December 2024

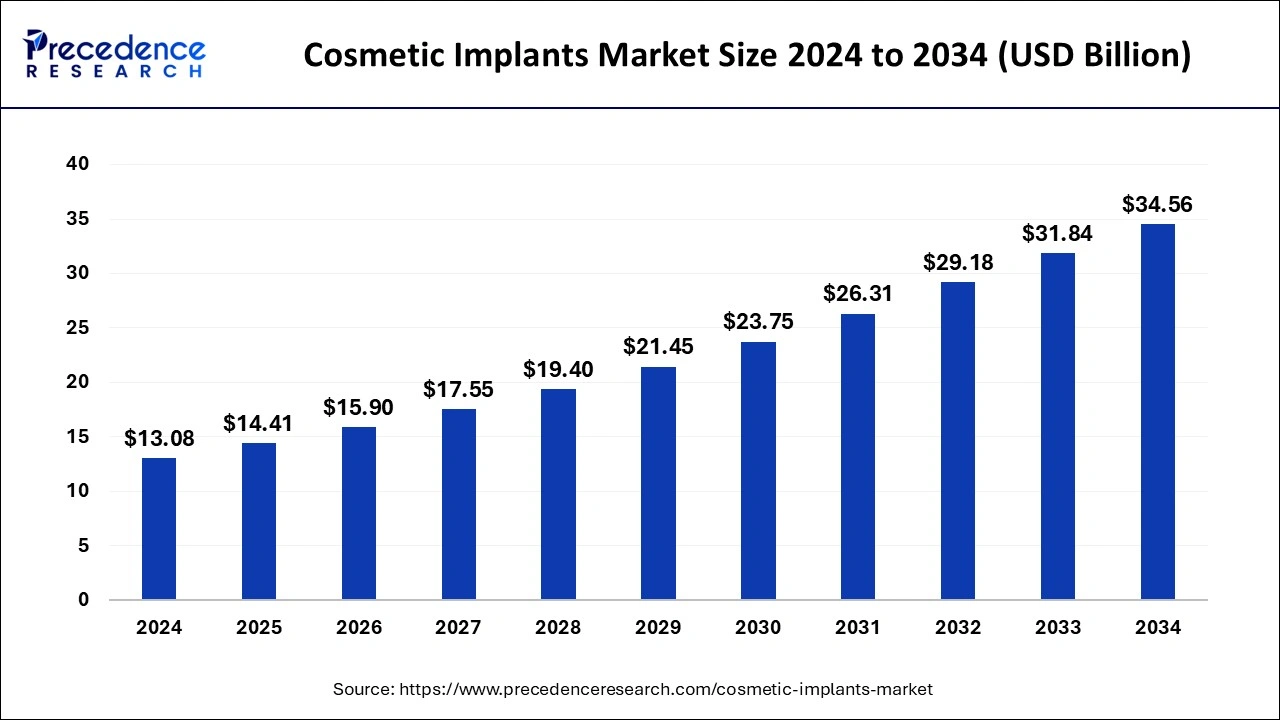

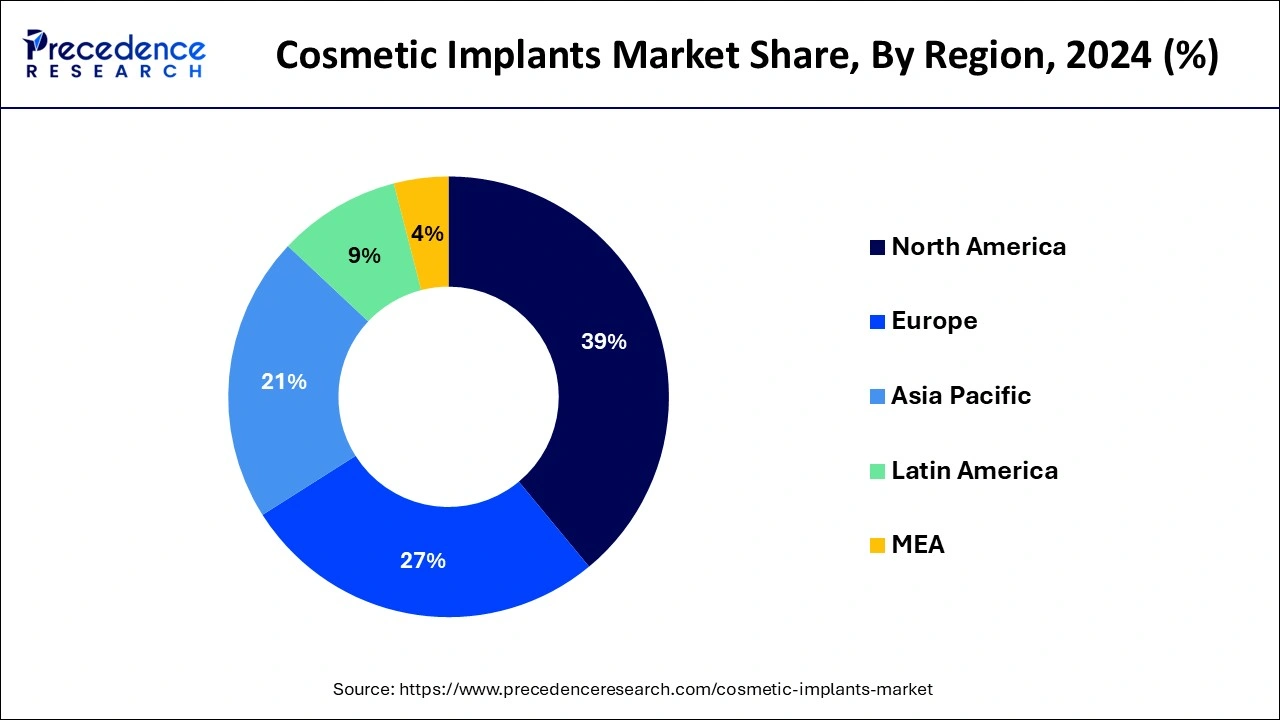

The global cosmetic implants market size is calculated at USD 14.41 billion in 2025 and is forecasted to reach around USD 34.56 billion by 2034, accelerating at a CAGR of 10.20% from 2025 to 2034. The North America market size surpassed USD 5.10 billion in 2024 and is expanding at a CAGR of 10.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cosmetic implants market size accounted for USD 13.08 billion in 2024 and is expected to exceed around USD 34.56 billion by 2034, growing at a CAGR of 10.20% from 2025 to 2034. The increasing number of cosmetic surgeries, growing demand for aesthetic appearance, and burgeoning cosmetic sector drive the cosmetic implants market.

Artificial intelligence (AI) and machine learning (ML) revolutionize the entire cosmetic sector, including cosmetic surgeries and cosmetic implants. AI and ML can be potentially used to design and develop novel cosmetic implants based on patients’ requirements. They enable personalized, precise, and innovative approaches to patient care. They can also aid in bulk manufacturing of cosmetic implants, improving efficiency and reproducibility. ML can analyze vast amounts of data and diagnose specific abnormalities, suggesting appropriate implants for the patients. Additionally, AI and ML can assist surgeons in performing cosmetic surgeries, enhancing surgical outcomes, and improving patient outcomes. AI and ML can optimize a patient’s recovery process and outcomes by monitoring progress and analyzing wound healing processes.

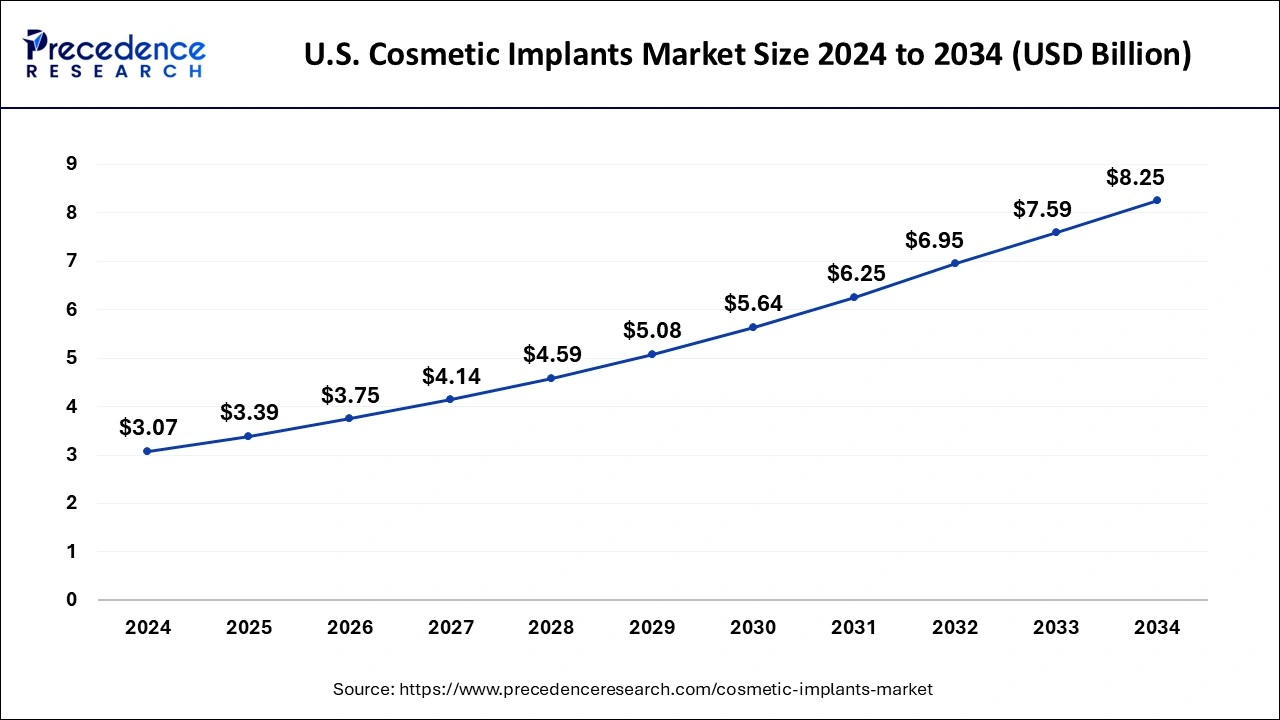

The U.S. cosmetic implants market size was exhibited at USD 3.07 billion in 2024 and is projected to be worth around USD 8.25 billion by 2034, growing at a CAGR of 1.39% from 2025 to 2034.

North America dominated the cosmetic implants market in 2024. The market for cosmetic implants in North America is growing due to the growing incidences of target diseases. In addition, the increase in healthcare expenditure is also paving way for the North America cosmetic implants market. Furthermore, the other factors such as favorable government policies and reimbursement policies as well as easy approvals of drugs and medications are supporting the expansion of cosmetic implants market in the region.

The increasing number of cosmetic surgeries in North America also potentiates market growth. The U.S. performs the highest number of cosmetic surgeries in the world. In 2024, around 4.7 million plastic surgeries were performed in the U.S. The rising number of plastic surgeons also favors market growth. There are around 7,000 plastic surgeons in the U.S.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China and Japandominate the cosmetic implants market in Asia-Pacific region. Dental caries affects around 60% of the Indian population, and periodontal disorders affects around 85% of the population, as per the Ministry of Health and Family Welfare. This results into surge in demand for dental implants. In addition, the growing geriatric population is also driving the growth and development of cosmetic implants market in Asia-Pacific region.

Cosmetic implants are categorized as non-invasive or minimally invasive cosmetic surgeries that can be carried out to reduce abnormalities of certain body parts. Breast implants, nasal prostheses, face implants, ocular prostheses, and injectable fillers are some of the most regularly performed cosmetic implants. Cosmetic surgery procedures enhance the appearance, making people feel more comfortable and confident of their appearance. The selection of a suitable implant is done depending on implant shape and size, external texture, and filler material.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.41 Billion |

| Market Size in 2034 | USD 34.56 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 10.20% |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Application, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Number of Cosmetic Surgeries

The increasing number of cosmetic surgeries increases the demand for cosmetic implants, boosting the cosmetic implants market. The number of cosmetic surgeries has increased due to the growing demand for aesthetic appearance or to treat certain chronic disorders. The rising incidences of breast cancer globally increase the demand for breast implants. According to an ISAPS report, approximately 35 million cosmetic surgical and non-surgical procedures were performed globally in 2023. Out of these, 4.1 million breast augmentation procedures were performed in 2023.

High Cost

The major challenge of the cosmetic implants market is the high cost of cosmetic implants and cosmetic surgeries. This limits the affordability of many patients, especially in low- and middle-income countries, restricting market growth.

3D Printing

3D printing is a rapidly emerging technology used in various sectors, including the cosmetic sector. It results in the production of customized implants of different shapes, sizes, and materials, offering excellent anatomical fit. It is a cost-effective method and manufactures products with complete restoration properties and aesthetic results. 3D printing minimizes the total waste generated, supporting environmental sustainability. It also reduces the overall cost required to produce an implant. It can also yield implants with improved functionality and enhanced biocompatibility.

The polymer materials segment dominated the cosmetic implants market in 2024. The qualities of ceramic materials make them unique. High melting points, low electrical and thermal conductivity, and high tensile properties are all common characteristics. They are also brittle and rigid, with excellent thermal and chemical stability. The ceramic materials are highly used in dental implants.

The biological materials segment is fastest growing segment of the market in 2024. The growing awareness of biological implants among consumers is driving the growth and expansion of the segment. In addition, the growing research and development activities are boosting the growth of the segment over the forecast period.

The dental implants segment dominated the cosmetic implants market in 2022. As per the American Academy of Implant Dentistry’s estimations, nearly 30 million Americans are missing all of their teeth in one or both jaws. In addition, almost 15 million people in the U.S. have had bridge and crown replacements. Globally, the senior population is growing at a rapid pace. The growing geriatric population is driving the growth of the segment. Moreover, dental problems are becoming more common all around the world. Cosmetic dentistry is becoming increasingly popular in Europe and North America. Furthermore, the technological advancements are contributing towards the expansion of dental implants segment.

The breast implants segment is fastest growing segment of the market during the forecast period. As per the International Society of Aesthetic Plastic Surgery, the global number of breast augmentation procedures is expected to rise by 6.1% in the upcoming years. Breast augmentation surgeries are becoming more popular, which is driving the growth of the segment. The factors such as rising prevalence of breast cancer and growing number of plastic surgeons are supporting the growth of breast implants segment.

Key Developments

By Raw Material

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

March 2025

February 2025