March 2025

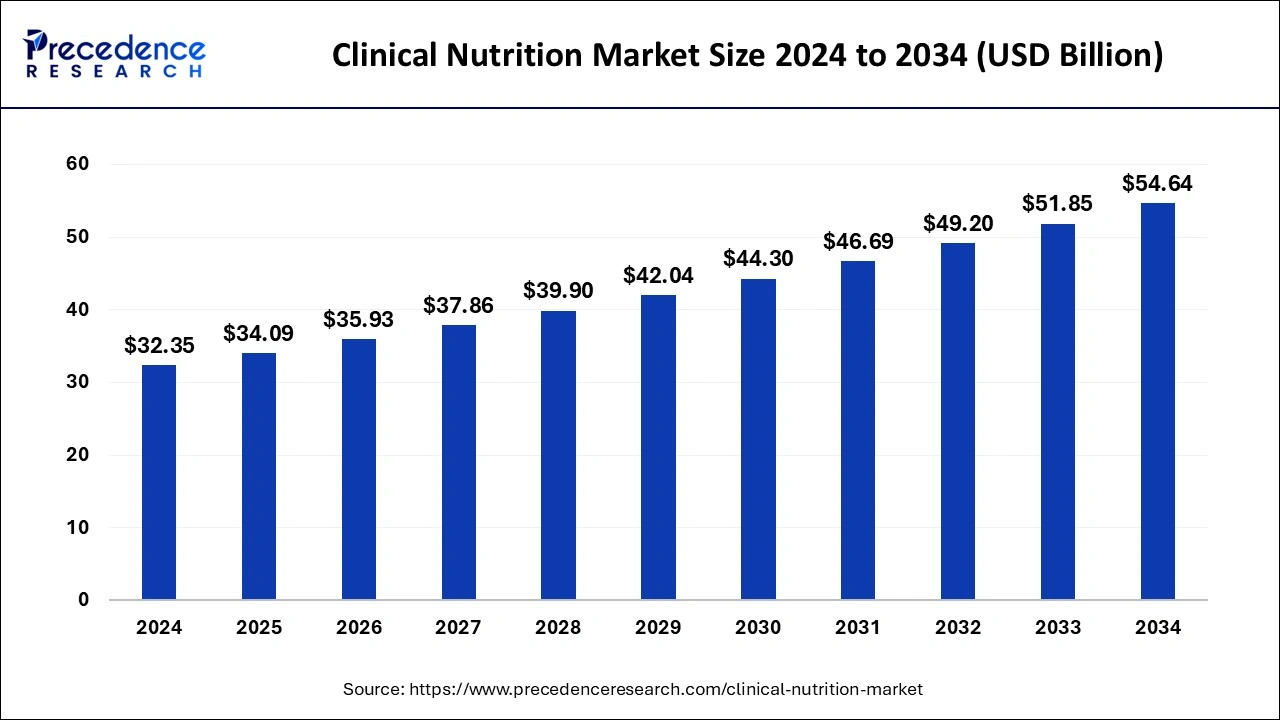

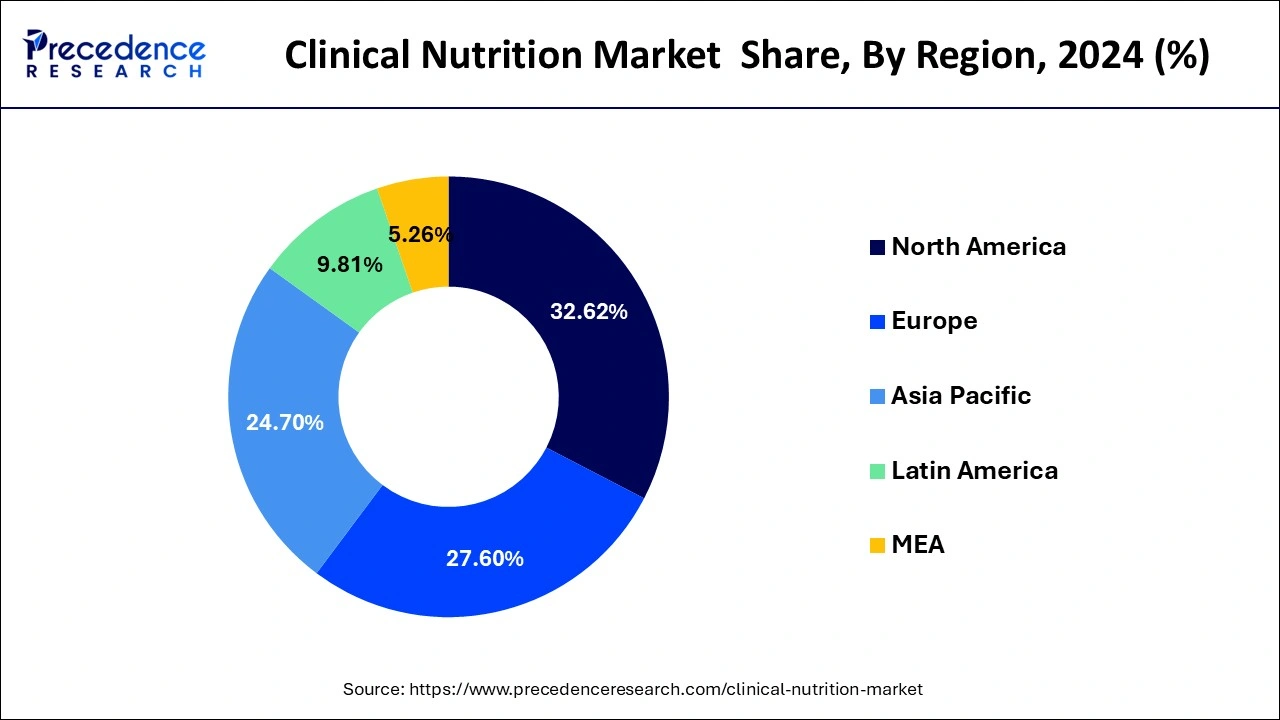

The global clinical nutrition market size is calculated at USD 34.09 billion in 2025 and is forecasted to reach around USD 54.64 billion by 2034, accelerating at a CAGR of 5.38% from 2025 to 2034. The North America clinical nutrition market size surpassed USD 10.55 billion in 2024 and is expanding at a CAGR of 5.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global clinical nutrition market size was accounted for USD 32.35 billion in 2024 and is anticipated to reach around USD 54.64 billion by 2034, growing at a CAGR of 5.38% from 2025 to 2034. The increasing prevalence of chronic diseases, the rising geriatric population, and growing demand for personalized nutrition drive the growth of the market.

In the field of healthcare, AI evolved as a game-changer solution that helps analyze large data sets to find upcoming tendencies, adjust formulas, and foresee buyers’ preferences. Supply chain management is one of the areas where healthcare companies turn to AI to increase effectiveness and decrease expenses. AI algorithms are widely used in nutritional deficiency detection, where they analyze the body condition and suggest the required diets. The capabilities of AI to analyze and store huge datasets are being used to develop new products according to consumer preferences. Additionally, AI accelerates the development of innovative nutritional products.

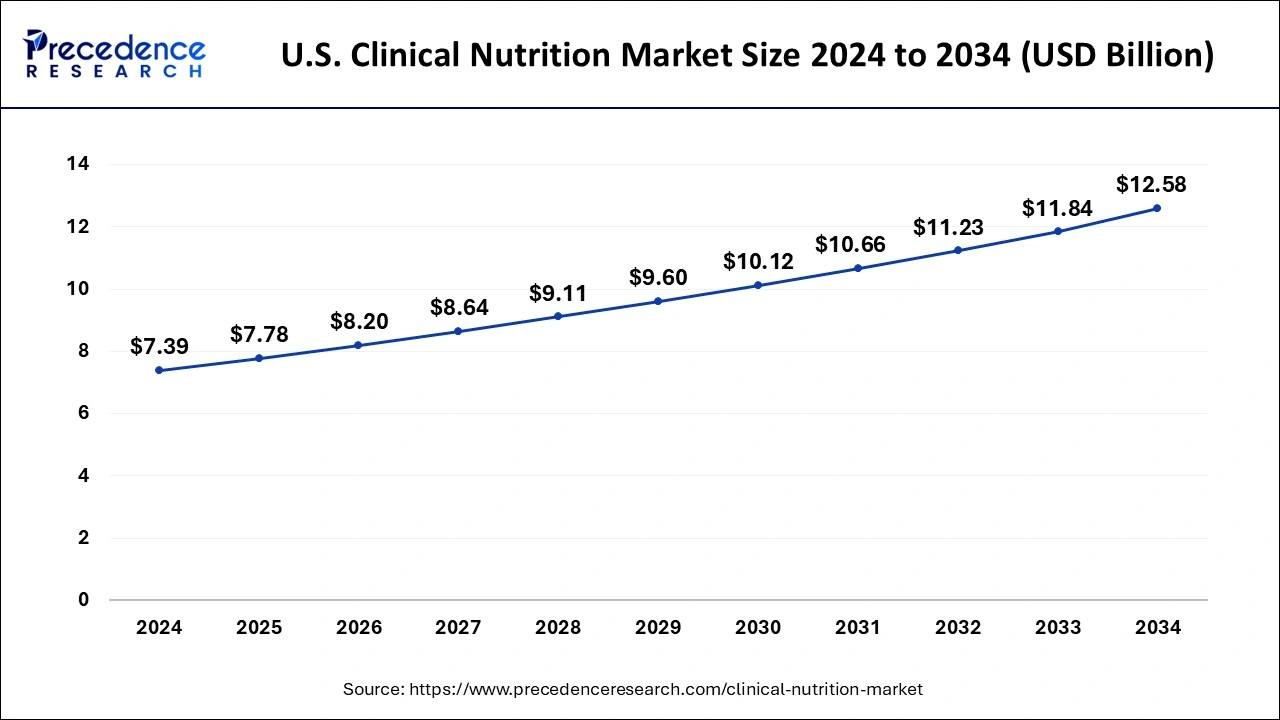

The U.S. clinical nutrition market size was exhibited at USD 7.39 billion in 2024 and is projected to be worth around USD 12.58 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

The North America segment dominated the global clinical nutrition market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. Due to significant research and development spending, the presence of large businesses and their product availability, and the region’s well established healthcare infrastructure.

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. The governments are spending in the construction of healthcare infrastructure; the Asia-Pacific is predicted to have the greatest CAGR during the forecast period.

The nutrition of patients in the healthcare industry is referred to as clinical nutrition. The goal of clinical nutrition is to help patients maintain a good energy balance while also providing essential nutrients such as minerals, vitamins, and protein. Clinical nutrition has several advantages, including its effectiveness in treating diabetes and its ability to help people live better at any age. Clinical nutrition products are given to people who are unable to absorb or chew food products.

Clinical nutrition sales are driven by expanding product lines, a constant newborn birth rate, and an aging population. The rise in the incidence of chronic diseases, the number of patients using sophisticated clinical nutritional products, and the growing concern about malnutrition are driving the clinical nutrition market growth. Additionally, changing consumer preferences in food consumption, as well as rising demand for nutritional products, are likely to boost the growth of the market during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 34.09 Billion |

| Market Size by 2034 | USD 54.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.38% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Route of Administration, End User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Awareness of Pediatric Nutrition

Heightened awareness about the importance of pediatric nutrition is likely to fuel the market’s growth. Parents and healthcare providers increasingly prioritize balanced nutrition during critical growth phases to prevent stunting, underweight, and developmental delays. According to the NHI, the global goal to reduce stunting in children under five by 40% and decrease childhood wasting to below 5% by 2025 has driven the demand for tailored dietary products in impacted regions. This demand is majorly driven by subsidies and awareness campaigns set by governments of emerging economies with high birth rates for pediatric nutrition programs. Moreover, changing consumer patterns in terms of diet and the rising consumption of nutritional products boost the market.

Restraint

High Product Cost and Regulatory Challenges

High costs associated with clinical nutrition products are anticipated to restrain the market growth, particularly in low- and middle-income countries. Specific compounds, intricate technologies used, and rigorous quality control standards elevate production costs and, therefore, the end products' prices. These products are expensive, and not everyone can afford them. Furthermore, obstacles such as regulatory frameworks, a lack of reimbursement policies, and limited government sponsorships for clinical nutrition products hinder market growth.

Rise of E-commerce

E-commerce platforms allow nutrition manufacturing companies to expand consumer reach. Consumers increasingly prefer to purchase healthcare products online because of affordability, better options, and product variety with home delivery services. Thus, it is expected that the manufacturers’ efforts to use digital marketing and data analytics for online sales management translate into a competitive advantage. E-commerce enhances the accessibility of products even in underserved regions.

Based on the route of administration, the oral dominates the clinical nutrition market during the forecast period. The increased focus on maintaining a robust immune system has resulted in an increase in demand for oral clinical supplements. The use of oral nutrition in combating malnutrition will contribute to the oral clinical nutrition segment growth.

On the other hand, the parental is expected to grow at rapid pace during the forecast period. The rising frequency of malnutrition among children, particularly in emerging and underdeveloped nations around the world, is one of the primary factors expected to boost demand for parental nutrition.

Based on the application, the metabolic disorders dominate the clinical nutrition market during the forecast period. The demand for clinical nutrition is increasing as the prevalence of metabolic diseases rises. Obesity, diabetes, malnutrition, and cardiovascular diseases contribute to increased hospitalization.

On the other hand, the cancer is expected to grow at rapid pace during the forecast period. Cancer is becoming more common, and people are becoming more aware of the importance of clinical nutrition in cancer treatment. Cancer is one of the top causes of death around the world

Based on the end user, the pediatric dominates the clinical nutrition market during the forecast period. This is attributed to the global incidence of malnutrition and related issues. Malnutrition is a major cause of high mortality and morbidity, particularly in developing and underdeveloped nations.

On the other hand, the geriatric is expected to grow at rapid pace during the forecast period. The geriatric population faces number of disorders. The geriatric population is above 65 years, who requires good amount of nutrition. This factor is driving the growth of the segment.

Key Companies & Market Share Insights

For expansion and diversification, these significant market players place a premium on strategic activities such as new product launches, collaborations, partnerships, and commercialization. Moreover, these industry leaders are heavily spending in research to enable them to introduce novel products to the market and maximize income and profit. Nestle Health Science signed agreement to buy IM HealthScience in August 2020. As public awareness of clinical nutrition grows, so does demand for adult and pediatric nutrition formulae. As a result, key market players are working to provide nutritional solutions that meet all of the needs of the target population around the world.

By Route of Administration

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025