February 2025

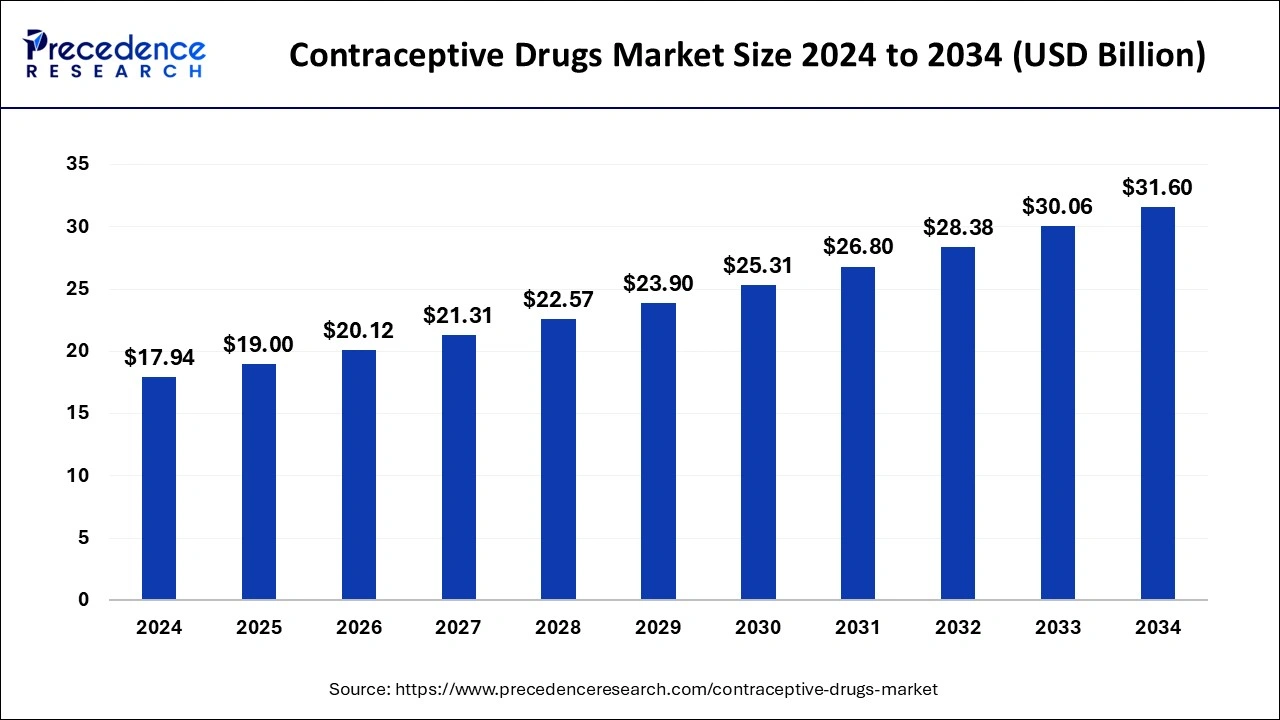

The global contraceptive drugs market size is calculated at USD 19 billion in 2025 and is forecasted to reach around USD 31.60 billion by 2034, accelerating at a CAGR of 5.82% from 2025 to 2034. The North America contraceptive drugs market size surpassed USD 7.36 billion in 2024 and is expanding at a CAGR of 5.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contraceptive drugs market size was valued at USD 17.94 billion in 2024 and it is expected to hit around USD 31.60 billion by 2034, poised to grow at a CAGR of 5.82% from 2025 to 2034. The rising number of unwanted pregnancy cases and sexually transmitted diseases fuel the development of the contraceptive drugs market.

The role of AI in medicine development is significant, as it is crucial in revolutionising the pharmaceutical industry. AI can monitor drug preparation and predict effectiveness, which increases the market's demand. The process of discovering drugs and developing new medicines is complex and consumes a lot of time and labour when following traditional methods. With the incorporation of artificial intelligence techniques such as natural language processing and machine learning this process becomes easy and complete within less time. Deep learning technology helps to predict the efficiency of medicines which ultimately increases the market demand and boosts the market development.

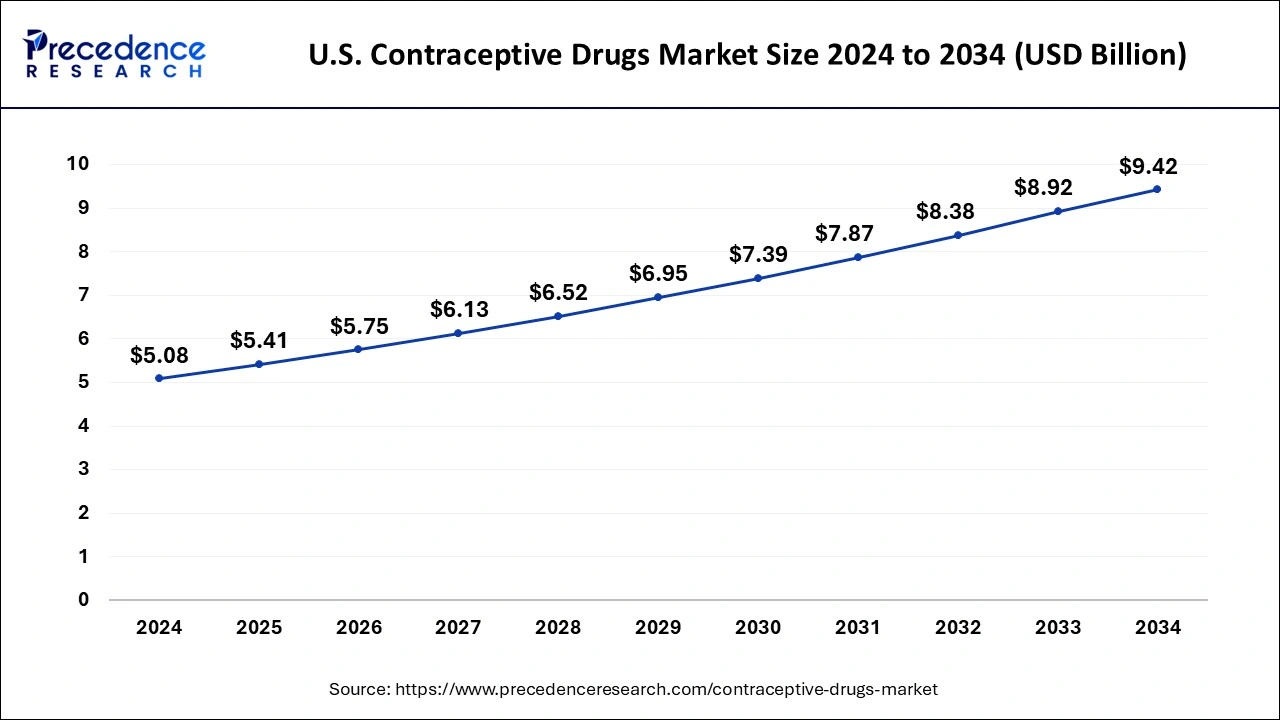

The U.S. contraceptive drugs market size was estimated at USD 5.08 billion in 2024 and is predicted to be worth around USD 9.42 billion by 2034, at a CAGR of 6.37% from 2025 to 2034.

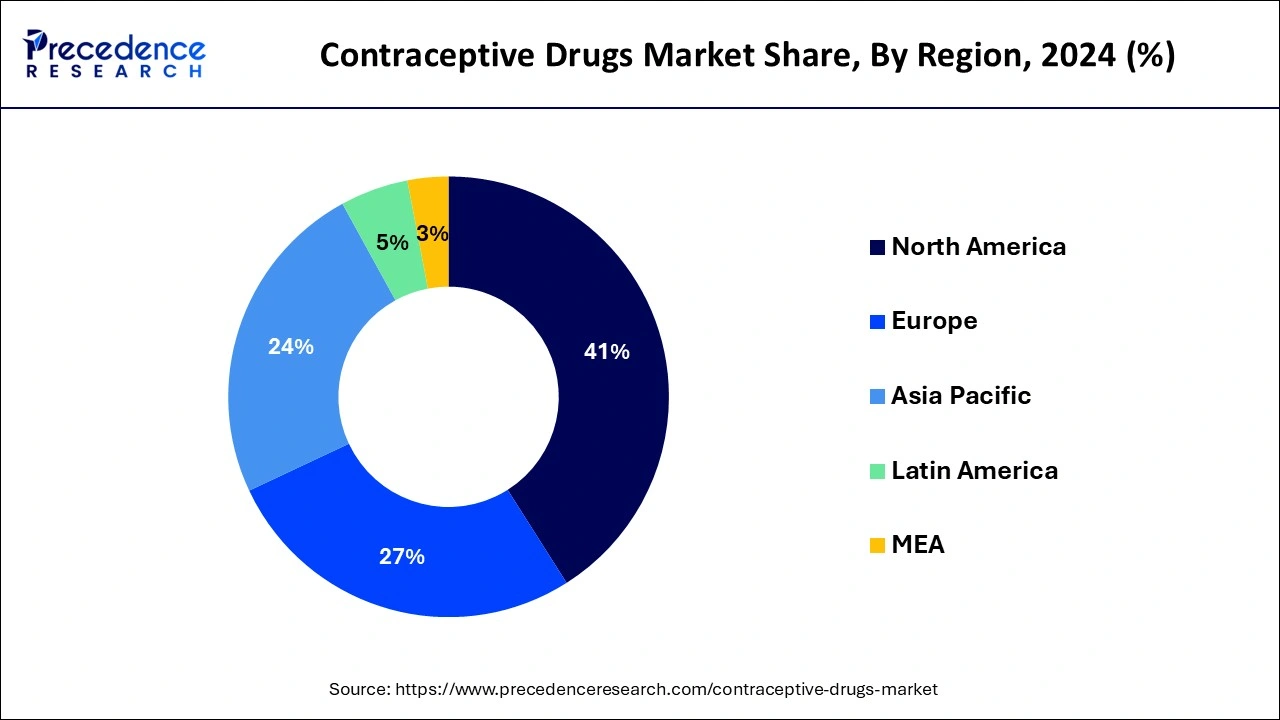

North America dominated the contraceptive drugs market in 2024. The growth of contraceptive drugs market in North America region is being driven by growing awareness about contraceptive pills among patients. According to Centers for Disease Control estimates, 14% of women aged 15 to 49 will be using contraceptive drugs in 2020. In addition, different strategies adopted by market players are also driving the growth of North America contraceptive drugs market. According to data published by the Bill & Melinda Gates Foundation in 2022, the foundation plans to invest $280 million per year from 2025 to 2034 in developing innovative and latest contraceptive technologies, supporting family planning programs that reflect local community preferences.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The Asia-Pacific contraceptive drugs market growth is attributed to the growing reimbursement policies. In addition, the rising childbearing population is also driving the growth of contraceptive drugs market in Asia-Pacific region. As per the report released by the United Nations Department of Economic and Social Affairs, the population was over 163 million in 2019. More than 56% of women in this category utilize contraception. As a result, the expansion of contraceptive drugs market in this region is expected in near future.

| Report Coverage | Details |

| Market Size in 2025 | USD 19 Billion |

| Market Size by 2034 | USD 31.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Distribution Channel, and By Age Group |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness about contraceptives

The growing awareness around contraception and women’s reproductive health as a result of widespread sex education and government family planning programs has led to substantial growth in the contraceptive drugs market. With the growing global population, more individuals are becoming aware of the need for contraceptives. Contraceptive drugs offer an effective way to undertake family planning and manage fertility. The increasing focus on women-centric health is also leading to higher demand for contraceptive drugs.

Regulatory restrictions and social stigma around contraception

Despite significant growth in the demand for contraception, there are several regulatory hurdles players in the space need to cross to get these drugs out in the market. Contraception deals with the production and suppression of sensitive hormones, which can have a crucial effect on an individual’s health. Thus, several strict mandates around the use and prescription of these drugs hinder market growth.

Expansion into emerging markets

As global awareness of contraceptives continues to grow, markets in underserved regions such as Asia Pacific, Africa, and the Middle East are seeing ramped-up demand for contraceptive drugs. The substantial expected demand for over-the-counter (OTC) contraceptives, now widely available due to the advent of biomedical research, is also expected to significantly boost demand in emerging economies for contraceptive drugs. As consumers seek more convenience and autonomy in managing their reproductive health, further growth is expected in the contraceptive drug market.

The oral contraceptive drugs segment has the largest revenue share in 2024. The oral contraceptive drugs demand and acceptance are gradually increasing, particularly in developing markets. This is owing to the clinical advantages of oral contraceptive drugs over other traditional techniques, as well as the reduced cost of these medications compared to other modern contraceptive drugs options. The number of women of reproductive age who use birth control tablets has climbed from roughly 97 million in 1994 to 151 million in 2019.

The vaginal ring segment is expected to reach remarkable growth from 2024 to 2033. The factors such as long product life cycle as well as cost effectiveness are driving the growth of the segment. The introduction of new products and the ease of use of vaginal rings are projected to boost demand for these birth control techniques. Annovera, a reusable silicone ring that protects against unplanned pregnancy for up to a year, received Food and Drug Administration approval and five-year market monopoly as a novel chemical entity in September 2018 and will be commercially introduced in the 1st quarter of 2020.

The retail pharmacy segment accounted largest revenue share in 2024. This is attributed to rising demand for contraceptive pills among the general public as well as increased awareness of various contraceptive drugs options. Birth control tablets are sold over the counter in various nations. As a result, customers are increasingly turning to retail pharmacies to obtain birth control tablets. Furthermore, favorable regulations have contributed to the expansion of the segment.

The online distribution channel segment is projected to grow at fastest rate during the forecast period. The increased usage of over-the-counter solutions, coupled with numerous online discounts and offers to entice clients, is ascribed to the larger growth of online channels.

By age, the 25–34-years segment led the global market. Women from this age group are choosing to manage their reproductive health earlier in life due to a shift in lifestyle leading to a rise in premarital physical relations. The growing awareness around healthcare and the need for menstrual regulation is also leading to higher demand from this age group for contraception.

By age, the 15–24 years segment is the fastest growing. The widespread use of contraceptive drugs among women and teenagers in developed economies is the reason there is significant demand in the market from this age range. Early maturity among women and teenagers of this age group is increasing the demand for contraceptives.

By Product

By Distribution Channel

By Age Group

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

January 2025

March 2025