Copper Market Size and Forecast 2025 to 2034

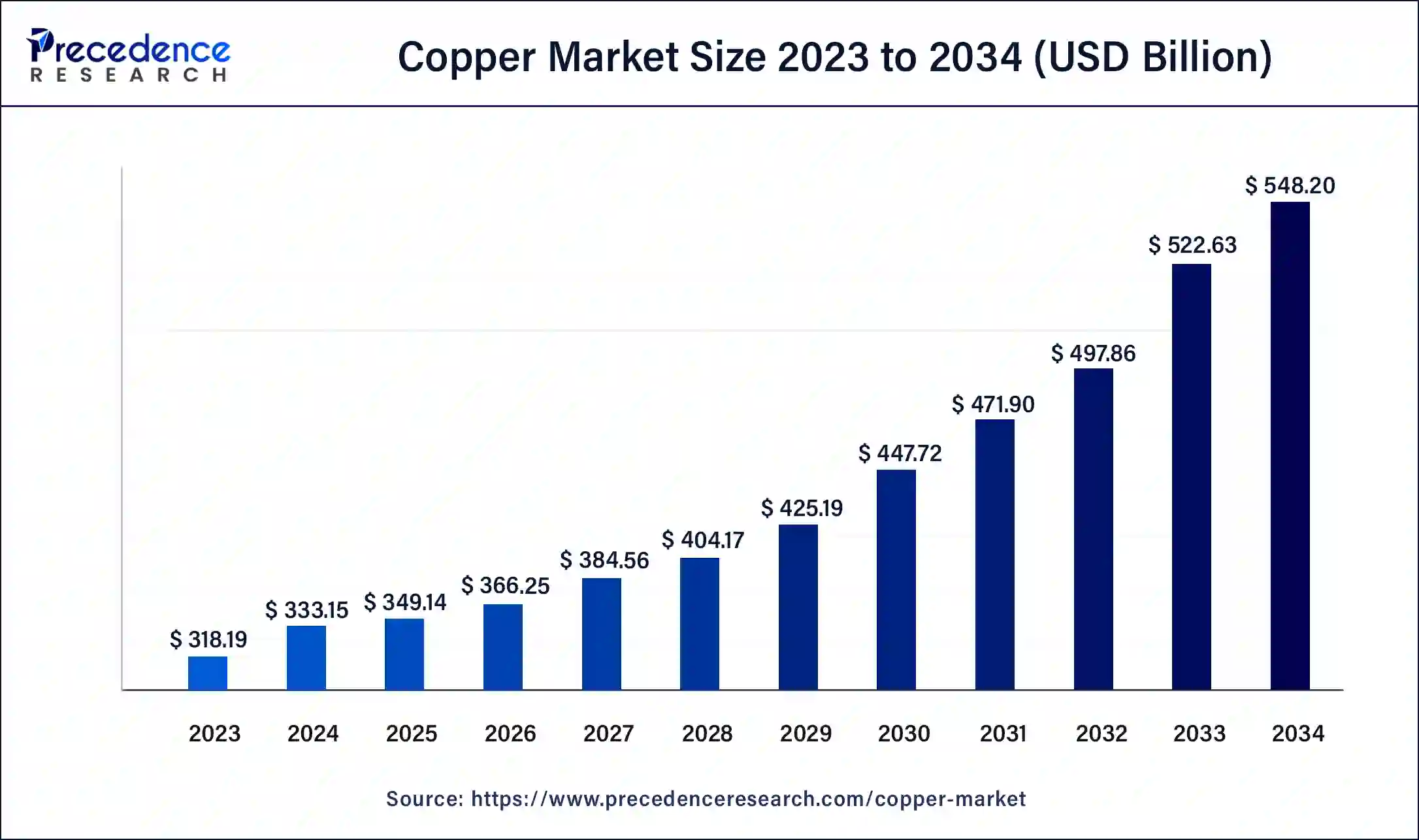

The global copper market size was calculated at USD 333.15 billion in 2024 and is expected to reach around USD 548.20 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034.

Copper Market Key Takeaways

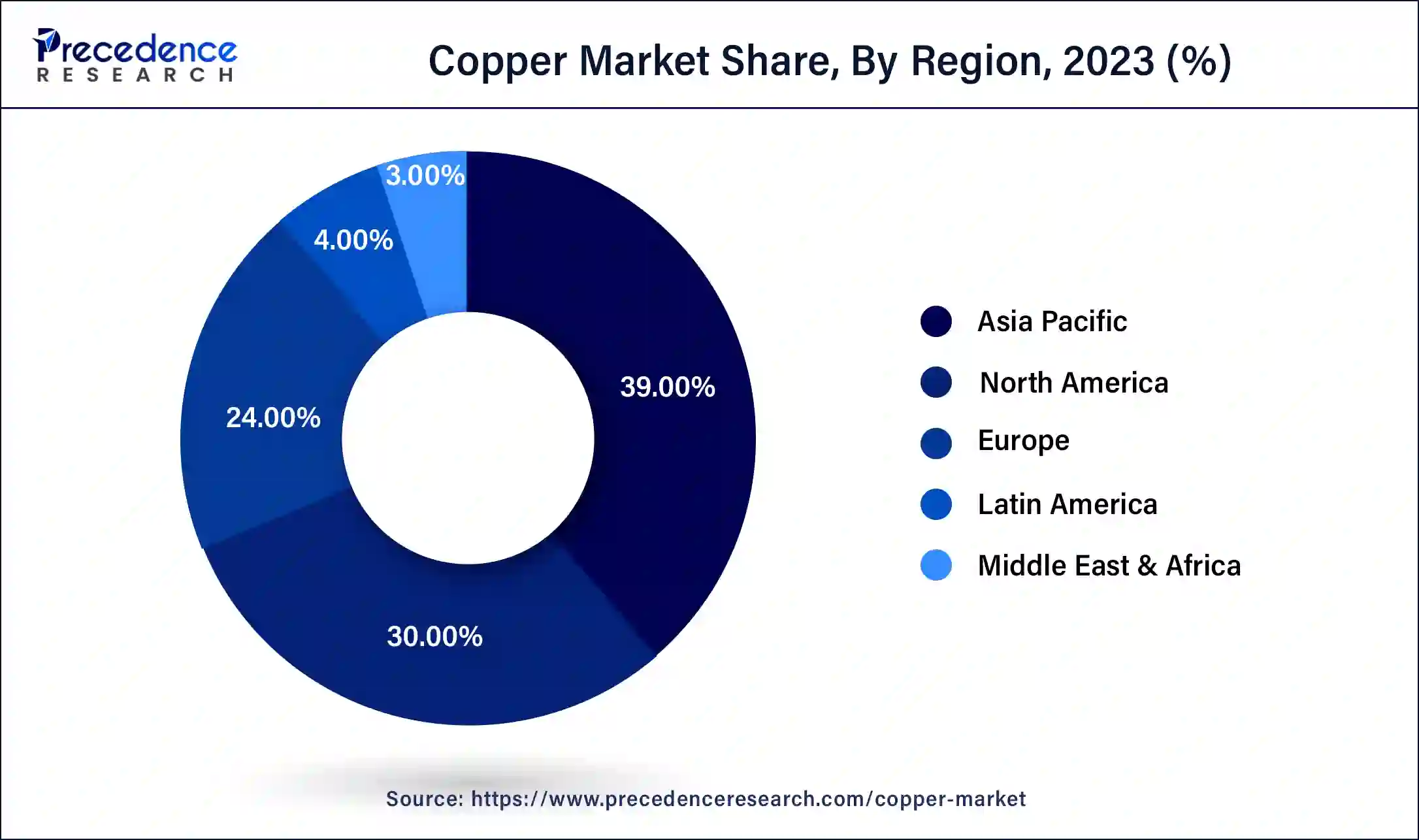

- Asia Pacific contributed more than 39% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

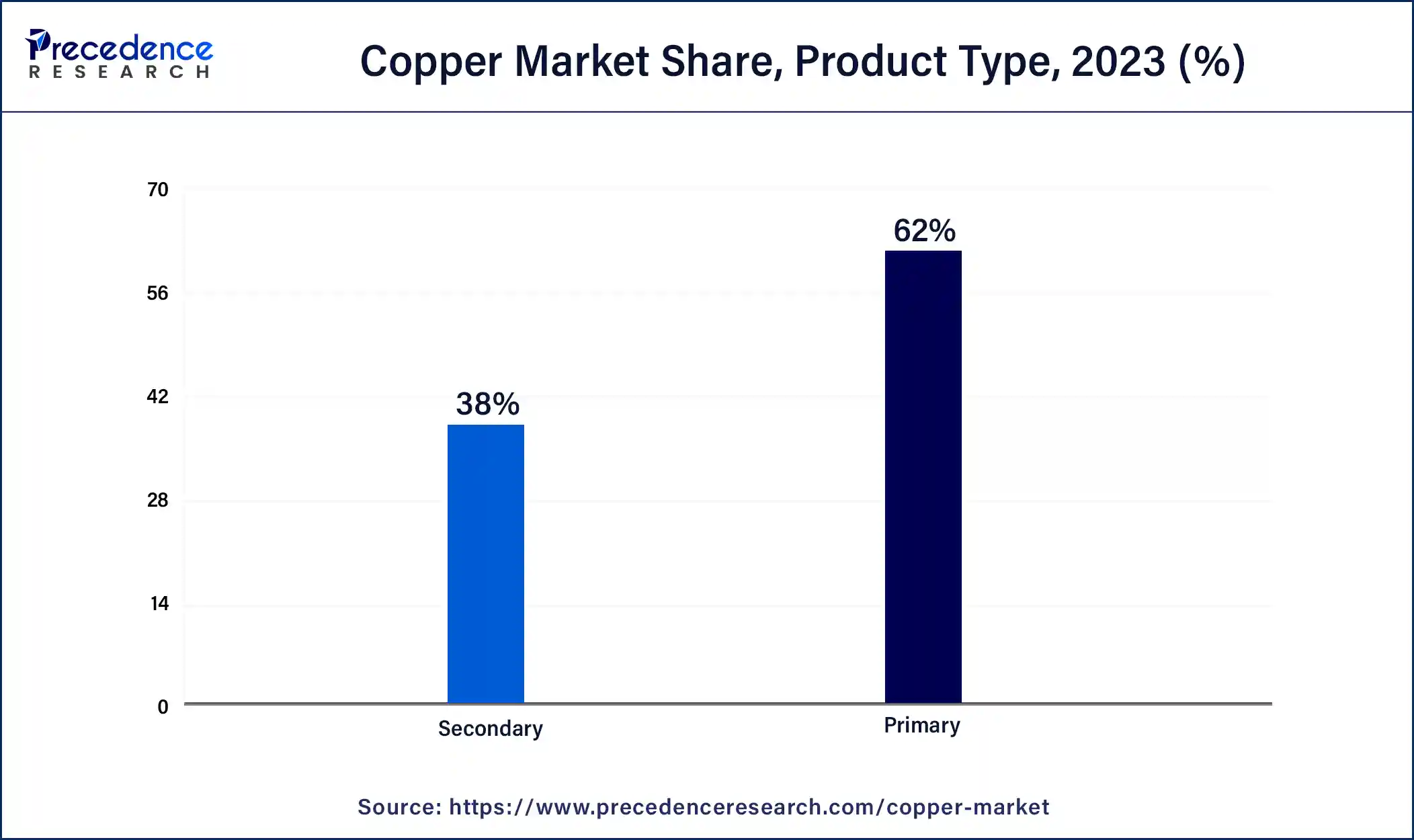

- By Product Type, the primary copper segment has held the largest market share of 62% in 2024.

- By Product Type, the secondary copper segment is anticipated to grow at a remarkable CAGR of 5.8% between 2025 and 2034.

- By End-user Industry, the construction segment had the largest market share of 32% in 2024.

- By End-user Industry, the others segment is expected to expand at the fastest CAGR over the projected period.

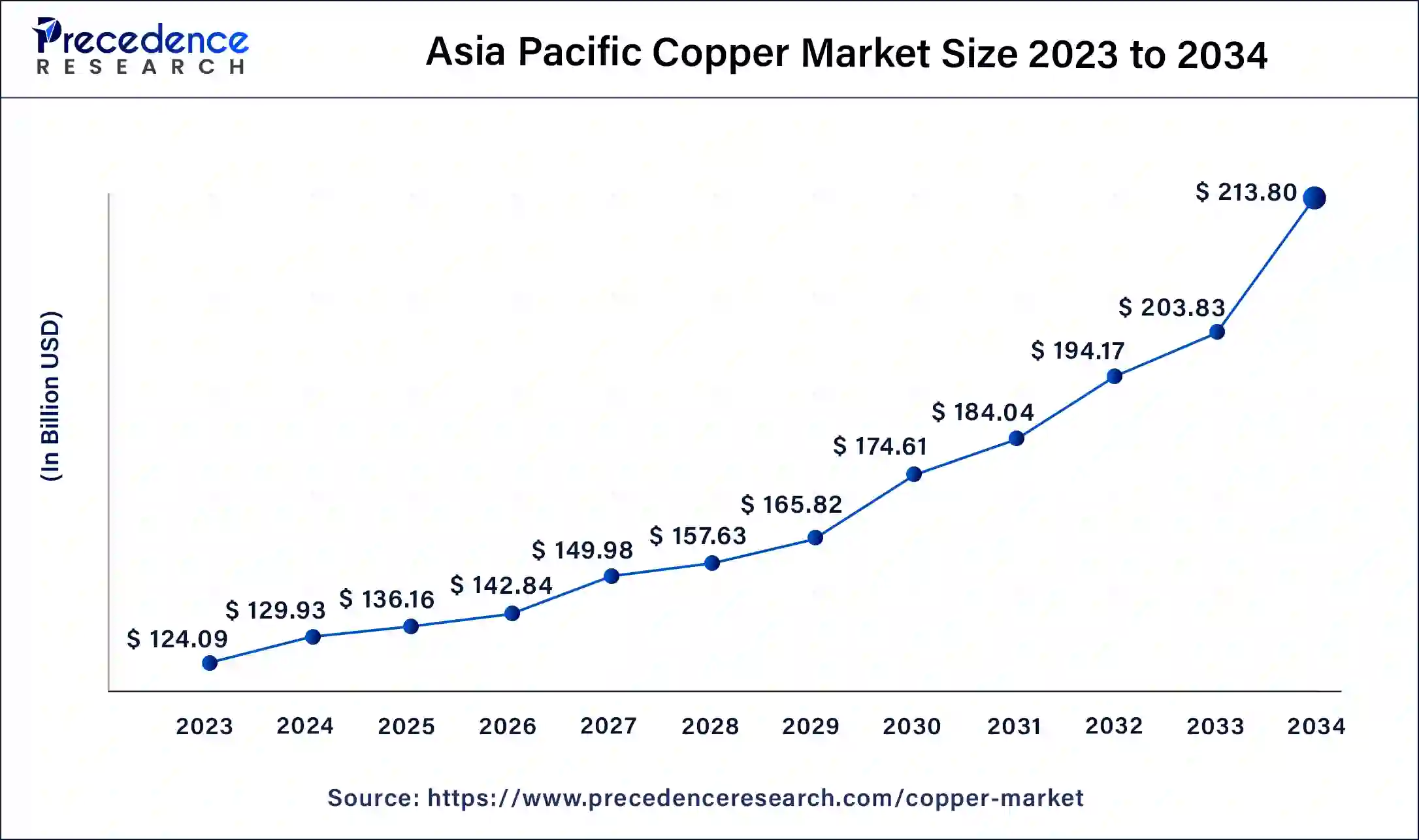

Asia Pacific Copper Market Size and Growth 2025 to 2034

The Asia Pacific copper market size is valued at USD 136.16 billion in 2025 and is expected to surpass USD 213.80 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

Asia Pacific has held the largest revenue share 39% in 2024. Asia Pacific commands a significant share of the copper market due to a combination of factors. The region's rapid industrialization, urbanization, and infrastructure development drive substantial demand for copper in construction, manufacturing, and electrical applications. Moreover, Asia Pacific's burgeoning automotive and electronics industries rely heavily on copper for components and wiring.

The region's adoption of renewable energy technologies, such as solar power and electric vehicles, further elevates copper consumption. Additionally, the presence of major copper-producing countries, like China, supports the regional supply chain. These dynamics collectively establish Asia Pacific as a dominant force in the global copper market.

North America is estimated to observe the fastest expansion. North America commands a significant share in the copper market due to several key factors. The region boasts a robust demand for copper across diverse sectors, including construction, electronics, automotive, and renewable energy. Its advanced industrial base and infrastructure development contribute to high copper usage.

Additionally, stringent environmental regulations drive the adoption of copper in green technologies. The presence of a well-established mining industry ensures a stable supply. North America's role as a global hub for technological innovation and the automotive sector further cements its prominent position in the copper market.

Why Did Europe Consider a Notable Region in the Copper Market?

Europe is expected to grow at a considerable rate in the upcoming period, both as a consumer and a producer, with a growing emphasis on sustainability and technological advancements. While Europe is a net importer of refined copper, it is a significant exporter of copper semis, i.e., semi-finished products. Many countries like Germany and the UK are leaders in copper demand and technology adoption, while other countries like France and Italy emphasize sustainability. The European Green Deal and the push for decarbonization are driving increased copper demand, particularly in areas like electric vehicles, renewable energy infrastructure, and energy-efficient technologies. Europe is also at the forefront of developing and adopting new copper-based technologies, especially in areas like electric vehicle components and renewable energy systems.

Market Overview

The copper market is a pivotal component within the global economic landscape. Copper, a highly conductive metal with applications spanning various sectors such as electronics, construction, and transportation, plays a fundamental role in contemporary technological advancements, including electric vehicles, telecommunications, and sustainable energy solutions. The market's vitality depends on factors like infrastructure development, industrial performance, and the evolution of cutting-edge technologies.

Moreover, the increasing emphasis on environmental sustainability has elevated the significance of copper recycling practices. Consequently, the copper market retains its prominence, demonstrating resilience and adaptability while continuing to evolve in response to changing economic and ecological demands.

Copper Market Growth Factors

- The growing use of electronic devices and renewable energy systems drives the demand for copper in wiring, PCBs, and electrical components.

- Infrastructure projects, such as construction and urbanization, necessitate substantial copper consumption for wiring, plumbing, and architectural applications.

- Copper is crucial in enhancing energy efficiency, leading to increased demand for its use in energy-efficient appliances and HVAC systems.

- Ongoing technological innovations in electronics, telecommunications, and automation systems boost copper demand.

- Rapid industrialization and urbanization in emerging economies increase copper demand for their expanding infrastructure and consumer markets.

- The ever-evolving consumer electronics market continues to drive copper consumption, especially in smartphones and tablets.

- The expansion of telecommunications networks, including 5G, requires copper for reliable data transmission.

- Copper-based products are used in agriculture as fungicides and soil supplements to enhance crop yields.

- Ongoing research into new applications, alloys, and technologies involving copper continues to fuel growth in the copper market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 548.20 Billion |

| Market Size in 2025 | USD 349.14 Billion |

| Market Size in 2024 | USD 333.15 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-user Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Economic growth and industrialization

Economic growth and industrialization are significant drivers of the copper market's expansion. As economies prosper and industrial sectors expand, the demand for copper increases. Copper's essential role in construction, manufacturing, and infrastructure development makes it a vital component in these growth phases. Rising urbanization, increased construction of buildings, bridges, and electrical grids, and the expansion of the manufacturing sector all necessitate substantial copper consumption.

Additionally, the rapid growth of the electronics industry, fueled by technological advancements, further elevates copper demand. As nations strive for economic development and modernization, the need for copper as a crucial industrial metal grows, creating a strong link between economic growth, industrialization, and the sustained growth of the copper market.

Restraint

Environmental concerns

Environmental concerns are increasingly restraining the copper market's growth. The copper mining and production processes generate significant environmental impacts, including habitat disruption, water pollution, and greenhouse gas emissions. These concerns have led to stricter regulations and increased scrutiny, resulting in higher operational costs for the copper industry. Additionally, there is a growing demand for sustainable and responsible sourcing of copper, putting pressure on companies to adopt eco-friendly practices. Recycling initiatives have gained traction, diverting some demand away from primary copper production.

Furthermore, public sentiment and investor preference for environmentally responsible investments are influencing the copper market. As consumers and investors seek products and companies with lower environmental footprints, the copper industry faces challenges in maintaining its growth trajectory. Balancing the need for copper with sustainable practices and mitigating environmental impacts is a critical issue affecting the industry's future prospects.

Opportunity

Emergence of electric vehicles

The proliferation of electric vehicles (EVs) is opening up substantial avenues in the copper market. EVs heavily depend on copper for their electrical systems, encompassing motors, wiring, and charging infrastructure. With the global automotive industry progressively transitioning to electrification in order to curtail carbon emissions, the demand for copper is witnessing a remarkable surge. This surge results from the convergence of consumer preferences for environmentally friendly transportation and government mandates that promote cleaner energy solutions.

The increasing integration of EVs into the market, coupled with the expansion of charging networks, represents a lasting growth prospect for the copper industry. Furthermore, continuous innovations in EV technology and the tendency towards higher battery capacities in electric vehicles further accentuate the need for copper. Copper producers and mining entities stand to gain from these promising opportunities, as they cater to the increasing demand for copper within the EV sector.

Additionally, this shift aligns with sustainability objectives and establishes copper as a key resource for a more sustainable, energy-efficient future. The burgeoning growth of the electric vehicle market presents a compelling array of opportunities for the copper industry.

Ongoing innovations in battery design, often featuring copper-intensive components, are poised to enhance the driving range and performance, driving even more significant demand for copper. Furthermore, the growth of EV charging networks, inclusive of high-speed charging stations, necessitates substantial copper-based infrastructure. This electrification of transportation not only underscores a sustainable opportunity but also aligns harmoniously with global initiatives to combat climate change and advance clean energy solutions.

Product Type Insights

The primary segment has held 62% revenue share in 2024. The primary segment holds a major share in the copper market due to its fundamental position in the copper production supply chain. Primary copper production involves the mining and refining of copper ore, making it the primary source of the metal. This segment's dominance is driven by the continuous demand for refined copper across various industries, including construction, electrical and electronics, and transportation.

While recycling and secondary copper sources are important for sustainability, primary copper remains vital to meet the ever-growing global demand, particularly in emerging economies where industrialization and infrastructure development drive substantial consumption.

The secondary segment is anticipated to expand at a significant CAGR of 5.1% during the projected period. The secondary segment holds significant growth in the copper market primarily due to the increasing emphasis on sustainability and recycling. As environmental concerns grow, the secondary copper segment, which encompasses recycled and reclaimed copper, gains prominence. Recycling copper from end-of-life products and scrap reduces the need for primary production, conserving resources and energy.

Additionally, secondary copper is cost-effective and helps meet the rising demand for the metal, especially in applications like electrical wiring, without overreliance on mining. This shift towards sustainable practices and resource efficiency has propelled the secondary copper segment to a major market growth.

End-user Industry Insights

The construction segment held the largest market share of 32% in 2024. The construction segment seizes a substantial share of the copper market due to copper's irreplaceable role in various construction applications. Copper's outstanding electrical conductivity and enduring qualities render it crucial for electrical and plumbing systems in residential, commercial, and industrial structures.

Additionally, it stands as a keystone in heating, ventilation, and air conditioning (HVAC) systems, ensuring efficient heat transfer. As global urbanization and infrastructure expansion persist, the demand for copper within the construction domain remains robust, upholding its primary position within the copper market as an essential element for advancing contemporary urban and industrial development.

The others segment is projected to grow at the fastest rate over the projected period. The segment in the copper market holds substantial growth primarily due to its diverse and inclusive nature. This category encompasses a wide array of industries, including aerospace, defense, and healthcare, which rely heavily on copper for its superior conductivity, durability, and corrosion resistance. These sectors demand copper for applications ranging from wiring in aircraft and military equipment to medical devices. The versatility of copper, its essential role in modern technology, and its adaptability to various niche applications make the segment a major contributor to the overall copper market.

Copper Market Companies

- Codelco

- BHP Group

- Glencore

- Freeport-McMoRan

- Southern Copper Corporation

- Rio Tinto

- Anglo American

- Jiangxi Copper Corporation

- First Quantum Minerals

- Lundin Mining

- Antofagasta

- KGHM Polska Miedz

- Teck Resources

- Hudbay Minerals

- OZ Minerals

Recent Developments

- In February 2025, two former executives from Glencore and Lundin Gold launched Moranda Metals, a private mining shell company focused on acquiring gold, silver, and copper assets across the Americas. This has created a unique market dynamic where commodity prices remain high, but investor interest in public mining companies has stagnated.

- In April 2025, Adani Enterprises Ltd is ready to start up a major copper smelter shortly. This is stated by the company's head of metals, Felipe Williams. This start would be the largest metallurgical complex of copper and other metals in the world.

- In September 2024, Electroninks announced the launch of the company's advanced conductive copper ink line. The new copper ink extends Electroninks' global-leading portfolio of metal complex inks while facilitating further manufacturing flexibility and lower total ownership costs to customers. This supports high-demand applications for the new copper ink is seed layer printing for fine-line metallization and RDL formation in combination with the company's proprietary iSAP™ process.

- In October 2023, Livpure introduced its new copper water purifier with a commercial. The newly introduced water purifier has 8.5-liter storage capacity with a copper-made insect-proof water tank.

Segments Covered in the Report

By Product Type

- Primary

- Secondary

By End-user Industry

- Automotive and Heavy Equipment

- Construction

- Electrical and Electronics

- Industrial

- Other End-user Industries (Consumer Products, Medical Devices, Etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting