January 2025

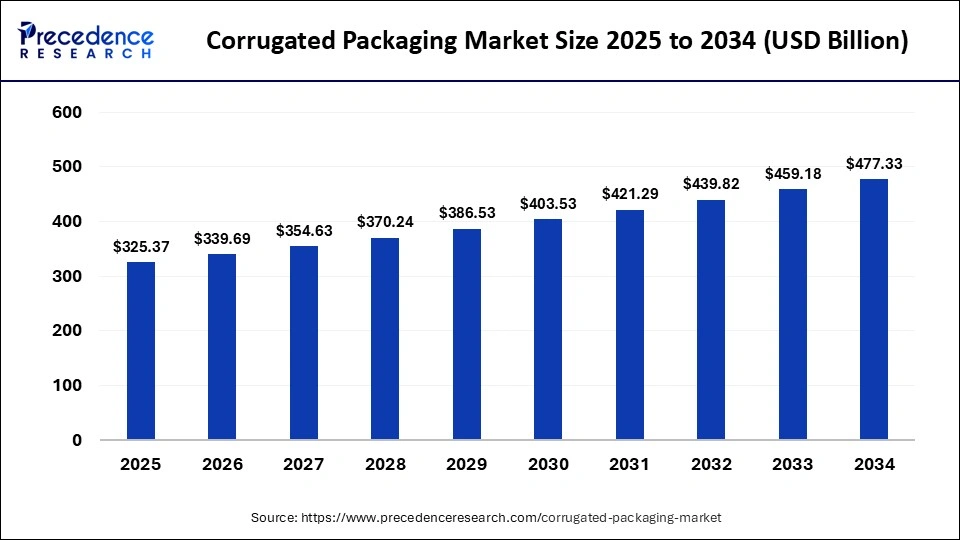

The global corrugated packaging market size is accounted at USD 325.37 billion in 2025 and is forecasted to hit around USD 477.33 billion by 2034, representing a CAGR of 4.36% from 2025 to 2034. The Asia Pacific market size was estimated at USD 112.20 billion in 2024 and is expanding at a CAGR of 4.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global corrugated packaging market size was calculated at USD 311.66 billion in 2024 and is predicted to reach around USD 477.33 billion by 2034, expanding at a CAGR of 4.36% from 2025 to 2034. Rising demand for a strong, versatile, and sustainable packing choice that protects the product during shipping and storage is increasing the adoption of the corrugated packaging market.

Integrating artificial intelligence into the corrugated packaging industry offers automation of the work process, leading to enhanced efficiency, reduced labour costs, and prioritization of employee safety. Emerging technology such as computer vision, machine learning and 3D printing is noticed to be widely used in the packing industry for sourcing, manufacturing, design, and distribution processes. AI-powered sensors provide real-time monitoring and predictive maintenance which detect anomalies or potential issues before they become a serious problem. The integrated AI algorithm analyses historical recorded data and market trends to optimize the production of the company.

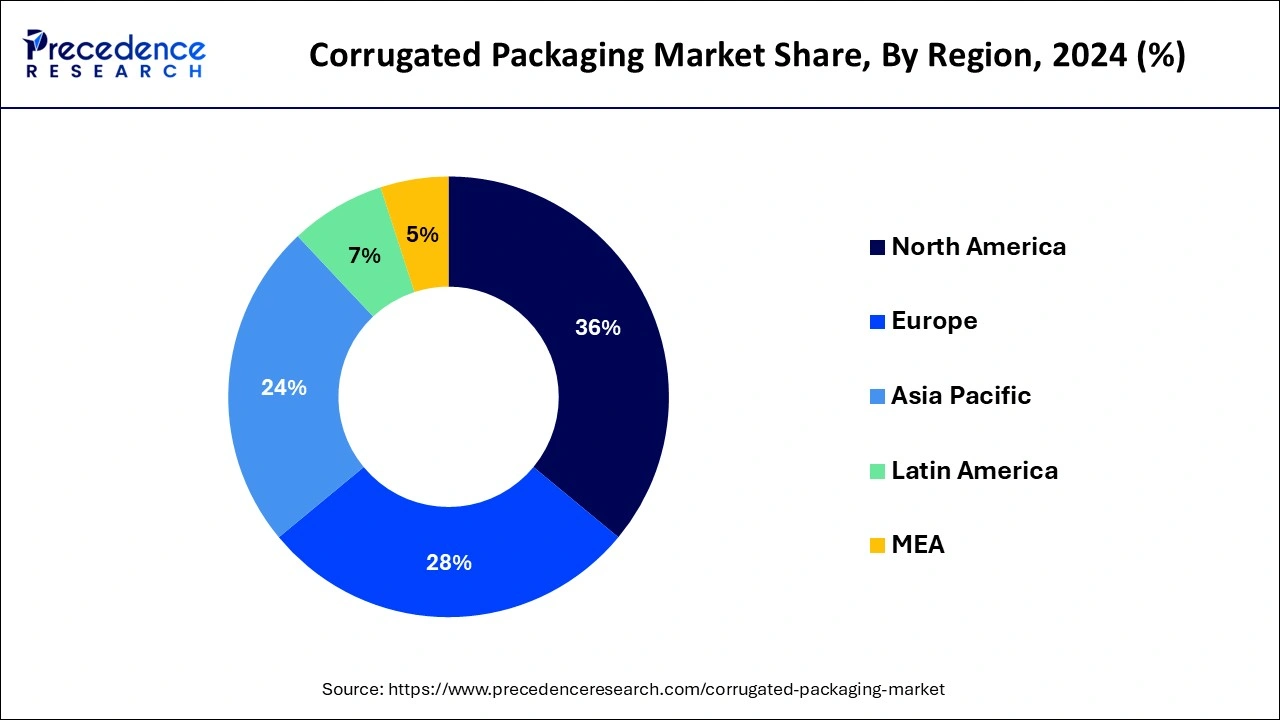

The Asia Pacific corrugated packaging market size was exhibited at USD 112.20 billion in 2024 and is projected to be worth around USD 174.22 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034.

Asia Pacific dominated the market with revenue share of over 35.14% in 2024. This region is the manufacturing hub of the world. Most of the electronics, homecare, and healthcare products are manufactured in the region and supplied globally. Moreover, the presence of huge population in the region makes it the most lucrative market for the food & beverages industry, which is expected to significantly drive the demand for the corrugated packaging. Moreover, the rising penetration of the e-commerce and various online shopping platforms in the region is fueling the demand for the corrugated packaging. All these factors are expected to foster the growth rate of the Asia Pacific corrugated packaging market in the foreseeable future.

North America is estimated to be the most opportunistic market during the forecast period. The stringent government regulations towards the use of eco-friendly packaging materials couple with the increased consumer awareness regarding the usage of environment-friendly materials has fostered the growth of the corrugated packaging market. The joint efforts of the Corrugated Packaging Alliance (CPA) and the American government has significant contributions towards the increased adoption of the corrugated packaging materials across the industries in North America. The major cities in US has banned the use of plastics owing to its harmful impact on the environment and human health, which has triggered the use of sustainable, reusable, and recyclable corrugated packaging in the region. It is estimated that US has more than 1,000 corrugated manufacturing units and over 50% of the corrugated boxes are made using recycled contents. US is among the top importers of the tree fibers that are used for making corrugated boxes.

| Report Coverage | Details |

| Market Size in 2025 | USD 325.37 Billion |

| Market Size by 2034 | USD 477.33 Billion |

| Market Growth Rate from 2025 to 203 | CAGR of 4.36% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Package Type, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of E-commerce and Related Sectors

The rapid growth of e-commerce in the past decade has tremendously spiked the consumption of corrugated packaging all over the globe. The rising popularity of e-commerce and online retail platforms such as Pepperfry, Amazon, Flipkart, eBay, Wal-Mart, and various others are penetrating the developing and underdeveloped markets at a rapid pace. The significant growth of telecommunications and the IT infrastructure, increased penetration of the internet, rising adoption of smartphones, and rising awareness regarding virtual stores among consumers are the major factors that have boosted the growth of the e-commerce industry across the globe. The rising disposable income and rising standards of living is resulting in the growth in the demand for various personal care, electronics, home products, and food products. The increasing adoption of e-commerce platforms among consumers to buy various types of goods is supplementing the growth of the corrugated packaging market.

Increase in Raw Material Cost

There are several challenges faced by the corrugated box industry, some of them vary with urgency and intensity depending on the company. The primary challenge the company needs to deal with is rising in raw material prices. The increasing demand and drop in supply is impacting the cost. The corrugated packaging companies need to spend more on raw materials such as kraft paper and many more, and the overall prices as increased in the supply chain. Another reason for the increase in raw material cost is the rising energy cost at the paper mills. This also increases the production cost in the corrugated box industry.

Global Sustainability Initiatives

The future of corrugated packaging is anticipated to grow more towards sustainability with driving factors including consumer awareness about environmental issues, rising preference for recyclability, and eco-friendliness. This trend is meeting the current market demand and setting the stage for a better sustainable and personalized market in the coming years.

The single wall boards segment dominated the global corrugated packaging market. This is attributed to the increased adoption of the single wall boards owing to its durability, strength, and feasible price. The single wall boards are more feasible for packaging and transportation of the majority of the products like food products, small electronic products, personal care, and pharmaceuticals. Hence, the increased adoption of the single wall boards has fueled the growth of this segment across the globe.

On the other hand, the double wall boards segment is estimated to be the most opportunistic segment during the forecast period. The higher strength and durability is needed for the packaging of the heavy products of the electronics, healthcare, and homecare products. The increased popularity of the e-commerce has created a huge demand for the consumer electronics across the globe such as laptops, washing machines, air conditioners, fans, and various other products that needs more protection especially during the transit. Hence, the rising penetration of the e-commerce is fostering the growth of the double wall board segment growth.

Based on the application, food & beverages dominated the global corrugated packaging market in 2023. The food & beverages industry accounts for the highest volume consumption and highest revenue generation in the corrugated packaging market. The food & beverages industry require the corrugated packaging for the storage, handling, and transportation of the processed food products, non-perishables, and fresh produce. Varieties of the corrugated packages is required based on the perishability of the food products. The corrugated packaging is non-reactive, which makes it a popular choice for packaging the food products for longer time period and for transportation. Therefore, the food & beverages industry has a significant contribution in the growth of the global corrugated packaging market.

On the other hand, the e-commerce is estimated to be the fastest-growing segment. This is attributable to the rapidly growing adoption of the online shopping in the developing and the underdeveloped economies. The easy availability of the desired products, easy payment options, availability of feasible EMI options, fast home deliveries, and easy replace and return policies offered by the e-commerce channels is fueling the online shopping across the globe, which in turn is expected to foster the demand for the corrugated packaging in the forthcoming years.

By Package Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

June 2024

September 2024