April 2025

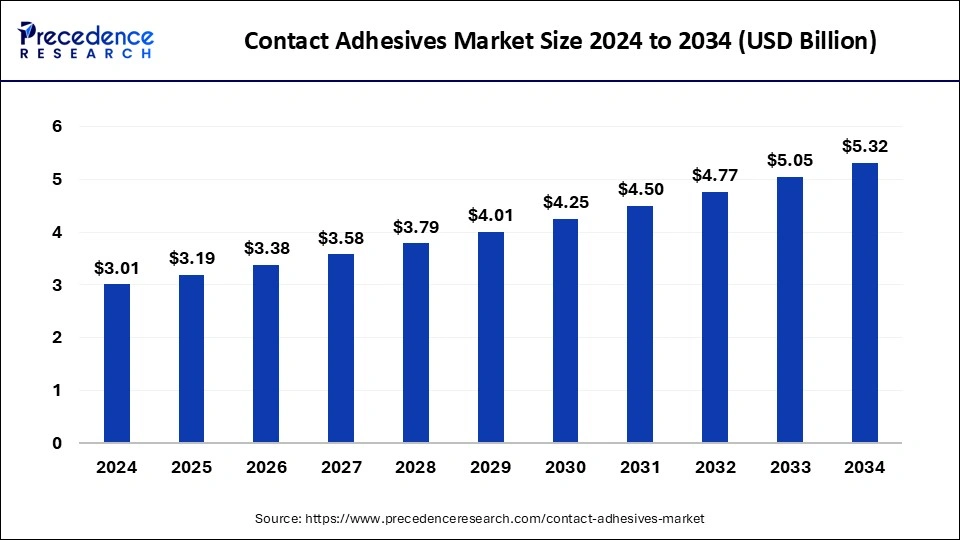

The global contact adhesives market size is accounted at USD 3.19 billion in 2025 and is forecasted to hit around USD 5.32 billion by 2034, representing a CAGR of 5.86% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contact adhesives market size was calculated at USD 3.01 billion in 2024 and is predicted to increase from USD 3.19 billion in 2025 to approximately USD 5.32 billion by 2034, expanding at a CAGR of 5.86% from 2025 to 2034. The rising demand for high-quality adhesive in several end-use industries that driving the growth of the market.

The contact adhesives market is gaining popularity in several industries due to its quick driving, water-based, and flexible properties that drive the growth of the market. The contact adhesive, also called contact cem, is a potent adhesive that bonds two materials or surfaces together. It creates a quick and strong bond between the two surfaces. DIY enthusiasts in various manufacturing or construction industries can use contact adhesives in various applications. It doesn’t require clamping like the other adhesive and has higher resistance to temperature, water, and humidity. The rising industrial infrastructure globally is accelerating the growth of the contact adhesives market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.32 Billion |

| Market Size in 2025 | USD 3.19 Billion |

| Market Size in 2024 | USD 3.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.86% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Substrate, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of the automobile industry

The increase in demand for the automobile industry is due to the rising shift in lifestyle and the increasing disposable income of the population. The growing competition in the automobile industry and automobile manufacturing influence the demand for contact adhesives in the manufacturing process. Contact adhesive is used in automobile assembly, flooring, interior automotive trim, and headliners. The rising demand for lowering weight, increasing assembly times, and streamlining are also causing problems. Vehicle contact adhesive is dry on the surface before being adhered to, instant bonding without clamping, and is also flexible, making it the ideal adhesive material for automobile manufacturing. The ongoing research on automotive adhesives in pressure and liquid sensitive adhesive (PSA) films and tapes further contributes to the growth of the contact adhesives market.

Environmental issues

The contact adhesive is made from the composition of chemicals that are hazardous to the environment and release a higher carbon footprint. The awareness of environmental impact limits the expansion of the contact adhesives market. Governments and regulatory bodies worldwide are increasingly imposing stringent regulations on the use of volatile organic compounds (VOCs) and hazardous substances found in many traditional contact adhesives. Compliance with these regulations often requires reformulation of adhesives, which can be costly and time-consuming.

Development of the sustainable and bio-based adhesives

The bio-based and sustainable adhesive is gaining popularity in several industrial applications due to its reduced environmental impacts. The rise in awareness regarding the environment and petroleum-based adhesives emit higher carbon into the environment, and the depletion of oil resources drives the demand for sustainable adhesive bio-based adhesives made from biomass like natural resins and vegetable oils. Moreover, the increasing research and development activities on sustainable adhesives for high performance, relics repairs, and reusable adhesives made with renewable materials for different industrial applications are driving the opportunities for the growth of the contact adhesives market.

The solvent segment dominated the contact adhesives market with the largest market share in 2023. Higher implementation of the solvent-based contact adhesive into different industrial applications drives the demand for the solvent adhesive. The solvent adhesive is applied on one side of the surface to create a permanent and flexible bond. Solvent adhesives are used in several industrial applications like polychloroprene-based contact cement, medical applications, solvent cement for plastic plumbing cement, and consumer glue. The rising demand for solvent adhesive is accelerating the market for the segment.

The wood-to-wood box segment held the largest share of the contact adhesives market in 2023. The contact adhesive is preferably used in wood bonding in carpentry and the furniture industry due to ease in applications. The rising prevalence of the furniture sale due to the rising construction industry and the increasing demand for commercial and domestic properties. The increasing demand for the wood furniture in the commercial and domestic properties due to its durability, aesthetics, and longer life cycle that driving the expansion of the furniture industry that drives the demand for the contact adhesive for the manufacturing of the furniture that fueling the demand for the contact adhesive in wood-to-wood segment.

Whereas the plastic-to-plastic segment is observed to witness a notable rate of growth in the market. Plastics are extensively used in various industries, including automotive, electronics, construction, packaging, and consumer goods. The lightweight, durable, and versatile nature of plastics makes them a preferred material, driving the demand for effective adhesives for plastic-to-plastic bonding. Innovations in plastic materials, such as the development of high-performance plastics and composites, require specialized adhesives that can bond these materials effectively. This has led to an increased demand for advanced contact adhesives specifically designed for plastic-to-plastic applications.

The construction and building segment dominated the contact adhesives market in 2023. The rapid development in the construction and building industry due to the rising population and the demand for residential and commercial buildings globally that highly contributing to the expansion of the contact adhesive. These can be used in several construction activities like decorative panels, wall coverings, and bonding material in both exterior and interior spaces. With the construction industry, the contact adhesive industry used in the various other industrial applications like automobiles, furniture, transportation, woodworking, textile and fabrics, leather goods, packaging, electronics and appliances, DIY and crafts, etc. the increasing demand from the several industries and the high-quality usage that drives the expansion of the contact adhesives market.

On the other hand, the furniture and woodworking segment is observed to grow at a significant rate in the contact adhesives market. Expanding real estate activities, including new residential and commercial construction projects, increases the need for furniture and interior decoration, further propelling the demand for contact adhesives in woodworking and furniture applications. Increased interest in home renovation and remodeling projects fuels the demand for high-quality, durable, and aesthetically pleasing furniture. Contact adhesives are essential for creating robust bonds in furniture construction and repair, making them integral to these projects.

Asia Pacific led in the contact adhesives market and is observed to sustain as a leader during the forecast period in 2023. The market is expecting a substantial growth in the region due to the rising infrastructural development in the economically developing countries and the development of several industrial infrastructure like automobile, construction, electronics, and textile industry that driving the demand for the contact adhesive for the manufacturing of the finished products that accelerating the growth of the market. The ongoing investment in the construction sector is driving the expansion of the contact adhesives market across the region.

North America is observed to grow at the fastest rate in the contact adhesives market during the forecast period. The growth of the market is attributed to the rising development in the construction and industrial activities is driving the demand for the contact adhesive for the designing of wall coverings, furniture, and interior aesthetics. The higher availability of the major manufacturing industries and the rising commercial and residential building construction activities and the increasing use of the contact adhesives in the automobile and transportation industry is also positively influencing the growth of the contact adhesives market in the region.

By Type

By Substrate

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

August 2024

January 2025