April 2025

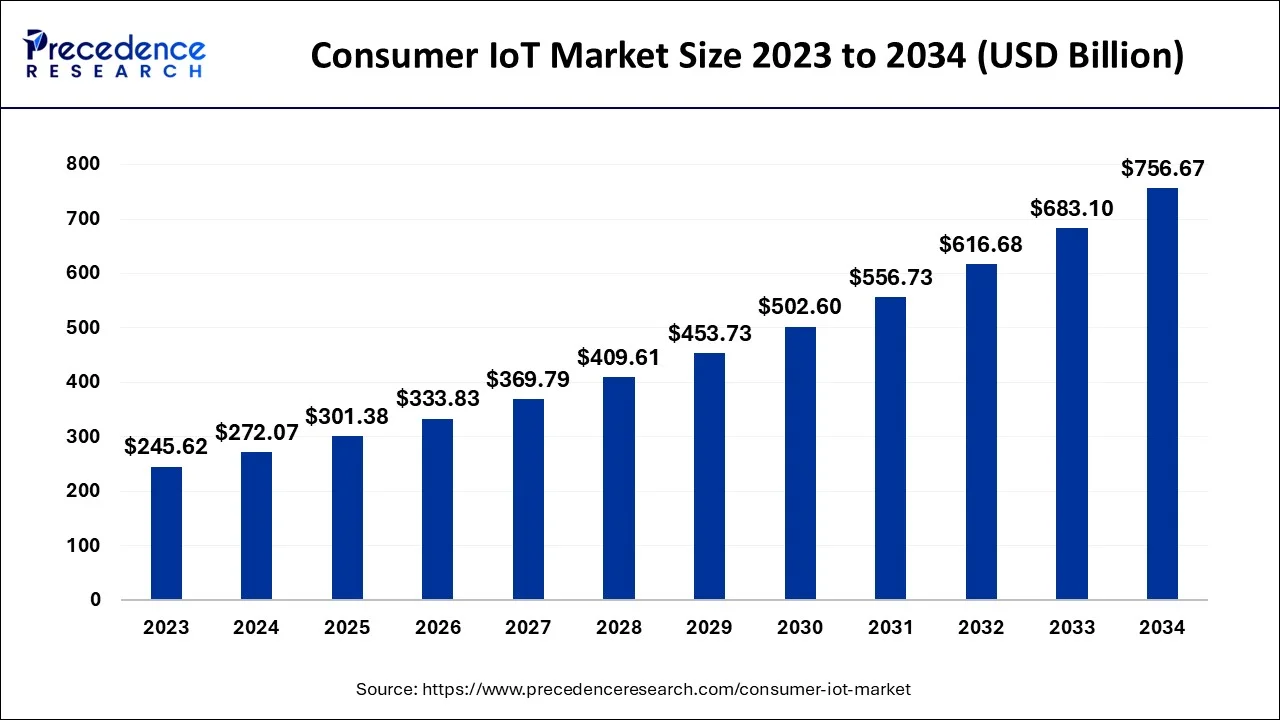

The global consumer IoT market size accounted for USD 272.07 billion in 2024, grew to USD 301.38 billion in 2025 and is projected to surpass around USD 756.67 billion by 2034, representing a healthy CAGR of 10.77% between 2024 and 2034. The North America consumer IoT market size is calculated at USD 97.95 billion in 2024 and is expected to grow at a fastest CAGR of 10.91% during the forecast year.

The global consumer IoT market size is estimated at USD 272.07 billion in 2024 and is anticipated to reach around USD 756.67 billion by 2034, expanding at a CAGR of 10.77% between 2024 and 2034.

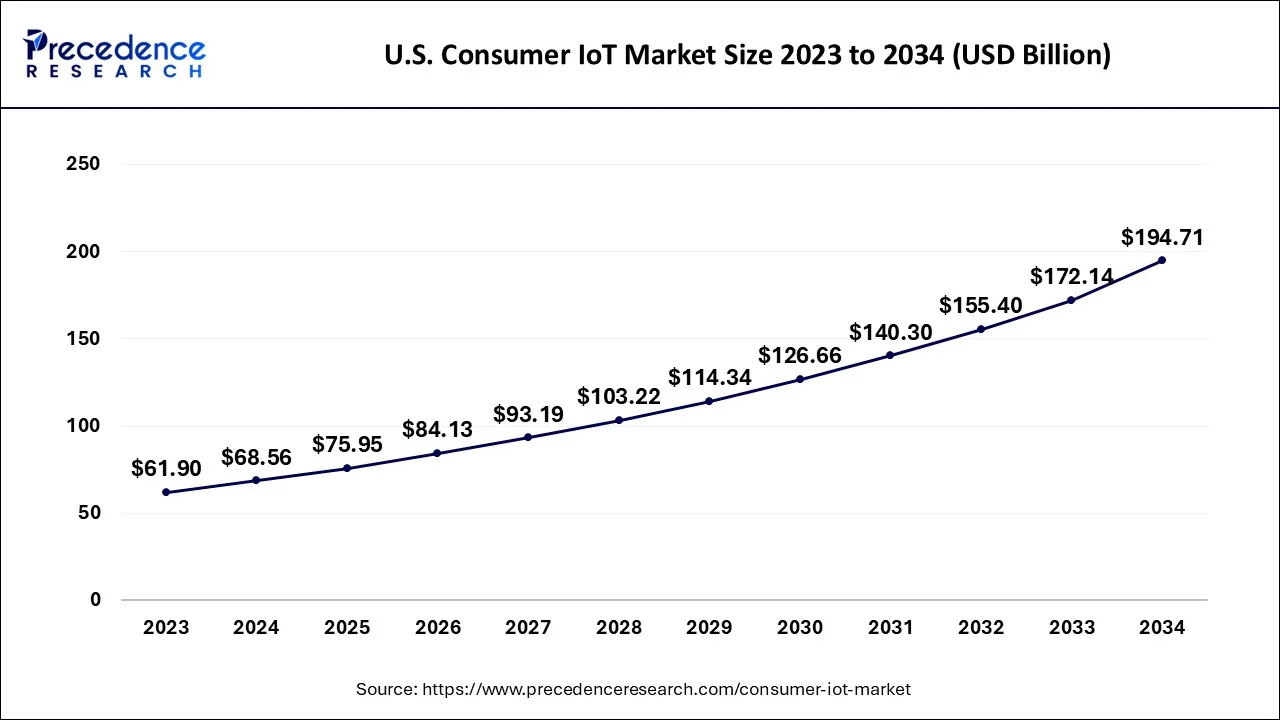

The U.S. consumer IoT market size is exhibited at USD 68.56 billion in 2024 and is predicted to be worth around USD 194.71 billion by 2034, expanding at a CAGR of 10.98% between 2024 and 2034.

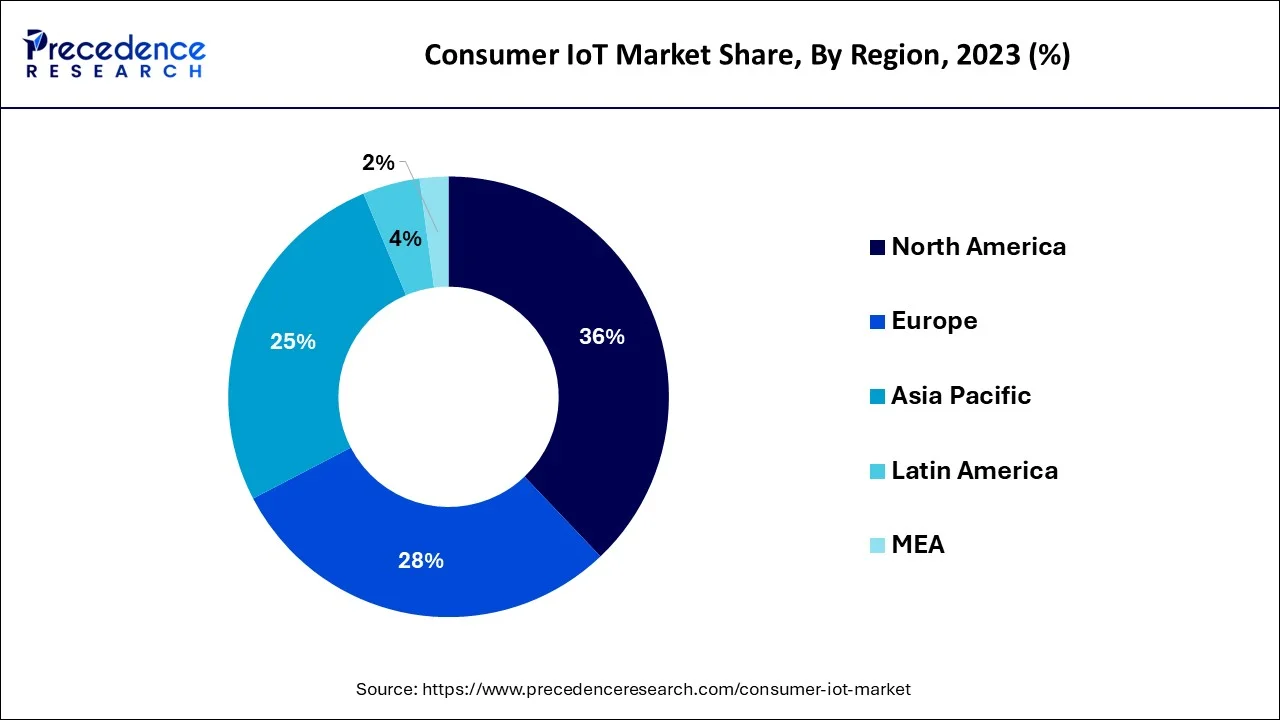

North America reported approximately 22% of the total share in 2023 and thus is predicted to expand during the projected period. This is attributed to enhanced product demand in the region, particularly for fitness-tracking gadgets. Furthermore, the growing health consciousness due to the increasing prevalence of chronic diseases and the number of diabetes patients, as well as the convenience of the use of medical devices, are driving market growth in this region.

The increased adoption of smart connected devices and the rapid digitalization of various consumer end-use applications have fueled the growth of IoT in North America. As per the 2022 ValuePenguin survey of around 1,500 users, 45% of Americans already use smartwatches, for instance, Apple Watches and Fitbits, and 69% are ready to utilize a fitness tracker to have health insurance discounts.

With the increasing acceptance of innovative home solutions in the area, Asia Pacific recorded a significant CAGR between 2023 to 2032. Asia Pacific is expected to be one of the important markets for IoT market growth. Asia Pacific is growing due to rising internet penetration, increased adoption of cloud-based services among small and medium-sized businesses, and government policies encouraging digitalization and innovative city development.

Furthermore, introducing high-speed networking technologies has been a major driving force in the market. Moreover, the growing interest of multinational players in the region and rising demand from developing economies such as India and China are expected to drive market growth. Ericsson predicts that cellular IoT connections will surpass 4 billion by 2024, owing to strong adoption in North-East Asia.

According to IDC's recent Worldwide Semiannual Internet of Things Spending Guide, the APAC IoT market will grow by 9.1% in 2022, up from 6.9% in 2021.

The Internet of Things (IoT) is evolving in every part of the globe, impacting every industry, particularly the consumer. The consumer Internet of Things (IoT) altered how consumers go about their everyday routines. Various businesses have integrated functionalities and sensors into their products to improve interaction with people, resource tracking, and product control.

The increasing popularity of advanced technological devices and home appliances can be attributed to growth. Consumer internet of things (IoT) tools are equipped with several microcontrollers and wireless technologies, enabling them to reveal data without requiring direct contact between users and computers. Consumer IoT represents an interconnected system of physical and digital objects designed for consumer markets, such as smart wearables, smartphones, and smart home appliances.

For instance, according to consumer research by Ampere Analysis, 52% of internet households in the UK have a voice assistant device. In the firm's survey of 25 countries, 32% claim to own a voice assistant-enabled device.

According to IDC, $742 billion will be spent on IoT technology globally by 2020. With COVID-19, 2020 experienced less spending than the previous year because hotels, theme parks, casinos, and movie theatres were closed for most of 2020. However, IoT spending double-digit by 2021 and is expected to exceed $1 trillion by 2023.

| Report Coverage | Details |

| Market Size in 2024 | USD 272.07 Billion |

| Market Size by 2034 | USD 756.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.77% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Connectivity Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The introduction of 5G

The 5G is predicted to accelerate market expansion. The 5G networks are anticipated to improve the reliability and execution of connected gadgets significantly. IoT and 5G lay the groundwork for medical devices, wearables, smartphones, and vehicles. Developing a 5G-powered IoT system propels the growth of smart cities and connected vehicle networks, benefits manufacturing firms, and enhances healthcare operational efficiency.

According to Ericsson, 5G will have 40% of the total population and 1.5 billion subscription services by 2024, making 5G the highest generation globally incorporated. This is driven by novel, inventive solutions reprocessing present infrastructure and a spectrum. Parallel to 5G deployment, cellular IoT achieves significant benchmarks toward becoming the leading method for broad IoT applications.

According to the Department of Telecommunications (DoT) 2018 National Digital Communication Policy (NDCP), an eco-system for 5 billion connected devices will be created by 2022. As a result, it is predicted that approximately 60% of the 5 billion connected devices, or 3 billion, will exist in India by 2022.

Data breach

Cyberattacks risk increases as these digital technologies become more prevalent in our daily lives as consumers. New products are constantly introducing flaws into the market. According to Consumer Reports, 11 security flaws were discovered in four new video doorbells and home security cameras in 2021, alerting their owners to hacking or leaks of personal data, such as email addresses and Wi-Fi passwords.

Inadequate updates, as well as outdated software

Updates are required to ensure the security of IoT devices. Devices should be updated regularly as soon as new vulnerabilities are discovered. Smartphones and computers typically receive monthly (or more frequently in some cases) updates, but this is only sometimes the case for IoT devices. These devices often lack a well-defined process for security updates and patches.

When designing IoT devices, OEMs frequently need to prioritize cyber security. As a result, devices that are more vulnerable to cyber-attacks are produced. This means that a device that was secure when the customer first purchased it is now unsafe and easily accessible to hackers and other security concerns.

The global consumer IoT industry comprises hardware, services, and software components. Due to the growing demand for IoT devices, the segment of hardware components accounts for approximately 37% of total revenue in 2023. These devices comprise actuators, gadgets, sensors, machines, and appliances that conduct data across networks and are designed for applications. Furthermore, ongoing technological advances are anticipated to favor segmental expansion during the projected period.

The sector of services component is predicted to expand at the fastest rate between 2023 and 2032, owing to the growing demand for solutions that encourage the operation of consumer IoT tools. The end-to-end software development solutions, including project planning, testing, and deployment, are offered by service providers to consumer IoT. They also provide consulting services like IoT tech stack, architectural engineering, software audit, and others.

The wireless connectivity technology sector is estimated to grow at the highest market share of approximately 12% in 2023 due to the network's better scalability. Hardware installations are not required in wireless connectivity technology and are easily extended without regard for facility obstructions. Wireless sensors are made up of nodes which may expand by adding more nodes as needed. Furthermore, they are cost-effective due to current developments in wireless technology and the rising amounts of firms.

The wired connectivity technology section also reported a major share in 2022 and is predicted to expand steadily as this connectivity method remains popular among users. Ethernet is typically used for the connectivity of networks in wired networks, which makes them exceptionally efficient. Additionally, as this technology is not influenced by device distance or placement, they provide faster data transmission speeds. Furthermore, wired networks are assured because they are equipped with a LAN firewall.

The consumer electronics division accounted for greater than 35% of the total share in 2023 due to the rising consumer preference for embracing innovative consumer electronics gadgets throughout residential areas. Home automation is now a reality due to the advancement of technologies like digital assistants, sensors, cloud computing, and advanced networking. According to reports, by 2023, almost 15% of households worldwide are estimated to have a smart home electrical device installed.

The wearable segment is expected to grow fastest from 2023 to 2032 due to expanding disposable incomes, rising internet users, and substantially lower retail prices of such devices. Furthermore, wearable devices benefit healthcare providers and patients by assisting in heart-rate monitoring, hand hygiene monitoring, glucose monitoring, depression monitoring, Parkinson's disease monitoring, and other activities.

As a result, the market is expected to benefit from the increasing acceptance of wearable consumer IoT devices for healthcare monitoring.

Segments Covered in the Report

By Component

By Connectivity Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

July 2024

August 2024

July 2024