October 2024

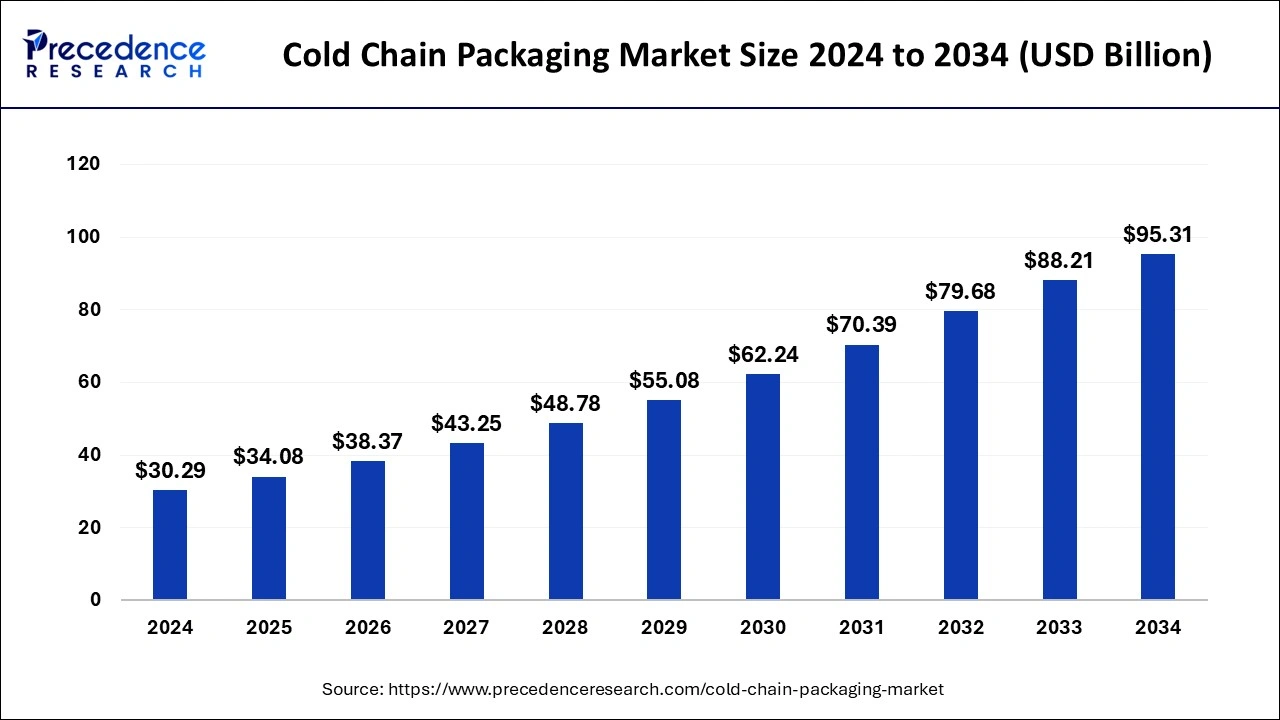

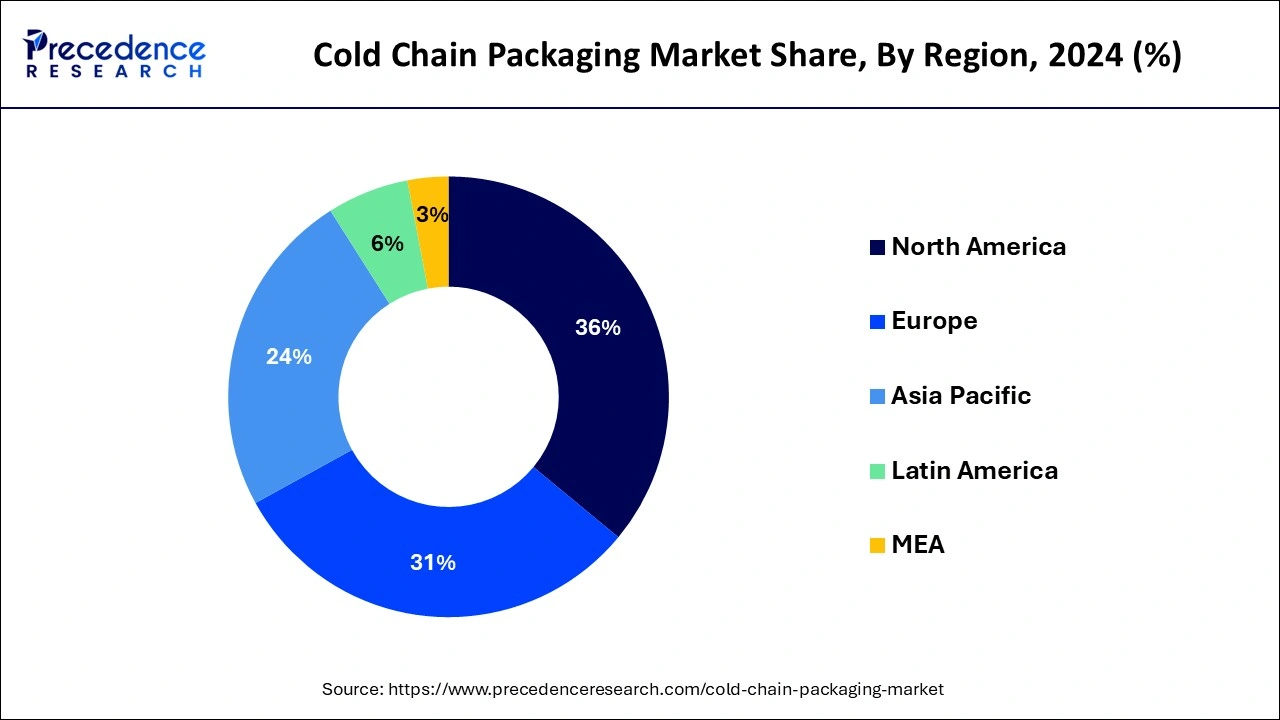

The global cold chain packaging market size is calculated at USD 34.08 billion in 2025 and is forecasted to reach around USD 95.31 billion by 2034, accelerating at a CAGR of 12.15% from 2025 to 2034. The North America cold chain packaging market size surpassed USD 10.90 billion in 2024 and is expanding at a CAGR of 12.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold chain packaging market size was valued at USD 30.29 billion in 2024 and is expected to surpass around USD 95.31 billion by 2034, growing at a CAGR of 12.15% during the forecast period 2025 to 2034.

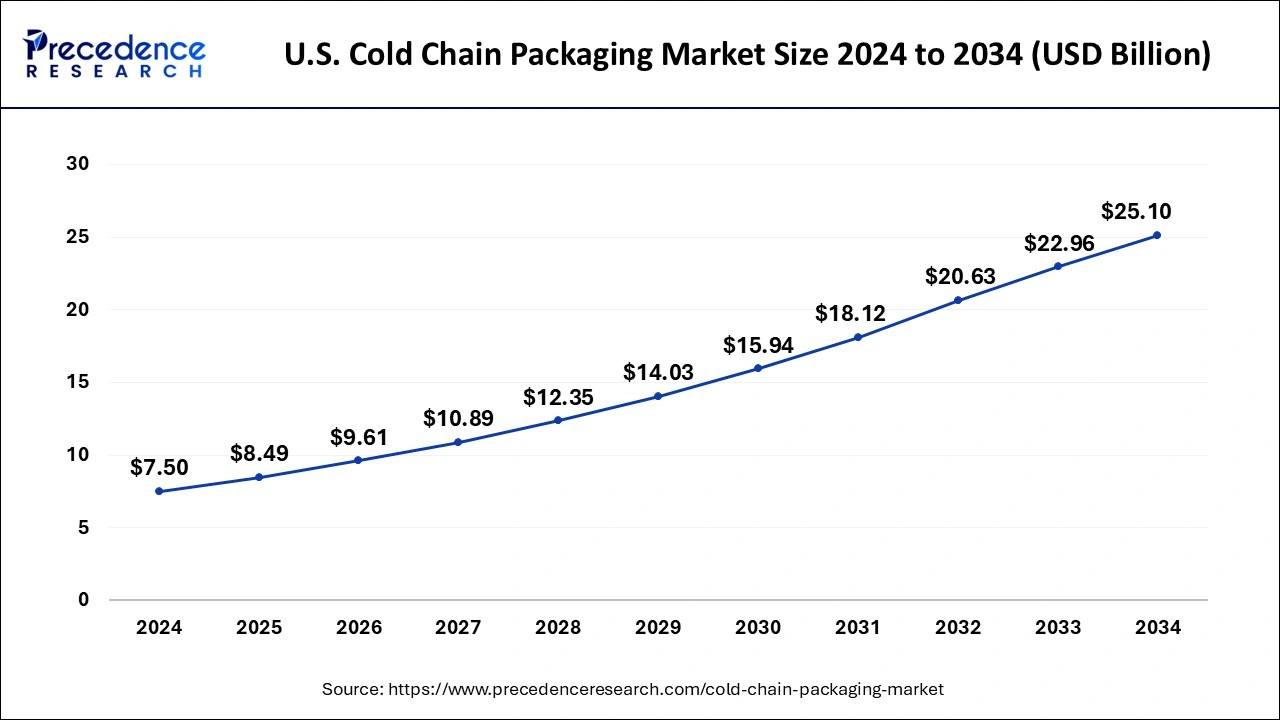

The U.S. cold chain packaging market size reached USD 7.50 billion in 2024 and is projected to be worth around USD 25.10 billion by 2034, at a CAGR of 12.84% between 2025 and 2034.

North America was the leading cold chain packaging market accounting for a revenue share of around 36% in 2024. This growth is attributed to the increased production volumes of meat, processed food, and fruits & vegetables. The demand for these processed and fresh food products is higher in the region. Furthermore, the high standard of living, busy and hectic schedule of the consumers, high disposable income, and increased demand for the packaged food has resulted in the higher demand for the cold chain packaging. Furthermore, the presence of top pharmaceutical companies in the region and the development of several drugs and vaccines that requires cold storage has fueled the adoption of the cold chain packaging in the pharmaceutical sector. The rising health consciousness among the consumers is spurring the demand for the organic food products especially fruits and vegetables, which is expected to drive the growth of the cold chain packaging market.

Asia Pacific is projected to be the most opportunistic market during the forecast period. This growth is attributable to the surging penetration of the top food processing and pharmaceutical companies in the region. Asia Pacific is the home to around 60% of the global population. The presence of huge youth population, rising employment, changing demographics, and rising disposable income are the major factors that are fueling the demand for the processed food. The growing demand for the fruits and vegetables along with the fresh meat and seafood in the region is another prominent driver of the cold chain packaging market in Asia Pacific.

Temperature controlling and monitoring has become an essential part of the modern day logistics that ensures the safety and quality of the product during transportation. The key players in the cold chain packaging market are investing in the development of new and efficient products that can effectively tackle the challenges and complexities associated with the cold chain logistics. The efficient cold chain packaging can reduce miscellaneous losses, keeps the product quality intact, and can increase the profit margins. The rapidly surging demand for the cold chain packaging in the food processing industry is expected to drive the growth of the cold chain market significantly during the forecast period. The rising population, increasing personal disposable income, and changing lifestyle of the consumers are some of the prominent factors that are driving the adoption of the cold chain packaging across the various applications. The demand for the packaged food, processed food, and ready-to-eat food products is surging with the changing lifestyle. The various food products such as dairy food products, sea food, meat, frozen fruits, and vegetables require efficient cold chain packaging during storage and transportation. The rising technological advancements in the food packaging is significantly driving the market growth across the globe.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.15% |

| Market Size in 2025 | USD 34.08 Billion |

| Market Size by 2034 | USD 95.31 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Application, Packaging Format, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Depending on the product, the global cold chain packaging market was dominated by the insulated container & boxes segment which accounted for over 58% of the market share in 2024. The high demand for reusable insulated containers and boxes for the purpose of storing fruits, vegetables, and processed food has led to the growth of this segment. The increased pressure on the pharma companies and the top food companies to reduce the costs of manufacturing has led to the increased adoption of reusable insulated boxes and containers, which has a significant role in the growth of this segment across the globe.

On the other hand, temperature-controlled pallet shippers are expected to be the most opportunistic segment during the forecast period. The easy and wider availability of several pallet shippers made of polyurethane, low-density polyethylene, and expanded polystyrene is positively contributing to the growth of the temperature-controlled pallet shippers segment. It is extensively used for shipping biological samples, frozen food products, and vaccines across the globe.

On the basis of material, the insulating materials segment constituted over 66% of the revenue and dominated the global cold chain packaging market in 2024. The insulating materials segment is further segregated into vacuum insulated panel, EPS, cryogenic tank, PUR, and others. The extensive demand for the EPS segment in the shipping sector has led to the dominance of this segment in the global cold chain market.

The refrigerant is expected to be the fastest-growing segment during the forecast period. This segment includes hydrocarbons, fluorocarbons, and inorganics. The surging inclination towards the low global warming potential and low ozone depletion potential gases is driving the adoption of the refrigerant segment. The rising concerns over ozone layer depletion and global warming has shifted the focus towards the adoption of sustainable packaging solutions across the globe. The refrigerant materials can help in effectively counter the challenges related to the global warming. The end users of the cold packaging are inclining towards these packaging materials to reduce costs and achieve sustainability goals. Therefore, this segment is anticipated to be the fastest-growing in the upcoming years.

Depending on the application, the fish, seafood, and meat segment garnered a revenue share of around 26% and led the global cold chain packaging market in 2024. The rising demand for the meat and sea food across the globe and the growing production of the fish and meat across globe is fueling the demand for the cold chain packaging. The bio-physiochemical changes that occurs in the meat and fish products naturally is the major factor that has boosted the adoption of the cold chain packaging in the fish, seafood, and meat sector. The freshness of the meat products needs to be maintained strictly till it reaches the consumer. Therefore, the increased need for maintaining the quality and freshness of the meat products, the demand for the cold chain packaging is higher in this sector.

The processed food is expected to be the most lucrative and opportunistic during the forecast period. The demand for the processed food products such as chocolates, canned food, pickles, jams, and canned meat is higher in the developed nations and it is gaining a rapid traction in the developing countries as well. The presence of high population in the developing nations and the rising disposable income is fueling the demand for the processed food among the population. The easy-to-cook and ready-to-eat food products are gaining rapid traction among the consumers, which is expected to drive the growth of this segment in the forthcoming future.

By Product

By Material

By Application

By Packaging Format

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

January 2025

January 2025