January 2025

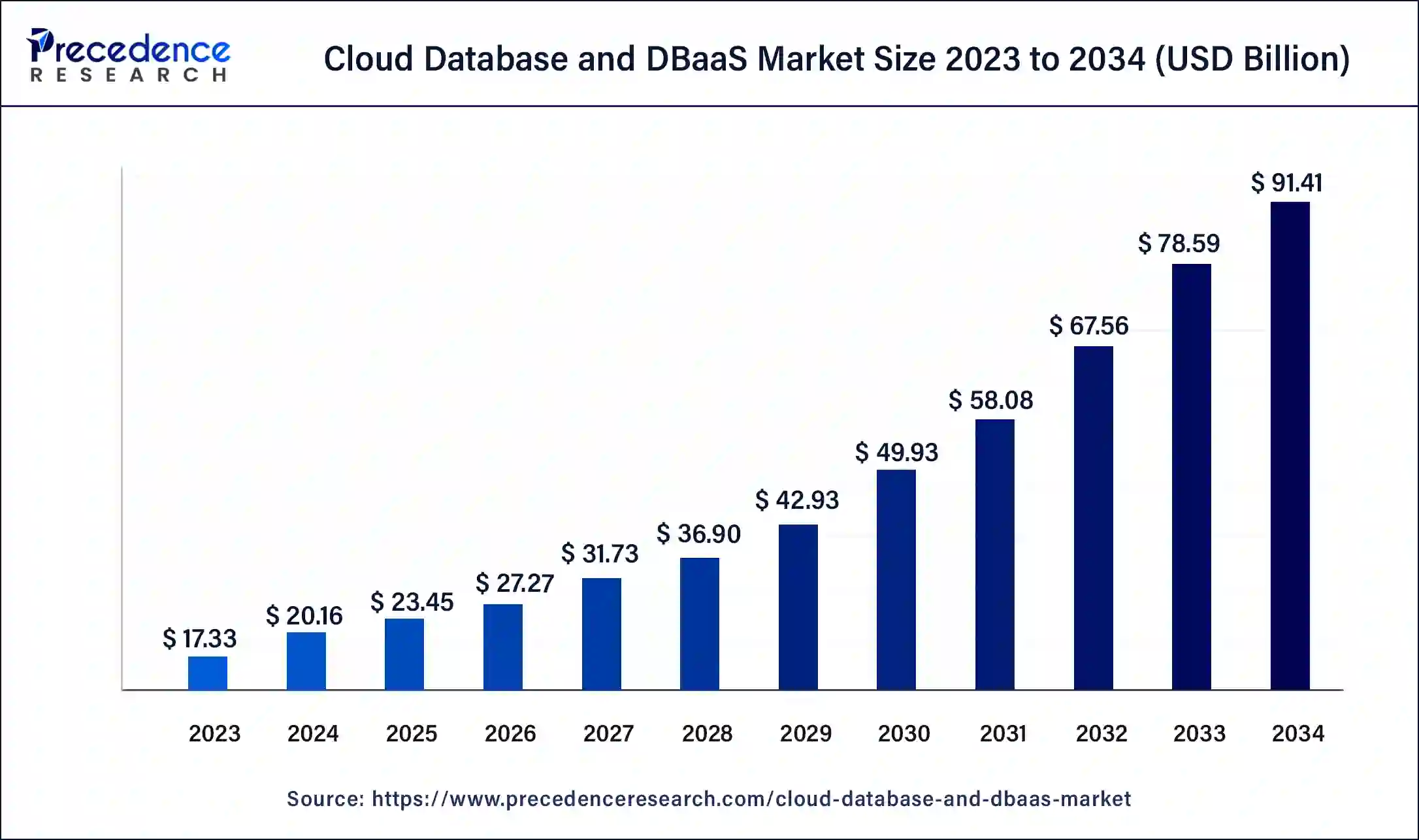

The global cloud database and DBaaS market size is projected to be worth around USD 91.41 billion by 2034 from USD 20.16 billion in 2024, at a CAGR of 16.32% from 2025 to 2034. The North America cloud database and DBaaS market size reached USD 6.24 billion in 2023. Increasing digitalization across the globe and the generation of huge amounts of unstructured data in various sectors that need to be managed efficiently are the major driving factors of the cloud database and DBaaS market.

The incorporation of AI into the cloud database and DBaaS is bound to proliferate the global cloud database and DBaaS market. AI has advanced capabilities like data analytics by using machine learning algorithms, which is helpful in extracting meaningful information from huge datasets that will boost business growth further by making the decision-making process easier. AI integration with the cloud database offers excellent features like automated database tuning for significant cost savings and improvisation of overall performance.

To optimize the operational efficiency of cloud databases, the proactive approach of AI minimizes downtime, which accelerates the cloud database and DBaaS market expansion further. This can be achievable due to the predictive abilities of AI, even with huge datasets and changing patterns, which, in turn, ensures data management and security at an optimum level.

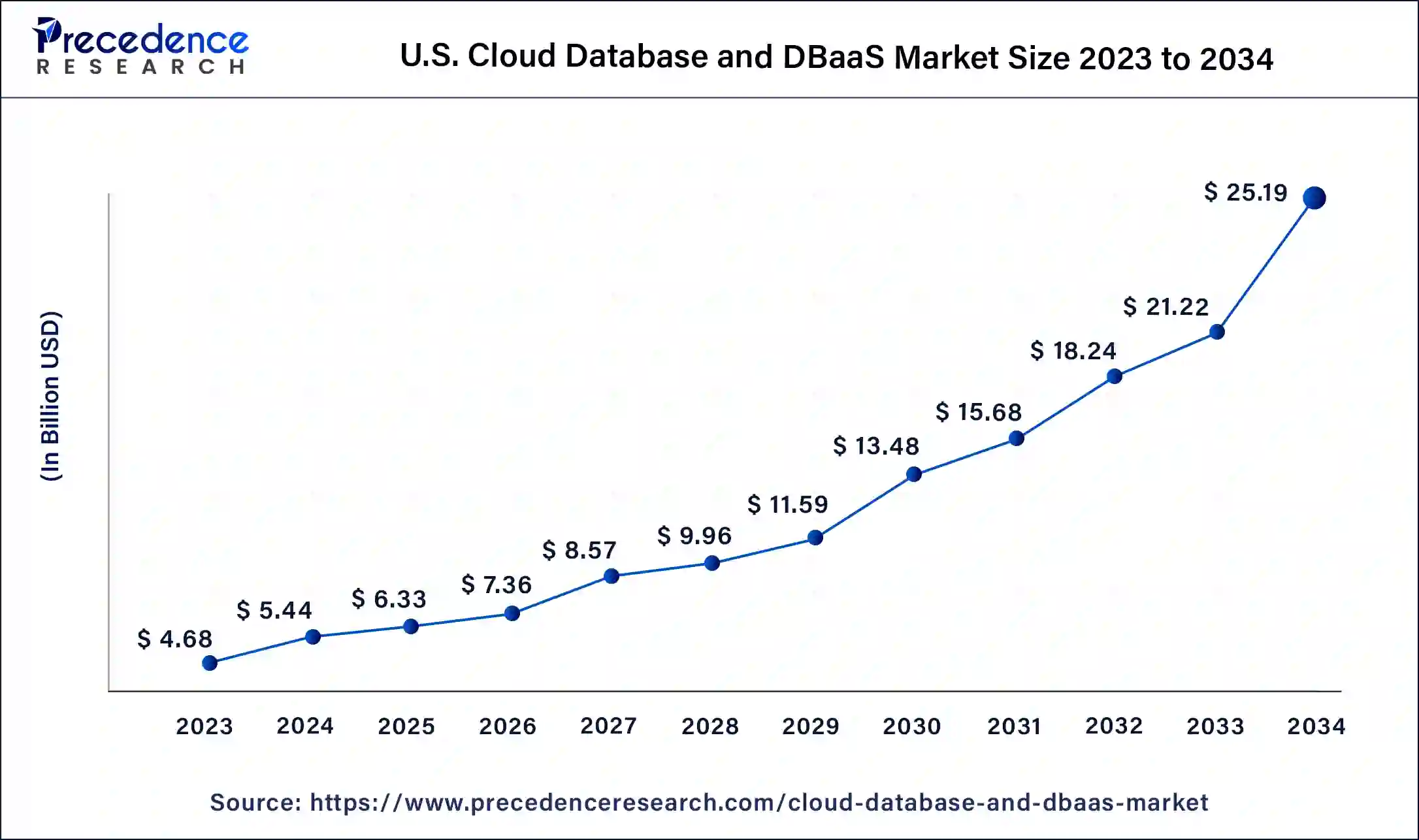

The U.S. cloud database and DBaaS market size was exhibited at USD 5.44 billion in 2024 and is projected to be worth around USD 25.19 billion by 2034, poised to grow at a CAGR of 16.53% from 2025 to 2034.

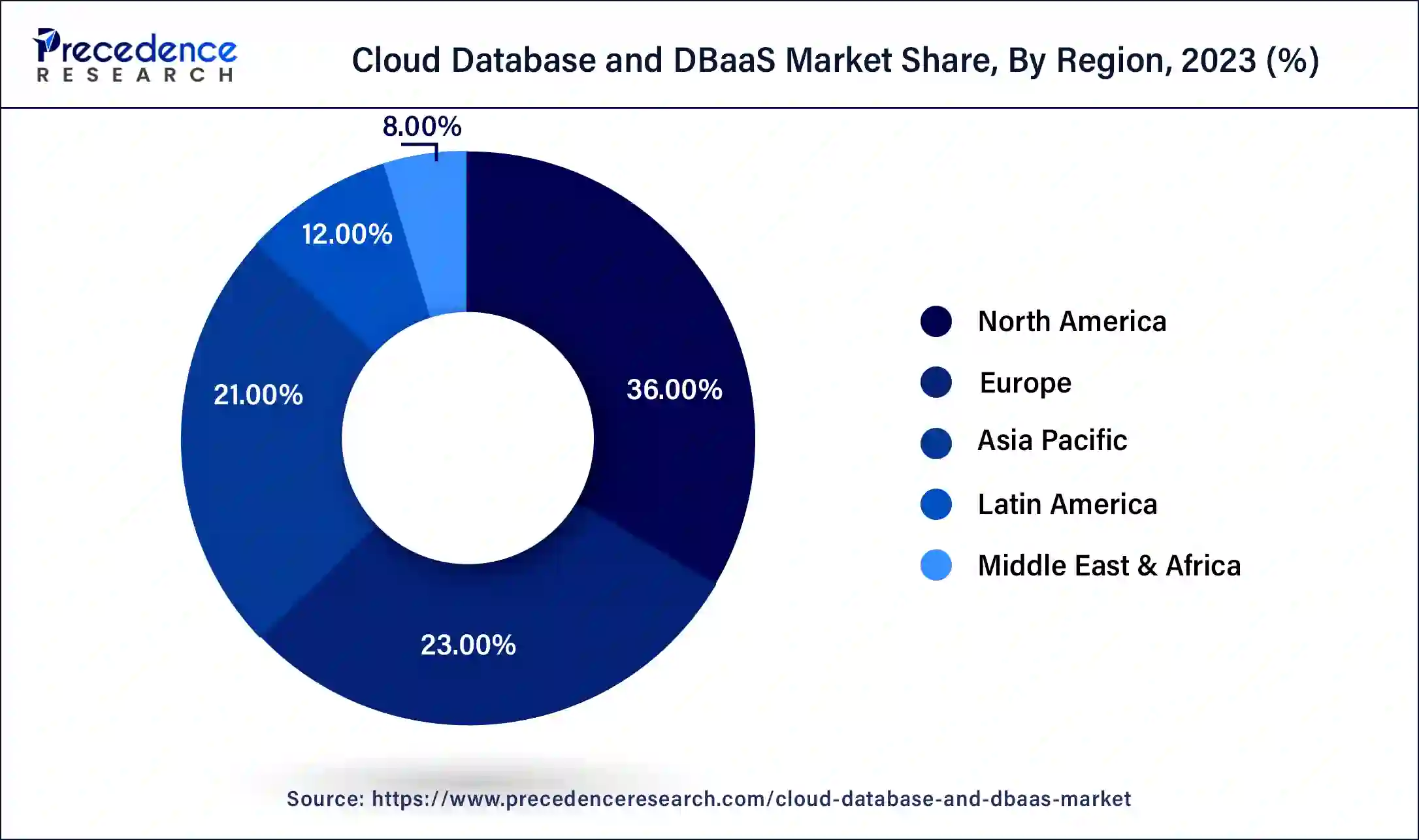

North America accounted for the largest share of the cloud database and DBaaS market in 2024. The growth of this region is attributed to several factors, including the rise of internet of things (IoT) and data analytics across North America. The expansion of cloud computing is again a propelling factor for the market. A number of businesses opt for cloud databases to upload and manage their data efficiently. Moreover, major key players in the region are launching innovative updates.

Asia Pacific is expected to grow at the highest CAGR in the cloud database and DBaaS market during the foreseeable period. The growth of this region can be attributed to emerging economies like China, Japan, and India investing heavily in cutting-edge technologies like cloud computing to become a frontier in the technology race. China is developing a powerful impact in the market for cloud databases owing to supportive government regulations and technological advancements with innovations in cloud database systems.

India is proliferating in this market due to the growing IT sector along with the increasing pace of digitalization across several industries. According to the data provided by Colliers International, nearly 40% of Indian organizations will likely adopt cloud services by the end of year 2024. Initiatives such as Digi locker, a unified mobile application for new-age governance-UMANG, are some examples of rising digitalization across India.

How does Europe impact the Cloud Database and DBaaS Market?

Europe is expected to grow at a notable rate in the foreseeable future in the cloud database and DBaaS market. This is because strong digital transformation initiatives where increasingly adopting cloud-based database solutions as part of their digital transformation efforts, stringent data protection regulations such as the General Data Protection Regulation, and an emphasis on data security, contributed to market growth. Additionally, many countries like Germany and the UK are at the forefront of cloud database adoption, encouraging data security and governance.

The cloud database and DBaaS market are experiencing a significant growth rate owing to major factors like rising cloud computing adoption in the global market across various sectors. Various organizations are continuing to shift their operations to the cloud platform as the demand for flexible, highly scalable, and cost-effective database solutions has hype recently.

The cloud database and DBaaS market is proliferating due to the reduced management requirements to handle solely, ease of use, and key drivers such as the rising need for real-time data analytics, inclination towards serverless computing, and the expansion of big data applications. Ongoing innovations in AI-based database optimization, including enhanced features for security purposes, are driving the market further. Key players in the market, like Microsoft Azure, AWS, and Google Cloud, are leading the market globally, as they offer numerous solutions for various business needs.

Despite several growing factors, barriers like vendor lock-in, stringent regulations, and, most importantly, the rising security concerns among businesses are impeding the cloud database and DBaaS market. However, as the market evolves with time, technological advancements are happening to resolve these challenges, which will further boost the growth of the market globally.

| Report Coverage | Details |

| Market Size by 2034 | USD 91.41 Billion |

| Market Size in 2025 | USD 23.45 Billion |

| Market Size in 2024 | USD 20.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Database, Deployment, Enterprise, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Reduced administrative burden

The major driver for the cloud database and DBaaS market is reduced administrative burden from developers as serverless databases provide serverless computing, including automating tasks like scaling and robust backups while reducing operational demand. Businesses choose assistance in managing their database from third parties, which enables them to focus on the core operations of the company that runs the business. To provide services for enterprises that are working in the regulated sectors, cloud providers are acquiring certifications and incorporating AI features to ensure data safety and management and fulfill the customized needs of every enterprise.

Moreover, enterprises are generating and collecting huge datasets at a faster pace than before, which raises the need to manage such a vast amount of data to gain specific insights for business proliferation. Here, the cloud database offers highly scalable and economical solutions for it. Therefore, companies are relying more on this cloud service provision system to store and manage crucial data as these services ensure data safety and adopt various strategies to keep privacy again.

The potential threat of data breaches and hacking

One of the major restraints for the cloud database and DBaaS market is hacking vulnerabilities and data breaches. A vast amount of data has been stored in the cloud storage by providers, making it more susceptible to cyber crimes. The frequent occurrence of high-profile data breaches is a warning sign to be more aware of such fraudulent activities. To avoid such mishaps, cloud database providers invest heavily in security and privacy-enhancing features like encryption techniques and multifactor authentication, including security audits, to lessen the risk of hacking.

While utilizing cloud storage, security features must be impeccable, and users must follow the protocols offered by their cloud database provider. For instance, healthcare and financial sector enterprises are often subject to stricter regulations than any other sector due to the sensitive personal data they hold. Hence, cloud database providers must follow stringent security regulations with appropriate certifications like HIPAA compliance or ISO 27001.

Augmenting multi-cloud and hybrid cloud strategies

The greatest opportunity that the cloud database and DBaaS market hold is the introduction of multi-cloud and hybrid cloud strategies offered by cloud database service providers. Multicloud is the term that incorporates multiple cloud computing and storage provided by different vendors within a single heterogeneous architecture. It helps companies to distribute their data and thereby workload with different vendors instead of relying on a single provider.

A hybrid cloud is slightly different from a multi-cloud service, where a company uses a combination of public and private clouds and on-premises computing methods for their management in the data center, known as a hybrid-cloud infrastructure. Advantages of the multi-cloud approach include the availability of data storage resources, ensuring its resilience, heightened flexibility and scalability options, improved proximity, increased security, and lower cost of ownership.

The solution segment held the largest share of the cloud database and DBaaS market in 2024 In the solution segment, a range of offerings are provided by cloud database providers to their consumers with different needs to meet and help proliferating businesses. These services can be data backup and recovery, data migration, performance tuning, high scalability, and security methods. These solutions are helpful in fostering businesses across major sectors, thus fuelling the growth of the market on a wider scale.

The service segment is anticipated to expand with a significant CAGR in the cloud database and DBaaS market during the foreseeable period. Cloud database providers offer several services to customers, ranging from primary hosting for databases to advanced data management services. These services include training, support, migration, consulting, and maintenance with continued monitoring.

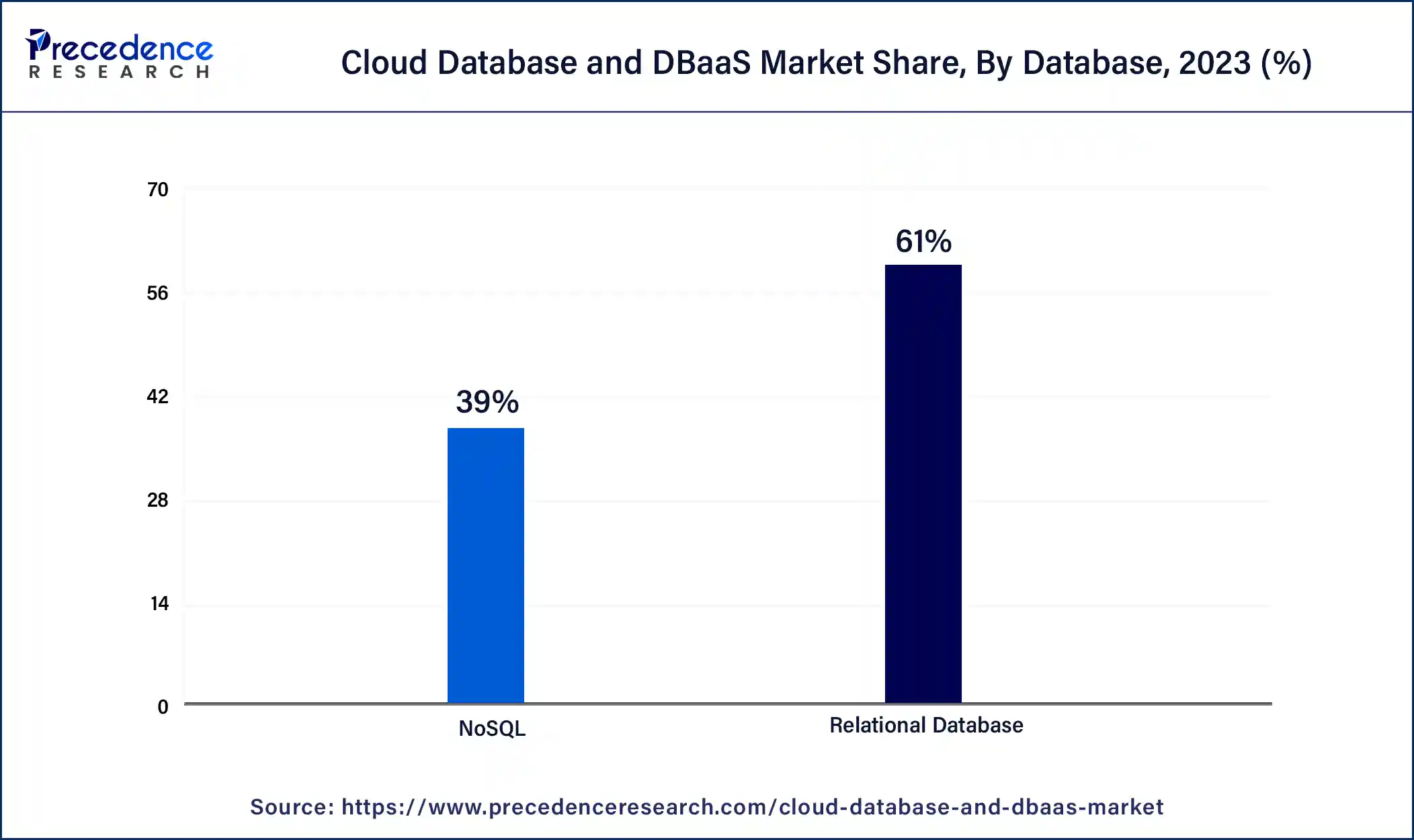

The relational database segment held the largest share of the cloud database and DBaaS market in 2024. Relational databases can provide options for scaling up or down as per the needs of the business. Since businesses these days are relying more on the generated data, it is essential to manage this data efficiently to gain useful insights from it. As the demand for scalable data storage has witnessed a sudden surge in recent years, cloud database provides the best solution for organizations to cater to this.

The NoSQL segment is anticipated to expand rapidly in the cloud database and DBaaS market during the foreseeable period. The growth of the No SQL segment is due to the vast amount of data generation due to social media, IoT, and the advent of big data, which is mostly in an unstructured format and needs to be managed in a more flexible way. Thus, the aim of the development of the NO SQL database was to combat the drawbacks of conventional databases.

The hybrid segment led the cloud database and DBaaS market in 2024. The growth of hybrid cloud databases is attributed to the flexibility they offer, such as providing both on-premises and cloud databases. Again, a hybrid cloud database helps save costs while exerting dominance over sensitive data for security purposes.

The private cloud segment is anticipated to expand rapidly in the cloud database and DBaaS market during the foreseeable period. The growth of this segment is mainly due to its dedicated environment for storing and managing data, which can be customized to meet the specific needs of an organization, such as scalability and recovery from any kind of data breach.

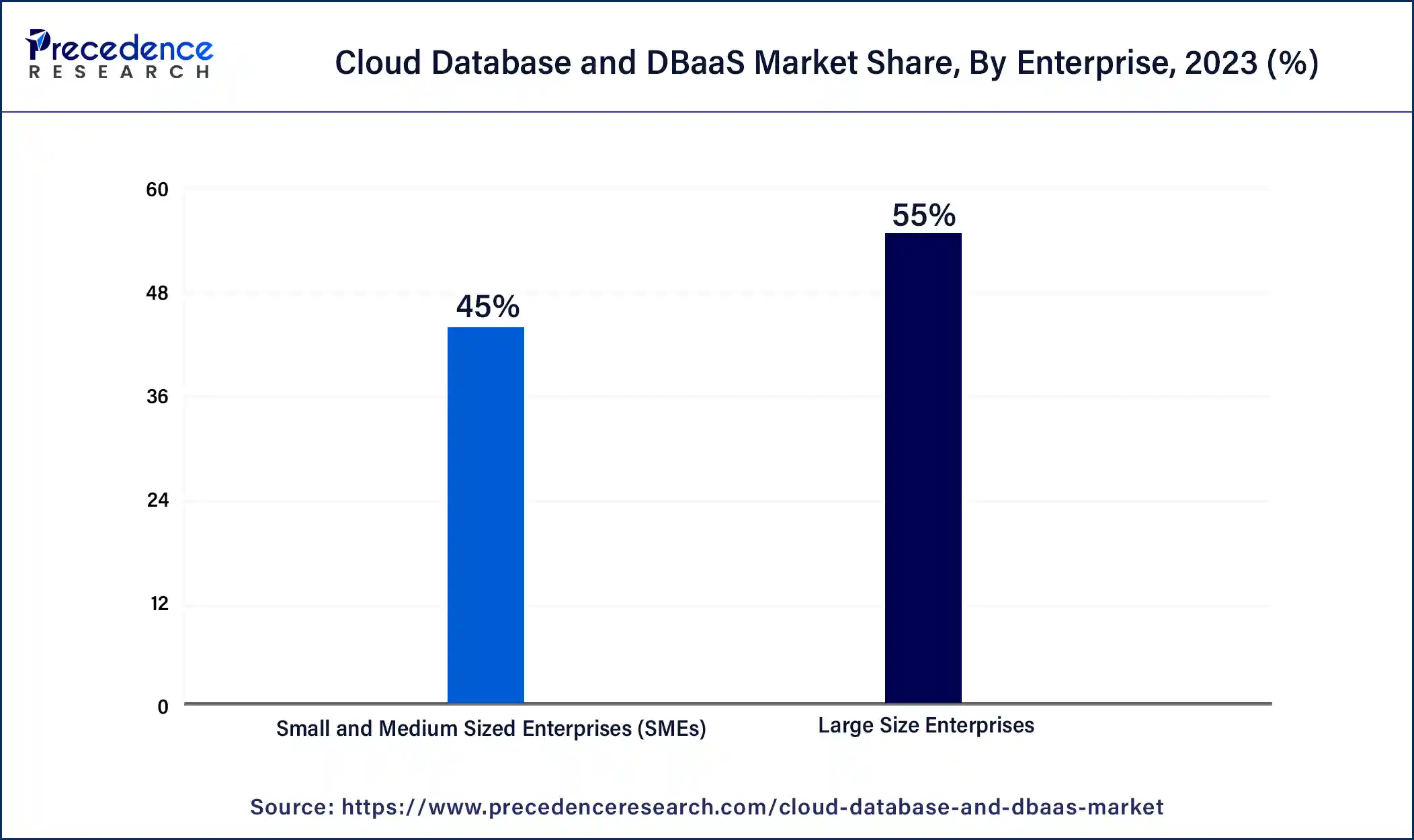

The large enterprise segment led the global cloud database and DBaaS market in 2024. Large enterprises often deal with huge and complex datasets; therefore, they need a tailored solution for data management to avoid downtime and operational complexity. Cloud databases offer virtual scalability and quick scaling for data storage with processing power. This factor is fuelling the cloud database and DBaaS market on a large scale.

The SME segment is anticipated to expand at a high CAGR in the cloud database and DBaaS market during the foreseeable period. SMEs are adopting cloud databases and DBaaS for their data management as they offer cost-effective and reliable methods to store and process their data without a need for on-premises infrastructure, which is way more expensive and burdensome for SMEs' budgets.

The IT & telecommunication segment held the largest share of the cloud database and DBaaS market in 2024. Cloud databases allow the IT and telecommunication sector to scale their database easily without physical hardware. It is helpful in reducing the time to manage the resources for handling data more effectively. It also provides load balancing, encryption, and recovery services for efficient data management.

The automotive segment is anticipated to expand rapidly in the cloud database and DBaaS market during the foreseeable period. In the automotive sector, a huge amount of data is generated by vehicles, consumers, and operations that need to be processed effectively to extract meaningful insights. Cloud database and DBaaS solutions are helpful in processing data from various sources like IoT devices, sensors, and consumer interactions for better data-driven decision-making.

By Component

By Database

By Deployment

By Enterprise

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2025

May 2025

January 2025