January 2025

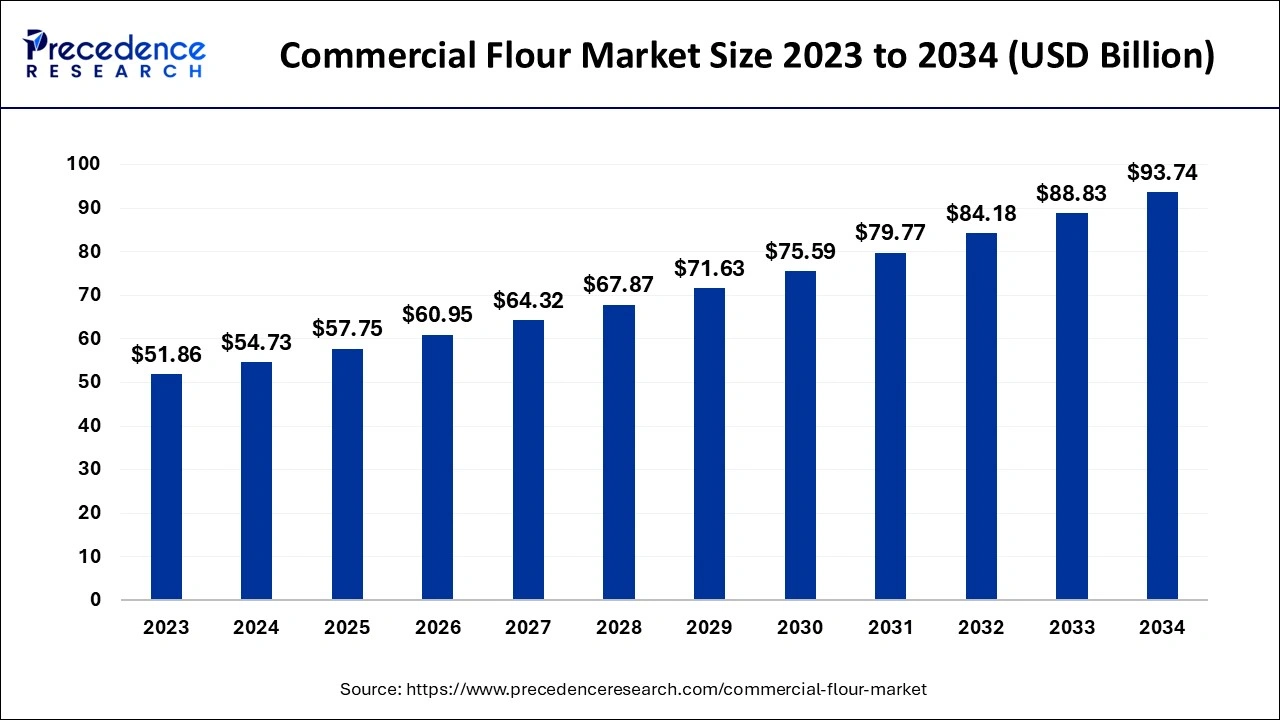

The global commercial flour market size is estimated at USD 54.73 billion in 2024, grew to USD 57.75 billion in 2025 and is predicted to hit around USD 93.74 billion by 2034, expanding at a CAGR of 3.53% between 2024 and 2034.

The global commercial flour market size is worth around USD 54.73 billion in 2024 and is anticipated to reach around USD 93.74 billion by 2034, growing at a CAGR of 3.53% from 2024 to 2034. The increased consumer demands for premium baked food products are driving the growth of the global commercial flour market. The market is witnessing spectacular growth due to increased demand for gluten-free products. The integration of advanced technologies in the market is likely to boost the growth in the forecast period.

The growing consumer demands for sustainable and eco-friendly food options are the key factors driving the growth of the global commercial flour market. The demands for organic, gluten-free, and fortified options are emerging in the market. The consumer’s preference has changed for the premium baked products. The demands for high-quality, specialty, and artisanal baked foods are driving developments in the manufacturing industries. Moreover, the adoption of cutting-edge technologies is improving the milling techniques and technologies, helping to improve efficiency and productivity of the flours.

The wheat flour, corn flour, and rye flour are trending in the market. The growing importance of wheat is the key factor that has increased its demand in food products like pasta and noodles. Changeling consumer lifestyle shifting their preference toward organic agriculture. Additionally, government bodies worldwide are focusing on innovative developments in the agriculture methods, leading the market to generate space for improvement. Moreover, the growing utilization of e-commerce is increasing online shopping rates, and the rising online orders for flowers are emerging in the market. With rising demands for specialty flour blends like ancient grain and gluten-free flours, and rising baking and food manufacturing sectors, the market is likely to continuously boost.

| Report Coverage | Details |

| Market Size by 2034 | USD 93.74 Billion |

| Market Size in 2024 | USD 54.73 Billion |

| Market Size in 2025 | USD 57.75 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-Users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for gluten-free and specialty flours

The increased prevalence of gluten intolerance has shifted consumer preference for the consumption of gluten-free products. The demand for gluten-free baked products like breads and pastries has increased. Moreover, the demand for specialty, ancient grain flours is driving on the top. Specialty flours like quinoa, kamut, and nut flours like hazelnut and almonds are trending in the market. The increased demands for such flours have raised their utilization in applications like bakeries, snacks, and beverages.

With growing awareness of health and sustainability, trends are fueling the adoption of specialty and gluten-free flours. Moreover, expanded distribution channels make it easy to make such flours available, leading to making them prior by the manufacturers as well as consumers. With growing demand for premium and artisanal products, the development of high-quality and efficient flours has increased.

Fluctuation in raw material prices

The volatility in raw material prices like wheat, corn, soybeans, and other grains is likely to hamper the growth of the commercial flour market. Changing climate or inconsistency in consumer preference can lead to enhanced costs of raw materials. In fluctuation in wheat prices can influence the manufacturers profit margins, causing difficulties to balance portability. Uncertainty of climate can lead to high costs of wheat and can cause challenges for manufacturing industries to build plans or predictions of future costs. Moreover, volatility in raw materials also impacts supply chains. The raw material price fluctuation reduces the portability of manufacturers, product quality, and productivity, as well as reduces the market competition.

Rising demand for plant-based flour

As the consumers interest has shifted toward the vegan and vegetarian products, the demand for plant-based flours has increased. The demand for some plant-based flours, including nut flours, flour from minor cereals, coconut flour, and flours from roots and tuber crops, is trending in the market. The rising consumer preference for plant-based diets is the reason behind this increased demand. Moreover, food processing companies have increased adoption of plant-based flours to utilize in applications like breads, cakes, pastries, snacks, and sausages. The beverage industry is expected to generate significant opportunity for the market to grow due to increased consumer adoption of plant-based milks.

As the demand has increased, the production of plant-based flours is rising. Expanded distribution channels and growing support of emerging markets are encouraging production in the manufacturing industries. The high protein content availability in plant-based flours like pea and rice is attracting the consumers. Moreover, the adoption of cutting-edge technologies is enabling the provision of enhanced functionality and texture of plant-based flours, making them more popular.

The wheat flour segment dominated the commercial flour market. The increased utilization of wheat flour in various goods like bakery, bread, pasta, and noodles is the key factor driving the growth of the segment. The wheat is one of the major produced crops, which makes easy availability and accessibility to the consumers. Moreover, the easy cultivation process of wheat always makes them the first proper in the agriculture. The growing adoption of wheat flour-based snacks is driving the segment's growth. The bread flour, cake flour, and pastry flour are trending in the market. Moreover, the government investments in supply chain distribution and manufacturing, the segment is expected to witness continuous growth in the forecast period.

The corn flour is the second-largest segment of the market. The main reason behind the growth of the segment is consumers increasing awareness of gluten intolerance. The demand for gluten-free products has increased, which is leading to the expansion of the corn flour segment. Moreover, the demand for corn flour in several applications like snacks and beverages has witnessed the growth. The easy blending ability of corns is making them popular among flour manufacturing industries. Due to increased demand for non-GMO products, the government has shifted their focus in support of corn production.

The conventional segment led the commercial flour market in 2023 owing to its affordability and acceptance across multiple areas. Conventional flour milling has a well-established global infrastructure, making it readily available and affordable. Products made from conventional flour are widely recognized and preferred by consumers, especially in traditional baked goods. Conventional flour, produced from wheat through traditional milling processes, is commonly used in a variety of applications, including bakery products, snacks, and processed foods.

Based on application, the food processing industry segment leads the market. The food processing industry is the major adopter of the flours as primary ingredients in various products. Food processing industries provide large amounts of flour-based products like breads, baked goods, and pasta. With growing demand for flour in pasta, noodles, bakery products, and snacks, the food processing industries have increased adoption of the flours. These companies get flour in bulk quantity at low prices and help to improve portability. Moreover, high utilization of packaging solutions for produced foods is highlighting the segment expansion in the market. With rising demand for premium and specialty food products, the segment is expected to continuously dominate the market.

The food service industry segment anticipated to witness significant growth in the forecast period due to growing developments of excellent food service option due to increased consumer demands for convenient dining. The need for high-quality food and food ingredients is fueling growth in the segment. The growing demand for the flour in food preparation and enhancing the utilization rate of commercial flour. Moreover, the availability of multiple menu options is driving the popularity of food service industries. The increased utilization of e-commerce is playing a crucial role in the increased adoption of food services industries. With consumers continuously finding convenient and affordable options, the food services industries are expanding significantly.

Increasing population and urbanization: to boost the market in Asia Pacific

Asia-Pacific dominated the global commercial flour market due to its vast population and urbanization base. The growing urbanizations are driving adoptions of the breads, noodles, and other baked food items. Additionally, the foreign influence on dietary habits is shifting the population toward four-based products. The increased population has led to increased demand for food services. The region is focusing on developments of cutting-edge food services like restaurants, cafes, and bakeries. Moreover, increased disposable income is supporting consumers for spending on customized food products.

India is leading the market due to a high consumer base and the availability of flour in the country. India is well known for its developed and vast agriculture. Moreover, growing government initiatives supporting food security. The Government of India is rapidly investing in agricultural research & developments, the establishment of advanced manufacturing industries, as well as supporting small-scale businesses, resulting in market expansion.

Modern flour milling infrastructure fueling the North American market

North America has well-established and high-capacity flour mills, which enable large-scale productions. Additionally, the growing adoption of automation in milling systems is helping to advance the productivity and functionality. North America is able to provide efficient and high-productivity flours due to its advanced milling infrastructure. The United States is leading the regional market with the presence of strict regulation. Regulatory frameworks of the US Food & Drug Administration (FDA) have issued strict rules regarding quality control of the food & beverage items. To meet with regulatory standards, the manufacturers are continuously innovative with cutting-edge technologies and solutions; as a result, the market growth is significantly enhancing. North America has upgraded its exciting milling infrastructure with cutting-edge technologies, which is helping the region to drive the growth of the commercial flour market.

By Type

By End-Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

October 2024