January 2025

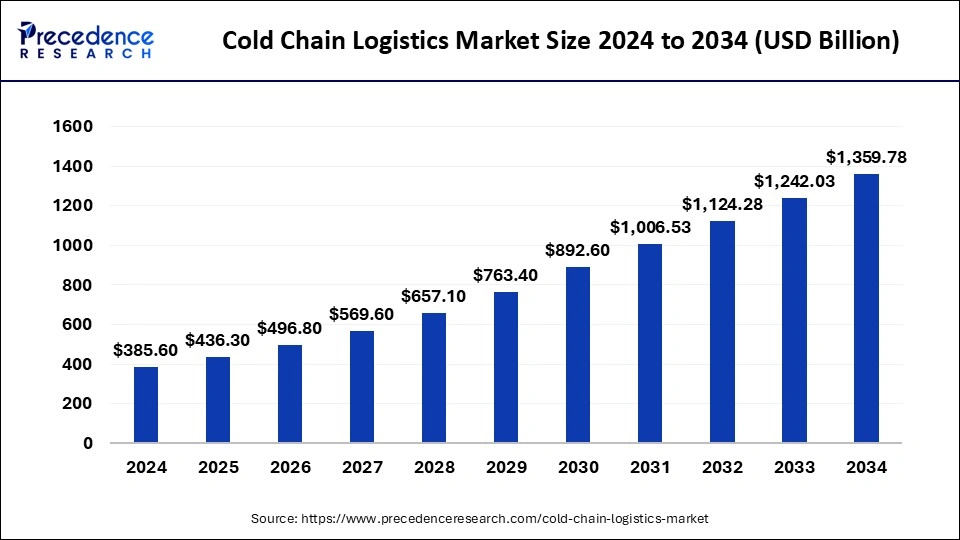

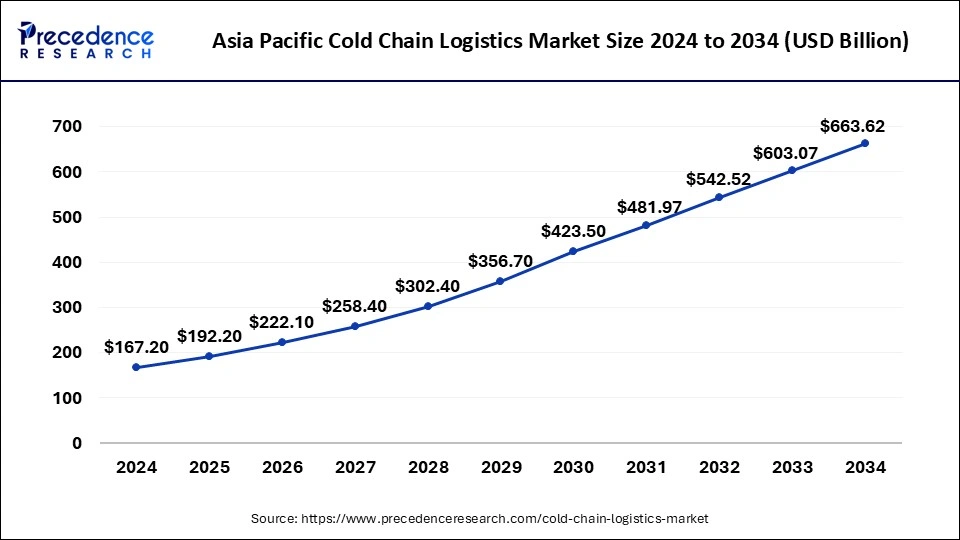

The global cold chain logistics market size is evaluated at USD 436.30 billion in 2025 and is forecasted to hit around USD 1,359.78 billion by 2034, growing at a CAGR of 13.46% from 2025 to 2034. The Asia Pacific market size was accounted at USD 167.20 billion in 2024 and is expanding at a CAGR of 14.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold chain logistics market size accounted for USD 385.60 billion in 2024 and is predicted to increase from USD 436.30 billion in 2025 to approximately USD 1,359.78 billion by 2034, expanding at a CAGR of 13.46% from 2025 to 2034.

The Asia Pacific cold chain logistics market size was exhibited at USD 167.20 billion in 2024 and is projected to be worth around USD 663.62 billion by 2034, growing at a CAGR of 14.76% from 2025 to 2034.

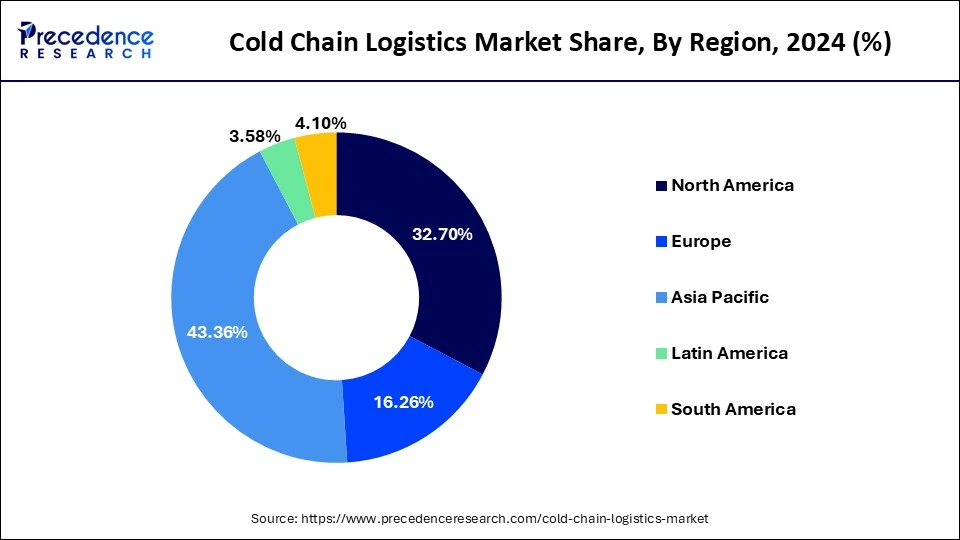

On the basis of geography, there shall be a great demand for cold chain logistics in the Asia Pacific region. The Asia Pacific region is expected to have the fastest growth during the forecast period as there has been an increase in the investment through the government of various nations for developing the infrastructure of cold chain logistics. There is a great demand for different types of processed food items and an increased demand for frozen dairy or even meat products which has led to a growth in the cold chain logistics market. There has been a maximum amount of growth in the regions like India, China, South Korea as well as Japan. These regions are expected to have the highest market share for the usage of cold chain logistics. Increase the number of different pharmaceutical companies and the increasing amount of FDI the market for cold chain logistics is expected to grow during the forecast period.

Apart from the Asia Pacific region other developing nations like Africa, Latin America as well as Middle East is also seeing a good demand for various food products that require cold storage warehousing and transport. Rapid industrialization is also expected to drive the market growth in the developing nations. In the developing nations there is a growth in the demand for frozen food products that are easy to cook and consume as the people in these nations have a hectic lifestyle.

In order to transport various goods and products that need to be stored at a particular temperature make use of the cold chain logistics technology. In order to transport various goods in a good condition this technology is used. Frozen food and various pharmaceutical products make use of this supply chain technology. In order to deliver agricultural products in the fresh form cold chain logistics is used. There is an increase in the use of this technology in every aspect of the supply chain. This technology is used for delivery purposes. It is also used for large scale storage of various products. And it is also used in the transportation of these products to its destination.

The transportation usually occurs through the use of the refrigerated cargo. Cold chain logistics makes use of roadways, Airways and even railways. When it comes to the storage a storage facility which has a warehouse which is insulated in order to have a temperature control is used. The increased use of cold chain logistics is due to and increases in the production of various goods. The use of this technology has been helpful in capturing larger markets for various products manufactured by the companies. The cold chain supply or logistics is extremely beneficial in maintaining the quality of various food products or even drugs.

During the pandemic due to a complete lockdown across various nations the logistics services were affected to a great extent. The cold storage logistics market was affected in different regions due to a restriction on movement. As there was restriction on transportation various industries were shut down during the pandemic. Restricted movement also caused lack of row material used in the production of various goods. After the pandemic there has been a steady growth in the market. Various companies are bringing in new policies that will be helpful in generating good amount of sales in order to recover the damage is caused during the pandemic

The global cold chain logistics market is expected to grow well during the forecast period. Due to a growing demand for refrigerated warehouses in the developed as well as the developing economies. During the pandemic cold chain logistics or cold storage transportation was used in order to carry out the vaccination rise. This market is expected to grow as there is a great demand through the pharmaceutical sector. The pharmaceutical market will provide a great business for the cold chain logistics. The food and beverages industry also makes use of cold chain logistics and it is expected to boost the demand for cold chain logistics. There has been a growth in the market due to constant research and development to have more effective services. There is an increase in the use of radio frequency identification technology in this market and this is expected to provide good growth during the forecast period.

The increased use of this software in various industries that make use of cold chain logistics will provide a better growth for the market. As there is a growth in the number of the various distribution channels like the supermarkets or the hypermarkets, different types of convenience stores there shall be a greater demand for cold storage logistics. Bully policies adopted by the government relating to the trade of various food products that will be helpful in reducing the wastage of food will also be helpful in having a effective distribution channel. They shall be an increase in the use of coal storage options and transportation options.

The larger retail chains in the organized form like spar, Walmart are focusing on providing their outlets in different developed nations. Apart from the developed nations these organized retail chains are also planning to expand their business to the developing nations. These expansions shall lead to an increase in the demand for cold chain logistics in the developed as well as the developing economies. Walmart is present in 24 countries which is a US based retail chain. It has 10,526 outlets in these 24 countries.

The expanding business of these retail chains across the globe and they are increasing operations in the developing as well as the developed nations will be helpful in providing better opportunities for growth of the cold chain logistics during the forecast period as the demand for refrigeration for transportation as well as storage will increase. There has also been an increase in the initiatives taken by various countries that are supportive of developing the market for coal chain logistics in developing nations. These government policies are also focusing on providing innovative solutions that will provide effective transportation as well as storage options for various food products that need temperature control. After the pandemic as there is a growth in the delivery services as the demand for the processed and the perishable food items has increased there shall be more opportunities in the market during the forecast period.

| Report Coverage | Details |

| Growth Rate from 20255 to 2034 | CAGR of 13.46% |

| Market Size in 2025 | USD 436.30 Billion |

| Market Size by 2034 | USD 1,359.78 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Temperature Type, Technology, Process, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

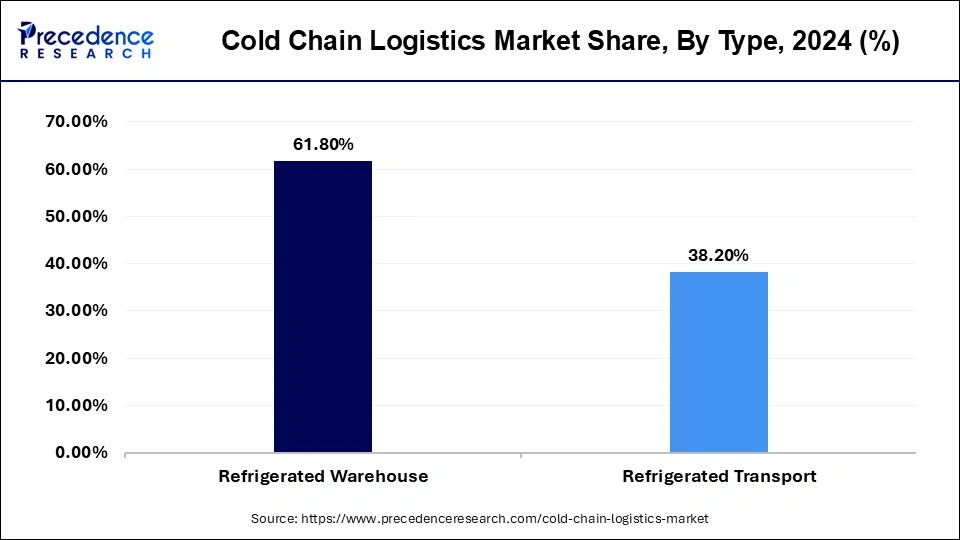

On the basis of the type, the refrigerated warehouse segment is expected to have the largest market share. The refrigerated warehouse segment will dominate the market in the coming years. As there is a growth in the demand for packaged food items across the globe the need for it's storage arises. Improve lifestyle and increase in the purchasing power has changed the patterns of consumption of food. There is a growth in the demand for various food products as well as frozen food items. These changes in the consumption of food products of the consumers will create a demand for these refrigerated warehouses in the coming years. In order to store the perishable and frozen food and for cold storage warehouses is increasing.

Apart from the warehouse the refrigerated transport segment will also have a good growth in the coming years. this transport segment then grow at a fast compound annual growth rate in the coming years as that is all good demand for the refrigerated transport. refrigerated transport helps in maintaining the quality of food during the transport. Cold storage plays a very important role Wendy's sensitive food items need to be transported from one place to another where the distance is large. The control temperature in these refrigerated transport helps in maintaining the quality of the food items. The different modes of transport used for moving these perishable or processed food items that need refrigeration or roadways, Airways, waterways and railways. Roadways are used for shorter distance travels. The refrigerated transportation segment will grow well in the coming year.

Global Cold Chain Logistics Market Revenue, By Type, 2022-2024 (USD Billion)

| By Type | 2022 | 2023 | 2024 |

| Refrigerated Warehouse | 187.40 | 211.26 | 238.29 |

| Refrigerated Transport | 117.43 | 131.49 | 147.28 |

On the basis of application, the frozen desserts and dairy segment we will have the largest market share in the coming years. This segment has dominated the market in the past. As there is an increase in the demand for various dairy products the market for the frozen desserts and dairy products is expected to grow. As there is an increase in the demand for frozen meat there shall be a growth in the market. Does the maximum amount of consumption of dairy products and therefore the segment is expected to have the largest market share during the forecast period. In order to transport various bakery products like cakes, muffins, bread, other baked items or for transporting various types of processed frozen food like poultry, pork, fish, meat or beef there is a growing demand for the usage of cold chain logistics. As there has been a drastic change in the consumption pattern of the consumers across the globe due to an increased purchasing power and dual income households. There is a growing demand for frozen food items or ready to consume food due to a hectic lifestyle the market for cold chain logistics is expected to grow during the forecast period.

Apart from the transport of the dairy products all different types of frozen desserts or meet there is also an increased use of cold chain logistics for the transport of vegetables as well as fruits. In order to transport different types of seasonal fruits across the boundaries there is an increase in the use of cold chain logistics through different modes. Due to an increased business of export and import of different types of fruits that are exclusive to a particular nation there shall be a growth in the demand for cold chain logistics. in order to transport different types of medicines or vaccinations that need a controlled temperature there shall be and increased demand for cold Chain logistics across the globe.

Global Cold Chain Logistics Market Revenue, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Pharmaceuticals | 77.9 | 86.2 | 94.6 |

| Dairy & Frozen Desserts | 98.9 | 117.4 | 139.2 |

| Fruits & Vegetables | 63.2 | 69.8 | 77.4 |

| Bakery & Confectionary | 36.5 | 39.4 | 42.6 |

| Process Food | 28.4 | 30.0 | 31.7 |

| Others | 21.7 | 23.0 | 24.4 |

By Type

By Temperature Type

By Technology

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2024

January 2025