Cloud Gaming Market Size and Forecast 2025 to 2034

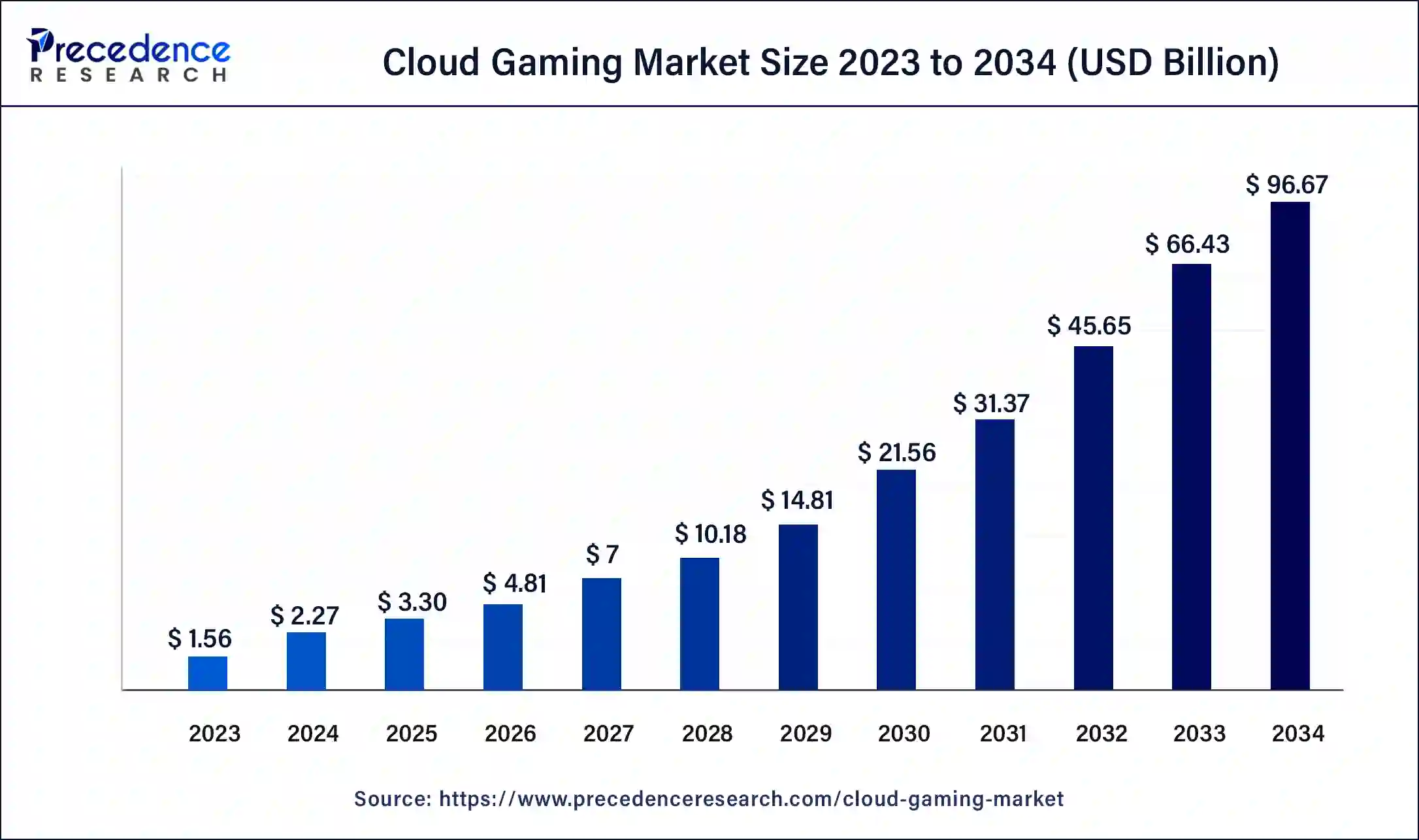

The global cloud gaming market size was estimated at USD 2.27 billion in 2024 and is predicted to increase from USD 3.3 billion in 2025 to approximately USD 96.67 billion by 2034, expanding at a CAGR of 45.52% from 2025 to 2034. The cloud gaming market growth is attributed to the growing popularity of gaming across the globe

Cloud Gaming Market Key Takeaways

- In terms of revenue, the global cloud gaming market was valued at USD 2.27 billion in 2024.

- It is projected to reach USD 96.67billion by 2034.

- The market is expected to grow at a CAGR of 45.52% from 2025 to 2034.

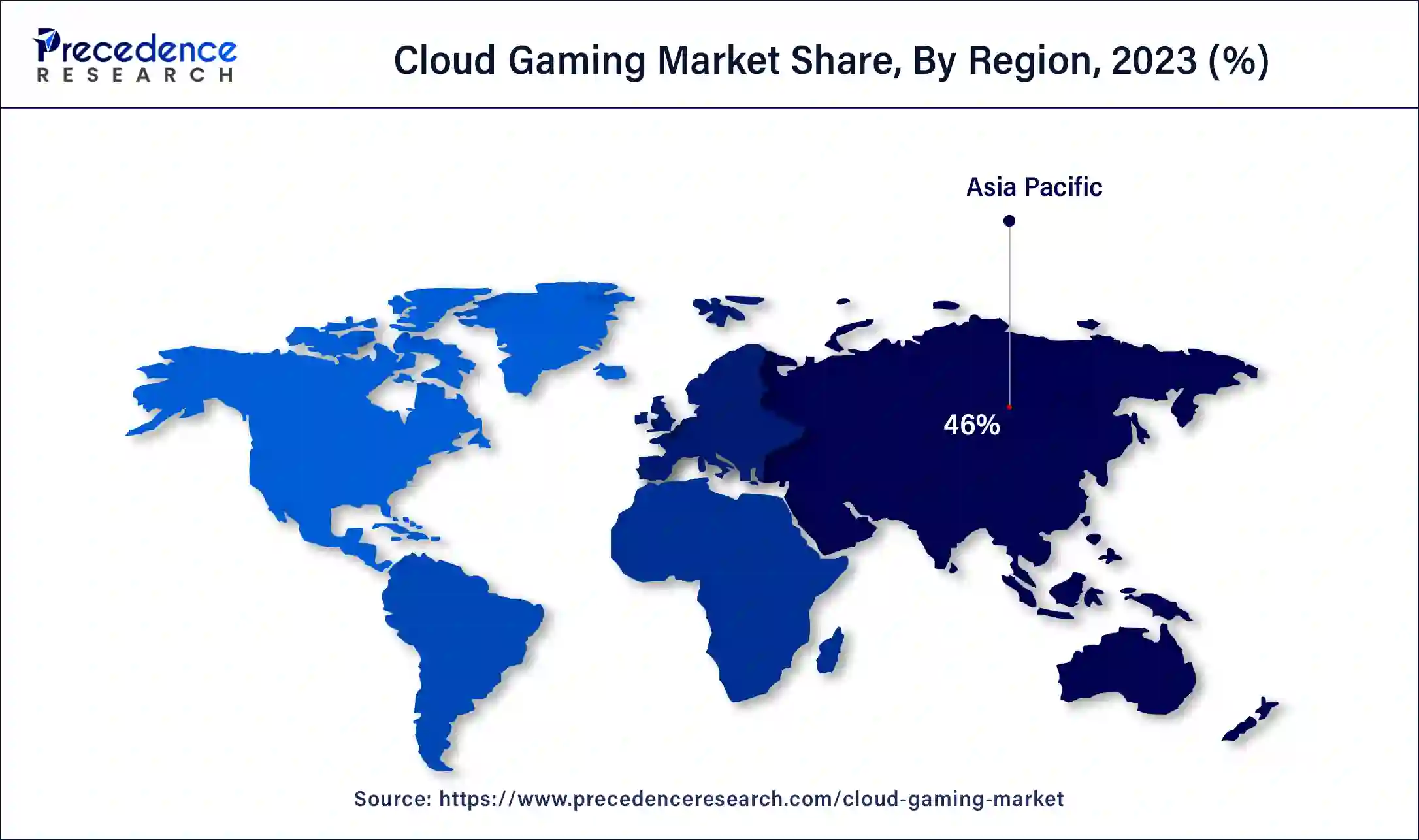

- Asia Pacific dominated the cloud gaming market with the largest market share of 46% in 2024.

- North America is projected to grow at a double digit CAGR of 44.03% during the coming years.

- By type, the video streaming segment captured more than 57% of market share in 2024.

- By type, the file streaming segment is expected to expand at a remarkable CAGR of 45.02% during the forecast period.

- By device type, the smartphone segment accounted for a dominant share of the market in 2024.

- By device type, the gaming console segment is projected to grow at a significant pace in the market during the forecast period.

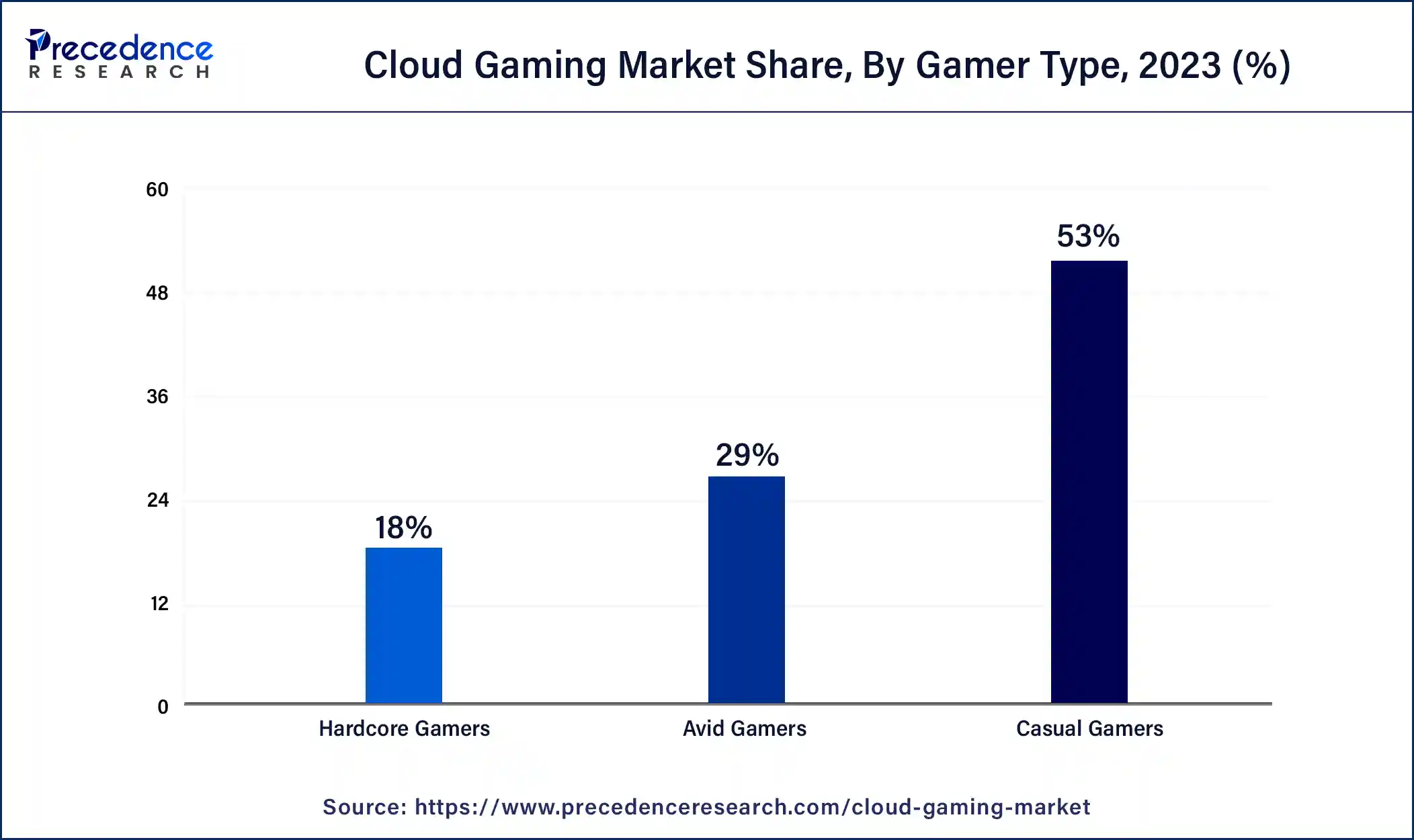

- By gamer type, the casual gamers segment accounted for the largest market share of 53% in 2024.

- By gamer type, the avid gamers segment is projected to grow at a notable CAGR of 45.03% during the coming years.

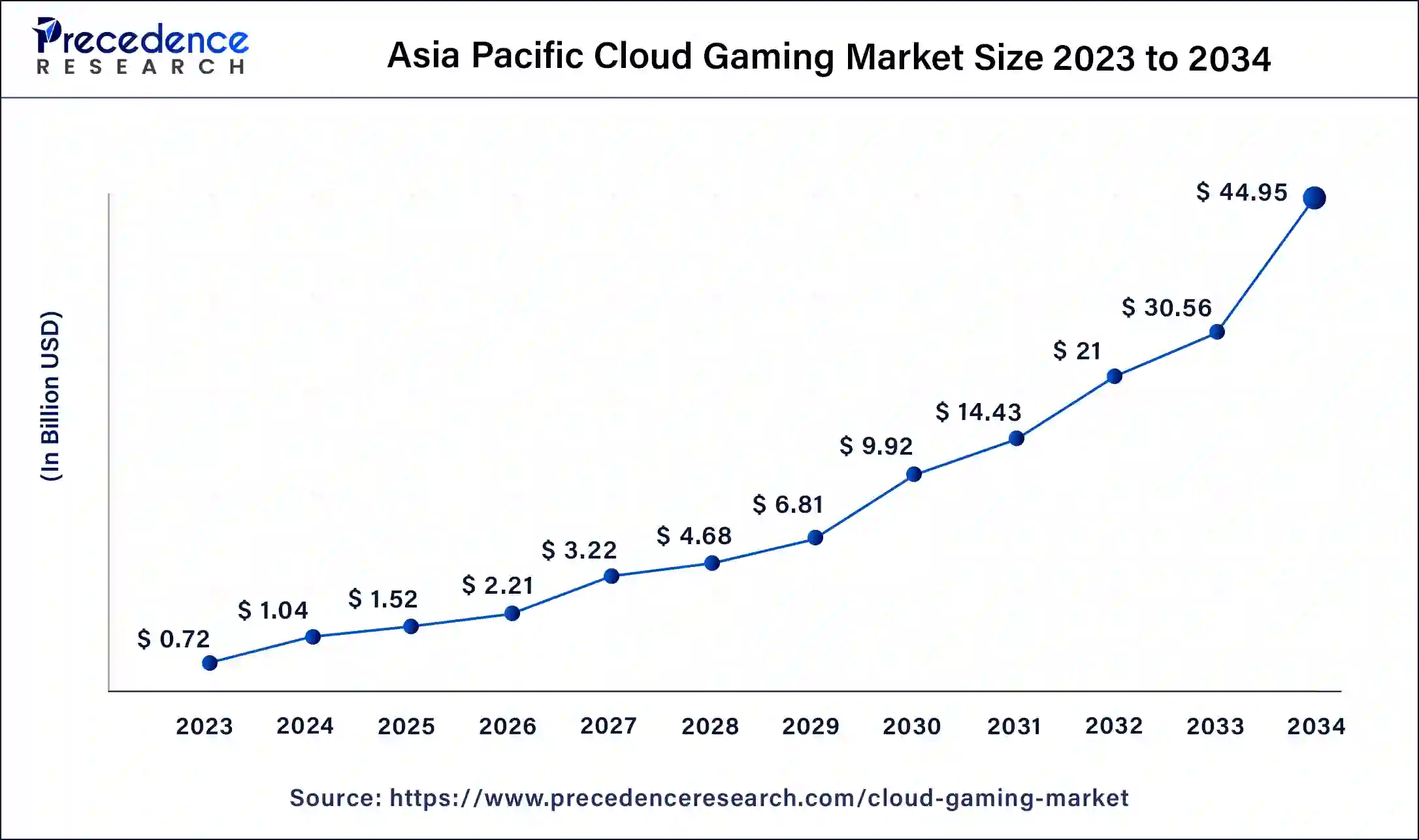

Asia Pacific Cloud Gaming Market Size and Growth 2025 to 2034

The Asia Pacific cloud gaming market size was calculated at USD 1.04 billion in 2024 and is projected to be worth around USD 44.95 billion by 2034, poised to grow at a CAGR of 45.74% from 2024 to 2034.

Asia Pacific has held a largest market share of 46% in 2024. The regional market growth is primarily attributed to the growing popularity of online games, owing to the rising adoption of smartphones and connected devices and the increasing internet subscribers in the region. Furthermore, the rising number of online gamers in countries such as India and China propels the market.

- According to the report published by the Press Information Bureau in August 2024, the total internet subscribers in India have increased from 251.59 million as of March 2014 to 954.40 million in March 2024.

- According to a report published in April 2024, India recorded around 455 million online gamers in 2023, up 8% from the previous year, and is expected to reach more than 491 million by 2024.

North America is projected to grow at a double digit CAGR of 44.03% in the coming years due to the availability of efficient internet infrastructure and the early acceptance of cloud technology. Furthermore, North America is home to various well-known tech giants and video game developers, such as Microsoft and Sony Interactive Entertainment LLC. This, in turn, fuels the market in the region.

Market Overview

Cloud gaming, also known as game streaming or gaming on demand, refers to gaming technology that allows gamers to play video games over the internet, eliminating the need to download or install games on their devices. It is a type of online gaming that allows gamers to play high-end video games on any device without requiring additional hardware.

Cloud gaming runs video games on remote server and streams the video of the game from the provider's servers to user's device. It allows gamers to stream high-end games even across handheld device and to play games form anywhere around the world. This means that gamers can access and play any game without having to worry about whether their device has enough storage for it or not. This enhances convenience and flexibility and allows gamers to access and play games instantly.

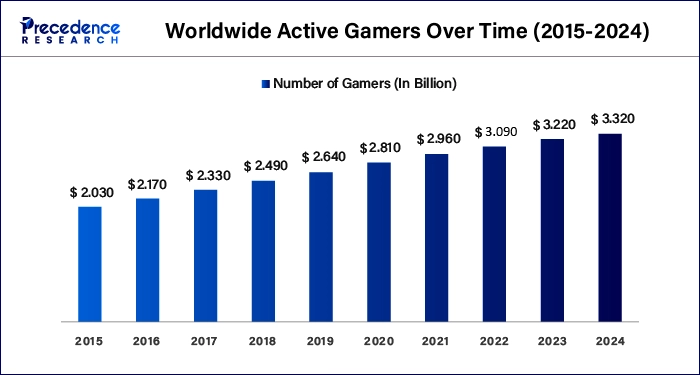

- As of 2023, there were approximately 3.220 billion gamers globally, and this number is projected to reach about 3.320 billion by the end of 2024.

Impact of AI on the Cloud Gaming Market

AI has a significant impact on the global cloud gaming market. The adoption of artificial intelligence (AI) technology in gaming is projected to augment the market. AI tools analyze player data and identify player preferences, aiding game developers in optimizing game features. AI has the ability to personalize game-play experiences for individual users, further enhancing creativity and player engagement.

Cloud Gaming Market Growth Factors

- Advancements in cloud gaming technology, such as reduced latency and enhanced video streaming quality, have made cloud gaming more appealing to gamers.

- Growing number of gamers worldwide is a major factor driving the demand for gaming services. This significantly augments the cloud gaming market in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 96.67 Billion |

| Market Size in 2025 | USD 3.3 Billion |

| Market Size in 2024 | USD 2.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 45.52% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Device, Gamer Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Proliferation of high-speed internet

The cloud gaming market is experiencing significant growth owing to the rising penetration of high-speed internet connectivity and the widespread adoption of smartphones across the globe. Higher bandwidth allows gamers to seamlessly play and stream high-quality games. Therefore, many gaming companies are collaborating with network enterprises to offer efficient cloud connectivity.

- In August 2022, Verizon entered into a partnership with Hi-Rez to take mobile gaming to a new level with Verizon 5G UltraWideband by offering an enhanced mobile experience in Hi-Rez's new game, Rogue Company Elite.

Growing popularity of online games

The growing popularity of online games is expected to boost the demand for the cloud gaming market during the forecast period. The advent of high-speed internet has made it possible to play online games seamlessly, attracting a wide audience base.

- According to the Online Gaming Statistics and Facts 2024, global online gaming audiences are anticipated to exceed 1.3 billion by 2025.

Restraints

Lack of efficient network infrastructure

A high-speed internet connection is required to access gaming services and play online games. However, online games often require high-speed internet connectivity, as fluctuations in internet speed may lag the game. Thus, the lack of efficient network infrastructure, especially in developing countries, hampers the market.

Growing privacy concerns

Some online games often require personal information, which may deter players from playing online games. Moreover, frauds in online gaming, such as fake gaming sites and copyright infringement, are increasing at a rapid pace. These factors are anticipated to hinder the market in the coming years.

- As per a study conducted by Lloyds Bank, identity theft and hacking are the most prevalent forms of fraud experienced by gamers. The study also revealed that more than 36% of parents are concerned about the possibility of their children becoming victims of gaming fraud and losing money.

Opportunity

Rising technological advancements in the gaming industry

Technologies such as augmented reality (AR) and virtual reality (VR) are shaping the gaming industry's landscape. These technologies provide realism that pushes the boundaries of interactive entertainment, elevating gaming realism and boosting the gaming experience by enhancing gamer's interactivity and engagement.

- As per the Virtual Reality Statistics 2024, the global AR/VR gamer user base is expected to surpass 216 million users by 2025.

Type Insights

The market is bifurcated into video streaming and file streaming. The video streaming segment has contributed more than 57% of market share in 2024. Video streaming services enable gamers to access and play a wide range of games on various devices over the internet without requiring additional hardware. It also allows gamers to stream games in real time. The increasing number of video streaming service users and the heightened demand for video streaming services among gamers is expected to drive the segment.

- Forbes estimates that there were approximately 1.1 billion subscriptions to online video streaming services worldwide in 2020. This figure reached to 1.8 billion in 2023.

The file streaming segment is projected to grow at a solid CAGR of 45.02% market during the forecast period. File streaming services allow gamers to download the game on their device. Gamers can run the game immediately after a certain percentage of files are downloaded. This, in turn, enhances flexibility and convenience.

Device Type Insights

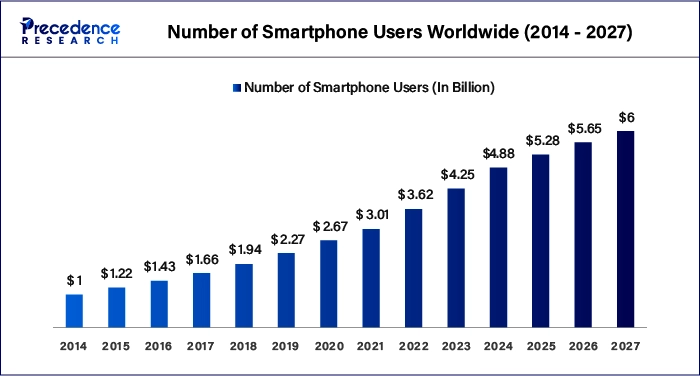

The cloud gaming market is fragmented into smartphones, PCs & laptops, gaming consoles, head-mounted displays, and smart TVs. The smartphone segment accounted for a dominant share of the cloud gaming market in 2024. The widespread adoption of smartphones has made online gaming more accessible, leading to an increased demand for mobile games and streaming services. Therefore, the rising adoption of smartphones is anticipated to fuel the segment.

- As of 2024, approximately 4.88 billion people own a smartphone. This is an increase of 635 million new smartphone users in the last year alone.

The gaming console segment is projected to grow at a significant pace in the cloud gaming market during the forecast period, as the gaming console is an attractive option, particularly for beginners. The availability of sound systems and high-end displays in consoles enhances the gaming experience. Furthermore, the rising technological advancements in gaming equipment are expected to boost the segment.

Gamer Type Insights

The global cloud gaming market is divided into casual gamers, avid gamers, and hardcore gamers. The casual gamers segment has generated more than 53% of the market share in 2024. The rising popularity of casual gamers is due to the increasing availability and accessibility of audience. The dominance of smartphones across the globe is observed to promote the segment's expansion in the upcoming years. Casual gaming allows wide appeal to both hardcore gamers and casual public.

At the same time, non-gamers are seen to prefer cloud gaming services for reasons such as less commitment, less time investment and relaxation. These factors along with multiple cognitive benefits are seen to serve as a growth factors for the segment to grow in the years.

The avid gamers segment is projected to register significant growth in the cloud gaming market in the coming years, owing to the rising investment in gaming services by avid gamers. The rising gaming community with the app purchases and integration of YouTube videos for gaming has promoted the expansion of the segment. Changes in consumer expectations are also seen to supplement the segment's expansion.

- As of June 2024, there are about 3.32 billion active video game players across the globe. 52% of gamers subscribe to at least one gaming service.

Cloud Gaming Markets Top 11 Companies

- Apple Inc.

- Amazon.com, Inc.

- Electronic Arts, Inc.

- Google LLC

- International Business Machines Corporation (IBM Corporation)

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Tencent Holdings Ltd.

- Ubitus Inc.

Recent Developments

- In April 2024, Electronic Arts Inc., a company pioneer in cloud gaming, introduced a breakthrough Game Patching Tech created by its employees. This game patching, called Know Version Patching (KVP), calculates the patch by knowing which game files already exist and comparing the changes to the new version.

- In April 2024, Tencent Games brought its latest technologies, services, and solutions in game development and operations to the Game Developers Conference (GDC) 2024. These technologies include generative game engine and Game AI Engine GiiNEX, which are expected to revolutionize the gaming industry landscape.

- In April 2023, LG Electronics (LG) announced that it is intensifying the cloud gaming experience on its 2023 TVs by adding 4K (3,840 x 2,160) support for NVIDIA GeForce NOW and launching the popular Boosteroid service in over sixty countries.

Segments Covered in the Report

By Type

- Video Streaming

- File Streaming

By Device

- Smartphones

- Pcs & Laptops

- Gaming Consoles

- Head-Mounted Displays

- Smart TVs

By Gamer Type

- Casual Gamers

- Avid Gamers

- Hardcore Gamers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344