September 2024

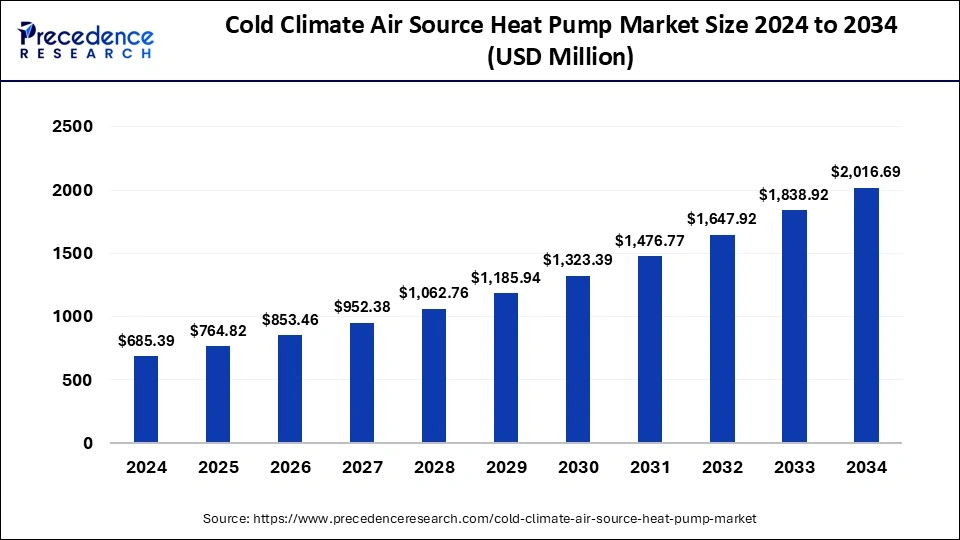

The global cold climate air source heat pump market size is accounted at USD 764.82 million in 2025 and is forecasted to hit around USD 2,016.69 million by 2034, representing a CAGR of 11.40% from 2025 to 2034. The North America market size was estimated at USD 226.18 million in 2024 and is expanding at a CAGR of 11.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold climate air source heat pump market size accounted for USD 685.39 million in 2024 and is predicted to increase from USD 764.82 million in 2025 to approximately USD 2,016.69 million by 2034, expanding at a CAGR of 11.40% from 2025 to 2034. Due to their excellent energy efficiency, the cold climate air source heat pump market offers considerable cost savings on heating expenses compared to conventional heating systems.

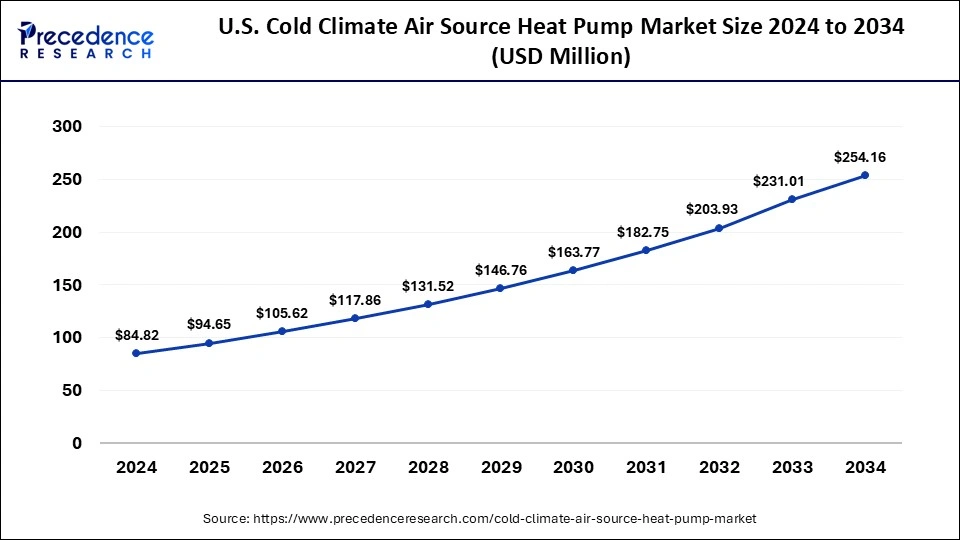

The U.S. cold climate air source heat pump market was exhibited at USD 84.82 million in 2024 and is projected to be worth around USD 254.16 million by 2034, growing at a CAGR of 11.60% from 2025 to 2034.

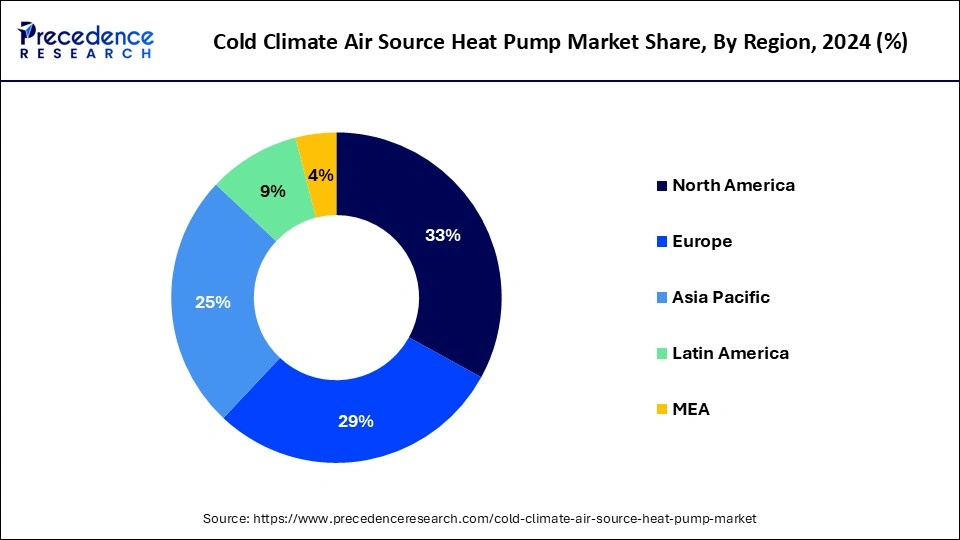

North America held the largest share of the cold climate air source heat pump market in 2024. Because of its capacity for energy-efficient heating and cooling, ASHPs are gaining popularity as the emphasis on lowering energy usage and carbon footprints grows. Because they are made especially to function well in lower temperatures, cold environment air source heat pumps are appropriate for use in parts of North America that experience severe winters. The adoption of ASHPs as a more environmentally friendly choice to conventional heating systems like oil or gas furnaces is being driven by rising environmental consciousness and the desire to minimize greenhouse gas emissions. Along with new installations in construction projects, converting older buildings with ASHP systems is becoming more and more popular. The market is expanding rapidly as a result of this dual strategy.

Asia Pacific is expected to host the fastest-growing cold climate air source heat pump market during the forecast period. Asia Pacific governments are enforcing strict laws to lower carbon emissions and encourage the use of renewable energy sources. The adoption of energy-efficient heating options, such as CCASHPs, is being fueled by this. Rising energy costs are pushing people and companies to look for more economical and energy-efficient heating options, such as CCASHPs, which have lower running costs than conventional heating systems. Demand for CCASHPs from environmentally conscious individuals and businesses is being driven by growing knowledge of the negative environmental effects of traditional heating systems and the advantages of sustainable alternatives. Despite the long-term cost savings and environmental advantages of CCASHP systems, some consumers and companies may find it difficult to adopt them because of their high initial expenditures.

Cold climate air source heat pumps (CCASHPs) are engineered to function effectively in subfreezing conditions, supplying residential, commercial, and industrial facilities with heating and, occasionally, cooling. These systems use cutting-edge refrigeration technology to be designed to remain very efficient even in cold weather. Consumers and businesses are predicted to demand effective and sustainable heating solutions to fuel growth in the cold climate air source heat pump market.

Features like defrost cycles are frequently included in ASHPs in colder regions to control the accumulation of ice on outdoor coils and guarantee reliable operation. They are adaptable and have the power to bring heat in from the outside air, even in extremely cold weather. The need for ASHPs that can offer effective heating solutions in cold areas is being driven by the growing emphasis on energy efficiency standards and regulations on a global scale. The cold climate air source heat pump market is expected to grow as long as technology continues to innovate and adoption rates in cold climate areas rise.

Customers and companies are gravitating toward more environmentally friendly heating choices as a result of growing awareness of the effects on the environment and the need to lower carbon footprints. Cold climate air source heat pumps are becoming more reliable and efficient due to continuous developments in system controls, refrigerants, and compressor technology. Driven by technology breakthroughs, environmental concerns, and regulatory support for energy-efficient solutions in difficult conditions, the cold climate air source heat pump market is a rising segment within the HVAC industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,016.69 Million |

| Market Size in 2025 | USD 764.82 Million |

| Market Size in 2024 | USD 685.39 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Operation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Integration with renewable energy systems

As sustainability and energy efficiency get more attention, integration with renewable energy systems is becoming more important in the cold climate air source heat pump market. When solar PV is combined with battery storage, it becomes possible to consume energy during periods when solar generation is limited, like at night or on cloudy days. A strong renewable energy system that can balance daily and seasonal changes in renewable energy generation can be produced by combining wind energy with solar PV and ASHPs. Smart grids that incorporate ASHPs can optimize energy consumption and lower peak load by reacting to demand signals.

Performance in extreme cold

In order to retain excellent performance and efficiency at low temperatures, the cold climate air source heat pump market makes use of cutting-edge technologies, including enhanced refrigerants and variable-speed compressors. Even in cases when temperatures drop considerably, these technologies aid in the heat pumps' ability to extract heat from the outside air. When the outside temperature drops exceptionally low, some CCASHP systems are outfitted with additional electric resistance heaters or are made to cooperate with other heating systems, such as furnaces, to supply extra heat. The Heating Seasonal Performance Factor (HSPF) and Coefficient of Performance (COP) at low temperatures are commonly used to grade CCASHPs. Higher ratings indicate better performance and efficiency in colder climates.

Retrofit sector

A sizable and expanding section of the cold climate air source heat pump market is the retrofit sector. Retrofitting entails replacing outdated heating systems with more sustainable and effective ASHP technology in existing buildings. When ASHPs are retrofitted instead of traditional heating systems, significant energy savings are achieved, which lowers consumer utility bills. Building owners are being driven to transition to more sustainable heating solutions by growing awareness of environmental issues and the need to minimize carbon footprints. Retrofitting is becoming a more appealing choice because of advancements in ASHP technology, such as increased efficiency and improved performance in extremely cold conditions. Many buildings, particularly those in northern climates, require replacement of their outdated heating systems. Modernizing these systems at a reasonable cost can be achieved through ASHP retrofitting.

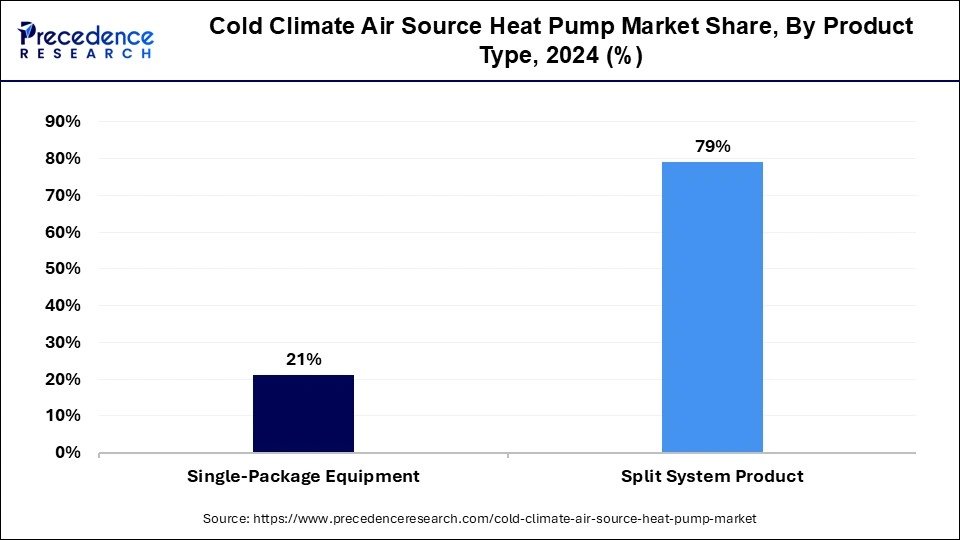

The split system segment held the largest share of the cold market in 2024. In the cold climate air source heat pump market, the split system product segment describes a heat pump arrangement in which the heat pump is separated into two main parts: an inside unit and an outside unit. This segmentation makes more adaptable installation options and effective space use possible. With a split system, the outdoor unit can be positioned outside the structure and linked to one or more indoor units that are spread throughout the interior. Given that the noisy compressor is outdoors, the division of components aids in decreasing noise levels inside the structure. Split systems are appropriate for a range of building sizes and heating requirements since they can be scaled by adding multiple indoor units to a single outdoor unit.

The single package equipment segment is expected to grow significantly in the market in the upcoming years. The single-package equipment category in the cold climate air source heat pump market describes machines in which the compressor, condenser, evaporator, and frequently the air handler or fan are all housed in a single outside unit. These systems are made to function well in colder areas, where the lower temperatures may cause regular heat pumps to malfunction. Because they are simple to install and maintain, they are becoming more and more popular and are a good option in areas with harsh winters. This market segment's growth is driven by factors including energy efficiency, dependability in cold climates, and simplicity of integration with current HVAC systems.

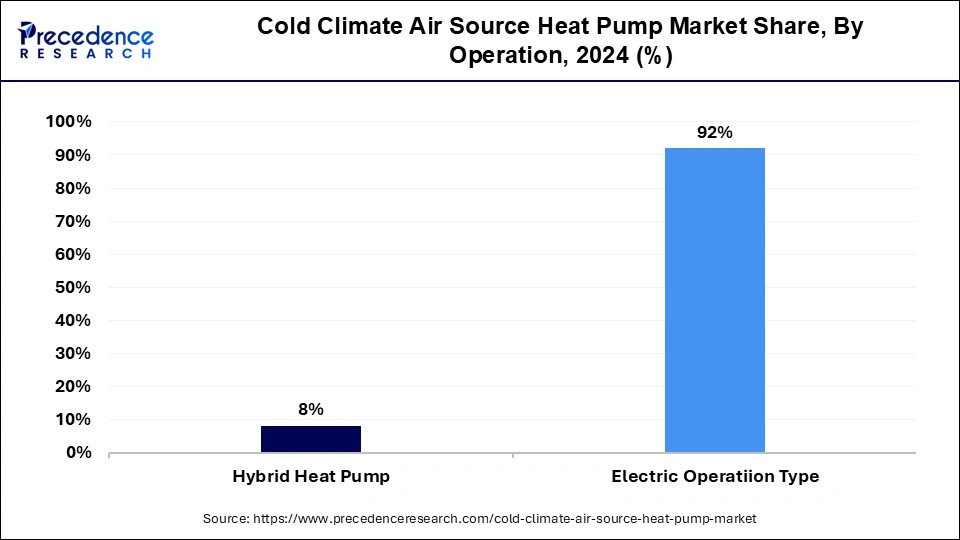

The electric operation segment led the global market in 2024. Heat pumps that use electricity as their main energy source are classified as being in the electric operation type section of the cold climate air source heat pump market. These heat pumps are made to effectively transport heat from chilly external air indoors for heating, especially in colder climates where other types of heat pumps can have trouble. Because they are more environmentally friendly and energy efficient than heating systems that rely on fossil fuels, they are becoming more and more popular. The increased awareness of environmental sustainability, energy efficiency standards, and technological breakthroughs that enhance heat pump performance in cold areas are driving the market for electric operation-type heat pumps.

The hybrid segment is projected to expand considerably in the cold climate air source heat pump market over the studied years. Systems that combine the advantages of air-source heat pumps with alternative heating methods, including gas or electric resistance heating, are referred to as hybrid heat pump systems. The purpose of these hybrid systems is to maximize performance and efficiency, particularly in areas with extremely low temperatures where conventional air source heat pumps can find it difficult to operate efficiently. Depending on the outside temperature, they normally move between the heat pump mode and the alternate heating mode, guaranteeing efficient heating and energy savings all year round. The capacity of this market to deliver dependable heating in colder regions while still providing the energy-saving advantages of heat pump technology is what is drawing attention to it.

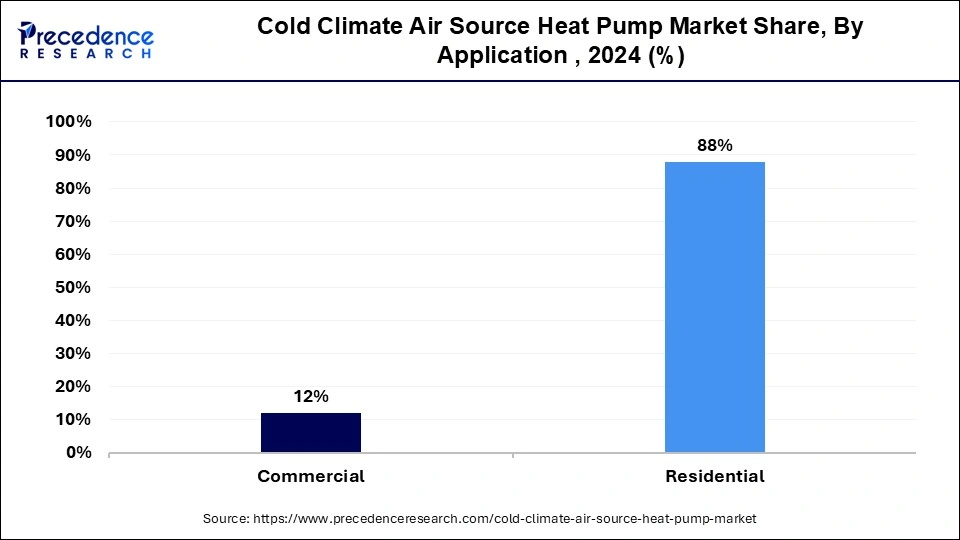

The residential segment dominated the cold climate air source heat pump market in 2024. Because they are made to function effectively at extremely low temperatures, ASHPs intended for cold climates are appropriate for use in household heating applications in colder climates. In colder areas, ASHPs are more efficient than more conventional heating systems like furnaces or electric resistance heaters, which might save homeowners money on energy. They support sustainability objectives by lowering greenhouse gas emissions through the utilization of renewable energy from ambient air. Reliability and operational effectiveness are increased in cold regions by constant innovation. Demand for energy-efficient heating systems is driven by homeowners who care about the environment. Government tax breaks, rebates, and subsidies promote the residential use of ASHPs, which accelerates market expansion.

The commercial segment is expected to grow rapidly in the market over the forecast period. The commercial section of the cold climate air source heat pump market mostly consists of heat pumps intended for bigger buildings, including offices, retail stores, hotels, and other commercial facilities. With an emphasis on energy economy and cost-effectiveness for commercial applications, these heat pumps are designed to function well in colder climates, offering summer cooling and winter heating. Technological developments, laws requiring energy efficiency, and the rising demand for environmentally friendly HVAC systems in commercial buildings are some of the factors affecting this market.

By Product Type

By Application

By Operation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

August 2024

August 2022