January 2025

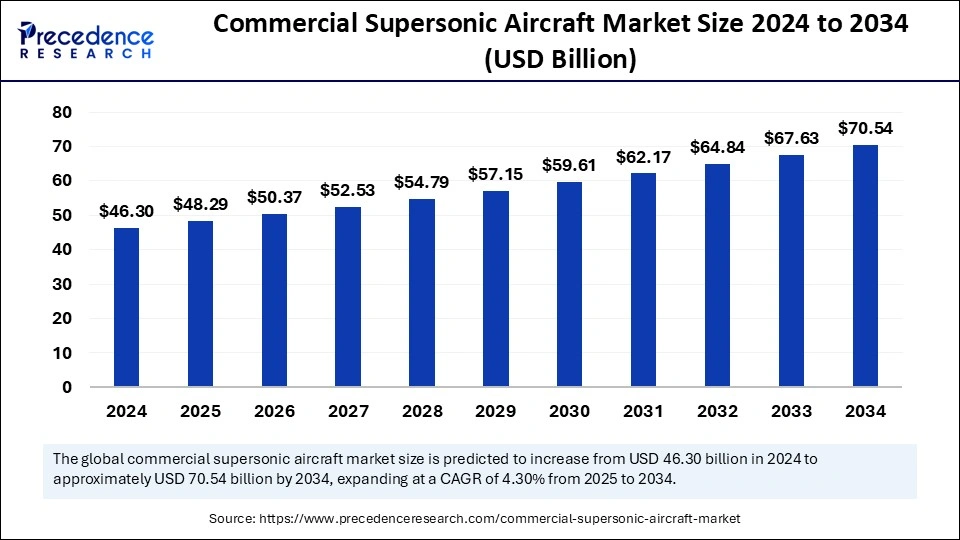

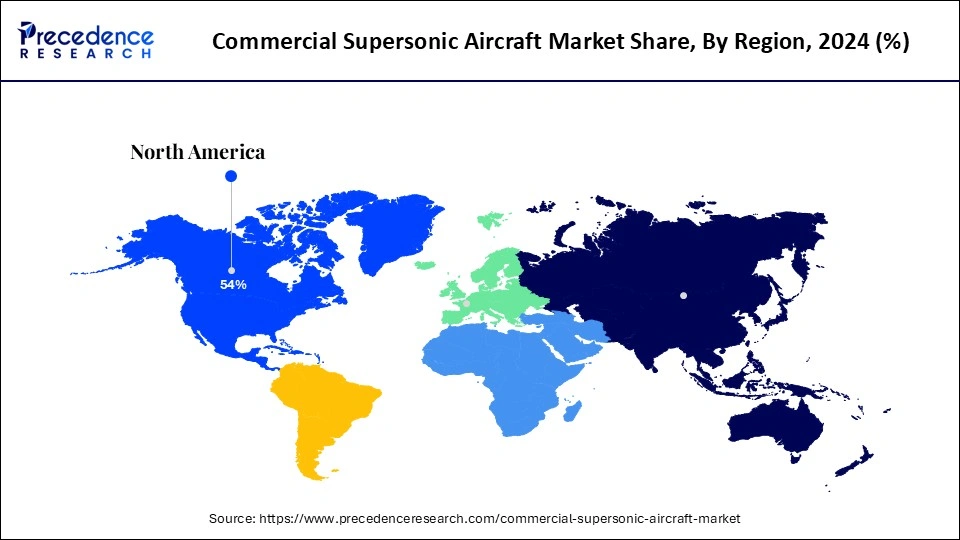

The global commercial supersonic aircraft market size is accounted at USD 48.29 billion in 2025 and is forecasted to hit around USD 70.54 billion by 2034, representing a CAGR of 4.30% from 2025 to 2034. The North America market size was estimated at USD 24.54 billion in 2024 and is expanding at a CAGR of 4.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global commercial supersonic aircraft market size was estimated at USD 46.30 billion in 2024 and is predicted to increase from USD 48.29 billion in 2025 to approximately USD 70.54 billion by 2034, expanding at a CAGR of 4.30% from 2025 to 2034.The growth of the commercial supersonic aircraft market is driven by the increasing consumer demand for quicker and more efficient travel.

Artificial intelligencesignificantly contributes to developing, functioning, and enhancing the commercial supersonic aircraft sector, facilitating improvements in aerodynamic design, fuel efficiency, predictive maintenance, and autonomous flight operations. As manufacturers strive to transform high-speed air travel, AI-driven technologies create supersonic aircraft that are faster, safer, and more eco-friendly. A major application of AI in supersonic aviation involves aerodynamic modeling and optimization. AI-based simulations provide engineers with the ability to examine shockwave behavior, drag reduction, and sonic boom mitigation with unmatched accuracy.

AI models allow aircraft manufacturers to enhance aircraft designs that lessen sonic boom effects, paving the way for overland supersonic travel in the foreseeable future. AI also improves fuel efficiency and propulsion systems. The commercial success of supersonic flight relies on lowering fuel consumption and emissions, as supersonic jets have traditionally been criticized for their significant environmental impact.

AI algorithms can enhance engine performance, fuel mixture ratios, and airflow dynamics to assure optimal efficiency while decreasing carbon emissions. Aviation companies are incorporating AI-supported predictive analytics to investigate alternative sustainable aviation fuels (SAF) and hydrogen-based propulsion systems, thereby making supersonic travel more eco-friendly. Another vital use of AI is in predictive maintenance and real-time aircraft surveillance. Supersonic aircraft function under demanding conditions, necessitating precise monitoring of structural integrity, engine health, and system performance. AI-enabled sensor networks and digital twins continuously evaluate aircraft components in real time, forecasting potential failures before they occur and minimizing unexpected downtime. By cutting maintenance expenses and enhancing aircraft reliability, AI-supported maintenance systems promote safer and more economical supersonic operations for airlines.

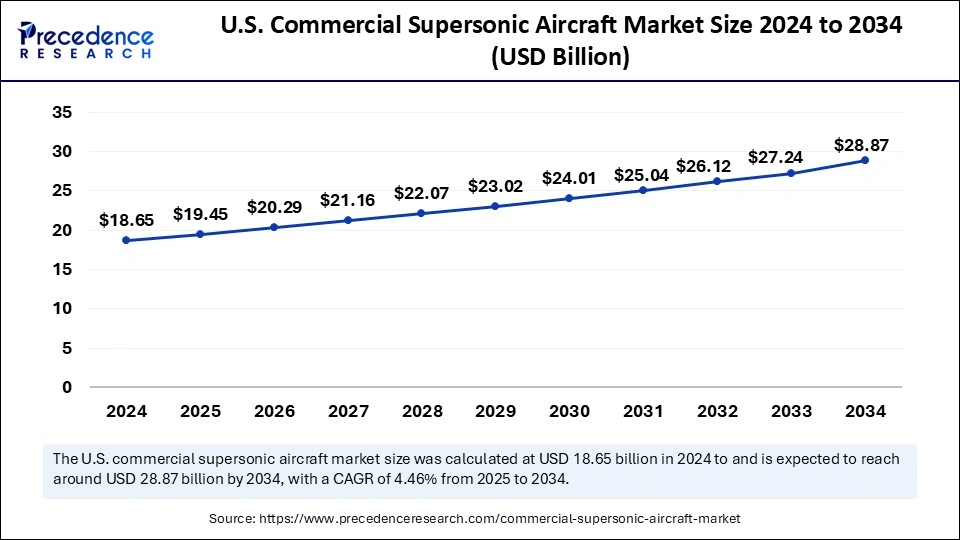

The U.S. commercial supersonic aircraft market size was exhibited at USD 18.65 billion in 2024 and is projected to be worth around USD 28.87 billion by 2034, growing at a CAGR of 4.46% from 2025 to 2034.

North American Commercial Supersonic Aircraft Market Trends

North America dominated the market with the largest share in 2024. This is mainly due to its robust aerospace sector, advanced aviation infrastructure, and high need for ultra-fast air travel. The presence of major supersonic aircraft manufacturers, such as Boom Supersonic, Lockheed Martin, and Hermeus, positions the region as a prominent player in the development of supersonic aircraft. Additionally, there is a strong focus on the development of sustainable aviation fuels (SAF), AI-driven flights, and noise reduction technologies. Major North American airlines, including United Airlines and American Airlines, have made considerable pre-orders for cutting-edge supersonic airliners, confirming the commercial potential of high-speed transcontinental travel. The region also enjoys substantial government backing, with agencies like NASA and the Federal Aviation Administration (FAA) financing research on low-boom supersonic travel and eco-friendly propulsion systems.

The U.S. is the major contributor to the North American commercial supersonic aircraft market. This is mainly due to its strong emphasis on aerospace research and increasing investments in research from the defense sector. Companies such as Boom Supersonic, Lockheed Martin, and Hermeus are engaged in the development of next-generation supersonic planes, emphasizing low-boom technology, sustainable propulsion, and AI-enhanced flight operations. NASA’s X-59 QueSST (Quiet Supersonic Transport) initiative is at the forefront of low-boom supersonic flight technology, potentially leading to eased restrictions on supersonic travel over land. With government support, private investments, and a well-developed aviation infrastructure, the U.S. remains a leader in the commercial supersonic aircraft market.

Canada is becoming a major player in the commercial supersonic aircraft market because of its robust aerospace sector and government-supported sustainability programs. Canadian airlines are investigating applications for supersonic business jets, while national research initiatives aim to cut emissions and enhance fuel efficiency in high-speed aircraft. Given Canada’s expansive geography and the need for ultra-fast connectivity, supersonic travel has the potential to transform routes between major business centers like Toronto and Vancouver. Furthermore, the Canadian government is partnering with global aerospace companies to advance research on SAF-powered supersonic aircraft, reinforcing Canada's leadership in this market.

Asia Pacific Commercial Supersonic Aircraft Market Trends

Asia Pacific is expected to emerge as the fastest-growing region in the market during the forecast period. The region's flourishing aviation sector, an increasing number of high-net-worth individuals, and a rising demand for ultra-fast business travel are contributing to the swift adoption of supersonic air travel. Asian countries are heavily investing in aerospace research, pioneering propulsion technologies, and the development of high-speed aircraft. The growing interest in supersonic business jets and faster flights, especially for long-haul routes, has encouraged major regional airlines to collaborate with supersonic aircraft manufacturers to foster innovation.

China is becoming a significant force in cutting-edge aerospace innovation, with government funding supporting research into supersonic and hypersonic aircraft as part of its Made in China 2025 initiative. Chinese aerospace companies, such as COMAC (Commercial Aircraft Corporation of China), are focusing on high-speed commercial and military aviation technologies. With major financial centers like Beijing, Shanghai, and Hong Kong, China views supersonic travel as a strategic advantage for business-class and VIP routes. The Chinese government is also investing in sustainable aviation fuels and AI-driven flight management systems, positioning the country as a market leader.

Japan is making substantial investments in quiet supersonic transport technologies, with organizations like JAXA (Japan Aerospace Exploration Agency) spearheading research on low-boom supersonic aircraft. Japanese airlines are partnering with international airlines to develop next-gen aircraft like the Overture. Given Tokyo’s status as a significant global business hub, Japan considers supersonic air travel a transformative opportunity for premium business routes. With a strong emphasis on technological advancements, sustainability, and high-speed transportation, Japan continues to be a key catalyst for the growth of the commercial supersonic aircraft market.

European Commercial Supersonic Aircraft Market Trends

Europe is considered to be a significantly growing area in the commercial supersonic aircraft market, driven by technological progress, sustainability efforts, and collaborations within European airlines. The region boasts a deep-rooted history in supersonic aviation, once being the home of the Concorde, and is currently concentrating on next-generation high-speed air travel. Governments and aerospace companies in Europe are actively investing in research related to supersonic aircraft, noise reduction technologies, and sustainable aviation solutions. With leading firms such as Airbus, Rolls-Royce, and Dassault Aviation engaged in high-speed aviation research and development, the region is establishing itself as a leader in the development of low-boom supersonic aircraft.

The UK continues to be a crucial participant in the development of supersonic aircraft, with firms like Rolls-Royce at the forefront of research into supersonic and hypersonic propulsion systems. Additionally, the UK government is backing green aviation endeavors, ensuring that future supersonic aircraft comply with stringent environmental standards. London serves as a major financial hub, making it a vital market for premium supersonic travel, especially for routes that connect Europe, North America, and Asia. The country’s dedication to sustainable aviation fuels and aerospace research strengthens its position as a leading force in supersonic aviation innovation.

France holds a significant potential to transform supersonic aviation. The country is currently directing its efforts toward the future of high-speed air travel. Companies like Airbus and Dassault Aviation are channeling investments into low-boom supersonic aircraft and eco-friendly propulsion technologies. Moreover, France plays a pivotal role in the aerospace sector, working alongside other European countries on research projects related to supersonic and hypersonic flight. The nation’s strategic emphasis on sustainable aviation fuels, AI-enhanced flight optimization, and noise reduction technologies makes it a vital player in advancing the European supersonic aviation industry.

The rising demand for faster travel, especially for long-distance, significantly impacts the commercial supersonic aircraft market. The increasing consumer desire for quicker, more efficient travel is one of the primary factors driving interest in commercial supersonic aircraft. Ongoing technological advancements and the growing demand for swift air travel, coupled with a commitment to sustainability, are leading to the development of supersonic commercial aircraft. Improvements in engine technology, materials, and aerodynamics are playing a key role in addressing difficulties associated with supersonic flight.

There is considerable potential in the freight and logistics industry. Supersonic aircraft's speed and range capabilities could transform global goods transportation, enabling quicker delivery times and more efficient international supply chains. This could become crucial for industries that depend on prompt deliveries, such as pharmaceuticals, technology, and high-value commodities. One of the main challenges facing the commercial supersonic aircraft market is the substantial development costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 70.54 Billion |

| Market Size in 2025 | USD 48.29 Billion |

| Market Size in 2024 | USD 46.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Aircraft Type, Engine Type, End-use Industry and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Rapid Business and Luxury Travel

A major catalyst for the commercial supersonic aircraft market is the burgeoning demand for expedited air travel, especially among business executives, government representatives, and affluent individuals who require efficient and time-conserving transportation. Supersonic planes can slash flight times by over 50%, allowing long-haul routes to be completed in half the time taken by usual aircraft. This notable decrease in travel duration offers a competitive edge to business travelers who need to attend several international meetings within a single day. As global business activities and international relations expand, the desire for faster, more exclusive, and premium travel options escalates.

Airlines targeting high-end customers are exploring supersonic routes to provide a differentiated premium experience, like how Concorde flights became a status symbol for corporate executives and celebrities. Companies like Boom Supersonic and Aerion Supersonic are crafting aircraft that emphasize speed, luxury, and fuel efficiency, ensuring that the next-generation supersonic jets meet the demands of both corporate and VIP travel. Furthermore, the government and defense sectors are showing interest in supersonic travel options for military purposes, which is further propelling the market growth. As the luxury air travel industry expands, airlines increasingly invest in premium supersonic services, supporting market growth.

Regulatory and Environmental Challenges

A significant constraint in the commercial supersonic aircraft market stems from the regulatory and environmental issues linked to sonic boom limitations, carbon emissions, and noise pollution. At present, many countries, including the U.S. and the European Union, impose strict restrictions on supersonic flight overland due to the disruptive impact of sonic booms when an aircraft surpasses the speed of sound. These regulations confine supersonic flight paths to over-ocean routes, thereby limiting airlines' operational flexibility.

Furthermore, supersonic aircraft have faced criticism for their substantial fuel consumption and carbon emissions, making them less environmentally friendly than contemporary subsonic aircraft. Nowadays, global aviation authorities are supporting more rigorous carbon reduction goals, encouraging aircraft manufacturers to design supersonic jets that meet fuel efficiency and emission regulations.

Another significant regulatory hurdle is the certification and safety approvals process, which can postpone the introduction of supersonic aircraft. The industry must tackle issues concerning fuel efficiency, engine noise, and sustainable operations before governments sanction new supersonic flight paths. While companies such as Boom Supersonic are actively pursuing low-boom technologies and sustainable fuel alternatives, the prevailing regulatory uncertainty and demanding compliance standards continue to be major obstacles to the widespread acceptance of commercial supersonic aircraft.

Advents of Sustainable Aviation Fuels (SAF) and Green Propulsion Technologies

A prominent opportunity within the commercial supersonic aircraft market lies in the development of Sustainable Aviation Fuels (SAF), hydrogen propulsion, and hybrid-electric jet engines, which can mitigate the environmental effects of supersonic aircraft. As aviation authorities and governments advocate for carbon-neutral air travel, aircraft manufacturers are dedicating efforts to creating fuel-efficient, low-emission propulsion systems that are in accordance with global sustainability objectives. Companies like Boom Supersonic have pledged to operate their Overture aircraft using 100% SAF, thereby minimizing carbon emissions and reliance on fossil fuels.

Researchers are investigating hydrogen-powered supersonic aircraft, which could provide zero-emission travel while maintaining high-speed capabilities. NASA’s X-59 QueSST program and various projects are also making investments in electric-hybrid and next-generation turbofan engines to enhance fuel efficiency and diminish noise levels.

Another significant opportunity arises from government and defense financing for supersonic and hypersonic technologies. Organizations such as the U.S. Air Force and NASA are putting resources into research for supersonic jets, which could speed up technological advancements in the commercial supersonic aircraft sector. With advancements in sustainability methods and regulatory backing for cleaner aviation, the prospect of revitalizing supersonic commercial travel in an environmentally friendly and cost-effective way is becoming increasingly viable. If these challenges are successfully navigated, supersonic flights become a common choice for long-haul international journeys in the upcoming decades.

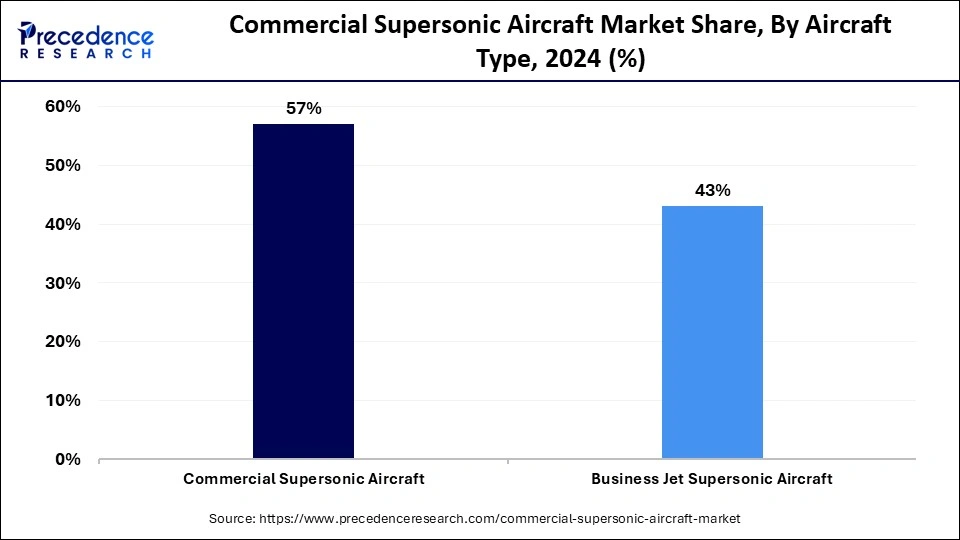

The commercial supersonic aircraft segment dominated the commercial supersonic aircraft market with the largest share in 2024. This is mainly due to the increases in demand for quicker air travel, shorter flight durations, and enhanced passenger experience. Airlines aiming to provide premium high-speed services have revived interest in supersonic passenger aircraft, especially on transoceanic routes where noise regulations are more lenient.

Major airlines like United Airlines and American Airlines have announced plans to pre-order Boom's Overture aircraft, anticipated to commence operations in the late 2020s or early 2030s. These aircraft are being designed to utilize sustainable aviation fuels (SAF) to meet global environmental objectives, enhancing their potential for widespread use. With progress in low-boom technology, improved fuel efficiency, and advanced airframe materials, commercial supersonic aircraft are poised to transform the aviation landscape by providing a unique, time-saving option for business-class and premium travelers.

The business jet supersonic aircraft segment is expected to grow at the fastest rate during the forecast period due to the rising desire for private high-speed travel. Business leaders, government representatives, and affluent individuals are increasingly looking for ultra-fast, long-range private jets to alleviate travel fatigue and improve global connectivity. Companies such as Aerion Supersonic, Hermeus, and Spike Aerospace are vigorously developing luxurious supersonic business jets that fly at rapid speeds and AI-enhanced flight automation to provide an unmatched experience.

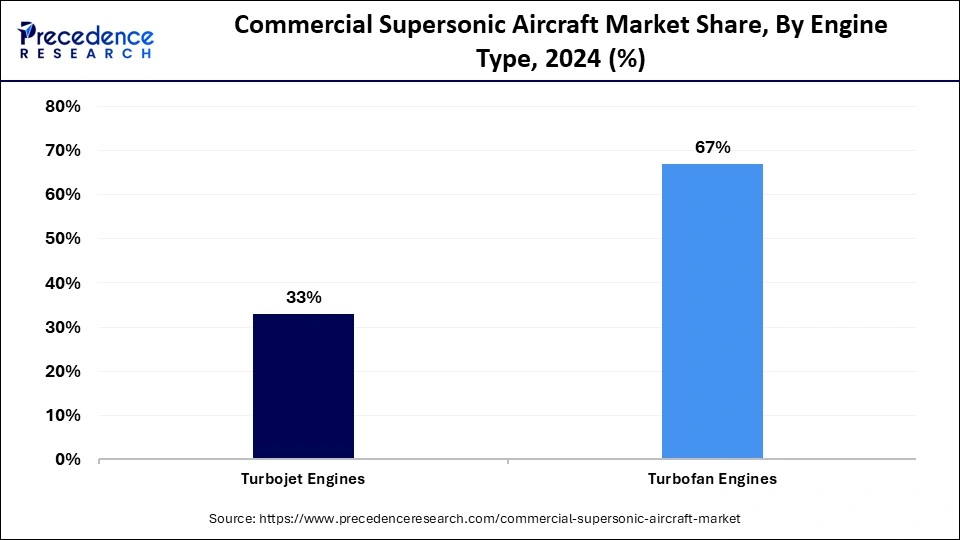

The turbofan engines segment dominated the commercial supersonic aircraft market in 2024. This is mainly due to their exceptional fuel efficiency, reduced noise output, and advantages in adhering to regulations. Unlike conventional turbojet engines that are tailored for high-speed performance but consume substantial fuel, turbofan engines strike a balance between velocity, fuel savings, and environmental responsibility. This balance has led to them being the preferred option for commercial supersonic aircraft, where concerns about fuel usage and emissions reductions are paramount. Recent enhancements include adaptive cycle engines, AI-enhanced fuel optimization technologies, and features designed to lower noise levels, helping to keep supersonic travel both cost-effective and environmentally compliant.

The turbojet engines segment is projected to grow at a notable CAGR during the forecast period due to the rising demand for faster and hypersonic-capable aircraft. Traditionally known for their powerful thrust, turbojet engines are undergoing modernization with new materials, AI-driven airflow enhancements, and compatibility with sustainable fuels to increase their performance and efficiency. While commercial supersonic airliners generally prefer turbofan engines, turbojets are regaining interest in defense, hypersonic research, and private aerospace ventures. Companies like Hermeus and Reaction Engines are developing hybrid turbojet/ramjet propulsion systems capable of reaching speeds over Mach 3, potentially paving the path for the next generation of hypersonic commercial travel.

The commercial airlines segment dominated the commercial supersonic aircraft market with the largest share as airlines strive to bring back supersonic travel for high-end passengers. With the aviation sector transitioning toward ultra-fast, long-range connectivity, prominent commercial airlines are collaborating with supersonic jet manufacturers to establish feasible commercial supersonic routes. United Airlines has placed orders for 15 Boom Overture aircraft, with an option for an additional 35, establishing itself as a leader in next-generation rapid travel. Likewise, American Airlines and Japan Airlines have made strategic commitments to supersonic projects, anticipating a robust demand for luxury business-class supersonic flights. The capability to significantly reduce flight durations while offering premium services makes supersonic airliners an appealing long-term investment for commercial airlines, reinforcing their market leadership.

The private aerospace companies segment is likely to grow rapidly during the forecast period as startups and private aerospace firms foster technological advancements in supersonic and hypersonic aviation. Private aerospace companies often invest in innovative supersonic technologies to foster developments. Companies like Boom Supersonic, Hermeus, Venus Aerospace, and Exosonic are actively working on next-gen propulsion systems, AI-enhanced flight controls, and lightweight composite materials to enhance the commercial viability of supersonic travel. These companies are also attracting funding from private investors, venture capital sources, and government contracts, empowering them to accelerate research and development efforts and position themselves as pivotal entities in the future of high-speed aviation.

By Aircraft Type

By Engine Type

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

July 2024