December 2024

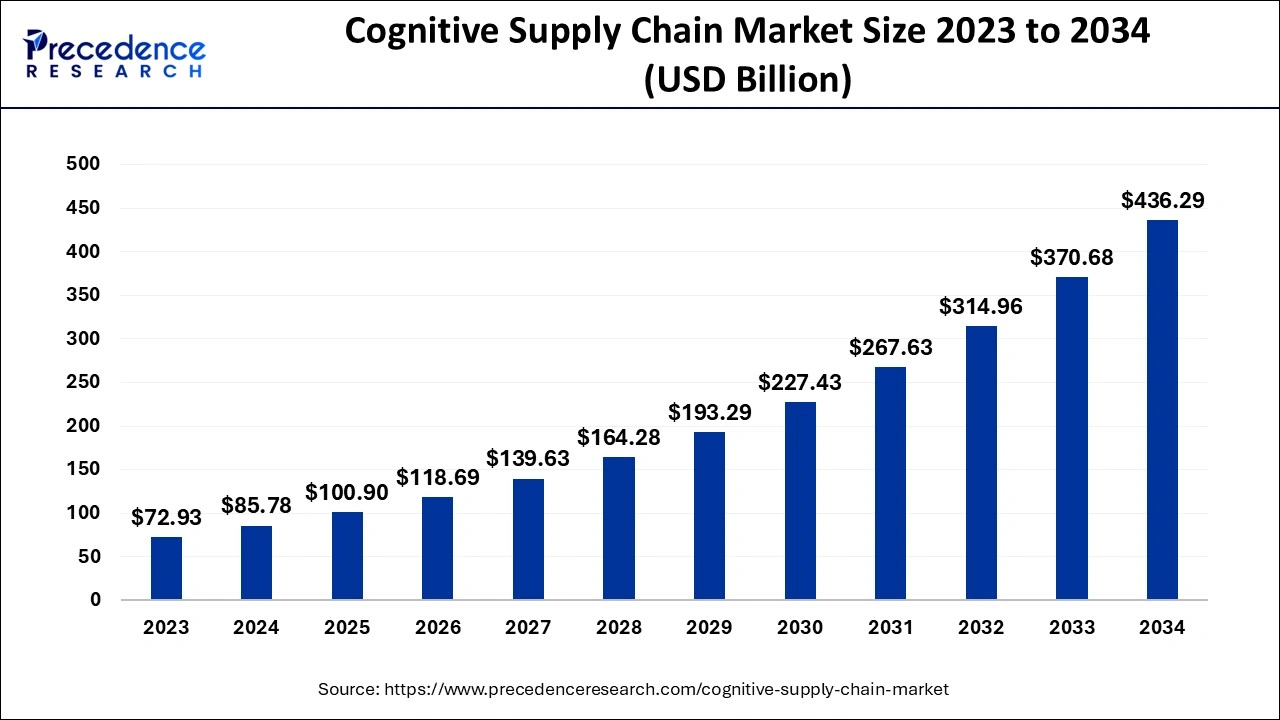

The global cognitive supply chain market size is evaluated at USD 85.78 billion in 2024, grew to USD 100.90 billion in 2025 and is anticipated to reach around USD 436.29 billion by 2034 and is expanding at a notable CAGR of 17.66% between 2024 and 2034. The North America cognitive supply chain market size is calculated at USD 30.88 billion in 2024 and is expected to grow at a CAGR of 17.81% during the forecast year.

The global cognitive supply chain market size accounted for USD 85.78 billion in 2024 and is expected to exceed USD 436.29 billion by 2034, growing at a CAGR of 17.66% from 2024 to 2034. The cognitive supply chain market is increasing because of the rising usage of artificial intelligence, machine learning, and the Internet of Things for processing and generating real-time information, sustainable development, and e-commerce.

The integration of artificial intelligence in the cognitive supply chain market allows a business to process large volumes of data from different sources in real-time. This can help companies make efficient decisions with less interference from humans. The cognitive supply chain is a self-learning network that uses artificial intelligence, machine learning, and advanced analytics to learn about changes and act proactively on risks in ever-changing environments. This intelligent supply chain is not only responsive but also proactive. It can also predict interruptions and effectively manage the business in real-time.

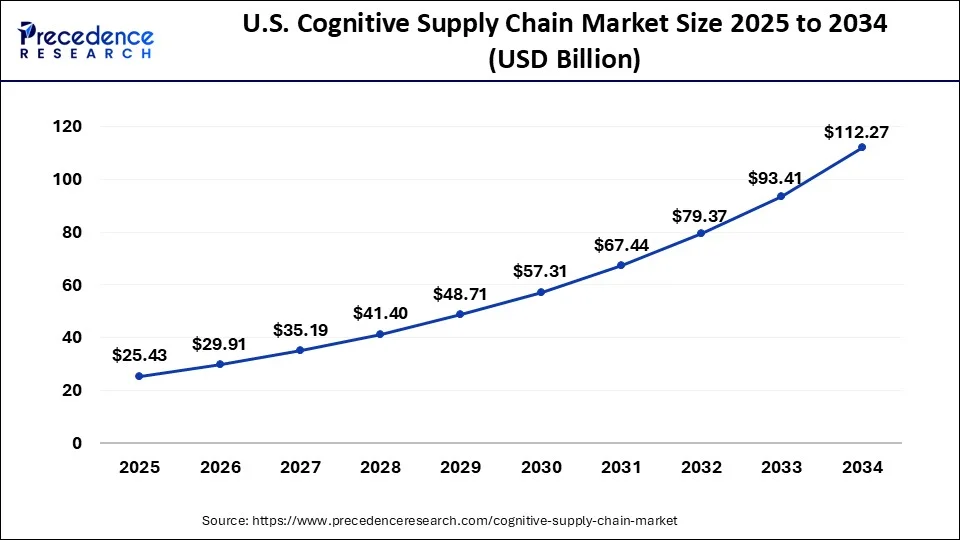

The U.S. cognitive supply chain market size is exhibited at USD 21.62 billion in 2024 and is projected to be worth around USD 112.27 billion by 2034, growing at a CAGR of 17.88% from 2024 to 2034.

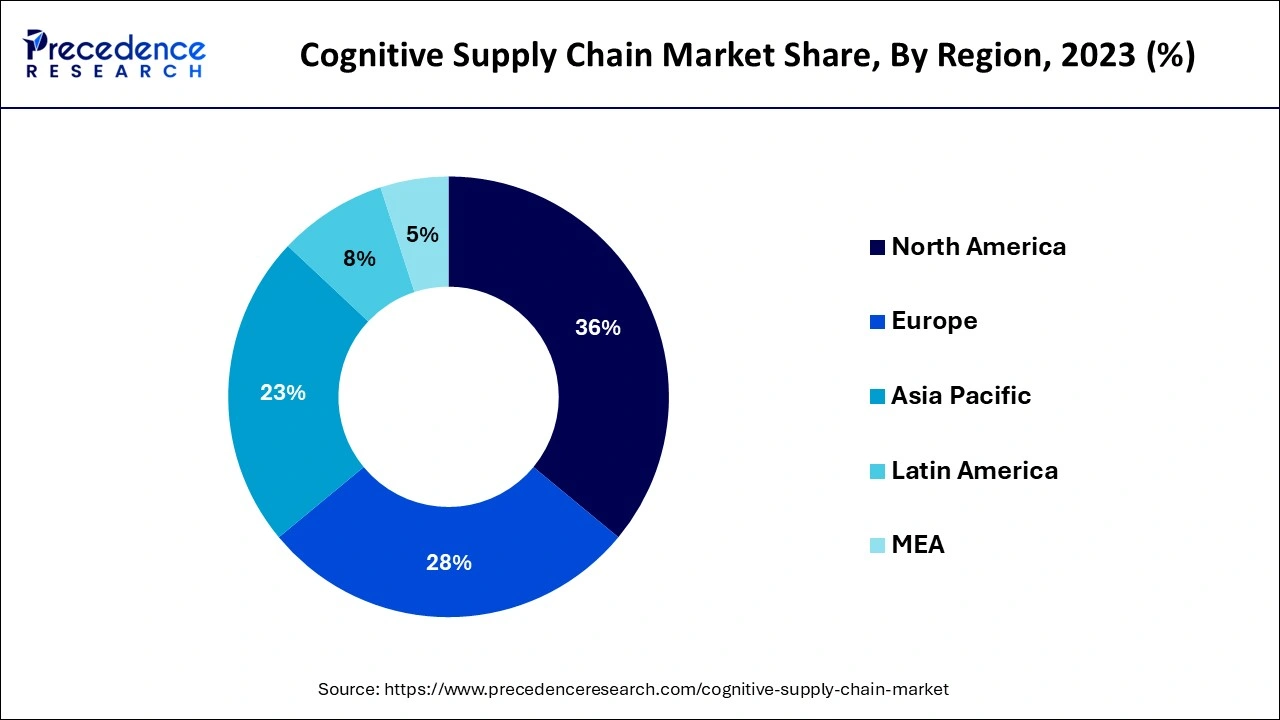

North America accounted for the largest share of the cognitive supply chain market in 2023. The rising need for performance and cost optimization represents one of the key factors. Organizations actively seek ways to streamline and effectively manage their supply chain activities, spend less, and increase efficiency. The availability and strength of numbers of IT firms and other related supply chain manufacturing firms in the U.S. have led to the development and implementation of cognitive supply chains. They are pouring large amounts of money into research and technology, resulting in higher levels of innovation, such as the application of forecasting techniques, inventory control, and logistics. Moreover, the promotion of digitalization and innovation strategies by the U.S. government influences favorable regulatory conditions.

Asia Pacific is anticipated to witness the fastest growth in the cognitive supply chain market during the forecasted years. The Asia Pacific market has risen due to two significant factors: the emergence of new technologies and the increasing need for an efficient supply chain. Since the region has a high level of economic development and almost all industries saw high levels of digitization, companies were actively interested in improving efficiency and cutting costs. Growing cases of implementing artificial intelligence and IoT in businesses through the government's embrace of its Digital India program. E-commerce expansion promotes the demand for advanced supply chain solutions.

The cognitive supply chain is a system that can creatively advance supply chain management with the help of artificial intelligence (AI), machine learning (ML), and analytics. It is capable of self-learning and self-optimizing and enables organizations to anticipate disruptions in the market while enhancing operations in real-time. Some applications of a cognitive supply chain include optimization of inventory visibility, manufacturing asset intelligence in real-time control, and visibility through a control tower.

Cognitive supply chain market technologies enhance the flow of operations so that products get to the customers within a short time and enhance the overall supply chain agility. Throughout the globe, the cost-cutting factor acts as one of the major forces behind the growth of this market. The use of cognitive technologies is growing not only in one field but also in several industries. There is increasing interest and acceptance of cognitive technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 436.29 Billion |

| Market Size in 2024 | USD 85.78 Billion |

| Market Size in 2025 | USD 100.90 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 17.66% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Deployment, Enterprise Size, Automation Used, Industry Verticals, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising e-commerce industry

Cognitive supply chain market allows e-commerce businesses to enhance supply chain management with the help of machine learning and analytics processes that deal with data received from partners in the supply chain. Cognitive supply chains offer businesses supply chain information in real-time from their supply chain partners. This can be useful to organizations, especially in determining when to make or buy some commodities, to avoid outdated stock or overcrowding of stocks.

Cognitive supply chains use artificial intelligence, machine learning, and advanced analytics to advance supply chain productivity, decrease costs, and boost customer experience. The key driver behind the cognitive supply chain market is the growing supply chain requirements of the e-commerce industry.

High cost of development and deployment

The cognitive supply chain market faces obstacles with high costs involved in development and deployment. Integration of modern capabilities like artificial intelligence, machine learning, Internet of Things (IoT), and big analytics requires a major investment. Integration with other systems, especially customization options, also contributes to this cost. However, maintenance, updates, and training in the future are added costs that will amount to the total expenditure. These financial factors make it difficult for small and medium businesses to implement cognitive supply chain solutions.

IoT and Cloud Solutions Transform Supply Chain Operations

In the cognitive supply chain market, the Internet of Things includes devices for tracking and collecting real-time information about inventory status, transportation, and environment, hence cutting down on time and increasing transparency. Stakeholders collect this information; cloud platforms consolidate it to support cooperation, demand planning, and supply chain management. Altogether, these technologies improve efficiency, drive down expenditure, and enable decision-making in real-time, thus evolving traditional supply chains into complex networks.

Uses cover demand prediction, stock management, distribution route determination, and risk assessment. The cognitive supply chain market is developing as more organizations target higher levels of resilience and efficiency as they leverage AI-specialized IoT and cloud solutions to their networks. It should be noted that this market provides an important foundation for the development of responsive, sustainable, and preventative supply chain solutions.

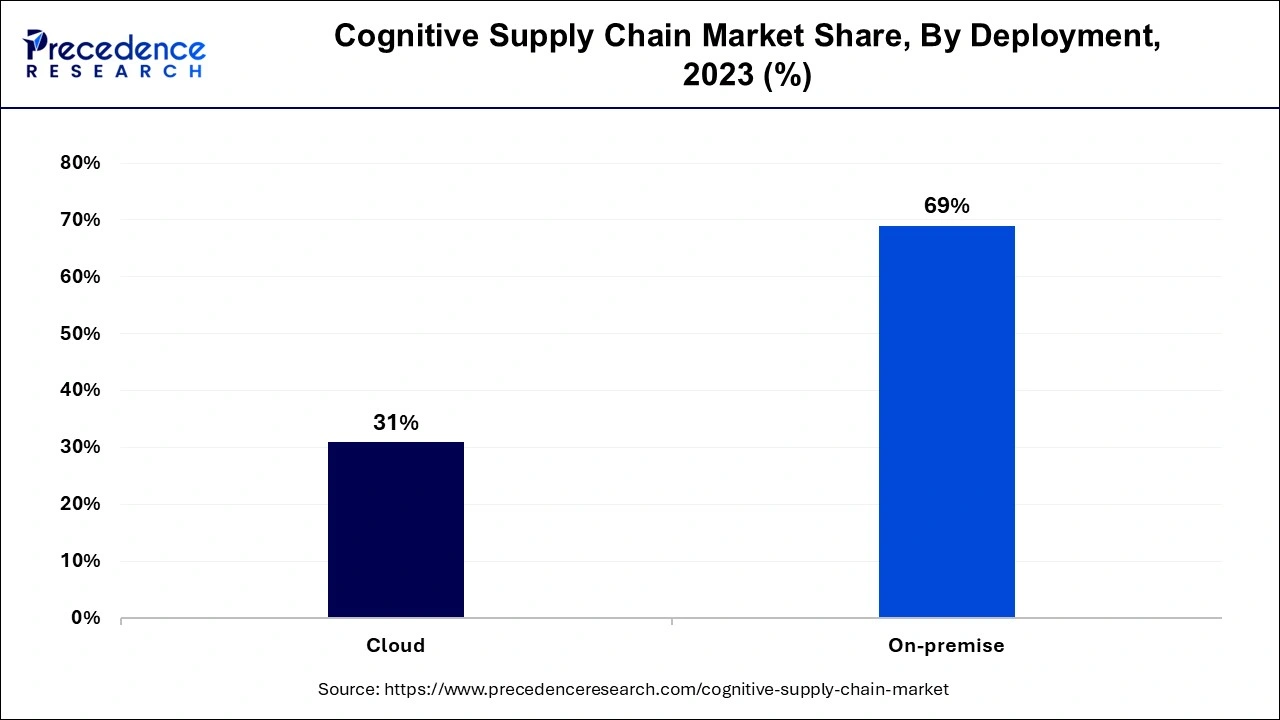

The on-premise deployment segment led the global cognitive supply chain market in 2023. On-premise is one of the models used to address the implementation of cognitive supply chain solutions within compound installations. Machine learning and analytics are used to track real-time stocks, which also aid in the automatic control of production and inventories. All these can lead to better inventory control, demand planning, and supply chain. Moreover, the cognitive supply chain involves a lot of data processing and analytics, low latency processing, and integration with existing technologies to provide a rationale for on-premises deployment preference. Furthermore, data privacy concerns help in increasing the adoption of on-premise deployment.

The cloud segment is projected to witness the fastest growth in the cognitive supply chain market during the forecast period. Cloud technology provides organizations with limitless capability for storage, analysis, and access to Big Data supply chain data. It also helps firms leverage cognitive computing and analytics applications, which demand a great deal of computing capacity and recurring expenses, receiving all the advantages of cheap and affordable solutions. A cognitive supply chain leverages cloud or container technologies such as machine learning, artificial intelligence, and data analytics to optimize decision-making in the supply chain. The major benefit that can be associated with the cloud deployment segment is that of cost-effectiveness.

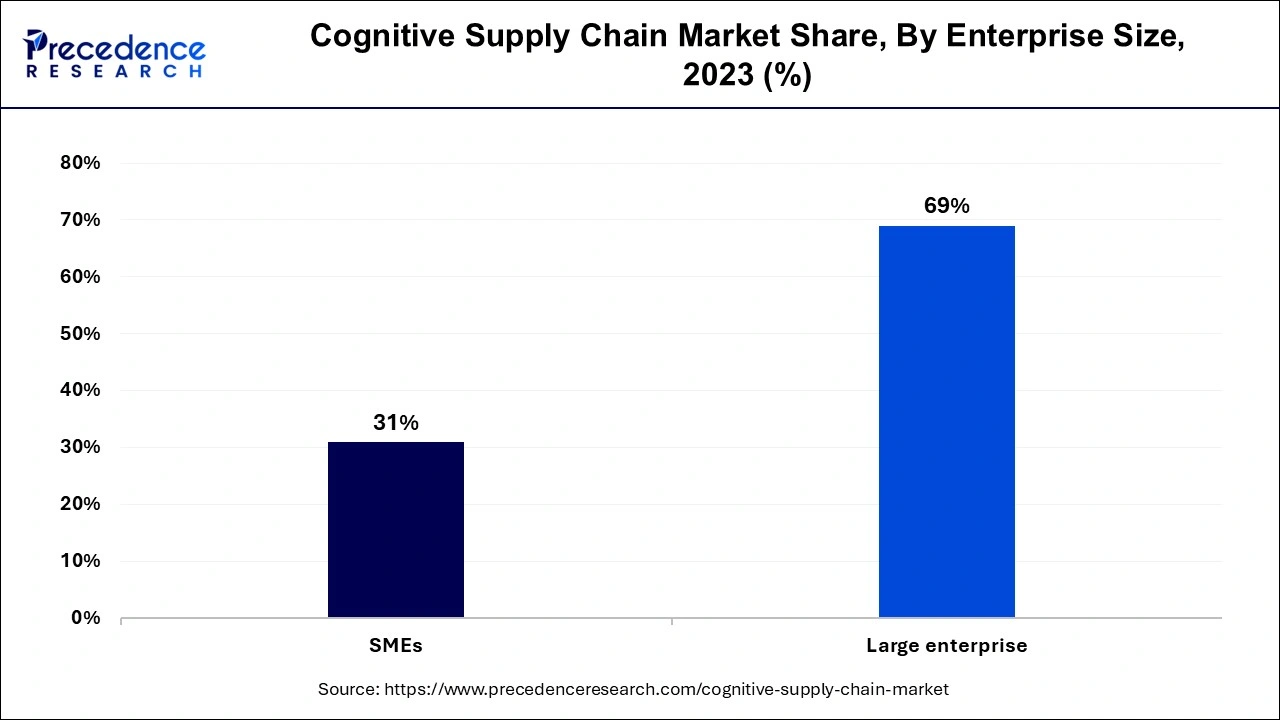

The large enterprises segment has contributed the largest share of the cognitive supply chain market in 2023. Cognitive supply chains are a good fit for large enterprises because they can help businesses make faster and more effective decisions. Business adoption of cognitive technologies has been across large enterprises and in several areas of supply chain management, such as demand planning, inventory planning, logistics, and supplier management. With AI and ML embedded into their supply chain operations, these enterprises have an opportunity to analyze large volumes of data, look for patterns and trends, and make fewer mistakes. Cognitive technologies also enhance efficiency, cut operation costs, and are characterized by less interruption of supply chain activities.

The SME segment is projected to witness the fastest growth in the cognitive supply chain market during the forecast period. Supply chain technology is an effective element of cognition since it is cost-friendly, specifically for SMEs, due to its application of scalability. SMEs have the availability to use cognitive supply chains in the cloud, which costs less than the traditional locally deployed ones, and thus, the price is relatively low for SMEs. This declined financial hurdle has allowed small and medium-sized enterprises to implement innovative technologies and acquire a competitive edge in their respective industries. Additionally, the scalability of cognitive supply chain solutions has been another dynamic force behind SME implementation.

The Internet of Things (IoT) segment noted the largest share of the cognitive supply chain market in 2023. Cognitive supply chain and IoT are two technologies that can enhance the supply chain. In the process of the implementation of RFID technology, businesses received many benefits from the collection and analysis of real-time supply chain data sets. The great level of visibility meant that the companies were able to predetermine. With real-time data collection and analysis, businesses enlarged valuable insights into the movement and condition of goods at each stage of the supply chain.

The machine learning (ML) segment is projected to witness the fastest growth in the cognitive supply chain market during the forecast period. A cognitive supply chain applies machine learning and artificial intelligence in the supply chain. The use of AI and ML is on the rise because organizations are aware of the possibility of using these technologies to enhance the supply chain. Automating the ML leads to enhancing the centralization and optimization of the supply chain processes, reducing operating costs, improving efficiency, and making more effective decisions in this market segment. Firms have adopted these solutions to increase visibility and efficiency in the supply chain.

The manufacturing segment contributed the largest share of the cognitive supply chain market in 2023. Cognitive manufacturing is the application of cognitive computing along with the industrial Internet of Things and analytics to reinvent manufacturing. Manufacturers are adopting cognitive technologies to carry out predictive maintenance techniques. They can examine data from sensors and equipment and determine when an element is likely to fail and maintain. A proactive practice helped to minimize physical outages and also bolster the longevity of crucial equipment, adding value to overall organizational performance. Quality control and defect detection are also areas in which remarkable developments in the manufacturing industry are being endorsed by cognitive supply chain solutions.

The logistics and transportation segment is projected to witness the fastest growth in the cognitive supply chain market during the forecast period. A cognitive supply chain uses analytics and machine learning to monitor stock levels in real-time, handling production and inventories mechanically to keep the entire network running smoothly. These vehicles rely very much on integrating attributes such as computer vision and machine learning techniques to capture traffic patterns, roadblocks, and the best route for delivering goods within the shortest time possible while observing traffic regulations. The logistics can predict demands, recognize risks, and manage inventories by incorporating data from numerous IoT devices, sensors, and weather predictions. The outcome is a lower cost of operations and higher levels of service delivery.

By Deployment

By Enterprise Size

By Automation Used

By Industry Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

January 2025

April 2024