January 2025

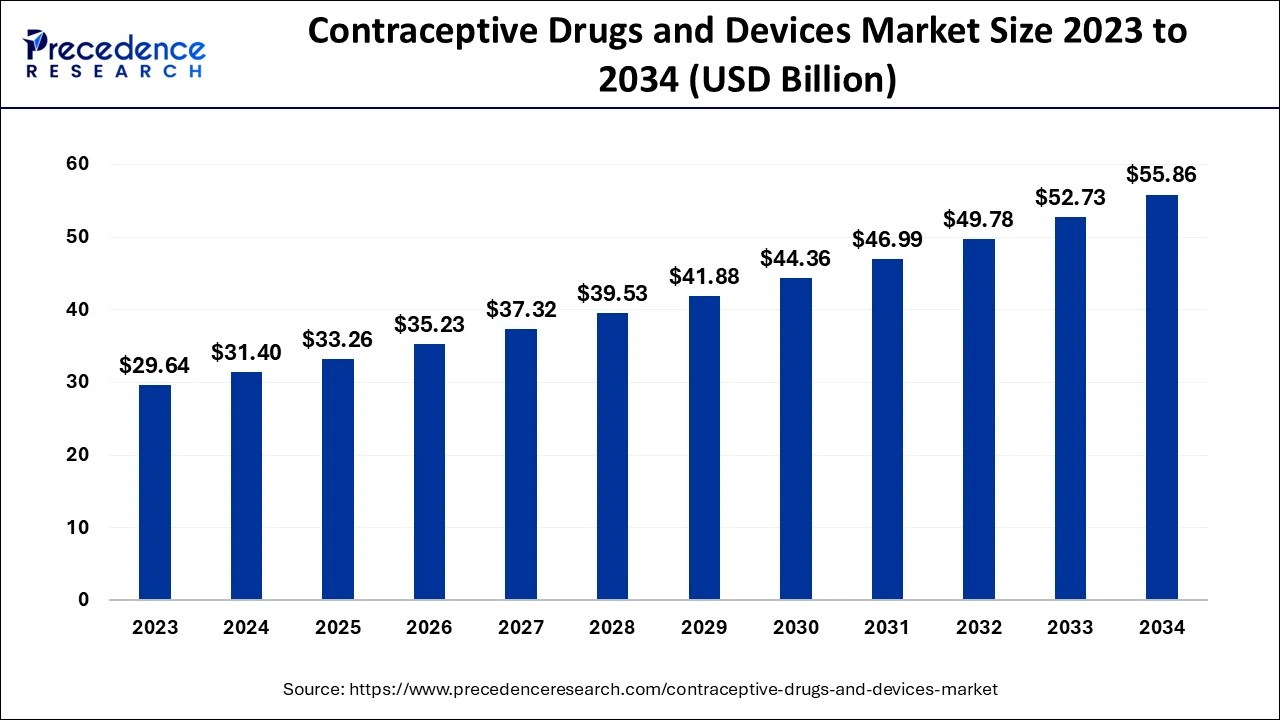

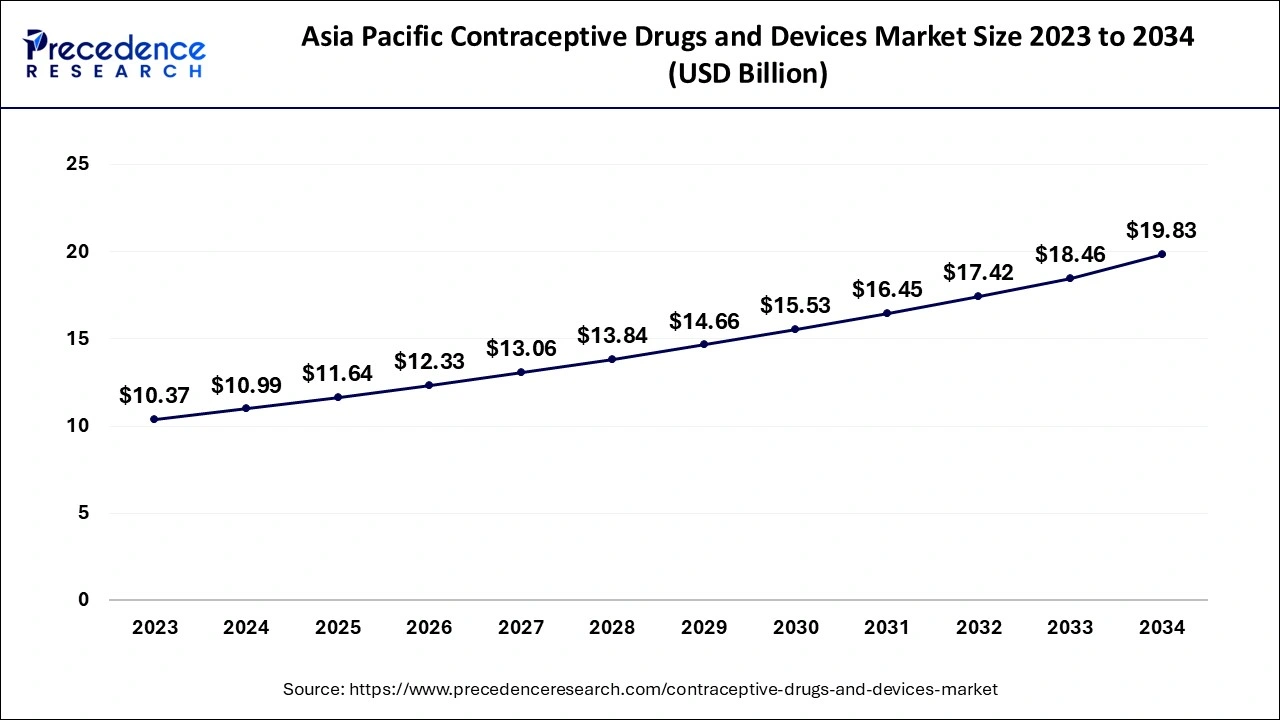

The global contraceptive drugs and devices market size accounted for USD 31.40 billion in 2024, grew to USD 33.26 billion in 2025 and is expected to be worth around USD 55.86 billion by 2034, registering a healthy CAGR of 5.93% between 2024 and 2034. The Asia Pacific contraceptive drugs and devices market size is evaluated at USD 10.99 billion in 2024 and is expected to grow at a CAGR of 6.07% during the forecast year.

The global contraceptive drugs and devices market size is calculated at USD 31.40 billion in 2024 and is projected to surpass around USD 55.86 billion by 2034, expanding at a CAGR of 5.93% from 2024 to 2034. The increase in the number of sexually transmitted diseases and unintended pregnancies is expected to drive market growth. Government efforts to spread awareness regarding contraception are also driving market growth. In addition, increasing government policies on controlling the population are further anticipated to enhance the contraceptive drugs and devices market growth.

The Asia Pacific contraceptive drugs and devices market size is exhibited at USD 10.99 billion in 2024 and is anticipated to reach around USD 19.83 billion by 2034, growing at a CAGR of 6.07% from 2024 to 2034.

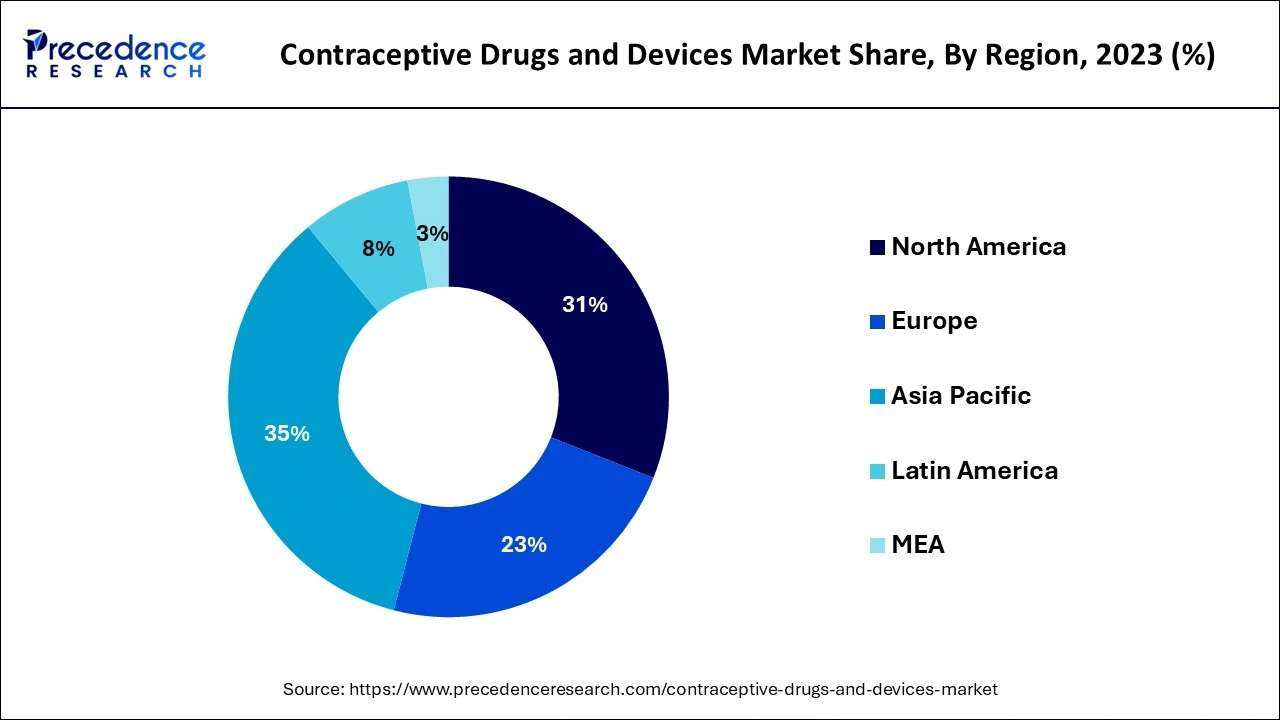

Asia Pacific dominated the contraceptive drugs and devices market in 2023. The market growth in the region is fueled by the increasing prevalence of unwanted pregnancies and STDs and the rising population. To mitigate problems such as STDs, abortion, and unwanted pregnancies, urban populations in the region have increased the use of contraceptive measures. In addition, increasing government initiatives and advanced healthcare infrastructure are further anticipated to enhance the market growth in North America.

The U.S. will dominate the North American contraceptive drugs and devices market in 2023. The major factors expected to the market growth in the U.S. are widespread access to an increase in the awareness of unwanted pregnancies and STDs and contraceptive measures. So many options for contraceptive measures are present in healthcare, making contraceptive devices and drugs more accessible to the population. In addition, increasing awareness by public and government welfare groups about abortions and STDs.

North America is expected to grow rapidly in the contraceptive drugs and devices market during the forecast period. The market growth in the region is attributed to the increasing initiatives taken by the government to make people aware of unwanted pregnancies and STDs. The government has also been active in offering contraceptive measures in the funded medical institutes of the government. In addition, the increasing focus on family planning by the rising population due to the rise in STDs and unwanted population has resulted in the increased sale of contraceptive devices and drugs in the Asia Pacific. China, India, Japan, and South Korea are the major countries in the region.

China is the major and fastest-growing country in the healthcare sector and held the Asia Pacific contraceptive drugs and devices market’s largest share in 2023. The market growth is driven by growing awareness about unwanted pregnancies and STDs and the presence of major manufacturing companies. Due to the presence of a developed cheap labor and manufacturing sector, Major pharmaceutical companies can manufacture contraceptive products in huge numbers. In addition, due to the country's strong distribution channel, the products are deployed quickly to the customers. Additionally, the increased population has been due to the government putting more initiatives to educate the population about contraceptive measures.

Contraceptive drugs and devices market deals with surgical treatments, medicines, and medical devices that are used to prevent pregnancy. Contraceptive devices and drugs are also working to keep sexually transmitted illnesses at STDs. It might be permanent or temporary, and both women and men could benefit from it. Sterilization for women and men is a permanent process, whereas non-hormonal and hormonal procedures are only temporary. In addition, increasing the number of women in the workforce, technological progress, and growing world population.

How is AI Changing the Contraceptive Drugs and Devices Market?

Artificial intelligence (AI) is changing the contraceptive drugs and devices market by providing innovative solutions beyond traditional methods of birth control. Diaphragms and smart condoms coupled with AI technology can offer potential risks, effectiveness, and real-time feedback on usage. It stands as an enhancing fore in generating a more inclusive, effective, and personalized approach to contraception beyond traditional birth control pills. Advanced algorithms provide personalized fertility window predictions by analyzing factors such as hormonal fluctuations, cervical mucus patterns, and basal body temperature. Thus aiding the development of non-hormonal contraceptive additives. Furthermore, AI-generated tracking techniques go beyond traditional methods. AI can assist in identifying non-hormonal methods tailored to individual preferences and health considerations by analyzing data related to fertility indicators and reproductive health.

| Report Coverage | Details |

| Market Size by 2034 | USD 55.86 Billion |

| Market Size in 2024 | USD 31.40 Billion |

| Market Size in 2025 | USD 33.26 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.93% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Outlook, Distribution Channels Outlook, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

The growing emphasis of major healthcare organizations and manufacturers

The increasing prevalence of major healthcare organizations and manufacturers raising awareness of contraception options is the major driver of market growth. Various issues, including supply chain disruption, were blamed for his higher revenue drop. In addition, there have been significant disruptions of family planning and contraception services in various countries. A rise in government activities, the number of unplanned pregnancies, and the increasing prevalence of STDs are some factors fueling the market growth. Since they are growing more commonplace globally, unwanted pregnancies are a major concern. Due to this, the increase in unwanted pregnancies is expected to increase demand for contraceptive devices and medications.

Side effects associated with drugs and lack of awareness

The long-term use of birth control devices and medications is related to various kinds of side effects such as weight gain, nausea, headaches, and bleeding. Various research studies have been published to highlight the long-term side effects associated with birth control drugs. In addition, social taboos and lack of awareness about contraception methods are accountable for the low adoption of drugs and devices in emerging countries. Furthermore, the availability of alternative contraceptive methods such as IUDs, condoms, and other physical barriers are effective side effects.

Rapidly growing product portfolio

The increasing number of new product launches and a rise in disposable income in developed and advancing countries are expected to offer significant opportunities for market growth in the coming year.

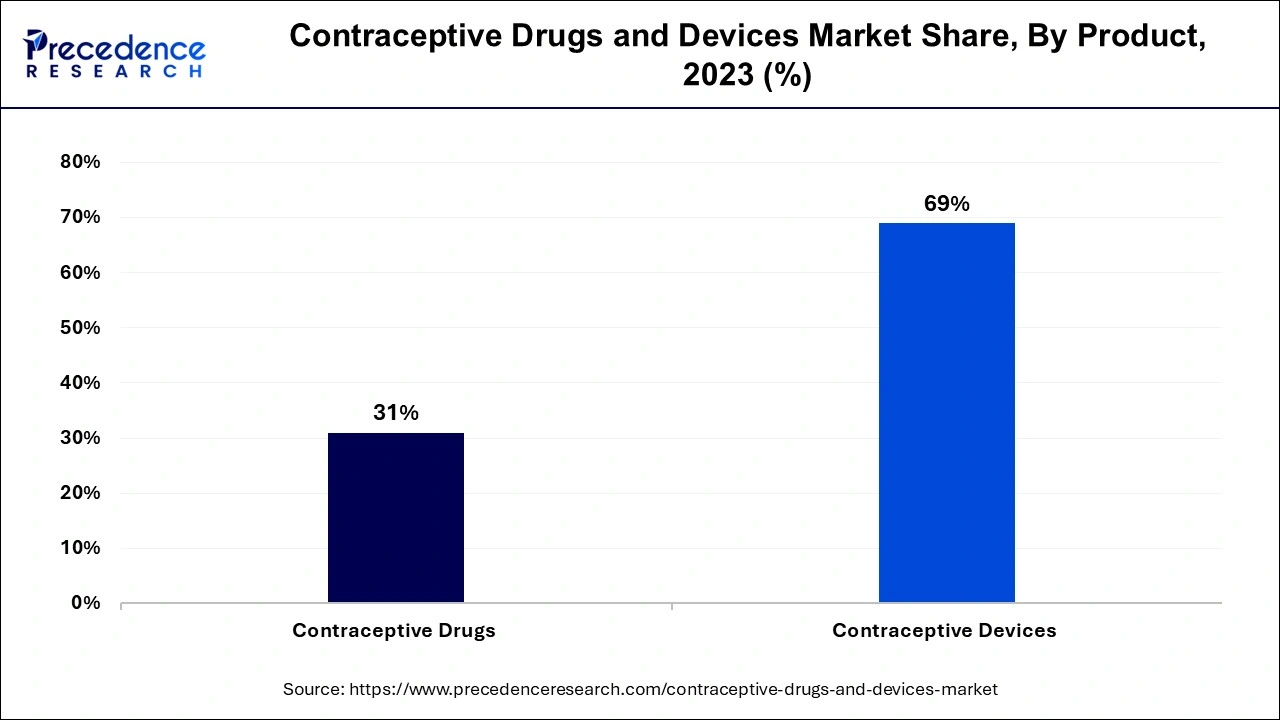

The contraceptive devices segment dominated the contraceptive drugs and devices market in 2023. The contraceptive devices segment is further classified into diaphragms, subdermal implants, vaginal rings, condoms, and intrauterine devices. The segment growth is driven by increasing awareness regarding contraceptive devices as public and government welfare groups have been active in spreading awareness related to unwanted pregnancies. Contraceptive devices are effective in preventing unwanted pregnancies and the spreading of STDs. In addition, major market players are investing significantly in emerging advanced contraceptive devices such as subdermal implants, vaginal rings, condoms and intrauterine devices, and more.

The contraceptive drugs segment is expected to grow at the fastest rate in the contraceptive drugs and devices market during the forecast period, leading to increasing awareness regarding preventive measures such as injectables, patches, and pills, and unwanted pregnancies. The growing acceptance and increased accessibility of contraceptive drugs across the urban population are fueling the market growth of this segment, as the population is giving higher importance to family planning and sexual health.

The retail pharmacy segment dominated the global contraceptive drugs and devices market in 2023. Various countries such as India, China, Mexico, and Brazil allow birth control pills to be sold across the medicine shops. This factor has led to a significant shift of customers toward retail pharmacies for acquiring birth control pills. Also, the increasing awareness about various contraception methods and increasing demand for OTC contraception drugs across the general population.

The online channels segment is expected to grow rapidly in the contraceptive drugs and devices market during the forecast period. The segment growth is responsible for the increasing adoption of over-the-counter services coupled with various online discounts and offers to attract customers. In addition, the all-time availability of these drugs and a wide distribution channel such as patches, injectables, and oral pills of different brands.

Segment Covered in the Report

By Product

By Distribution Channels Outlook

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

March 2025