October 2024

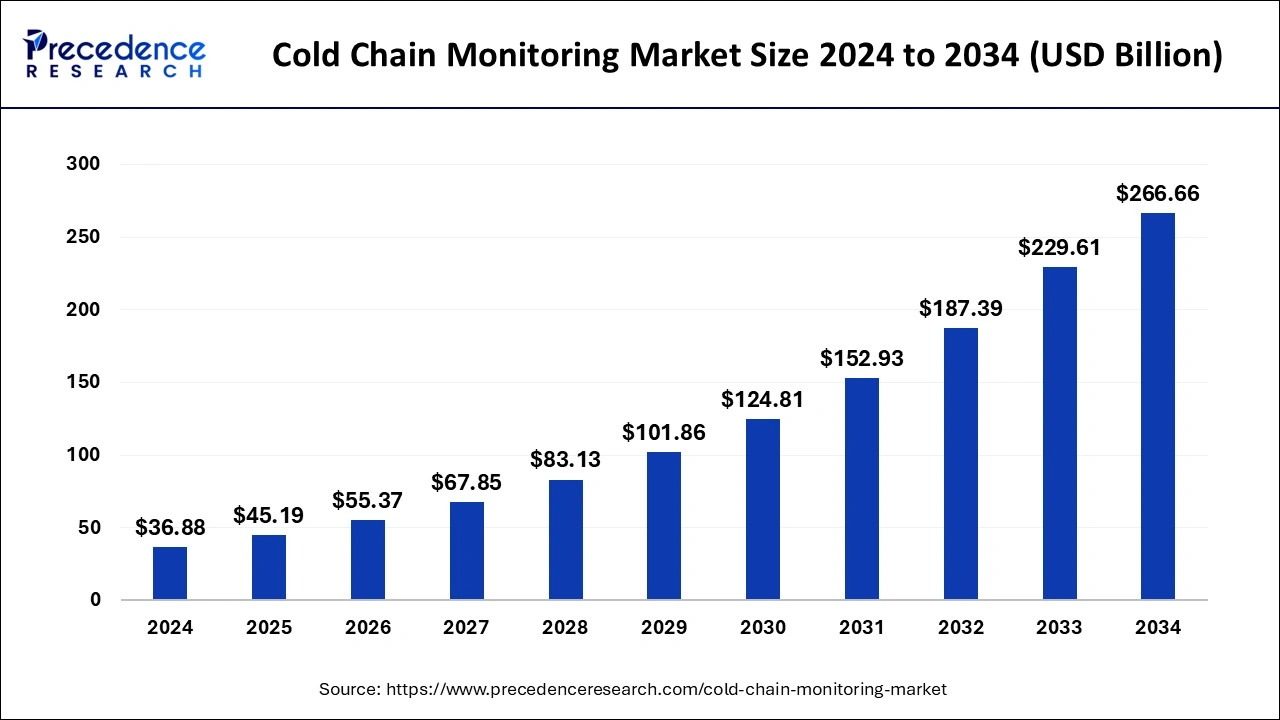

The global cold chain monitoring market size is calculated at USD 45.19 billion in 2025 and is forecasted to reach around USD 266.66 billion by 2034, accelerating at a CAGR of 21.88% from 2025 to 2034. The North America market size surpassed USD 12.91 billion in 2024 and is expanding at a CAGR of 21.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold chain monitoring market size accounted for USD 36.88 billion in 2024 and is expected to exceed around USD 266.66 billion by 2034, growing at a CAGR of 21.88% from 2025 to 2034. The cold chain monitoring market is driven by the increasing demand for temperature-sensitive pharmaceutical products, such as vaccines, biologics, and insulin.

Manual temperature checks are inefficient and can be manipulated by deliberate deception or human error. Artificial intelligence, combined with specialized sensors and Internet of Things devices, eliminates those issues and offers carriers and other stakeholders' real-time visibility by continuously monitoring the temperature of reefer trailers, even in separate compartments inside a single trailer. In addition to generating thorough reports for quality assurance, compliance audits, and strategic decision-making, it can spot trends and evaluate regulatory compliance.

AI can help ensure that cold chain logistics regulations and rules are followed. AI systems can evaluate compliance levels and provide detailed reports for auditing purposes by comparing temperature data with required temperature ranges or industry standards.

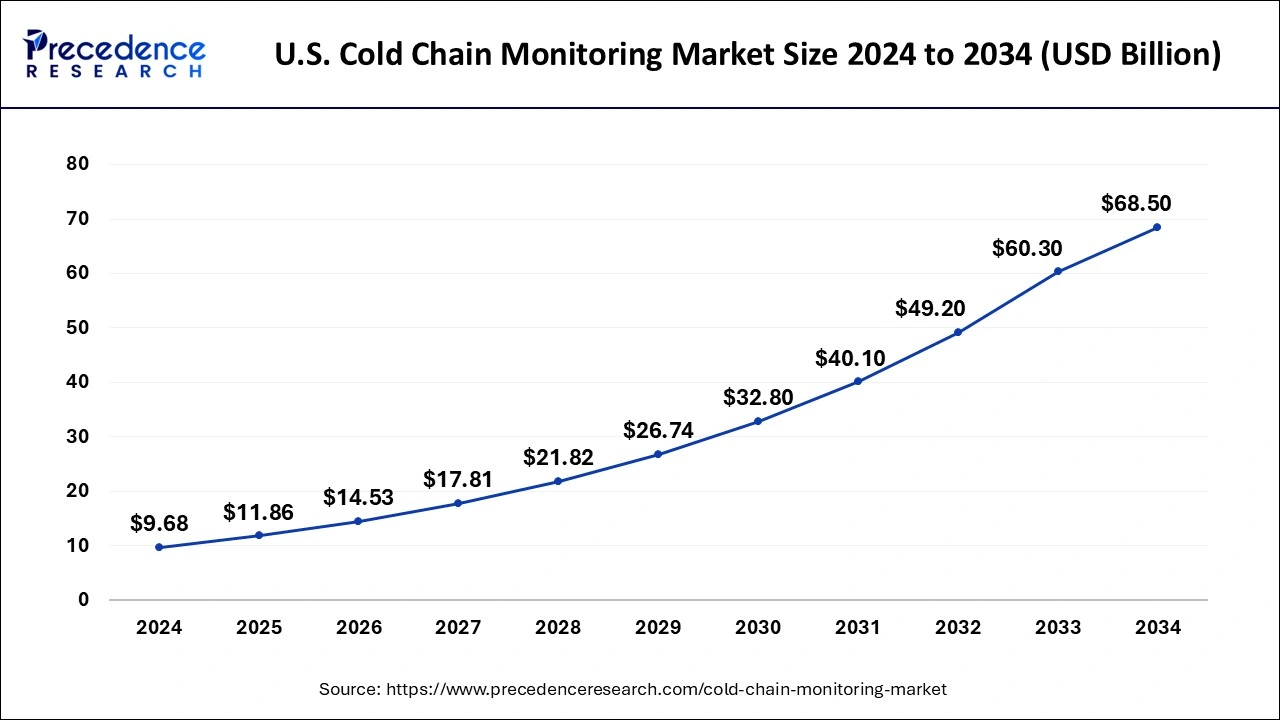

The U.S. cold chain monitoring market size was exhibited at USD 9.68 billion in 2024 and is projected to be worth around USD 68.50 billion by 2034, growing at a CAGR of 21.61% from 2025 to 2034.

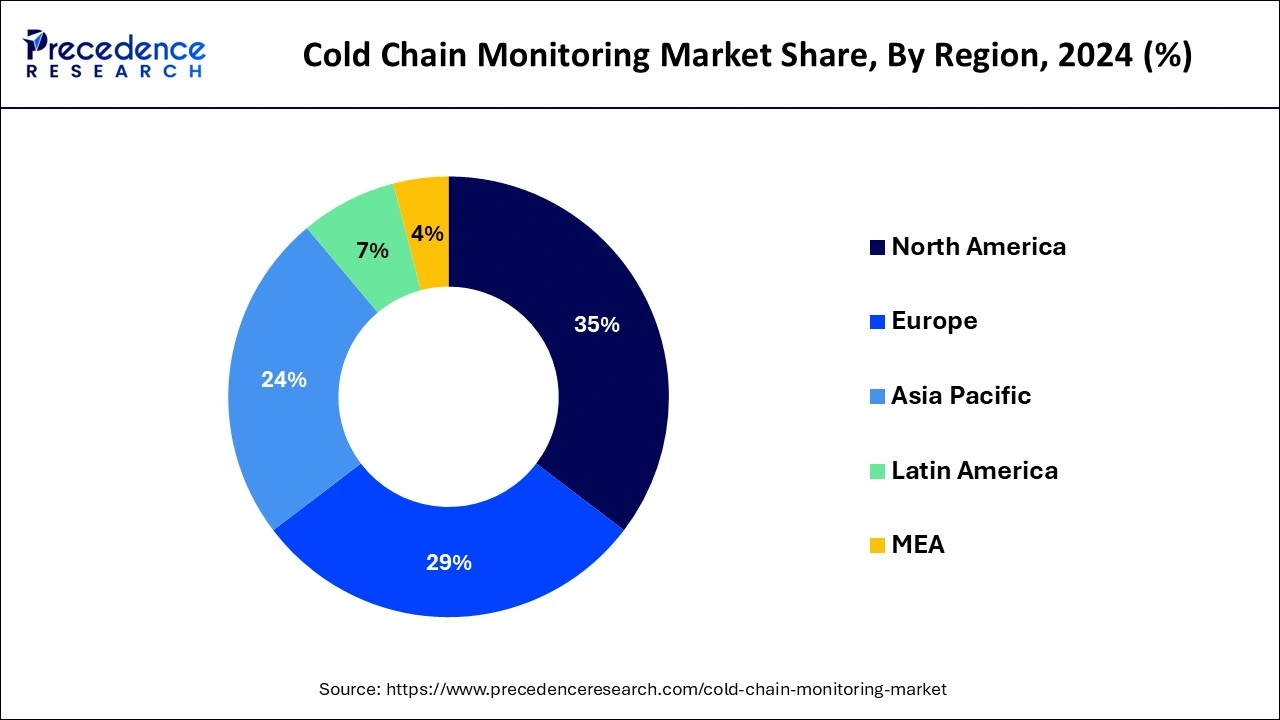

North America held the largest market share of 35% the cold chain monitoring market in 2023 due to several factors. Firstly, the region boasts advanced healthcare and pharmaceutical industries with stringent regulations, driving the demand for temperature-sensitive logistics solutions. Secondly, the presence of prominent cold chain monitoring solution providers and technological innovations contribute to market dominance. Additionally, increasing consumer demand for fresh and perishable goods, along with the rise of e-commerce, further propels the adoption of cold chain monitoring systems, solidifying North America's position as a key market leader.

The Asia-Pacific region is poised for significant growth in the cold chain monitoring market due to several factors. Rapid urbanization, population growth, and increasing consumer demand for perishable goods drive the need for robust cold chain infrastructure. Additionally, the expanding pharmaceutical and healthcare industries in countries like China and India contribute to the demand for temperature-controlled logistics. Moreover, government initiatives aimed at improving food safety and healthcare access further propel market growth. With rising awareness of the importance of cold chain management, the Asia-Pacific region presents lucrative opportunities for cold chain monitoring providers.

Meanwhile, Europe is experiencing significant growth in the cold chain monitoring market due to several factors. Stringent regulations regarding the transportation and storage of temperature-sensitive products, coupled with the increasing demand for pharmaceuticals and biologics, are driving the adoption of cold chain monitoring solutions. Additionally, advancements in technology, such as IoT sensors and data analytics, are enhancing visibility and control over the cold chain. Moreover, the rise of e-commerce and online grocery delivery services is further fueling the demand for reliable cold chain monitoring to ensure the safe and timely delivery of perishable goods.

Cold chain monitoring is a system used to track and manage the temperature and conditions of products that require a controlled environment during storage and transportation, such as food, pharmaceuticals, and vaccines. It ensures that these products remain within specified temperature ranges to maintain their quality, efficacy, and safety. This monitoring process typically involves sensors, data loggers, and software that collect real-time data on temperature, humidity, and other relevant factors. If there is a deviation from the recommended conditions, alerts are triggered to notify stakeholders, allowing them to take corrective action promptly. Cold chain monitoring helps prevent spoilage, degradation, or contamination of sensitive products, reducing the risk of financial losses and safeguarding public health by ensuring that items like perishable food and life-saving medications reach consumers and patients in optimal condition.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.88% |

| Global Market Size in 2025 | USD 45.19 Billion |

| Global Market Size by 2034 | USD 266.66 Billion |

| Base Year | 2024 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Expansion of pharmaceutical and healthcare industries

The expansion of the pharmaceutical and healthcare industries globally has significantly surged the demand for cold chain monitoring solutions. With the increasing globalization of pharmaceutical supply chains and the rise in demand for temperature-sensitive medications, vaccines, and biologics, there is a growing need for robust cold chain monitoring systems to ensure the safe and effective transportation of these products. Pharmaceutical products often require strict temperature control throughout the entire supply chain to maintain their potency, efficacy, and safety. Moreover, the emergence of new healthcare treatments and therapies, including biopharmaceuticals and personalized medicines, further amplifies the demand for cold chain monitoring.

These advanced medical products often have stringent temperature requirements and are highly sensitive to environmental conditions. Therefore, the pharmaceutical and healthcare industries rely heavily on cold chain monitoring solutions to adhere to regulatory requirements, mitigate risks of product degradation, and uphold patient safety and well-being. As a result, the expansion of these industries fuels the growth of the cold chain monitoring market, driving innovation and investment in temperature monitoring technologies and solutions.

Restraint

Infrastructure limitations

Infrastructure limitations significantly restrain the market demand for cold chain monitoring solutions. In regions with inadequate infrastructure, including unreliable power supply and poor transportation networks, maintaining the integrity of the cold chain becomes challenging. Limited access to cold storage facilities further exacerbates these challenges, as temperature-sensitive products require specialized storage conditions to prevent spoilage and ensure quality. Without proper infrastructure, the effectiveness of cold chain monitoring systems is compromised, hindering their adoption and utilization by businesses operating in these regions

Moreover, infrastructure limitations can impact the overall efficiency of the cold chain, leading to delays, product losses, and increased costs. Inefficient transportation networks and lack of refrigerated storage facilities increase the risk of temperature excursions during transit, jeopardizing product integrity and safety. As a result, businesses may be hesitant to invest in cold chain monitoring solutions in regions with infrastructure limitations, as the benefits of these systems may be mitigated by broader logistical challenges beyond their control. Addressing infrastructure deficiencies is essential to unlocking the full potential of cold chain monitoring technologies and expanding their market demand globally.

Opportunity

Focus on sustainability and environmental responsibility

The increasing focus on sustainability and environmental responsibility within the supply chain industry is creating significant opportunities for the cold chain monitoring market. As businesses strive to reduce their carbon footprint and minimize environmental impact, there is a growing demand for cold chain monitoring solutions that prioritize energy efficiency, waste reduction, and sustainable practices. Providers offering eco-friendly technologies, such as energy-efficient sensors, refrigeration systems, and packaging materials, are well-positioned to capitalize on this trend.

Furthermore, cold chain monitoring solutions that enable companies to track and optimize their resource utilization, minimize food and product waste, and reduce greenhouse gas emissions are increasingly sought after. Sustainable cold chain practices not only align with corporate social responsibility objectives but also offer long-term cost savings and competitive advantages. As a result, there is a growing market opportunity for cold chain monitoring providers to offer innovative solutions that address sustainability concerns while meeting the stringent requirements for product quality, safety, and regulatory compliance in the cold chain industry.

The hardware segment held the highest market share of 79% in 2024. In the cold chain monitoring market, the hardware segment encompasses physical devices and equipment used to measure, monitor, and control temperature and other environmental conditions during the transportation and storage of temperature-sensitive goods. This includes sensors, data loggers, temperature monitors, RFID tags, and other monitoring devices. Recent trends in the hardware segment of the cold chain monitoring market include the development of more compact and cost-effective sensors with wireless connectivity capabilities, allowing for real-time monitoring and data transmission. Additionally, there's a growing focus on ruggedized and durable hardware solutions capable of withstanding harsh environmental conditions, ensuring reliable performance in diverse cold chain settings. These advancements in hardware technology aim to improve the accuracy, efficiency, and reliability of cold chain monitoring systems, meeting the evolving needs of industries such as pharmaceuticals, food and beverage, and healthcare.

The software segment is anticipated to witness rapid growth at a significant CAGR of 23.72% during the projected period. In the cold chain monitoring market, the software segment refers to the digital programs and applications used to analyze, manage, and interpret data collected from sensors and monitoring devices. These software solutions offer real-time visibility into temperature, humidity, and other critical parameters, enabling proactive decision-making and risk mitigation. Trends in the software segment of cold chain monitoring include the adoption of cloud-based platforms for data storage and analysis, integration of advanced analytics and machine learning algorithms for predictive insights, and the development of user-friendly interfaces for enhanced usability and accessibility across various devices and platforms. These trends aim to improve the efficiency, accuracy, and scalability of cold chain monitoring operations while facilitating compliance with regulatory requirements and industry standards.

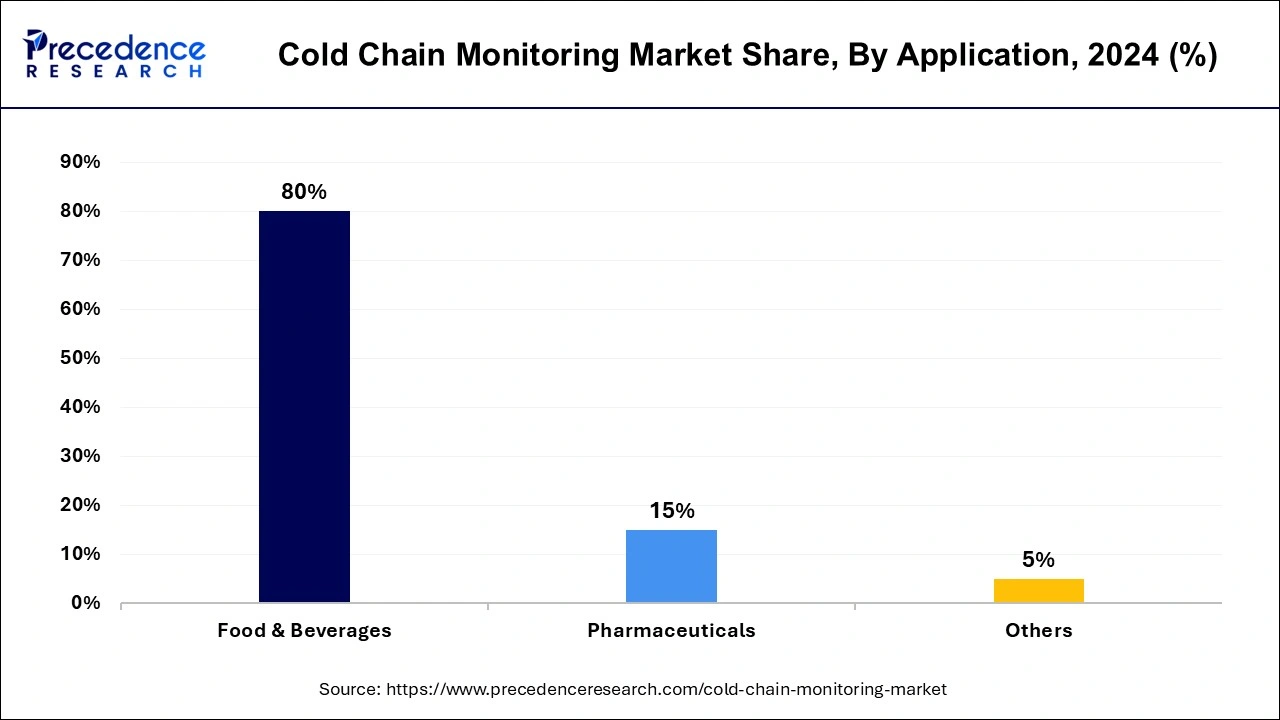

The food & beverages segment has held a 78% market share in 2024. In the cold chain monitoring market, the food and beverages segment refers to the monitoring of temperature-sensitive food products and beverages throughout the supply chain, from production to consumption. This includes perishable items such as fruits, vegetables, dairy products, meat, seafood, and beverages that require strict temperature control to maintain freshness, quality, and safety. Trends in the food and beverages segment of the cold chain monitoring market include increased adoption of IoT-enabled sensors for real-time temperature monitoring, demand for sustainable packaging solutions to reduce food waste, and the integration of data analytics for improved supply chain visibility and efficiency. These trends aim to enhance food safety, reduce spoilage, and optimize logistics processes in the food and beverage industry.

The pharmaceuticals segment is anticipated to grow at a CAGR of 24.52% over the projected period. In the cold chain monitoring market, the pharmaceutical segment refers to the monitoring and management of temperature-sensitive medications, vaccines, and biologics throughout their transportation and storage. This includes maintaining specific temperature ranges to ensure product efficacy, quality, and safety. Recent trends in the pharmaceutical segment of the cold chain monitoring market include the adoption of advanced monitoring technologies like IoT sensors and real-time data analytics. Additionally, there's a growing emphasis on regulatory compliance and the integration of sustainability practices to reduce environmental impact and enhance supply chain efficiency.

Segments Covered in the Report

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

December 2024

December 2024