March 2025

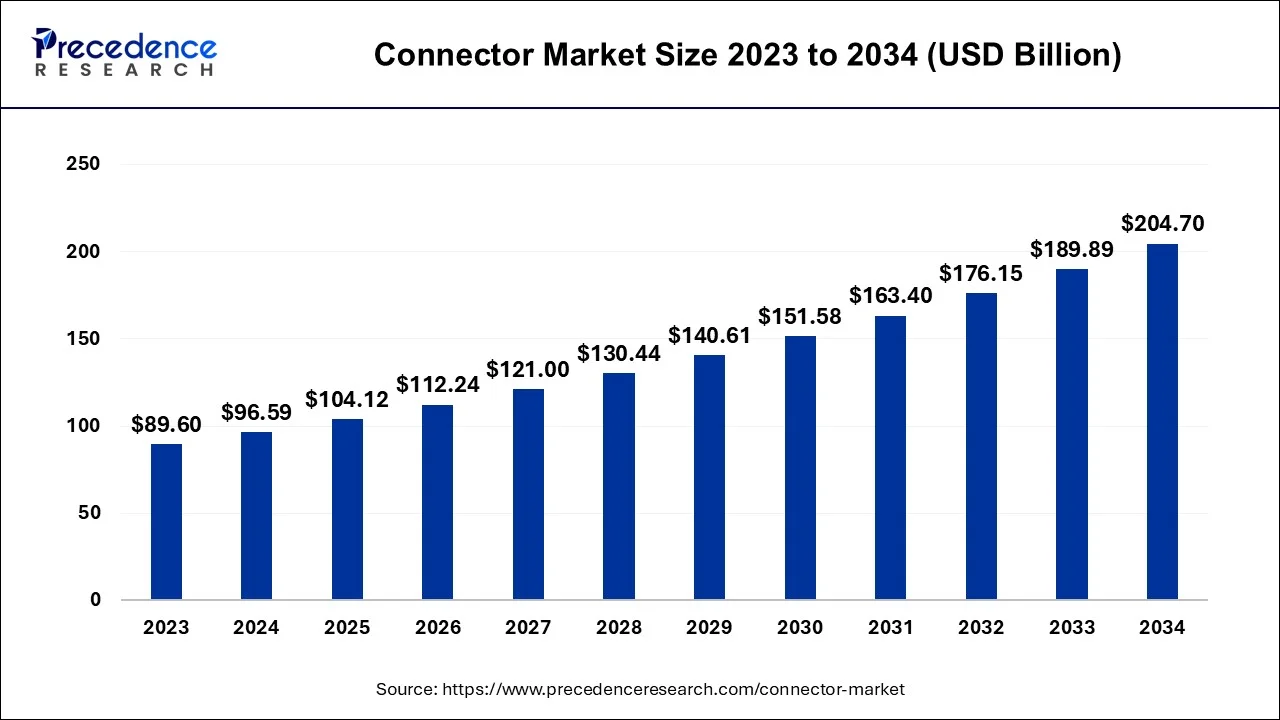

The global connector market size accounted for USD 96.59 billion in 2024, grew to USD 104.12 billion in 2025 and is projected to surpass around USD 204.70 billion by 2034, representing a healthy CAGR of 7.80% between 2024 and 2034

The global connector market size is estimated at USD 96.59 billion in 2024, grew to USD 104.12 billion in 2025 and is anticipated to reach around USD 204.70 billion by 2034, representing at a notable CAGR of 7.80% between 2024 and 2034

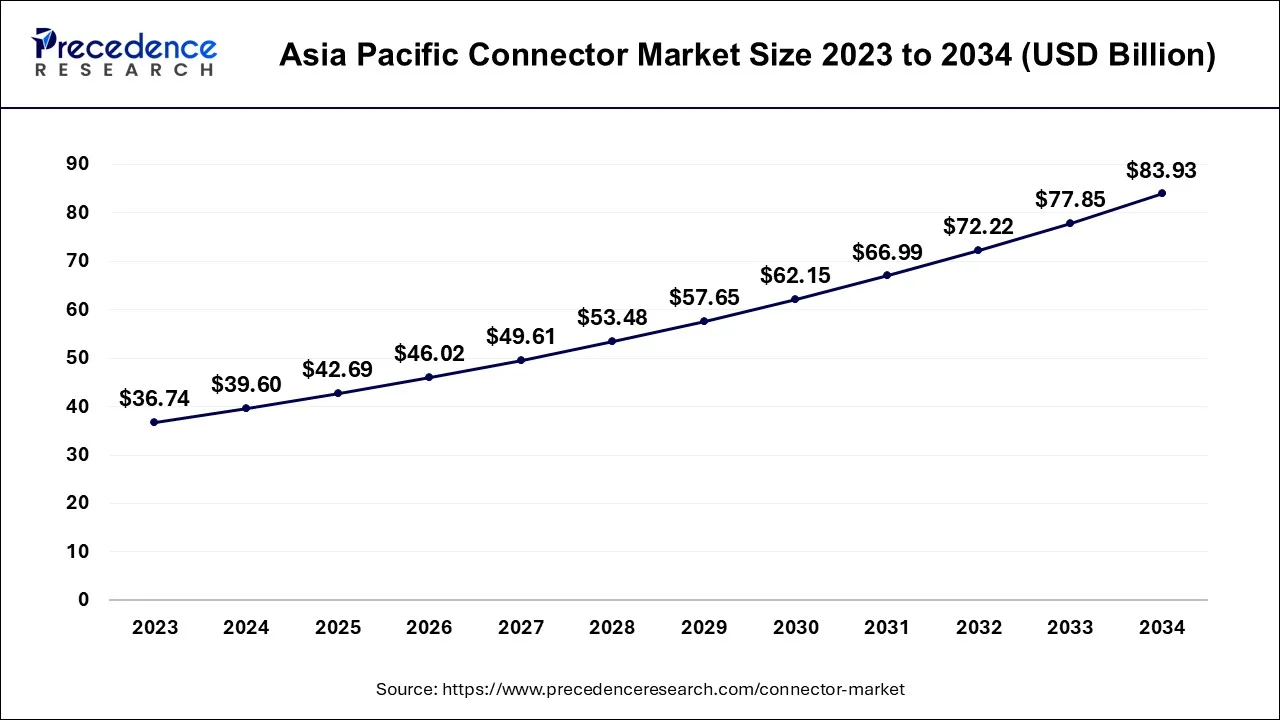

The Asia Pacific connector market size accounted for USD 39.60 billion in 2024 and is expected to be worth around USD 83.93 billion by 2034, growing at a CAGR of 7.81% from 2024 to 2034.

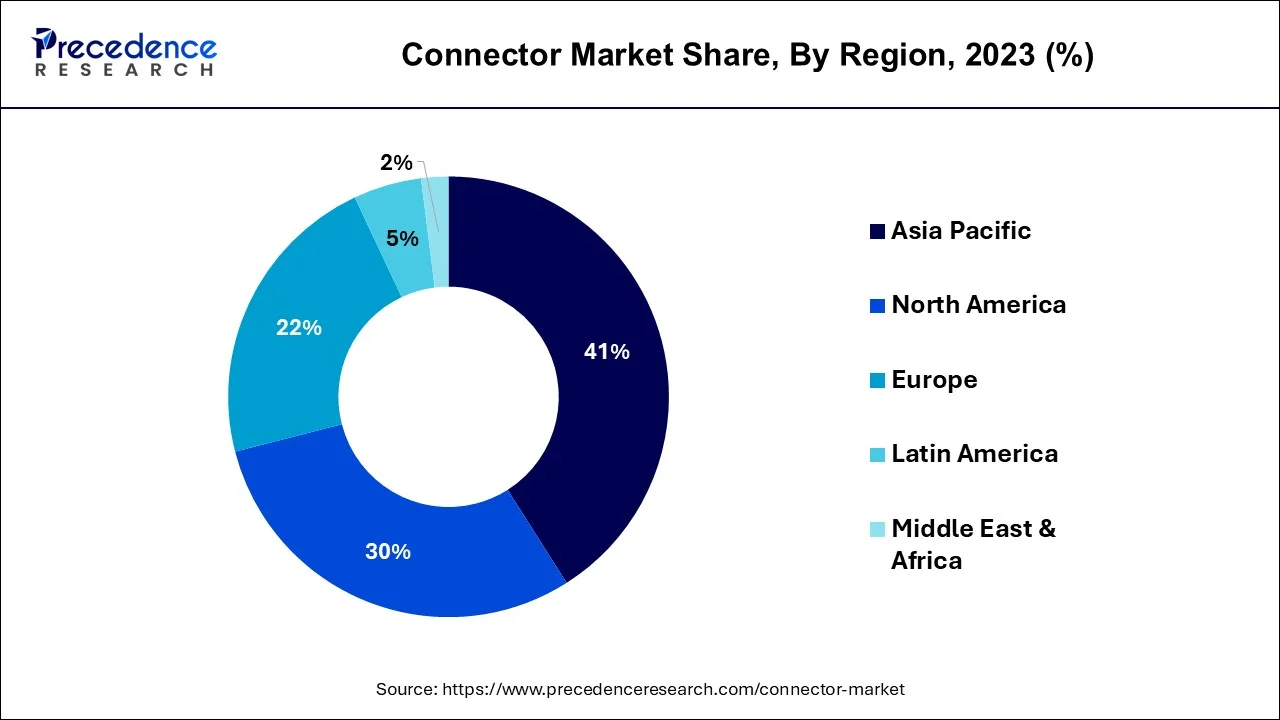

Asia Pacific has held the largest revenue share of 41% in 2023. Asia Pacific exerts a commanding influence on the connector market, marked by distinctive factors. The region serves as an epicenter for electronic fabrication, with nations such as China, Japan, and South Korea at the vanguard of technological innovation and manufacturing prowess. Swift urbanization and industrial expansion within Asia Pacific propel the call for connectors across a spectrum of sectors, encompassing automotive, telecommunications, and consumer electronics.

Furthermore, the burgeoning adoption of 5G technology, the Internet of Things (IoT), and intelligent devices escalates the clamor for connectors. Asia Pacific's formidable manufacturing capabilities, vast consumer base, and substantial investments in technological infrastructure combine to firmly establish it as a preeminent player in the global connector market.

Europe is estimated to observe the fastest expansion. Europe commands a substantial growth in the connector market for various compelling reasons. The region's strong industrial presence, particularly in the automotive, aerospace, and telecommunications sectors, underscores its reliance on connectors for data and power transmission. Europe's unwavering commitment to technological progression fuels the demand for cutting-edge connectors, aligning with evolving industry requirements. Moreover, Europe's dedicated pursuit of sustainability, reflected in the increased adoption of electric vehicles, serves as a growth driver in the connector market. The region's well-established manufacturing infrastructure and export-oriented industries further consolidate its standing as a dominant growth in the global connector market.

A connector acts as a specialized bridge, allowing disparate elements to unite seamlessly. These components serve as junctions, linking items in various domains, be it in the realm of electronics, automotive, or machinery. In the electronic domain, connectors function like intricate puzzle pieces, merging wires and components for the exchange of power and data. They come in diverse configurations, each tailored to specific requirements, but precision is vital for a harmonious connection. Connectors are often categorized as male and female counterparts; the male side features pins or prongs that neatly fit into corresponding slots or receptacles on the female side.

Selecting the appropriate connector and maintaining it meticulously is of utmost importance, as it ensures the smooth flow of information and power while preventing system malfunctions. In essence, connectors serve as the essential conduits that foster collaboration among distinct elements, enhancing the efficacy of the interconnected system.

| Report Coverage | Details |

| Market Size in 2024 | USD 96.59 Billion |

| Market Size by 2034 | USD 204.70 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.80% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive industry growth

The growth of the car industry is like a strong engine pushing the connector market forward. Modern cars are becoming more like smart gadgets, full of electronic parts and sensors. To make these parts work together and share power, connectors are the handy helpers. Electric cars, in particular, are giving the connector market a big boost. They need special connectors to charge up quickly and manage their batteries. As more people switch to electric cars, the demand for these special connectors is shooting up.

Moreover, there are self-driving cars, which need connectors for their sensors and cameras to drive safely. These connectors are like traffic signals that help self-driving systems navigate the road. So, in simple terms, the connector market gets a lift from the car industry's growth because it needs to keep up with all the fancy tech in today's cars, whether they run on gas or electricity, or even drive themselves.

Cyclical nature of industries

The cyclical nature of certain industries represents a significant restraint on the growth of the connector market. Industries like automotive, manufacturing, and construction, which heavily rely on connectors, often experience economic cycles. During economic downturns or recessions, these sectors typically reduce their investments in infrastructure, production, and technology, including connectors. This leads to a decreased demand for connectors, resulting in revenue and growth challenges for connector manufacturers. The automotive industry, for instance, can witness fluctuations in production and sales due to economic conditions, impacting the need for connectors in vehicle manufacturing.

Similarly, the manufacturing sector's growth is closely tied to economic stability, influencing the demand for connectors used in various automated systems and machinery. The cyclical nature of these industries introduces an inherent vulnerability for connector manufacturers, who must adapt their strategies to manage fluctuations in demand and revenue caused by economic uncertainties. This requires a level of flexibility and resilience in the connector market to navigate these industry-specific challenges.

5G technology

The rise of 5G technology offers distinctive prospects within the connector market. 5G networks demand connectors capable of managing high-frequency and swift data transfers, cementing their essential role in the network's infrastructure. Primarily, the 5G network's increased density, characterized by the proliferation of small cells, antennas, and base stations, necessitates connectors that are not only compact but also robust, ensuring the preservation of signal quality. This engenders a surge in demand for specialized connectors explicitly tailored for these specific applications.

Furthermore, the amplified hunger for mobile data, intensified connectivity, and the burgeoning Internet of Things (IoT) sector that accompanies 5G technology underscores the requirement for connectors adept at efficiently transmitting data and power to numerous devices and sensors. Conclusively, as 5G technology unfolds and extends its reach, it unlocks opportunities for connector manufacturers to supply solutions that facilitate the full potential of this transformative technology.

According to the product, the PCB connectors segment has held 31% revenue share in 2023. PCB (Printed Circuit Board) connectors hold a substantial share in the connector market due to their integral role in modern electronic devices. These connectors are designed to establish secure connections between components on a PCB, facilitating data transfer and power distribution.

With the increasing complexity of electronic systems, from smartphones to industrial equipment, PCB connectors offer a compact and reliable solution. Their versatility, compatibility with various applications, and the continuous demand for miniaturization in electronics make PCB connectors a dominant segment in the market, supporting the growing need for interconnected and high-performance electronic devices.

The I/O connectors segment is anticipated to expand at a significant CAGR of 8.2% during the projected period. The I/O (Input/Output) connectors segment's commanding growth in the connector market is attributed to its fundamental function in enabling data interchange across a wide array of electronic devices and systems. These connectors serve as linchpins for connecting peripherals seamlessly with devices such as computers, smartphones, and consumer electronics.

The escalating growth of the Internet of Things (IoT) and the escalating demand for high-speed data transfer in sectors like telecommunications and data centers have propelled the necessity for I/O connectors. Their versatility, spanning from USB and HDMI connectors to audio jacks, underscores their irreplaceable role in contemporary electronic devices, substantially contributing to their noteworthy market growth.

In 2023, the telecom segment had the highest market share of 32% on the basis of the end user. The telecom segment holds a significant share in the connector market due to the surging demand for high-speed data transmission and the widespread expansion of telecommunications infrastructure, particularly with the deployment of 5G networks. Connectors are crucial components in building the network infrastructure, from base stations to small cells and antennas.

As the telecommunications industry continually evolves to meet the growing need for faster and more reliable connectivity, connectors play a pivotal role in supporting these technological advancements, making the telecom sector a major contributor to the connector market's growth and revenue.

The aerospace and defense segment is anticipated to expand fastest over the projected period. The aerospace and defense segment commands substantial growth in the connector market due to its distinct requirements for high-performance connectors. These connectors are crucial for critical applications, ensuring the reliable transfer of data and power in aerospace, military, and defense systems.

The stringent demands for durability, resistance to extreme conditions, and compliance with strict industry standards drive the need for specialized connectors. The constant innovation and upgrading of aerospace and defense technologies contribute to a consistent demand for advanced connectors, establishing this segment as a major growth leader in the connector market.

Segments Covered in the Report

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025