August 2023

Cosmetic Chemicals Market (By Product type: Surfactants, Emollients & Moisturizers, Film-Formers, Colorants & Pigments, Preservatives, Emulsifying & Thickening Agents, Single-Use Additives, Others; Application: Skin Care, Hair Care, Makeup, Oral Care, Fragrances, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

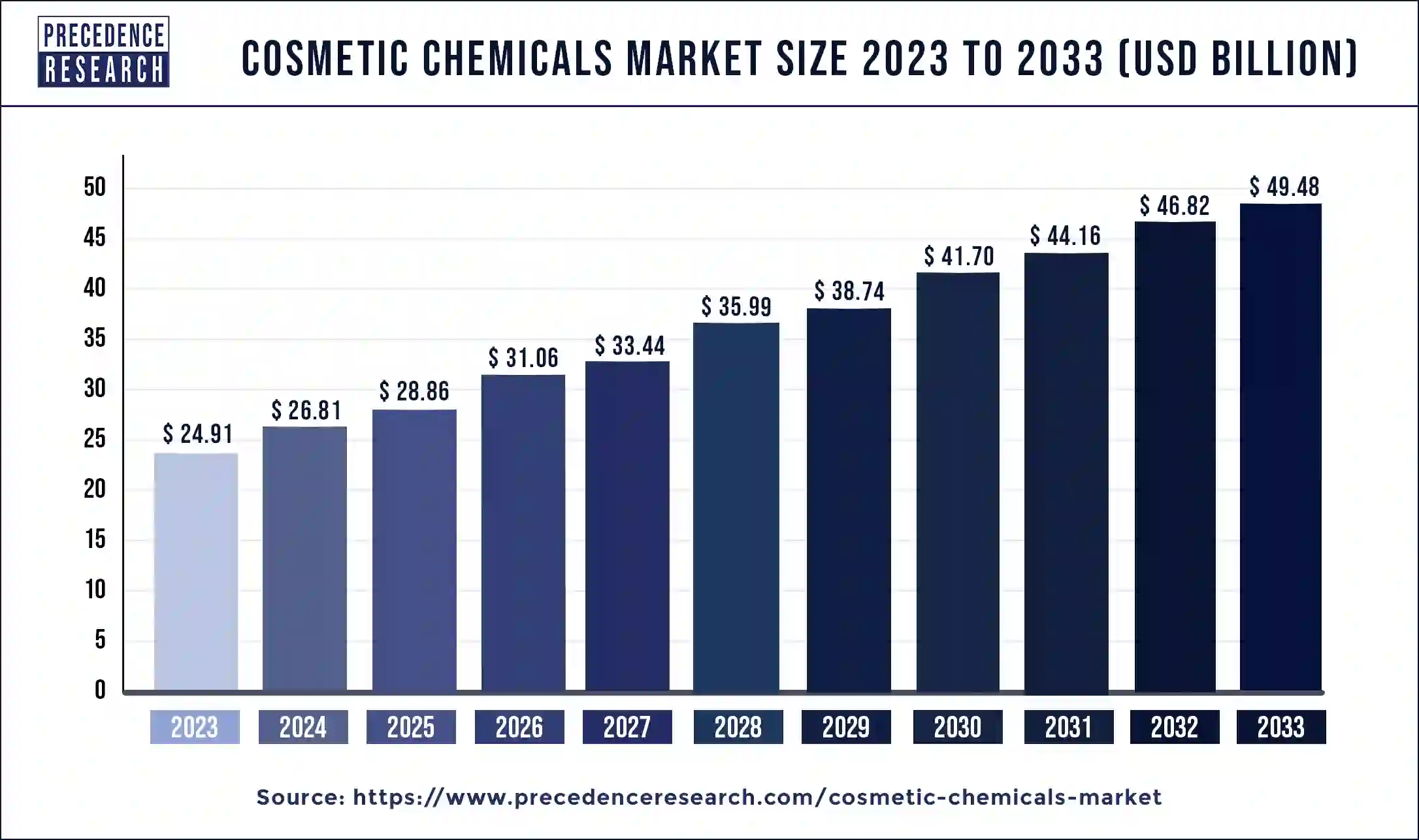

The global cosmetic chemicals market size was estimated at USD 24.91 billion in 2023 and is expected to hit around USD 49.48 billion by 2033, growing at a CAGR of 7.10% during the forecast period 2024 to 2033.

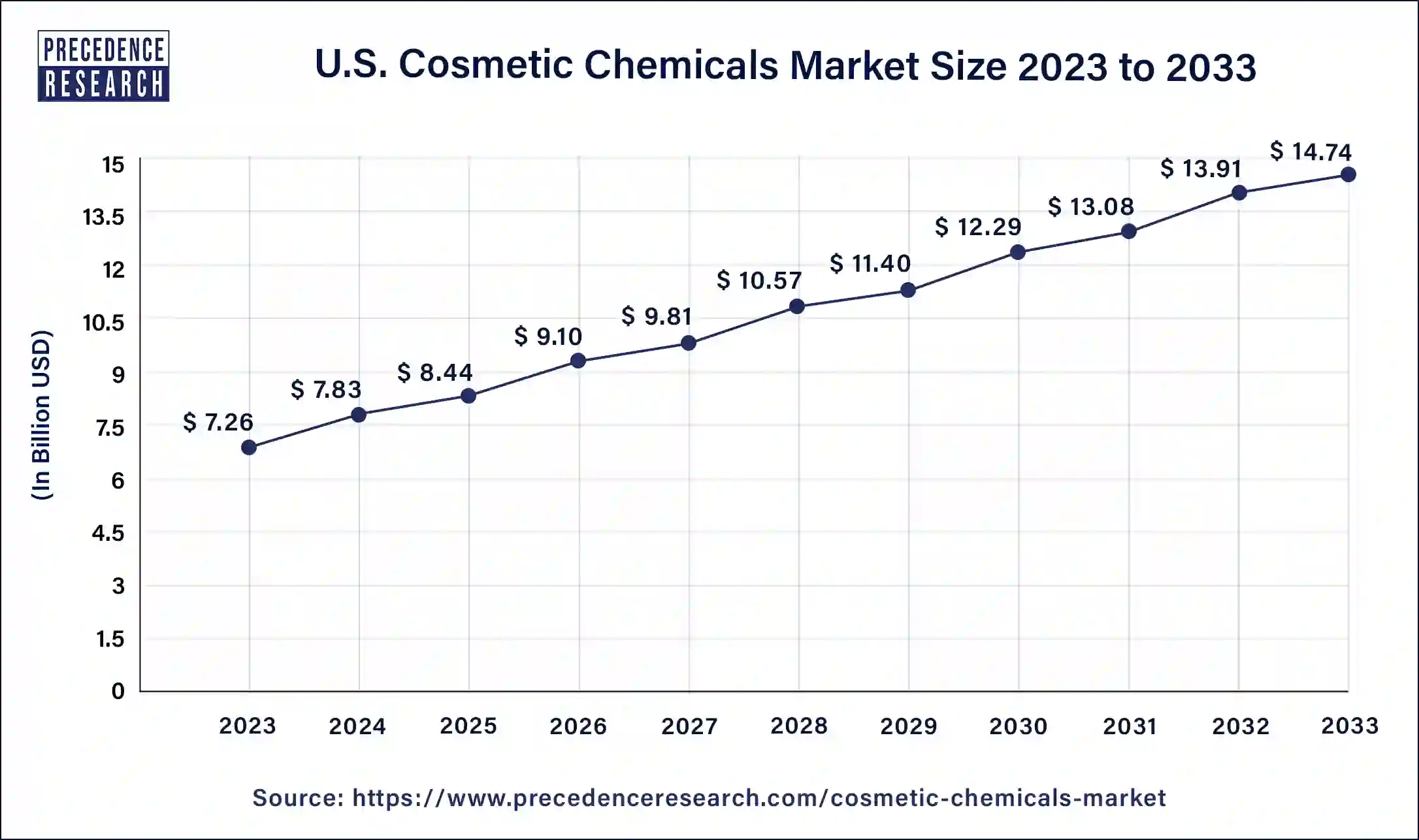

The U.S. cosmetic chemicals market size was valued at USD 7.26 billion in 2023 and it is expected to surpass around USD 14.74 billion by 2033 with a CAGR of 6.88% from 2024 to 2033.

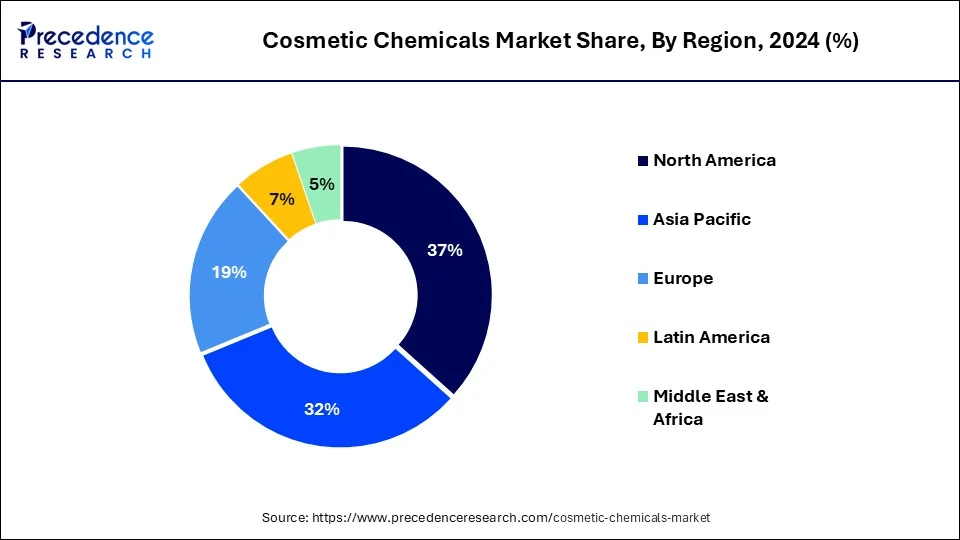

Due to the area's high demand for the cosmetic product, North America is anticipated to have the greatest shareholder by geographic region. Every year brings new heights for the cosmetic and personal care industries in the United States. Manufacturers in the country are using an integrated approach rather than seeing personal care products under the categories of health and beauty. Many market participants are concentrating on boosting the entry of biotechnology, pharmaceutical, and food ingredient firms into the beauty sector, which will lead to the release of cutting-edge goods. Men in the nation use an average of six personal care items each day, compared to 12 for women. In addition, a 2021 poll of the clique community in the United States revealed that 63% of women saw skin care as an investment in their wellbeing. Additionally, there is a rise in demand for skincare products among consumers as a result of increased knowledge of the importance of skin health and skin care. Globally rising demand for face creams, sunscreens, and body lotions is anticipated to fuel the expansion of the cosmetic chemicals industry. Major businesses in the cosmetic chemicals sector are now concentrating more on the creation of cutting-edge skin care products. Additionally, a shift in consumer preference toward goods made from natural sources and generated from organic materials is anticipated to fuel the expansion of the cosmetic chemicals market. Some businesses source the majority of their chemicals from plants, such as camelina, polyphenols, and marine sources including collagen, algae, and insects. Many brand-new, smaller firms have also entered the market in an effort to benefit from the sector's ongoing success. Additionally, the market is expanding as a result of increasing investments in skincare product R&D.

The market for cosmetic chemicals in Asia-Pacific is anticipated to expand at the quickest rate. Asia-Pacific consumers' demand for cosmetic chemicals is rising as a result of skin care applications.

Global demand for cosmetic chemicals is rising as a result of the fast rise in buying power in nations like India and China. Asia Pacific is anticipated to use cosmetic chemicals the most in the near future. In the upcoming years, Southeast Asia, which encompasses Thailand, Malaysia, Indonesia, Vietnam, and Singapore, is anticipated to have fast growth.

The market for cosmetic chemicals in Europe is anticipated to increase by 5.28% CAGR between 2024 and 2033 as a result of ongoing R&D expenditures, rising individual disposable income and purchasing power, and growing consumer desire for cosmetics made with natural components.

A variety of chemical substances from synthetic sources make up cosmetic chemicals. They are the primary components utilised in the creation of cosmetic or personal care products. Colorants, surfactants, emollients, preservatives rheology control agents are just a few of the cosmetic chemicals that are often present in cosmetic products. The increasing desire for cosmetic products created with natural ingredients and consumer willingness to pay more for premium items are driving the market for cosmetic chemicals.

Emulsifiers, preservatives, thickeners, moisturisers, colours, and perfumes are a few of the components that are frequently used in cosmetics. They can be created artificially or naturally. Additionally, synthetic compounds can be made from natural resources like petroleum or bio-based materials. However, because of the complex synthesis process they go through and the use of derived reagents and catalysts, these chemicals are referred to be synthetic. Products made from plants, minerals, animals, and microbes all seem to be examples of natural commodities. There are around 1500 chemical units recognised as cosmetic chemicals worldwide.

Among the most common ingredients used in cosmetics are thickening agents, carrier powders, pigments, colorants, preservatives, film formers, emollients and moisturisers. The cosmetic industry is fragmented because a huge number of suppliers offer a wide range of natural and inorganic chemicals, which are essential components. Nevertheless, a significant share of the market's commerce in cosmetic chemicals is controlled by twenty or more large worldwide businesses.

Additionally, during the aforementioned projection period, the market for cosmetic chemicals will have several potential prospects due to the booming demand for innovative beauty products and rising consumer spending on branded organic toiletries.

The desire to enhance one's look and increasing disposable earnings in emerging countries like India and China are the main factors driving the worldwide market for cosmetic chemicals. The rapidly growing fashion and entertainment industries in developed and emerging countries like the U.S., France, and South Korea have also increased consumer demand for cosmetics, which is expected to eventually fuel demand for cosmetic chemicals in the near future. Additionally, it is anticipated that throughout the projected period, demand for cosmetic chemicals would increase due to the growing number of working women in major businesses and international firms as well as their high consumption of beauty products.

One of the key elements influencing the cosmetic business is the rising demand from ethnic communities for beauty products that are catered to their demands. In addition, it is anticipated that ageing baby boomers would have more awareness of and desire for personal care products, which will raise demand for cosmetic chemicals. However, the worldwide market for cosmetic chemicals may experience a growth slowdown due to the growing desire for natural substances. Major firms must also follow rules and laws specific to their sector.

| Report Coverage | Details |

| Market Size in 2024 |

USD 26.81 Billion |

| Market Size by 2033 |

USD 49.48 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Application, Geography |

| Companies Mentioned |

SOLVAY SA, Croda International PLC, Evonik Industries AG, Stepan Company, Symrise, Ashland Inc, Dow, Givaudan, Eastman Chemical Company, Lonza Group, Lanxess, The Dow Chemical Company, BASF SE, P&G Chemicals, Bayer AG., Cargill Incorporated |

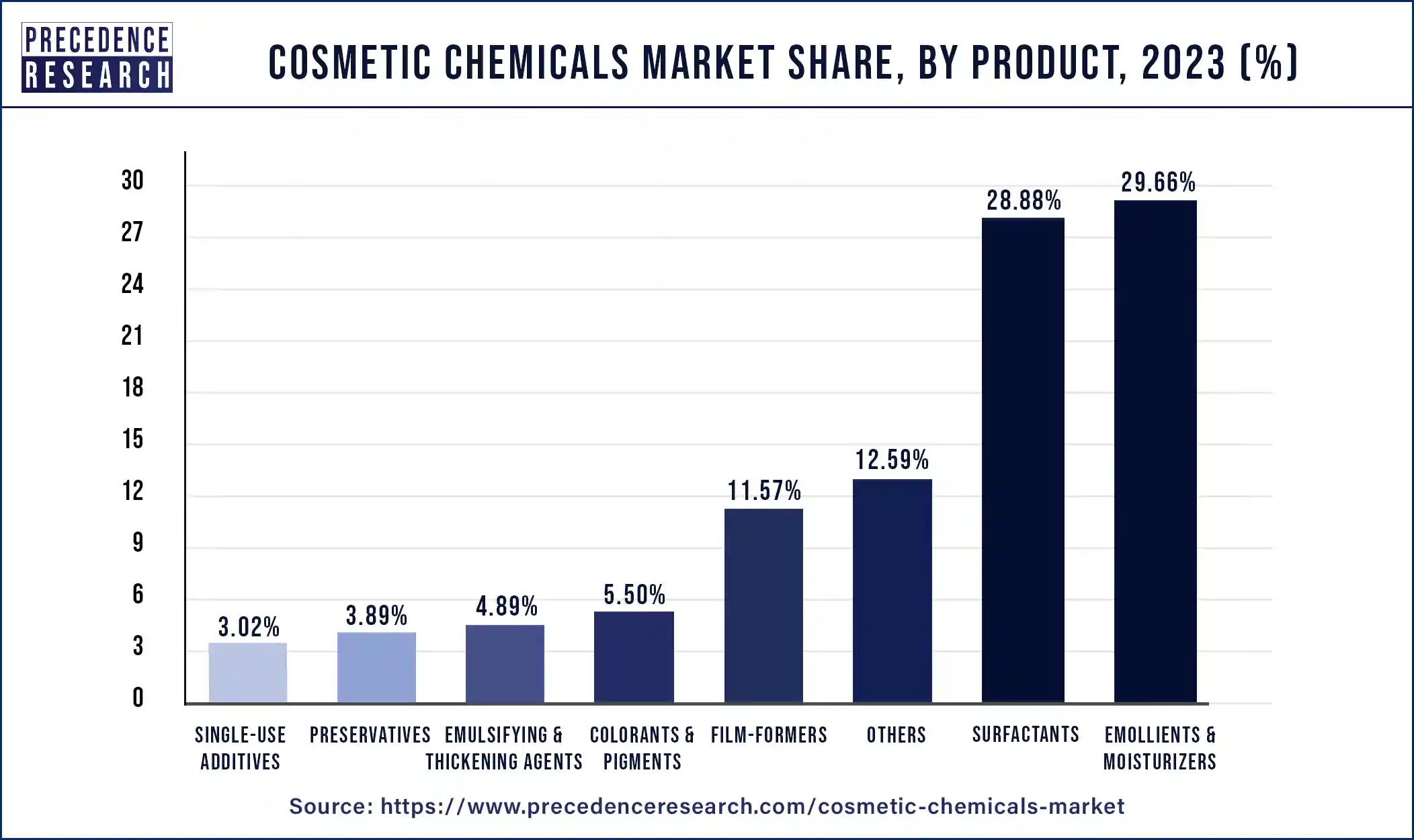

In terms of revenue, the emollients & moisturizers segment dominated the market in 2023, accounting for about 29.66%. Emollients are polymer molecules, for instance, that soften the skin by lowering water loss. In addition to other cosmetics and personal care products, they are present in face creams, body lotions, lipsticks, and moisturisers for the skin. The market for cosmetic chemicals has seen the emollients and moisturiser sector emerge as the dominant category with a revenue share of over 30% in 2021. Emollients inhibit water loss from the skin, softening it. They may be found in a variety of personal care and cosmetic items, including lipstick, face cream, body lotion, and skin moisturisers. These emollients are offered for sale in both natural and synthetic varieties. Olive oil, coconut oil, beeswax, lanolin, petrolatum (petroleum jelly), glycerin, mineral oil, zinc oxide, diglycol laurate, and butyl stearate are a few of the often used emollients.

The majority of cosmetic products contain preservatives, which are often included in the formulations to increase shelf life and stop the growth of germs and fungus. The development of these microorganisms has the potential to affect both the application and the product. Because the majority of bacteria live in water, the preservatives utilised must be water soluble.

Cosmetic preservatives come in a variety of formulations and concentrations. Depending on the need of the product, the preservatives employed in formulations might range from 0.01% to 5.2%. Formaldehyde, parabens, salicylic acid, benzyl alcohol, and tetrasodium ethylenediaminetetra-acetic acid are a few of the preservatives that are often utilized (EDTA).

Global Cosmetic Chemicals Market, By Product Type, 2020 – 2023 (USD million)

| Product Type | 2020 | 2021 | 2022 | 2023 |

| Surfactants | 5,735.2 | 6,185.6 | 6,668.2 | 7,194.8 |

| Emollients & Moisturizers | 5,797.1 | 6,285.3 | 6,812.6 | 7,391.3 |

| Film-Formers | 2,307.1 | 2,485.5 | 2,676.4 | 2,884.6 |

| Colorants & Pigments | 1,127.1 | 1,203.2 | 1,283.8 | 1,371.0 |

| Preservatives | 782.7 | 840.7 | 902.5 | 969.7 |

| Emulsifying & Thickening Agents | 978.1 | 1,052.9 | 1,132.9 | 1,220.0 |

| Single-Use Additives | 607.1 | 652.2 | 700.3 | 752.6 |

| Others | 2,660.0 | 2,810.4 | 2,964.8 | 3,127.8 |

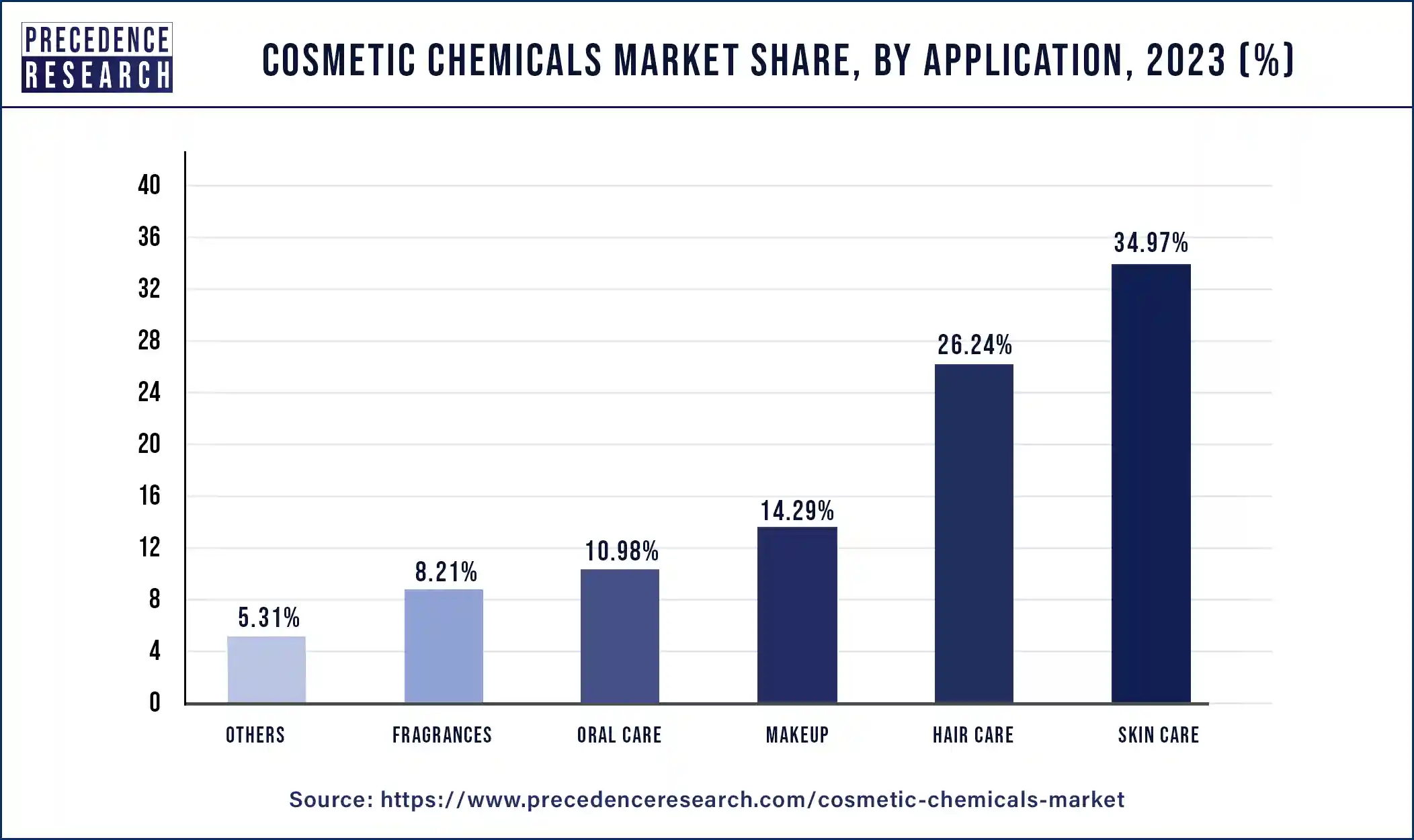

In 2023, the skin care market sector held the largest market share of around 34.97%. This is ascribed to an increase in consumer demand for skin care products as a result of rising worries about having healthy skin and taking care of it. The global demand for sunscreen, face creams, and body lotions is anticipated to fuel the expansion of the market for cosmetic chemicals. Major businesses in the cosmetic chemicals sector are now concentrating more on the creation of cutting-edge skin care products. Additionally, a shift in consumer preference toward products made from natural sources and generated from organic components is anticipated to fuel the expansion of the cosmetic chemicals market throughout the course of the projected period. According to a survey of the cosmetic chemicals market, the demand for products used in hair care and skincare will account for more than 30% of total sales in 2022. The CAGR for this market is anticipated to be approximately 4.89% over the following ten years.

The usage of advanced grade cosmetic chemicals has increased recently due to the growing demand for face creams, body lotions, sunscreens, shampoos, conditioners, and other hair care products. As consumers' environmental concerns grow, they are turning more and more toward organic products.

Growing consumer concerns about hair loss and greying hair, and also shifting fashion industry hair style trends, are the main factors driving the market for hair care products. Growing levels of stress and pollution are two major factors in young and middle-aged people's hair loss, discolouration, thinning of hair, and dandruff. Additionally, it is projected that this would increase their use of hair care products. Over the course of the forecast period, the aforementioned factors are anticipated to have a major impact on the market for cosmetic chemicals. Customers who have greater discretionary money might spend more on upscale goods like perfumes. Due to customers' higher living standards, the hygiene goods market is also anticipated to expand over the next years. An important trend affecting the rise in consumer awareness and, consequently, in product demand is the increase in spending by cosmetics product producers on marketing and commercialization.

Global Cosmetic Chemicals Market, By Application, 2020 – 2023 (USD million)

| Application | 2020 | 2021 | 2022 | 2023 |

| Skin Care | 6,887.0 | 7,448.8 | 8,052.6 | 8,713.1 |

| Hair Care | 5,207.0 | 5,617.4 | 6,057.4 | 6,537.7 |

| Makeup | 2,895.8 | 3,102.9 | 3,323.0 | 3,561.5 |

| Oral Care | 2,253.9 | 2,404.9 | 2,564.6 | 2,737.1 |

| Fragrances | 1,654.0 | 1,775.7 | 1,905.5 | 2,046.5 |

| Others | 1,096.6 | 1,166.2 | 1,238.7 | 1,315.9 |

Key market developments

In January 2020, BASF SE introduced new skincare active ingredients and displayed its actives portfolio, which includes Inolixir, bioactive compounds for cosmetic applications, Hydagen Aquaporin, and Hydrasensyl Glucan. Hydagen Aquaporin, Hydrasensyl Glucan, and Inolixir were created as skin moisturisers, while Hydrasensyl Glucan helps to create healthy skin and provides a calming sensation.

Key market players

Segments covered in the report

By Product type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2023

November 2024

November 2024

October 2024