November 2024

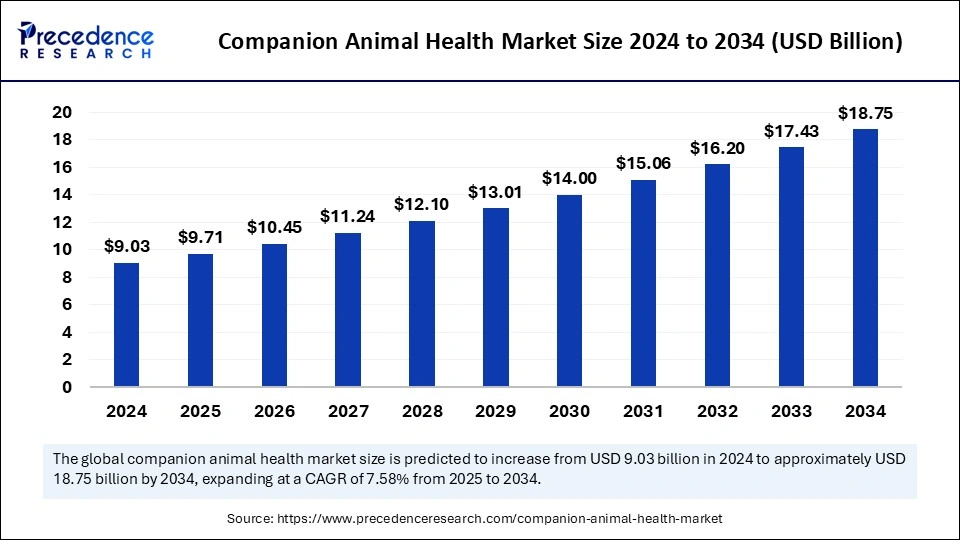

The global companion animal health market size is calculated at USD 9.71 billion in 2025 and is forecasted to reach around USD 18.75 billion by 2034, accelerating at a CAGR of 7.58% from 2025 to 2034. The North America market size surpassed USD 3.52 billion in 2024 and is expanding at a CAGR of 7.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global companion animal health market size accounted for USD 9.03 billion in 2024 and is predicted to increase from USD 9.71 billion in 2025 to approximately USD 18.75 billion by 2034, expanding at a CAGR of 7.58% from 2025 to 2034. The global market growth is attributed to the growing spending and pet population, increasing pet humanization, and increasing rate of medical care for pets.

Artificial intelligence is revolutionizing companion animal healthcare within the fast-changing realm of veterinary medicine. AI-driven tools and technologies assist veterinarians in optimizing clinic operations, tailoring treatment strategies, and boosting diagnostic precision. The integration of AI in Veterinary Clinic Software significantly enhances numerous clinic functions, enabling the swift and accurate analysis of vast data sets.

To identify patterns and early signs of diseases, AI-powered systems can sift through medical records, laboratory results, and clinical notes. AI allows veterinarians to enhance personalized treatment plans. AI technologies, like Veterinary Clinic Management Software, can improve clinic efficiency and streamline various administrative tasks. Various veterinary clinics have successfully implemented AI technology to improve clinic efficiency and patient care, which is further expected to revolutionize the growth of the companion animal health market in the coming years.

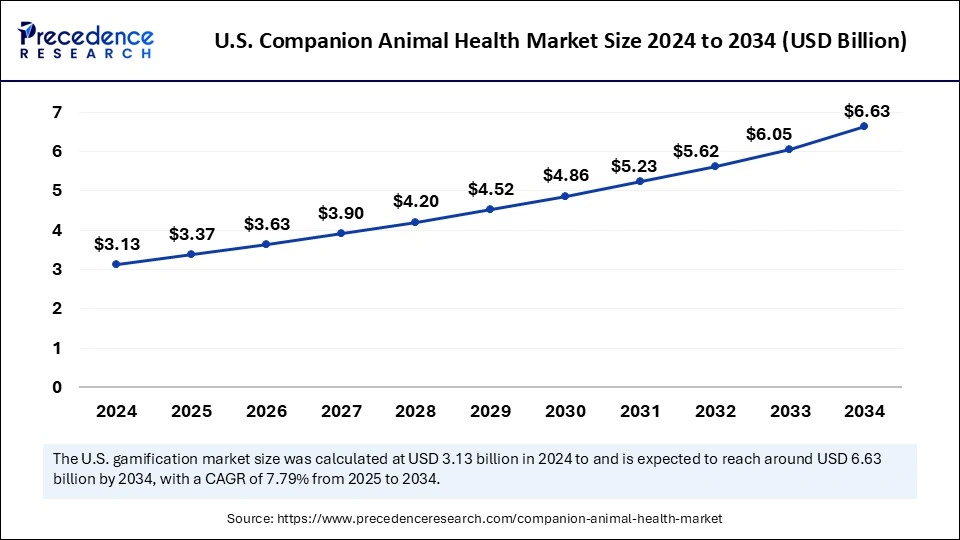

The U.S. companion animal health market size was exhibited at USD 3.13 billion in 2024 and is projected to be worth around USD 6.63 billion by 2034, growing at a CAGR of 7.79% from 2025 to 2034.

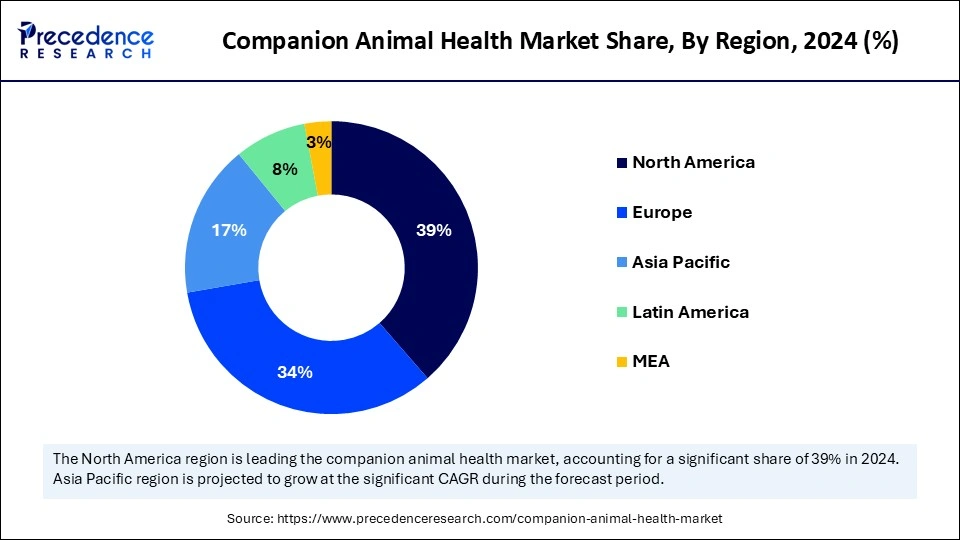

North America dominated the companion animal health market in 2024. The market growth is attributed to factors such as the expansion of pet insurance coverage, advances in veterinary medicine, and the increasing existence of various well-developed pharmaceutical companies that are significantly increasing their commercializing their products and rising pet ownership. The U.S. and Canada are the dominant countries driving the market growth.

The U.S. has dominated the market growth in 2024, driven by factors such as the increasing concerns among pet owners regarding their animals' health, growing pet ownership of cats and dogs, and increasing high pet ownership rates in the U.S.

Asia Pacific is expected to grow fastest during the forecast period. The companion animal health market growth in the region is attributed to the increasing shift in pet adoption practices, rising adoption of the Western lifestyle, and growing pet humanization. In addition, the increasing urgent need to reduce the frequency of zoonotic illnesses, ongoing initiatives to commercialize veterinary vaccines and medicines, and rising significant research and development investments made by international firms. China, India, Japan, and South Korea are the fastest-growing countries in the region.

China is the fastest-growing country in the market, and the Chinese market is experiencing robust growth propelled by the increasing demand for preventive treatments such as pharmaceuticals and vaccines and rising pet health awareness. In addition, the increasing prevalence of diseases in animals and the growing companion animal population are further expected to enhance the growth of the companion animal health market in China.

Europe holds a considerable share of the global market. The market growth in Europe is attributed to the increasingly robust focus on research and development on animal welfare and rising technological advancements. Various companies are developing diagnostic tools, treatments, and new vaccines to improve the quality of care provided to pets. For instance, Germany had 34.7 million pets and 83 million of the world's wealthiest consumers.

The companion animal health market revolves around the distribution and production of medications designed especially for pets, such as birds, dogs, cats, and other domesticated animals, kept primarily for companionship instead of commercial objectives. Companion animal drug development has enhanced in tandem with advancements in human medicine, allowing pets to obtain therapies and prescriptions that can efficiently increase their longevity, enhance their well-being, and treat medical issues.

In addition, drug companion animals can enhance the geriatric dog’s comfort and quality of life and deal with these problems. The companion animal health market is also driven by various factors such as changing lifestyles, rising disposable income, increasing preference towards veterinary vaccinations, increasing activities by various governments, increasing number of animals, and the increasing focus on animal health monitoring solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.75 Billion |

| Market Size by 2025 | USD 9.71 Billion |

| Market Size in 2024 | USD 9.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.58% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal, Product, Distribution Channel, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The dogs segment dominated the companion animal health market in 2024. The segment growth in the market is attributed to the increasing prevalence of chronic diseases in dogs. Dogs are the most popular pets across the globe. Dogs often need more frequent veterinary care due to their susceptibility to various health issues such as infections, injuries, genetic diseases, and age-related diseases. Animals such as dogs can provide health benefits in a professional capacity. In addition, by lessening sympathetic nervous system arousal and decreasing their anxiety, service dogs help children and adult abuse victims testify. Dog ownership has been associated with physical health benefits such as improved cardiovascular health and greater physical activity.

The cats segment is expected to grow fastest during the forecast period. The segment growth in the market is attributed to the growing trend of pet humanization, the increasing prevalence of feline-specific diseases, and the increasing adoption of cats as companion animals in emerging countries. Cats are considered low maintenance because they do not need special training for basic hygiene and self-cleaning. In addition, the increasing cat adoption rate with rising demand for feline-specific drugs is driving the major players to make research and development investments.

The pharmaceuticals product segment accounted for the highest market share in 2023. The segment growth in the market is attributed to the rising continuous innovation and development of veterinary medicines and drugs. In addition, the rising advancements in pet medicine, such as new drugs and treatments, provide more options to maintain health diseases, which is further expected to propel the demand for pharmaceuticals.

The diagnostics segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by the increasing prevalence of various health conditions and diseases in companion animals, such as infectious diseases, cardiovascular diseases, and cancer. These advanced factors significantly increased the demand for advanced diagnostic technologies and tools. In addition, pet owners are willing to invest in comprehensive diagnostic services to provide appropriate treatment, detect issues early, and become more proactive in monitoring their pets' health.

The hospital pharmacies segment dominated the companion animal health market in 2024. The segment dominated the market growth due to factors such as the increasing focus on expertise and quality to enhance customer loyalty and trust in hospital pharmacies. Hospital pharmacies ensure easy access to necessary medications for pet owners and provide a wide range of pharmaceutical products particularly employed for companion animals. In addition, hospital pharmacies are ensuring their product’s efficacy and safety and maintaining stringent quality control measures.

The e-commerce segment is expected to grow fastest during the forecast period. The segment growth in the market is attributed to the increasing demand for specialized pet care services and products, the willingness of owners to invest in their pets' health, the increasing humanization of pets, the rise in pet ownership rates, and the growing demand for online pet care services. In addition, the increasing convenience and wide selection of products available on e-commerce platforms and rising adoption of online shopping among pet owners are further expected to drive the segment growth.

The clinics or hospitals segment dominated the companion animal health market in 2024. The segment growth in the market is attributed to the rise in the number of veterinarians and the increasing growth of veterinary clinics and hospitals with innovative infrastructure across the globe. The survey revealed that only 32% of the city’s roughly 310,000 dogs and 40% of its 77,000 cats have been sterilized.

The point-of-care/in-house testing segment is expected to grow is expected to grow fastest during the forecast period. The segment growth in the market is attributed to the increasing demand for accurate and rapid diagnostic solutions in veterinary industries. To perform tests and receive results quickly, these technologies enable veterinarians to allow for improved patient outcomes and timely interventions.

By Animal Type

By Product

By Distribution Channel

By End-use

Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

June 2024

December 2024