May 2025

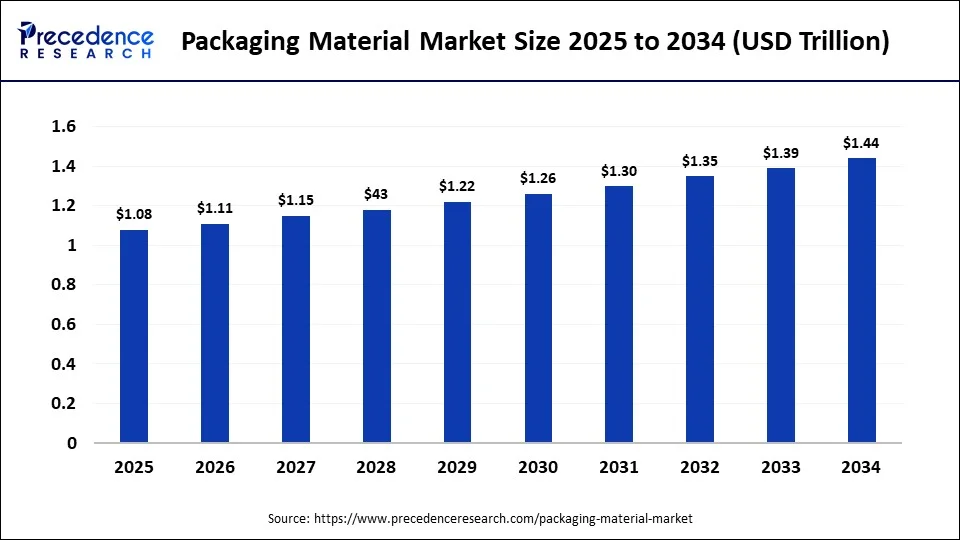

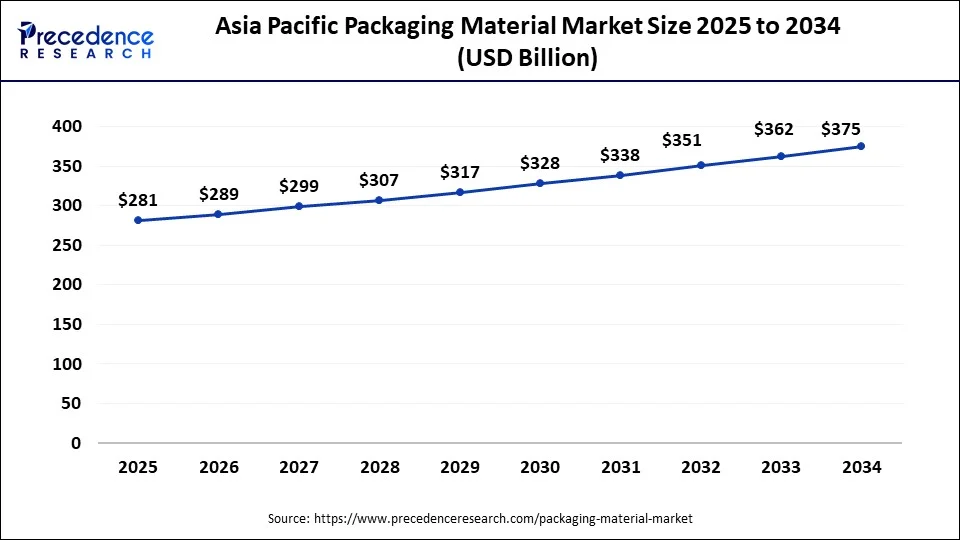

The global packaging materials market size is evaluated at USD 1.08 trillion in 2025 and is forecasted to hit around USD 1.44 trillion by 2034, growing at a CAGR of 3.20% from 2025 to 2034. The Asia Pacific market size accounted for USD 273 billion in 2024 and is expanding at a CAGR of 3.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global packaging material market size was valued at USD 1.05 trillion in 2024, accounted for USD 1.08 trillion in 2025, and is expected to reach around USD 1.44 trillion by 2034, expanding at a CAGR of 3.2% from 2025 to 2034. The expansion of end-users across the globe along with new product innovation for packaging purposes are observed to boost the growth of the packaging material market during the forecast period.

The Asia Pacific packaging material market size is estimated at USD 281 billion in 2025 and is predicted to be worth around USD 375 billion by 2034, at a CAGR of 3.4% from 2025 to 2034.

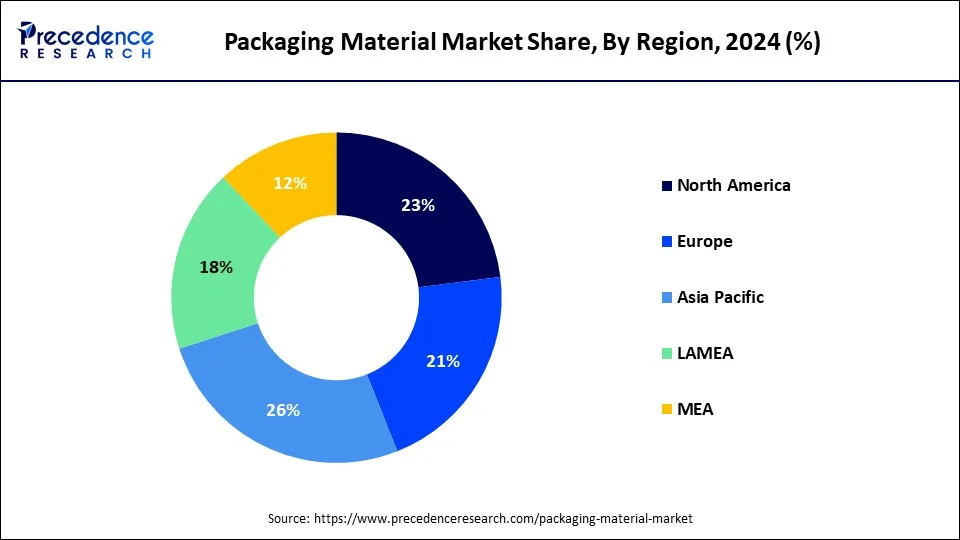

Asia Pacific is expected to dominate the packaging material market during the forecast period. The fastest market growth in Asia Pacific is promoted by the higher plastic consumption in numerous industries. Rising urbanization and industrialization in developing countries of Asia Pacific are demanding innovative packaging solutions; this is intended to boost the market’s growth during the forecast period. Moreover, the availability of low-cost supplies needed in financially viable packaging solutions continues to drive market growth in Asia Pacific. China is the Asia Pacific region's largest market for packaging solutions, which is followed by Japan, India, and South Korea.

The North American packaging material market is mature and highly competitive, with the United States and Canada being the key markets. The demand for sustainable packaging materials, such as bioplastics and recycled materials, is increasing due to growing environmental concerns. In addition, stringent regulations on packaging materials, including recyclability and composability requirements, are influencing the market dynamics in North America.

Europe is another significant market for packaging materials, with countries such as Germany, France, and the United Kingdom leading the industry. The European packaging material market is driven by factors such as increasing consumer awareness of sustainability, stringent regulations on single-use plastics, and a growing demand for convenience packaging. The focus on recyclable and renewable packaging materials and innovative packaging designs and technologies is shaping the market landscape in Europe.

The packaging material market is a dynamic and rapidly growing industry that is critical in protecting and preserving various products during transportation, storage, and sale. Packaging materials are used in a wide range of applications, including food and beverage packaging, pharmaceutical packaging, personal care packaging, industrial packaging, and more.

The market’s growth is driven by multiple regulations and standards set by governments and industry bodies for the packaging material industries and manufacturers. Regulations promoting the use of recyclable or reusable packaging materials, restrictions on single-use plastics, and food safety and hygiene requirements can shape the demand for packaging materials.

For instance, in July 2022, India banned the use of single-use plastic to curb the pollution caused by plastic packaging and wrapping. This step by the Indian government is expected to boost the production of sustainable packaging materials in the upcoming years, which subsequently promote the market’s growth.

The growth of the packaging material market is driven by the rising e-commerce industry worldwide. The booming e-commerce industry requires specialized packaging materials to ensure the safe and efficient shipping of products. Packaging materials designed for e-commerce, such as protective packaging, void fill materials, and returnable packaging, can offer significant growth opportunities for businesses catering to the e-commerce market.

With increasing awareness about environmental concerns, there is a growing demand for sustainable and eco-friendly packaging materials. Businesses that offer packaging materials made from renewable, biodegradable, and compostable materials are expected to witness a significant increase during the projected timeframe.

Technological advancement in packaging material innovation is another significant driving factor for the growth of the packaging material market. Advances in technology can drive innovation in the packaging material market. For example, developing new materials, coatings, and printing techniques can lead to improved packaging performance, durability, and aesthetics, driving adoption in the market.

In February 2023, the global leader in beverage products, Coco-Cola, announced that the company aims to launch the minute maid range of fruit-based drinks, especially for the Indian market. The new carton development for fruit-based drinks is described as a seamless package in unique shapes. The company will utilize Direct Injection Moulding Concept Technology for the latest innovative packaging solution, ensuring a great pouring experience with an easy grip.

Improvements in the efficiency of the packaging supply chain, such as advancements in logistics, transportation, and warehousing, are observed to impact the market in a positive way. Efficient supply chain management can lead to cost savings, reduced waste, and improved delivery times, which can influence the choice of packaging materials. Economic factors such as GDP growth, disposable income, and consumer spending patterns are driving the growth of the packaging material market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1.44 Trillion |

| Market Size in 2025 | USD 1.08 Trillion |

| Market Size in 2024 | USD 1.05 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 3.2% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising e-commerce food delivery industry

The rise of e-commerce and online food delivery services has revolutionized the food industry, creating new opportunities and challenges for packaging. Food products ordered online require packaging that can withstand the rigors of transportation, protect the products from damage and heat, and maintain their freshness until they reach the consumer's doorstep. This has led to the development of specialized packaging materials for e-commerce and online food delivery, such as insulated packaging, tamper-evident packaging, and sustainable packaging that can be easily recycled. The growth of the food industry's e-commerce and online food delivery segments drives the demand for these specialized packaging materials, leading to the development of the packaging material market.

In addition, many e-commerce businesses focus on utilizing recyclable and sustainable packaging solutions; this is predicted to drive the market’s growth. For instance, in April 2022, India's largest food delivery partner, Zomato, stated that it would be using 100% plastic-neutral packaging onwards by setting up a target to deliver more than ten crore orders in sustainable packaging.

Environmental concerns

Rising environmental concerns are observed to act as a significant restraint on the growth of the packaging material market by limiting market players from developing new materials. Increasing awareness and concern about environmental issues such as plastic pollution, deforestation, and climate change has increased the demand for sustainable packaging materials. Traditional packaging materials that are not eco-friendly, such as single-use plastics or non-recyclable materials, may face limitations regarding consumer acceptance, regulatory compliance, and market demand, which can impact their growth prospects.

Governments and regulatory bodies around the world are imposing stricter regulations and standards on packaging materials to promote environmental sustainability. These regulations may include restrictions on the use of certain materials, such as plastic bags or polystyrene packaging, or requirements for recycling or composability. Compliance with these regulations may be challenging for traditional packaging materials that do not meet the sustainability criteria, leading to potential restraints in the market.

Rising demand for customized packaging

Customized packaging creates a unique brand identity for companies; by using such packaging solutions, companies focus on their brand recognition. Factors such as competitive advantages, improved business scope, favorable outcomes, changing consumer preferences, and increasing focus on sustainability through packaging have boosted the demand for customized packaging solutions across the globe. Customized packaging that caters to the specific needs of various industries, such as food and beverage, healthcare, and e-commerce, can be a lucrative opportunity, as businesses require innovative packaging solutions. Especially, rising e-commerce business activities are supporting the demand for customized packaging. Companies that offer packaging materials that are tailored to meet the specific requirements of different industries can attract niche markets and create a loyal customer base.

Covid-19 Impacts:

The Covid-19 pandemic showed significant impacts on the packaging material market. The pandemic has led to an increased demand for packaging materials, particularly for products like personal protective equipment (PPE), disinfectants, and medical supplies. This has led to shortages in certain types of packaging materials, such as plastics and paper-based products.

The pandemic has also led to changes in consumer behavior, with more people opting for online shopping and home delivery services. This has increased the demand for packaging materials for e-commerce, such as boxes, tape, and protective materials.

The pandemic has disrupted global supply chains, causing shortages of raw materials and transportation delays. This has led to increased prices and decreased availability of specific packaging materials.

Despite the increased demand for packaging materials, the pandemic has also highlighted the importance of sustainability in the packaging industry. Many companies are now looking for more sustainable options, such as biodegradable and compostable materials, to reduce their environmental impact.

Overall, the Covid-19 pandemic has significantly impacted the packaging material market, leading to changes in consumer behavior, increased demand for certain types of packaging, disruptions in the supply chain, and a renewed focus on sustainability.

Due to the rising consumer preferences for paper bags, pouches, and other packaging forms, the paper segment is expected to dominate the global sustainable packaging market during the forecast timeframe. Given the growing environmental concerns, many clothing brands, packaged food product companies, and other end-users are focusing on promising sustainable packaging.

In 2022, the plastic segment held a significant market share; the segment grew steadily during the analysis period. The increasing production of recycled plastic material for multiple end-users, particularly pharmaceutical applications, is expected to drive segment growth during the forecast period. Furthermore, because of its low cost and lightweight properties, plastic is used as sustainable packaging.

During the forecast period, the glass segment remains the most promising segment in the packaging material market. Sustainable glass packaging is becoming increasingly popular due to its environmental benefits, health and safety benefits, durability, attractive appearance, and purchaser interest in environmentally conscious packaging options. The producers of alcoholic and non-alcoholic beverages are expected to contribute the most to the segment's growth.

The bottles segment dominated the global glass packaging market in 2024 and will continue to do so during the forecast period. The segment's progress has been facilitated by the design flexibility and durability of bottles. In addition, rising demand for recycled material from the food and beverage industries is expected to keep the bottles segment expanding during the forecast period.

Another factor considered for the growth of the bottle segment is rising disposable income; as disposable income rises, consumers are more likely to purchase premium products that are often packaged in glass bottles, such as high-end wine, spirits, and cosmetics.

The box segment shows a promising growth during the forecast period, the rise of online shopping businesses that require lightweight packaging solutions for easy transportation is expected to propel the growth of box segment. Moreover, boxes can be easily designed and recycled, the rising environmental concerns are expected to support the growth of box segment.

The food and beverages segment dominated the market in 2024; the segment will continue its dominance throughout the forecast period. The emerging online food industry that requires branding and marketing along with safe food transportation is fueling the demand for packaging materials in the food and beverage industry. Moreover, the combination of factors such as the need for protection, preservation, and regulatory requirements in the food industry are observed to boost the segment’s growth.

The household products segment is expected to hold a significant market share. The Covid pandemic has forced the population to adopt multiple sanitization methods, which resulted in increased demand for household products. The enormous demand for household products boosted the demand for cardboard and plastic packaging. The increased demand in recent years for cleaning and hygiene-based products even forced several market players to develop innovative solutions for packaging specially designed for household products.

For instance, in February 2023, Total Energies and EcoLabs announced their collaboration to introduce post-consumer recycled plastic into post-consumer recycled into primary packaging for highly concentrated cleaning products in order to deliver sustainable packaging solutions.

By Material

By Product

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

March 2025