January 2025

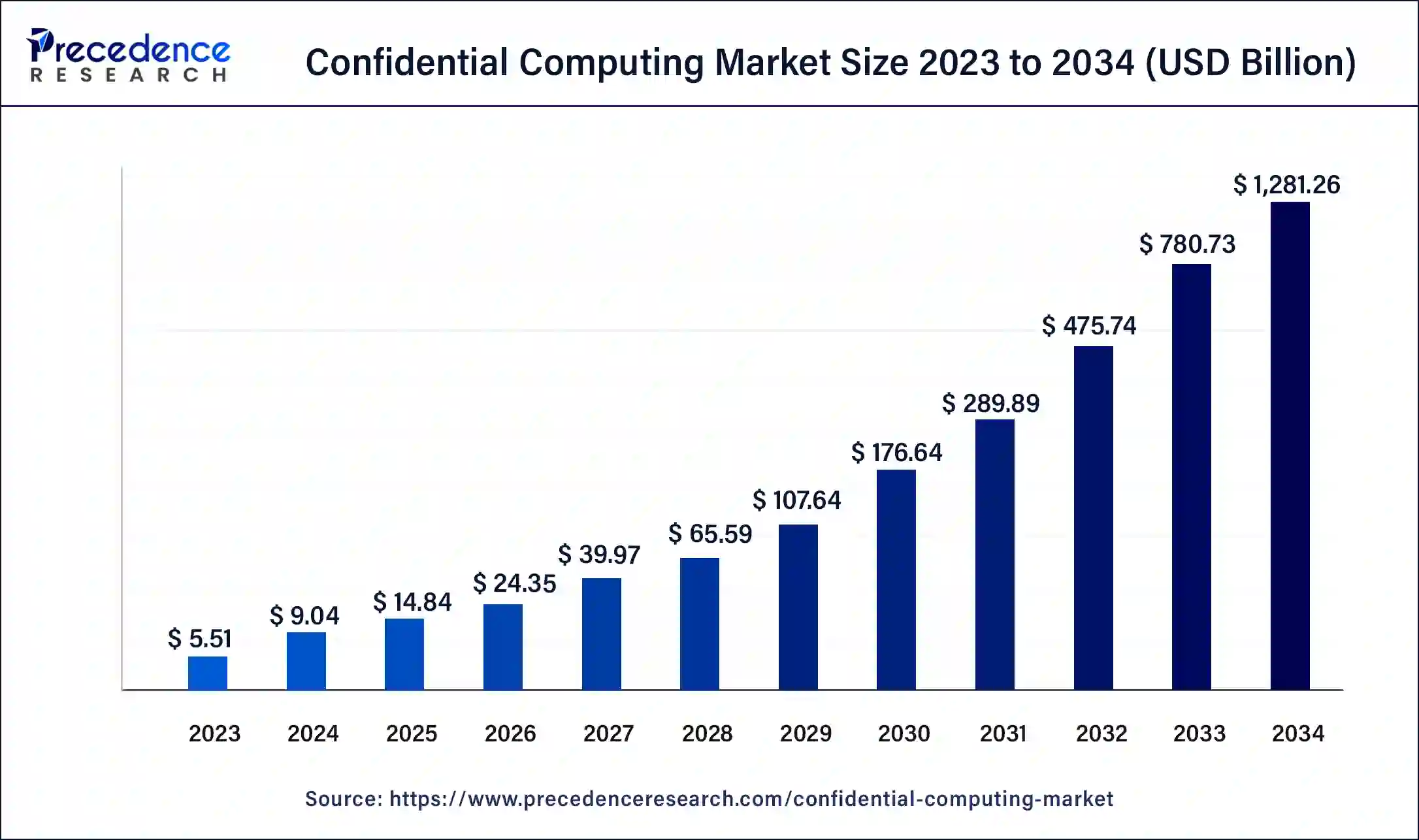

The global confidential computing market size was USD 5.51 billion in 2023, estimated at USD 9.04 billion in 2024 and is expected to reach around USD 1281.26 billion by 2034, expanding at a CAGR of 64.11% from 2024 to 2034.

The global confidential computing market size is projected to be worth around USD 1281.26 billion by 2034 from USD 9.04 billion in 2024, at a CAGR of 64.11% from 2024 to 2034. The rising demand for effective data protection solutions by the end-use industries is driving the growth of the market.

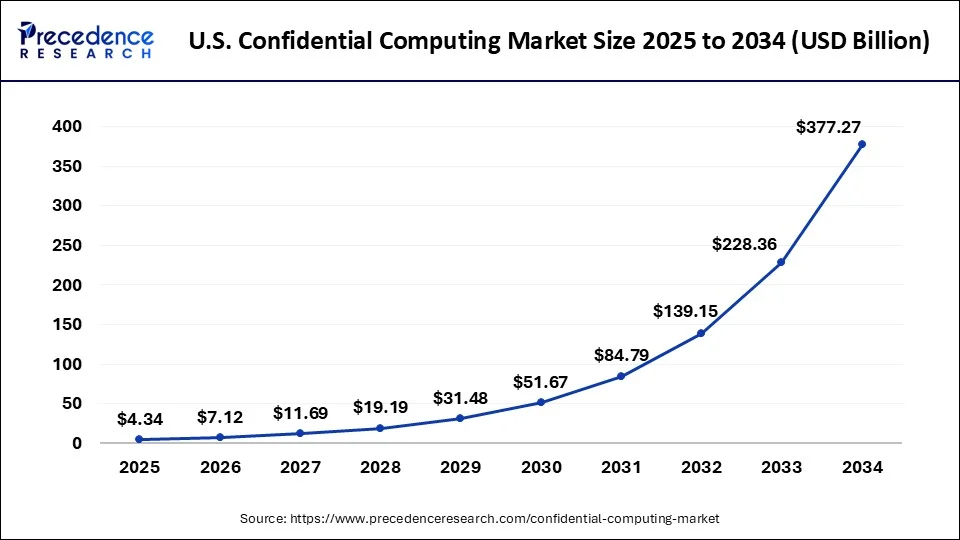

The U.S. confidential computing market size was valued at USD 1.61 billion in 2023 and is predicted to attain around USD 3.77.27 billion by 2034, growing at a CAGR of 64.22 from 2024 to 2034

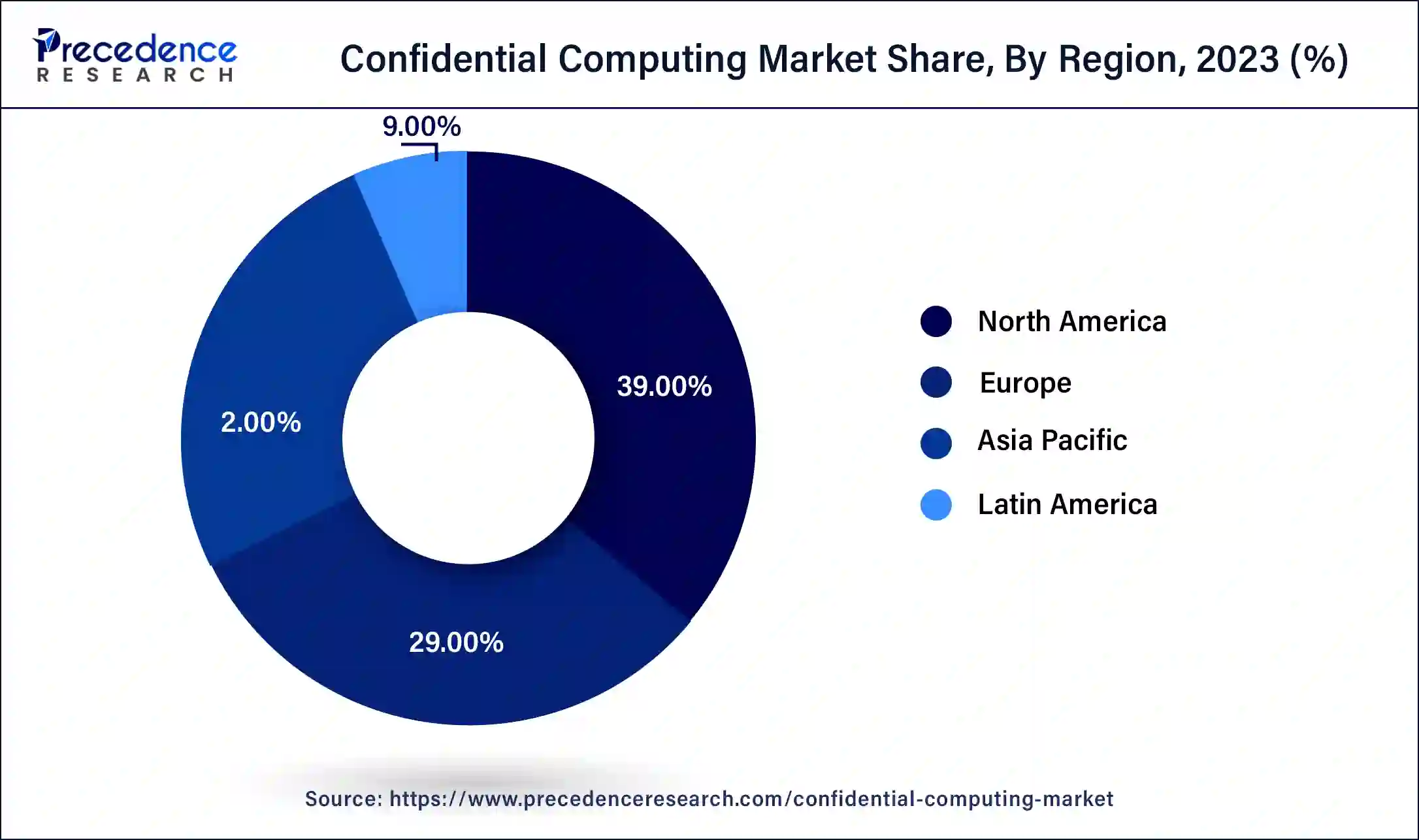

North America dominated the market with the largest market share in 2023. The growth of the market is attributed to the rising industrial infrastructure, which is driving the demand for confidential computing for the data security process. The increasing presence of technology leaders in regional countries like the U.S. and Canada and the rising digitization and automation in the industries are accelerating the growth of the confidential computing market in the region.

For Instance,

Asia Pacific is expected to be the fastest-growing confidential computing market during the forecast period. The growth of the market is attributed to the rising global population and the rising industrial infrastructure, and the demand for data security is driving the growth of the market. The rising technological advancement in the industry verticals such as banking and finance, healthcare, retail, and others drives the growth of the confidential computing market in the region.

Confidential computing is a technology that is highly adopted by a number of end-use industries for dealing with cybercrime and secured data processing activities. Confidential computing is a cloud-based computing technology that aims to protect the data during processing. The technology had the overall control over the end-to-end encryption of the data processing. The technology stores the sensitive data in the CPU enclave during the processing. Confidential computing can help organizations in many ways, including protecting sensitive data during processing, increasing cloud computing benefits to sensitive workloads, protecting intellectual property, helping in securely collaborating with partners on new cloud solutions, reducing threats while choosing to collaborate with cloud providers, and protecting data at the edge. The rising concern about data breaches and cybersecurity drives the growth of the confidential computing market.

Market Trends

How can AI impact Confidential Computing?

The rising implementation of artificial intelligence into industrial applications enhances the productivity and efficiency of industries' working capabilities. AI plays a significant role in confidential computing and cyber security; it protects the data and allows organizations to continue using AI power to maintain privacy, security, and required standards for the business. Confidential AI is the combined term of artificial intelligence and confidential computing. Confidentiality AI is filling a gap between zero trust policies made for generative AI and secure private data. AI-enhanced the protection of digital systems and data from cyber threats with the help of neural networks, machine learning, and other AI technologies that help detect, analyze, and prevent data from potential cyber threats.

For Instance,

| Report Coverage | Details |

| Market Size by 2034 | USD 1281.26 Billion |

| Market Size in 2023 | USD 5.51 Billion |

| Market Size in 2024 | USD 9.04 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 64.11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| 2024 to 2034 | Component, Deployment, Application, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in confidential computing in IT and telecommunication

IT and telecommunication are two of the major and leading industries in the country's overall development. Confidential computing plays a significant role in securing data related to the telecom industry. It helps in various applications of the telecom, such as moving virtualized network functions like 5G core applications to the public cloud while keeping data encrypted, reducing the requirement of infrastructural development and potential security risk, and protecting digital assets with encryption and remote attestation. The rise in the 5G network has also increased the data quality and quantity and has the potential threat to cybercrime, which also boosts the growth of the confidential computing market.

Complex infrastructure

The complex cloud infrastructure and the high-cost installation of confidential computing in organizations are limiting the growth of the confidential computing market.

The integration of GPU into confidential computing

The increasing demand and the availability of confidential computing in small to medium-scale organizations. The rising investment by major technology giants such as Microsoft and NVIDIA is planning to offer a solution that will help scale the large language models. Businesses are highly adopting confidential computing to enhance the safety of a wide range of applications. The rising research and development activities in the development of technologies drive the growth of the confidential computing market.

The hardware segment dominated the confidential computing market in 2023. The rising demand for confidential computing hardware by the number of end-use industries for higher security is driving the demand for confidential computing hardware. The hardware segment enhances the security solution at the lowest layer possible. Hardware can deliver efficient defense-in-depth mechanisms and security boundaries by confidential computing.

For Instance

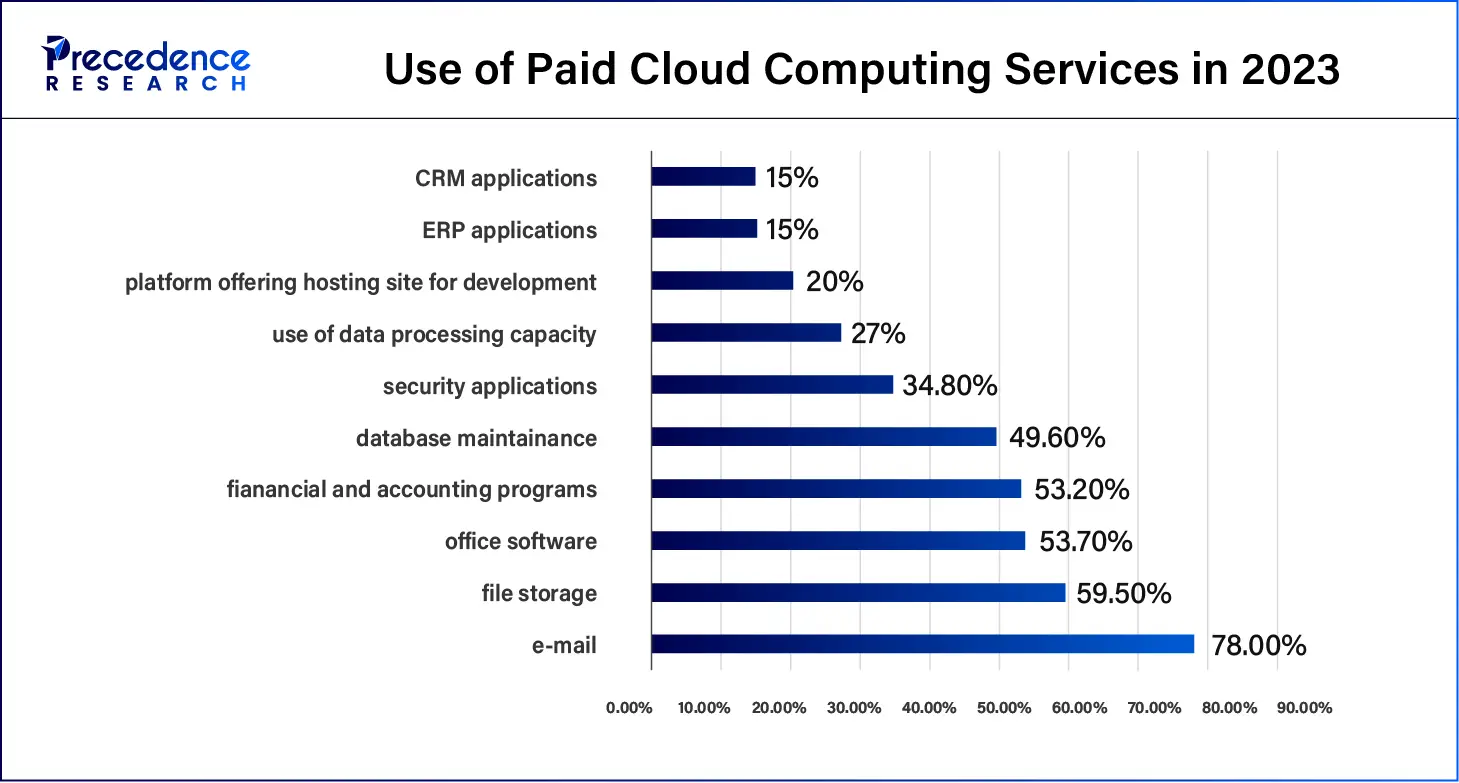

The cloud-based segment held the largest share of the confidential computing market in 2023. There is an increasing demand for cloud-based solutions in organizations for hosting and managing confidential computing environments. Cloud-based software eliminates the requirement of infrastructure development, and it can efficiently hold secure data processing without the need for heavy infrastructure. It is a more durable, scalable, and cost-efficient solution than the on-premise deployment in the organizations. The rising investment in cloud-based solutions by the major market players is driving the demand for the segment.

For instance,

The pellucidity between users segment dominated the market with the largest confidential computing market share in 2023. The confidential computing helps I enhanced the communication ad transparency between the organizations. Confidential computing allows organizations to share data without compromising security; it helps in enhancing the trusted and secure execution environment. The pellucidity between users allowed safer collaboration and data sharing between the organizations.

The retail industry accounted for the largest market share in 2023. The increasing global population and the disposable income in the population are driving the demand for consumer goods and accelerating demand for the retail industry. The rising implementation of confidential computing for security purposes boosts the growth of confidential computing in the retail industry. The increasing use of online or mobile payment drives the demand for an efficient security process. Confidential computing helps protect payment information during the transaction process. It reduces fraudulent activities and data breaches in the online transaction process, which also boosts the growth of the confidential computing market.

Segments Covered in the Report

By Component

By Deployment

By Application

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

January 2025

August 2024