September 2024

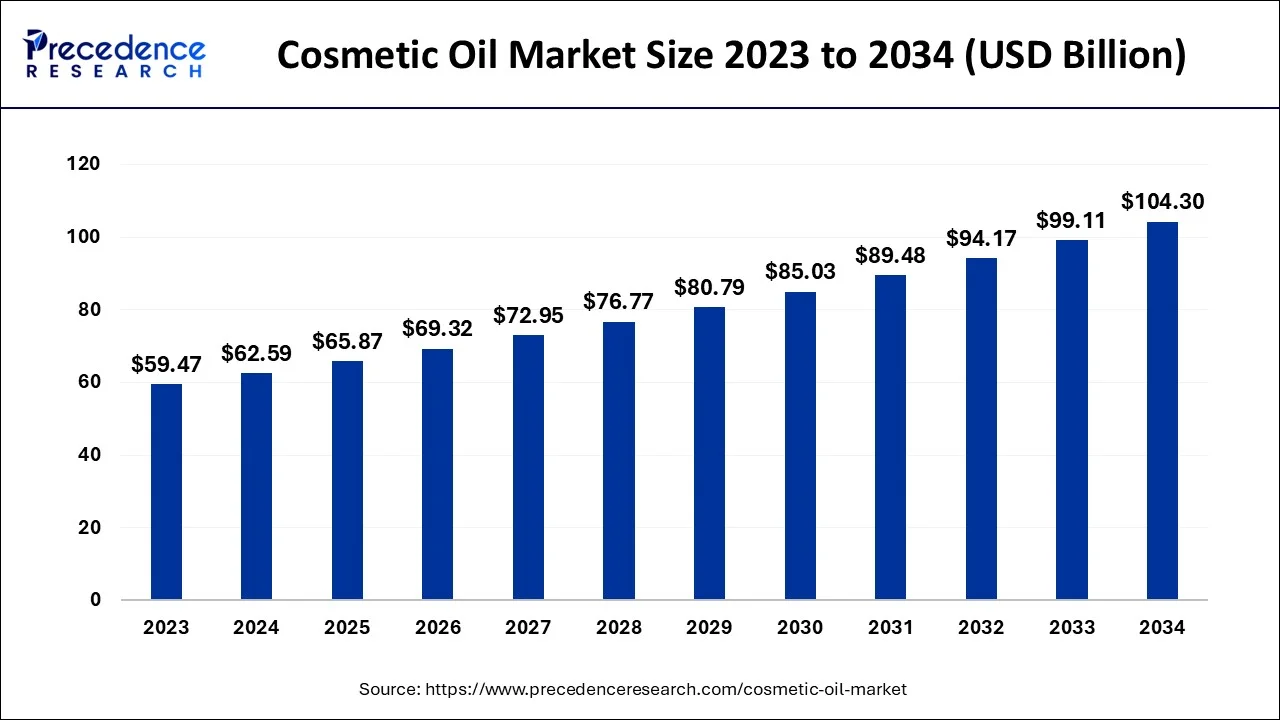

The global cosmetic oil market size accounted for USD 62.59 billion in 2024, grew to USD 65.87 billion in 2025 and is predicted to surpass around USD 104.30 billion by 2034, representing a healthy CAGR of 5.24% between 2024 and 2034.

The global cosmetic oil market size is estimated at USD 62.59 billion in 2024 and is anticipated to reach around USD 104.30 billion by 2034, expanding at a CAGR of 5.24% from 2024 to 2034.

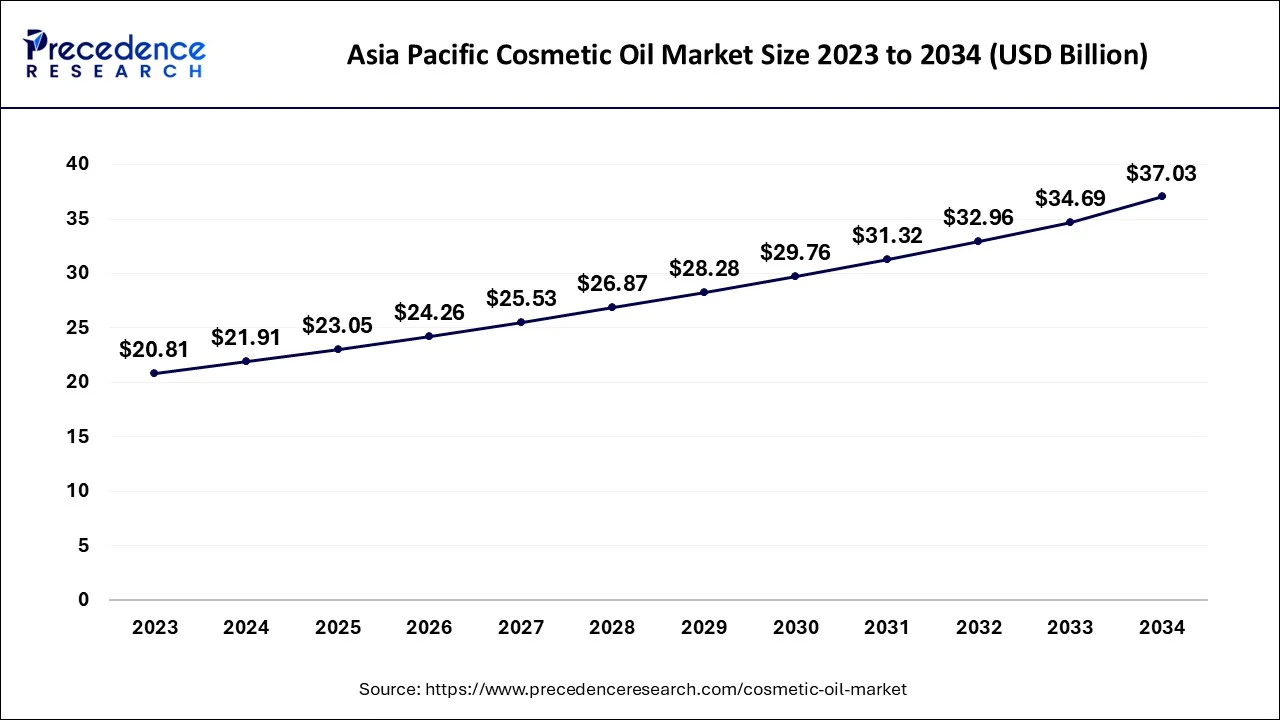

The Asia Pacific cosmetic oil market size is estimated at USD 21.91 billion in 2024 and is expected to be worth around USD 37.03 billion by 2034, rising at a CAGR of 5.38% from 2024 to 2034.

Over the course of the forecast period, the Asia Pacific cosmetic oil market is anticipated to expand at a CAGR of over 5.38%. The significant growth is linked to urbanization, population increase, and economic growth. Additionally, the growing production of personal care and cosmetic products in Asian nations like China and India is probably going to support market expansion in the area. More than 80% of the Asia-Pacific market for cosmetic oil is anticipated to be accounted for by China, Japan, India, and South Korea.

Essential oils and carrier oils like almond and coconut oil are both used in cosmetics. In the upcoming years, demand for these oils is anticipated to be driven by a variety of qualities, including their antibacterial, moisturizing, and anti-inflammatory properties, which will subsequently support market growth. Demand is also anticipated to increase due to consumers' growing preference for organic and natural cosmetic products. In addition to lipsticks, lip balms, moisturizers, and serums, cosmetic oils are utilized in hair and skincare products such as hair, facial, and elixir oils.

Depending on the kind of skin, cosmetic oils are used for a number of purposes, including nourishing the skin and avoiding irritation and skin inflammation. At first, makers of cosmetic oils mostly targeted women, but as social media influencers proliferated and beauty awareness increased, they started to also target guys. During the projection period, it is predicted that expanding operations to other demographics would strengthen the cosmetic oil industry.

The market for cosmetic oils will see increased sales due to the rising demand for cosmetic goods as a result of people's increased awareness of outward attractiveness. Because of its inherent capacity to hydrate and nourish skin as well as to give a natural odor, cosmetic oil is utilized in cosmetic goods. During the anticipated timeframe, the expansion of men-focused beauty goods and the quick development of the gender-neutral cosmetic industry are anticipated to drive product growth.

Cosmetic oils provide a number of advantages, including the ability to heal sunburn, prevent dandruff, treat acne, enhance the quality of the skin, protect the skin, prevent wrinkles, and treat acne. They are also rich in antioxidants and antibacterial qualities.

| Report Coverage | Details |

| Market Size in 2024 | USD 62.59 Billion |

| Market Size by 2034 | USD 104.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.24% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of source, the vegetable oil segment has held the largest market share in 2023. The fastest-growing segment of the market is one that may be attributed to the rising demand for vegetable oil in cosmetic applications. Due to their ability to heal and protect the skin, essential oils, avocado, almond, palm, and other types of vegetable oils are commonly used in cosmetic goods. Due to increased public awareness of its beneficial effects on the skin, vegetable oil is being utilized more commonly in cosmetics. The market share for cosmetic oils will also be encouraged by the expansion of the use of innovative vegetable oils in cosmetic goods. Vegetable oils have also received a lot of attention because of their numerous biological roles and appealing technical characteristics including simple skin absorption and remarkable spreadability.

Due to its growing use in skin and hair care products, coconut oil has the greatest market share. Due to its ability to moisturize skin, coconut oil is frequently utilized in cosmetic goods. Additionally, coconut oil cures wounds, combats acne, and treats skin diseases and infections. Additionally, the growing popularity of organic and natural certifications in cosmetics has significantly increased the demand for vegetable oils recently, driving the growth of the industry as a whole. The development of the cosmetic oil industry will be further accelerated by the increased innovation of cosmetic products using various vegetable oils.

On the basis of application, the hair care segment has captured the largest market share in 2023. To give the hair a shiny and smooth texture, cosmetic oil is widely used in a variety of hair care products such as hair oil, shampoos, conditioners, serums, and other hairstyle products. These oils also promote the development of hair follicles by moisturizing the scalp. Additionally, the growing significance of hair care and style in people's life has had a favorable impact on the demand for various hair care products, regardless of gender.

By Source

By Application

By Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

July 2024