March 2025

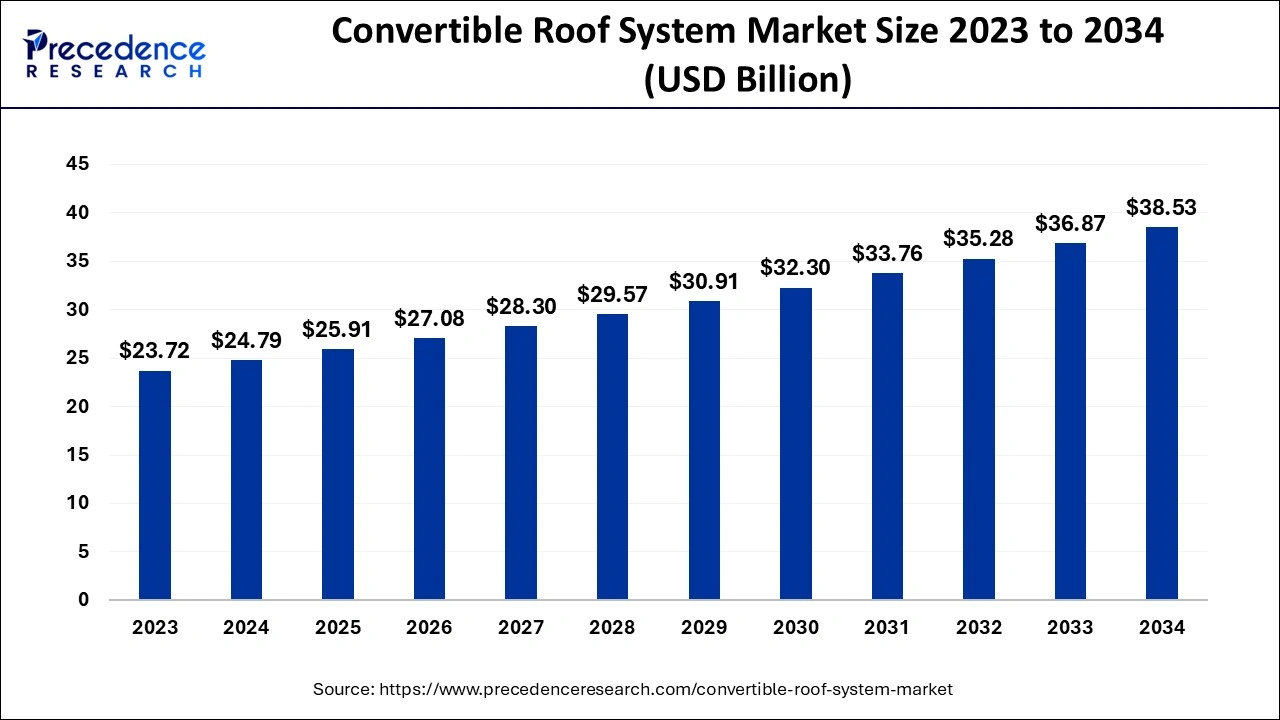

The global convertible roof system market size accounted for USD 14.12 billion in 2024, grew to USD 14.72 billion in 2025 and is expected to be worth around USD 21.42 billion by 2034, registering a CAGR of 4.26% between 2024 and 2034.

The global convertible roof system market size is calculated at USD 14.12 billion in 2024 and is projected to surpass around USD 21.42 billion by 2034, expanding at a CAGR of 4.26% from 2024 to 2034. The convertible roof system market growth is attributed to the increasing consumer preference for stylish and versatile vehicles that offer enhanced driving experiences and advanced technological features.

The global convertible roof system market is expanding due to the growing consumers’ longing for new technologies in the automotive industry. Due to customer demand for new types of functional and entertaining vehicles, automotive producers are paying greater attention and investing in the latest convertible roof systems. These consumer benefits include increased assembly and efficiency of lightweight and auto systems. The National Highway Traffic Safety Administration (NHTSA) underlines in its research that improvements to safety systems in car models with a retractable roof help lower the number of accidents and increase consumer demand.

According to information obtained from the International Organization of Motor Vehicle Manufacturers (OICA) to support the growing automotive market. Passenger car production, which incorporates convertibles production, will reach 77 million units by the year 2022.

Impact of Artificial Intelligence (AI) on the Convertible Roof System Market

Artificial Intelligence (AI) is being utilized to produce advanced results in ability, pattern, design, and the manufacturing line of the convertible roof system market. The application of AI in the production process helps companies automate supply chain processes and minimize time for product creation. This has greatly transformed the creation of convertible roof systems where AI enables companies to predict customer trends and also identify shortcomings at the design stage.

With the help of machine learning algorithms, manufacturers in the convertible roof system market improve conventional roof functionality and make it smarter. They enhance the driving environment and thus meet the modern demands of smart, self-governing car components. Furthermore, the enhanced developments in this field of AI are transforming how manufacturers design and make convertible roof systems to enhance the market competitively.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.42 Billion |

| Market Size in 2024 | USD 14.12 Billion |

| Market Size in 2025 | USD 14.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.26% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Rooftop Type, Material Type, Propulsion Type, Body Style Type, Vehicle Class Type, Electric Vehicles Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

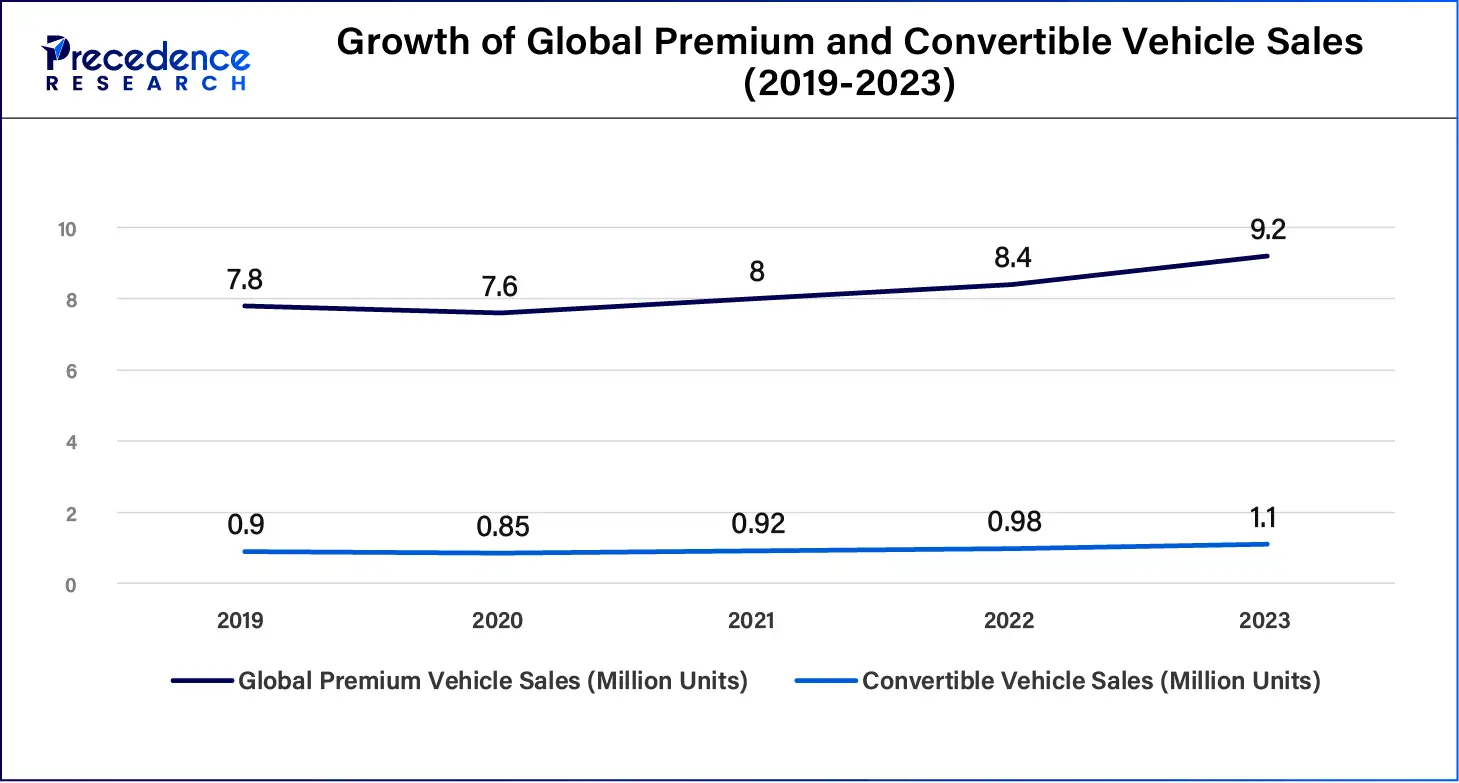

Increased need for luxury cars

Consumer preference for premium vehicles is facilitating the incorporation of convertible roof systems, thus boosting the convertible roof system market. The growth in disposable income, particularly in the developing world and especially in countries including China and India. Consumers are demanding automobiles that are comfortable in anticipation of being chauffeured. Furthermore, the automated convertible roofs and smart features have also been adopted by luxury car makers, including BMW, Audi, and Mercedes Benz, thus fuelling the market.

The buyer of convertible roof system market products perceives convertibles as prestigious and stylish, and they indeed offer a high-class lifestyle, as they attract the target clientele. This is underlined by improvements in automobile engineering that enable manufacturers to reap the desired gains in embodying the benefits of the convertible roofs' convenience, safety, and probably aesthetic value to the consumers.

| Year | Global Premium Vehicle Sales (Million Units) | Convertible Vehicle Sales (Million Units) |

| 2019 | 7.8 | 0.9 |

| 2020 | 7.6 | 0.85 |

| 2021 | 8.0 | 0.92 |

| 2022 | 8.4 | 0.98 |

| 2023 | 9.2 | 1.1 |

Weather and other environmental aspects

Uncongenial climates in some regions are expected to limit the growth of the convertible roof system market size in the forecast timeframe due to their impact on the systems. Many buyers find convertibles unsuitable for hot climate zones and for regions that experience intense rainfall or extended freezing periods. These types of roofs are caused by environmental stresses that diminish their effectiveness and durability. Consumers shy away from convertibles as they have issues with leaking, insulation, and resistance to harsh weather. Furthermore, variable climates affect the functionality of south-facing roofs with conversion features or even make them a less selling proposition to consumers in such an environment.

Fast-paced technological innovation in roof systems

Rising technological innovations in roofs make convertible roof systems, which are expected to create immense opportunities for manufacturers to propel the convertible roof system market further. Convertible manufacturers are seeking solutions that deliver lighter yet stronger and more efficient roof structures, new material for the fabric, and more effective mechanisms to open and close a roof. Moreover, the advanced functions of smart technology in one-touch automatic opening and closing of the roof and weather sensing capabilities improve usability and demand for convertible roofs. This increasing level of development in technology is believed to catalyze increased usage of convertible roof systems in car models with capacities and classes of luxury and power.

The hardtop segment held a dominant presence in the convertible roof system market in 2023 due to the stronger structure with additional safety features. Fixed-roof convertible cars are safer in terms of weather conditions than their counterpart soft-roof cars. The latest trend is the demand for security and reliability of products, and this is especially true for countries with severe climate changes. The current bacteriologists have also increased the usage of hardtop roofs due to their tremendous improvement in performance and designing capabilities. Additionally, hardtop models provide improved soundproofing, which plays a part in improving the user's experience.

The soft top segment is expected to grow at the fastest rate in the convertible roof system market during the forecast period of 2024 to 2034, owing to its lightweight and relatively low costs. Soft tops are generally lighter than hard tops, making them powerful, hence being a product of environmental concerns. Purchasers are finding that designers are using higher quality, weather-resistant fabrics that improve the life of the garment while at the same time giving the garment a better appearance. Soft tops are also increasingly popular in the automotive industry, customizing and personalizing the products with numerous designs and colors of soft tops to match the tastes of consumers.

The PVC segment accounted for a considerable share of the convertible roof system market in 2023 due to its properties of offering high roof resistance to various weather conditions. PVC’s low density means that there are improvements in fuel efficiency, and consumers increasingly demand inexpensive and sustainable automobiles. Furthermore, manufacturers are also likely to remain committed to developing outstanding PVC formulas that have superior resistance to UV and durability.

The carbon fiber segment is anticipated to grow with the highest CAGR in the convertible roof system market during the studied years due to the unique strength-to-weight ratio and novelty of the product. Manufacturers of automobiles also use carbon fiber to fashion attractive and elegant drop headtops / convertible roofs, which, in essence, enhances the auto manufacturing firm’s output besides fuel economy. Moreover, improvements in manufacturing techniques, such as the AFP (automated fiber placement) system and better resin system, are expected to bring the cost per volume down further.

The ICE segment led the global convertible roof system market due to the lack of a disappearance rate among consumers for traditional vehicles, as seen below. Most customers select ICE vehicles, as they have tested and proven performance and availability, plus the well-developed distribution networks for fuels. Furthermore, the incorporation of fuel-efficient and lower-emitting ICE models is becoming a primary goal of manufacturers, thereby making the environmentally sensitive customer demographic a viable market for such vehicles.

The EVs segment is projected to expand rapidly in the convertible roof system market in the coming years, owing to the trend towards sustainable transportation all over the world. Furthermore, automotive producers directed substantial capital towards EV equipment and generation, including promising electric vehicle plans for the production portfolio. There are strong realistic expectations that the number of consumers willing to buy EVs, along with the concentration on lowering carbon footprints.

The sedan/hatchback segment dominated the global convertible roof system market in 2023, as they are popular and useful among people. Two-door and four-door sedans and hatchbacks have continued to be some of the most popular car types in the world. Moreover, companies are investing in developing the design and operation of the flexibility of the roof of these models, as well as additional options, including one-touch control and better weatherproofing systems, thus boosting the segment.

The roadster/sports car segment is projected to grow at the fastest rate in the convertible roof system market in the future years, owing to the increasing consumer awareness for performance-oriented vehicles that provide high thrills of dynamic performance. Additionally, the manufacturers are investing in creating lightweight structures and stronger engines, which increase both driving experience and power, thus reaching this segment’s target market.

The luxury vehicles segment dominated the steel rebar convertible roof system market during the forecasting period due to the growing expectation levels of auto consumers regarding luxury automobile rides. Cars have high levels of luxury, that is, prestige and status, provide comfort, have great technology and design, and are chosen by consumers with high standards of living. With the help of their innovations in the roof structures, such as the fabric\metal structure in Mercedes-Benz, BMW, and Audi convertibles, brands took the top of this niche. European automobile companies also sell important product models with more customized characteristics, and the special roofs of some luxury cars are opened or closed according to the buyer’s characteristic needs.

The semi-luxury vehicles segment is projected to lead the convertible roof system market in the future years, as consumers are increasingly looking for automobiles that provide the comfort of a prestige car at a reasonable price. The semi-luxury car aims at people looking for the features of a luxury automobile but without having to pay large amounts of money. Additionally, the current trend of rising disposable income per capita is coupled with changes in the perception of vehicle ownership.

The BEV segment led the global convertible roof system market. The consumer has changed his attitude towards the environment and the availability of governmental incentives to provide people with electric vehicles. The experience in battery production leads to the development of a better range and performance, which is attractive to the wider public. The car manufacturers are incorporating usable roof systems into their BEV models, allowing roofs to add luxury and fashion to the driving experience while being environment-friendly.

The hybrid electric vehicle (HEV) segment is projected to expand rapidly in the convertible roof system market in the coming years. Consumers are demanding better plug-in hybrid electric vehicle (PHEV) convertible roof systems from manufacturers to provide the same drive experience while retaining far greater fuel economy. Furthermore, interventions such as state policies within the context of increasing consumption of hybrid technologies strengthen the demand for PHEVs. This segment has a high potential for growth as consumer preferences vary over time; it forms a promising segment in the convertible roof system market along with BEVs.

Europe dominated the convertible roof system market in 202 due to the high demand for luxurious and high-performance cars. The area's rich customer population, combined with a high demand for an open-air motoring appeal, has made consumers move towards convertibles. Additionally, improvements in vehicle technology, such as the safety and convenience aspects of having folding roofs on convertibles, have also contributed to their flexibility among consumers. Government incentives for ecology have also stimulated market development, as manufacturers provide hybrids and electric cars, including those with state-of-the-art roof mechanisms.

Asia Pacific is projected to host the fastest-growing convertible roof system market in the coming years. This can be attributed to the growth in disposable incomes and the expansion of middle-income groups in countries such as China and India. There is a high demand for such vehicles, especially for the younger generation, and enhanced urbanization.

Segments Covered in the Report

By Rooftop Type

By Material Type

By Propulsion Type

By Body Style Type

By Vehicle Class Type

By Electric Vehicles Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

September 2024

April 2025