December 2024

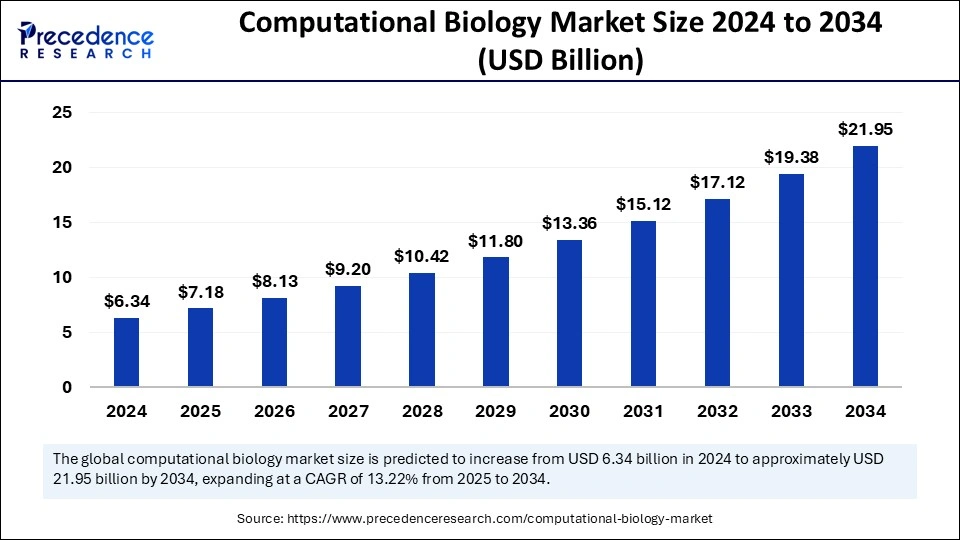

The global computational biology market size is calculated at USD 7.18 billion in 2025 and is forecasted to reach around USD 21.95 billion by 2034, accelerating at a CAGR of 13.22% from 2025 to 2034. The North America market size surpassed USD 3.11 billion in 2024 and is expanding at a CAGR of 13.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global computational biology market size was calculated at USD 6.34 billion in 2024 and is predicted to increase from USD 7.18 billion in 2025 to approximately USD 21.95 billion by 2034, expanding at a CAGR of 13.22% from 2025 to 2034. The computational biology market is driven by ongoing launches of innovative computational platforms and tools, rising investments, integration of artificial intelligence and progress in multiomics research.

Various life science research companies, technological organization and research institutions are actively adopting and integrating AI in their workflows owing to the enhanced accuracy, improved efficiency and potential for unlocking new avenues in drug discovery and research with computational biology. Different types of artificial intelligence algorithms such as machine learning , deep learning, natural language processing and data mining tools are employed for analysing vast amounts of biological datasets and implementation of generative AI models can be utilized for predicting 3D molecular structures, generating genomic sequences and for simulating biological systems.

Furthermore, AI can be applied in gene therapy for designing vectors and modelling gene delivery methods, for developing personalized medicine strategies, in metagenomics and microbiome analysis, for protein identification, for automating biological image analysis in microscopy and medical imaging, using mathematical models for predicting cancer outcomes and for enhancing gene editing technologies such as CRISPR.

Pharmaceutical and biotechnology companies, research organizations and venture capitalists are heavily investing in developing AI-powered platforms and tools for discovering new drugs and for integrating data on different levels of biological scales. Ongoing advancements in AI technologies and increased support from government bodies is creating opportunities for market growth.

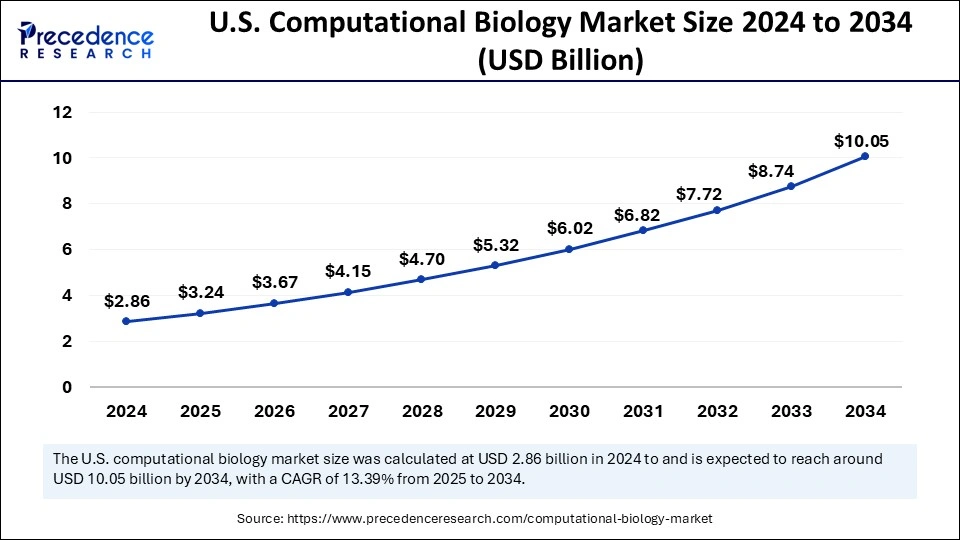

The U.S. computational biology market size was exhibited at USD 2.86 billion in 2024 and is projected to be worth around USD 10.05 billion by 2034, growing at a CAGR of 13.39% from 2025 to 2034.

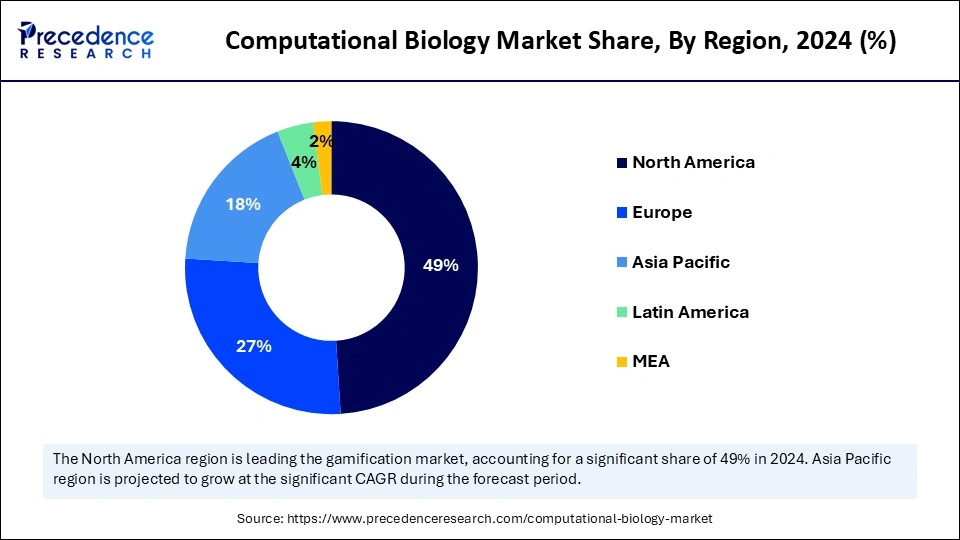

North America dominated the global computational biology market with the largest share in 2024. The market dominance of this region is driven by the presence of world-class academic institutions and research organizations, increased investments for development of bioinformatics tools, major market players focused on developing advanced technological platforms and existence of skilled researchers and computational biologists. Furthermore, ongoing advancements with the adoption of artificial intelligence and blockchain technologies is fostering market growth.

How Does the U.S. Lead Global Innovation in Computational Biology?

U.S. being a hub for research in computational biology is leading the market in North America owing to the surging demand for personalized medicine, growing emphasis on data-driven research with digitalization of biological data, expanding applications of big data analytics in biology, rising investments and collaborations and increased adoption of computational methods.

Moreover, active involvement of the U.S. government through various agencies and programs such as National Institute of Health (NIH) and Department of Energy (DOE). Several institutes and programs under the NIH such as the National Cancer Institute, National Institute of Neurological Disorders and Stroke (NINDS), and Bioinformatics and Computational Biology (BCB) among others utilize computational biology tools though research initiatives and funding from the government for various applications such as systems biology, data management and analysis, software and tool development, training , data sharing and integration of AI which fosters the market growth.

Asia Pacific is anticipated to witness lucrative growth in the market during the forecast period. The ongoing advancements and adoption of genomics and bioinformatics technologies, large population base creating demand for personalized medicine, increasing expenditure on healthcare, surge in bioinformatics start-ups fostering innovation with AI-powered drug development strategies, rise in number of clinical trials backed by diverse demographics, supportive government initiatives for research and regulatory flexibility of the region fuels the market growth of this region.

Key organizations and initiatives in the Asia Pacific region

The computational biology market in the Asia Pacific region is expanding owing to the increased influence of key regional players on establishing a vibrant bioinformatics and computational biology community through various organizations and initiatives such as the Asia Pacific Bioinformatics Network (APBioNet), Association of Asian Societies for Bioinformatics (AASBi), Japanese Society for Bioinformatics (JSBi), Asia Pacific Bioinformatics and Interaction and Networking Society (APBians) and the International Society for Computational Biology (ISCB).

Expansion of Pharma Sector: India & China to Grow Rapidly

China is anticipated to dominate the Asia Pacific region owing to the rising investments in health technologies, surge in pharmacogenomics and pharmacokinetics clinical studies, supportive government initiatives boosting bioinformatics research activities and launch of innovative AI-driven drug discovery platforms such as Tencent’s iDrug.

Indian computational biology market is growing significantly. The expanding biopharmaceutical industries, increased investments in healthcare IT and life science research and the influence of government initiatives such as the GenomeINDIA project creating demand for advanced computational biology tools.

Europe is expected to see a notable growth in the computational biology market in the upcoming years. The market is driven by the rising investments to address the demands in drug discovery and personalized medicine, expansion of bioinformatics research, need for infrastructure and hardware services for increasing access to high-performance computing resources, surge in clinical trials and increased use of biosimulation software by major companies to get the upper hand in the market.

Germany’s computational biology market is expected to grow significantly due to the increasing strategic collaborations between organizations for advancing drug discovery and vaccine development, increased adoption of AI and machine learning tools, growing availability of omics generated biological data and rising expenditure on healthcare by the government and various investors.

Computational biology refers to a scientific field utilizing mathematics, statistics and computers for studying biological systems. This field focuses on developing algorithms, models and simulations for testing hypotheses as well as for collecting, storing and organizing huge amounts of data and integrating the data from various biological sources.

The ongoing advancements in bioinformatics tools, platform launches, increased demand for skilled professionals, growing adoption of computational tools, supportive government initiatives, surge in number of outsourcing service providers for computational biology tools and integration of Internet of Medical Things (IoMT) devices such as smart sensors and digital biomarkers for early disease detection, remote patient monitoring and big data analysis are the factors boosting the growth of the computational biology market.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.95 Billion |

| Market Size in 2025 | USD 7.18 Billion |

| Market Size in 2024 | USD 6.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.22% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Application, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Ongoing advancements in bioinformatics and data science

The increased focus on implementing advanced computational tools in the field biology for enhancing applications in drug discovery and precision medicine are driving the market growth. Furthermore, rising investments by various pharmaceutical companies, government funding and private investors for implementing bioinformatics tools in life science research to reduce the increasing chronic disease burden and embracing longevity. Ongoing launches of bioinformatics platforms and data analysis tools integrated with AI technologies is streamlining workflows and automating experimentation leading to increased adoption by companies and research organizations for developing novel treatments and therapies.

Disintegration and mismanagement of data

In the field of computational biology, researchers and biologists need to deal with huge amounts of complex datasets which is made available from various sources and can be noisy. Absence of standardized formats and metadata makes it difficult for comparing and incorporating data from various sources and platforms further affecting reproducibility of research findings. Moreover, issues in data quality, shortage of skilled personnel, complexity of biological systems and need for robust computational resources and power as well as the high costs for successful implementation of data management platforms are the factors restraining the growth of the computational biology market.

Increased emphasis on adopting advanced technologies

Rising market competition, increased focus on expanding product portfolios for strengthening market presence, rising investments for developing innovative technologies and the multitude of applications in life science fields with the use of computation tools is boosting the adoption of advanced technologies. Furthermore, rapid advancements in biotechnology and genomics, accelerated drug discovery and development processes, development of robust bioinformatics tools, integration of machine learning techniques, increased cross-disciplinary research collaboration and rising influence of government and regulatory agencies is creating opportunities for market growth.

The software platform segment dominated the market with the largest share in 2024 and is anticipated to show the fastest growth during the forecast period. Ongoing advancements in software development technologies covering a vast range of areas such as generation of code, source code management, software packaging and delivery with containerization technologies, software testing and deployment, cloud computing platforms and project management are further enhancing the scientific discovery processes.

The rising investments by public and private sectors for research and development purposes, increased collaborations and acquisitions between various companies and organizations, need for computational tools, growing emphasis on personalized medicine, government support, launch of open-source platforms and progress in genomics, computational modelling and bioinformatics are the factors driving the growth of the software platform segment.

The infrastructure & hardware segment is predicted to witness notable growth in the predicted timeframe. With the rapid expansion of data generated by several omics technologies such as genomics, proteomics, metabolomics and transcriptomics is creating the demand for robust computing infrastructure and hardware. Furthermore, advancements in AI & machine learning methodologies, utilization of bioinformatics tools, active involvement of government through funding for research and development by upgrading infrastructure and developing academic courses, demand for high-performance computing (HPC) for performing complex simulations and rising research collaborations among computational biologists, clinicians, experimental biologists and biopharmaceutical companies is driving the adoption and market growth of this segment.

The clinical trials segment accounted for the largest market share in 2024. Pharmaceutical and biotechnology companies as well as outsourcing service providers such as Contract Research Organizations (CROs) are increasingly depending on computational tools for enhancing accuracy and streamlining workflows in clinical trials and drug development. Computational models are applied for optimizing clinical trials designs, integrating patient data from electronic health records (EHR), improving patient selection and recruitment, tailoring personalized treatments for individual patients, biomarker identification, predicting patient responses and improving dosage regimens. Furthermore, integration of AI in clinical trials for enhancing regulatory compliance and increased access to data across various biological fields are boosting the market growth.

The computational genomics segment is anticipated to witness lucrative growth over the forecast period. Rising investments in research and development of genomics, increased demand for sophisticated data analysis tools, advancements in single-cell genomics, incorporating genomics with other omics such as proteomics and launch of innovative platforms are fuelling the market growth of this segment.

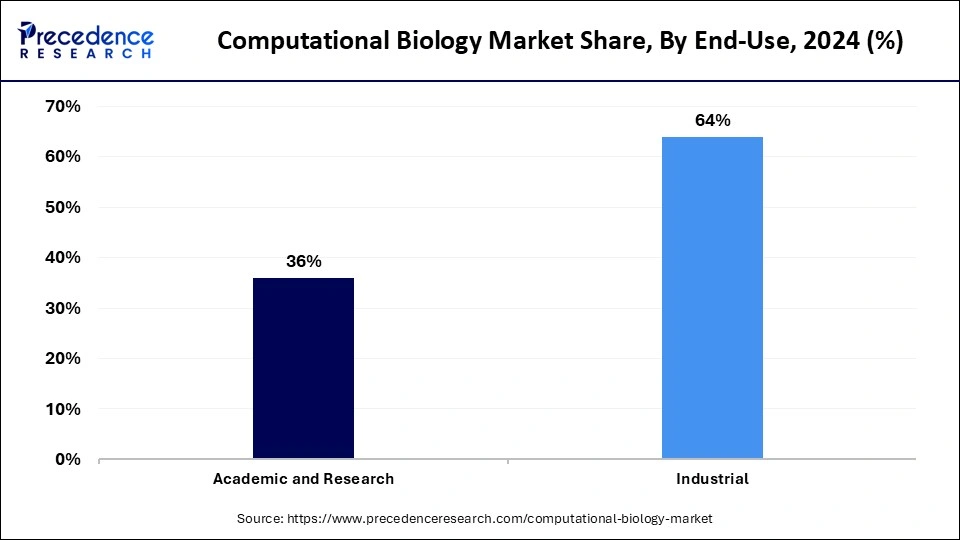

The industrial segment held the largest market share in 2024. Industries are actively exploiting advanced computational biology tools for strengthening their market presence, expanding product pipelines and keeping up with the constantly changing consumer needs. The market growth is driven by the increased collaborations with academic institutions and research organizations rising investments in emerging markets for advancing healthcare infrastructure, leveraging computational models for developing rare diseases treatments, utilization of biosimulation tools and quantitative systems pharmacology (QSP) for drug development and implementing digital twin technology for conducting computer-based trials by creating virtual patients for predicting drug behaviour and responses.

The academic & research segment is expected to show the fastest growth during the forecast period. Academic institutes and research organizations implement computational tools for understanding biological systems and analysing the massive and complex data generated by broad range of research areas including genomics, proteomics, metagenomics, phylogenomics, computational biophysics among others for enhancing applications in drug discovery and disease research.

Furthermore, the rising number of training programs and courses related to bioinformatics and AI being added to curriculum in academic institutes and universities to address the shortage of skilled professionals, increased collaborations with industries and government support are the factors favouring the market expansion of this segment.

By Service

By Application

By End-Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

January 2025

June 2024