List of Contents

What is the Skincare Market Size?

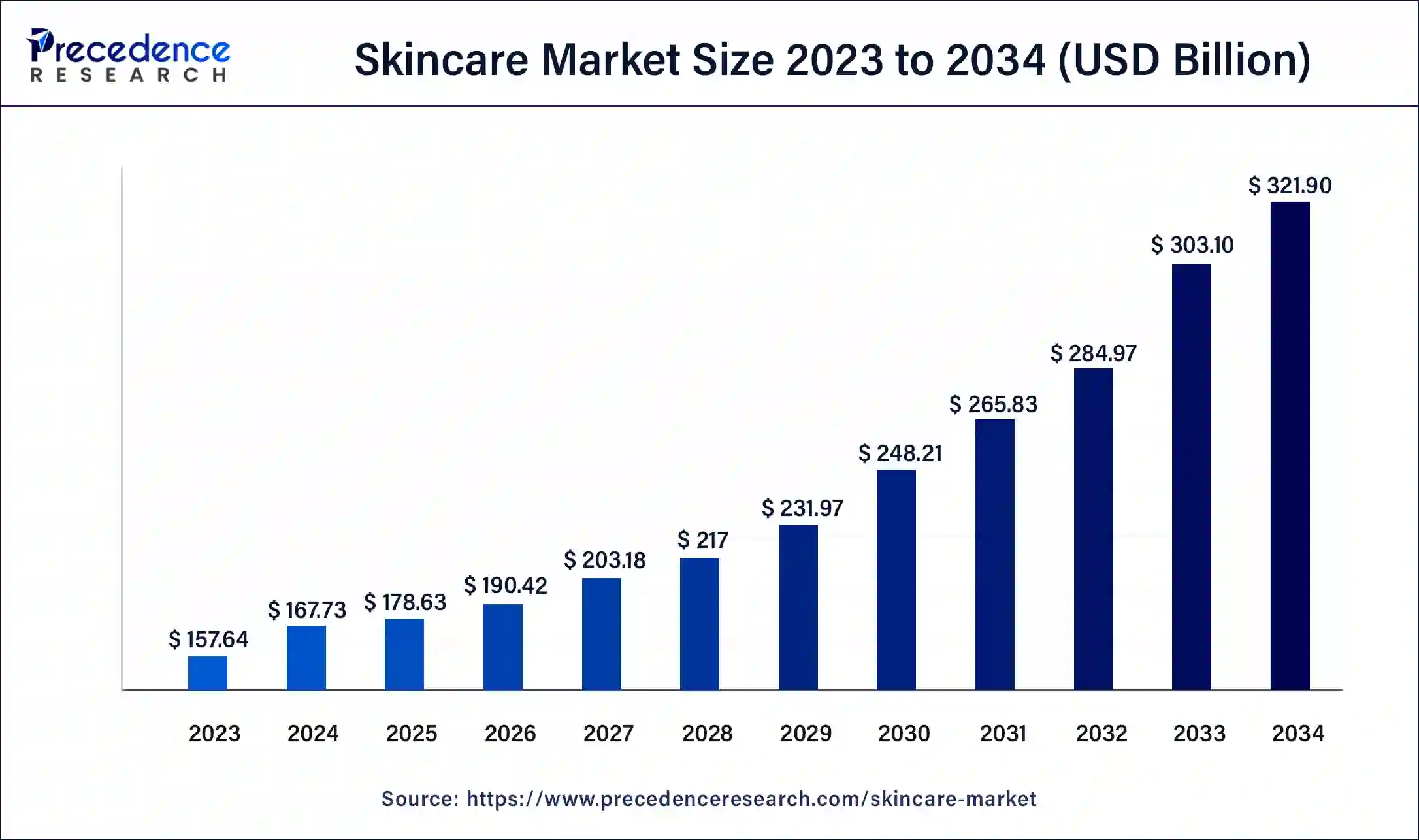

The global skincare market size is USD 178.63 billion in 2025, calculated at USD 190.42 billion in 2026 and is expected to reach around USD 321.90 billion by 2034, expanding at a CAGR of 6.74% from 2025 to 2034.

Market Highlights

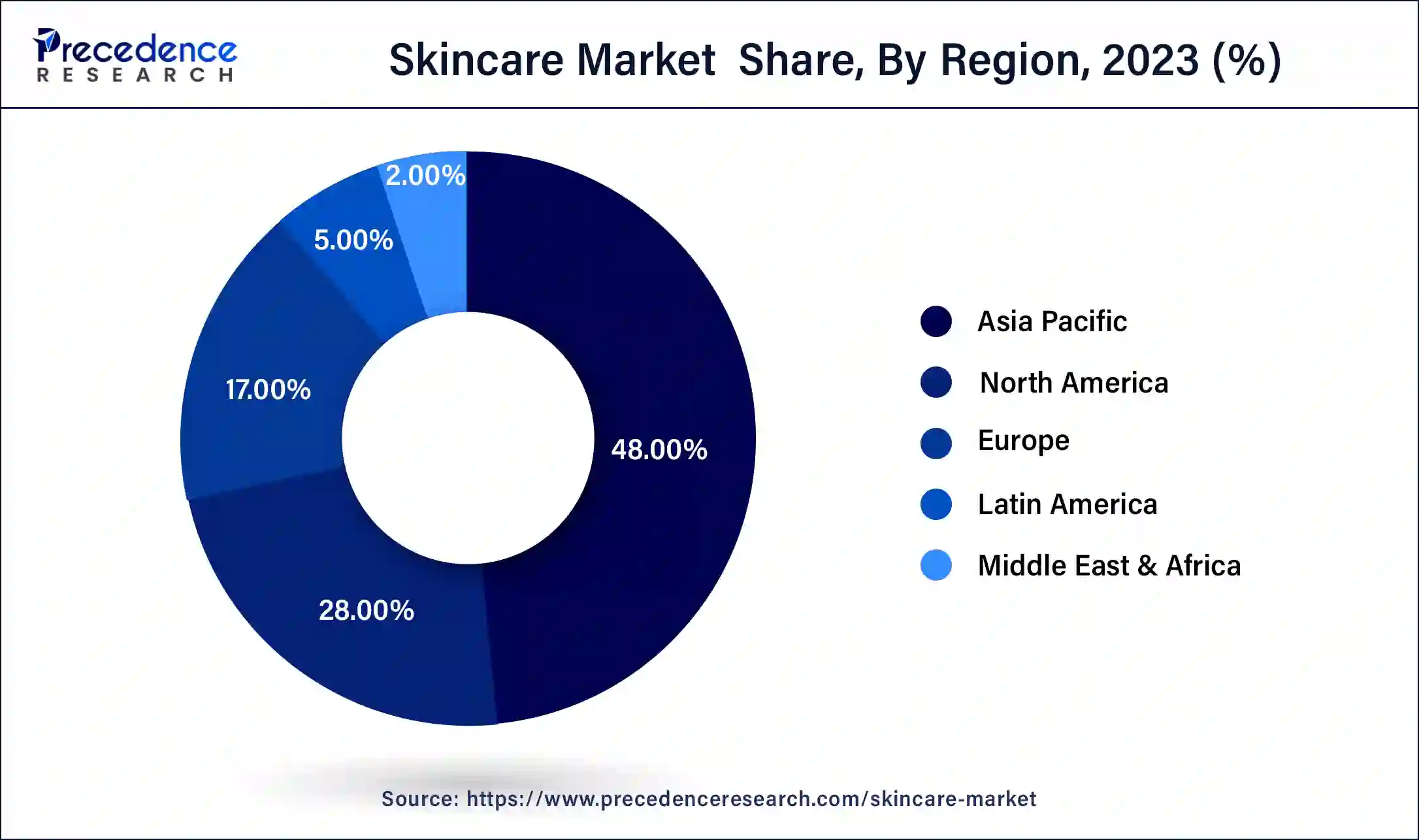

- Asia Pacific contributed more than 48% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By products, the creams and moisturizers segment has held the largest market share of 35% in 2025.

- By products, the powder segment is anticipated to grow at a remarkable CAGR of 7.2% between 2025 and 2034.

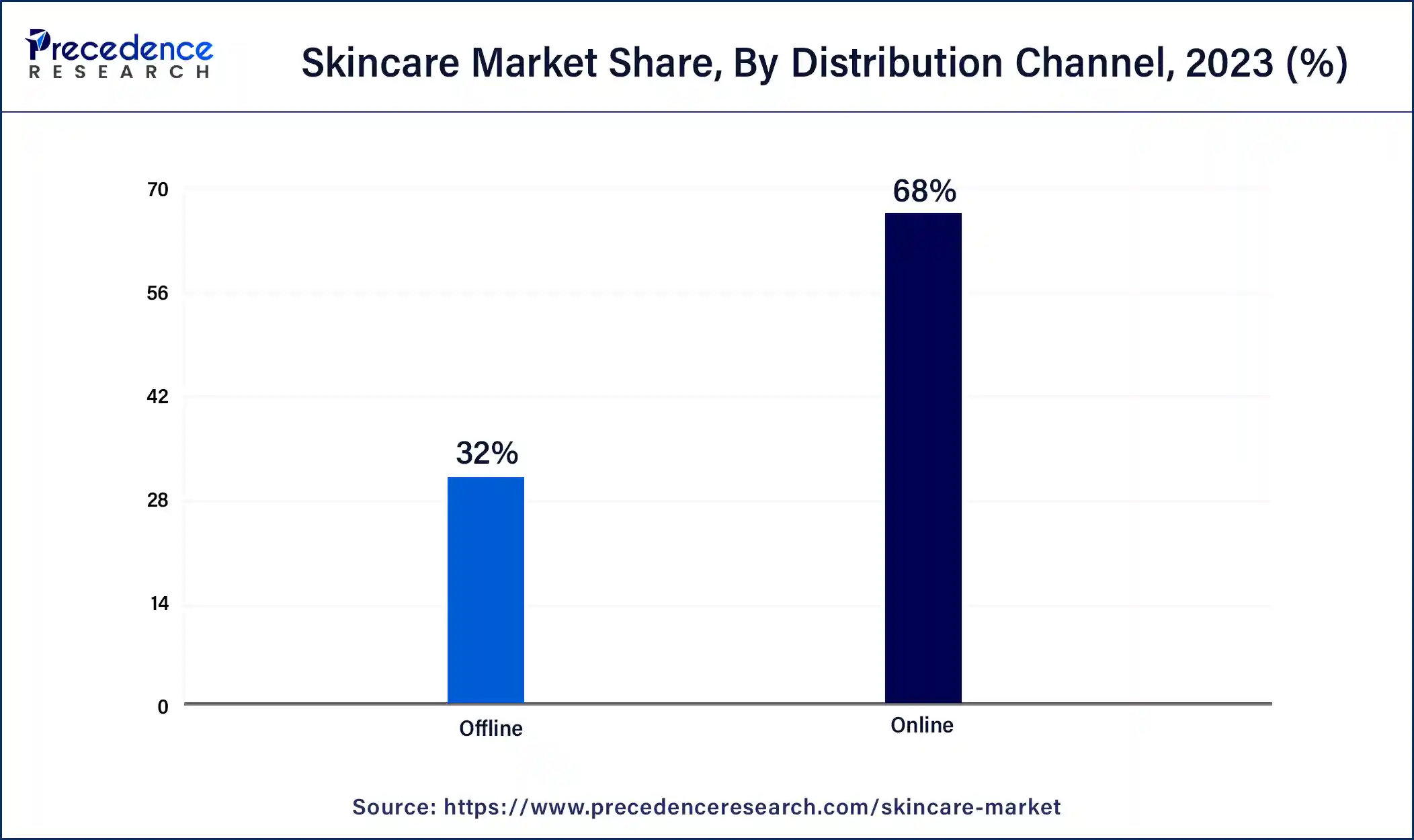

- By distribution channel, the offline segment generated over 68% of revenue share in 2025.

- By distribution channel, the online segment is expected to expand at the fastest CAGR over the projected period.

- By gender, the female segment generated over 72% of revenue share in 2025.

- By gender, the male segment is expected to expand at the fastest CAGR over the projected period.

- By packaging, the tubes segment generated over 41% of revenue share in 2025.

- By packaging, the bottles and jars segment is expected to expand at the fastest CAGR over the projected period.

How Does Changing Consumers' Needs Impact the Skincare Sector?

Skincare items provide a wide variety, each designed for particular skin types and issues, reflecting ongoing innovation in the beauty sector. Ongoing progress involves integrating natural elements and state-of-the-art technologies to meet changing consumer needs. Selecting products based on individual skin requirements is crucial, as a personalized skincare routine contributes to promoting healthier, more radiant skin. Consistent use of quality skincare products can elevate skin texture, tone, and overall vibrancy, fostering a youthful and rejuvenated complexion.

Skincare Market Growth Factors

- Growing awareness among consumers about the importance of skincare and the availability of diverse products contribute to market expansion.

- The aging population's desire for anti-aging solutions fuels the demand for skincare products incorporating innovative technologies.

- Continuous development in ingredient technology, such as peptides and stem cells, drives the formulation of more effective and targeted skincare solutions.

- The rise of online shopping platforms provides consumers with easy access to a wide range of skincare products, fostering market growth.

- Growing interest in personalized skincare routines leads to the development of customized products catering to individual skin needs.

- The impact of social media platforms in promoting beauty standards and trends significantly boosts the skincare market as consumers seek to emulate influencers.

- Increasing environmental consciousness propels the demand for sustainable and natural skincare products, driving market expansion.

- The expanding men's grooming market contributes to skincare growth, with men increasingly incorporating skincare products into their daily routines.

- Unique and visually appealing packaging designs attract consumers, influencing their purchasing decisions and contributing to market growth.

- As disposable incomes increase globally, consumers are more willing to invest in premium skincare products, boosting market revenue.

- The emphasis on overall health and wellness encourages consumers to adopt comprehensive skincare routines, supporting market expansion.

- The convergence of skincare with medical aesthetics results in the development of advanced and clinically proven products, driving market growth.

- The proliferation of beauty specialty stores provides consumers with dedicated spaces to explore and purchase skincare products, influencing market dynamics.

- Urbanization trends contribute to the skincare market's growth, with urban lifestyles often associated with higher skincare product usage.

- The emergence and popularity of indie skincare brands disrupt traditional market dynamics, offering unique formulations and niche products.

- Partnerships between skincare brands and beauty influencers amplify product visibility and consumer trust, driving market growth.

Skincare Market Outlook

- Global Expansion: Prominent growth is propelled by a growing consumer awareness, the popularity of anti-ageing and natural/organic products, and the progression of e-commerce.

- Major Investors: In January 2025, the PE firm co-founded by Kim Kardashian made a minority investment in the clinically inspired skincare brand 111Skin.

- Startup Ecosystem: Glacies Biome is a 2024 startup that employs sophisticated AI models and facial microbiome sequencing to develop highly personalized skincare products and treatment plans for professionals.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 178.63 Billion |

| Market Size in 2026 | USD 190.42 Billion |

| Market Size by 2034 | USD 321.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.74% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, Gender, Packaging, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for natural and organic products and men's grooming trend

The upswing in the demand for natural and organic skin care products stems from a heightened awareness of the potential advantages of clean beauty. Consumers are increasingly mindful of the environmental repercussions of traditional beauty items, leading them to seek skincare solutions with natural ingredients. This inclination toward plant-based, cruelty-free, and sustainably sourced options reflects a preference for clear and ethical practices, propelling the expansion of the skincare market. Concurrently, the men's grooming trend is making a notable impact on the skincare market by challenging conventional gender norms. Men are now adopting comprehensive skincare routines, driving an increased need for products crafted to meet their specific requirements.

Restraint

Allergies & sensitivities and counterfeit products

Allergies and sensitivities pose significant restraints on the skincare market as they limit the formulation and inclusion of certain ingredients. The prevalence of skin allergies among consumers necessitates meticulous product testing and formulation, adding complexity and cost to product development. Manufacturers must navigate the challenge of creating hypoallergenic products that cater to a diverse consumer base, hindering the speed of innovation in the industry.

Additionally, the market faces constraints from counterfeit skincare products, which not only compromise consumer safety but also undermine the credibility of genuine brands. The presence of fraudulent products erodes consumer trust, making it imperative for companies to invest in robust authentication measures and stringent quality control. The impact of allergies, sensitivities, and counterfeit products collectively restricts market growth by influencing consumer choices and industry practices, requiring vigilant strategies to overcome these challenges.

Opportunity

The rising popularity of online platforms and emerging markets

The rising popularity of online platforms and the exploration of emerging markets collectively present significant growth opportunities in the skincare industry. The increasing preference for online shopping allows skincare brands to expand their market presence, reaching a broader and more diverse consumer base. E-commerce platforms offer a convenient avenue for consumers to explore and purchase skincare products, fostering brand visibility and accessibility.

Simultaneously, the untapped potential in emerging markets, characterized by changing lifestyles and rising disposable incomes, creates substantial opportunities for skincare companies. These regions often exhibit a growing demand for personal care products, presenting a chance for brands to introduce and establish their offerings. Strategic market entry and customization of products to suit local preferences in these emerging markets can lead to considerable market share gains and long-term success for skincare brands willing to capitalize on these opportunities.

Segments Insights

Product Type Insights

The cream and moisturizer segment had the highest market share of 35% in 2025. In skincare, creams and moisturizers are fundamental product categories. Creams typically boast a denser consistency, offering profound hydration and targeting specific skin concerns like signs of aging or blemishes. Moisturizers, conversely, concentrate on preserving skin moisture and preventing dryness. Current trends underscore a heightened interest in versatile products, such as BB creams, seamlessly blending skincare benefits with light coverage.

Additionally, there's a growing emphasis on incorporating natural ingredients and cutting-edge formulations, aligning with consumer preferences for effective yet environmentally friendly and sustainable skincare solutions.

The powder segment is anticipated to expand at a significant CAGR of 7.2% during the projected period. In the skincare market, the powder segment refers to powdered formulations designed for various applications, such as cleansing, exfoliating, and masking. A notable trend in this segment involves the surge in popularity of powder-to-liquid formulations, allowing users to customize product consistency and efficacy by adding liquid components. This trend aligns with the broader consumer demand for personalized skincare experiences, offering a novel approach to skincare routines and fostering the perception of tailored solutions catering to individual preferences and skin needs.

Distribution Channel Insights

The offline segment has held a 68% revenue share in 2025. The offline segment in the skincare market pertains to traditional retail channels like physical stores, specialty shops, and department stores. Despite the growth of online sales, offline channels remain vital. Recent trends include a focus on experiential retail, offering in-store experiences, personalized consultations, and interactive displays. Brands are also collaborating with beauty experts and influencers to enhance the offline shopping experience, providing expert guidance and strengthening the tangible connection between consumers and skincare products.

The online segment is anticipated to expand fastest over the projected period. A notable trend in this sector involves the integration of augmented reality and virtual try-on features, allowing consumers to virtually test products before making a purchase. Furthermore, personalized online consultations and skincare quizzes are gaining popularity, enhancing the online shopping experience by addressing individual skincare needs.

Gender Insights

The female segment had the highest market share of 72% in 2025. The female segment in the skincare market pertains to women, a significant consumer group. Current trends highlight a rising interest in inclusive and personalized skincare items, addressing various skin needs. Brands are adapting by incorporating natural elements, anti-aging solutions, and holistic wellness features. The female skincare segment, influenced by beauty influencers and a focus on self-care, plays a key role in propelling market growth. Women's discerning preferences drive the demand for products that align with individual lifestyles, emphasizing the importance of tailored skincare solutions in the market.

The male segment is anticipated to expand fastest over the projected period. The male segment in the skincare market refers to the specific demographic of men seeking personal care and grooming products. In recent years, there has been a notable trend of increased male engagement in skincare, moving beyond traditional grooming practices. Men's skincare trends include the rising popularity of specialized products addressing unique needs, such as facial cleansers and moisturizers tailored for men. The industry observes a shift in cultural attitudes, as men embrace comprehensive skincare routines, driving innovation and creating opportunities for skincare brands to cater to this expanding market segment.

Packaging Insights

The tubes segment had the highest market share of 41% in 2025. The tubes segment in the skincare market refers to packaging solutions utilizing cylindrical containers, often made of plastic or aluminum, with a squeezable design. This packaging format is favored for its convenience, ease of use, and ability to preserve product freshness. A current trend in skincare tube packaging involves eco-friendly materials and minimalist designs, aligning with the industries increased focus on sustainability. Brands are opting for recyclable materials and sleek, travel-friendly tube designs, meeting consumer demands for both functionality and environmental responsibility in skincare packaging.

The bottles and jars segment is anticipated to expand fastest over the projected period. The medical devices segment in the skincare market encompasses the use of skincare in healthcare applications. This includes their integral role in magnetic resonance imaging (MRI) machines, which offer high-resolution diagnostic imaging.

A prominent trend in this segment is the ongoing development of higher-performance skincare to enhance the precision and sensitivity of MRI equipment, leading to more accurate and detailed medical imaging. Additionally, skincare is increasingly employed in emerging medical technologies for applications like non-invasive brain mapping and monitoring physiological parameters, reflecting a growing demand for these devices in the healthcare sector.

Regional Insights

Asia Pacific Skincare Market Size and Growth 2025 to 2034

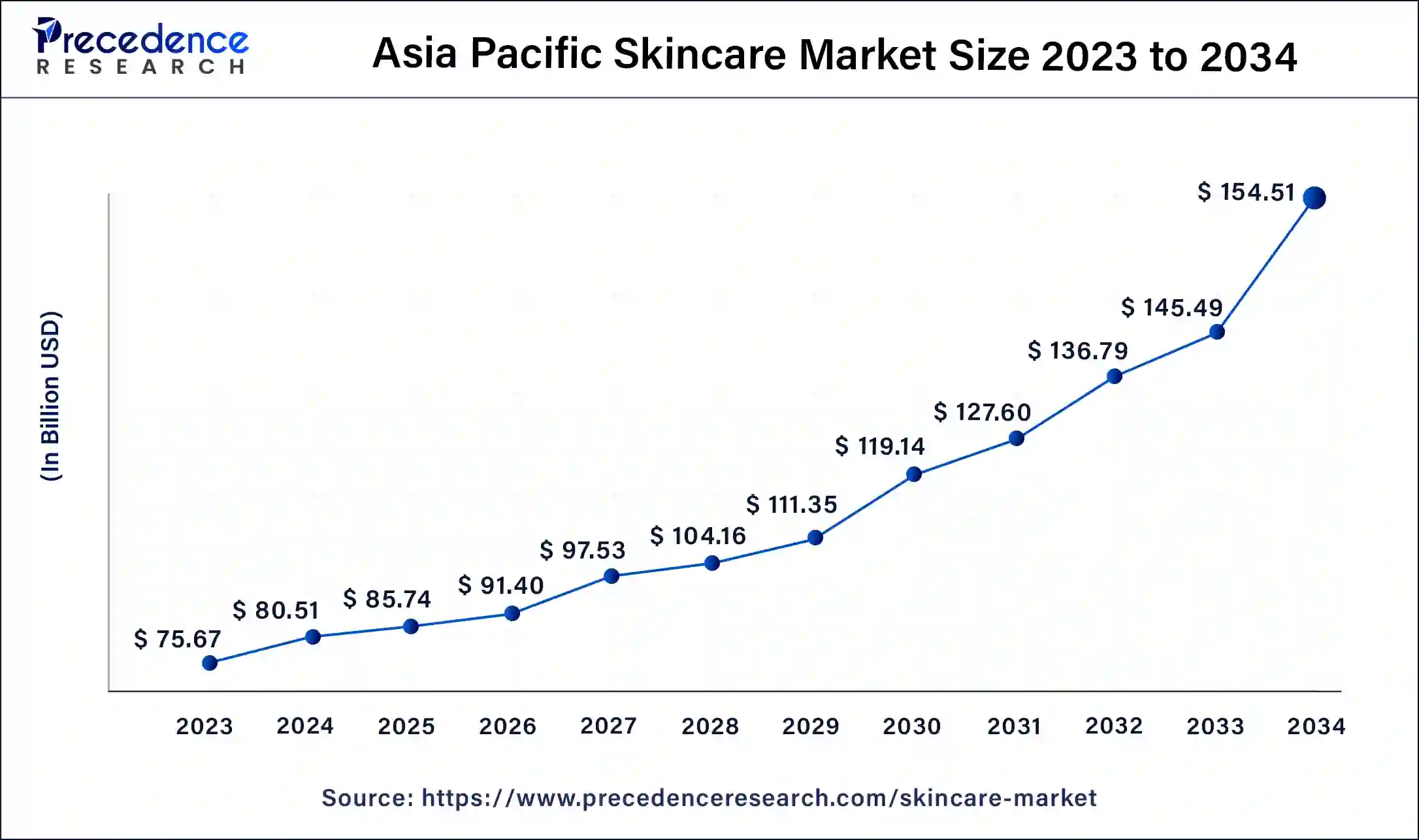

The Asia Pacific skincare market size is valued at USD 85.74 billion in 2025 and is expected to reach USD 154.51 billion by 2034, growing at a CAGR of 7% from 2025 to 2034.

Why did the Asia Pacific hold a Major Share of the Market in 2024?

Asia Pacific has held largest revenue share of 48% in 2025. Asia Pacific dominates the skincare market due to a confluence of factors. Rapid urbanization, increasing disposable incomes, and a growing population with a heightened focus on personal grooming contribute to robust demand. Cultural emphasis on skincare and beauty, particularly in countries like South Korea and Japan, fuels market growth. Additionally, the region sees a surge in product innovation, incorporating traditional ingredients and advanced technologies. With a dynamic consumer base and evolving beauty standards, Asia Pacific holds a substantial share in the global skincare market.

Robust Retail Infrastructure is Driving North America

North America is estimated to observe the fastest expansion. North America holds significant growth in the skincare market due to factors such as high consumer awareness, robust research and development activities, and a mature beauty and personal care industry. The region's affluent consumer base is receptive to premium skincare products, and a strong emphasis on health and wellness further drives market demand. Additionally, the presence of key market players, extensive retail infrastructure, and a cultural emphasis on youthful aesthetics contribute to North America's dominance growth in the skincare sector.

Extensive Trend of Jelly Skin: Supports the South Korean Market

The South Korean market captured a major share of the ASAP market, as the trend is going beyond the "glass skin" aesthetic to emphasize holistic skin health and structure, further focusing on expanded collagen production, intense hydration, and UV protection to achieve a plump, firm complexion.

Stepping into Clean Beauty and Sustainability: Explores the U.S. Market

The ongoing growth of the U.S. market is fueled by the rising demand for natural, organic, and ethically sourced products. For this, several brands are leveraging transparency, non-toxic formulations, and eco-friendly/refillable packaging. For example, DEW MIGHTY, a US-based startup, produces sustainable, refillable skincare with undiluted ingredients to minimise plastic waste.

Immersive Personalisation & Technology is Encouraging Europe

With a lucrative growth, Europe is fostering the broader adoption of AI to facilitate customised skincare solutions. Such brands are utilising AI-enabled skin analysis tools (like La Roche-Posay's Spotscan+) and at-home devices to recommend particular products and evolve personalized formulas.

For instance,

In June 2025, Revieve, a Finnish beauty tech company, partnered with celebrity dermatologist Dr. Simon Ourian, M.D., to introduce an AI-assisted skincare and nutrition advisory tool.

Substantial Technological Breakthroughs: Drives the French Market

Different firms/brands are evolving internet-enabled gadgets for the analysis of skin in real time and adjusting treatments, such as the My Blend mask with its LED technology for enhancing collagen. As well as refillable packaging solutions are used to lower waste, including Clarins unveiled refillable product jars, and others are incorporating more recycled materials into their packaging.

Skincare Market: Value Chain Analysis

- Product Conceptualization and Design

This primarily includes presenting the product's purpose, target audience, and major features through market research, followed by a design phase that encompasses formulation and packaging.

Key Players: Cosmewax, Zymo Cosmetics, Amoha Herbals, etc. - Branding and Packaging

Alignment of a brand's identity with its target audience through planned design choices, from visual elements, such as color and typography, to material selection and mandatory information, is needed at this stage.

Key Players: Amcor and Berry Global Group, APC Packaging, etc. - End-of-Life Management

The players are following the discard of expired products properly, considering the environmental impact, and the execution of "end-of-life beauty planning."

Key Players: TerraCycle, Saahas Zero Waste, Green Savera Waste Management Service Pvt Ltd, etc.

Top Companies and Their Contributions and Offerings in the Market

- L'Oréal S.A.: A global leader in the beauty industry, focusing heavily on science-backed innovation (Green Sciences, microbiome research) and "Beauty Tech," offering a vast portfolio of mass-market to luxury, inclusive, and dermatological brands (e.g., CeraVe, Lancôme, Garnier).

- Procter & Gamble Co.: Offers diversified personal care and skincare via major brands like Olay, SK-II, and Native, known for strong brand identity, extensive R&D, and global market penetration across various price points.

- Johnson & Johnson: Focused on science-backed, health-oriented consumer products through brands like Neutrogena and Aveeno, targeting specific skin concerns with dermatologist-tested, gentle formulations.

- Estée Lauder Companies Inc.: A leader in prestige beauty, offering a diverse portfolio of luxury brands (e.g., La Mer, Clinique, Origins) focused on high-performance, sophisticated, and high-touch customer experiences.

- Unilever PLC: Competes with a diverse portfolio of global brands emphasizing sustainability and ethical sourcing, with significant market penetration in mass beauty and personal care categories.

Recent Developments

- In November 2022, Avon entered into a strategic partnership with Perfect Corp., a leading AI-based beauty tech solutions provider. The collaboration aimed to enhance Avon's virtual makeup technology system, providing consumers with improved tools to choose suitable skincare products.

- In November 2022, Kao Corporation joined forces with Daiichi Sankyo, a prominent healthcare company, to foster innovation in new products and elevate their skincare business revenue, reflecting a commitment to advancement in the beauty and healthcare sectors.

- In July 2022, Johnson & Johnson unveiled a new range of skincare brands, 'VIVVI & BLOOM,' specifically designed for children, catering to both skin and hair needs.

- In 2022, The Estée Lauder Companies partnered with Nyka to launch the 'BEAUTY & YOU INDIA' scheme, aimed at supporting next-generation investments in the Indian beauty care industry, fostering growth and development.

- In July 2022, Beiersdorf introduced its inaugural 'Climate Care Moisturizer' for men. Manufactured with recycled CO, the product is designed to be beneficial for both skin and the environment, reflecting a commitment to sustainable skincare solutions.

Segments Covered in the Report

By Products

- Creams and Moisturizers

- Powder

- Cleansers and Face Wash

- Others

By Distribution Channel

- Online

- Offline

By Gender

- Male

- Female

By Packaging

- Tubes

- Bottles and Jars

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client