February 2025

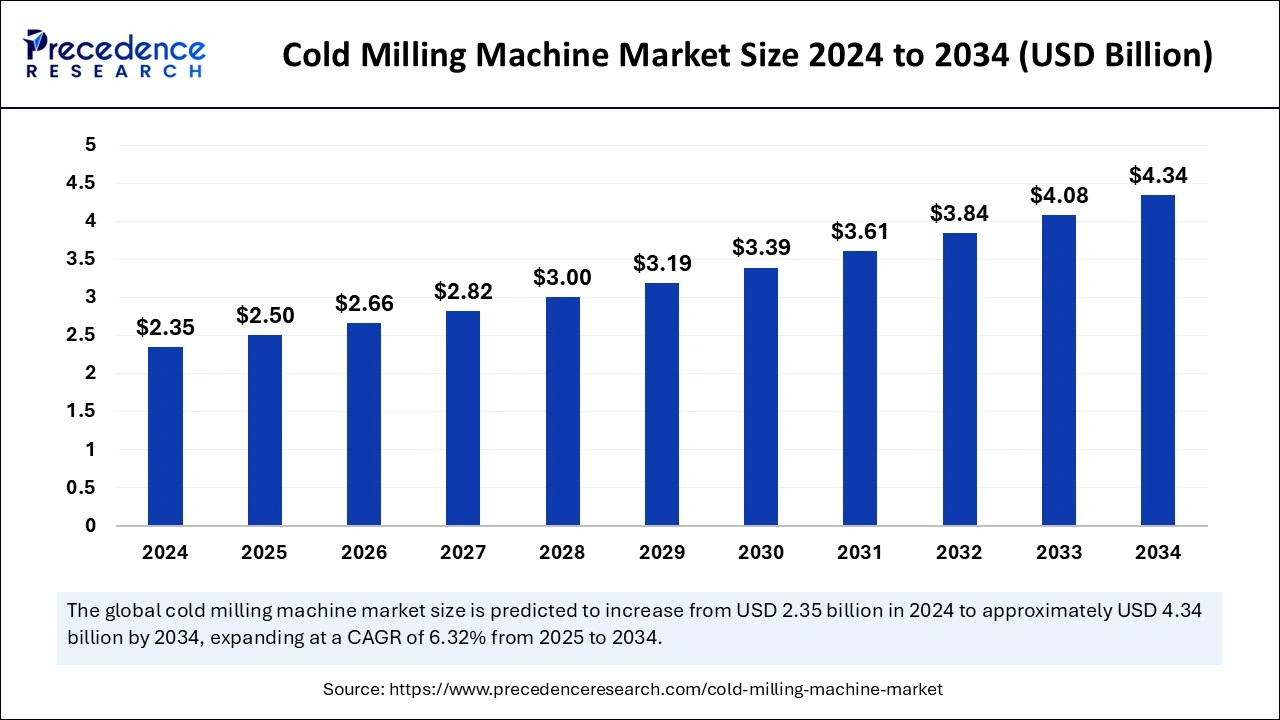

The global cold milling machine market size is accounted at USD 2.50 billion in 2025 and is forecasted to hit around USD 4.34 billion by 2034, representing a CAGR of 6.32% from 2025 to 2034. The Asia Pacific market size was estimated at USD 940 million in 2024 and is expanding at a CAGR of 6.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cold milling machine market size was calculated at USD 2.35 billion in 2024 and is predicted to increase from USD 2.50 billion in 2025 to approximately USD 4.34 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034. The market is gaining traction as it allows for a quick and efficient way to remove old asphalt and concrete surfaces.

The integration of artificial intelligence and automation in the cold milling machine market has the potential to improve precision, efficiency, and safety in operations. Automation offers real-time monitoring and control of the milling processes which provides operators with optimal performance with minimalized human errors. Majority of the companies are incorporating self-driving construction machinery to perform a repetitive task more efficiently than humans. Excavation and prep work on job sites require autonomous or self-driving earthmovers which can prepare a job site for human programmers.

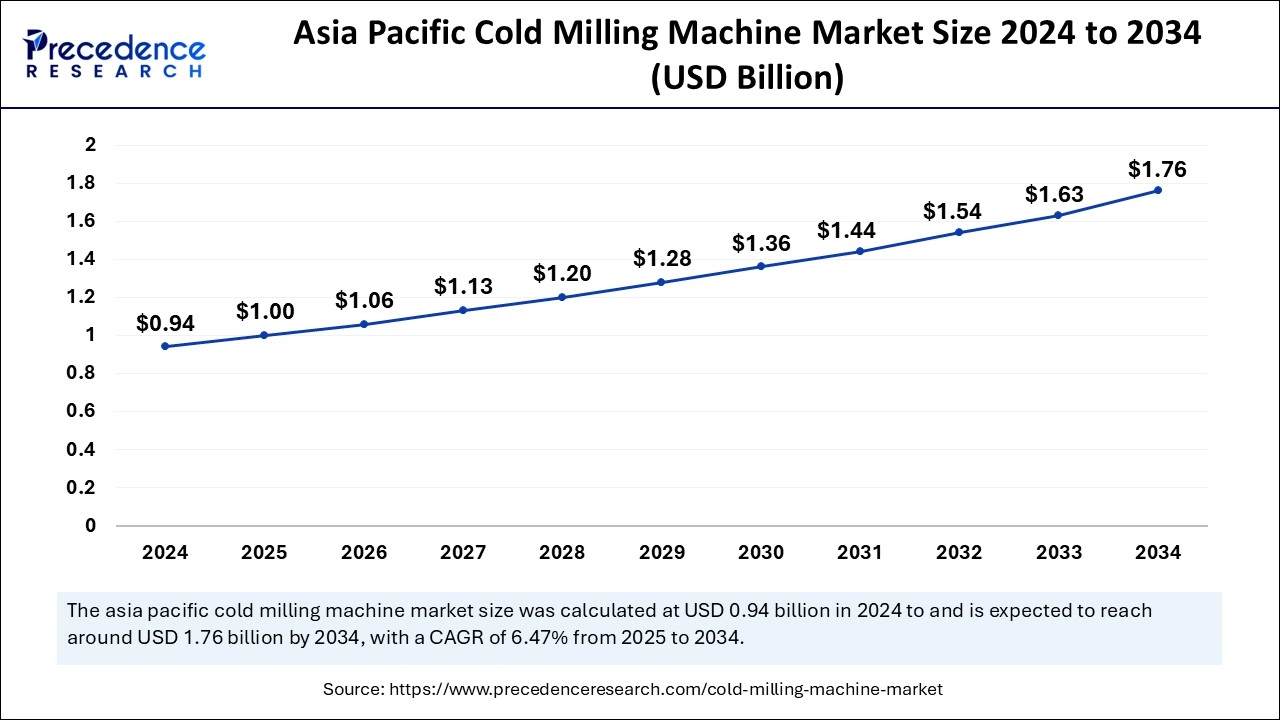

The Asia Pacific cold milling machine market size was evaluated at USD 0.94 billion in 2024 and is projected to be worth around USD 1.76 billion by 2034, growing at a CAGR of 6.47% from 2025 to 2034.

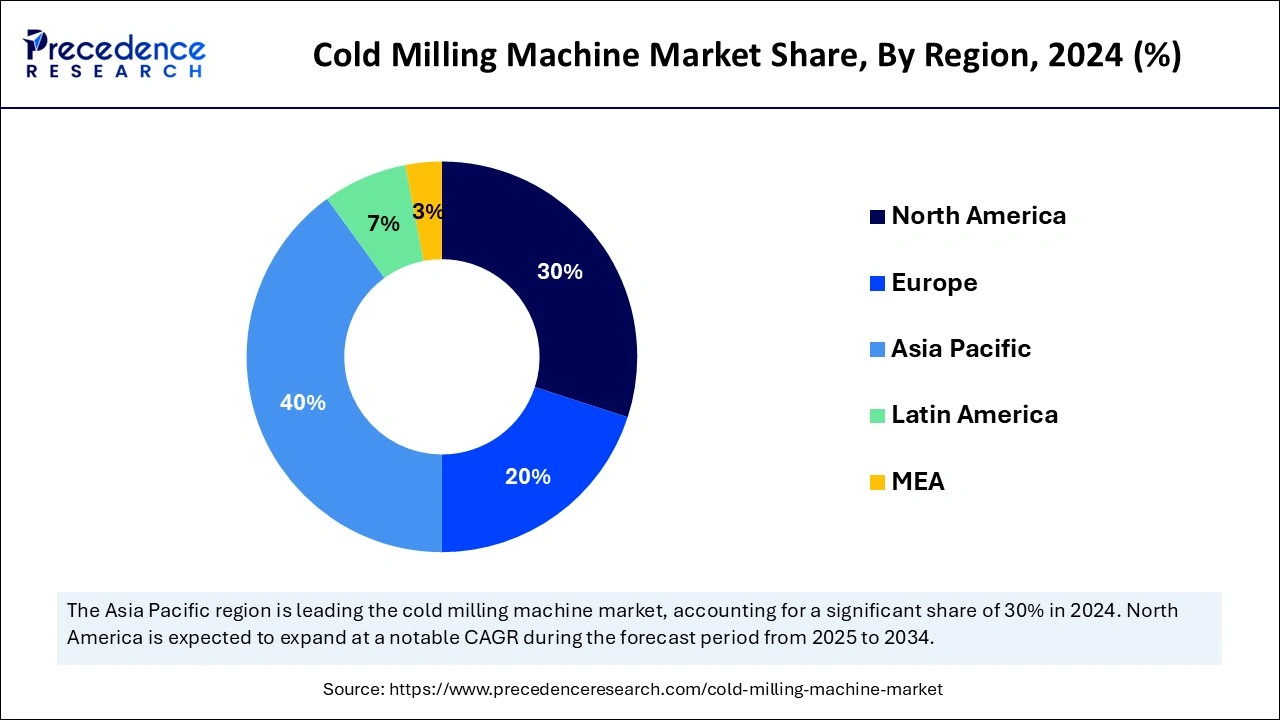

Asia Pacific led the global cold milling machine market with the highest share in 2024. The dominance of the region is experienced due to the smart city initiative which is fueling the demand for cold milling machines. The increasing adoption of building technologies is another factor growth of the market in the region. The smart city initiative mainly focuses on using the internet to improve operational efficiency, share information and provide a better quality of service.

The growing incorporation of technologies into building automation systems to optimize building and road efficiency, sustainability, and citizen experience. Countries seeing the major industrial transformation in Singapore, South Korea, China, and India. There has been a greater investment in smart infrastructure.

North America is anticipated to grow at the fastest CAGR in the cold milling machine market during the forecast period. The expansion is observed due to investment into highways and roadway construction which is eventually increasing the demand for cold milling machines. The government funding is primarily driven by the market in North America under the Infrastructure Investment and Job Act which allocated over USD 350 billion for highway transformation projects over 5 years. This act addresses the large backlog in repair and maintenance.

Cold million machine is specialized in construction equipment used for quick and efficient removal of asphalt and concrete pavement surfaces. Creating a level of foundation with the required width and depth for a new surface layer of uniform thickness. A cold milling machine is a powerful and durable construction machine designed to scrape off the top layer from the paved surface. The cold milling machine market application is widely observed in the construction of parking lots, roadways, and highways. A machine has a sizable rotating drum with cutting teeth usually made from tungsten carbide, it has exceptional hardness and wear resistance which make it ideal for machining tough material. The desired finished result is a clear and uniform surface.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.34 Billion |

| Market Size by 2025 | USD 2.50 Billion |

| Market Size in 2024 | USD 2.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Power, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding infrastructure development

The development of road construction infrastructure is a pioneer of a fast-growing economy. Road infrastructure is a crucial medium to communicate miles of connectivity. The U.S. has the largest road network in the world and later comes India. There has been a special emphasis on the road to provide high-quality, the road being lengthy isn’t enough, it should be able to withstand weather patterns in different countries and several quality measures should be on point. Moreover, the expanding road infrastructure brings an extensive range of employment and helps sustain the growth of long-term.

High Cost

The cold milling machine has a high cost challenge which comes with other investment expenditures. The initial acquisition cost is extremely high. Any earthmoving machine purchased by the company owner must be equipped with the latest technology. However, the high cost creates a financial hurdle for many businesses. Other than that, there is an operational cost required for maintenance, repair, and fuel consumption. This becomes an affordability issue for small companies in the cold milling machine market.

Shock reduction technology

The future of the cold milling machine market is anticipated to witness innovations towards a new creep travel mode combined with boom and arm shock reduction technology. This feature will minimise material spillage during transportation and operations, along with enhancing safety for the operator and surrounding environment. Shock reduction technology in construction machines comprises features such as shock absorption, vibration isolators, and damping material to reduce the impact of vibration and shocks.

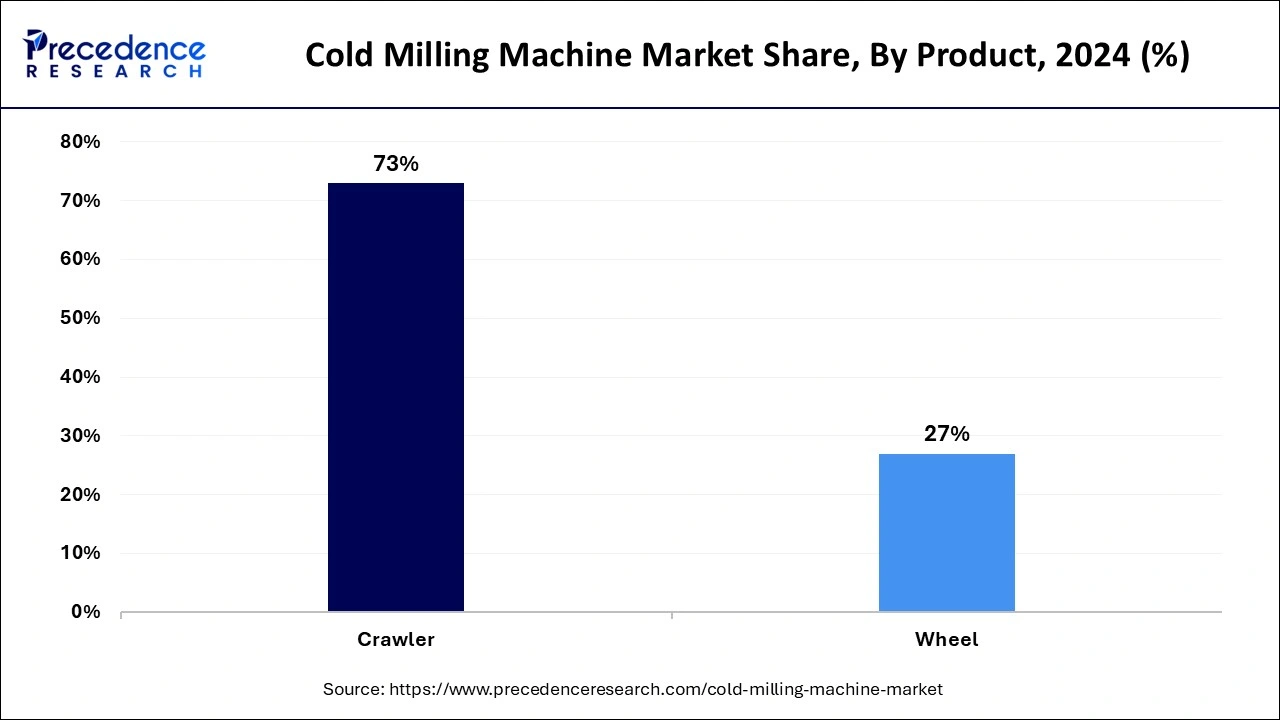

The crawler segment has held the largest cold milling machine market share in 2024. The dominance of this segment is observed due to its broad utility and the fact that it is the fastest-selling earthmoving equipment in the majority of countries. Crawlers are widely used on construction sites for work which includes digging trenches, holes, and foundations along with, handling materials, moving earth, demolition, dredging, and many more. Several contractors and construction company owners buy crawlers considering ground conditions, machine stability, transportation costs, maintenance, and attachment versatility. The demand for crawlers is growing with new models, and equipment loaded with electronic intelligence, Global Positioning System (GPS), and telematics.

The 300kW segment captured the biggest cold milling machine market share in 2024. This segment is highly driven as it is suitable for commercial, residential use, and industrial use. Another factor for its increasing adoption is it has a considerate level of fuel consumption, consumes less fuel, and minimizes energy costs. This is commonly applicable in road and highway building. A 300kW cold milling machine is a generator providing electricity for a heavy-duty construction machine. It is designed to deliver high output, reliability, and efficiency.

The 500kW segment is estimated to expand at the fastest CAGR over the projected period. The expansion of this segment in cold milling machines is credited to the broad utility of in restoration of roads, airport pavement, and many more. A 500kW machine is designed for large-scale construction projects including industrial applications and emergency power needs. This has a robust performance, high scalability, and fuel efficiency equipped with advanced technology to optimize fuel consumption and reduce operation expense and environmental impact.

The concrete rehabilitation segment registered a maximum cold milling machine market share in 2024. The popularity of concrete paving roads is credited to the various advantages it has to offer. A primary advantage a concrete road construction offers is longevity, on average a concrete road last for 20-40 years. It is a sustainable way of building roads as it can be recyclable. Concrete has the potential to withstand high weight and pressure credited to its sturdy surface which is also less prone to dips and rutting.

By Product

By Power

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

January 2025

October 2024