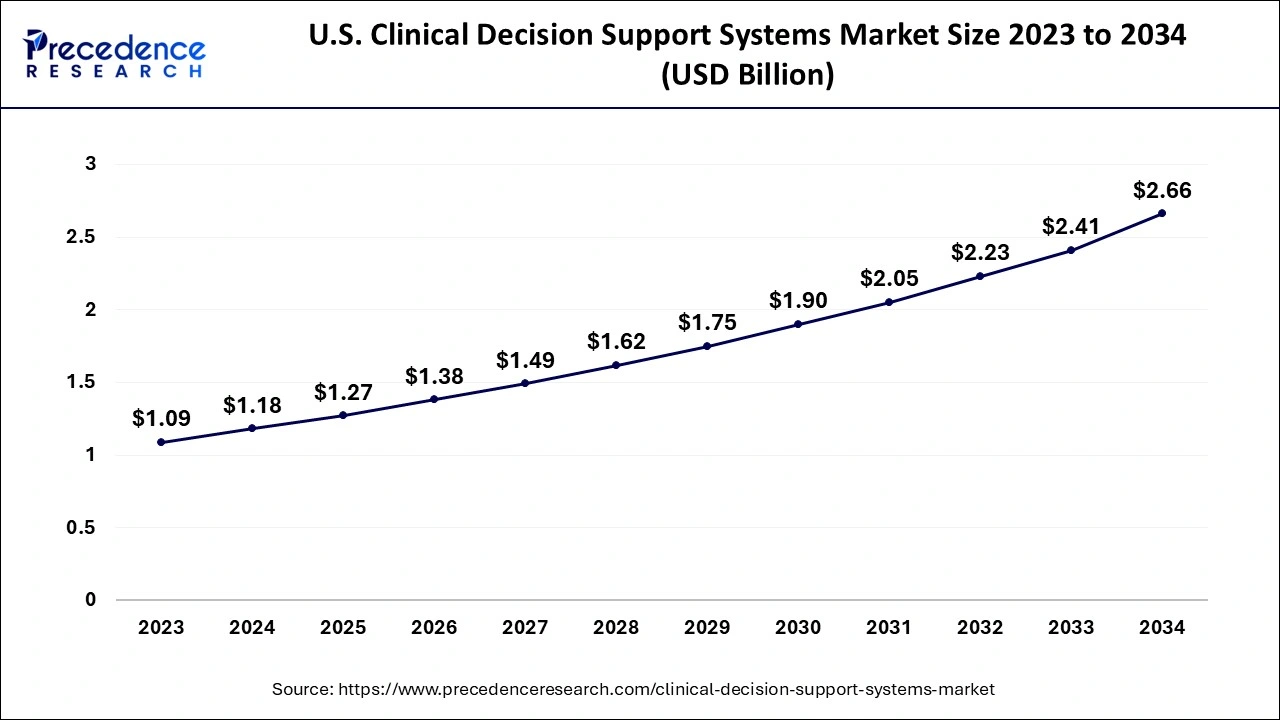

The U.S. clinical decision support systems market size is evaluated at USD 1.18 billion in 2024 and is predicted to be worth around USD 2.66 billion by 2034, rising at a CAGR of 8.45% from 2024 to 2034.

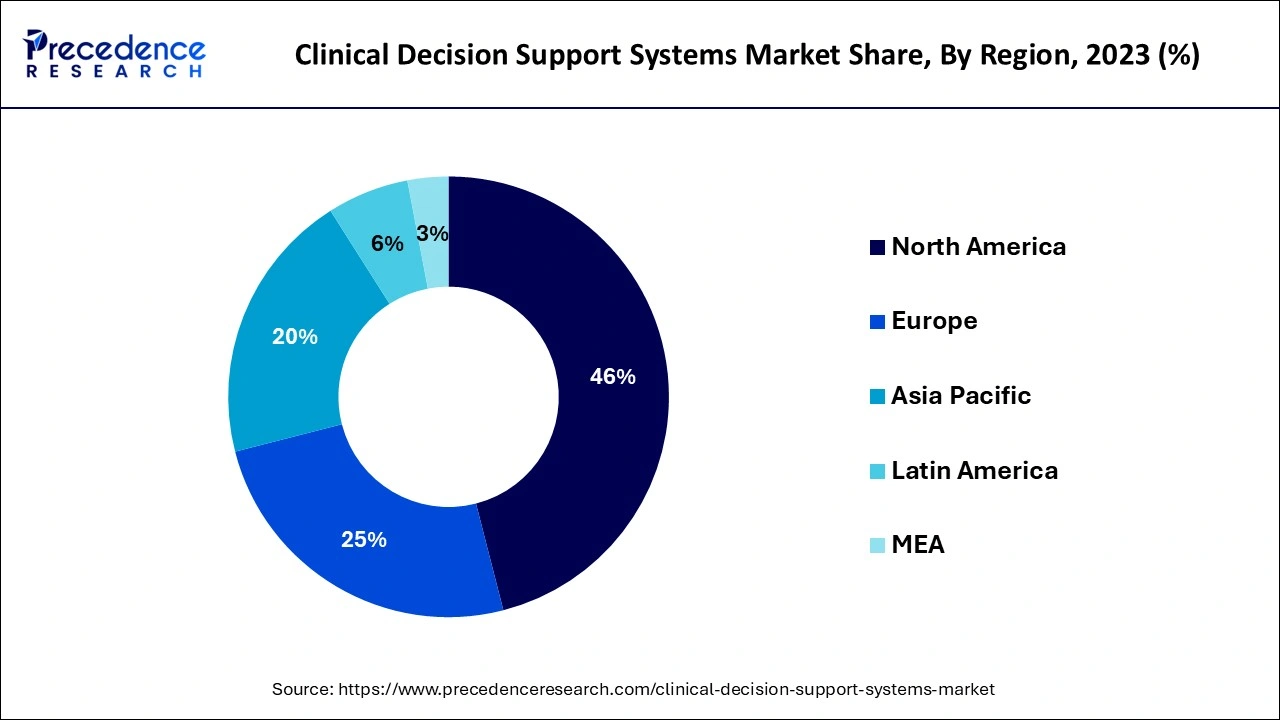

The North American region dominated the global CDSS market and had the largest revenue share 46% in the year 2023. The increasing demand for information technology solutions in the health care industry or the medical industry has led to the growth of the market. There's an increased importance for providing quality healthcare and rapid technological advancements these factors help in providing for the growth of the market in this region.

The Asia Pacific market is also expected to have a good growth during the forecast period. There are increasing investments in the healthcare sector in various countries like India China Japan and Australia. Improved research and development techniques and the expenditure and investments by the government in this field are the reasons which are helping increasing the penetration of information technology in the medical industry.

As there is an increasing demand for quality care services and integrated reliable technical solutions. The market for clinical decision support systems is expected to grow during the forecast period. Many hospitals and healthcare service providers are adopting the use of clinical decision support systems as many favorable initiatives are taken by governments across the world. FDA and CE mark are the regulatory authorities of the clinical decision support systems market. FDA and CE mark set the various criteria for the launch of various platforms. These platforms that are introduced which are in the developmental phases need to fulfill all the criteria which is set by these organizations. They need to adhere to the cyber laws. The products should assure integrity and non-violation of information technology.

In order to curb the pandemic, the clinical decision support systems vendor and the organizations have taken initiatives to do so. These vendors played an important role in fighting against COVID-19. Efforts were taken in order to develop various tools for combating the pandemic. A CDS tool was developed named CORAL.

In the recent years there has been a good growth in the number of health care facilities and hospitals of various types that are adopting the clinical decision support systems. The demand for clinical decision support systems is expected to grow during the forecast period due to the increased demand for these systems. The use of this system which is based on real time knowledge or factual evidence is expected to see a quicker growth rate. As it becomes difficult to manage each and every patient that visits the clinics for the hospital there is an increased use of clinical decision support systems in these hospitals. Due to increased advancements in the field of bioinformatics and biotechnology or providing improvements and optimization in the management analytics and data storage platforms.

The market is expected to grow well during the forecast period as there are a large number of innovations due to the research and development projects. Increasing investments and integration of cloud computing are leading the growth of the market It is promoting seamless data flow and smooth functioning in the hospital facility as the market is expected to grow during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.65 Billion |

| Market Size by 2034 | USD 8.10 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.30% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Delivery Mode, Component, Model, Type, Level of Interactivity, Settings and Geography |

On the basis of product, the standalone CDSS segment had the largest revenue share till the year 2023 which was about 32%. The segment will continue to keep on growing during the forecast period as it is easy to use in various hospitals setups and also the clinical setups. There is an increased adoption of CDSS and systems which help in improving the efficiency of the clinical care which helps in saving time for gathering information about the patient's history. When the standalone CDSS system is integrated with the electronic health records they provide a better output this integrated segment is expected to see a good growth during the forecast period. There is a great adoption of these systems due to increased awareness about the benefits of this system in multi-specialty healthcare units.

The system helps in providing solutions and suggests the medication that could be prescribed for the patient. The automation in the clinical workflow will help in saving time and provide efficient solution in services to the customers.

On the basis of application, the drug allergy alert segment had about 28% of the revenue in the previous years. The growing importance of the systems that could provide allergy alerts as many people are allergic to specific drugs is an extremely important benefit of such systems. There is increase in the drug allergies amongst the patients. Therefore when drugs are prescribed to a particular patient the dispensing and administering of a drug may cause adverse effects and it could spoil the case even more. Proper care needs to be taken when prescribing these drugs to a particular patient.

The clinical guideline segment is also expected to have a lucrative growth during the forecast. This system provides the guidelines for diagnosis and treatments of a particular disease these guidelines help a practitioner in retrieving data in order to utilize it for the treatment of the patient and also prescribes various guidelines that he needs to follow during the treatment course which helps in providing the quality services to the patients.

On the basis of the components, the services segment hit largest market share 43% in 2023. Advancements in the use of the software and the skills to use these softwares have helped in rendering quality services to the patients. It also involves software as well as hardware upgrades. The software segment is also expected to have a lucrative growth during the forecast. When the CDs software is used in integration with the EHR help in providing better decision support for customers and special results in patients.

On the basis of delivery mode, the on-premise system segment accounted largest market share 42% in 2023. The on premise segment is expected to have a good growth during the forecast. A trained person for the use of these software and the access ability provided by these systems as they are set up in the organization provide an upper hand in the growth of the market. The second largest revenue share was held by the cloud-based systems.

Cloud based systems have an application in healthcare sector due to the innovation and information technology. These systems are cost effective and reliable. In order to provide services to the end user the cloud providers help in installing and managing the software for the use of the practitioner. Data which is stored on the web is easily accessible with the use of various devices so the web based devices system is also expected to grow during the forecast. The web based systems provide accurate diagnosis of various health conditions.

By Product

By Application

By Delivery Mode

By Component

By Model

By Type

By Level of Interactivity

By Settings

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025