Virtual Reality Market Size and Forecast 2025 to 2034

The global virtual reality market size was estimated at USD 36.13 billion in 2024 and is predicted to increase from USD 44.4 billion in 2025 to approximately USD 284.04 billion by 2034, expanding at a CAGR of 22.90% from 2025 to 2034.

Virtual Reality Market Key Takeaways

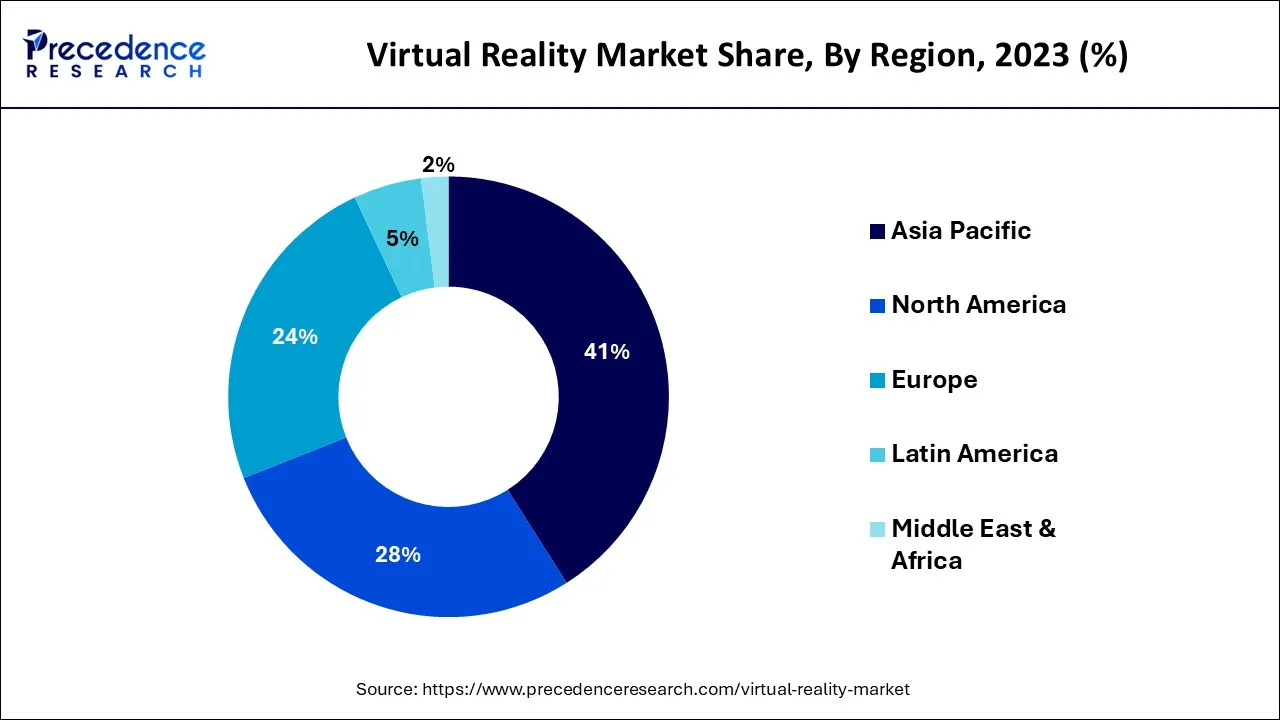

- Asia Pacific has generated more than 41% of revenue share in 2024.

- By Device, the head-mounted display (HMD) device segment contributed the biggest market share of 60.40% in 2024.

- By Technology, the semi- and fully-immersive segment captured the highest market share of 83% in 2024.

- By Component, the hardware segment generated the major market share of 66% in 2024.

- By Application, the commercial segment has held the largest market share of 56% in 2024.

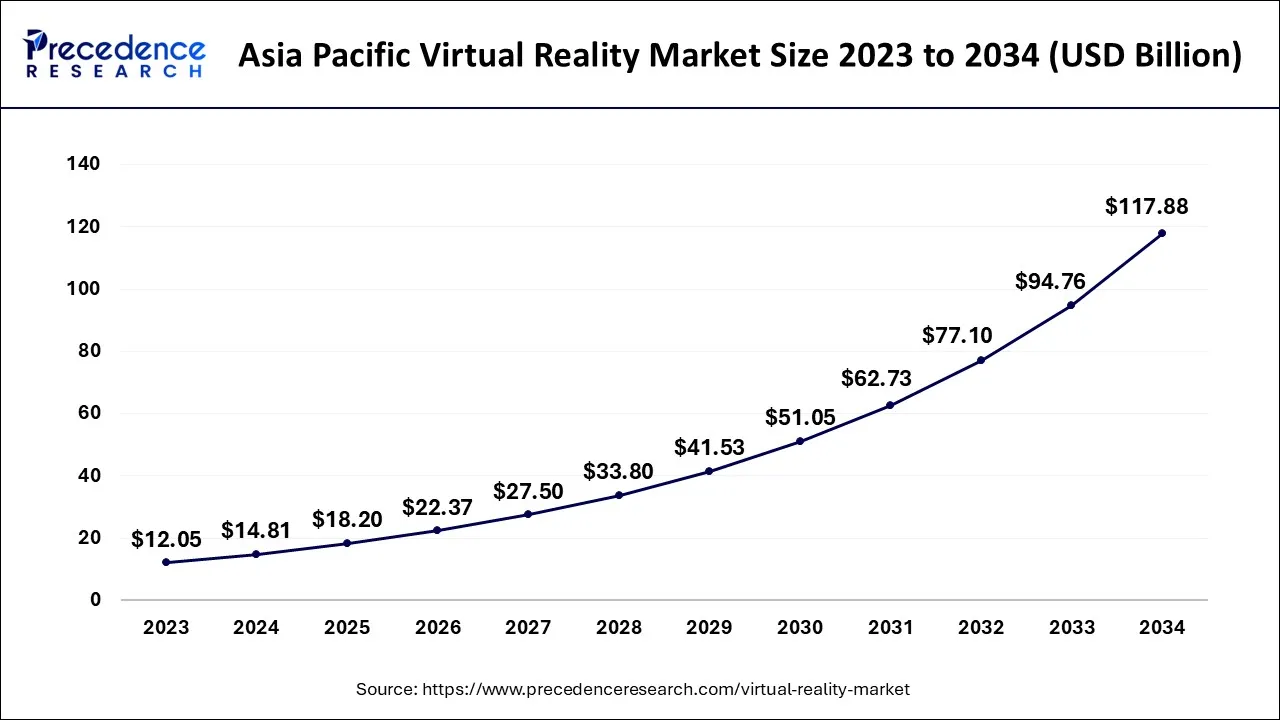

Asia Pacific Virtual Reality Market Size and Growth 2025 to 2034

The Asia Pacific virtual reality market size was exhibited at USD 14.81 billion in 2024 and is projected to be worth around USD 117.88 billion by 2034, growing at a CAGR of 23.05% from 2025 to 2034.

Because of the rapid advancements in VR technology,Asia Pacific held the greatest revenue share of almost 41% in 2024. The development of the regional market can be linked to nations like China, who are important manufacturers and suppliers of gear related to virtual reality.

Due to the drive towards automation, the area is also home to numerous businesses and factories that use virtual reality in a variety of operations. Additionally, market growth is anticipated to be fueled by the Asia Pacific region's increasing use of handheld devices with VR capabilities.

Market Overview

Computer technology is used to build virtual reality settings. Users can explore a three-dimensional environment in the real world via virtual reality (VR). Consumers enjoy this immersive experience due to VR technology, which is used in devices like bodysuits, glasses, or gloves. As it allows users to immerse themselves in a highly realistic game environment, virtual reality technology has also revolutionized the gaming and entertainment industries.

Virtual Reality Market Growth Factors

The market is expanding due to the growing acceptance of VR technology across industries like gaming and entertainment, healthcare, automotive, architecture, and education. Over the course of the projection period, it is anticipated that the gaming and entertainment industry would drive VR market expansion more. Players in the market are spending more money creating new game content, software, and gear. Additionally, the expansion of the virtual reality industry is being aided by the increasing demand for theme parks, gaming arcades, and virtual worlds.

Technological Advancement

Technological advancement in the virtual reality market features strong headsets, 5G, software, AI, and machine learning. For a quality experience, VR and augmented reality (AR) are highly considered in the advancement of companies. With the rise in e-commerce, gaming, and entertainment, technology is considered to be a key base to boost the customer experience. The improvisation in VR software platforms and contributions in developing tools give an exposure to connect with reality and interact at a quality level with the virtual world.

The advancement is a vast spread in various applications across industries like manufacturing, retail, healthcare, enterprise, real estate, and primarily in gaming and entertainment. The highest of the used technology, with the advancement in hardware, is standalone VR headsets. Popularly known for its portability. The leading development in virtual reality headsets is the newest technology to gain popularity in the virtual reality market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 36.13 Billion |

| Market Size in 2025 | USD 44.4 Billion |

| Market Size by 2034 | USD 284.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.9% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device, Technology, Component, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing adoption HMDs in different industries

Modem-equipped devices are compact, transportable, and simple to operate. They are used to present data in graphical and pictorial formats. These devices need to be simple and compact with high-quality displays. Demand for HMDs, HUDs, and VR projectors has significantly increased across many industries, including consumer electronics, aerospace & defence, health and transportation. The majority of these systems use direct-view OELD displays with panels that range in size from 2 to 6 inches, despite the fact that VR HMDS are becoming more and more popular in consumer applications for entertainment and gaming. Given the popularity and demand for VR HMDS, the leading display manufacturers are developing better displays for VR HMDs. For instance, Kopin has developed a microdisplay especially for VR HMDS.

CMOS/OLED microdisplays for use in mobile devices have been developed as a result of the large, affordable OLED microdisplay (LOMID) initiative.

Given the advancements in VR display discussed above, it is projected that the demand for VR HMDS would soar among technologists, which will propel the growth of the worldwide VR market. In addition, HMDs are essential for a variety of applications, including flight simulation, scientific visualization, engineering for the medical field, designing and prototyping, instruction and training, wearable computing, and entertainment options. Compared to 3D screens, they offer a decent mix between price and distinctive features.

Restraint

Cybersecurity threats

Cybersecurity concerns are one of the major obstacles to the virtual retail business. The virtual retail business is extremely vulnerable to cyberattacks due to the growing reliance on technology and the rise in online sales. Hackers and online criminals are constantly looking for new methods to use flaws in online systems to steal information or money from unwary customers. Such occurrences not only compromise the privacy and personal information of customers but also harm the standing and confidence of online merchants.

Opportunity

Personalization

Personalization is an opportunity that has the potential to have a big impact on the online retail sector. Retailers are able to customize the online buying experience for customers because of the availability of customer data and sophisticated analytics tools. Retailers can customize product recommendations and marketing messages to each customer's unique requirements and preferences by utilizing consumer data such as purchase history, browsing habits, and demographics.

Personalization may boost revenue, client loyalty, and engagement. Additionally, it can enhance the entire client experience, resulting in higher customer retention and satisfaction. Additionally, personalization can give merchants insightful information about consumer behavior and preferences that they can use to enhance their product offerings, marketing plans, and customer service.

Device Insights

The head-mounted display (HMD) device sector is anticipated to continue to dominate the market through 2034, recording a revenue share of around 60.40% in 2024. Virtual reality headset demand is being fueled by the technology's expanding use in both consumer and commercial applications. The segment is expanding as a result of the variety and type of HMDs available, including tethered, hybrid, and wireless HMDs.

The HMD devices are used to train people in a variety of fields, including research, aerospace, engineering, the military, and medicine, as well as to show a wide range of application cases utilizing interactive elements. Businesses also commonly make strategic alliances and investments in technological advancements to give customers a very immersive experience.

Technology Insights

In 2024, the semi- and fully-immersive segment accounted for more than 83% of total revenue. Additionally, the segment is anticipated to have the greatest CAGR of over 15.45% during the forecast period. The continuous increase in the demand for virtual reality HMDs for commercial and academic purposes can be credited to the segment growth.

For complex work and planning, fully and partially immersive technology replicates the architecture of real environments in a virtual platform. It uses multiple emulators, powerful personal computers, and monitors with high resolution. Additionally, virtual reality technology is in demand for educational applications because it enables students to engage in motor and thinking exercises that are impossible to carry out in a traditional classroom.

In 2023, the non-immersive market accounted for around 17.40% of total revenue. In contrast to immersive virtual reality, which immerses users in a lifelike environment, non-immersive virtual reality provides them with a workstation-generated or virtual environment. This technology is popular because it is more broadly accessible and more effective at managing networks.

Component Insights

In 2024, the hardware sector's revenue share was above 66%, which was the highest. The widespread adoption of smartphones, tablets, and other cutting-edge electronic portable devices is anticipated to support the segment's expansion as more device manufacturers include virtual reality-based capabilities.

The market also comprises consoles, input devices, and output devices that consumers purchase as add-ons for virtual reality setups. In addition, it is projected that the expanding use of virtual reality headsets in business settings, theme parks, and other locations would present growth prospects for original equipment manufacturers (OEMs) to turn into VR equipment providers.

During the projected period, the software segment is expected to have the highest CAGR, at around 15.46%. The software's ability to generate feedback, analyze data, and manage the input/output sources can be credited with the segment's expansion. Virtual reality technology is widely utilized in product development because it creates a three-dimensional environment that allows people to interact with jobs and apps in an impressive way.

The technology can be utilized in training, simulation, building virtual tools, VR applications, VR game development, learning experience platforms, and segment reality, therefore it is projected that the segment would see rising demand.

Application Insights

In 2024, the commercial segment's revenue share was the highest at about 56%. The business sector, which includes real estate, auto showrooms, and retail outlets, is using virtual reality headsets and experience rooms more frequently, which offers fresh market growth potential.

Additionally, the commercial use of VR technology is anticipated to increase as smartphones and other handheld devices become more prevalent. Similar to this, companies are introducing new items to the public through virtual reality to entice customers with a more immersive experience.

Over the forecast period, the healthcare segment is anticipated to have the highest CAGR, at around 15.40%. The usage of virtual reality in the healthcare industry, particularly in disease awareness, operational procedures, learning, and training, can be ascribed to this.

As hospitals and medical schools adopt VR solutions and technologies to instruct students and professionals, the need for the segment is anticipated to increase. Additionally, the tendency towards complex procedures and remote surgeries is anticipated to fuel the segment's expansion. For instance, before performing difficult surgery on live patients, surgeons can test the likelihood of success in virtual reality.

Virtual Reality MarketCompanies

- Meta Platforms Inc.

- GoerTek Inc.

- Google LLC

- Samsung Electronics

- NVIDIA Corp.

- Microsoft Corp.

- Spectra7 Microsystems

- Unity Technologies Ltd.

- HTC Corp.

- Sunny Optical Technology

Recent Developments

- In May 2025, Gold Water recipients focus on improving and enhancing virtual reality more accessible. The developmental efforts to innovate will increase the excellent customer experience.

- In April 2025, Georgia Tech joins the Virtual Reality Augmented Reality Association. Georgia Tech's membership with VRARA has encouraged the company to grow and sustain in the virtual reality market.

- In April 2025, the two graduates of the University of Arkansas at Little Rock highlighted their virtual reality skills at the 32nd Institute of Electrical and Electronics Engineers (IEEE) International Conference on Virtual Reality and 3D User Interfaces, held on March 8-12 in Saint-Malo, France.

Segments Covered in the Report

By Device

- Head-mounted Display (HMD)

- Gesture-tracking Device (GTD)

- Projectors & Display Wall (PDW)

By Technology

- Semi & Fully Immersive

- Non-immersive

By Component

- Hardware

- Software

By Application

- Aerospace & Defense

- Consumer

- Commercial

- Enterprise

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content