May 2024

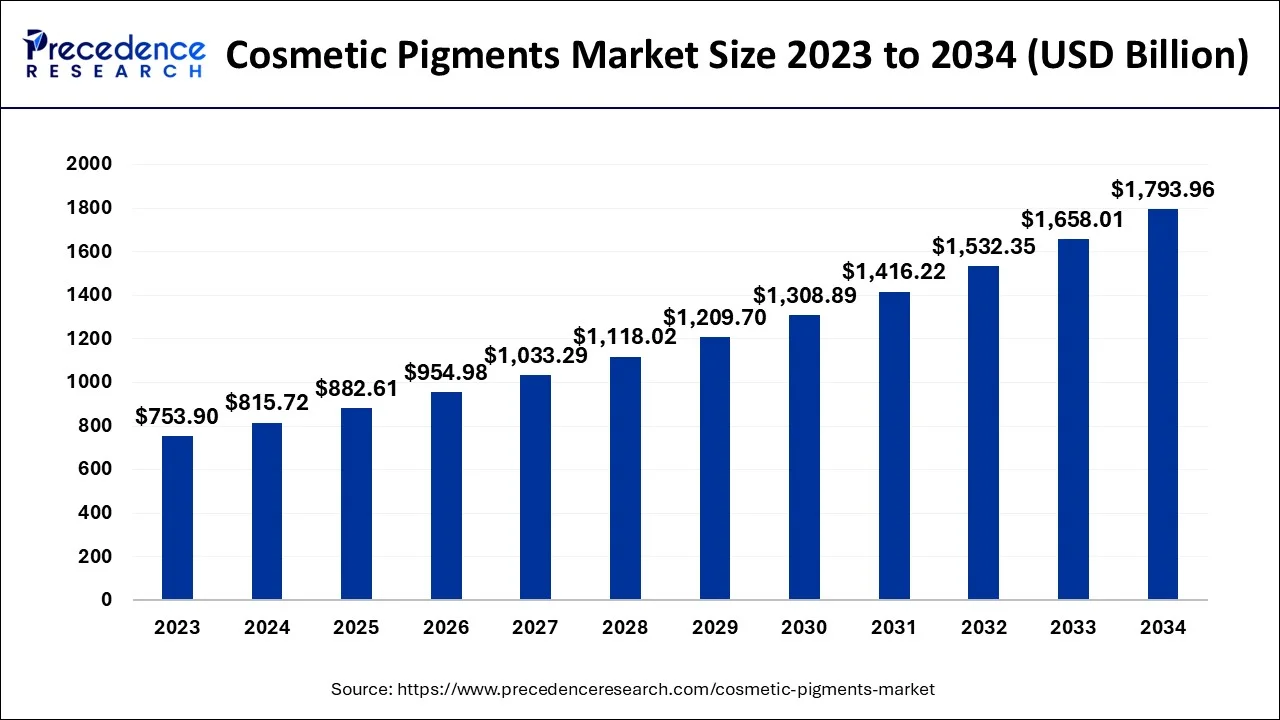

The global cosmetic pigments market size accounted for USD 815.72 billion in 2024, grew to USD 882.61 billion in 2025 and is predicted to surpass around USD 1793.96 billion by 2034, representing a healthy CAGR of 8.20% between 2024 and 2034.

The global cosmetic pigments market size is estimated at USD 815.72 billion in 2024 and is anticipated to reach around USD 1793.96 billion by 2034, expanding at a CAGR of 8.20% from 2024 to 2034.

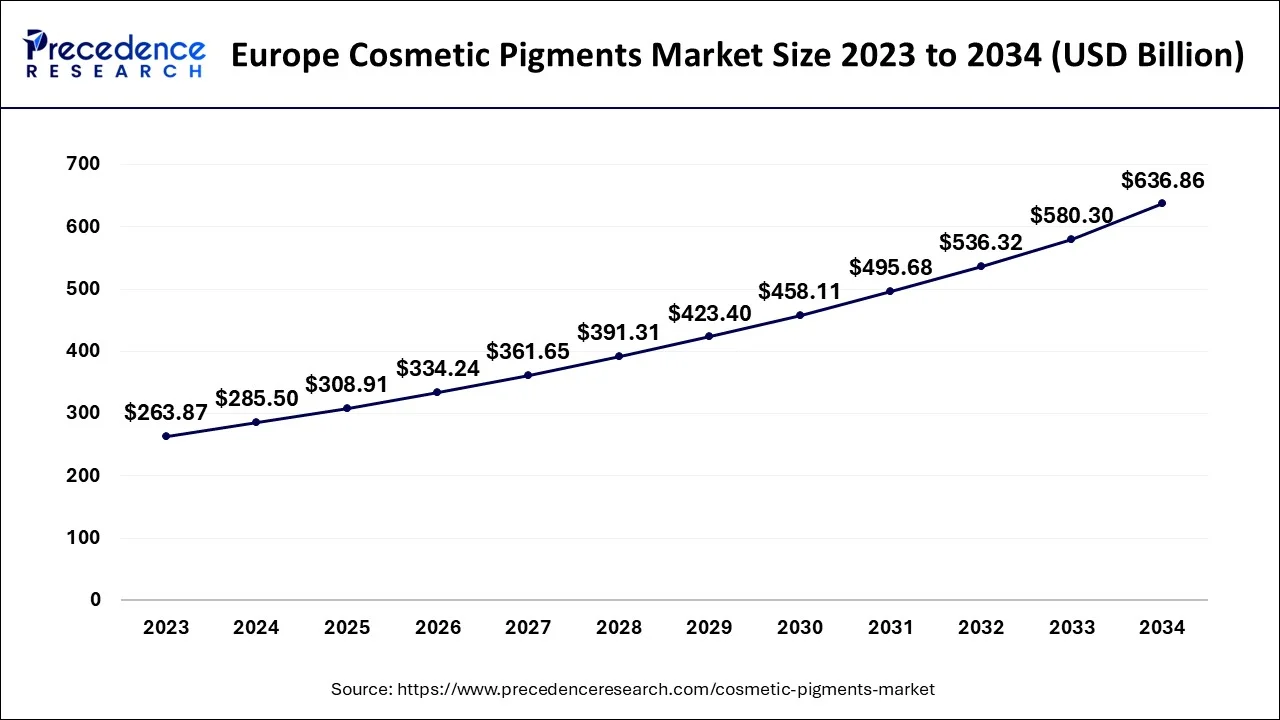

The Europe cosmetic pigments market size is estimated at USD 285.50 billion in 2024 and is expected to be worth around USD 636.86 billion by 2034, rising at a CAGR of 8.34% from 2024 to 2034.

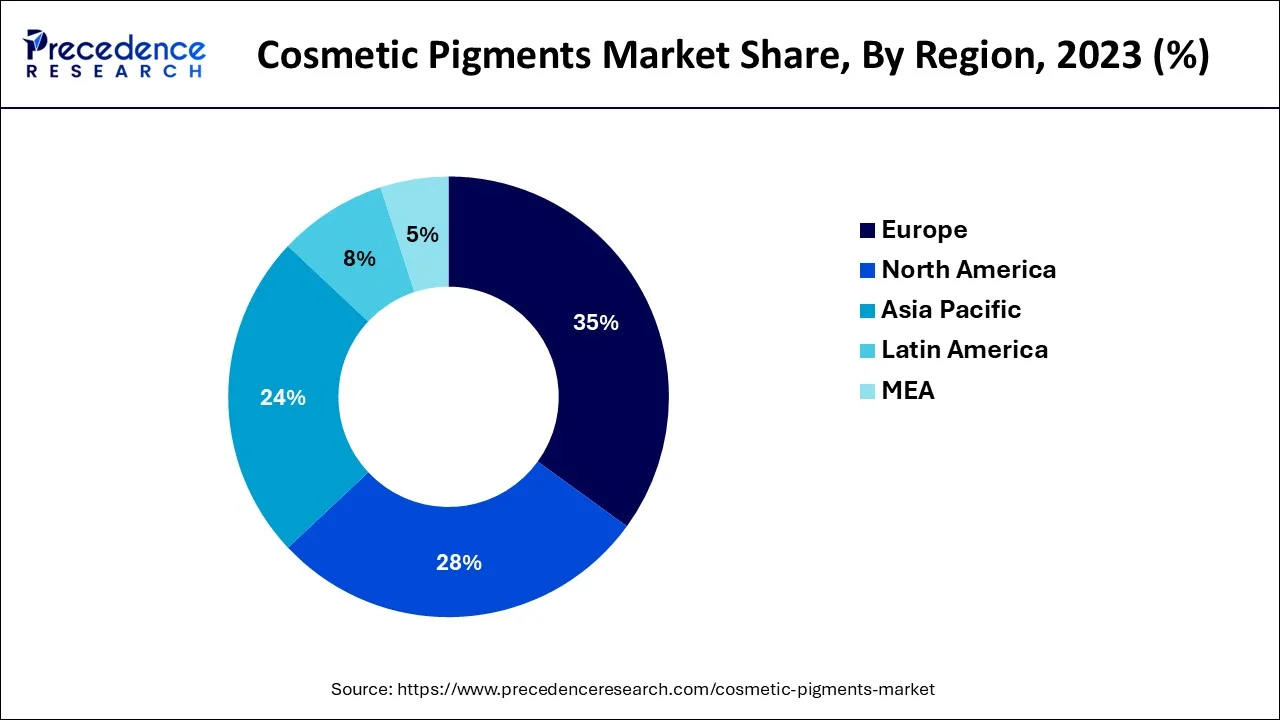

On the basis of geography, Europe has garnered the highest market share in 2023. The market for cosmetic pigments in Europe is expanding as a result of rising urbanization, a greater awareness of personal grooming, and the value of looking presentable, as well as worldwide trends like resource concern, individualization, and digitization. With a share of about 35% in 2023, Europe led the market as a whole. Over 20,000 businesses, mostly in Italy, Spain, and France, operate on the wholesale side of the cosmetics industry in Europe. A Cosmetics Europe survey indicated that 88% of people find it difficult to live without cosmetics, 33% of women find it impossible to live without foundation or concealer, 25% of men find it difficult to live without aftershave, and the market for cosmetics pigment is growing as a result.

In Asia Pacific, the market for cosmetic pigments is divided into China, Japan, India, South Korea, and the Rest of Asia Pacific. Due to rising personal affluence, the Asia Pacific cosmetics and personal care market is expanding quickly. The market for cosmetic pigments in this region is being driven by changing lifestyles and the desire for high-quality cosmetic and personal care products.

A colored substance that is insoluble in water or almost insoluble in water is referred to as a pigment. In contrast to dyes, which are typically organic substances, pigments are inorganic substances. Lapis lazuli, ochre, and charcoal are a few examples of ancient and modern pigments. Cosmetic pigments add a variety of colors, textures, and looks to cosmetic products. Cosmetic pigments come in a variety of hues, as well as white pigments, metallic tones, and other substances. They are used to create personal care items like skincare, nail polish, hair color, and lip care.

Based on their chemical makeup, cosmetic pigments are separated into two categories: organic pigments and inorganic pigments. Carbon chains make up organic pigments, giving them a brighter hue than inorganic pigments. A variety of inorganic pigments with different chemical compositions, including iron oxides, ultramarines, chromium dioxides, white pigments, and others, are employed in the formulation of cosmetic products. Black, red, and yellow is the three colors of iron oxide. These can be found in blushers, face powders, and liquid foundations. Cosmetics frequently contain white pigments like titanium oxide and zinc oxide. These pigments are incredibly light, heat-resistant, and have great covering power. Ultramarines are flat, powerful, matte pigments with vivid colors that are manufactured to a high level of perfection and adhere to all cosmetic standards. Among the cosmetic items that contain them are lipsticks, correctives, foundations, and colored eye shadows. They are crucial in the creation of cosmetics.

The market is being driven by both the efficient and excellent qualities of cosmetic pigments, as well as the rapid expansion of specialized applications using them globally.

Cosmetic pigments have a sheen, shimmer, and shine that is bright and brilliant. These pigments are made up of colored, colorless, or fluorescent particles. They could be finely powdered organic or inorganic substances. Typically, they are insoluble and unaffected by the chemically integrated medium. They can be found in many different items, including nail paint, lip products, eye products, and facial makeup. Cosmetic pigments, particularly pearlescent pigments, are used in facial cosmetics to cover imperfections and uneven skin tone.

| Report Coverage | Details |

| Market Size in 2024 | USD 815.72 Billion |

| Market Size by 2034 | USD 1793.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.20% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of elemental composition, the inorganic pigments segment accounted highest revenue share in 2022. White opaque inorganic pigments are used to brighten and opacify other colors by adding opaqueness to them. These pigments' color intensity is less intense than that of organic pigments. As a result of its widespread use in all cosmetic pigment applications, inorganic pigments like titanium dioxide are in high demand, fueling the expansion of the cosmetic pigments market in this sector.

Throughout the projection period, it is anticipated that the organic pigments segment will expand significantly. Through the projection period, it is anticipated that rising consumer preferences for the usage of dark and vivid colors, notably in nail polish, eyelashes, and lipsticks, together with the low environmental effect, will fuel the demand for the product.

On the basis of application, the facial makeup segment has generated the largest market share in 2022. The market for this application is anticipated to be driven by escalating demand for foundations and face powders, which are basic makeup items. Face makeup dominates the market for cosmetic pigments. Cosmetic pigments used in facial cosmetics products including foundation, blushers, and powders are brightened by titanium dioxide.

In June 2019 – Leading chemical solutions provider BASF formed a strategic alliance with UK-based start-up siHealth Ltd to market satellite and optronic products with a scientific foundation to the global personal care market. The collaboration should speed up BASF's goods while also enabling new technological advancements in the personal care sector.

By Elemental Composition

By Application

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

August 2023

November 2024

October 2024