December 2024

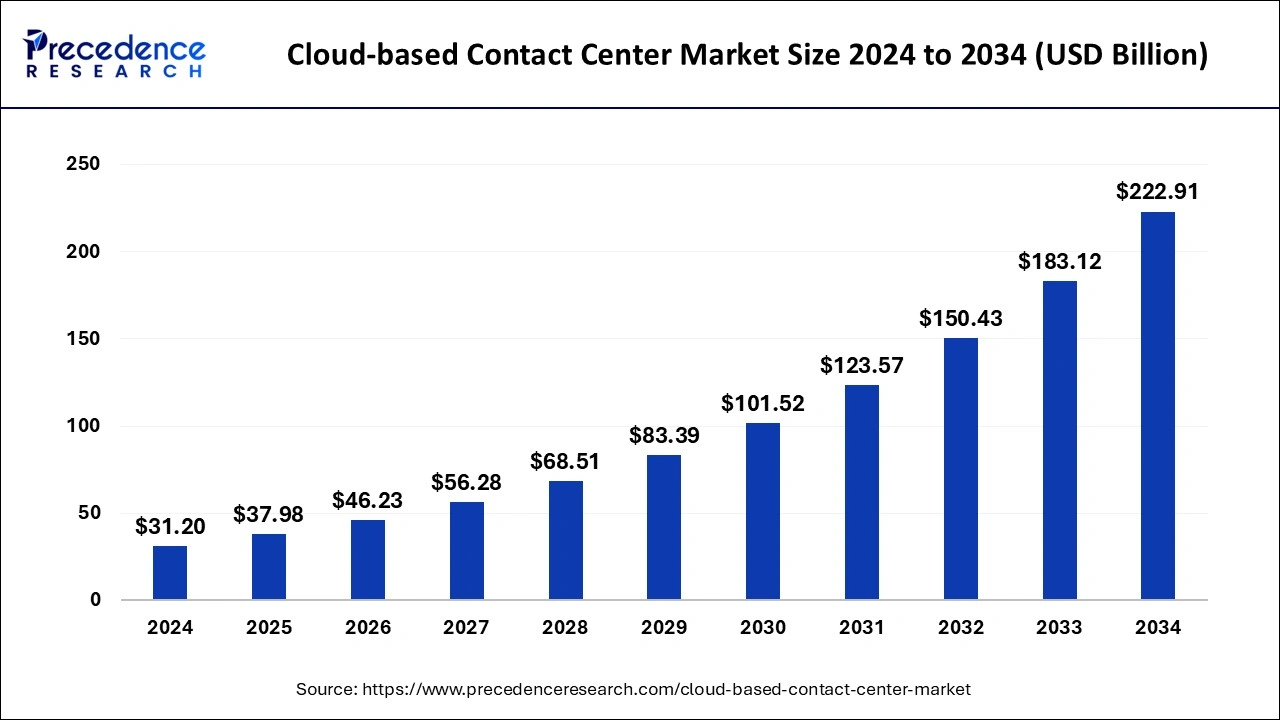

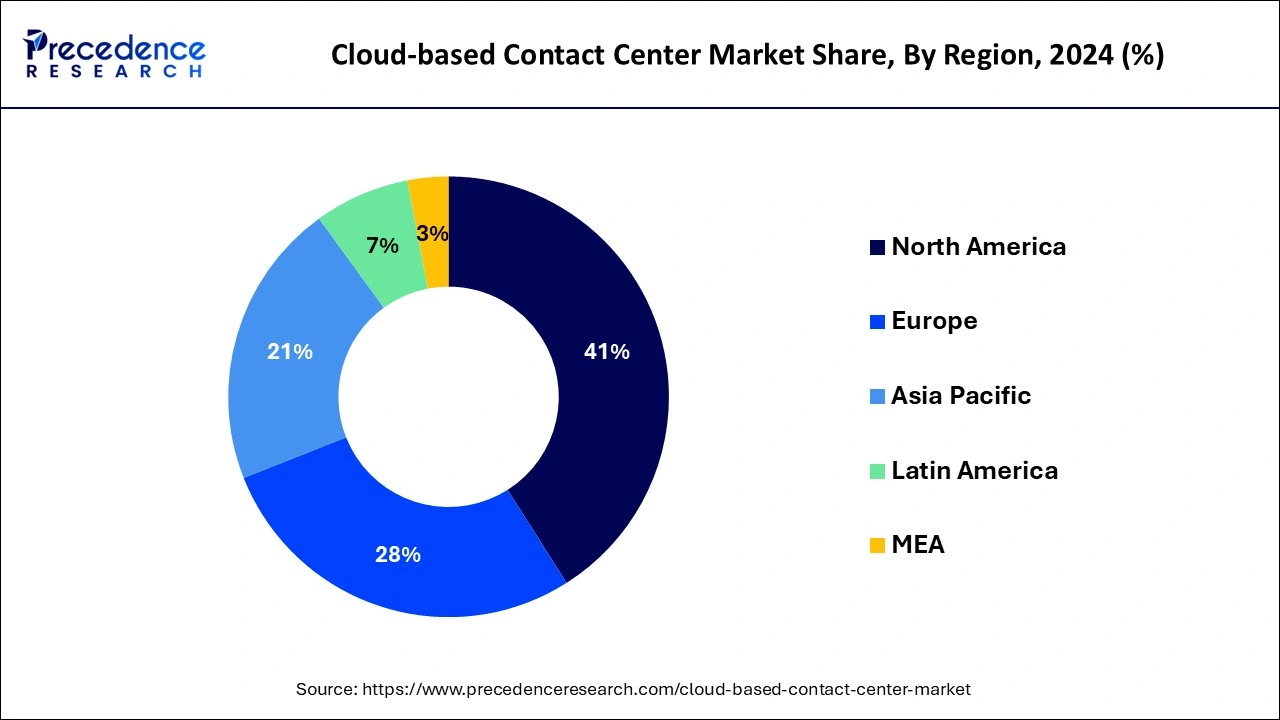

The global cloud-based contact center market size is calculated at USD 37.98 billion in 2025 and is forecasted to reach around USD 222.91 billion by 2034, accelerating at a CAGR of 21.73% from 2025 to 2034. The North America cloud-based contact center market size surpassed USD 12.79 billion in 2024 and is expanding at a CAGR of 21.88% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud-based contact center market size was estimated at USD 31.20 billion in 2024 and is predicted to increase from USD 37.98 billion in 2025 to approximately USD 222.91 billion by 2034, expanding at a CAGR of 21.73% from 2025 to 2034. The cloud-based contact center market is driven by a smooth, customized omnichannel consumer journey.

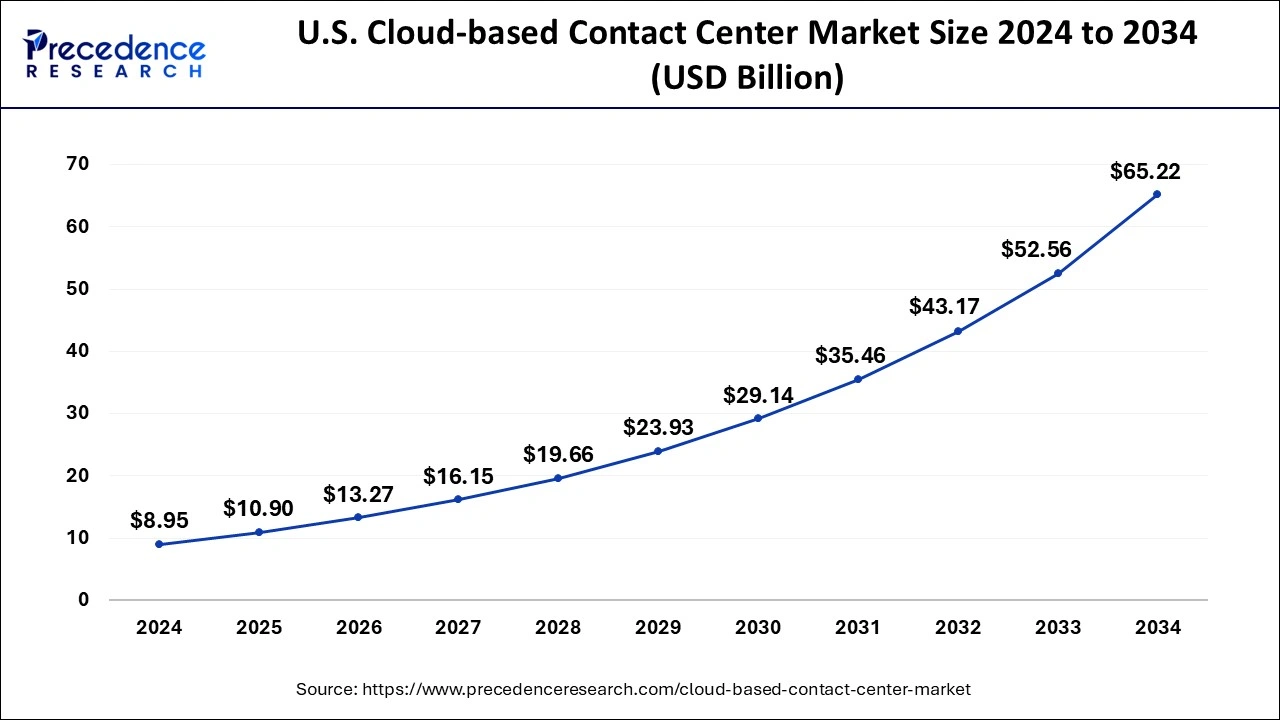

The U.S. cloud-based contact center market size was valued at USD 8.95 billion in 2024 and is predicted to cross USD 65.22 billion by 2034, expanding at a CAGR of 21.97% from 2025 to 2034.

North America, in 2024, dominated the cloud-based contact center market and the region is observed to sustain the position throughout the forecast period. Due to the large population base and strong demand for customer support services, cloud-based contact center solutions are becoming increasingly popular to manage customer interactions effectively.

The internet has been more widely used, allowing companies to use cloud-based solutions for consumer engagement without making significant infrastructure investments. Because cloud-based models do not require large upfront investments in software and hardware infrastructure, they are more affordable for small and medium-sized organizations (SMEs) and regional businesses.

The cloud-based contact center market offers services associated with communication hub using cloud-hosted call center technology, that manages all incoming and outgoing client calls and phone, email, SMS, social media, and online communications. Scalability is a feature of cloud-based contact centers that makes it simple for companies to grow or shrink in response to changing demands. Businesses that are increasing or in season will find this flexibility especially helpful.

It has integrated analytics tools that offer insightful information about consumer interactions. Companies can use these data to find patterns, boost customer satisfaction, and increase operational effectiveness. Additionally, it has disaster recovery and redundancy built in, guaranteeing continuous operation even in the event of hardware malfunctions or outages. Sustaining consumer satisfaction and business continuity depends heavily on this resilience.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.73% |

| Market Size in 2025 | USD 37.98 Billion |

| Market Size by 2034 | USD 222.91 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Organization Size, By Organization Size, and By Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of SMAC technologies

Cloud-based contact center solutions allow businesses to scale up or down as needed without making large infrastructure expenditures by utilizing cloud infrastructures scalability to accommodate fluctuating workloads readily. The analytics features that SMAC technology offers give important insights into customers' trends, interests, and behavior. Cloud-based contact centers use these analytics to improve customer experiences, streamline operations, and spur corporate expansion. Thereby, the rising adoption of SMAC technologies create a significant driver for the cloud-based contact center market.

Improved customer experience

Scalability is a feature of cloud-based contact centers that enables companies to quickly and effectively adapt resources to changes in demand. This guarantees that client inquiries are handled promptly. Using a cloud-based contact center removes the requirement for substantial hardware and infrastructure upfront expenditures. Businesses can choose subscription-based models instead, which lower total expenses and increase return on investment. Thereby, the improved customer experience offered by such centers offer a significant driver for the cloud-based contact center market.

Rising risk of cybercrimes

Processing and keeping sensitive client data in the cloud raises the possibility of cyberattacks like malware, hacking, and data breaches. Businesses are concerned about the security and accuracy of their data. Ransomware attacks are one type of cybercrime that can interfere with contact center operations, leading to lost productivity, downtime, and financial losses. This interruption may negatively impact the contact center's general effectiveness and performance in a chain reaction. Customer trust can be lost, and reputational harm can result from a cyberattack on a cloud-based contact center. Consumers might be reluctant to interact with a contact center that has been compromised in terms of security, which could result in a decline in business and income. Such concerns act as a major restraint for the cloud-based contact center market.

Expansion of e-commerce

Customer contacts, including questions, support requests, and sales-related correspondence, rise along with e-commerce. Scalable and adaptable customer support solutions are therefore required. Customer queries and assistance requests fluctuate frequently for e-commerce enterprises, particularly during sales events or peak seasons. Cloud-based contact centers ensure optimal resource use by scaling up or down to handle different workloads easily.

Agents may rapidly obtain customer and order data with cloud-based contact center solutions that link with CRMs and e-commerce platforms. The customer experience is improved overall, and efficiency is increased through this integration. Since e-commerce runs around the clock, customer service must be offered. The ability to deliver continuous help independent of time zones or geographic locations is made possible by cloud-based contact centers. Hereby, the expansion of e-commerce sector is observed to act as an opportunity for the cloud-based contact center market.

Growth in the healthcare industry

The proliferation of telehealth services demands that patients and healthcare practitioners have strong lines of communication. Cloud-based contact centers provide adaptable and scalable ways to handle this surge in demand effectively. Healthcare companies can optimize costs and improve operational efficiency by adjusting resources in response to changing demand due to the scalable nature of cloud-based solutions.

Cloud-based contact centers enable remote access for healthcare agents in line with the trend toward remote work, allowing them to operate from any location and stay in touch with colleagues and patients.

The services segment dominated the cloud-based contact center market with the largest revenue share in 2024. Many companies use specialized service providers to handle their contact center operations because they can use their experience, scalability, and affordability. Businesses are looking for service providers who can help them optimize their contact center operations to increase customer happiness and loyalty as the emphasis on providing excellent customer experiences grows. By utilizing cloud-based contact center services, businesses can save money using pay-as-you-go pricing structures, cheaper maintenance costs, and less infrastructure investment.

The solutions segment witnessed a significant growth in the cloud-based contact center market during the forecast period. Cloud-based solutions remove the necessity for significant upfront investments in hardware and infrastructure. Subscription-based approaches, however, provide contact centers with predictable recurring costs and lower upfront prices. It frequently interacts smoothly with other business systems like customer relationship management (CRM) platforms, improving data exchange and expediting departmental procedures.

The large enterprises segment dominated the cloud-based contact center market in 2024. Large businesses usually have complicated processes and sizable consumer bases. Scalability provided by cloud-based contact center solutions enables these businesses to quickly grow or shrink their customer support departments without making significant infrastructural investments. Cloud-based contact center solutions make Greater flexibility and agility possible, which help big businesses rapidly adjust to shifting consumer demands and market situations. Without waiting for protracted deployment delays or disrupting their operations, they can quickly incorporate new channels, features, and functionalities.

The small and medium enterprises (SMEs) segment show a significant growth in the cloud-based contact center market during the forecast period. SMEs can scale their operations up or down by business needs by utilizing cloud-based contact center solutions. Because of its scalability, SMEs won't have to deal with the trouble of buying and installing more gear or software to adapt to changes in call volumes or business growth. Compared to conventional on-premises systems, it can be implemented more quickly. However, the installation and configuration procedures are frequently more involved. Due to this rapid deployment, SMEs may swiftly adopt new contact center capabilities or adjust to shifting market conditions.

The public segment held the largest share of the market in 2024. Public cloud solutions offer a cost-effective alternative to traditional on-premises contact center infrastructure. With public cloud services, organizations can avoid hefty upfront investments in hardware, software licenses, and infrastructure maintenance. Instead, they can pay for cloud services on a subscription basis, scaling resources up or down as needed, which aligns with their operational budgets and cost optimization strategies.

The private segment is observed to witness a significant rate of expansion during the forecast period. Private cloud solutions provide organizations with greater customization and control over their contact center environments compared to public cloud platforms. Organizations can tailor the infrastructure, applications, and configurations to their specific needs, workflows, and business requirements. This level of customization enables organizations to optimize performance, scalability, and resource allocation based on their unique operational needs and objectives.

The BFSI segment dominated the cloud-based contact center market in 2024. Multichannel communication is necessary in the BFSI sector to accommodate a wide range of consumer preferences. The ability to seamlessly integrate several communication modes, including chat, email, voice, and social media, is provided by omnichannel features found in cloud-based contact centers. Advanced analytics and reporting tools offered by cloud-based contact centers help BFSI businesses learn essential lessons about customer interactions. These insights aid in process optimization, customer experience enhancement, and service quality improvement.

The telecommunication segment shows a significant growth in the cloud-based contact center market during the forecast period. Cloud-based solutions are being adopted by telecom businesses more frequently to improve their customer service offerings. Cloud-based contact centers' scalability, flexibility, and cost-effectiveness allow telecom firms to handle consumer questions and support services effectively. The growth of cloud-based contact centers is driven by the telecoms industry's growing need for omnichannel communication solutions.

Telecom firms offer integrated and consistent customer experiences via chat, email, social media, and phone due to these solutions. These technologies enhance customer pleasure and loyalty by enabling smooth communication channels, intelligent call routing, and individualized customer interactions.

By Component

By Organization Size

By Deployment Mode

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

January 2025

February 2025