October 2024

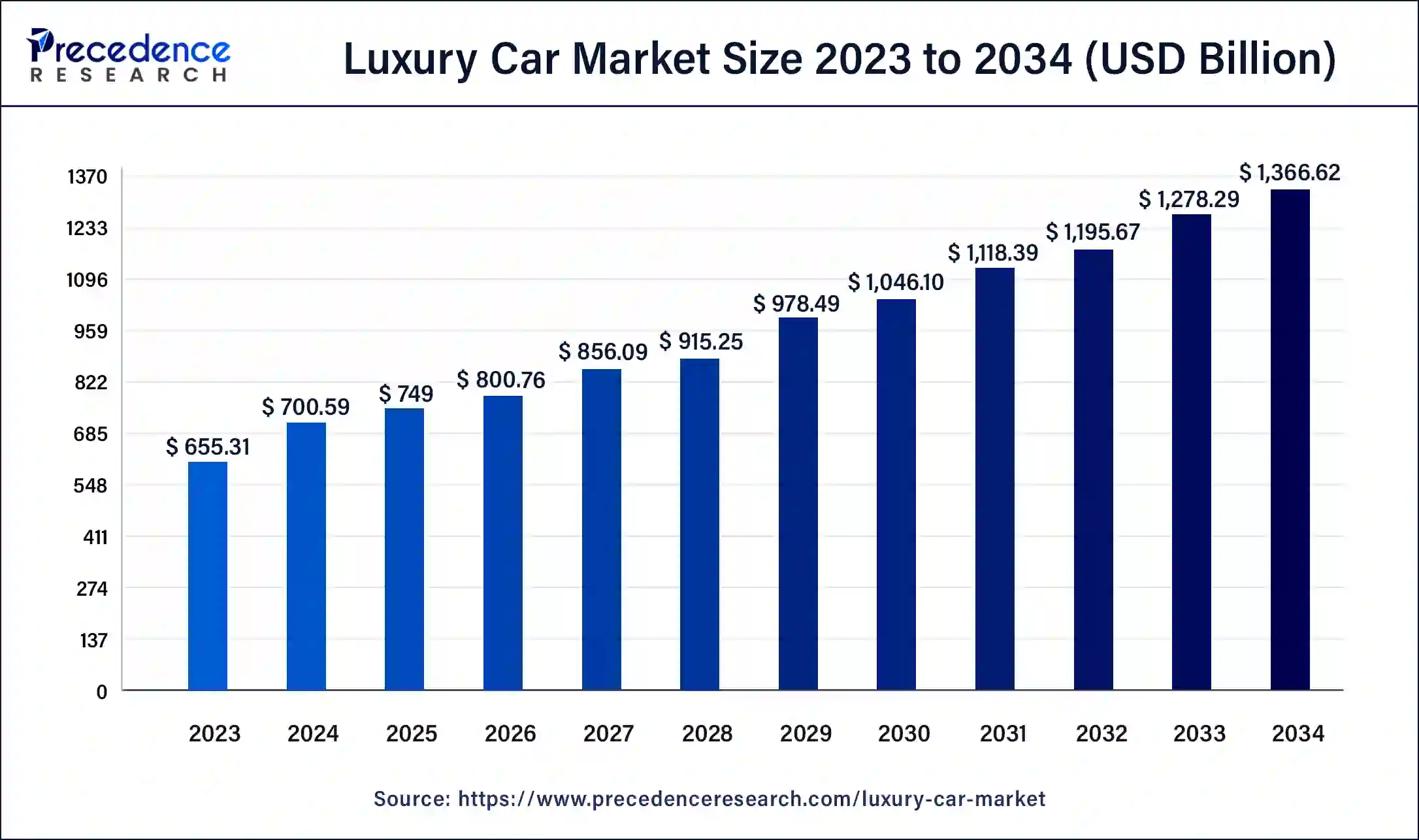

The global luxury car market size is calculated at USD 749 billion in 2025 and is predicted to hit around USD 1,366.62 billion by 2034, expanding at a CAGR of 6.91% between 2025 and 2034. The Europe luxury car market size accounted for USD 299.60 billion in 2025 and is anticipated to grow at a fastest CAGR of 7.03% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global luxury car market size was expected to be worth USD 700.59 billion in 2024 and is anticipated to reach around USD 1,366.62 billion by 2034, growing at a CAGR of 6.91% over the forecast period 2025 to 2034. The luxury car market is proliferating due to the consumer's shift from sedans to SUVs, owing to the increasing disposable incomes across various regions, along with the new launch of automotive by major key players.

AI is significantly impacting the luxury car market. Two revolutions are the talk of the automotive industry. One of them is the incorporation of AI into luxury cars so that they can drive without human intervention. The best example of AI and automotive integration is the TESLA car, which is a self-driving car launched by the Tesla group.

Safety features can be integrated with the AI with the help of machine learning algorithms. They can automatically make real-time decisions while traveling by navigating through the roads with sensors around them. AI-integrated cars, therefore, are the future of the globe. For instance, TESLA’ Autopilot’ is the first advanced driver assistance systems incorporated with luxury cars to make the car self-driving.

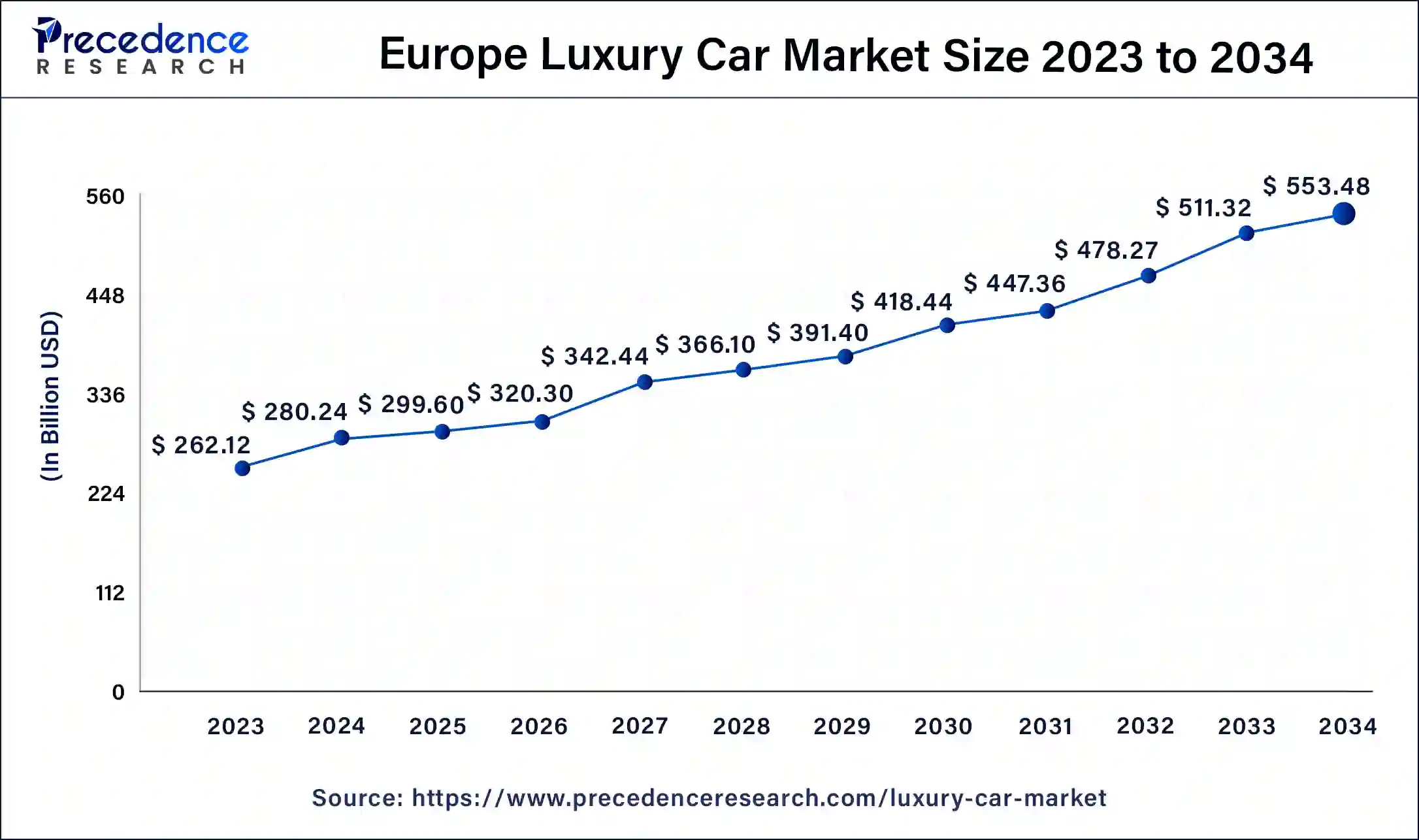

The Europe luxury car market size was exhibited at USD 280.24 billion in 2024 and is projected to be worth around USD 553.48 billion by 2034, poised to grow at a CAGR of 7.03% from 2025 to 2034.

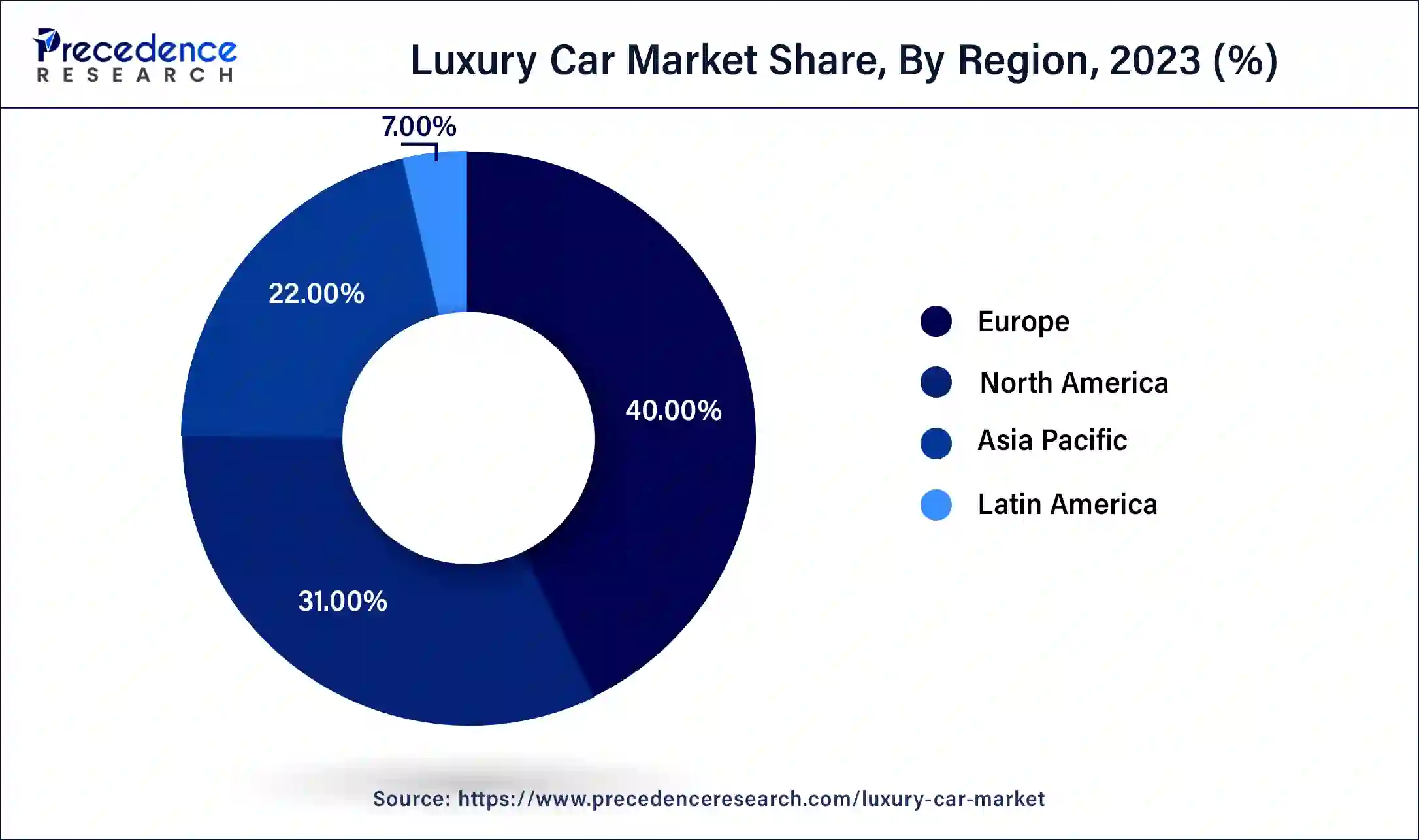

Europe accounted for the largest share of the luxury car market in 2024. The European market is expanding due to factors like the well-established market of automobiles and the presence of major automobile companies, fuelling the growth of the market further. Also, highly advanced industries for automotive manufacturing are supported by government funding and different rules and policies.

North America witnessed significant growth in the global luxury car market. This growth is due to leading countries like Canada and the U.S. and the increasing adoption of luxury cars in these countries. A strong economy and a huge proportion of highly affluent consumers fuel the market growth in this region. According to the country, the U.S. has been the top consumer of luxury cars. High disposable income and the prestige of automotive-featured cars in the U.S. are driving the market further.

Asia Pacific is expected to host the fastest-growing luxury car market during the foreseeable period. The growth of this region is due to increasing demand for high-tech vehicles, owing to the rising disposable income and GDP in economically growing countries like India, Japan, Korea, and China. The government is also funding electric vehicles to reduce their carbon footprint in terms of combating the global warming issue. By acknowledging this, major market players are gaining traction with high-profile customers by launching innovative luxury models.

The luxury car market is expanding due to the increasing inclination towards lavish lifestyles across the globe and the prestigious aura around the automotive, along with an increasing number of affluent individuals and groups in emerging countries who are attracted to luxury vehicles and tend to buy them. Moreover, technological advancements such as hybrid electric vehicles and electric vehicles are immensely affecting the market position globally. Major market key players are investing heavily in multimedia luxury cars due to the increasing demand from various regions.

Region-wise, Europe and North America are significantly growing due to the presence of major key players in the region, plus a group of wealthy people tend to buy such a luxurious vehicle. Also, companies are heavily investing in cutting-edge technology and its implementation in the automotive industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,366.62 Billion |

| Market Size in 2025 | USD 749 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.91% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Propulsion Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Better performance with high safety features

A significant driving factor for the proliferation of the luxury car market is the better performance and advanced safety features available in it. As compared to economy cars, the luxury car provides much better safety options, such as airbags, traction control, safety door locks, and multimedia systems equipped with highly advanced technology like AI. Another driving factor in buying a luxury car is that it withstands even a fatal accidental crash, gaining the traction of wealthy groups across the globe.

High cost of repairing the luxury car

A major drawback that the luxury car market is witnessing is the substantial amount needed to repair; even small damage in the luxury car hinders the growth of the market. It is very hard to track the shop that can repair perfectly to such highly advanced and technologically equipped care, which causes more damage if not repaired properly. Moreover, a luxury car depreciates more than a normal budget-friendly car. In a nutshell, buying a luxury car is a costly affair that only affluent people can handle; it is not affordable for middle-class or upper-middle-class people.

Expansion of SUVs world widely

The major opportunity that the luxury car market holds is the rising inclination to buy SUVs with various features and spaciousness. Luxury cars like SUVs are gaining traction among high-profile and ultra-high-profile individuals due to their versatility, stylish appearance, prestigious look, and sense of safety with advanced technology built into them. Families and young professionals are more attracted to luxury cars like SUVs, creating lucrative opportunities for the market on a global scale. The enhanced driving features and highly robust build of SUVs are the attractive parts that resonate with both the demand for safety and appearance.

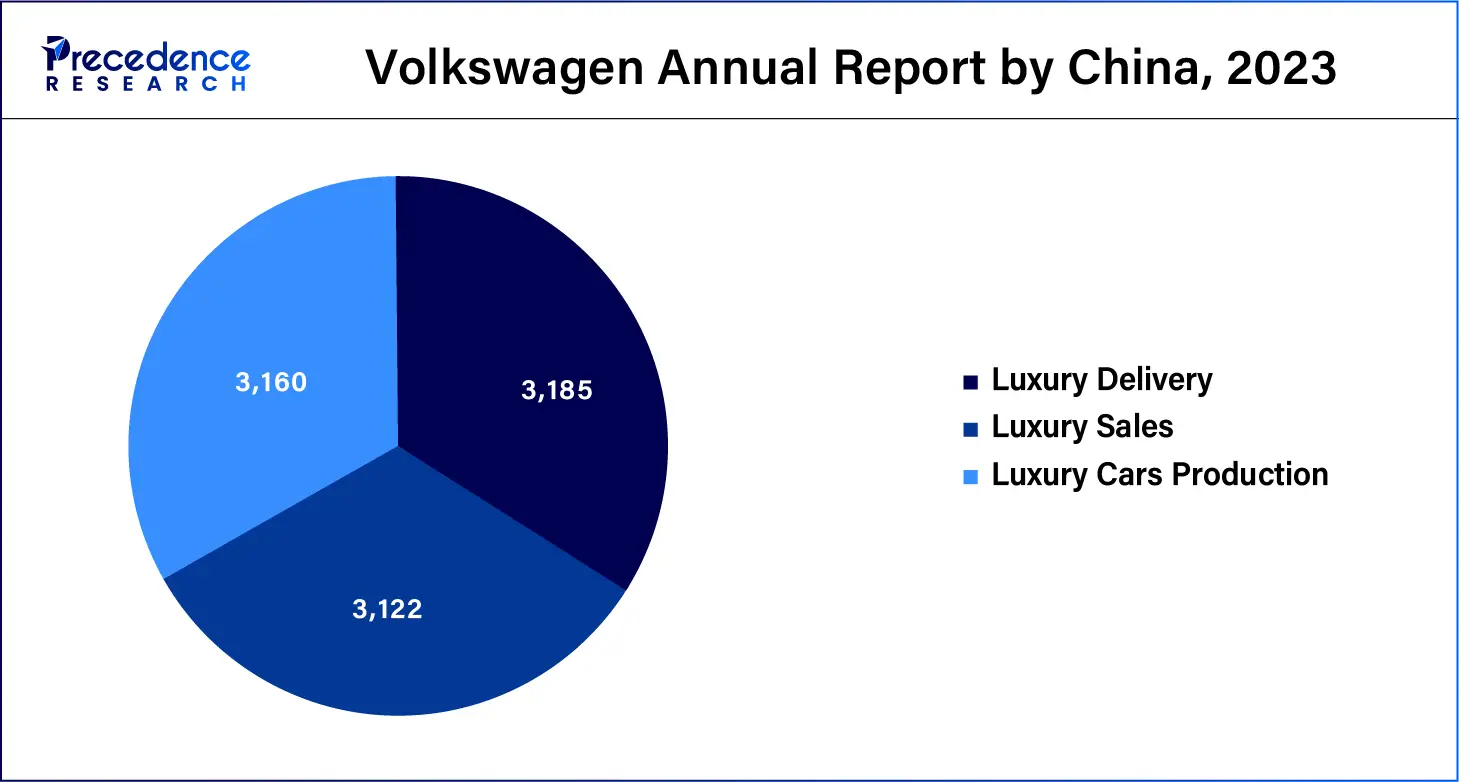

Region-wise, China and North America are the prime buyers of luxury SUVs, which are in high demand from these countries. Economic conditions and climate also play important roles in influencing the luxury car market. Overall economic prosperity, including high disposable income, is the major reason behind the dynamics of the market.

The luxury car market is distinguished by high growth potential, fueled by technological innovations, and rising wealth, coupled with the increasing consumer preferences for sustainable and advanced vehicles. The major players in the market include Mercedes-Benz, BMW, and Audi, along with other emerging brands.

The sport utility segment was estimated to have the largest share of the luxury car market in 2024. The market is further segmented into hatchback and sedan. The growth of the sport utility segment is related to the increasing demand for aesthetic looks for bikes and styling along with different high-tech features, comfort, and safety.

The hatchback segment is anticipated to witness the fastest growth in the luxury car market over the forecasted years. The segment is proliferating in the market due to the increasing global disposable income, easy availability of vehicle loans, and innovative models launched by market players.

The internal combustion engine (ICE) segment accounted for the largest share of the luxury car market in 2024. The growth of this segment is attributed to factors like the well-established structure of ICEs worldwide; most of the vehicles have ICEs as engines already running on the roads, and there is easy availability, affordability, and high performance.

The electric segment is anticipated to expand at a higher rate in the luxury car market over the forecast period. The growth of this segment is attributed to the increasing adoption of electric vehicles by the leading countries in Asia Pacific. Moreover, the leading country's government is also taking initiatives to reduce carbon footprints to accelerate decarbonization. They offer subsidies and incentives to consumers and manufacturers.

By Vehicle Type

By Propulsion Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

September 2024

November 2024