January 2025

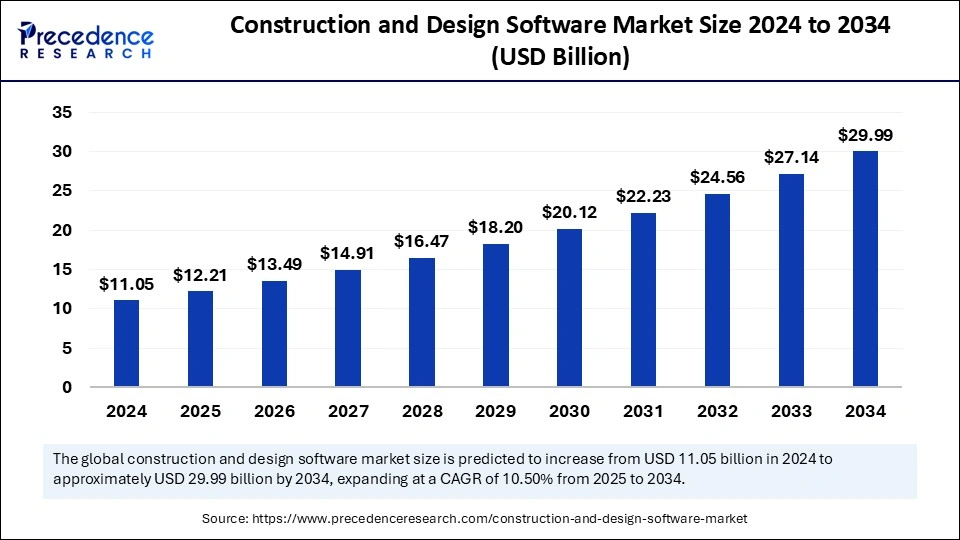

The global construction and design software market size is calculated at USD 12.21 billion in 2025 and is forecasted to reach around USD 29.99 billion by 2034, accelerating at a CAGR of 10.50% from 2025 to 2034. The North America market size surpassed USD 3.65 billion in 2024 and is expanding at a CAGR of 10.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global construction and design software market size accounted for USD 11.05 billion in 2024 and is predicted to increase from USD 12.21 billion in 2025 to approximately USD 29.99 billion by 2034, expanding at a CAGR of 10.50% from 2025 to 2034. The rising adoption of AI and ML technology, increasing demand for energy-efficient design, and growing investment in smart city projects are expected to drive the growth of the construction and design software market throughout the projection period.

Artificial intelligence technology emerges as a transformative force that holds great potential to reshape the construction industry. AI in construction refers to the usage of various AI-powered tools specifically designed for the construction industry. AI is widely being adopted in design and planning construction, especially for optimization purposes. To stay ahead in the evolving infrastructure landscape, contractors, civil engineers, asset owners, and architects are increasingly using AI to improve multiple facets of construction by refining project planning, streamlining design processes, improving project efficiency, and ensuring long-term structural health monitoring. It facilitates data-driven decision-making, which often results in improved efficiency and safety on construction sites.

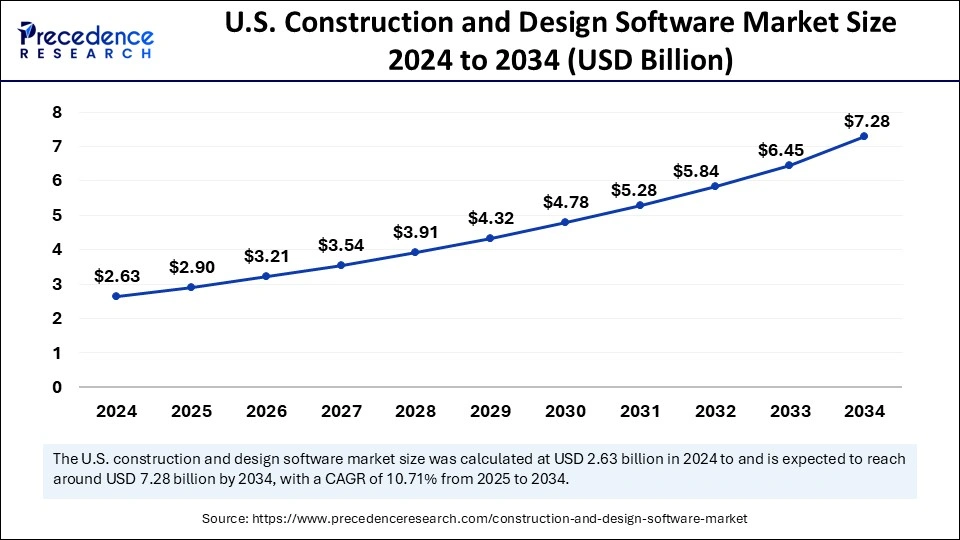

The U.S. construction and design software market size was exhibited at USD 2.63 billion in 2024 and is projected to be worth around USD 7.28 billion by 2034, growing at a CAGR of 10.71% from 2025 to 2034.

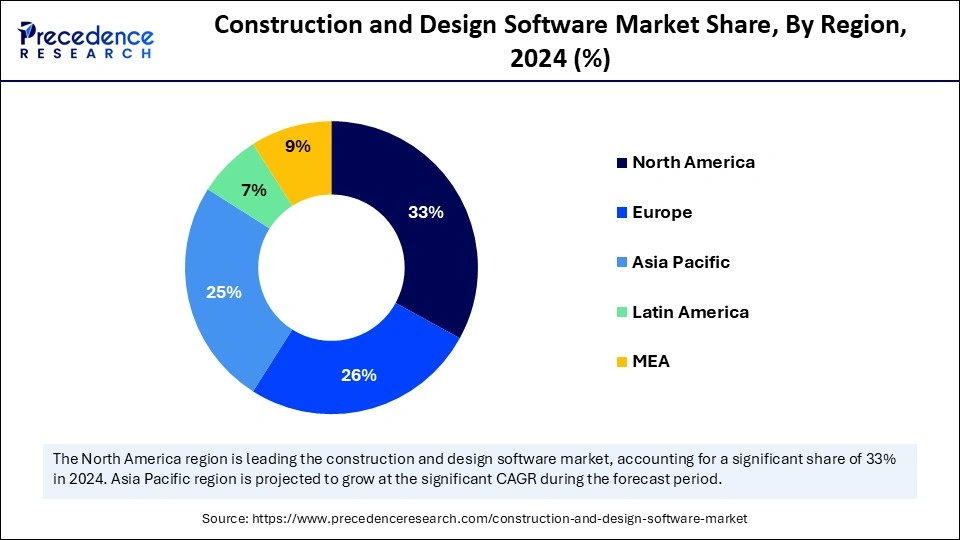

North America dominated the construction and design software market by capturing the largest share in 2024. This is mainly due to the increase in consumer preference for better interior design in buildings, the rise in investment in smart and sustainable infrastructure, and the high adoption of digital solutions in the construction sector. There is a high adoption of building information modeling (BIM) in sustainable building development and the surge in investments in the construction sector, especially across the U.S. and Canada, bolstered the regional market growth. Moreover, the rise in government investments in infrastructure development influenced the market in North America.

Asia Pacific is anticipated to witness the fastest growth in the market during the forecast period. The regional market growth is driven by the rapid infrastructure development, rising integration of advanced technologies in the construction industry to manage large-scale projects, and increasing demand for Building Information Modeling (BIM) solutions in energy-efficient buildings. Rapid urbanization, growing adoption of advanced design tools, and favorable government initiatives supporting smart and sustainable infrastructure further support market growth. Countries like Japan, Singapore, China, India, and South Korea are major contributors to the market owing to the rapid urbanization and increasing investment in smart city projects. In addition, the rising adoption of cloud-based design software to significantly improve project coordination and alleviate costs of large-scale construction projects and the rising construction activities contribute to market growth.

Europe is anticipated to experience notable growth in the market during the forecast period. Rising digitization in the construction sector, focus on energy-efficient and sustainable construction practices, increasing integration of digital tools like 3D modeling and digital twins in the construction industry, and rising integration of AI-powered solutions to streamline construction processes are expected to drive the growth of the construction and design software market in Europe. In addition, supportive government regulations promoting smart cities and sustainable urban development and the rising demand for cloud-based construction management solutions are expected to propel the growth of the market during the forecast period.

In the era of a rapidly evolving digital landscape, construction and design software emerges as a transformative force and holds great potential to revolutionize the construction industry around the world. Construction design and software use multiple digital tools and applications for the effective planning, designing, and management of construction projects. These software platforms allow architects, contractors, and engineers to enhance design accuracy, reduce costs, optimize resource management, boost collaboration, and streamline workflows. The construction and design software market is experiencing rapid growth due to the increasing construction activities across the globe.

| Report Coverage | Details |

| Market Size by 2034 | USD 29.99 Billion |

| Market Size in 2025 | USD 12.21 Billion |

| Market Size in 2024 | USD 11.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Deployment, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Adoption of Building Information Modeling (BIM)

The increasing utilization of building information modeling (BIM) is boosting the growth of the construction and design software market. The market has witnessed the extensive adoption of BIM as a standard practice in the construction industry. Building Information Modeling (BIM) is a popular innovative approach to the design, construction, and effective management of building projects. It offers numerous advantages over conventional tools. The critical information about various elements of a construction project is enabled through the utilization of BIM, which may include spatial relationships, geometry, material quantities, or schedules. Moreover, using BIM enhances predictability, accuracy, and clarity regarding the life cycles of projects, yielding compelling results and providing stakeholders with information about whether the projects will be completed and within budget.

Reluctant to Adopt Advanced Technologies

The reluctance to adopt advanced technologies is projected to hinder the growth of the global construction and design software market. In addition, there is a lack of skilled professionals in many under-developed countries, limiting the adoption of construction and design software. Different software solutions require training for effective installation and use, discouraging some architects and contractors from adopting them.

Increasing Investments in Infrastructure Development

The surge in investments in global infrastructure development is anticipated to create lucrative opportunities in the construction and design software market. The rising public and private investment in the development of smart cities leads to an increasing demand for digital tools and BIM in construction projects. Construction and design software are widely adopted in the construction of energy-efficient buildings and smart cities. In addition, the rising investment in various digital tools has streamlined the processes and has significantly changed how organizations approach and implement construction and design projects. With the rising focus on reducing operational costs and boosting productivity, the construction sector is experiencing remarkable growth in the adoption of advanced technologies.

The project management & scheduling segment held the largest share of the construction and design software market in 2024. Several construction companies around the world increasingly rely on construction and design software to optimize the process for effective project management and scheduling. It helps construction professionals create and manage project schedules. Construction scheduling software stores and saves all the critical project information in a single place, enabling stakeholders to get continuous access to the project flow. Cloud-based project management & scheduling software can effectively manage projects and simplify the scheduling process. Cloud-based construction scheduling applications enables teams to work on various complex projects, optimizes project efficiency, and significantly improves overall project management.

The on across bid management segment is expected to witness a significant growth during the forecast period. This is mainly due to the increasing adoption of bid management software by construction companies. Bid management is one of the most important aspects for construction companies when hiring contractors to carry out multiple tasks in a construction project. Construction bid management centers on getting contracts to assist in generating a lumpsum profit and also aligns with a construction company’s abilities and goals.

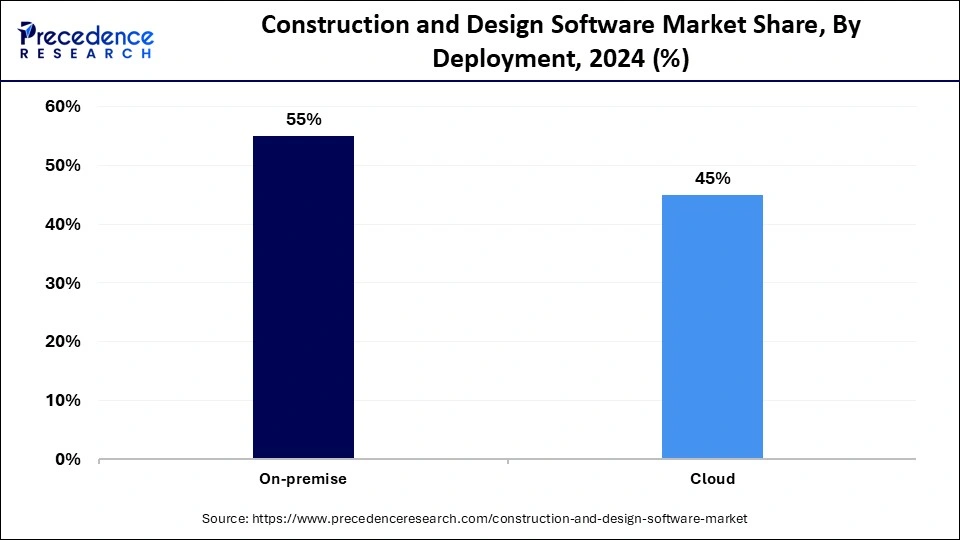

The on-premise segment dominated the construction and design software market with the largest share in 2024. On-premise software is specifically designed to be installed and run directly on an organization’s infrastructure. It enables users to get complete control over the ownership of the infrastructure. Moreover, on-premise software supports scalable operations, which allows businesses to enhance their storage capacity, computational power, and software licenses as required.

The cloud segment is expected to grow significantly during the projected period. Cloud-based construction and design software provides numerous benefits, such as cost-effectiveness, scalability, collaboration enhancement, and advanced security measures. Cloud-based software allows teams to collaborate remotely and manage projects from different locations.

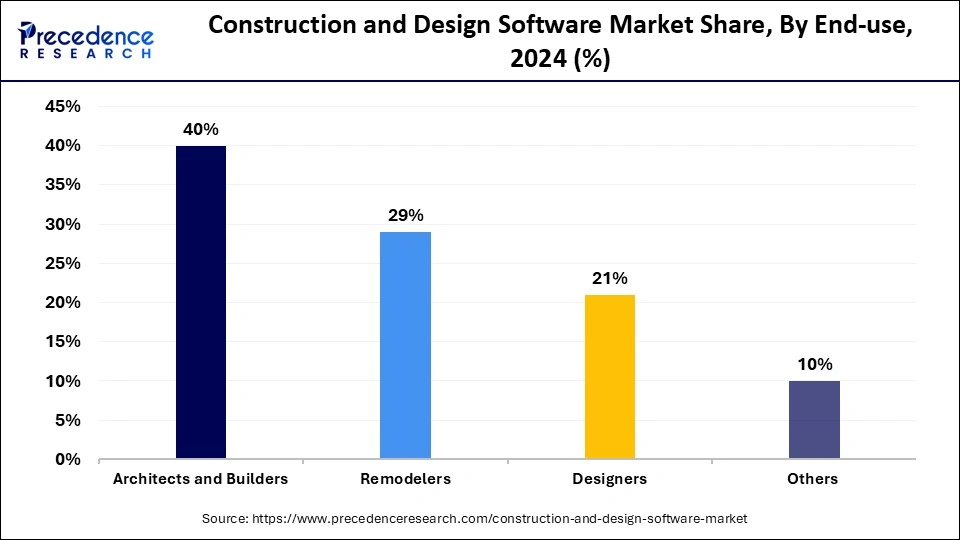

The architects & builders segment held the largest share of the construction and design software market owing to the increasing investment in the development of sustainable buildings and smart cities. Builders and architects widely use construction and design software to obtain all the necessary design tools for various types of home construction or renovation projects. Additionally, this software assists in effectively handling workflows and project management tasks.

The designers segment is expected to witness remarkable growth during the forecast period. The segment growth is attributed to the increasing demand for aesthetic interior design and décor. Tools like building information modeling (BIM) and computer-aided design (CAD) help design teams effortlessly design interior as well as exterior designs of buildings. Several designers around the world are increasingly utilizing construction and design software to boost overall productivity.

By Function

By Deployment

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

October 2024

February 2025