July 2024

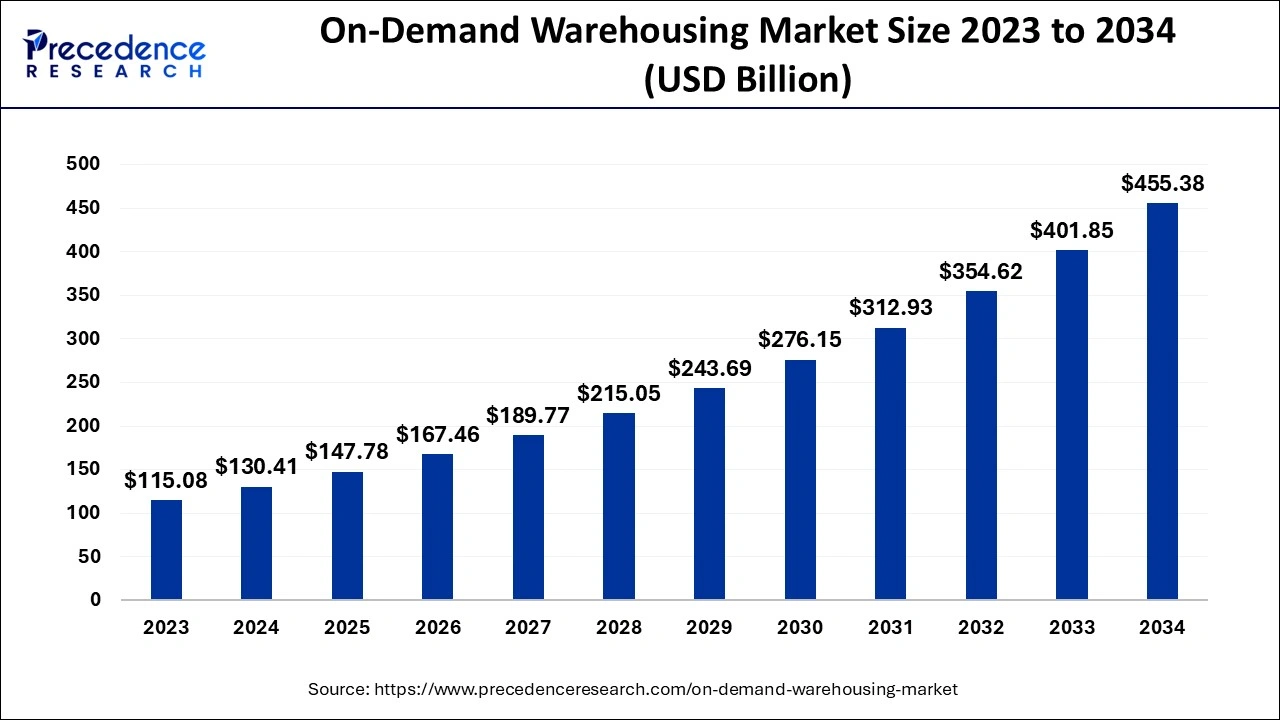

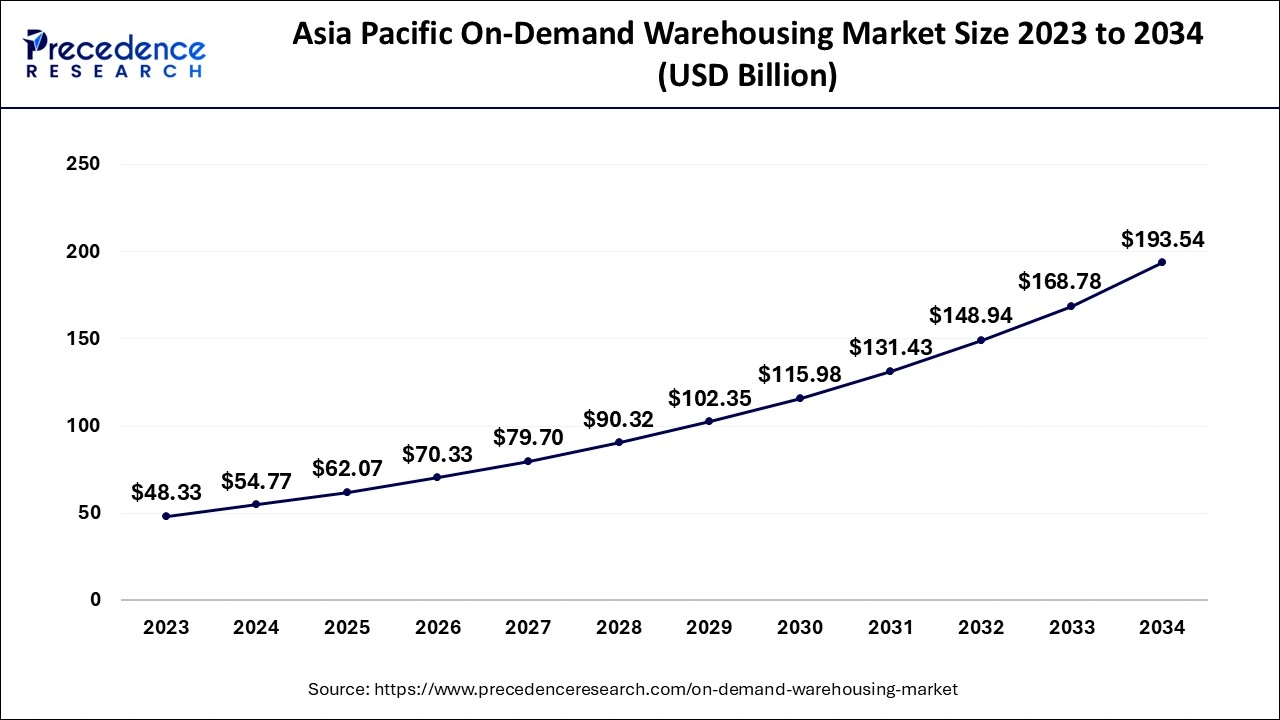

The global on-demand warehousing market size accounted for USD 130.41 billion in 2024, grew to USD 147.78 billion in 2025 and is expected to be worth around USD 455.38 billion by 2034, registering a healthy CAGR of 13.32% between 2024 and 2034. The Asia Pacific on-demand warehousing market size is evaluated at USD 54.77 billion in 2024 and is expected to grow at a CAGR of 13.44% during the forecast year.

The global on-demand warehousing market size is calculated at USD 130.41 billion in 2024 and is predicted to reach around USD 455.38 billion by 2034, expanding at a CAGR of 13.32% from 2024 to 2034. The on-demand warehousing market growth is attributed to the increasing demand for flexible and efficient logistics solutions driven by the rise of e-commerce and changing consumer preferences.

The Asia Pacific on-demand warehousing market size is evaluated at USD 54.77 billion in 2024 and is projected to be worth around USD 193.54 billion by 2034, growing at a CAGR of 13.44% from 2024 to 2034.

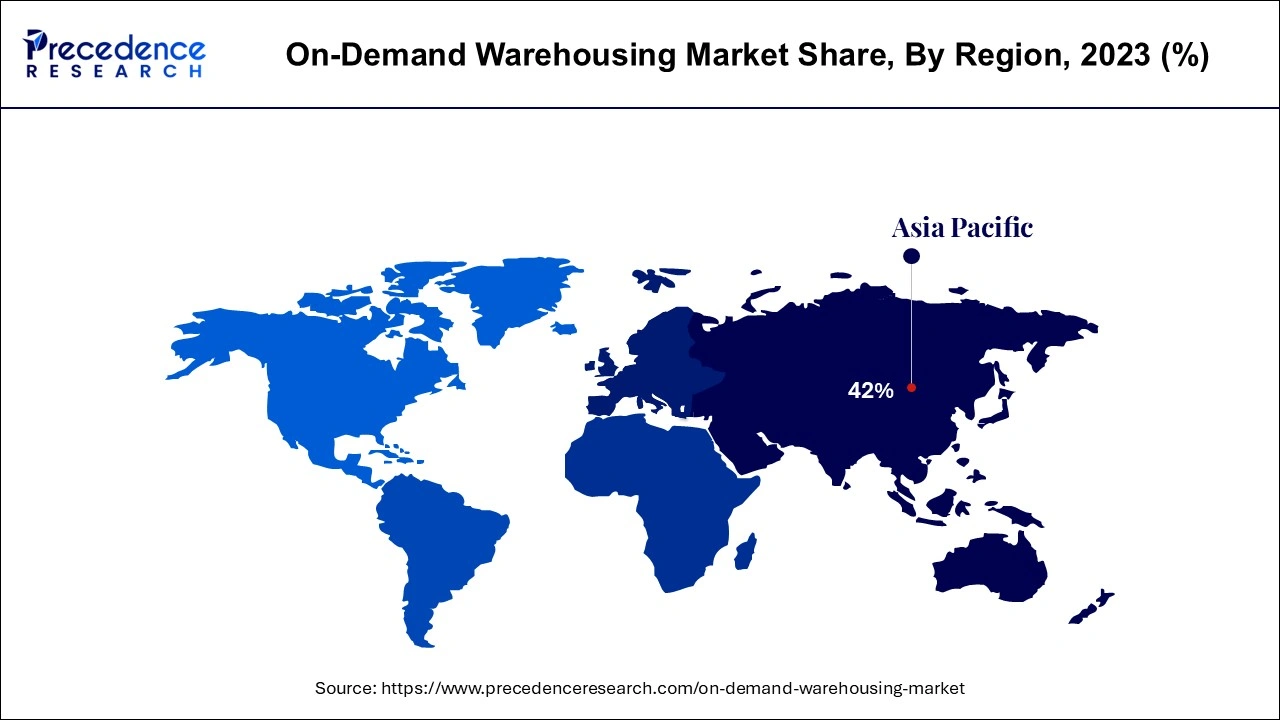

Asia Pacific held the largest share of the on-demand warehousing market in 2023, owing to the rapidly growing e-commerce industry and more logistics investments. The newly emergent middle-income population is projected to drive online shopping, thus creating incremental demand for more flexibility in warehousing facilities in the region. Logistics and transportation, being critical in fulfilling requirements of on-demand warehousing, have witnessed a rise.

North America is projected to host the fastest-growing on-demand warehousing market in the coming years, due to the growing number of e-commerce companies, and fast-evolving logistics requirements. This trend is expected to sustain, as several businesses seek on-demand warehousing services since consumers require better time to deliver and prompt supply chain transformation.

Growing needs for dynamic and specifically tailored logistic services lead to a strong and consistent development of the on-demand warehousing market. The increasing trend in online selling has subsequently made organizations look for flexible and versatile solutions for their warehouses. This changing inventory demand and the need to provide swift delivery for customer orders creates demand for these on-demand warehousing solutions.

The on-demand warehousing market provides critical solutions that businesses need to leverage to target modern consumers’ demands enabled by these technologies. Additionally, the growing shift to sustainability improves the popularity of the flexible warehousing models since companies and logistic providers want to have sustainable storage operations while minimizing their impacts on the environment.

Impact of Artificial Intelligence on the On-demand Warehousing Market

In the on-demand warehousing market, AI helps companies minimize inventories, predict customer demand, and decrease costs. AI predicts the requisites of inventory accurately, so stock out or overstocking rarely. High-technology solutions, such as robots and self-driving automobiles, enhance the control of the material flow and enable minimum dependence on manual operations. This increased automation optimizes order deliverability, blend accuracy, and flow from storage to distribution. Furthermore, this technology improves customer satisfaction, as the status can be monitored in real-time, and delivery estimates are usually accurate to meet the transparency requirement of modern society.

| Report Coverage | Details |

| Market Size by 2034 | USD 455.38 Billion |

| Market Size in 2024 | USD 130.41 Billion |

| Market Size in 2025 | USD 147.78 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Organization, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing e-commerce demand

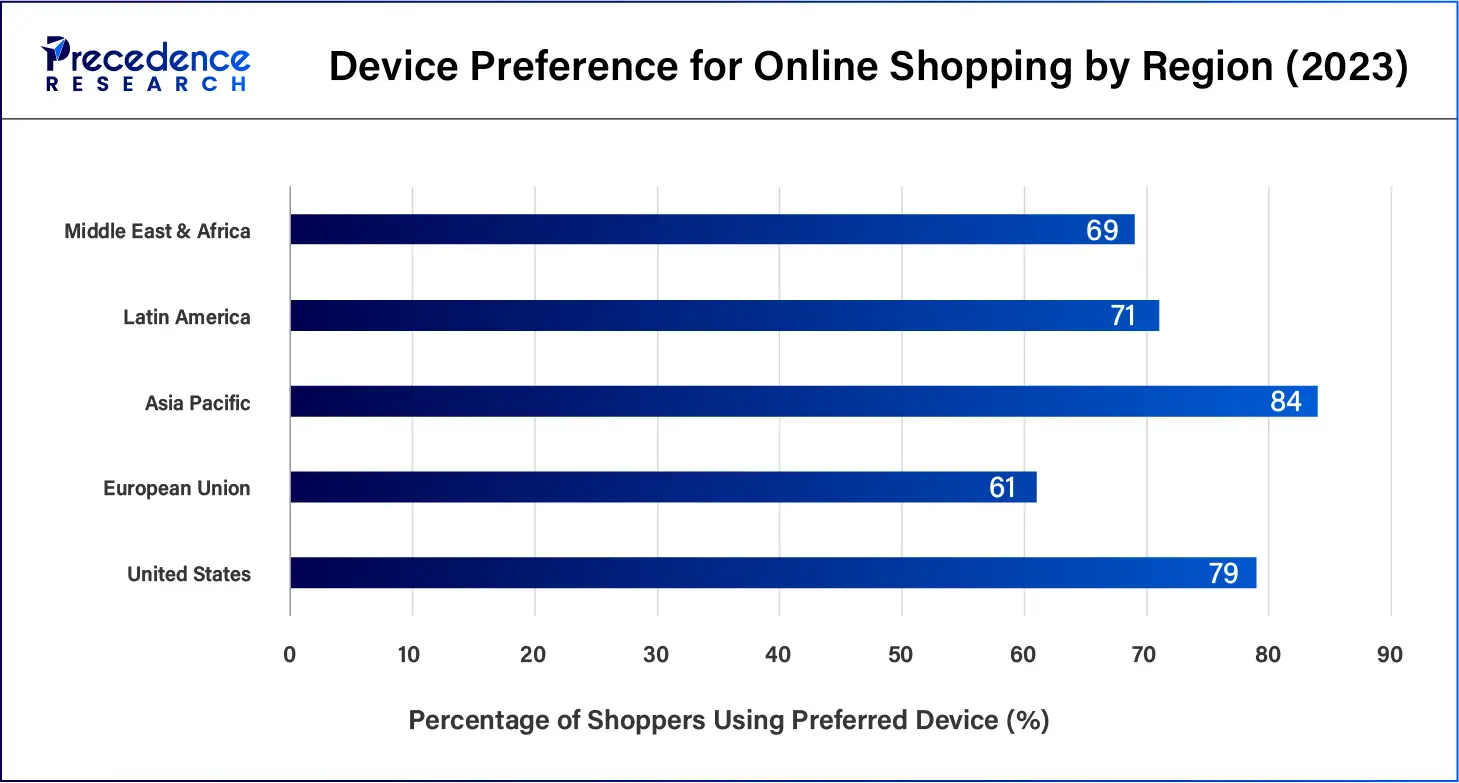

Increasing e-commerce demand is expected to drive the growth of the on-demand warehousing market. The rise of digitalization in trade agreements and the use of sophisticated technology solution tools that support trade compliance further boost the market. About 64% of manufacturers, retailers, and logistics firms are either using cross-border e-commerce or are eager to join this market within the upcoming year, facilitating the demand for on-demand warehousing solutions.

| Region | Preferred Shopping Device | % of Online Shoppers Using Device | Popular Product Category |

| United States | Mobile | 79% | Electronics, Apparel |

| European Union | Desktop | 61% | Fashion, Personal Care |

| Asia Pacific | Mobile | 84% | Electronics, Beauty |

| Latin America | Mobile | 71% | Apparel, Electronics |

| Middle East & Africa | Mobile | 69% | Electronics, Groceries |

Impede limited accessibility to remote locations

The limited reach of the on-demand warehousing market in remote or rural areas is expected to hamper market growth. Most on-demand warehousing service providers exist in urban areas where demand for their services is high while leaving rural areas, which experience both a challenge and high storage costs. This model is inclined to the urban markets, thus leaving the businesses that sell products to the rural markets with limited options in terms of managing flexibility in storage. Furthermore, the lack of centers in rural areas for companies in agriculture or manufacturing requires the service for distributing products.

Increasing adoption of advanced technologies

Increasing adoption of automation, artificial intelligence (AI), and Internet of Things (IoT) technologies presents a significant opportunity for the on-demand warehousing market. Technologies increase inventories, operations, and order fulfillment through the latest technologies in the supply chain. Integration of robotics minimizes human intervention, hence cutting on errors, while smart technologies enable efficient use of space. The IoT technology grants real-time data on the state of stocks, hence efficient control of the same. Furthermore, a large number of businesses are shifting to accurate, efficient, and competitive warehousing services.

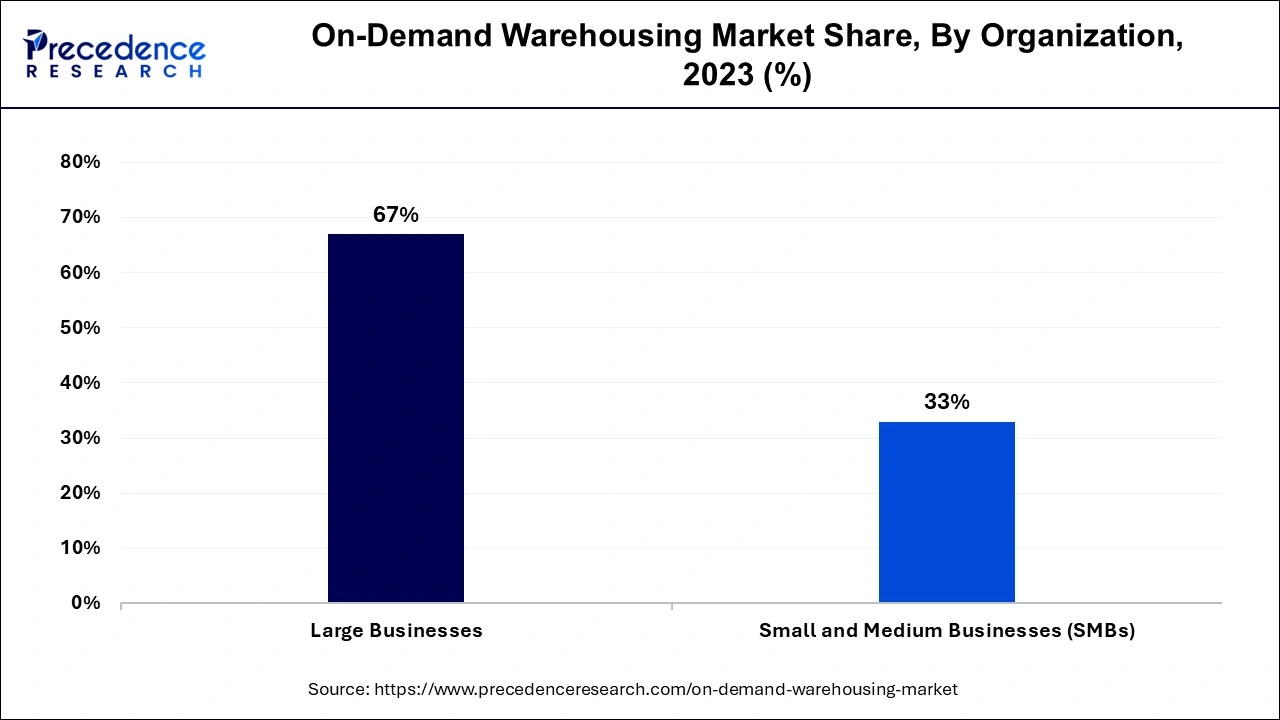

The large segment held a dominant presence in the on-demand warehousing market in 2023, owing to their rising dependence on sophisticated warehousing solutions wed to strategic imperatives. Through this investment, they are in a position to work efficiently, eliminate the long cycle of production, and experience an efficient reduction in large fluctuations of inventory during their busy season.

The small & medium businesses segment is expected to grow at the fastest rate in the on-demand warehousing market during the forecast period of 2024 to 2034, as they require quality customization and flexibility at a relatively cheaper and affordable rate compared to large, established businesses. SMBs require a system enabling them to address the issue of the dynamic volume of inventory without signing contracts for the space for years.

The manufacturing segment accounted for a considerable share of the on-demand warehousing market in 2023, owing to the demands for efficient stock storage and elastic logistics services. Companies are looking for flexible warehousing solutions for the changing demand schedule in production. Furthermore, this trend boosts the demand for technologies that are efficient in the use of space and supply chain logistics.

The retail & E-commerce segment is anticipated to grow with the highest CAGR in the on-demand warehousing market during the studied years, as the market primarily focuses on digital platforms and quick delivery. Technology has advanced dramatically in the last few years, and e-shopping has increased exponentially over the same period. Retailers are now incorporating demand warehousing to make improvements to their stock handling to meet consumer demands for speed of delivery. Additionally, the retailers aim to adopt flexible warehousing solutions.

Segments Covered in the Report

By Organization

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024