October 2024

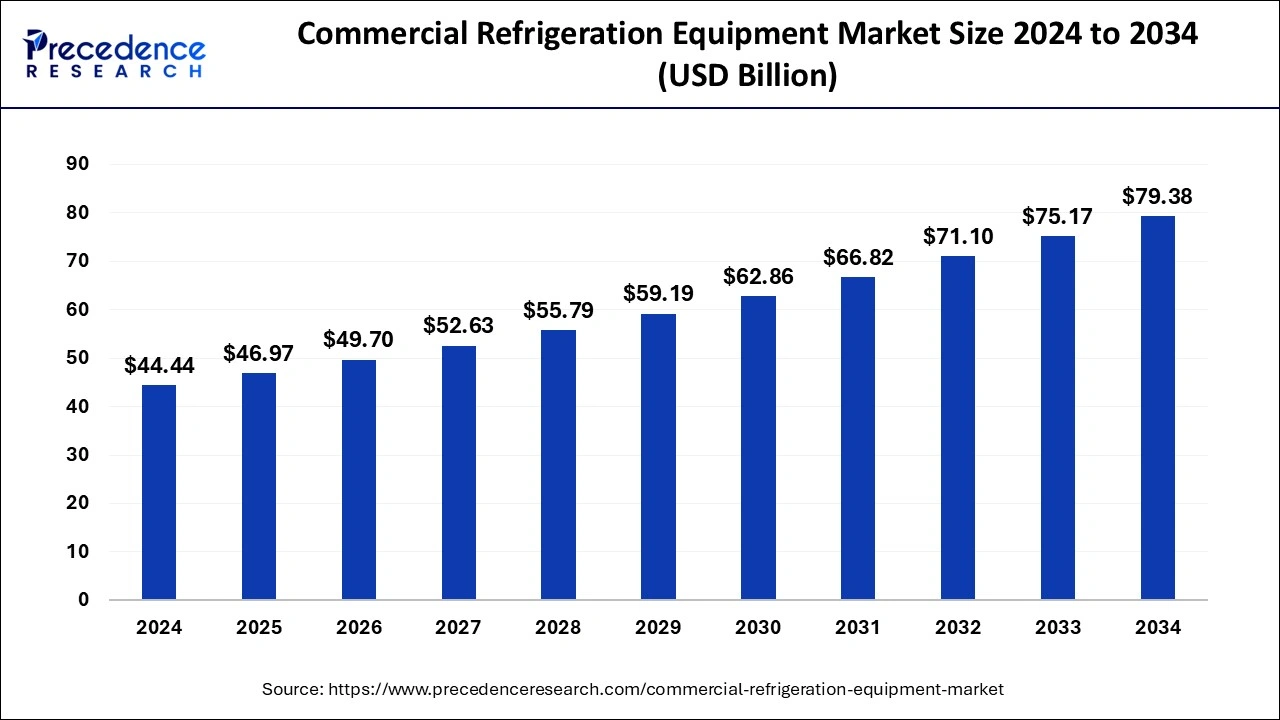

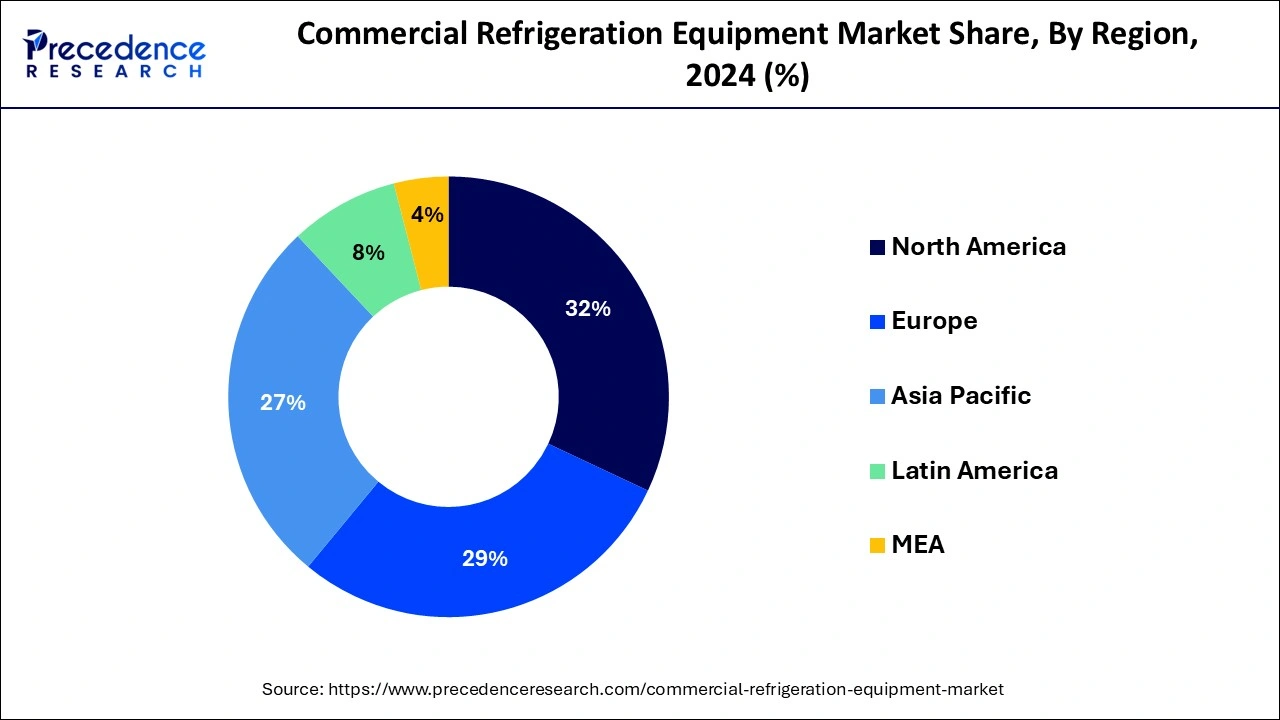

The global commercial refrigeration equipment market size is accounted at USD 46.97 billion in 2025 and is forecasted to hit around USD 79.38 billion by 2034, representing a CAGR of 5.97% from 2025 to 2034. The North America market size was estimated at USD 14.22 billion in 2024 and is expanding at a CAGR of 6.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global commercial refrigeration equipment market size was calculated at USD 44.44 billion in 2024 and is predicted to reach around USD 79.38 billion by 2034, expanding at a CAGR of 5.97% from 2025 to 2034.

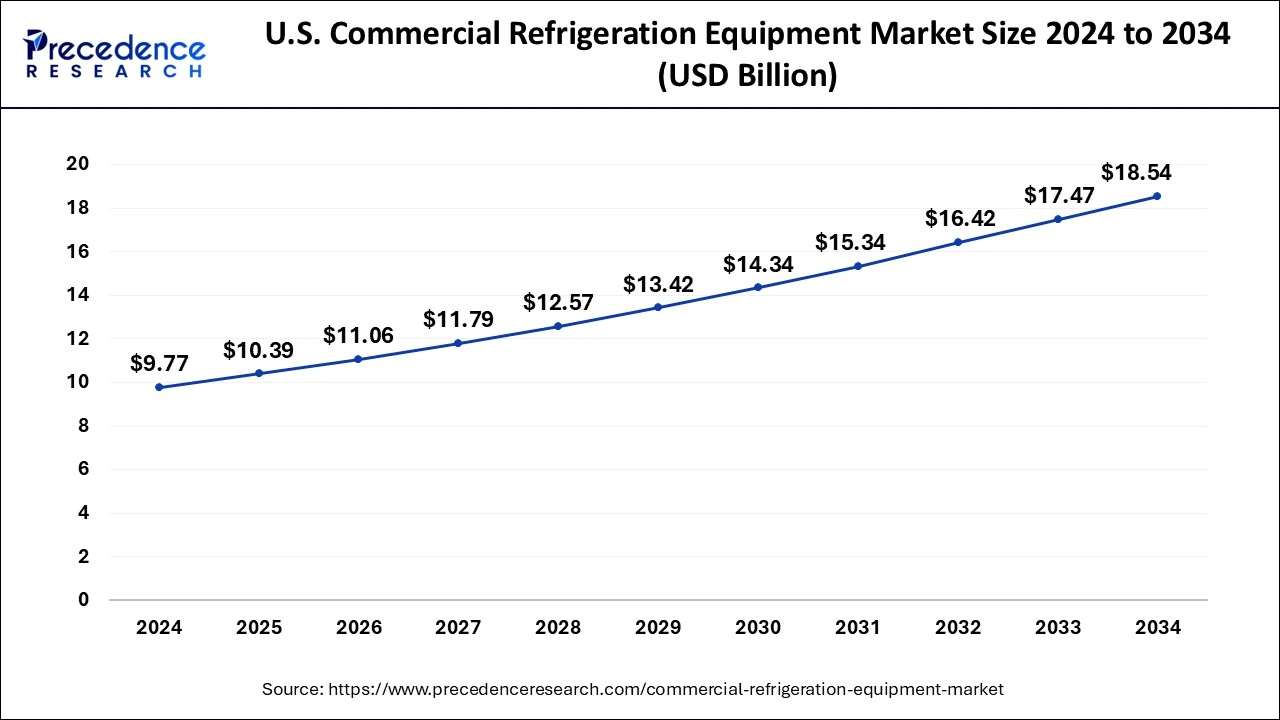

The U.S. commercial refrigeration equipment market size was exhibited at USD 9.77 billion in 2024 and is projected to be worth around USD 18.54 billion by 2034, growing at a CAGR of 6.62% from 2025 to 2034.

On the basis of geography, North America dominates the market, primarily driven by the large food and beverage industry and the need for cold storage and transportation of temperature-sensitive products. Also, the market in North America has seen a shift towards more energy-efficient and environmentally friendly refrigeration equipment. Regulations and policies drive this to reduce energy consumption and greenhouse gas emissions. Manufacturers have responded to this trend by developing new technologies, such as advanced insulation and compressor technologies, that improve energy efficiency and reduce operating costs.

Europe is a significant market for commercial refrigeration equipment, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The market is driven by the well-developed food industries, including food processing and cold chain logistics, which are major users of commercial refrigeration equipment. In addition, consumer preferences are also driving the demand for more sustainable refrigeration equipment. Consumers are becoming more conscious of the effect of their purchasing choices on the environment and are demanding more environmentally friendly products. This trend is expected to continue to drive innovation in Europe's commercial refrigeration equipment market.

The region in Asia-Pacific is anticipated to have the greatest CAGR. This growth is primarily driven by the growing food and beverage industry, the increasing demand for processed food products, and the rising awareness of food safety and hygiene. In addition, the growth of the retail sector, including convenience stores, supermarkets, and hypermarkets, is also driving the demand for commercial refrigeration equipment in the region.

The commercial refrigeration equipment market refers to equipment used to store and display food and beverages at commercial establishments such as restaurants, supermarkets, convenience stores, and other food service outlets. Commercial refrigeration equipment is essential for preserving the quality and safety of perishable food items and is used to maintain consistent temperatures for various types of food and beverages. Commercial refrigeration equipment includes various products such as refrigerators, freezers, coolers, display cases, beverage dispensers, ice machines, and walk-in coolers and freezers. These products are available in various sizes and configurations to meet the needs of different types of businesses.

Several factors, such as the growth of the food service industry, the increasing demand for convenience foods, and the need for energy-efficient refrigeration solutions, drive the commercial refrigeration equipment market. Government regulations on refrigerants, food safety standards, and consumer preferences for sustainable and eco-friendly refrigeration solutions also influence the market.

Furthermore, the food service industry continues to grow, and the demand for commercial refrigeration equipment is also increasing. Restaurants, cafes, convenience stores, and other food service establishments need refrigeration equipment to store and display their products. Also, the demand for convenience foods such as ready-to-eat meals, snacks, and beverages is increasing, driving the demand for commercial refrigeration equipment. These products require refrigeration to maintain their quality and freshness.

However, high initial investment, maintenance and repair costs, competition from used/refurbished equipment and environmental concerns are anticipated to impede the market growth. There is rising fear about the environmental impact of refrigeration equipment, particularly concerning greenhouse gas emissions. Businesses may face pressure to adopt more sustainable and eco-friendly refrigeration solutions, impacting demand for traditional refrigeration equipment. Also, Commercial refrigeration equipment can be expensive to purchase and install, which may be a barrier for some businesses, particularly small and medium-sized enterprises.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased demand for commercial refrigeration equipment in the healthcare industry. The pandemic has led to demand for refrigeration equipment for storing vaccines and other medical supplies. However, the pandemic has severely impacted the hospitality industry, including restaurants and hotels. Many businesses in this sector have closed or reduced their operations, resulting in decreased demand for commercial refrigeration equipment.

In addition, the pandemic has disrupted supply chains and caused delays in the production and delivery of commercial refrigeration equipment. This has increased lead times and higher costs for businesses purchasing new equipment.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.97% |

| Market Size in 2025 | USD 46.97 Billion |

| Market Size by 2034 | USD 79.38 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and System Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Growth of the food service industry to brighten the market prospect

The food service industry includes restaurants, cafeterias, hotels, and other establishments providing customers with meals and beverages. As the food service industry grows, so does the need for reliable refrigeration equipment to store and preserve food and beverages. Commercial refrigeration equipment such as refrigerators, freezers, and coolers are essential for keeping food fresh, safe, and at the proper temperature.

In addition, the increasing demand for convenience food and ready-to-eat meals has boosted the demand for commercial refrigeration equipment. Such food items require proper storage and preservation to maintain quality and safety.

Moreover, advancements in technology have led to the development of more efficient and environmentally friendly refrigeration equipment, which has further fueled the growth of the commercial refrigeration equipment market. Thus, the growth of the food service industry, coupled with the demand for convenience food and advancements in refrigeration technology, are key drivers of the commercial refrigeration equipment market.

Increasing demand for specialty refrigeration equipment

As the food industry continues to expand and diversify, there is a growing need for specialized refrigeration equipment that can maintain specific temperatures, humidity levels, and other environmental conditions to ensure the quality and safety of various food products. This includes refrigeration equipment for specific foods, such as dairy products, meat, seafood, fruits and vegetables, and specialized equipment for food processing and storage facilities. The pharmaceutical industry also uses specialty refrigeration equipment to store and transport sensitive medications and vaccines.

Thus, manufacturers of commercial refrigeration equipment are developing new and innovative products to meet the evolving needs of the food industry, which is driving demand for these products in the market. For instance, in November 2022, Chemours collaborated with BOHN to innovate the cold food chain and launched the first low GWP Solution in the Americas based on A2L technology.

In addition to meeting the specific needs of different industries, specialty refrigeration equipment is also becoming more energy-efficient and environmentally friendly. This is due to the growing demand for sustainable solutions and the need to reduce energy costs associated with operating refrigeration systems. Thus, the increasing demand for specialty refrigeration equipment is driving the demand for the commercial refrigeration equipment market.

Key Market Challenges:

Limited accessibility is causing hindrances to the market:

The cost of purchasing and installing refrigeration systems can vary widely depending on the size, type, and complexity of the equipment needed. For instance, a small walk-in cooler may cost several thousand dollars, while a larger industrial refrigeration system can cost hundreds of thousands of dollars. The initial investment required can be particularly daunting for small businesses, which may not have the financial resources to purchase the equipment outright. In addition to the initial cost, ongoing maintenance and repair expenses and energy costs may be associated with operating the refrigeration equipment. These expenses can add up over time and may further deter some businesses.

To address this issue, some manufacturers are developing more cost-effective and energy-efficient refrigeration systems to help reduce overall business costs. Additionally, leasing and financing options may help businesses spread out the cost of equipment purchases over time. Some businesses may opt for used or refurbished equipment, a more affordable alternative to buying new equipment. While used equipment may come with some risks, it can be a viable option for businesses looking to save money on equipment purchases. Thus, the high initial cost of commercial refrigeration equipment can significantly restrain the demand in the market. However, various solutions, such as more cost-effective and energy-efficient systems, leasing and financing options, and used or refurbished equipment, can help businesses overcome this barrier and invest in the necessary equipment to grow and thrive.

Key Market Opportunities:

These are the following factor which is likely to create opportunity over the forecast period.

On the basis of product, the commercial refrigeration equipment market is divided into transportation refrigeration equipment, refrigerators & freezers, beverage refrigeration, display showcases, ice merchandisers & ice vending equipment and other equipment, with the refrigerators & freezers segment accounting for most of the market. This is due to the increasing demand for cold storage and preservation of food products and the growth of the food and beverage industry.

Refrigerators and freezers are widely used in restaurants, hotels, supermarkets, and convenience stores, among other places. The beverage refrigeration segment is also expected to grow significantly in the coming years, driven by the increasing demand for cold drinks, juices, and other beverages.

On the basis of the application, the commercial refrigeration equipment market is divided into food service, food & beverage retail, food & beverage distribution, food & beverage production, and others, with food & beverage distribution accounting for most of the market. This is due to the increasing demand for cold storage and transportation of food products and the growth of the food and beverage industry. Food and beverage distributors require commercial refrigeration equipment for storing, transporting, and displaying food products.

The food and beverage retail segment is also expected to grow significantly, driven by the increasing demand for supermarkets, hypermarkets, and convenience stores. Commercial refrigeration equipment is used in these retail outlets to store and display food products, including fruits, vegetables, meat, and dairy.

On the basis of system type, the commercial refrigeration equipment market is divided into self-contained and remotely operated, with the self-contained accounting for most of the market. This is because self-contained systems are typically used in smaller refrigeration units and are easy to install and operate. They comprise a single unit that includes all the necessary components for cooling and refrigeration.

The remote compressor system segment is expected to grow significantly, driven by the increasing demand for energy-efficient and eco-friendly refrigeration systems. Remote compressor systems are designed to separate the compressor from the refrigeration unit, allowing for more flexibility in the design and installation of the system.

By Product

By Application

By System Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

February 2025