March 2024

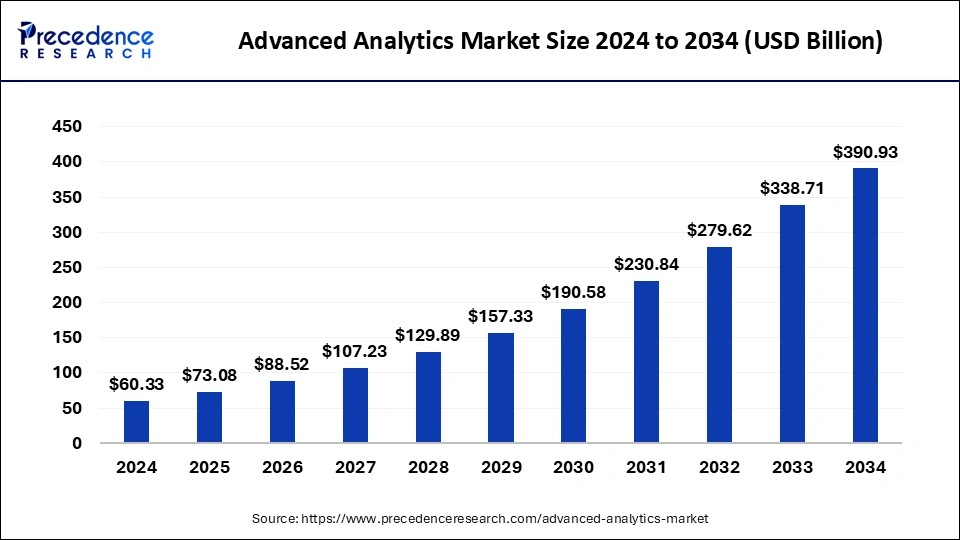

The global advanced analytics market size is calculated at USD 73.08 billion in 2025 and is forecasted to reach around USD 390.93 billion by 2034, accelerating at a CAGR of 20.55% from 2025 to 2034. The North America advanced analytics market size surpassed USD 27.75 billion in 2024 and is expanding at a CAGR of 20.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global advanced analytics market size was estimated at USD 60.33 billion in 2024 and is predicted to increase from USD 73.08 billion in 2025 to approximately USD 390.93 billion by 2034, expanding at a CAGR of 20.55% from 2025 to 2034. With the use of advanced analytics and a large dataset derived from diverse sources, including social media, IoT devices, and transactional systems, data generation from these sources has grown exponentially.

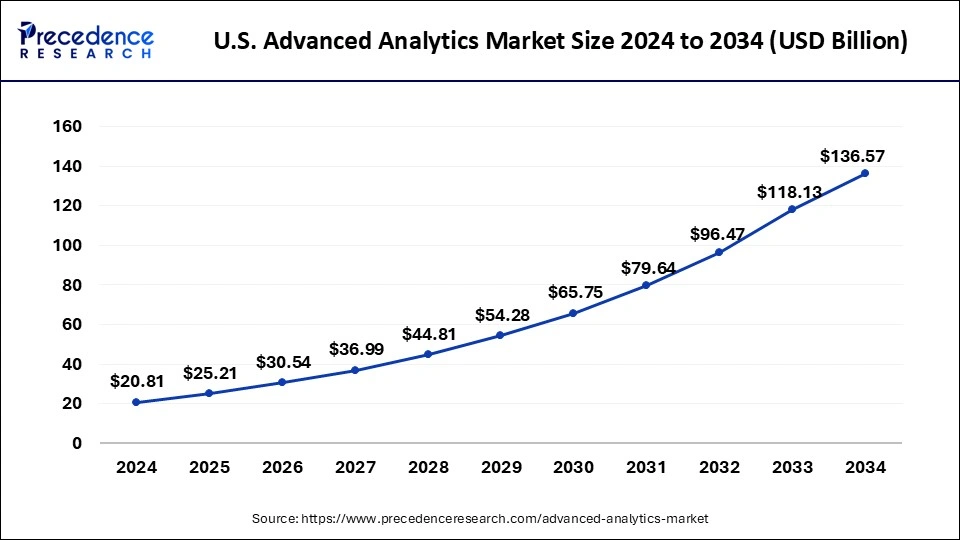

The U.S. advanced analytics market size surpassed USD 20.81 billion in 2024 and is projected to attain around USD 136.57 billion by 2034, poised to grow at a CAGR of 20.70% from 2025 to 2034.

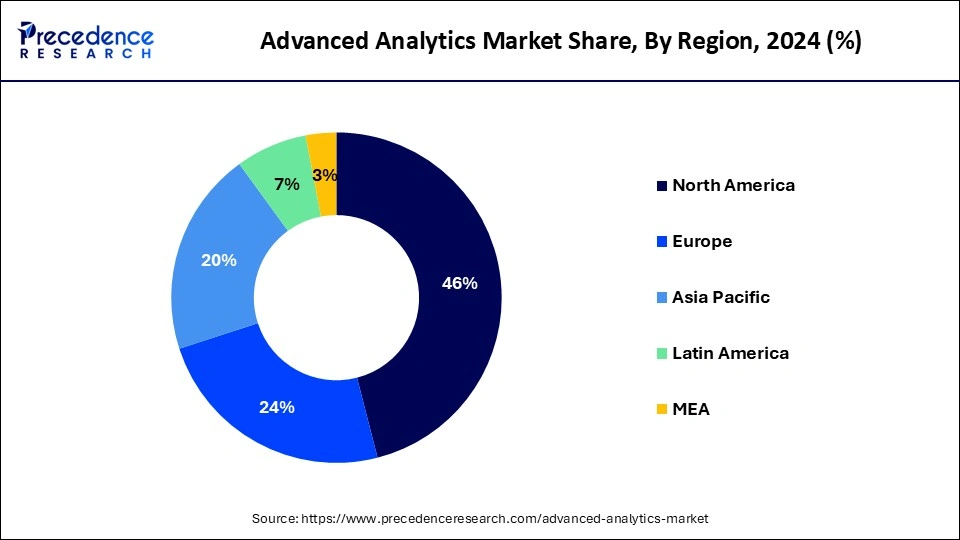

North America holds the largest share of the advanced analytics market. In order to identify anomalous transaction patterns and lower financial risks, the BFSI (Banking, financial services, and insurance) industry is substantially investing in advanced analytics. Advanced analytics is being used by industries like manufacturing, healthcare, and retail to improve operational effectiveness and forecast market trends. The industry is expanding more quickly thanks to the creation of new analytics solutions, such as cloud-based platforms and AI-driven tools. Forecasts indicate that the industry will continue to develop rapidly due to advancements in big data, AI, and machine learning technologies. North America, and especially the US, will probably be at the forefront of this boom because of its early embrace of cutting-edge technologies and abundance of analytics providers.

Asia Pacific is expected to grow at a notable CAGR in the advanced analytics market over the projected years. Businesses in a variety of industries, such as healthcare, retail, telecommunications, and BFSI, are embracing sophisticated analytics more and more to improve consumer experiences and decision-making processes.

The Asia-Pacific region's governments are encouraging data-driven decision-making by investing in analytics infrastructure and enacting supportive laws. Businesses, particularly small and medium-sized organizations (SMEs), are benefiting from this encouragement as they implement advanced analytics solutions. Asian businesses, for example, are using analytics to help with customer service, sales, and digital marketing, which is improving customer lifecycle management and increasing sales conversion rates. For many businesses, integrating several data sources and guaranteeing connection across many platforms continues to be a major difficulty. Analytics programs must be successful, and this requires effective data integration.

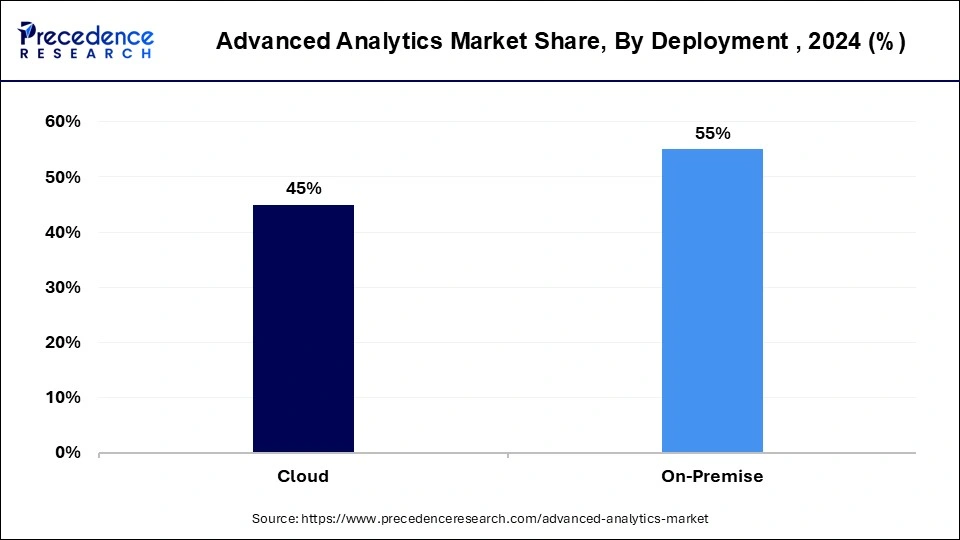

The increasing use of big data analytics across several industries and the growing acceptance of AI and machine learning for tailored customer experiences are driving the market's growth. Because it appeals to companies with strict security, regulatory, and data control requirements particularly in industries like finance and healthcare on-premises deployment continues to have the biggest market share. The largest business function category, supply chain management, is where advanced analytics are mostly applied. Using this tool can improve overall operational efficiency, streamline logistics, and optimize inventory. The banking, financial services, and insurance (BFSI) industry has the biggest market share because it uses analytics extensively for risk assessment, fraud detection, and individualized customer care.

Healthcare, IT and telecom, retail, and manufacturing are some other prominent industrial sectors that use analytics to boost productivity, enhance consumer insights, and streamline workflows. It is anticipated that the market will keep expanding quickly due to technology breakthroughs, the growing significance of data-driven decision-making, and the continuous digital transformation of various sectors. Because of rising investments in artificial intelligence (AI) and big data analytics, especially in China and India, the region is expected to expand at the fastest rate of return. Due to the wide range of data analytics tool providers and the high adoption rates of big data technologies, North America dominates the advanced analytics market.

| Report Coverage | Details |

| Market Size by 2034 |

USD 390.93 Billion |

| Market Size in 2025 | USD 73.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 20.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Enterprise Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Predictive and prescriptive analytics

Advanced analytics, which is increasingly being used in a variety of industries to support data-driven decision-making and obtain a competitive edge, includes predictive and prescriptive analytics as essential components. Utilizing statistical algorithms, machine learning methods, and historical data, predictive analytics determines the probability of future events. The objective is to project future events based on trends found in historical data.

Businesses may improve customer happiness, streamline processes, and proactively address possible problems with the help of predictive analytics. Deeper insights and practical recommendations are being provided by predictive and prescriptive analytics, which is revolutionizing the way firms run. The effectiveness and adoption of these analytics techniques across many industries will be further enhanced by their integration with emerging technologies as the advanced analytics industry continues to expand.

Ethical considerations

The market for advanced analytics is expanding quickly due to advancements in artificial intelligence, machine learning, and data science. To guarantee the proper use of technology, however, important ethical issues raised by these developments must be addressed. One of the main concerns is making sure that people's personal information is secure and not exploited.

The significance of data privacy is emphasized by laws like the CCPA in California and the GDPR in Europe. It is imperative to guarantee that analytics models are equitable and do not prejudice any group on the basis of race, gender, socioeconomic status, or other protected characteristics. Businesses that use sophisticated analytics have to take responsibility for the results of their models, especially in fields like healthcare, finance, or criminal justice, where decisions have an influence on people's lives.

Retail and e-commerce

Advanced analytics examines a customer's preferences, buying habits, and interactions across several channels to assist businesses and e-commerce platforms in better understanding their customers. Businesses can make data-driven decisions to optimize inventory levels, decrease stockouts, and enhance overall operational efficiency by examining historical sales data, market trends, and external factors like weather patterns or economic indicators.

Businesses engaged in retail or e-commerce are susceptible to fraud-related threats such as identity theft, payment fraud, and account takeover. These businesses can prevent financial losses by implementing preventive measures and detecting abnormalities and patterns that point to fraudulent behavior thanks to advanced analytics.

The big data analytics segment held the largest share of the market in 2024. In order to find hidden patterns, correlations, and other insights, big data analytics, which deals with processing and analyzing enormous amounts of complex and diverse data sets, is a critical component of the advanced analytics market. This section focuses on using cutting-edge methods and tools to mine structured, semi-structured, and unstructured data sources for insightful information. Big data analytics has applications in many different industries, including manufacturing, telecommunications, retail, healthcare, and finance.

These insights are used by organizations to improve customer experiences, streamline operations, improve decision-making, reduce risks, and spur innovation. The advanced analytics market's big data analytics segment is expanding quickly due to the abundance of data sources and the increasing understanding of the benefits that businesses can derive from data-driven insights.

The customer analytics segment is expected to grow at the fastest rate in the advanced analytics market during the period studied. A crucial area of the advanced analytics industry is customer analytics, which uses data analysis to understand consumer behavior, preferences, and demands. It uses a variety of cutting-edge analytical methods, such as data mining, machine learning, and predictive modeling, to glean meaningful insights from massive amounts of client data.

Collecting information from a range of sources, including social media, demographics, and consumer interactions and transactions. For analysis, this data is subsequently combined into a single database. Recommending courses of action or tactics to maximize corporate results via simulations and prediction models. Prescriptive analytics offers useful information to help with decision-making. Analyzing past data to identify patterns, trends, and customer behavior. Historical context can be gained through descriptive analytics.

The on-premises segment dominated the advanced analytics market in 2024. The advanced analytics market's "on-premises" sector describes a deployment approach in which an organization installs and runs its software and computing infrastructure on its own property, as opposed to having it hosted remotely by a third-party service provider (like a cloud provider). With on-premises solutions, businesses may analyze massive amounts of data locally by utilizing strong hardware resources that are tailored to their particular requirements.

In comparison to cloud-based options, this enables more customization, interoperability with current systems, and possibly better processing speeds. On-premises solutions could come with a hefty initial outlay for software and hardware licenses in addition to continuing maintenance and support expenses.

The cloud segment is expected to expand significantly in the advanced analytics market over the forecast period. The utilization of cloud computing resources and services for advanced analytics tasks is referred to as the cloud segment in the advanced analytics market. Advanced analytics is the process of analyzing data and drawing conclusions from it using complex methods and tools, frequently in conjunction with artificial intelligence, machine learning, and other cutting-edge algorithms.

Businesses can stop investing in and maintaining their own hardware infrastructure by utilizing cloud computing. Alternatively, companies can opt for pay-as-you-go computing resource billing, which can prove to be more economical, particularly for small and medium-sized enterprises. Teams and stakeholders can work together and share data from anywhere, thanks to cloud-based analytics platforms. This encourages cooperation and makes it possible to make decisions based on data-driven insights more quickly.

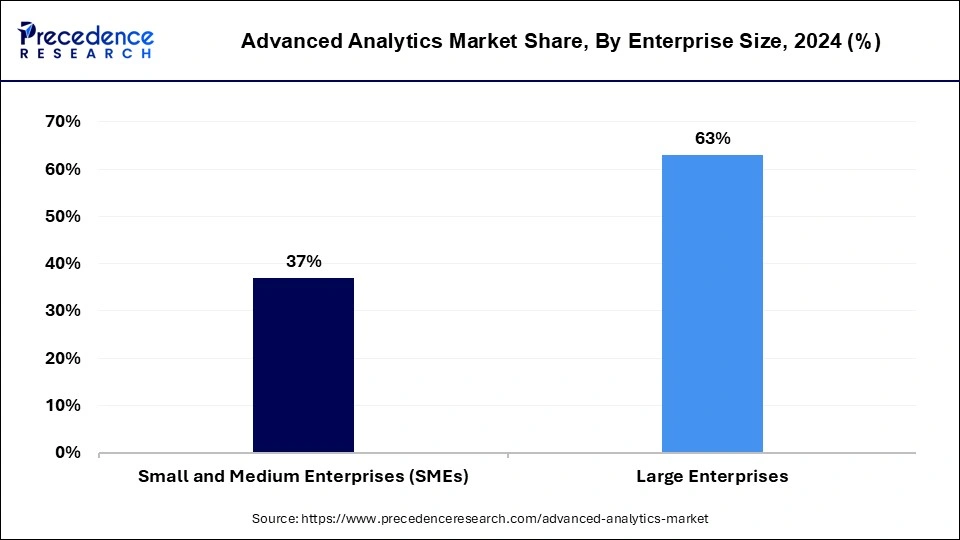

The large enterprise segment holds the largest share of the advanced analytics market. In the advanced analytics market, companies or organizations with sizable operations, resources, and size are referred to as large enterprises. These are usually large, internationally operating firms or corporations with significant revenue streams that span multiple industries or locations. Large businesses handle enormous volumes of both structured and unstructured data, necessitating the processing, analysis, and extraction of useful insights using sophisticated analytics tools and methodologies.

Major corporations devote significant resources to the implementation of advanced analytics solutions, encompassing expenditures in technical infrastructure, hiring personnel with expertise in data science, and continuous maintenance and support. Large businesses frequently have pre-existing IT architectures and legacy technologies. For data security, interoperability, and consistency to be guaranteed, advanced analytics solutions must be seamlessly integrated with these systems.

The small & medium enterprises (SMEs) segment is expected to grow significantly in the advanced analytics market during the forecast period. SMEs are starting to understand the importance of using advanced analytics to obtain insights, improve decision-making, and boost competitiveness as technology becomes more widely available and more reasonably priced. SMEs are coming to understand how crucial data-driven insights are to maintaining their competitiveness in their markets. In order to better analyze customer behavior, streamline processes, and spot new opportunities, they are progressively implementing advanced analytics solutions. SMEs who successfully use advanced analytics acquire a competitive edge through data-driven decision-making, trend prediction, resource allocation optimization, and client personalization.

The BFSI segment accounted for the largest share of the advanced analytics market in 2024. BFSI businesses extensively use sophisticated analytics to identify and reduce risks. Through the examination of extensive datasets containing market trends, consumer behavior, and transaction patterns, they are able to recognize possible hazards and proactively reduce losses. They can examine consumer data using advanced analytics to learn important details about their requirements, interests, and habits. This information helps them create individualized marketing campaigns and product offers. The BFSI sector operates inside a highly regulated environment with stringent compliance standards. Through the analysis of enormous volumes of data to spot any irregularities or possible breaches, advanced analytics tools assist financial institutions in ensuring regulatory compliance.

The IT & telecom segment is projected to gain a significant share of the advanced analytics market in the upcoming years. Large volumes of data are produced by the telecom and IT sectors from a variety of sources, including network logs, client interactions, device data, and more. By using advanced analytics, this data may be used to gain insightful knowledge about a variety of topics, including network performance, security risks, and customer behavior. Advanced analytics is used by telecom businesses to guarantee quality of service, forecast and prevent network disruptions, and optimize network performance. Telecom operators can increase dependability and decrease downtime by proactively identifying and resolving issues through real-time analysis of network data. Through the examination of data from several sources, including supply chain management systems, maintenance records, and equipment sensors, businesses may pinpoint opportunities for enhancement, optimize workflows, and allocate resources.

By Type

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

February 2025

October 2024

July 2024