January 2025

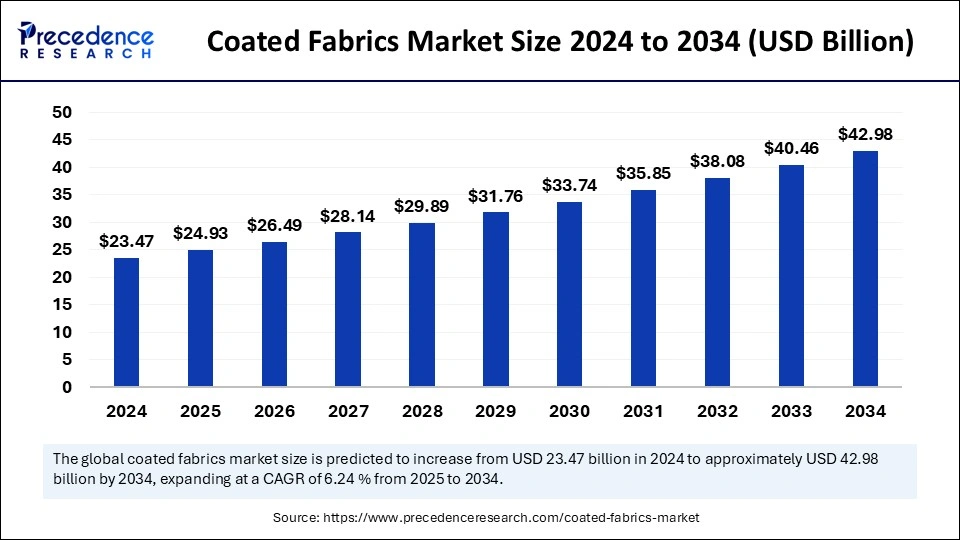

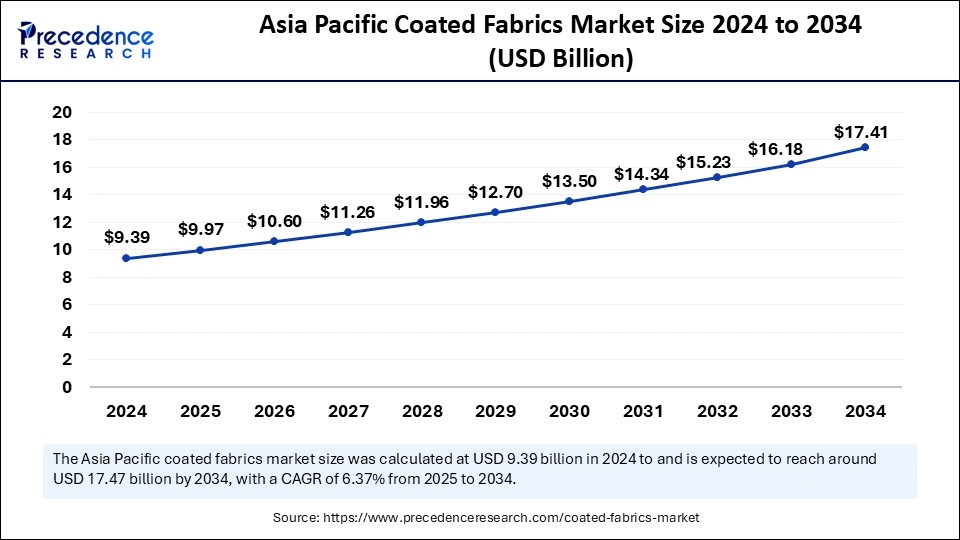

The global coated fabrics market size is calculated at USD 24.93 billion in 2025 and is forecasted to reach around USD 42.98 billion by 2034, accelerating at a CAGR of 6.24% from 2025 to 2034. The Asia Pacific market size surpassed USD 9.39 billion in 2024 and is expanding at a CAGR of 6.37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global coated fabrics market size accounted for USD 23.47 billion in 2024 and is predicted to increase from USD 24.93 billion in 2025 to approximately USD 42.98 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The coated fabrics market growth can be linked to the increased focus on implementing advanced textile fabrication methods, increased demand for protective clothing, innovations in coating technology and expansion of production facilites.

Integrating Artificial Intelligence in coated fabrics market can lead to enhanced reliability on product, waste reduction and improved efficiency in the textile industry. AI-powered machine vision systems like advanced computer vision, machine learning methodologies and deep learning algorithms can automate quality control processes by detecting minor flaws such as misalignment of fiber, uneven coatings or irregularities in surface as well as for identification of defects like inconsistencies in coating, loose threads, misweaves, contamination and yarn breakages.

Furthermore, AI can be applied in predictive maintenance of equipment reducing downtime with timely maintenance and for implementing sustainable manufacturing practices further minimizing environmental impacts linked with coating processes. Development of novel materials by analyzing large amounts of datasets and fabrication of smart coatings with enhance features like water-repellent, self-healing or antimicrobial properties is possible with the use of AI.

The Asia Pacific coated fabrics market size was exhibited at USD 9.39 billion in 2024 and is projected to be worth around USD 17.41 billion by 2034, growing at a CAGR of 6.37% from 2025 to 2034.

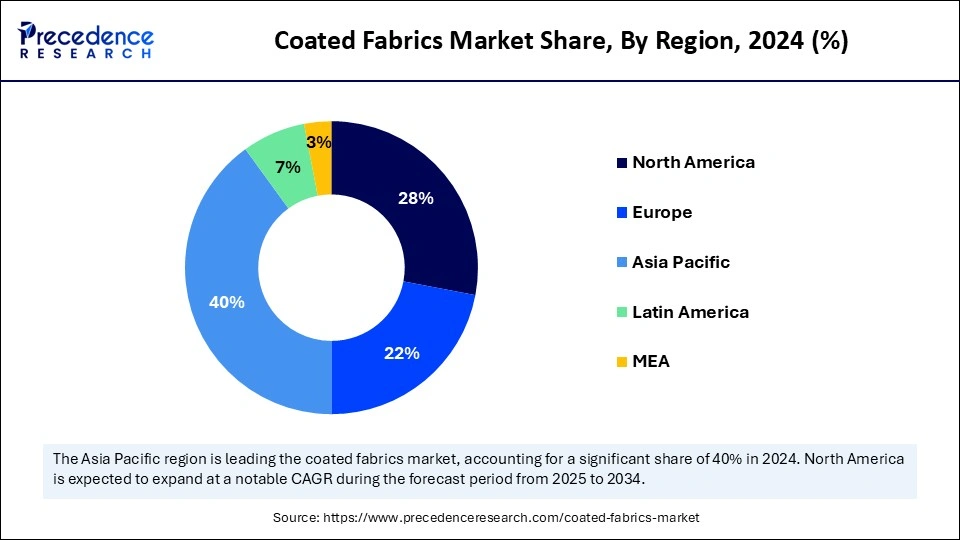

Asia Pacific dominated the global coated fabrics market with the largest share in 2024. The region’s dominance is favoured by the rising investments for infrastructure development, rapidly growing population, increased urbanization and industrialization activities in India and China. Furthermore, rising disposable incomes and consumer spending with economic upswing, stringent government regulations for maintaining quality and safety as well as the expansion of chemical processing, food processing, healthcare sectors and automotive industries is creating great demand for protective clothing and coated fabrics for automotive applications.

China Coated Fabrics Market Trends

China dominates Asia Pacific in the coated fabrics market owing to the factors such as flourishing automotive industry, increased industrialization activities and strong presence coating technology companies.

North America is anticipated to witness fastest growth in the global coated fabrics market during the forecast period. The presence of robust manufacturing base, surging demand for protective clothing in pharmaceutical and chemical industries, ongoing advancements and innovations in coating technology, strong automotive industry and growing focus on using environment friendly and lightweight coating materials are the factors boosting the market growth of this region.

U.S. Coated Fabrics Market Trends

U.S. is expected to grow at the fastest rate in North America. The market growth is driven by the presence of key market players, widespread distribution channels, growing demand for textiles in various industries like protective clothing and furniture, increased use of advanced technologies and automated systems, and increased research activities for developing innovative coating technologies. Moreover, regulations like the Clean Air Act (CAA) by the U.S. Environmental Protection Agency (EPA) setting emission standards for coating, printing and dyeing fabrics which uses hazardous air pollutants (HAPs) as well as the establishment of classification and safety standards for coated fabrics by U.S. government agencies like the Occupational Safety and Health Administration (OSHA) and Customs and Border protection (CBP) significantly impact the market growth.

For instance, in August 2024, at the University of Massachusetts (UMass) Amherst, a group of scientists developed a chalk-based coating for fabrics which can significantly decrease body temperature. The coating was developed to address challenges regarding the rising global temperatures due to climate change.

Coated fabrics are textiles treated with coating materials forming a one or multiple layers on the fabric for enhancing their functionality and performance like water resistance, durability, antimicrobial protection or flame retardancy. Usually, a resin or polymer material is applied for coating. The most commonly used coating materials are acrylic, plastic resins, polyurethane, rubber, silicone and vinyl. Coating process for manufacturing coated fabrics includes techniques like direct application, roll coating, dip coating, spray coating, flame lamination among others.

The coated fabrics is expected to grow significantly in the upcoming years due to rising investments in manufacturing sectors, rapid industrialization and urbanization, expansion of the automotive industry with increased production rates and growing use of coated fabrics in automotive interiors like trims and upholstery, focus of manufacturers on extending product portfolios by introducing new products, use of sustainable and recycled materials as well as advancements in textile technology.

| Report Coverage | Details |

| Market Size by 2034 | USD 42.98 Billion |

| Market Size in 2025 | USD 24.93 Billion |

| arket Size in 2024 | USD 23.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand across various industries

The ability of coated fabrics for enhancing material properties as well as their durability and versatility are driving their demand for diverse range of industrial applications. Factors such as accelerated urban development, government policies for implementing strict safety standards, surge in industrial activities and escalating investments in developed countries as well as in emerging economies are fuelling demand in key industries like transportation, construction, healthcare and other industries. Furthermore, ongoing advancements in coating technologies such as use of nanotechnology-based coatings, self-cleaning formulations and breathable coatings which enhance the longevity and functionality of coated fabrics is driving their adoption fostering market expansion.

Raw material price fluctuations and substitute availability

Fluctuations in raw material market prices, especially in polymers and speciality chemicals used for fabric coatings due to shortage of raw materials and lack of skilled labor can lead to hike in production costs, high prices of finished products, disruptions in supply chains and geopolitical factors like trade agreements can potentially slow down the market growth.

Additionally, the increased access to alternatives such as uncoated fabrics, plastic products, leather and bio-based alternatives that compete with coated fabrics, owing to cost-competitive nature and enhanced features are restricting the expansion of coated fabrics market.

Use of smart technologies and sustainable materials

With the ongoing technological advancements and growing investments, manufacturers and researchers are focused on implementing these technologies for the development of innovative coatings, smart fabric creation with the integration of sensors and electronics into coated fabrics, temperature-sensitive fabrics, use of nanomaterials for enhancing the performance of coated fabrics.

Increased consumer demand and stringent government regulations are encouraging manufacturers to implement sustainable practices and use of eco-friendly materials in manufacturing of coated fabrics for reducing environmental impact. Use of natural fibers like hemp and cotton as well as deploying closed-loop recycling systems is creating opportunities for market growth.

The vinyl-coated fabrics dominated the market with the largest share in 2024. Vinyl-coated fabrics are in great demand across various industries such as in automotive, construction, healthcare, transportation and protective clothing due to their high durability, resistance to wear and tear, water resistance and chemical resistance. Advancements in coating technologies with rising investments fosters the development of coated fabrics with enhanced performance and permanence. Furthermore, increased focus on developing sustainable and eco-friendly alternatives, research on utilization of recycled materials such as recycled poly (vinyl butyral) for UV protection, and addition of smart features like self-cleaning, temperature regulation, antimicrobial properties in vinyl-coated fabrics are the factors expanding the market.

The polymer-coated fabrics segment is anticipated to witness lucrative growth during the forecast period. The market growth of this segment can be attributed to the growing demand for high-capacity materials with enhanced durability and functionality like waterproofness and breathability, increased urbanization and infrastructure development activities, technological advancements fostering the development of new polymer coatings with enhanced features and innovative techniques like fluorine-free methods.

Additionally, rising investments fostering the economic expansion of various industries like automotive and construction, surging use of eco-friendly coating materials, increased emphasis of researchers on exploring innovative nanocomposite fabrics by using well-dispersed nanofillers for enhancing armor resistance in anti-ballistic applications as well as development of recyclable and low-VOC (volatile organic compound) coatings by manufacturers to maintain adherence to stringent regulations and changing consumer needs are fostering the market growth of this segment.

Transportation segment accounted for the largest market share in 2024. Coated fabrics such as polyurethane (PU) coated fabrics, polyvinyl chloride (PVC) coated fabrics and rubber coated fabrics are extensively used in various transportation industries including aerospace, automotive, marine and railway applications owing to their high weather resistance and enhance durability. Rising sales of automotive, stringent government regulations for concerning safety and security of vehicles such as airbags and other precautionary measures as well as increased emphasis on advancing road and rail infrastructure are the factors boosting the market growth of this segment.

The protective clothing segment is expected to show the fastest growth during the forecast period. Protective clothing coated fabrics are gaining traction in the market due to increased demand for various applications across several industries like construction, healthcare and manufacturing. Recent technological advancements in coated fabrics such as graphene-modified textiles improving mechanical strength and abrasion resistance among others, development of smart textiles with features like real-time monitoring of user’s health or environmental hazards, hydrogel-based breathable barriers like thermoresponsive gels allowing heat management and better control of breathability, and use of conductive coatings are being implemented for developing protective clothing.

Moreover, progress in nanotechnology like metal-organic frameworks (MOF) for enhancing functionality of protective textiles, availability of multi-layered fabrics offering comprehensive protection, increased use in military and law enforcement for protection against ballistic threats and chemical hazards, use of materials like activated carbon and plant-derived compounds for developing bioprotective textiles are the factors driving the market growth of this segment.

By Product Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024