February 2025

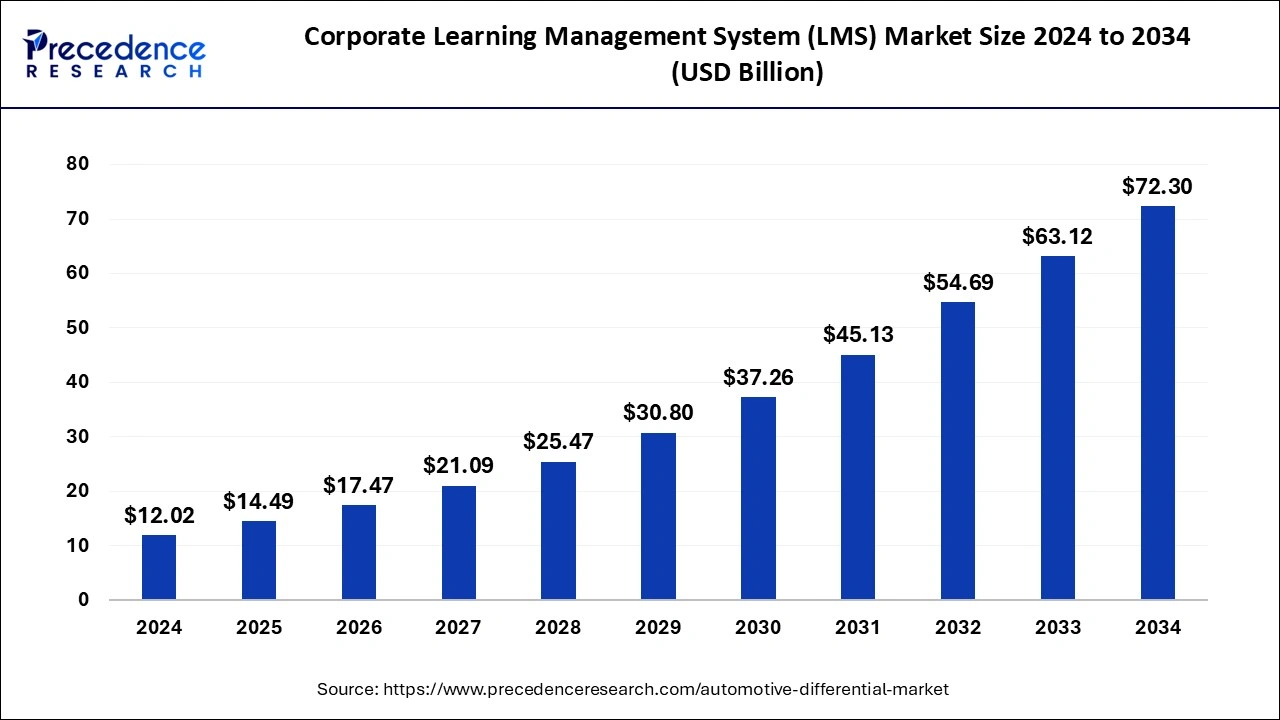

The global corporate learning management system (LMS) market size is calculated at USD 14.49 billion in 2025 and is forecasted to reach around USD 72.30 billion by 2034, accelerating at a CAGR of 19.65% from 2025 to 2034. The North America corporate learning management system (LMS) market size surpassed USD 4.69 billion in 2024 and is expanding at a CAGR of 19.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global corporate learning management system (LMS) market size was estimated at USD 12.02 billion in 2024 and is predicted to increase from USD 14.49 billion in 2025 to approximately USD 72.30 billion by 2034, expanding at a CAGR of 19.65% from 2025 to 2034.

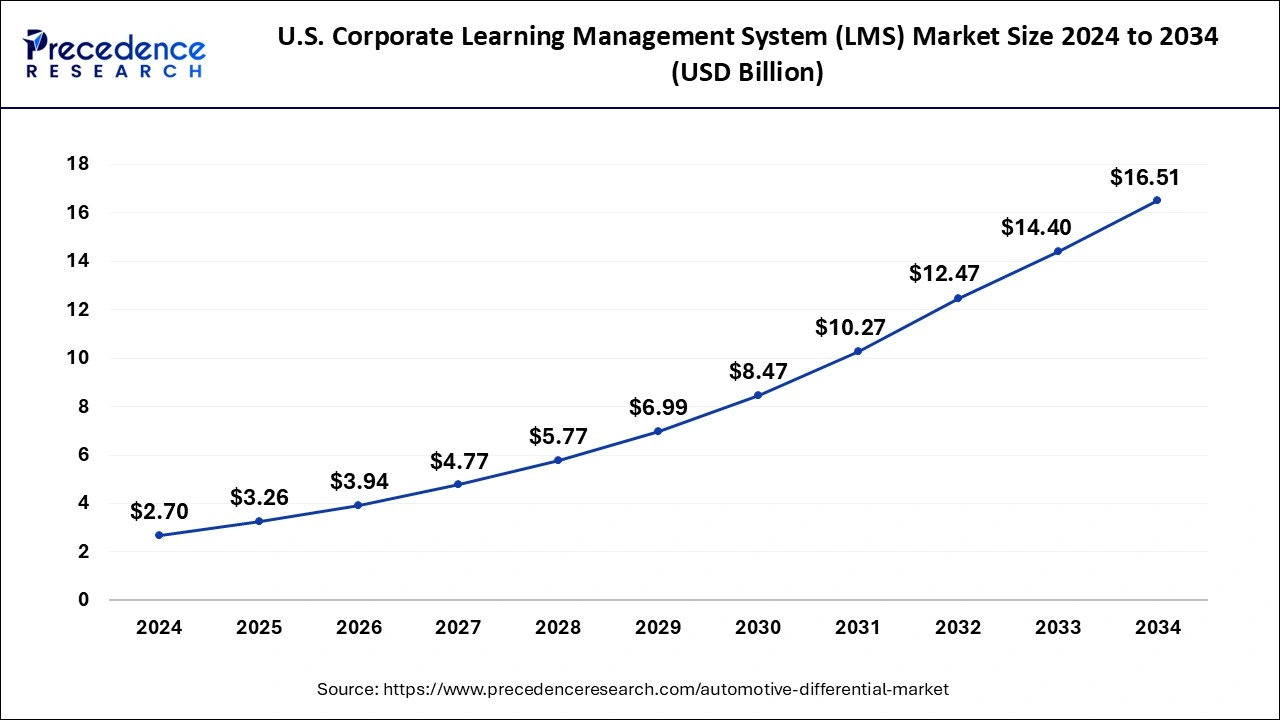

The U.S. corporate learning management system (LMS) market size was valued at USD 2.70 billion in 2024 and is estimated to reach around USD 16.51 billion by 2034, growing at a CAGR of 19.85% from 2025 to 2034.

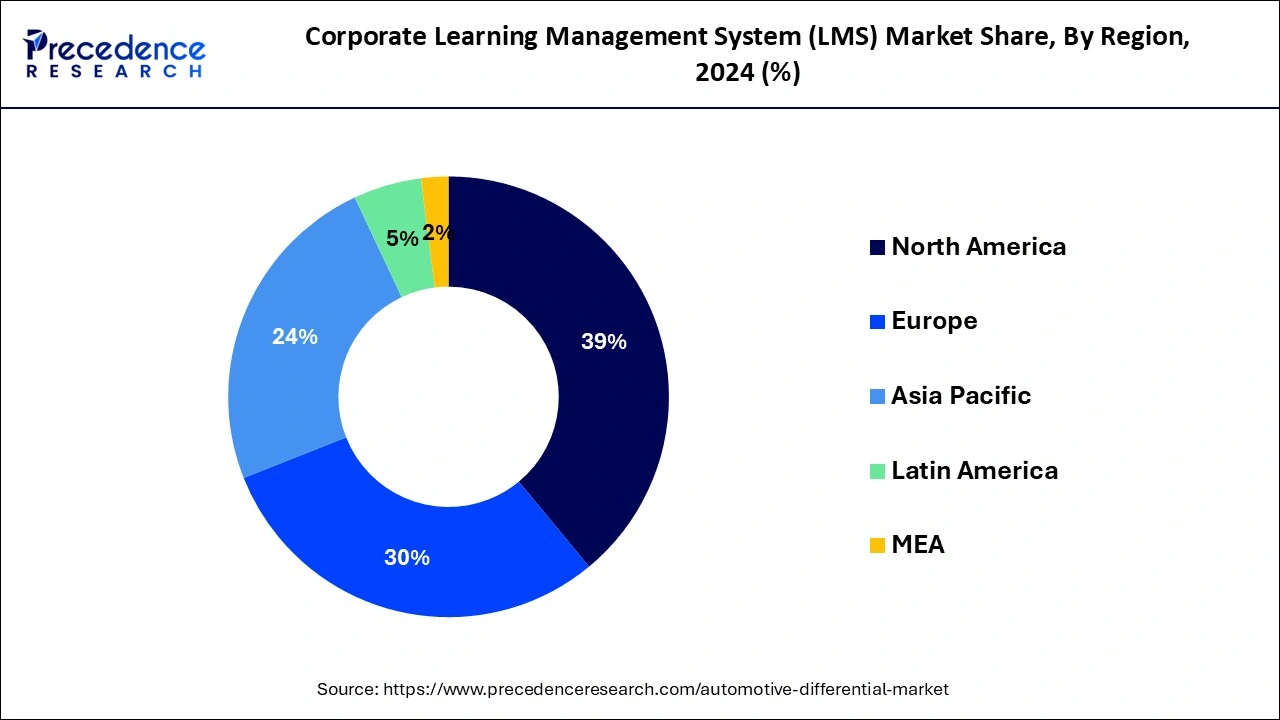

North America dominated the corporate learning management system market in 2024. The growth of the market in the region is attributed to the industrialization and increasing demand for the training and development program for employees. The rising number of IT infrastructure in the countries like the United States, and Canada is driving the growth of the corporate learning management system market in the region. The region has a well-established ecosystem of e-learning content creators, ed-tech startups and learning technology providers, this element fosters the market’s expansion in North America.

Asia Pacific is anticipated to witness the fastest rate of growth during the forecast period. The growth of industrialization in countries like India, China, and Japan. Increasing adoption of learning management systems rather than traditional methods of training and developing skills of employees are driving the growth of the corporate learning management system market across the region. The region’s commitment to research and development in multiple industries is leading to the creation of advanced e-learning technologies, further bolstering the corporate learning management system market.

Learning management system (LMS) software is the technology which is used for the learning process in the organization. LMS software is powered by smart technologies, they are also integrated with cloud technology and other HR and enterprise management systems. The learning management system tracks and delivers required training and learning content. Rising industrialization is driving the requirement for the learning management system applications for training and learning processes of employees. LMS software is one of the major tools for helping businesses to continue and offer personalized learning experience to both employees and enterprises.

In the modern era of industrialization and ever-evolving technologies, the demand for skill training and learning software has increased from the corporate sector. This shift is observed to supplement the growth of corporate learning management market. Most of organizations are adopting the LMS software for training and development of the employees that gives them personalized learning experience which is benefitting the employees as well as employers.

Employee training, onboarding, professional development and continuous training, channel training and extended enterprise, and compliance training are a few applications of learning management system in the corporate sector. LMS software helps automate the Human Resource (HR) tasks like onboarding. Rising investment by private organizations for training and learning development of the employees will result in higher productivity is observed to promote the growth of corporate learning management system market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.65% |

| Market Size in 2025 | USD 14.49 Billion |

| Market Size by 2034 | USD 72.30 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Deployment, By Organization Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Effortless learning

The learning management system is a modern approach of training and development programs for employees at the corporate level. Corporate learning management systems can offer effortless learning, which is observed to promote the market’s growth. Learning management systems are developed in a way to resolve practical issues that arise in the corporate sector, including tome required for tasks or grading papers. As companies and organizations put emphasis on adopting advanced solutions for employee activity betterment, the adoption of LMS is observed to grow.

Higher administrative cost and adaptability issues

Installing the learning management system in the organization results in higher administrative costs or installation costs. Installation of LMS requires considerable time and money. Many organizations are still using the traditional methods for training and development of their employees so there are adaptability issues for LMS which is also hampering the corporate learning management system market.

AI-based learning management system

Artificial Intelligence in learning management systems is revolutionizing the LMS program in the corporate sector. AI allows the LMS platform to assemble information about the learner, their past performance, and learning preference. All this information is beneficial for the personalized training to the learners for their better performance. For instance, if the employee is struggling with a specific concept, AI is capable of providing adequate resources or exercise. Automation and less human errors can be achieved with the deployment of artificial intelligence in learning management systems. Thereby, the factor is observed to offer opportunities for the corporate learning management systems market’s expansion.

The solution segment dominated the market in 2024. By allowing organizations to select only the components they need, solution components can potentially reduce costs, which is a significant consideration for many businesses. Solution component vendors often specialize in their respective areas, offering in-depth expertise and support, which can be more attractive to organizations seeking domain-specific solutions. Many solution components focus on enhancing the user experience, offering features like intuitive interfaces and personalized learning paths. This results in higher user engagement and adoption.

The service segment is expected to grow at a significant rate during the predicted timeframe. Substantial requirement for technical assistance and installation of learning management systems in organizations is promoting the segment’s growth.

The on-premise deployment segment led the market in 2024. The growth of the segment is attributed to the higher security specification offered by on-premise deployment of corporate learning management systems. On-premise learning management system is highly beneficial for the organization who maintains the high degree of security. The on-premise deployment also offers customization and specialized integration on the organization.

The cloud-based deployment segment is expected to grow at the fastest rate during the forecast period. The easy accessibility offered by cloud-based deployment is considered a major factor for the segment’s expansion. In recent times, most organizations have started preferring programs and training online, which requires cloud-based deployment. increase in knowledge retention, organizational performance and learner engagement. Cloud-based learning management is made to streamline the process of learning and development programs, it saves time, cost and effort. There are several benefits of adopting the cloud learning management system in corporate such as its adaptive design, personalized training, decreases training costs, better scalability, and low maintenance.

The large organization segment dominated the global corporate learning management system market in 2024; the segment is expected to sustain its position throughout the forecast period. Rising demand for the learning management system from large companies or enterprises to streamline their complex learning process and modalities has propelled the segment’s growth. According to research, 43% of large organizations are willing to shift or replace their learning management system software. Most of the large organizations require LMS to manage, and control and the entire organizational learning process. Large organizations have a diverse workforce, they often need LMS platforms that can seamlessly integrate with their existing HR and other software systems.

Small and medium-scale organizations segment is expected to grow at a significant rate. Technological advancement results in the growth of learning management system software in small and medium scale organizations. The learning management system is helping small and medium scale organizations in saving costs that are required to be invested in training programs.

The software and technology vertical segment dominated the market in 2024. The substantial need for the continuous training of employees in the software and technology related companies is driving the growth of the learning management system in these software and technology industries. Learning management systems can collect and analyze data on learning outcomes, helping software companies assess the effectiveness of training programs and make data-driven decisions to enhance workforce productivity. The software and technology industry must adhere to strict compliance and security standards. LMS platforms provide a structured way to ensure that employees are well-informed about security protocols and compliance requirements.

The retail industry vertical segment is expected to witness the quickest rate of growth during the forecast period. The retail industry is one of the most engaged industries across the globe. Retailers can tailor learning management systems platforms to their specific needs, incorporating training on customer service, product knowledge and compliance. Retailers often have a large, diverse workforce. LMS solutions that can scale easily to accommodate this are crucial.

By Component

By Deployment

By Organization Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

November 2024

October 2024