August 2024

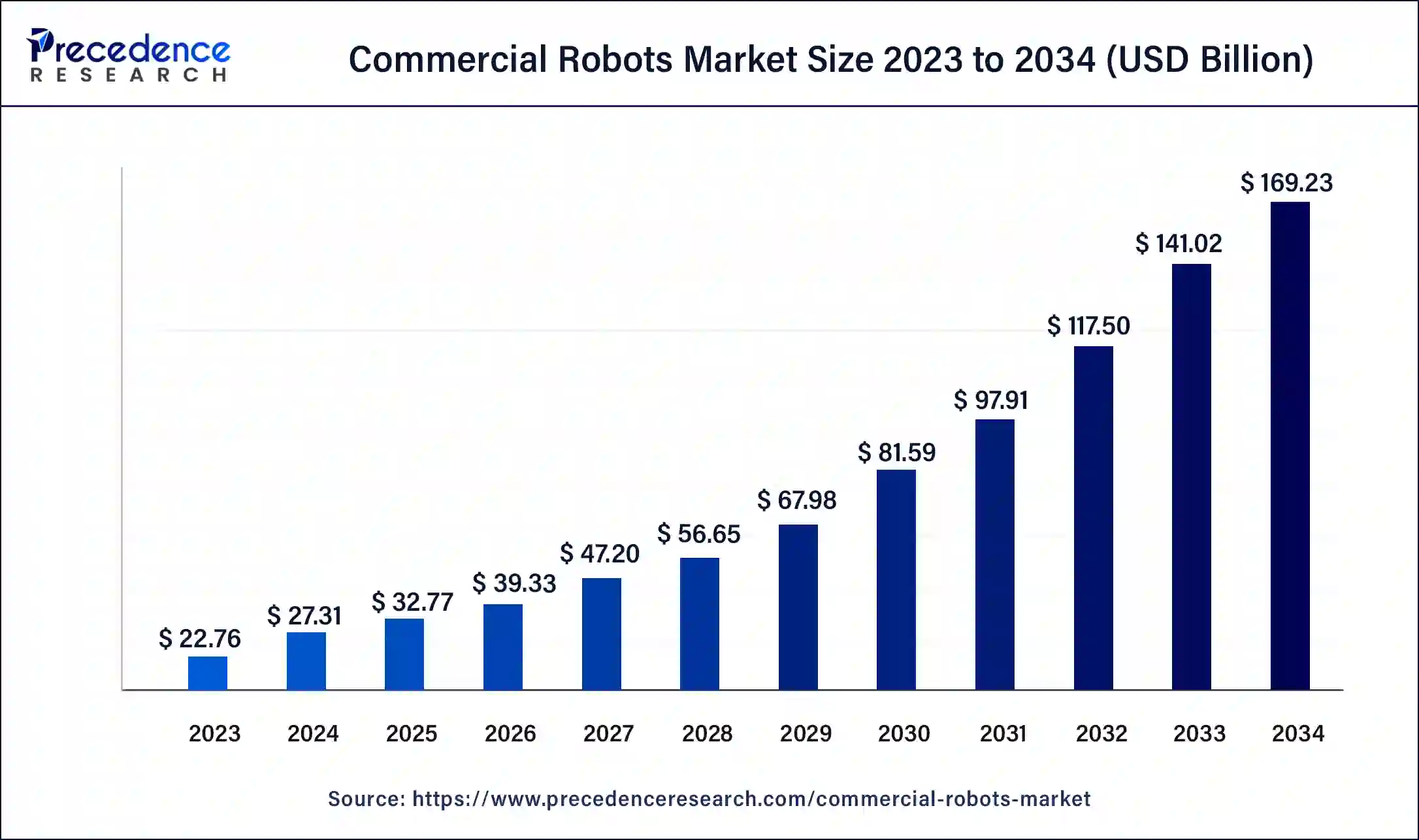

The global commercial robots market size surpassed USD 22.76 billion in 2023 and is estimated to increase from USD 27.31 billion in 2024 to approximately USD 169.23 billion by 2034. It is projected to grow at a CAGR of 20.01% from 2024 to 2034.

The global commercial robots market size is projected to be worth around USD 169.23 billion by 2034 from USD 27.31 billion in 2024, at a CAGR of 20.01% from 2024 to 2034. The rapid growth in the industrial sector, as well as increasing urbanization, has raised the demand for commercial robots, which is estimated to drive the growth of the global commercial robots market during the forecast period.

The multidisciplinary study and practice of designing, building, operating, and utilizing robots is known as robotics. Most robotics research aims to create technologies that can support and aid people. Numerous robots are designed to perform tasks that pose a risk to human safety, like searching for survivors in unstable wrecks and exploring space, mines, and shipwrecks. Others take over tasks that humans find tedious, repetitive, or unpleasant, like assembly, cleaning, monitoring, and transportation.

A robot is an automated device that may be programmed to do a task; the term robotics refers to the field of study concerned with creating robots and automation. Every robot is autonomous to varying degrees. These phases go from human-controlled task-completing bots to fully autonomous bots that work independently of outside input. Robots come in a variety of forms and are employed for a wide range of purposes in a variety of settings. Mechanical construction, software, and electric components are the three fundamental aspects of their design and construction that they all share despite their many applications and forms.

The main components of a robot are the control system, actuators, power supply, and end effectors. Certain robots are built with preprogrammed functions; these robots work in a controlled environment, performing repetitive, uncomplicated jobs, similar to a mechanical arm on an assembly line for cars. Some robots are autonomous; they do tasks in open spaces without the assistance of human operators. They employ sensors to sense their surroundings in order to function, and then they use decision-making structures typically computers to determine the best course of action based on their mission and data.

How is AI Changing the Robotics Industry?

AI is significantly affecting the commercial robots market as it helps in enhanced autonomy and adaptability. AI-based robots can perform complex tasks without human intervention or with less help from humans in the task. Thus, such robots can be assets for various industries like logistics, manufacturing and retail. By learning from the environmental conditions these robots can self-adapt easily to navigate in complex settings like crowded platforms, stores and warehouses etc.

AI driven robots can be revolutionary in manufacturing by optimizing the production lines with the help of data analysis from real-time conditions to improve overall productivity and efficiency of the work. To reduce operational cost in logistics repetitive work like sorting, packing and delivery process can be automated with the help of AI-powered robots. They are also useful in faster turnaround time to improve work efficiency.

| Report Coverage | Details |

| Market Size by 2034 | USD 169.23 Billion |

| Market Size in 2023 | USD 22.76 Billion |

| Market Size in 2024 | USD 27.31 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.01% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Change in infrastructure and automation of the retail store

Retail stores are undergoing transformation by integrating commercial robotics into their stores, which is expected to drive the growth of the global commercial robots market over the forecast period. The introduction of commercial robots into the retail environment is among the most exciting recent advancements for merchants.

Nearly every industry is being impacted by robotics and AI, which is leading to worker reskilling, disruption, and a renewed emphasis on change management among business executives. Though they were already coming, the pandemic brought about significant changes that were incorporated more quickly than most had predicted. Along with these shifts came a quick transition from purchasing in physical stores to online and omnichannel platforms, as well as a customer base that lost brand or store loyalty in favor of convenience and quick access to necessities.

Challenges and high costs of automation

The challenges and limitations imposed by commercial robotics and the high initial cost for installation can restrict the growth of the global commercial robots market. Automation has several benefits, including lower costs, better quality, higher safety, increased efficiency, and data collecting and analysis. However, there are drawbacks as well, including initial investment, upkeep and repairs, less flexibility, less inventiveness, and possible job losses.

Quality assurance teams may easily interface with several systems and guarantee perfect synchronization with the help of automated retail software testing. Retail businesses mainly employ third-party interfaces to help them accomplish specific workflows on a daily basis, such as tax computations and fraud orders. Consequently, when third-party integrations are employed, the number of test cases required to test apps will increase. This is a serious problem for retail companies because it will cost more money and effort to carry out automation testing.

Increase in adoption of inorganic growth strategies.

Consumer or personal robots, such as adorable personal butler robots or automated floor cleaners, are not the same as commercial robots. Drones are one example of a robot form factor that can be used both for business and personal use. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to increase rate of advancement and adoption of commercial robotics by industrial sector, which is expected to create lucrative opportunity for the growth of the global commercial robots market over the forecast period.

The autonomous guided robotics segment dominated the commercial robots market in 2023. A robot that is autonomous can function unsupervised on its own. It is more difficult than it would seem to accomplish that since it depends on a variety of inputs to understand what is happening in the environment around it. On the basis of these inputs, it must then make decisions.

In manufacturing plants, warehouses, and distribution centers, autonomous guided robotics systems facilitate product movement and transportation without the need for an operator or a fixed conveying system. It optimizes transport, pickup, and storage processes in a premium space environment with the use of programmable guide pathways.

Because the majority of the automatic guided vehicle systems (AGVs) were wired or fixed to the surface, they were fairly inflexible and expensive to install. Numerous advantages, such as fewer accidents, reduced labor costs, more output, and increased productivity and accuracy, may arise from this adaptability. Moreover, the field robots sub-segment is estimated to grow at a significant rate due to the increasing launch of the new corporate website, which is able to handle robots in the field with the integration of artificial intelligence.

The medical & healthcare segment is expected to grow at a significant rate in the commercial robots market during the forecast period. Commercial robotics integrated with artificial intelligence is altering endoscopy and diagnostic imaging procedures, among other areas of medical technology. The expansion of its applications promises improved patient outcomes and precision. Each aspect of the medical field has been impacted by technology, including record administration, communication between medical teams, and diagnosis and treatment.

Hospital procedures have been expedited and enhanced by automated tools and systems, which have also decreased errors and maximized the use of resources. The key players operating in the market are adopting inorganic growth strategies like partnership and collaboration for the introduction and emergence of the healthcare robotic startup and setting new trends in the medical field, which is expected to drive the growth of the segment over the forecast period.

Asia Pacific dominated the global commercial robots market in 2023. Asia Pacific is predicted to increase significantly due to the region's increasing levels of automation in industrial manufacturing and technological advancements. The significant and powerful economies of China, India, and Japan propel the Asia-Pacific market. The two key growth drivers driving industrial automation are also expanding government initiatives in the manufacturing sector and a heightened emphasis on economic diversification in developing countries.

The increasing density of commercial robots in the regional market is the most promising factor expected to propel the market's notable growth throughout the forecast period. The emergence of new market players for commercial robotics is expected to drive the growth of the commercial robots market in the region over the forecast period. Increasing innovation, research, and development activity for the introduction of commercial robots to the agriculture and forest sector in the region is expected to foster the growth of the commercial robots market in the near future.

India has a long history of agriculture that dates back many centuries. Aside from that, there should be a way to supply food to meet the country's expanding demand, given its quickly expanding population. Often referred to as robots or agri-robots, agricultural robots are made to automate and improve various farming processes with the goals of maximizing resource use, lowering labor costs, and increasing efficiency. Depending on the particular function, these robots can work in outdoor, indoor, or greenhouse settings. India is a major agricultural force in the world. It boasts the greatest cattle herd (buffaloes), the largest area covered in wheat, rice, and cotton, and it is the world's largest producer of milk, pulses, and spices.

North America is expected to grow at a significant rate in the commercial robots market during the forecast period. This is on account of the launch of a new commercial robotics controlling platform and advanced technology adoption due to rapid automation of the industrial sector in the region. Moreover, in North America, major countries like the U.S. and Canada have designed and developed advanced manufacturing infrastructure, which continues to rely on automation solutions to enhance productivity and reduce production costs.

Segment Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

January 2025

October 2024