February 2025

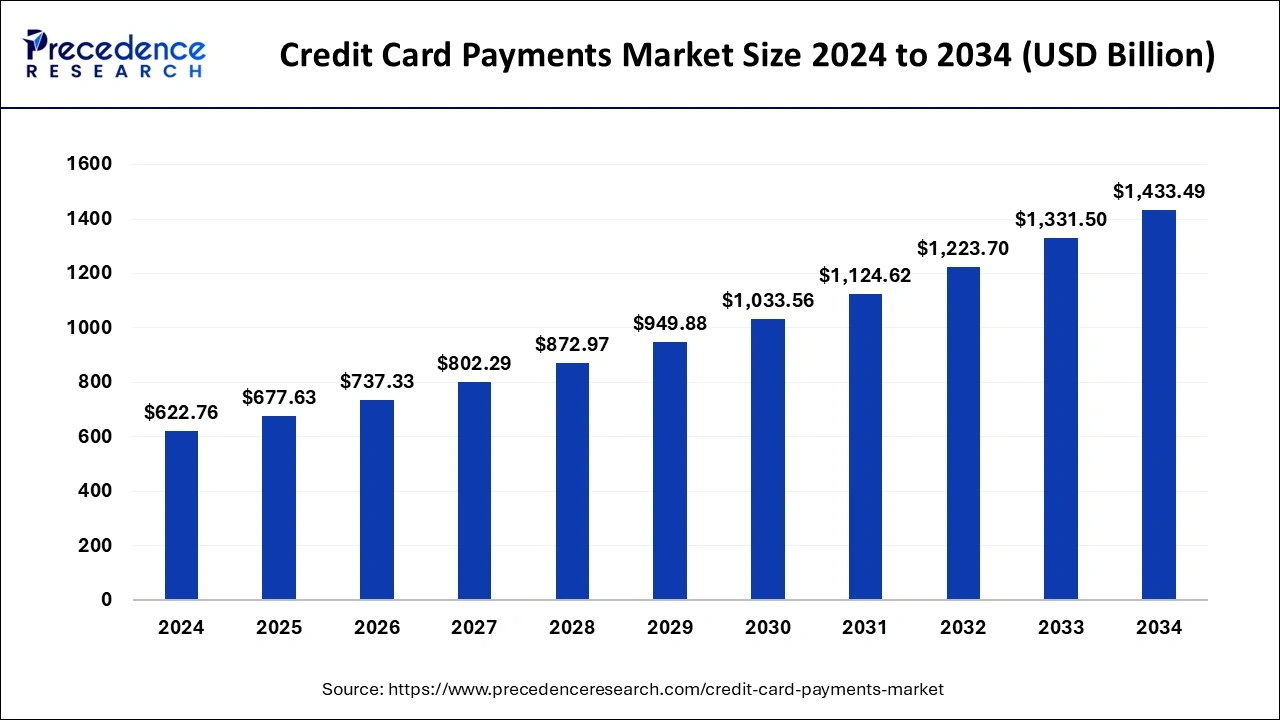

The global credit card payments market size is calculated at USD 677.63 billion in 2025 and is forecasted to reach around USD 1,433.49 billion by 2034, accelerating at a CAGR of 8.69% from 2025 to 2034. The North America credit card payments market size surpassed USD 261.56 billion in 2024 and is expanding at a CAGR of 8.82% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global credit card payments market size was estimated at USD 622.76 billion in 2024 and is predicted to increase from USD 677.63 billion in 2025 to approximately USD 1,433.49 billion by 2034, expanding at a CAGR of 8.69% from 2025 to 2034.

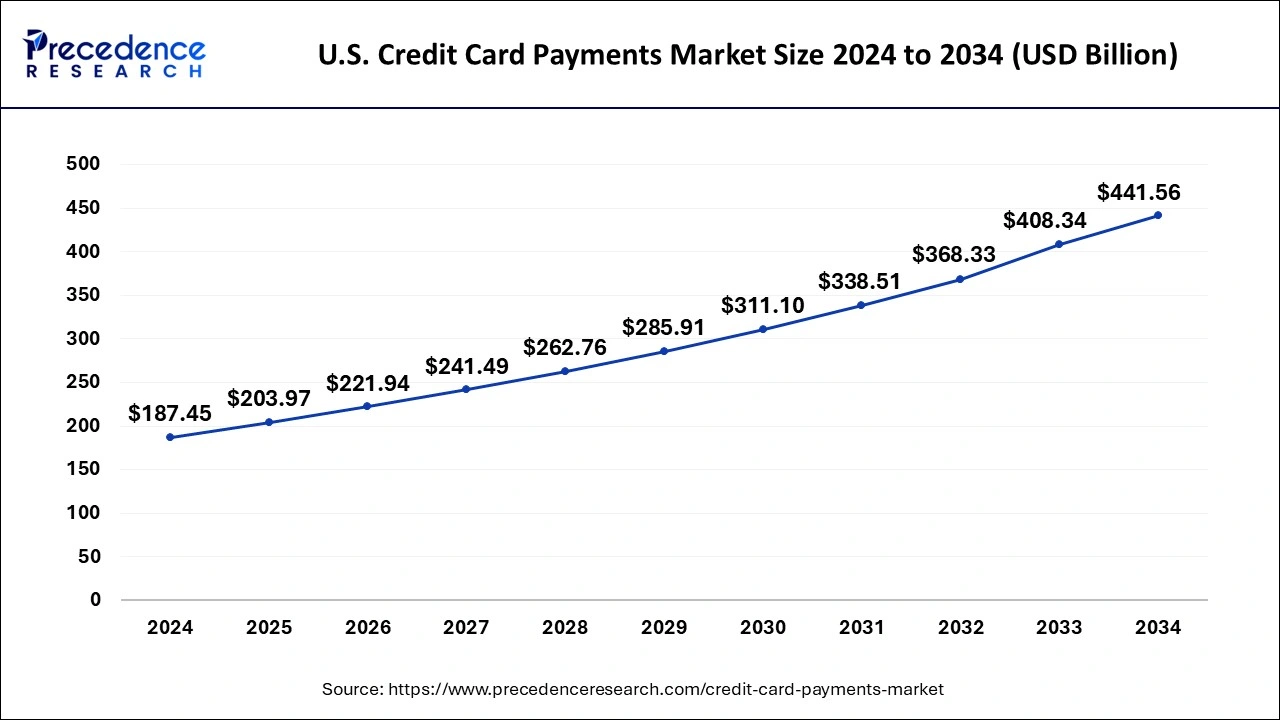

The U.S. credit card payments market size was valued at USD 187.45 billion in 2024 and is predicted to be worth around USD 441.56 billion by 2034, at a CAGR of 8.94% from 2025 to 2034.

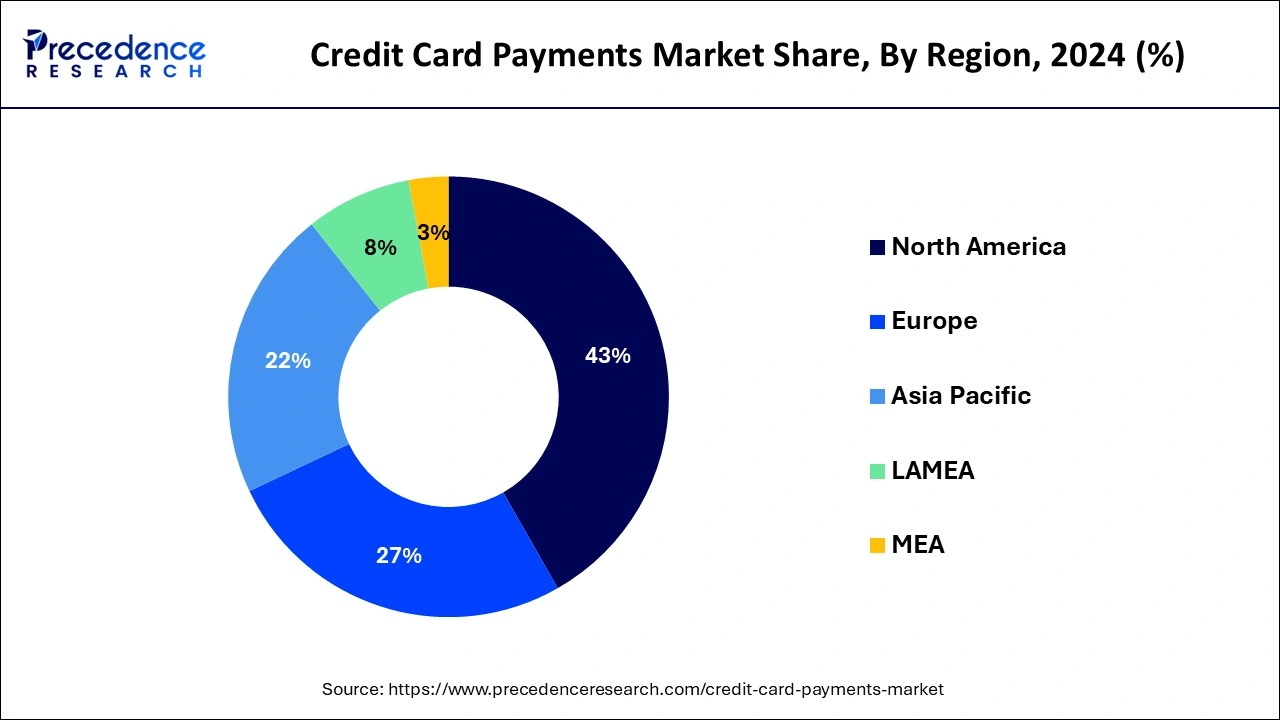

North America held the dominant share of the credit card payments market in 2024 and is expected to witness prolific growth during the forecast period. The region is observed to witness prolific growth during the forecast period. The growth of the region is driven by the increasing presence of sophisticated financial services organizations, the economy's rapid growth, the rising acceptance of credit cards, the growing customer preference for digital transactions, and the advancement in technology.

The rapid growth of e-commerce platforms, along with the increasing use of touchless payment options, has resulted in increasing dependency on the credit card payments market in North America. In addition, there is the presence of key prominent players such as Mastercard, Visa, American Express, and Discover Financial Services. Among all of them, MasterCard is used by the majority of the population in the United States, according to secondary sources.

According to the Canadian Bankers Association, in 2023, credit cards will be widely preferred by both consumers and retailers as they offer valuable benefits. The majority of Canadians use credit cards as a method of payment rather than borrowing. Nearly two-thirds of consumers, or 65 %, say credit card purchases are beneficial to merchants and directly help them grow their businesses.

Europe is expected to expand at a rapid pace in the credit card payments market during the forecast period. In Europe, the market has witnessed the rapid adoption of credit cards owing to increasing loyalty programs and reward points offered by financial organizations to credit card holders. Thus, this is expected to propel the market growth in the region during the forecast period.

Additionally, the rising popularity of credit cards among young people in countries such as the United Kingdom, France, Italy, Germany, and others is anticipated to fuel the credit card payments market’s growth during the forecast period. Additionally, the rise in retail and e-commerce sales is projected to be due to the significance of credit cards as a preferred method for online transactions in the region.

Earlier, cash was the most popular method of payment, but gradually, it is declining due to rapid digitalization around the world. Credit card payments have become the preferred choice for payments as a way to promote digital transactions. A credit card is a payment card issued by a bank to an account holder, allowing its cardholder to purchase goods or services or withdraw cash on credit. Credit cards are widely used to make payments around the world. The credit card also facilitates the conversion of purchases into easy EMIs.

A cardholder is liable to repay the used credit limit or minimum due on or before the due date to avoid additional interest. It is one of the flexible modes of payment that offers cardholders more time to pay accrued charges to card issuers. Payment through credit cards helps to enhance the purchasing power of individuals, create a credit score for loans, and offer cashback, zero foreign transaction fees, and others.

| Report Coverage | Details |

| Market Size in 2025 | USD 622.76 Billion |

| Market Size by 2034 | USD 1,331.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.81% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Card Type, Application, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of credit card

The rapidly rising adoption of credit cards is expected to boost the credit card payments market revenue during the forecast period. In the digital revolution era, the rapid adoption of credit cards is owing to the customer preference for quick, safe, and cashless transactions. Credit cards offer a convenient and flexible way of borrowing money to pay for several products and services, with many relying on credit cards in day-to-day life for things such as paying petrol or bills, shopping, and others.

Credit cards are accepted in more than 200 countries and at millions of locations across the globe. It offers several other benefits, such as access to unsecured credit, interest-free payment from the time of purchase to the end of the billing period, instant receipt of goods and services, and a wide range of discounts and offers. Therefore, the rising use of credit cards to buy goods or services drives the growth of the credit card payments market.

Security concerns and fraudulent activities

The security concerns and fraudulent activities are anticipated to hamper the market's growth. Credit card payments often face severe security issues and fraud risks. Despite the robust advancement in security technology, fraudsters continue to target credit card transactions, which causes data breaches, illegal access to sensitive information of card holders, and other security purposes. In addition, the market has experienced an increasing number of payment scams on e-commerce sites. In many cases, the purchased product is either not received or cannot be tracked by the customer, which is likely to limit the expansion of the global credit card payments market.

Robust growth of the e-commerce and retail sector

The robust growth of the e-commerce and retail sector is projected to offer lucrative growth opportunities for the credit card payments market in the coming years. The e-commerce and retail sector has encouraged and promoted the use of credit card payments rather than paying cash for shopping for electronics, apparel, accessories, food products, and others.

Several e-commerce companies offer attractive points, rewards, and cashback to their customers to engage them in purchase activities, leading to an increase in credit card payments. With the growth in e-commerce activities and the expanding popularity of credit card transactions, as well as while shopping on e-commerce and retail sector platforms, consumers prefer credit cards for ease, speed, security, and others. Thereby bolstering the credit card payments market growth.

The general purpose credit cards segment accounted for the largest share of the credit card payments market in 2024 and is projected to continue its dominance over the forecast period. The segment’s growth is driven by the increasing offerings of exclusive rewards, points, and other advantageous perks, which resulted in the increasing adoption of premium cards by credit card users. General Purpose Credit Cards enable a consumer to purchase goods and services at a variety of stores and businesses.

The specialty & other credit cards segment is expected to witness considerable growth in the credit card payments market over the forecast period. These credit cards offer higher credit or spending limits provided by the financial institution than others. Specialty credit cards are tailored to align the unique demands of a particular group of consumers, including college students and business professionals. Organizations often offer these cards to their employees to keep track of employee expenses on travel, inventory purchases, and various other responsibilities that require transactions. Thus boosting the growth of the segment.

The food & groceries segment held the largest share of the credit card payments market in 2024. The segment is expected to sustain its position throughout the forecast period owing to the increasing use of credit cards in the food and grocery sector to purchase food and groceries. Credit card payments are gaining significant popularity in the food and grocery sector due to their convenience and contactless nature, which improves customer satisfaction. Customers often prefer swiping or tapping credit cards for smooth and quick transactions at supermarkets and grocery stores. Credit cards offer rewards or cashback incentives for purchases made in supermarkets, grocery stores, and restaurants, which in turn makes them an appealing payment for cash alternatives and assists people in managing their household budgets. Such supportive factors drive the growth of the segment.

The health & pharmacy segment is expected to grow significantly in the credit card payments market during the forecast period. In the health and pharmacy industries, credit cards are widely used as a secure payment process, simplifying billing procedures by eliminating the need for cash handling and improving the overall experience of customers. Credit cards are used for multiple purposes in the health and pharmacy industries, such as prescription drugs, medical services, and other healthcare-related expenses. Credit cards offer various attractive perks, including cashback or rewards for spending on healthcare-related items.

The Mastercard segment is estimated to hold the dominating share of the credit card payments market during the forecast period. Mastercard is a leading financial services corporation globally. It specializes in payment processing and technology. Mastercard partners with banks and merchants to provide a smooth and safe credit card payment experience across various areas and industries. Mastercard also offers debit, credit, and prepaid card services, making it one of the world’s most extensive payment networks.

The Visa segment is expected to grow notably in the credit card payments market over the studied period. Visa is a global payment technology company that offers credit, prepaid cards, gift cards, and debit card services. Visa cards have a global presence and extensive network and are a versatile and accessible payment option in a wide range of businesses. Visa credit cards are accepted in more than 200 countries and territories globally, making them gain significant popularity both among consumers and companies. Financial institutions and merchants collaborate with Visa to offer various credit card options and efficient payment solutions.

By Card Type

By Application

By Provider

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

February 2025

January 2025