What is the Container Security Market Size?

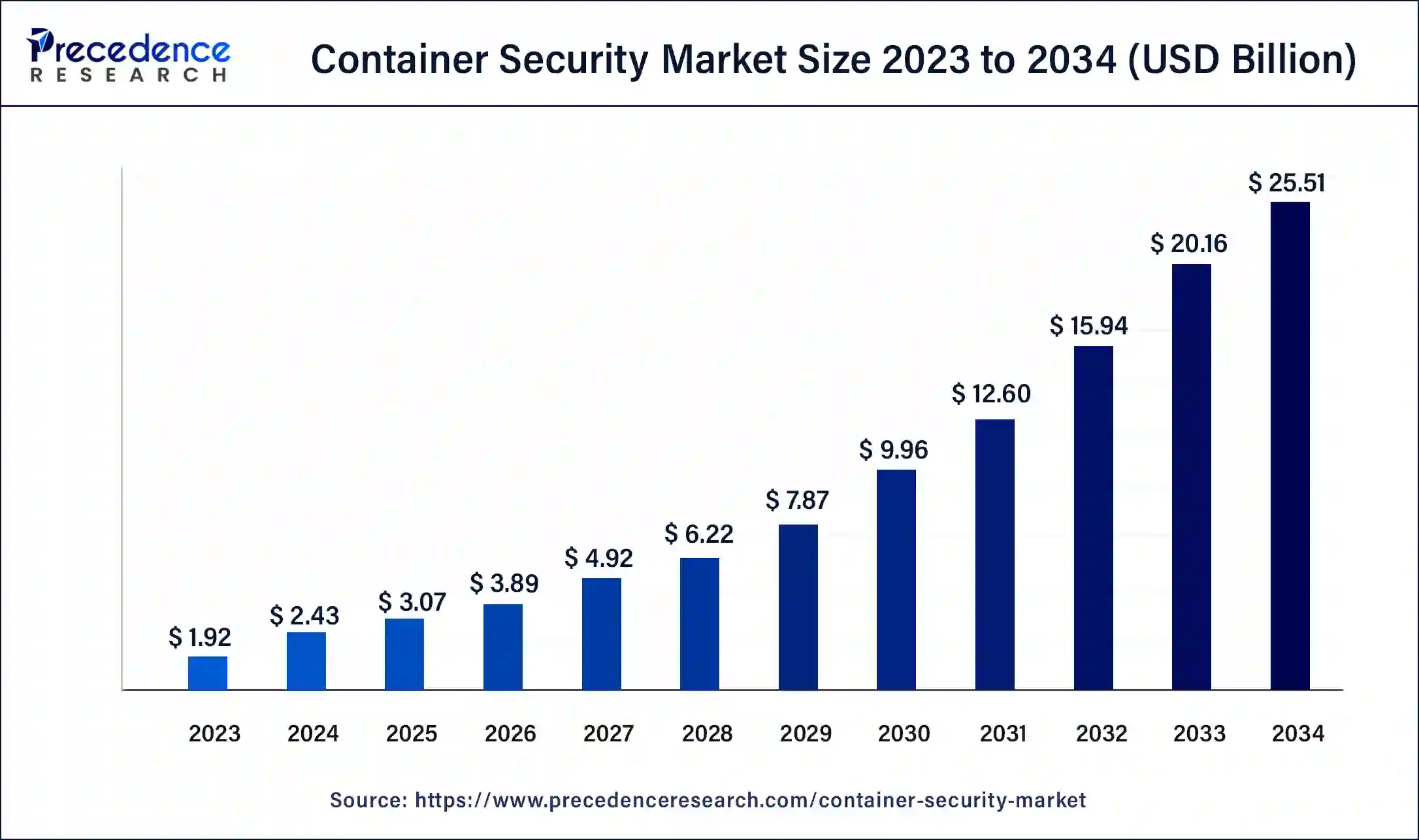

The global container security market size is valued at USD 3.07 billion in 2025 and is predicted to increase from USD 3.89 billion in 2026 to approximately USD 25.51 billion by 2034, growing at a CAGR of 26.51% over the forecast period 2025 to 2034. The North America container security market size reached USD 600 million in 2023. The container security market growth is attributed to rising cloud computing and the need for advanced security solutions to address evolving cyber threats and regulatory requirements.

Container Security Market Key Takeaways

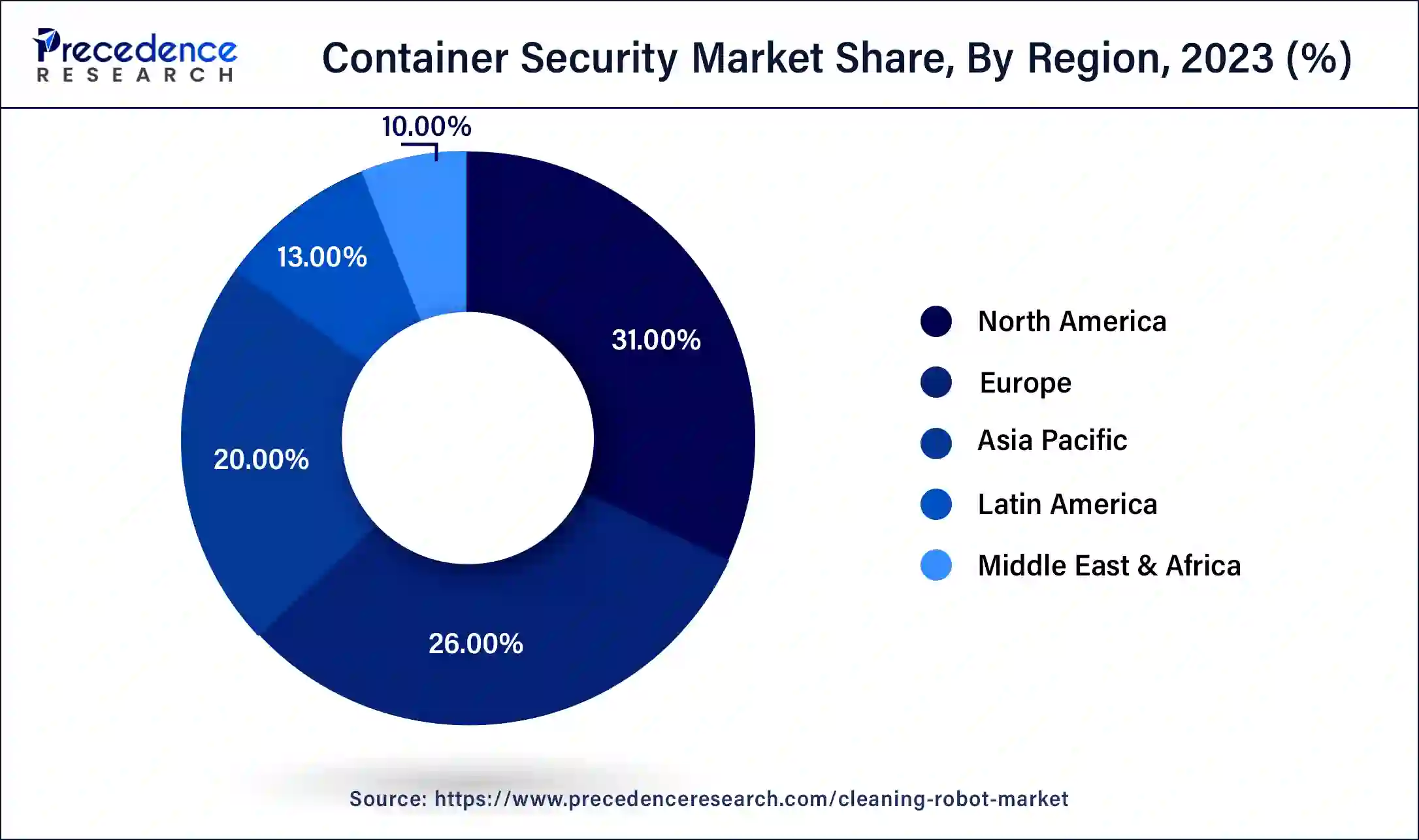

- North America dominated the container security market with the largest market share of 31% in 2024.

- Asia Pacific is expected to grow at a double digit CAGR of 29.94% during the forecast period.

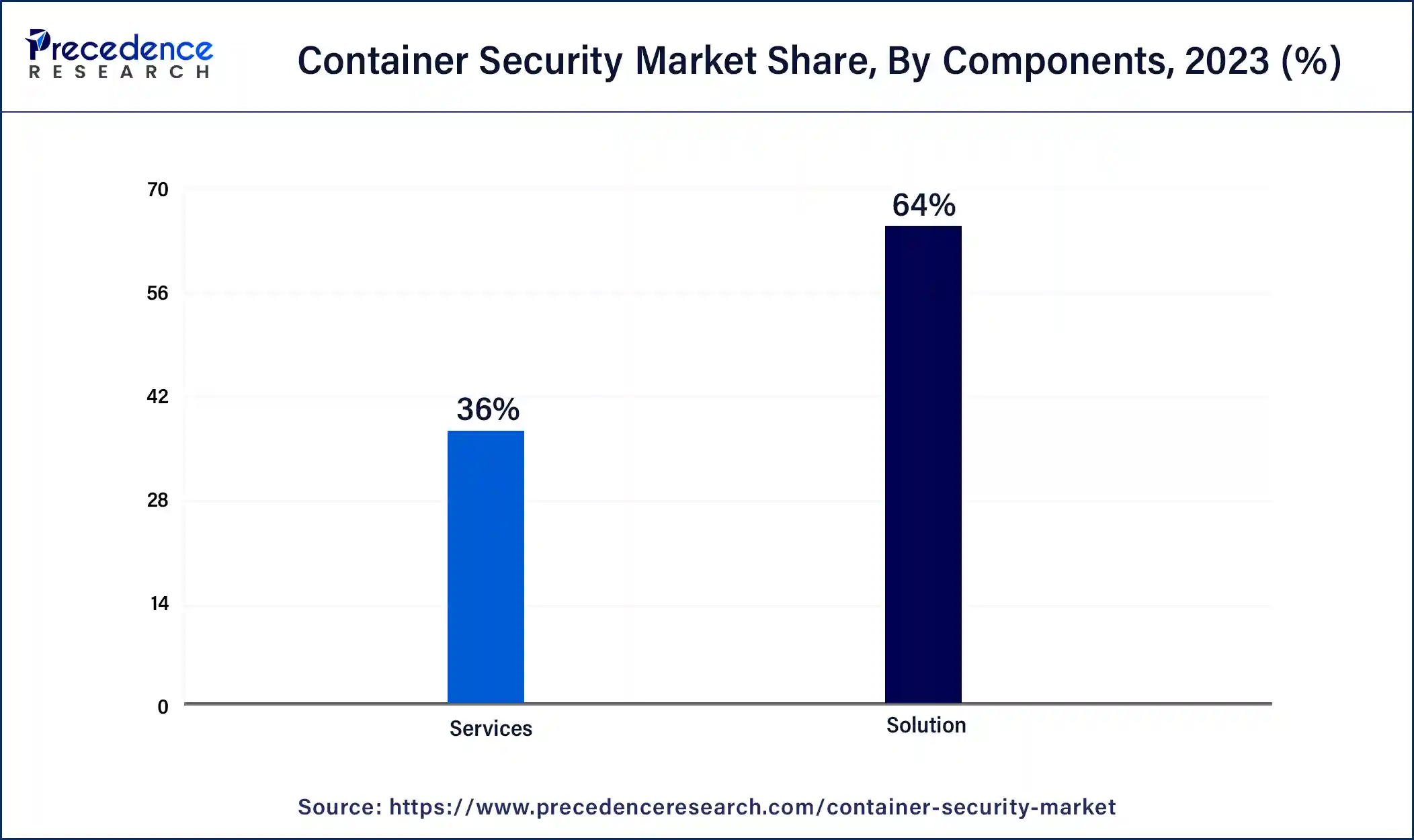

- By component, the solution segment contributed the highest market share of 64% in 2024.

- By component, the services segment is projected to expand at a notable CAGR of 27.42% during the forecast period.

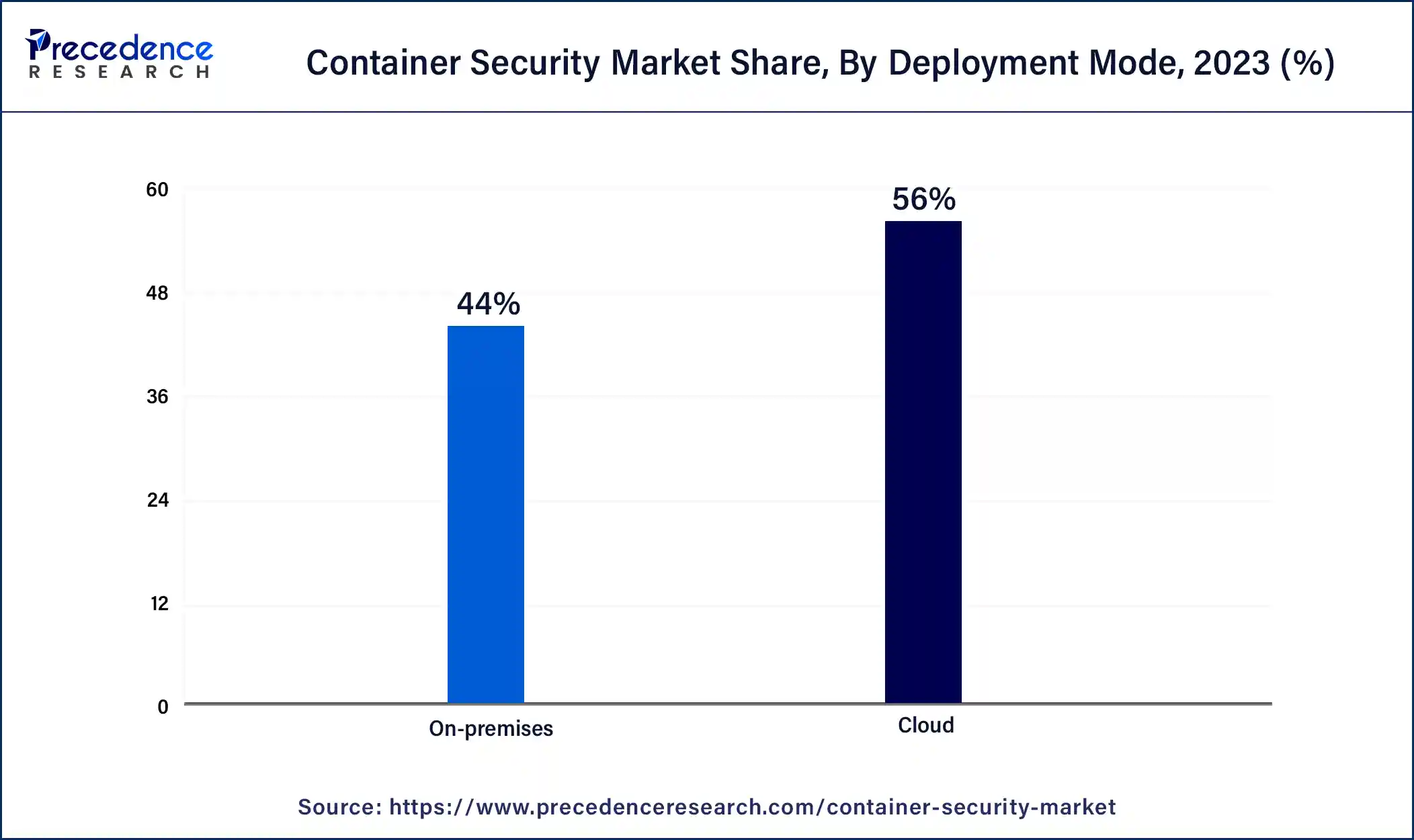

- By deployment mode, the cloud segment generated the largest market share of 56% in 2024.

- By deployment mode, the on-premises segment is registering a double digit CAGR of 24.62% during the forecast period.

- By enterprise size, the large enterprises segment captured the highest market share of 53% in 2024.

- By enterprise size, the small & medium enterprises segment is projected to grow at a solid CAGR of 27.33% during the forecasting period

- By vertical, the IT & telecommunication segment held the largest share of 23% in 2024.

- By vertical, the healthcare segment is projected to expand rapidly in the market in the coming years.

U.S. Container Security Market Size and Forecast 2025 to 2034

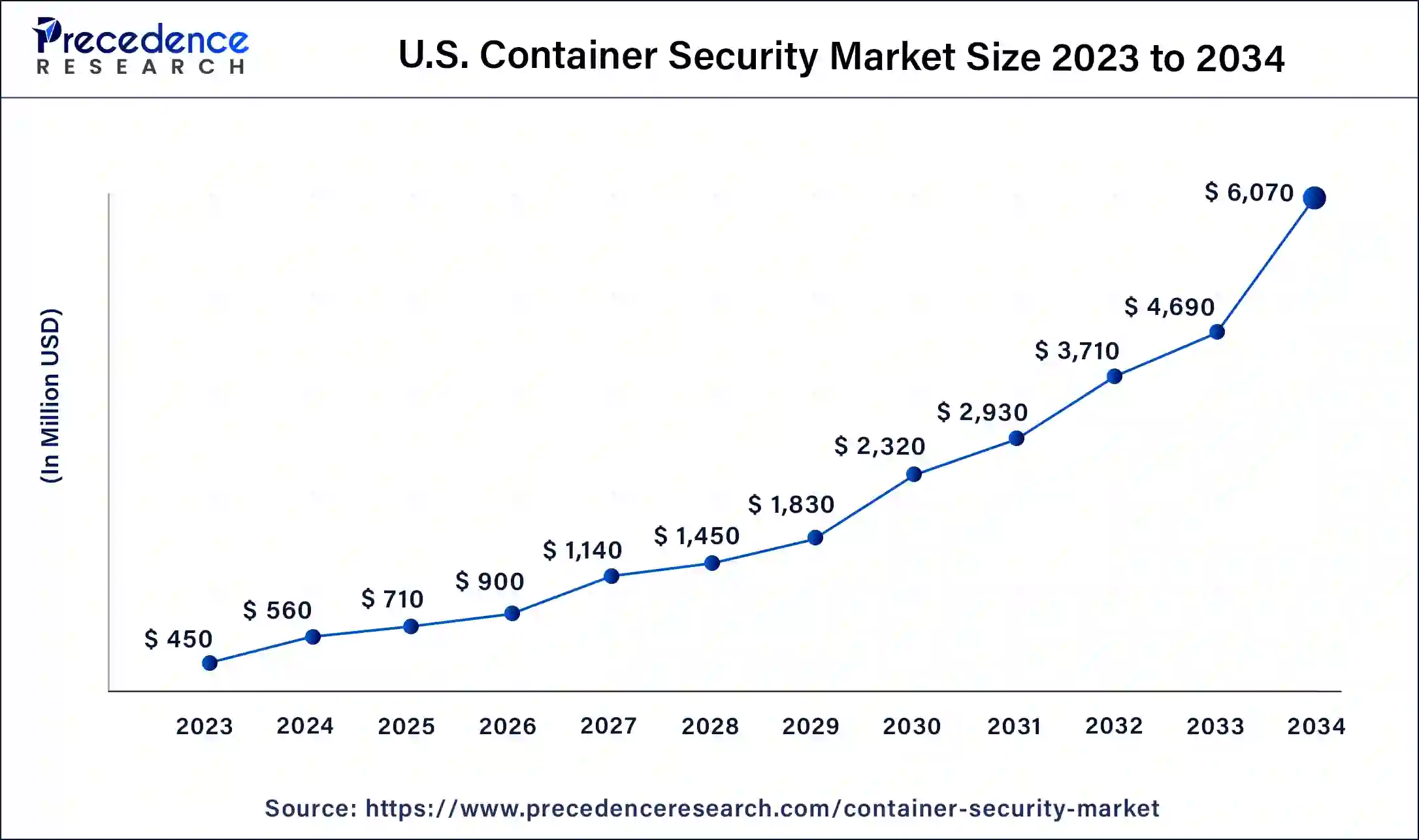

The U.S. container security market size is exhibited at USD 710 million in 2025 and is projected to surpass around USD 6,070 million by 2034, poised to grow at a CAGR of 26.68% from 2025 to 2034.

North America dominated the container security market in 2024 owing to the advanced technological environment and high rates of adopting containerized applications in the region. IT, financial, healthcare companies, and others in this region have incorporated container technologies to improve flexibility and business growth. The region's emphasis on cybersecurity combined with specific legal requirements, such as GDPR and HIPAA, significantly boosted the need for a secure container. Moreover, the companies spent money on security technologies and compliance with industry regulations, thus boosting the market.

North America: U.S. Container Security Market Trends

In the U.S., the market is accelerating as companies rapidly adopt cloud-native and containerized applications, triggering strong demand for runtime protection and image-scanning solutions. Regulatory and compliance pressures, especially in industries like healthcare and finance, are pushing firms to secure their container environments aggressively. Automated security tools, integrated with CI/CD pipelines and DevSecOps workflows, are becoming the norm, enabling vulnerability scanning and threat detection earlier in the development cycle.

Asia Pacific is expected to grow at the fastest CAGR in the container security market during the forecast period due to the increased rate of digitization and growth of the adoption of containers in several fields and sectors. These countries, including China, India, and Japan, are expected to show high growth because of the increasing IT infrastructure adopted in developing countries, along with growing consciousness about cloud solutions. There is an increasing number of startups and SMEs in this region, which creates a need for secure and elastic IT solutions, such as container security. The demand for new regulations and the desire to counter increasingly complex cyber threats are fuelling investment in secure containers, which further propels the market in this region.

Europe: Germany Container Security Market Trends

Germany's market is rapidly growing, supported by a surge in demand for real time visibility and protection of containerized applications, especially with increasing cyber threats. The rise of containerization and DevOps practices in German companies is driving adoption of full-lifecycle security solutions that cover development, deployment, and runtime. Government policies emphasizing cybersecurity and infrastructure protection are pushing organizations to implement stricter container security controls.

The European container security market is growing steadily, propelled by growing reliance on cloud-native applications and increasing concerns during periods of cyber threat. Enterprises are prioritizing strong container security solutions to protect important workloads. As demands increase and as organizations pursue regulatory initiatives and digital transformation, the container security market will experience growth with increasing demand for cloud-based, automated, platform security solutions for containerized environments.

Why did Latin America experience remarkable growth in the global container security market?

Latin America has seen remarkable growth, primarily because corporations are migrating to cloud platforms and are in greater need of better security for digital applications. Brazil, Mexico, and Chile scaled their IT systems, and demand for protecting containers surged. A wave of cyberattacks compelled organizations to add to their security tool suite. There were good opportunities across the region for low-cost security platforms, managed services, and training programs, which allowed more businesses to onboard modern cloud native protection.

Brazil Container Security Market Trends

Brazil led the Latin American region in the container security market. Its financial, retail, and telecom sectors were quickly migrating to cloud-native applications. As businesses implemented containers (in response to scaling services), a desire for strong security grew alongside. Brazil was experiencing a wave of cyber-issues, which subsequently caused businesses to invest more in security. The region also has a rising number of local technical stretching from security to wider tech partnerships with global vendors, allowing organizations to improve runtime protection, monitoring, and compliance.

Why did the Middle East & Africa experience remarkable growth in the global container security market?

The Middle East & Africa area expanded quickly because the region invested heavily in the modernization of cloud systems and cybersecurity. Banks, oil and gas enterprises, and public sector agencies used containers as they modernized operations, leading to increased security requirements. The area received increased cyber threat risk, which resulted in increased spending on protection tools. There were also numerous instances of securing automation, real-time observability, and scalable cloud-native security use cases, especially in the GCC countries and in South Africa.

The UAE Container Security Market Trends

The UAE led the region as it has been very aggressive in its investment in digital transformation and cloud. There were numerous examples of governmental agencies and large enterprises adopting containers as they created smart-city projects and fintech programs, which led to an increased appetite for newer security tools. Additional benefits of the UAE include strong cybersecurity laws and partnerships with leading cloud vendors, leading to enhanced monitoring, compliance, and protection systems.

What is Container Security?

Increasing trends in serverless technologies force organizations to upgrade their security services further and boost the container security market. Organizations are leveraging innovative tools, including CIAM frameworks, to safeguard vital organizational data and users' personal data. These security structures improve the capability to control access, meet the requirements of law, and address threats linked to unauthorized entry. Businesses are also buying advanced security systems that are all-in-one and have real-time analytics and alerts, detection systems, and automated responses. The ongoing development of information technologies and the growth of digitalization are creating the need for effective security solutions for modern IT infrastructures, which is becoming acute.

The Impact of artificial intelligence on the container security market

Businesses in different sectors apply AI in business processes in order to cut costs of delivering services or goods and deliver services tailored to individual client needs. AI algorithms take huge amounts of data and process them in order to identify frauds, trends, and optimal trades. It helps retailers control inventory, supply chain, and marketing using insights derived from the application of artificial intelligence, thereby prompting sales and increasing the satisfaction of their clients. Furthermore, the utilization of AI facilitates technological development, which boosts the demand for new solutions and contributes to fueling the container security market growth.

- In May 2024, Aqua Security Software Ltd, a leading provider of security solutions, introduced an advanced feature specifically designed to secure the development and operation of generative AI applications that leverage Large Language Models (LLMs). As businesses increasingly adopt LLMs, new attack vectors emerge, posing challenges to application and operational security.

What are the Growth Factors in the Container Security Market?

- Container security solutions are experiencing significant growth due to the increasing adoption of containerized applications across enterprises of all sizes. The rise in cloud computing and serverless technologies also drives demand for the container security market.

- The IT & telecommunication sector has led the market, with large enterprises dominating the space due to their extensive use of container technologies and complex security needs. However, SMEs are expected to become a major growth driver of the container security market in the future as container adoption broadens.

- North America has historically been the leading region due to its advanced technological infrastructure and high investment in cybersecurity.

- Cloud deployment of container security solutions has been dominant, attributed to its scalability and ease of integration. However, hybrid cloud deployments are expected to lead in the future as organizations seek solutions that can secure both cloud and on-premises environments.

- Emerging technologies such as AI and machine learning are playing a significant role in enhancing container security. Advanced solutions that offer automated threat detection, real-time monitoring, and integrated security management are becoming essential for protecting containerized environments.

Container Security Market Outlook

- Industry Growth Overview: The container security segment is expected to rapidly grow from 2025 to 2030 as the adoption of cloud-native applications, microservices, and stronger cybersecurity requirements all increase. Growth was accelerated by a strong push from enterprises in North America and Asia Pacific that are moving to automated, policy-based security for their Kubernetes and DevOps pipelines.

- Sustainability Trends: Sustainability influenced container security by promoting energy-efficient cloud operations, decreasing waste in infrastructure, and smarter resource allocation. Vendors invested in a more efficient security stack through lightweight and optimized security agents and an AI-driven, proactive workload scanning to reduce processing overhead. Moreover, vendors also aligned with a global green-IT push and data-center operational mandates.

- Global Expansion: Key players expanded to Southeast Asia, Eastern European region, and LATAM to capitalize on growing cloud adoption in addition to meeting local compliance requirements. Companies built and extended local datacenters and security integration hubs to allow organizations to secure containers near the end user and government-mandated data-sovereignty requirements.

- Key Investors: Private equity and strategic investors found this market attractive due to its strong ARR potential, high technical complexity, and long enterprise security spend cycles. Investors like Thoma Bravo and Insight Partners expanded their investments in cloud-native security portfolios. These investors backed up several platforms that were providing unified or single-pane-of-glass protection across containers, serverless workloads, and CI/CD pipelines.

- Startup Ecosystem: The startup in this space grew rapidly as new companies and projects came out; many focused on runtime security, identity-based workload protection, and AI-assisted anomaly detection. Startups on the Sysdig architecture and new Kubernetes security companies emerging in India and the U.S. received notable VC funding as businesses looked for faster and more developer-friendly tooling.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.51 Billion |

| Market Size in 2025 | USD 3.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 26.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Components, Deployment Mode, Enterprise Size, Vertical and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of containers

Increasing adoption of containers is anticipated to drive the demand for robust security solutions. BMC has identified that there is a fast and constant growth of containerized applications that increase the flexibility of application development and deployment. Microservices architecture is implemented using containers, and while it helps increase efficiency, new forms of security threats are created. Furthermore, the changing to hybrid and multi-cloud patterns increases security requirements that should be implemented similarly throughout the infrastructure. Thus driving the container security market.

Companies are trying to adopt and implement the best security measures that are suitable for the container kinds of environments and fit the regulatory requirements. Such a trend contributes to the development of specialized security tools that provide threat detection in real-time and manage vulnerabilities above and beyond monitoring throughout the settings of containers. All these factors will further contribute to boosting the container security market in the coming years.

- In May 2024, Picus Security, a prominent provider of detection analytics and mitigation solutions, unveiled a new security validation capability for Kubernetes. This addition enables Security and DevOps teams to leverage containers securely by proactively assessing and enhancing the resilience of their clusters.

Restraints

Complexity of the industry

Hamper adoption due to complexity is anticipated to impact the container security market. Protecting the containerized hosting environment is complex, made of intricate procedures, and best handled by professionals. One more challenge is that security programs do not fit smoothly into the IT environment and, thus, require more time and money to be implemented. The problem of security standardization across different container platforms adds to the deployment issue. This characteristic may limit the penetration of effective container security solutions, especially by small enterprises, due to resource constraints, thereby limiting the market growth.

Opportunity

High demand for automated security solutions

Growing demand for automated and advanced security solutions is expected to create immense opportunities for the players competing in the container security market. Containerization is a powerful component for the security of the organization's network, using automated security systems to facilitate continuous monitoring and eliminate threats in real-time. These tools help maintain an organized procedure in terms of security across various infrastructures, thus improving efficiency and security jointly.

Continuous increase in the concept of DevSecOps intensifies this need, making ample growth opportunities available for vendors specializing in refined automatic security solutions. Furthermore, other automated tools help in scalability by dealing with large numbers and diversification of operations on containerized applications. They also enhance compliance operations since they accrue automated reports and record-keeping, and forestalls are critical in compiling indispensable authoritative standards.

Components Insights

The solution segment held the largest share of the container security market in 2024 due to the gradual adoption of potentially optimized security technologies specifically designed for the usage of containers. Businesses focused on strong product development, which included security programs, firewalls, and other means of safeguarding container applications from highly sophisticated threats. These products provided threat detection in real-time, constant monitoring, and self-approval for compliance, which were the biggest requirements as containers began to be used actively. Furthermore, the growing awareness of the specificity of threats and the need for specific products that would ensure the safety of containers further boost their demand.

The services segment is projected to witness rapid growth in the container security market in the future years, owing to the growing awareness and demand for professional assistance and solutions in the sphere of creating and implementing container environments. Organizations are beginning to embrace the use of container technology to deal with security challenges that arise. Consulting and implementation, for example, managed security services, are expected to be resilient as more and more businesses need to incorporate robust security solutions with ease. The phenomenon of using third-party service providers in security management is expected to expand as companies continue delegating this function to firms specializing in this area. All these factors are contributing to fuelling the segment's growth.

Deployment Mode Insights

The cloud segment led the global container security market in 2024 due to the strong tendency to use cloud-native technologies and the significant transition to cloud-based environments. Businesses, therefore, have started to move their applications to the cloud to take advantage of aspects such as capacity, elasticity, and cheaper means. This transition increased the requirement for advanced protection procedures suitable for the cloud. Container security solutions deployed on the cloud provide tight integration with applications, the ability to update the solution on its own, and real-time threat identification, which comes as a convenient solution for those organizations focusing on innovation and faster deployments. This segment's growth propels the diversification of hybrid & multi-cloud environments with similar, uniform security challenges.

The on-premises segment is projected to expand rapidly in the container security market in the coming years due to the move towards the use of hybrid clouds as part of the continued growth, especially by large-scale business organizations. Businesses are required to adopt hybrid cloud solutions to combine the advantages of both cloud and on-premise infrastructures while providing faster and more efficient cost-output ratios. This approach needs security solutions that offer undisturbed protection of the different infrastructures, including the on-premise and cloud structures.

Enterprise Size Insights

The large enterprises segment dominated the container security market in 2024 due to their large-scale investment functions and high levels of need for security. These organizations use containerized applications substantially to increase the availability of better performance, flexibility, reliability, and density. The scale leaders increased their focus on the extended container protection tools that provide listing and potential risk identification and management in real time. This factor of protecting vital business processes and customer relations has made large enterprises, which further boosts the container security market.

The small & medium enterprises segment is projected to grow rapidly in the container security market during the forecasting period, owing to the growing use of container technologies in small and medium-sized organizations. SMEs are to run containerized applications to attain outcomes of cost optimization and flexibility in business operations. This adoption means that there is a need for adequate security measures that are put in place to meet their need. Increased availability of cheap and easy-to-implement container security solutions also presents the ability for SMEs to start protecting their container environments. Furthermore, the rising concern for cyber security attacks and compliance needs may also increase the need for sophisticated security tools among SMEs.

Vertical Insights

The IT & telecommunication segment held the largest share of the container security market in 2023, owing to the increasing use of containers in apps and delivery of microservices architectures across the industry. The firms in this sector used containers to increase flexibility, complete software delivery faster, and address resource management effectively. The situation in IT & telecommunication was complicated by the scale and scope of the infrastructures dealing with the security of data, reliable service delivery, and meeting regulatory requirements. Constant evolution and the nature of business in this industry that focused on utilizing up-to-date technologies raised the need for sound, reliable, efficient, and highly effective container security options capable of offering real-time risk identification, handling of all types of vulnerabilities, and monitoring.

The healthcare segment is projected to expand rapidly in the container security market in the coming years due to the advance of modern technologies in the sector and higher legal standards. Envisioning containerized applications embraced by healthcare organizations as nursing care delivery models, healthcare operations, and modern research in medical practice. Healthcare data has a lot of individual data that have to be secure when stored. Furthermore, the increased focus on safeguarding patients' data and the overall soundness of healthcare systems leads to the development of stronger container security measures within this segment.

Container Security Market Companies

- Amazon Web Services

- Anchore

- Aqua Security

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- CROWDSTRIKE

- Docker Inc.

- HCL Technologies Limited

- IBM

- Microsoft Corporation

- Palo Alto Networks

- Qualys

- Sophos

- VMware

- Zscaler

Recent Developments

- In May 2025, Red Hat launched version 10 of Red Hat Enterprise Linux (RHEL). This new platform offers companies an intelligent and secure foundation for hybrid cloud environments and AI workloads. RHEL 10 introduces AI-driven management technology, post-quantum cryptography, and a container-native approach to operating systems and applications. (Source: https://www.techzine.eu)

- In May 2025, Docker launched Docker Hardened Images (DHI), a curated catalog of secure container images for enterprise environments. The solution offers minimal, continuously maintained images that meet strict security standards and are available immediately via Docker Hub. (Source: https://www.techzine.eu)

- In April 2025, Aqua Security, the pioneer in cloud native security, announced the Container Security Risk Assessment (CSRA), the industry's first free assessment focused on uncovering real-world risks in running containerized environments. Aqua's CSRA provides insight into containerized environments by identifying anomalous behavior, potential misconfigurations, and active threats using telemetry from Aqua's runtime agents. (Source: https://www.globenewswire.com)

- In April 2025, Lineaje announced new end-to-end capabilities aimed at improving software supply chain security for organisations. The new offerings include agentic AI-powered self-healing for open-source software, source code, and containers, alongside Gold Open Source Packages, Gold Open Source Images, and a software risk analysis engine called SCA360. The agentic AI functionality enables automatic detection and remediation of security risks within codebases and container environments. (Source: https://securitybrief.asia)

- In April 2025, Seal Security, a leader in open-source vulnerability remediation, launched the Seal Base Images, a solution designed to future-proof containerized applications. Seal Base Images delivers secure, continuously updated, and vulnerability-free base images, effectively eliminating up to 99% of potential future vulnerabilities. (Source: https://www.wric.com)

- In October 2022, Veracode, a global leader in application security, announced an upgrade to its continuous software security platform, incorporating container security. The enhanced Veracode Container Security is tailored to meet the needs of cloud-native software engineering teams.

- In October 2023, AO Kaspersky Lab launched Kaspersky Container Security (KCS), a comprehensive solution for securing containerized environments. KCS provides protection for containerized applications throughout their development and operational phases. The solution is designed for ease of use, with a low-cost, simple deployment process that integrates seamlessly into existing IT infrastructures.

Segments Covered in the Report

By Components

- Solution

- Services

By Deployment Mode

- Cloud

- On-premises

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Retail

- Government

- Healthcare

- Manufacturing

- IT & Telecommunication

- Other

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting