January 2025

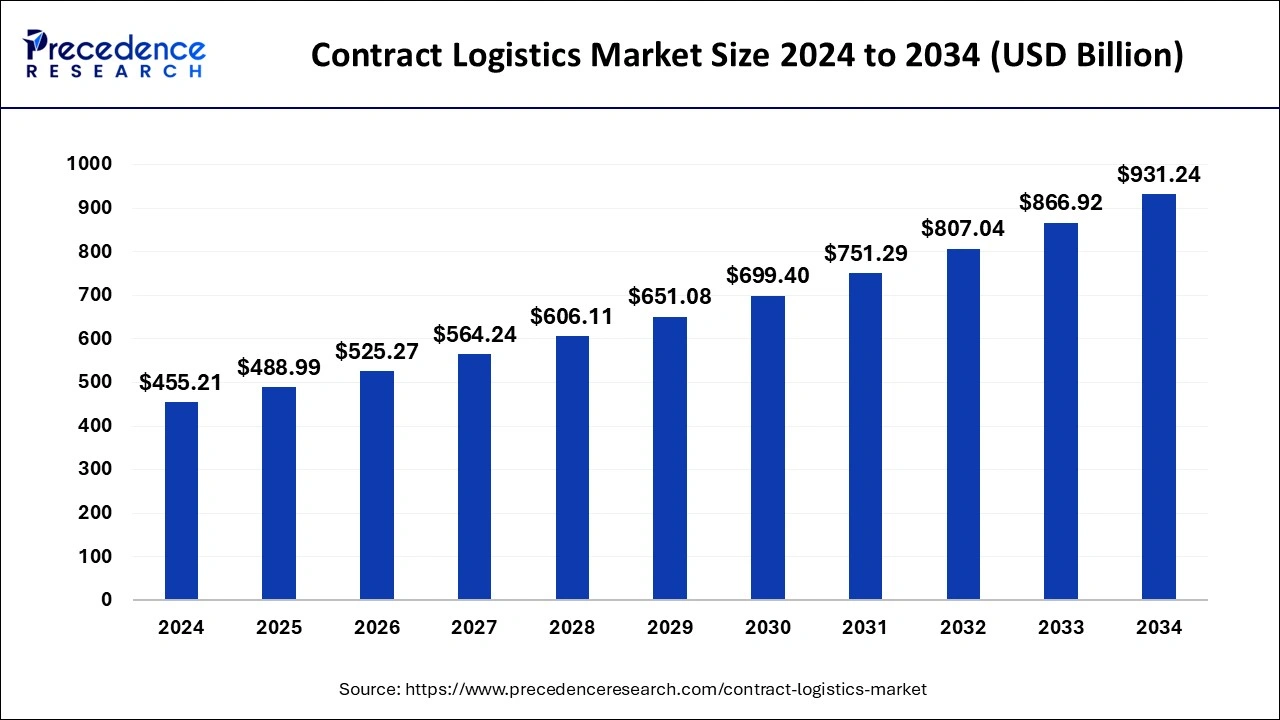

The global contract logistics market size is estimated at USD 488.99 billion in 2025 and is predicted to reach around USD 931.24 billion by 2034, accelerating at a CAGR of 7.42% from 2025 to 2034. The Asia Pacific contract logistics market size surpassed USD 166.26 billion in 2025 and is expanding at a CAGR of 7.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contract logistics market size was estimated for USD 455.21 billion in 2024 and is anticipated to reach around USD 931.24 billion by 2034, growing at a CAGR of 7.42% from 2025 to 2034. The contract logistics market is growing significantly due to the growing benefits of hiring third parties for logistics, which includes overall better management, time management, smooth flow of work, and so on.

Logistics companies have utilized artificial technology, or AI, to find patterns in data and provide insights. For instance, operations, including route optimization, intelligent transportation, demand forecasting, and budget planning, will benefit from its advancement. Furthermore, AI-driven logistics optimization may reduce costs through behavioral coaching and real-time forecasting to drive the contract logistics business. The projected incremental value of AI in the logistics & transportation business will be higher than that of others.

Over the past two decades, innovative logistic robotic companies have worked hard to incorporate AI & machine learning, better sensors & reaction times, logistics management software, and warehouse management software. The supply chain has lately seen an increase in warehouse automation, and vast amounts of money and investment have been made in the sector. While Google invested $500 million in JD's automated logistics, Alibaba invested $15 billion in robotic logistics infrastructure.

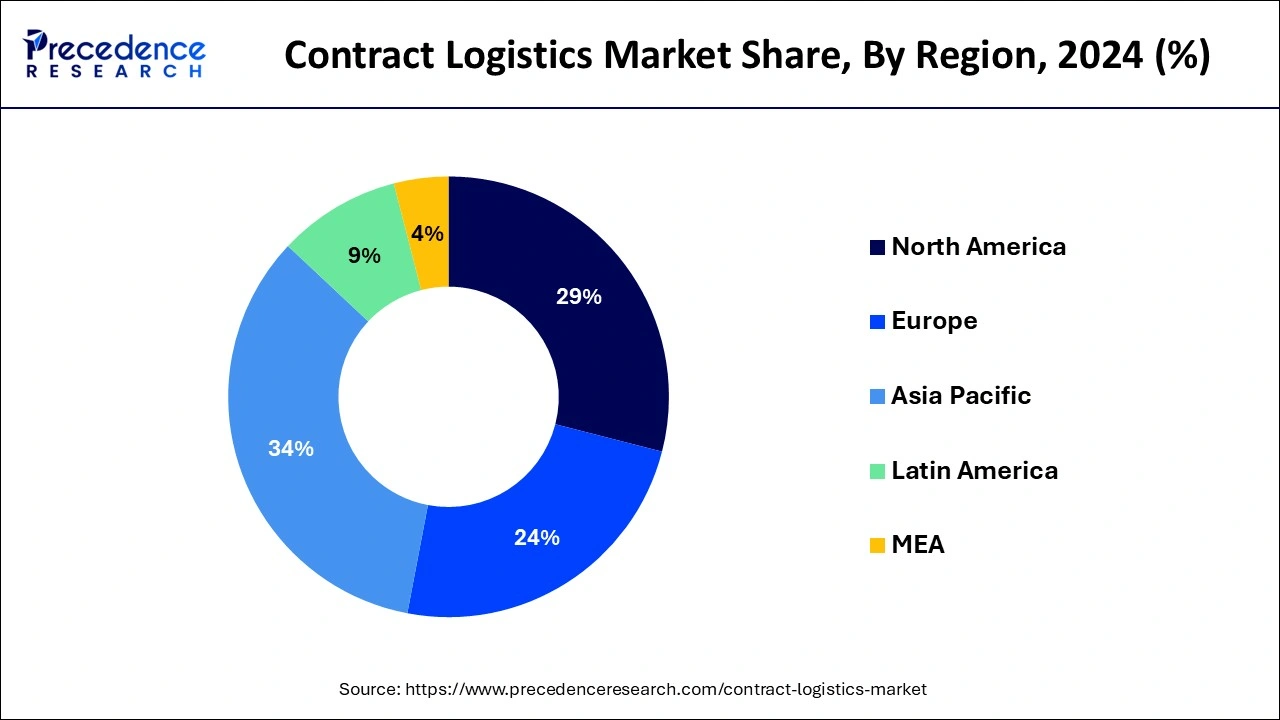

The Asia Pacific contract logistics market size was estimated at USD 154.77 billion in 2024 and is anticipated to be surpass around USD 321.28 billion by 2034, rising at a CAGR of 7.57% from 2025 to 2034.

Asia Pacific dominated the global contract logistics market with the largest market share of 34% in 2024. At the same time, Middle East & Africa are likely to develop at the most significant CAGR over the forecast period. Early adoption of technology in e-commerce will advance the sectors.

Several bilateral and multilateral trade agreements have been made with the United Arab Emirates. In the GCC, the United Arab Emirates has close business connections with Kuwait, Bahrain, Saudi Arabia, and Oman. The United Arab Emirates enjoys free trade connectivity to Egypt, Bahrain, Jordan, Iraq, Lebanon, Kuwait, Libya, Oman, Morocco, Qatar, Palestine, Syria, Saudi Arabia, Tunisia, and Yemen via the Greater Arab Free Trade Area Agreement (GAFTA). Along with other nations, the Emirates has struck agreements with Algeria, Pakistan, South Korea, India, and the Netherlands. This will drive the contract logistics market in Middle East & Africa over the projected period.

The contract logistics industry in Asia Pacific is growing quickly as a result of the region's thriving industrial base and economic development. The need for advanced logistics solutions to handle ever-more complicated supply chains has increased as nations like China and India continue to industrialize and urbanize. The demand for effective distribution networks and cutting-edge logistics skills to support the industrial, retail, and e-commerce sectors is what is driving this expansion. Online shopping has grown in popularity due to a sizable and expanding middle class, necessitating effective order fulfillment and last-mile delivery services. Another key element driving the market's growth is the growth of e-commerce in Asia Pacific. The region's contract logistics companies are taking advantage of this trend by providing customized solutions that cater to the unique requirements of e-commerce companies, such as quick delivery and inventory control.

Growing government measures for economic diversification lead to infrastructure development, digitization, and industrialization. They are likely to increase the market for contract logistics and e-commerce, producing huge demand for contract logistics services. The rise in foreign direct investments (FDIs), rapid growth in the e-commerce sector, and focus on risk management in supply chains are calling in existing players with various non-asset entrants.

Additionally, the manufacturing sector's rapid expansion and focus on core competencies, the growing demand for job optimization, achieving cost efficiency, and technology supply chain integrations help to drive market growth. Some limitations and difficulties will prevent the development of the contract logistics sector. For instance, logistic database management is challenging because of elements, including potential misunderstandings that result in incorrect interpretations of facts, data, and information. The lack of experienced individuals who can comprehend and fix issues to retain transparency causes regional differences and the supply chain's complexity to affect the overall process negatively. Budget restrictions are another possible hindrance to the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 488.99 Billion |

| Market Size by 2034 | USD 931.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Service, By Industrial Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Growing e-commerce industry

The term "e-commerce" describes the purchasing and selling of commodities using the Internet. Product shipment to customers is included in third-party logistics service providers. The e-commerce industry also uses contract logistics services to oversee and manage the supply chain of e-commerce companies, allowing them to focus on marketing and other business-related duties. Therefore, because logistics offers the e-commerce sector so many advantages, the use of logistics services has grown significantly, which fuels the expansion of the contract logistics market.

Shortage of skilled workforce

One of the problems facing the contract logistics industry is the shortage of trained workers. Talent with the ability to handle cutting-edge technology like robots, artificial intelligence, etc., is in short supply due to the industrial and retail sectors' increasing demand for complicated logistic demands. Hiring and retaining personnel is a challenge for logistics organizations, which raises operating expenses.

Various growth & expansion opportunities

There are a lot of prospects for growth and expansion in the contract logistics business. Third-party logistics companies can use their experience and make investments in cutting-edge capabilities to increase their business as a result of ongoing globalization and outsourcing trends. For logistics companies, expanding e-commerce and omnichannel shopping has created new opportunities. By integrating modern technology, they can guarantee flawless fulfillment and provide value-added services. This will guarantee increased cash streams and aid in gaining new clients.

Based on type, the contract logistics market is divided into outsourcing and insourcing segments. Throughout the forecast period, outsourcing is anticipated to dominate the market and account for more than 55% of revenue share in 2024. outsourcing is anticipated to dominate the market as it is a low-cost strategy for expanding a business's international footprint and profitability. The cost associated with hiring staff and renting storage is less than hosting activities internally. Companies that employ an outsourced supply chain can focus on their core business functions while creating new concepts, goods, and services and entering new markets. It may be time and money-saving to outsource logistics operations to a reputable partner with substantial training and experience. A contract logistics sector provides significant flexibility advantages. Depending on the current inventory, they may modify the available space, labor, and transportation. They can aid in easing the change from one season to another and consider industry variations.

Businesses may easily alter their standards to accommodate customers' actual needs. Additionally, the contract logistics sector may use its expertise to improve projections, helping to optimize inventory levels and save holding costs. Client businesses can also create additional channels for distribution, switching from a B2B-focused strategy to an omnichannel that includes B2C clients.

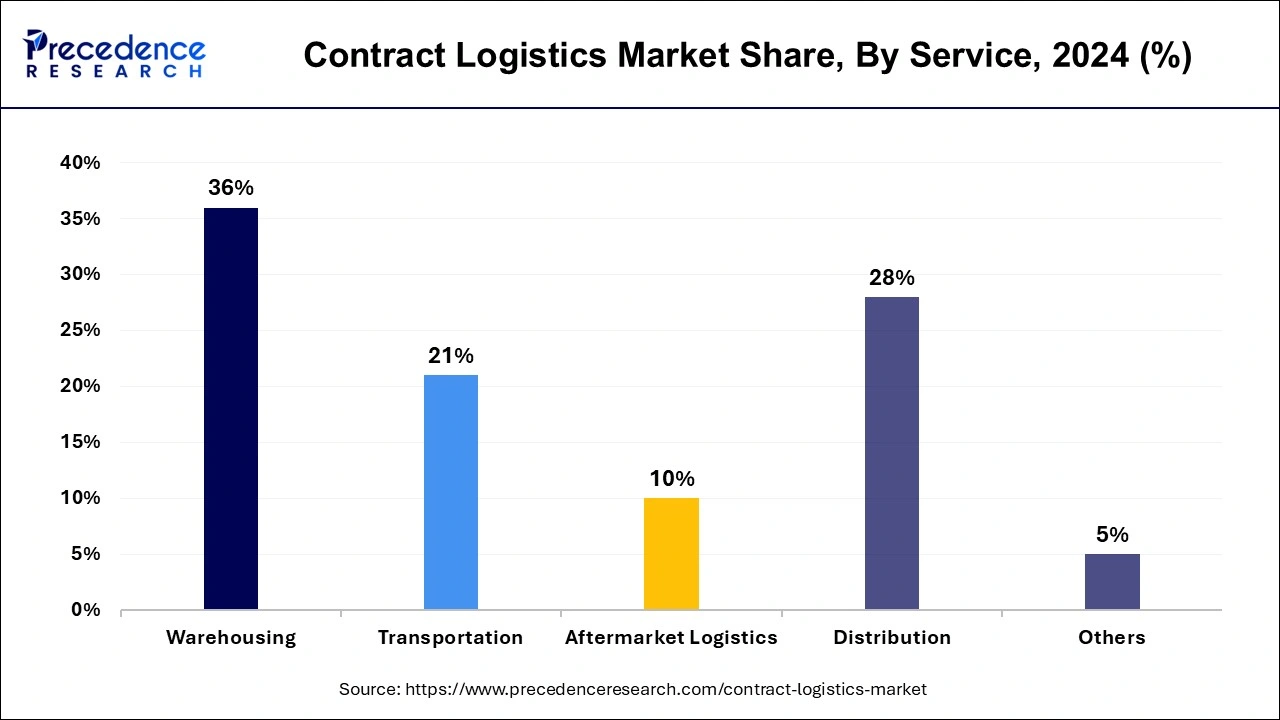

The warehousing segment contributed the highest market share of 36% in 2024. The segments of the market are based on services, transportation, distribution, warehousing, aftermarket logistics, and others. Due to cost savings throughout the entire supply chain process, distribution management is a crucial function. It benefits all contract logistics services, including mode network optimization, network analysis, warehousing, and vendor compliance monitoring. Thus, distribution management offers a better value-added service in the contract logistics industry.

Based on industry vertical, the market is divided into manufacturing, retail, and e-commerce, among others. Retail and e-commerce held the largest share of the overall market. While the retail industry is predicted to increase due to rising urbanization, e-commerce is still in its nascent phase and is anticipated to develop exponentially over the next few years.

By Type

By Service

By Industrial Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

August 2024

March 2025