January 2025

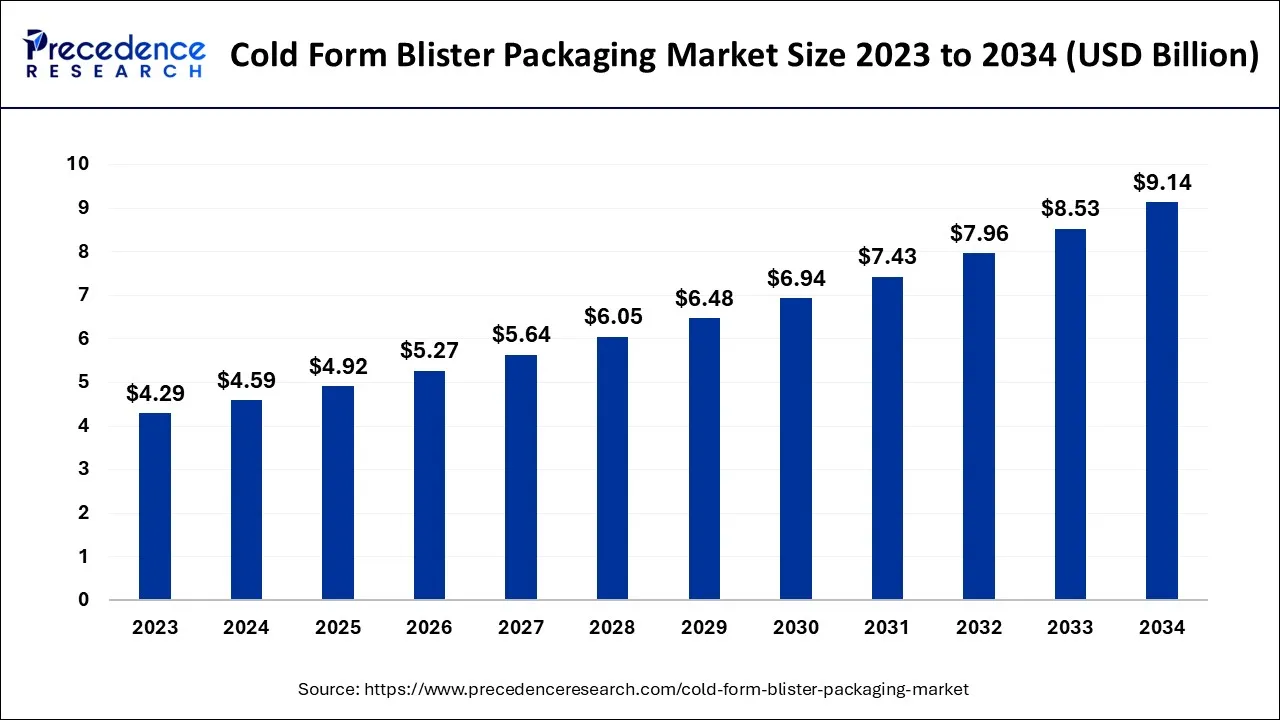

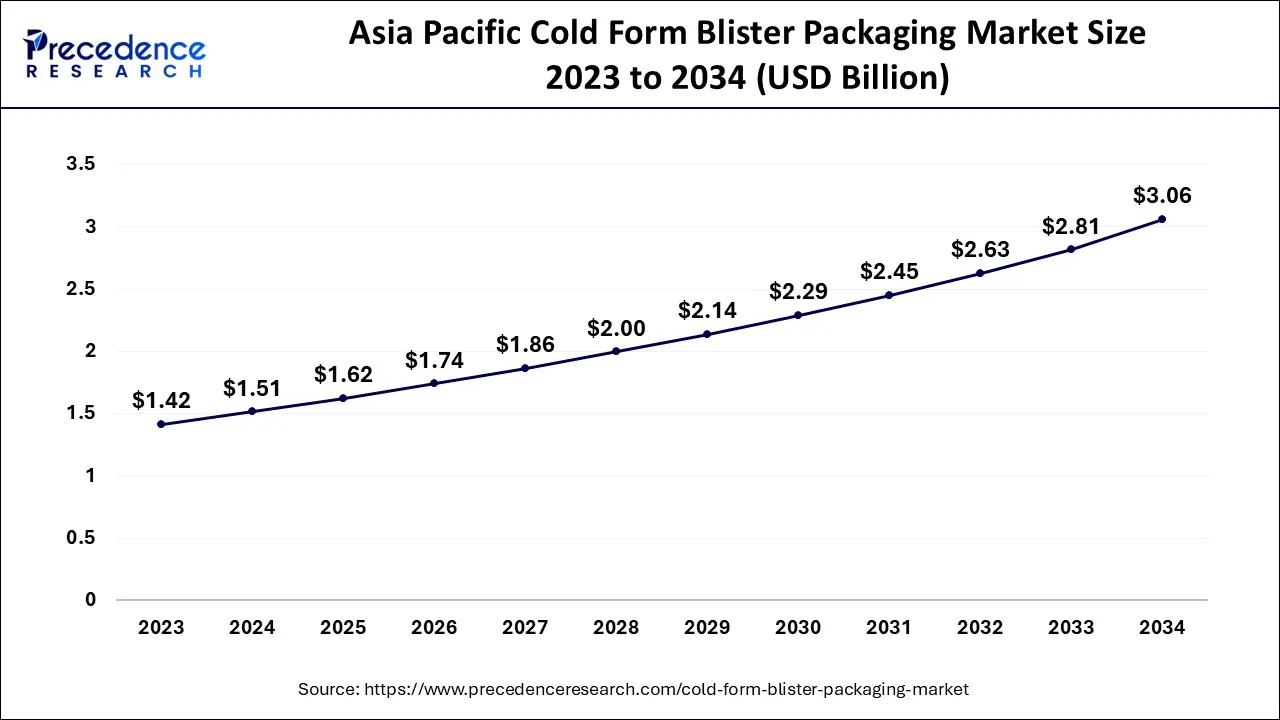

The global cold form blister packaging market size accounted for USD 4.59 billion in 2024, grew to USD 4.92 billion in 2025 and is expected to be worth around USD 9.14 billion by 2034, registering a CAGR of 7.13% between 2024 and 2034. The Asia Pacific cold form blister packaging market size is calculated at USD 1.51 billion in 2024 and is estimated to grow at a CAGR of 7.29% during the forecast period.

The global cold form blister packaging market size is calculated at USD 4.59 billion in 2024 and is projected to surpass around USD 9.14 billion by 2034, growing at a CAGR of 7.13% from 2024 to 2034.

The Asia Pacific cold form blister packaging market size is exhibited at USD 1.51 billion in 2024 and is projected to be worth around USD 3.06 billion by 2034, growing at a CAGR of 7.29% from 2024 to 2034.

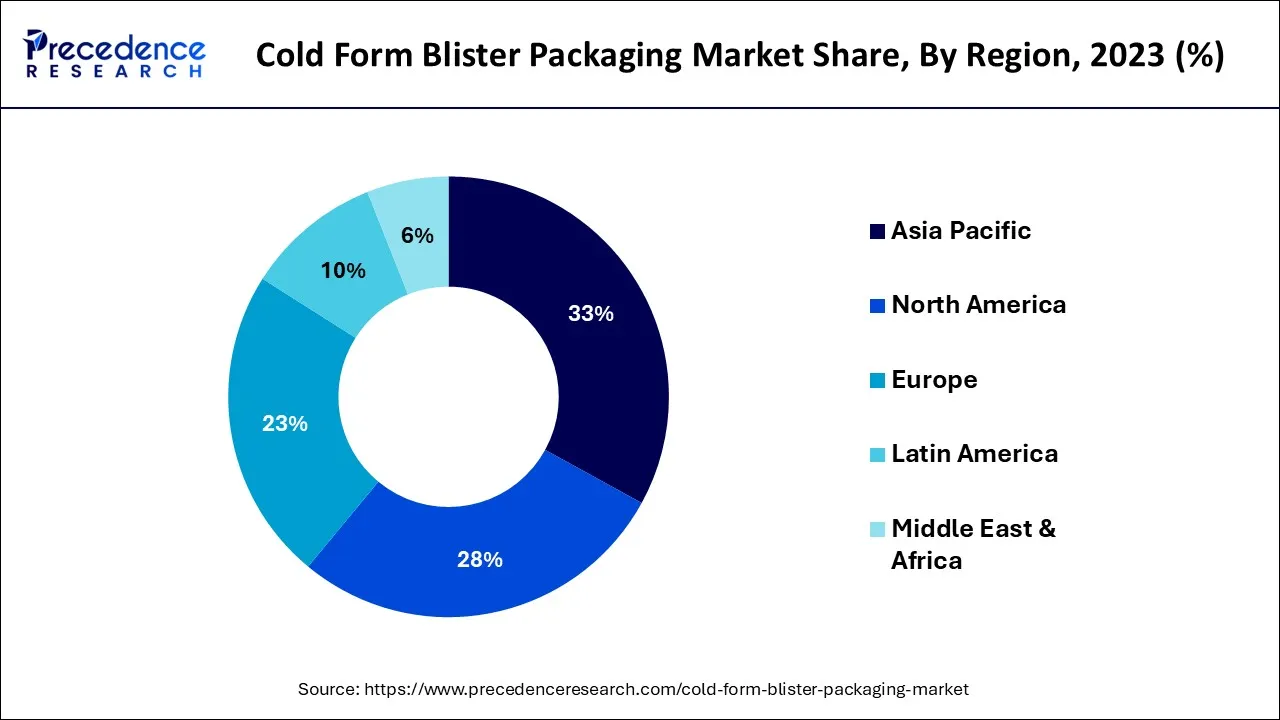

By region, due to the rapid growth of end-use industries like healthcare, food, consumer goods, and industrial goods, Asia-Pacific is predicted to account for the largest revenue share in the global cold blister packaging market throughout the forecast period. Additionally, the regional market is expected to see revenue growth throughout the projection period due to a rise in high-visibility items, increasing disposable income, a growing middle-class population, and a growing healthcare sector. The overall development of the packaging industry will also accelerate the development of.

North America held a significant share of the market in 2023. Due to a firmly established pharmaceutical sector, the geographical area of North America continues to grow rapidly. The pharmaceutical industry in North America is heavily focused on developing practical and advanced packaging, competitive key players, and rapid adoption of cutting-edge machinery for innovative packaging. This is due to the region's strong emphasis on producing contamination-free and integrated packaging for medicines.

The global cold form blister packaging market revolves around the production, innovation and distribution of blister packaging that is widely used in the pharmaceutical industry. Aluminum-containing laminate film in the shape of thin sheets is used in the cold-form blister packing method. Cold forming employs a stamp to press the sheets into a form, enabling the aluminum-based films to expand and hold the mold shape after removing the stamp to produce blister packs. Pharmaceuticals are packaged frequently using the method of cold-form blister packaging as the aluminum-based film stops moisture from entering the packing.

An important factor influencing the cold-form blister packaging market is the consumer preference for protection and security, which extends the product's shelf life. Other essential market drivers include growing government initiatives to assist healthcare facilities, global urbanization trends, and rising disposable income. In addition, an increase in demand from developing nations will open up more chances and fuel the expansion of the market for cold-form blister packaging throughout the forecast period.

The rising need for cold-form packing across a range of end-use sectors is another factor driving the growth of the global market. Additionally, packaging materials are frequently employed to raise environmental standards; as a result, the worldwide cold-form blister packaging market will likely grow in the future.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.29 Billion |

| Market Size by 2034 | USD 7.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.13% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand across multiple end-users

Cold blister packaging is less expensive than other packaging types like rigid packaging since it requires less material for packing, takes up less room on store shelves, and offers a fantastic hang-hook display. As the requirement for temper-proof and practical packaging rises, cold blister packaging is becoming increasingly essential in the pharmaceutical industry. As a result of increasing demand from end-use industries like food, healthcare, industrial goods, and consumer goods, the market for cold blister packaging is growing globally.

Limitations for packaging

Cold form blister packaging is not considered an effective method for packaging heavy goods, it is typically used to preserve lightweight items such as pharmaceutical drugs. The paperboard or plastic film that supports heavy items during packing will be under more significant strain. This could result in product loss and increased costs due to packaging damage from storing, handling, and shipping the product. Additionally, using blister packaging for pricey and delicate products is not advised as it could result in product damage or cracking. This situation could pose problems with expanding the cold blister packaging market.

Rising application from the food industry

In the food industry, cold blister packaging is most frequently utilized. Retailers can use blister packs, which are pretty helpful, to package a variety of fresh commodities, including meat, fruit, bakery items, candy, ice cream, etc. Blisters effectively display the items and safeguard food from damage during handling and transit. Additionally, blisters offer superior product protection and are more lightweight than materials such as glass or metal. Blisters are affordable, even for packaging relatively simple products, because they make it easier to follow stringent hygiene regulations. Luxury chocolate boxes frequently contain blisters inside of them to package the chocolate. Consequently, the growing need for cold-form blister packaging from the food industry offers lucrative potential for the worldwide cold-form packaging industry. As a result, there is a profitable opportunity for the growth of the worldwide cold-form blister packaging market due to the food sector's rising need for cold-form blister packaging.

By material, in the cold-form blister packaging industry, the aluminum category holds the most significant market share. It does so because of its distinct qualities, which include guarding against contamination, serving as a strong barrier, and increasing the expected lifespan of the goods by keeping moisture and oxygen out. Aluminum has a strong mechanical resistance and is resistant to numerous external forces. It has the propensity to penetrate other substances and shatter but including plastic resolves these problems.

The PVC category will expand at a sizable rate during the projection period because of its high visibility qualities and affordability. The cost-effectiveness of PVC is its key benefit. PVC sheets are combined with PVDC, or polyvinylidene chloride, to enhance the barrier qualities of the packaging. This offers excellent defense against oxygen and moisture.

The global demand for eco-friendly packaging solutions is driven by rising consumer demand and a focus on sustainability. PET plastic sheet offers outstanding mechanical strength, superior creep resistance, and high stability. PET material is one of the many productive plastics globally because it is affordable, adaptable, and durable.

By application, the market was dominated by the healthcare application segment. Generally, the healthcare sector prefers to use cold-forming packaging supplies, and it seals items like tablets, capsules, medicines, vials, ampoules, syringes, and liquids. Packaging tamper-evident, child-resistant, anti-counterfeit, and senior-friendly is highly sought-after globally.

The consumer goods application segment is also expected to expand significantly during the scheduled period. Consumers must scrutinize the goods and their claims due to the rising demand for a variety of goods, including bar soap, lipstick, shower gel, toothbrushes, and other items. Consumers can view the product within cold-form blister packaging thanks to the application of transparent plastic film materials. The packaging looks better thanks to the transparency, which increases the products' aesthetic attractiveness on the store's shelves and draws customers' attention.

Due to its ability to handle various electronic equipment or components based on their dimensions and particular requirements, the semiconductor and electronics application segment is also expanding significantly.

Segment Covered in the Report:

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

January 2025