January 2025

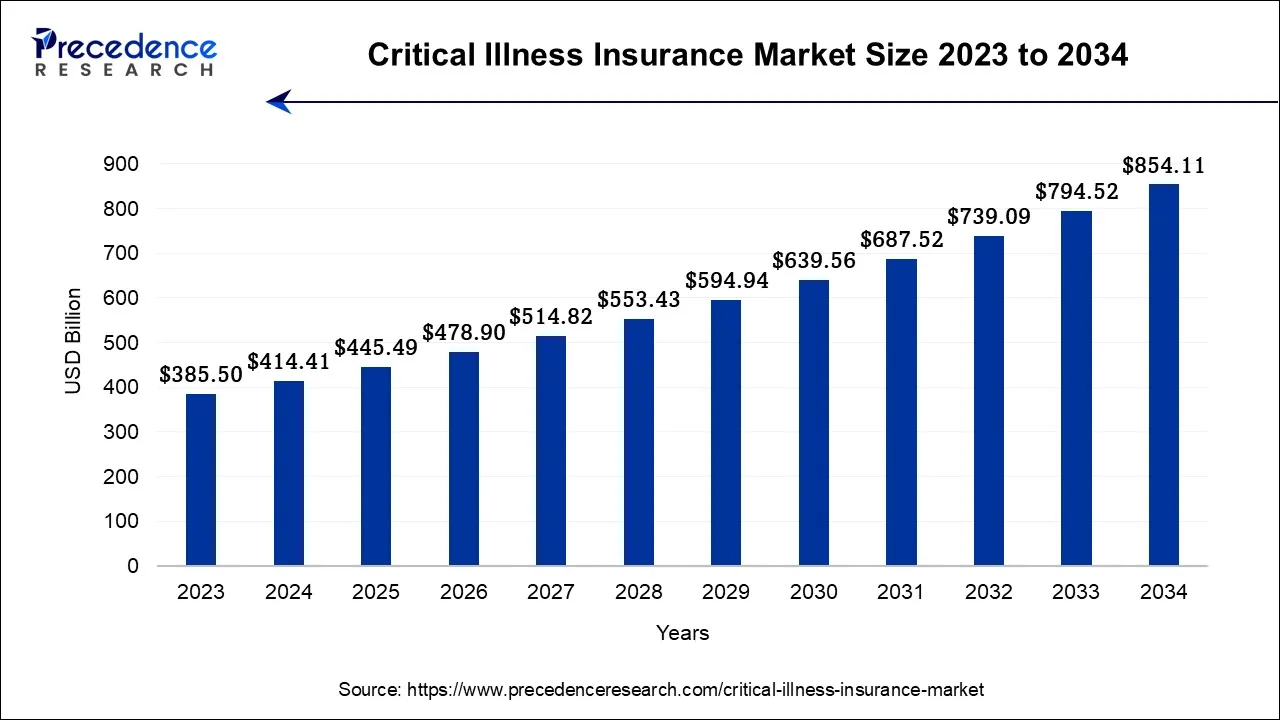

The global critical illness insurance market size is calculated at USD 385.50 billion in 2024, grew to USD 414.41 billion in 2025, and is predicted to hit around USD 854.11 billion by 2034, poised to grow at a CAGR of 7.5% between 2024 and 2034. The North America critical illness insurance market size accounted for USD 149.19 billion in 2024 and is anticipated to grow at the fastest CAGR of 7.64% during the forecast year.

The global critical illness insurance market size is expected to be valued at USD 385.50 billion in 2024 and is anticipated to reach around USD 854.11 billion by 2034, expanding at a CAGR of 7.5% over the forecast period from 2024 to 2034.

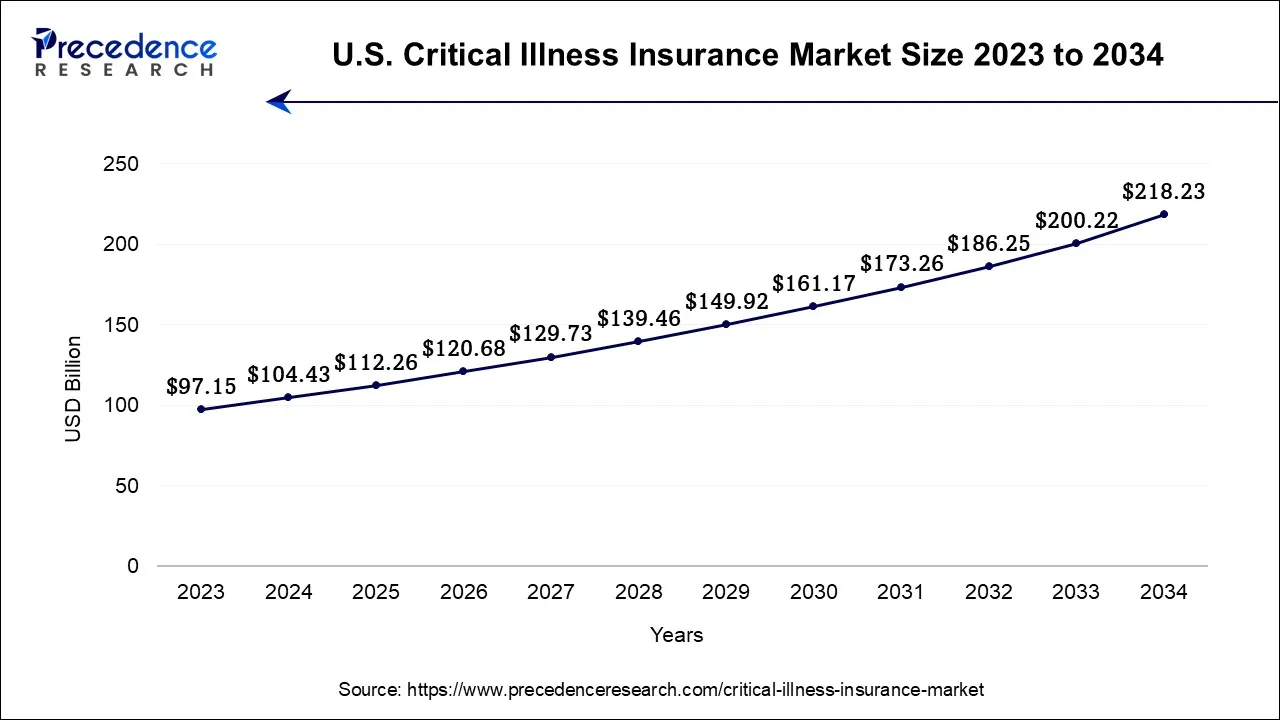

The U.S. critical illness insurance market size is accounted for USD 104.43 billion in 2024 and is projected to be worth around USD 218.23 billion by 2034, poised to grow at a CAGR of 7.65% from 2024 to 2034.

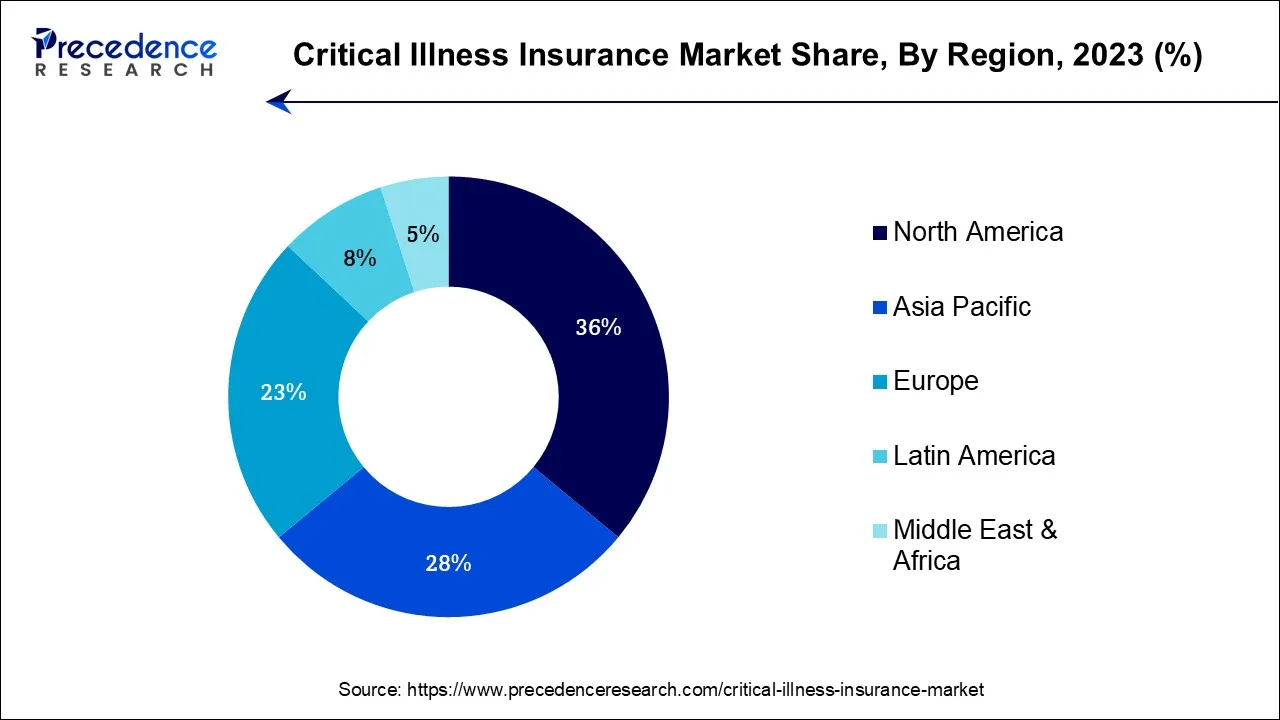

North America has held the largest revenue share 36% in 2023. In North America, the critical illness insurance market pertains to insurance policies that provide financial protection to policyholders diagnosed with covered critical illnesses. It offers a lump-sum payment upon diagnosis, assisting in covering medical expenses and income loss. In North America, key trends include an increasing focus on cancer-specific coverage, aligning with the region's high cancer incidence rates. Insurers are also offering more customizable policies to cater to individual needs and preferences. Additionally, digitalization and telehealth integration are streamlining policy issuance and claims processing, enhancing customer experience and accessibility.

Asia-Pacific is estimated to observe the fastest expansion The Asia-Pacific critical illness insurance market includes the insurance sector in the region, offering policies that grant financial protection to individuals diagnosed with specific critical illnesses, such as cancer, heart disease, and strokes. Recent trends in the Asia-Pacific market include a growing awareness of health-related risks, particularly among the rising middle class, leading to increased demand for critical illness insurance. Insurers are also exploring digitalization to enhance distribution and customer engagement. Moreover, some countries in the region are witnessing regulatory developments aimed at promoting insurance penetration and consumer protection, further shaping the market landscape.

The critical illness insurance market refers to the sector within the insurance industry that specializes in providing coverage for policyholders in the event of severe medical conditions such as cancer, heart disease, or stroke. This market is characterized by policies designed to offer financial protection, typically paying out a lump sum upon diagnosis of a covered critical illness. It serves individuals seeking additional security against high medical expenses and loss of income during treatment, addressing the growing need for health-related financial safeguards in an uncertain healthcare landscape.

The critical illness insurance market is a vital segment within the insurance industry that addresses the growing need for financial protection against severe medical conditions. This market offers policyholders a crucial safety net by providing a lump-sum payout upon the diagnosis of covered critical illnesses such as cancer, heart disease, and strokes. This summary explores the nature of this market, its industry trends and growth drivers, as well as the challenges and business opportunities it faces.

The critical illness insurance market is experiencing robust growth due to several key industry trends and growth drivers, including increasing awareness among individuals about the financial risks associated with critical illnesses has led to a rising demand for such insurance policies. Moreover, the aging population in many countries has contributed to market expansion, as older individuals are more prone to critical illnesses, making this coverage more attractive.

Additionally, technological advancements have streamlined policy issuance and claims processing, making it more convenient for consumers to access critical illness insurance. Moreover, the COVID-19 pandemic has underscored the importance of health-related financial protection, further driving market growth. The introduction of innovative policy options, such as hybrid plans that combine critical illness coverage with life insurance or long-term care benefits, is also attracting a broader customer base.

Despite its growth potential, the critical illness insurance market faces certain challenges. One significant hurdle is pricing, as insurers need to strike a balance between affordable premiums and providing adequate coverage.

The increasing prevalence of pre-existing medical conditions among potential policyholders presents underwriting challenges, as insurers must assess and manage these risks effectively. Regulatory changes and evolving healthcare landscapes can also impact the market's dynamics, requiring insurers to adapt to new compliance standards and medical advancements continually. Furthermore, the market's competitiveness requires insurers to differentiate their offerings and provide superior customer service to maintain a competitive edge.

The critical illness insurance market offers numerous opportunities for insurers and related businesses. Expanding into emerging markets with low insurance penetration rates can provide significant growth potential. Developing innovative products, such as policies tailored to specific critical illnesses or targeting niche demographics, can also open new avenues for growth. Collaboration with healthcare providers to offer bundled insurance and health services packages can enhance customer value and retention. Additionally, leveraging data analytics to enhance underwriting processes and customer insights can lead to more accurate risk assessment and personalized policy offerings.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.5% |

| Market Size in 2024 | USD 385.50 Billion |

| Market Size by 2034 | USD 854.11 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Premium Type, By Diseases, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing health awareness has surged demand for the critical illness insurance industry as individuals now better understand the potential financial devastation caused by severe medical conditions. This heightened awareness prompts more people to seek protection against substantial healthcare costs and lost income during treatment. Consequently, they are increasingly turning to critical illness insurance policies as a prudent means to safeguard their financial well-being in the event of a life-altering illness, thereby driving the market's growth.

Moreover, the aging population significantly boosts demand for critical illness insurance as older individuals face a higher risk of severe medical conditions. Consequently, older demographics seek this insurance to safeguard their financial well-being, cover costly medical treatments, and ease the burden on their families. This demographic shift amplifies the market demand for Critical Illness Insurance, making it a crucial component of financial planning for seniors.

Costly premiums act as a significant restraint on the critical illness insurance industry. These high insurance costs can deter potential policyholders, making coverage less accessible, especially for individuals on tight budgets. The expense of premiums may lead some individuals to opt for alternative insurance options or forego critical illness coverage altogether. Addressing affordability concerns and offering more cost-effective options is crucial for expanding market demand in this segment.

Moreover, limited coverage in critical illness insurance restrains market demand by creating uncertainty and dissatisfaction among potential policyholders. Exclusions, waiting periods, and specific illness restrictions can lead individuals to question the value of such policies. When coverage does not align with their expectations or needs, it discourages uptake and leaves them seeking more comprehensive alternatives, impacting the market's growth potential.

Tailored solutions in the critical illness insurance industry boost market demand by addressing specific customer needs and preferences. Tailored policies cater to niche demographics, such as seniors, young families, or individuals with unique health risks. This customization enhances relevance, attracting individuals who may have otherwise been hesitant to purchase generic policies. By offering tailored solutions, insurers tap into diverse market segments and empower consumers to choose coverage that aligns precisely with their circumstances, thus driving demand. Moreover, Healthcare partnerships can significantly boost market demand for critical illness insurance by creating synergy between insurance and medical services.

Collaborations with hospitals and healthcare providers can offer policyholders bundled packages, enhancing the perceived value of insurance. Access to specialized care, reduced medical costs, and streamlined claims processes can attract more customers. This approach not only drives demand but also enhances the overall customer experience, making critical illness insurance a more attractive and comprehensive solution.

According to the Premium Type, the monthly premium segment held a 46.5% revenue share in 2023. Monthly premium in critical illness insurance refers to the regular payment made by policyholders on a monthly basis to maintain their coverage against severe medical conditions. This payment structure offers affordability and flexibility, making it an attractive choice for many consumers. Trends in the critical illness insurance market indicate a growing preference for monthly premium plans. This trend aligns with the desire for budget-friendly options and reflects insurers' efforts to cater to a wider range of customers by offering more accessible payment terms, thereby contributing to the market's continued growth.

The Yearly premiums segment is anticipated to expand at a significant CAGR of 8.2% during the projected period. Yearly premiums in the critical illness insurance market are the annual fees paid by policyholders for coverage against severe medical conditions. These premiums fluctuate based on variables like age, health status, coverage extent, and policy conditions. Recent market trends indicate a modest rise in yearly premiums, driven by factors such as escalating healthcare expenses, growing awareness of critical illnesses, and the introduction of broader coverage options. This shift reflects insurers' efforts to balance competitive pricing while meeting the rising demand for comprehensive protection.

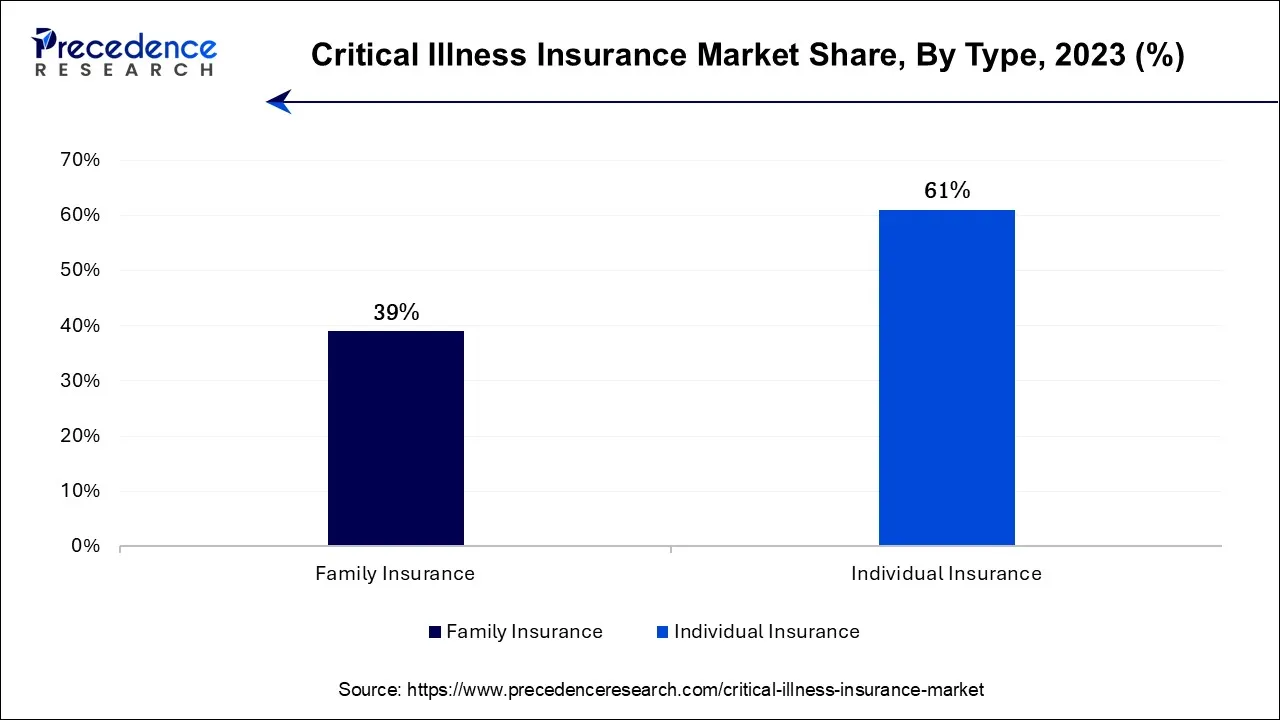

Based on the type, the individual insurance segment is anticipated to hold the largest market share of 61% in 2023. Individual critical illness insurance offers financial security to an individual policyholder when they receive a diagnosis of a specified critical illness, such as cancer, heart disease, or stroke. In the event of diagnosis, this insurance provides a lump-sum payout, empowering policyholders to effectively address medical costs and sustain their financial stability throughout their treatment and recovery journey.

Recent trends in the individual critical illness insurance market include increasing customization options, enabling policyholders to tailor coverage to their specific needs. Insurers are also leveraging technology to simplify the application and claims processes, making it more convenient for customers. Additionally, there is a growing focus on promoting health and wellness, with some insurers offering policyholder incentives for adopting healthier lifestyles as a preventive measure against critical illnesses.

On the other hand, the family insurance segment is projected to grow at the fastest rate over the projected period. Family insurance in the critical illness insurance market refers to policies designed to cover multiple family members under a single plan. These plans typically offer financial protection in the event of critical illnesses diagnosed among any covered family member, providing a lump-sum payout.

A notable trend in family critical illness insurance is the inclusion of child-specific coverage, recognizing the vulnerability of children to critical illnesses. Insurers are also offering flexible plan options that allow policyholders to add or remove family members as needed, providing more customized coverage. Additionally, some policies offer wellness and health-related benefits to promote overall family well-being and prevention of critical illnesses.

In 2023, the cancer segment had the highest market share of 36.8% on the basis of the diseases. Cancer, a debilitating disease characterized by abnormal cell growth, is a prominent focus in the Critical Illness Insurance Market. Critical illness policies often provide coverage specifically for cancer diagnosis, offering policyholders a lump-sum payout upon confirmation of this disease. Recent trends show a growing emphasis on cancer-specific insurance coverage, with policies designed to address the rising incidence of cancer cases globally. Insurers are also incorporating advancements in cancer treatment and care into their policies, offering more comprehensive coverage and support, including access to cutting-edge treatments and personalized cancer care solutions.

The heart attack segment is anticipated to expand at the fastest rate over the projected period. Heart attack, medically known as myocardial infarction, is a covered critical illness in many insurance policies. In recent years, there's been a trend towards more comprehensive heart attack coverage in critical illness insurance. Some insurers now offer specialized policies that cover various types and severities of heart attacks. Additionally, policies may provide additional benefits, such as access to cardiac rehabilitation programs and genetic testing for heart disease risk assessment.

Segments Covered in the Report:

By Premium Type

By Diseases

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2024

October 2024

January 2025