November 2024

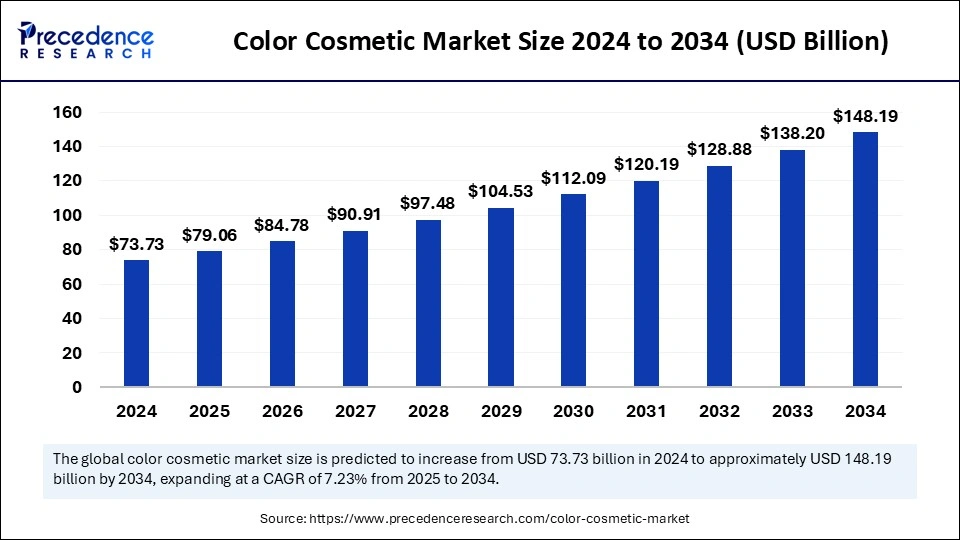

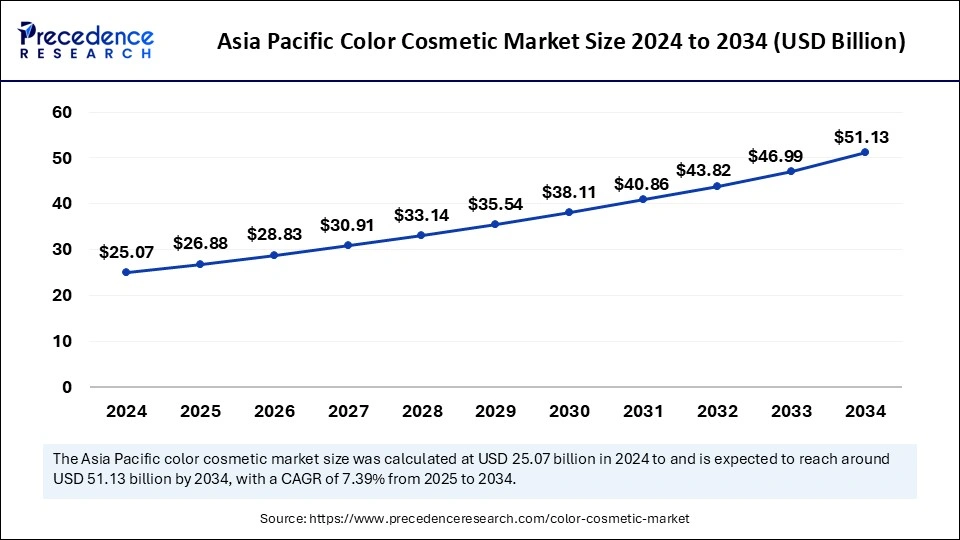

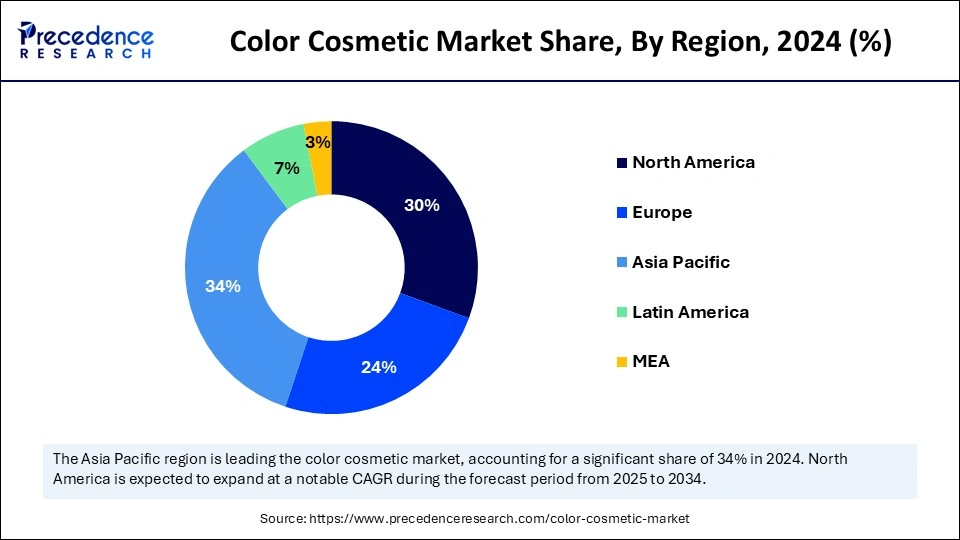

The global color cosmetic market size is calculated at USD 79.06 billion in 2025 and is forecasted to reach around USD 148.19 billion by 2034, accelerating at a CAGR of 7.23% from 2025 to 2034. The Asia Pacific market size surpassed USD 25.07 billion in 2024 and is expanding at a CAGR of 7.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global color cosmetic market size was estimated at USD 73.73 billion in 2024 and is predicted to increase from USD 79.06 billion in 2025 to approximately USD 148.19 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The rising demand for different brands of cosmetics that can correct the natural pigmentation of the skin and further research on the development of new cosmetic products with skin benefits are observed to promote the market’s expansion.

The integration of Artificial Intelligence into the cosmetics industry aims to transform productivity and quality and helps in the evaluation of new products as per consumer demand. AI in the color cosmetic market offers a personalized experience by analyzing consumer needs, skin preferences, and other factors that boost the consumer experience and satisfaction. AI helps in recommending tailored cosmetic products by analyzing skin type color preferences and previous purchases. There are several leading brands like Neutrogena using AI-driven tools to recommend personalized skincare solutions.

The Asia Pacific color cosmetic market size was evaluated at USD 25.07 billion in 2024 and is projected to be worth around USD 51.13 billion by 2034, growing at a CAGR of 7.39% from 2025 to 2034.

Asia Pacific dominated the color cosmetic market in 2024. The growth of the market is owing to the rising population in regional countries like China and India and the greater availability of the younger generation, which are highly interested in cosmetics and skin care products that drive the demand for color cosmetics. The economic stability in the regional countries and the driving disposable income in the population surge the investment in lifestyle and expand the consumer goods sector. The rising urbanization and social media culture in the younger generation are contributing to the growing demand for cosmetics products. Additionally, the rising market entrants in the cosmetic market and the availability of several distribution channels, such as various e-commerce sites and specialty stores of different brands.

China

The Chinese color cosmetics market is expanding owing to the increased rate of health-conscious consumers looking for hybrid products, including skincare formulae with color cosmetics. Such multifunctional beauty products are setting trends in China to enhance skin and hair texture. Also, demographic shifts are responsible for market growth. Many e-commerce platforms have emerged these days that offer doorstep delivery within a decided time slot, and have increased their popularity globally.

As per recent data, in 2024, nearly 60.9% of the Chinese population comes from the underage group of 16 to 59 years old. These people are generally more aware of the external appearance and try to make it more appealing. Increasing demand for clean beauty products like natural ingredient-based skin and hair products is again a major reason for the market growth in China.

Europe expects notable growth in the market during the forecast period. European countries like France, Germany, U.K. are some of the leading contributors to the cosmetic market. The greater availability of the leading cosmetics manufacturers and the demand for cosmetic and skincare products. The increasing demand for organic skincare and cosmetic products and the awareness of age-related concerns are collectively driving the growth of the color cosmetic market across the region.

North America

The U.S. color cosmetics market has witnessed a significant surge in the demand for various colored cosmetics as consumers are looking for convenient, branded, and high-quality products for personal hygiene and increasing attention to outer appearance. Consumers are looking for particular solutions for skin and hair to target root causes and get help from well-experienced dermatologists.

According to the recent data published in YouGov PLC 2024, nearly 60% of females have a fixed skincare routine which is fixed, and they are also opting to spend on quality products. Also, 60% of Gen-Z consumers prefer ethical color cosmetic brands made in the U.S. Additionally, intelligent marketing strategies from different skincare/haircare brands and the capacity of customers to spend more on quality products via both online and offline platforms are further expanding the market growth.

The cosmetics industry is one of the leading sectors across the world, with continuous demand and market competition. The continuously rising consumer base in the cosmetic industry is driving the development of new products in the color cosmetic market. Color cosmetics is one of the robust parts of the cosmetic industry, which can be referred as the wide range of makeup and beauty products categories which help conceal the skin’s natural pigmentations with the makeup color or the cosmetic color. Eyeshadow, eyeliner, lipstick, blush, lip pencils, lip gloss, highlighter, concealers, foundation, and others are some products that are included in the color cosmetics. The rising social media culture and awareness regarding makeup and different types of grooming products are accelerating the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 148.19 Billion |

| Market Size in 2025 | USD 79.06 Billion |

| Market Size in 2024 | USD 73.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Price Range, Age Group, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Changing trends for cosmetics in female consumers

The makeup or the cosmetic industry is one of the fastest-growing industries around the world. The rising global population, changing lifestyles, social media culture, and awareness of being socially attractive and well-groomed is highly contributing to the expansion of the market. In the case of the color cosmetic market, it is one of the most important aspects of makeup, which further includes the color dimensions, pigments, harmonies, and reflectiveness. Color cosmetics come into two different categories such as organic and inorganic. The increasing awareness regarding sustainability and natural chemical-free cosmetic products with no side effects and natural hydrating qualities is driving the demand for organic color cosmetics.

Cost of the product and market competition

The cost of cosmetic products is somehow limiting the adoption of the products and consumer base for color cosmetics. The number of luxury brands that are investing in the development of color cosmetics, the continuous intervention of several new players in the cosmetics market, and sometimes the side effects due to the quality of cosmetics and raw materials used in cosmetic production are collectively restraining the growth of the color cosmetic market.

Integration of color cosmetics with skincare

The increasing awareness regarding skincare as the changing environmental condition, rising pollution levels, aging factors, and several others are contributing to the dullness of the skin and several other skin problems, which drive the demand for cosmetics products with added skincare qualities. There are several leading cosmetics brands that are investing their time and money in the development of color cosmetics, which align with every individual need for cosmetics.

The awareness of skincare in the consumer opens a new market opportunity for the cosmetics industry. The continuously rising demand for skin-friendly cosmetic products demonstrates that they provide skin benefits like pollution and UV protection, skin hydration, and radiance, and others contribute to the further growth opportunities in the color cosmetic market.

The facial product segment led the market in 2024. The rising social awareness in the population and the increasing beauty standards in the people are driving the demand for cosmetics products. Facial cosmetics is one of the largest segments in the cosmetics market, with the inclusion of a number of products such as foundation, blush, face powders, concealers, facial setting sprays, primers, and several others. The rising inclination of the younger age population towards cosmetic products and skincare for meeting the rising beauty standards is contributing to the growing demand for the facial color cosmetic segment.

The lip product segment expects the fastest growth in the market during the predicted period. The increasing demand for lip products in the cosmetic range for enhancing the color of the lips. Efficient lip care products help in addressing lip pigmentation and roughness. It helps in regaining the natural softness and color of lips. There are several leading cosmetic companies that are investing in lip products such as lipstick ranges and the launch of new and comforting colors as per the skin type and skin tone of the consumer, boosting the sale of lip products in the color cosmetic market.

The mass segment dominated the color cosmetic market in 2024. The increasing demand for consumer goods such as skincare and cosmetics products is due to the rising awareness regarding societal beauty standards, awareness regarding skincare, and other factors that boost the demand for the segment. There are leading cosmetics and skincare brands that are developing affordable beauty products that can be affordable that can cover a mass number of consumers, and the continuous intervention of new cosmetics or beauty brands in the market has further strengthened the segment expansion.

The millennial segment dominated the color cosmetic market in 2024. The rising demand for cosmetic products forms the millennial generation due to rising consciousness about the social presence in this age group; people are interested in investing in luxury beauty products to enhance beauty. The increasing social media culture and the social media influences are creating awareness towards beauty products, product applications, and other tutorials regarding makeup that boosts the interest towards beauty products.

The modern trade segment led the market in 2024. The increasing adaptation of the modern trade type of distribution channels, such as the increased sale of cosmetic products from the beauty specialty stores and departmental stores due to the better relevancies over the product and the stores can provide the in-person quality checking of the product as per the consumer requirements. In the modern trade, the consumer can check the color of the cosmetic as per the skin type and skin tone. Furthermore, specialty stores can also offer several discounts, coupons, and offers on every purchase.

The e-commerce segment expects significant growth in the color cosmetic market during the predicted period. The rising inclination towards the online shopping platform for the buying of several consumer goods with attractive discount offers, availability of a wide range of products on one platform, and doorstep delivery are driving people towards the e-commerce shopping platform. Additionally, the growing market of the e-commerce industry, with the availability of a number of online shopping platforms and the intervention of new players.

By Product Type

By Price Range

By Age Group

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

May 2025

July 2024